Get IRS 8960 Form

When understanding the intricate web of tax obligations, one crucial piece emerges for individuals navigating the complexities of investment income: the IRS 8960 form. Designed to calculate the Net Investment Income Tax (NIIT), this form addresses taxpayers who find themselves subject to an additional tax on their investment income, aiming to ensure fairness in the tax system. Amidst the labyrinth of taxation rules, the 8960 form serves as a critical tool for individuals with earnings from investments, such as dividends, interests, and capital gains, among others. The additional tax, typically pegged at 3.8%, applies to either the total net investment income or the amount by which one’s modified adjusted gross income surpasses the designated threshold, whichever is less. Hence, understanding this form becomes paramount for those seeking to navigate their tax obligations accurately, providing a clear path to compliance while potentially uncovering opportunities for tax optimization.

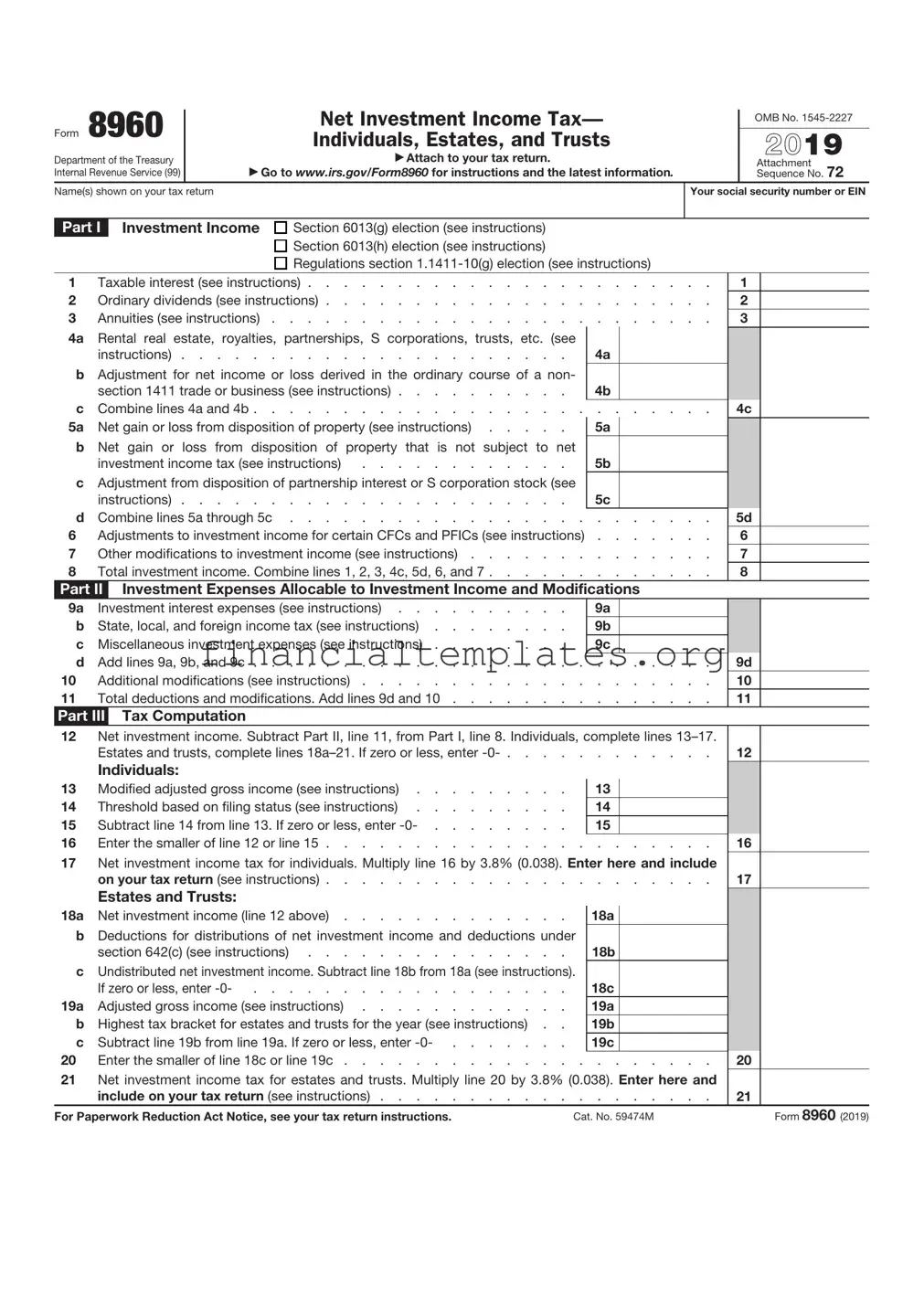

IRS 8960 Example

Form 8960 |

|

|

Net Investment Income Tax— |

|

OMB No. |

|||||||

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|||||

|

|

Individuals, Estates, and Trusts |

|

|

|

|||||||

|

|

|

2022 |

|||||||||

Department of the Treasury |

|

|

Attach to your tax return. |

|

|

|

|

|

||||

|

|

|

|

Go to www.irs.gov/Form8960 for instructions and the latest information. |

|

Attachment |

||||||

Internal Revenue Service |

|

|

Sequence No. 72 |

|||||||||

Name(s) shown on your tax return |

|

|

|

|

|

Your social security number or EIN |

||||||

|

|

|

|

|

|

|

|

|

|

|||

Part I |

Investment Income |

Section 6013(g) election (see instructions) |

|

|

|

|

|

|

|

|||

|

|

|

|

|

Section 6013(h) election (see instructions) |

|

|

|

|

|

|

|

|

|

|

|

|

Regulations section |

|

|

|

||||

1 |

Taxable interest (see instructions) |

. . |

. . . . . . . |

1 |

|

|||||||

2 |

Ordinary dividends (see instructions) |

. . |

. . . . . . . |

2 |

|

|||||||

3 |

Annuities (see instructions) |

. . |

. . . . . . . |

3 |

|

|||||||

4a |

Rental real estate, royalties, partnerships, S corporations, trusts, etc. (see |

|

|

|

|

|

|

|||||

|

instructions) |

. |

4a |

|

|

|

|

|||||

b Adjustment for net income or loss derived in the ordinary course of a non- |

|

|

|

|

|

|

||||||

|

section 1411 trade or business (see instructions) |

. |

4b |

|

|

|

|

|||||

c |

Combine lines 4a and 4b |

. . |

. . . . . . . |

4c |

|

|||||||

5a |

Net gain or loss from disposition of property (see instructions) . . . . |

. |

5a |

|

|

|

|

|||||

b |

Net gain or loss from disposition of property that is not subject to |

net |

|

|

|

|

|

|

||||

|

investment income tax (see instructions) |

. |

5b |

|

|

|

|

|||||

c |

Adjustment from disposition of partnership interest or S corporation stock (see |

|

|

|

|

|

|

|||||

|

instructions) |

. |

5c |

|

|

|

|

|||||

d |

Combine lines 5a through 5c |

. . |

. . . . . . . |

5d |

|

|||||||

6 |

Adjustments to investment income for certain CFCs and PFICs (see instructions) |

. . . . . . . |

6 |

|

||||||||

7 |

Other modifications to investment income (see instructions) |

. . |

. . . . . . . |

7 |

|

|||||||

8 |

Total investment income. Combine lines 1, 2, 3, 4c, 5d, 6, and 7 . . . . |

. . |

. . . . . . . |

8 |

|

|||||||

Part II |

Investment Expenses Allocable to Investment Income and Modifications |

|

|

|

||||||||

9a |

Investment interest expenses (see instructions) |

. |

9a |

|

|

|

|

|||||

b |

State, local, and foreign income tax (see instructions) |

. |

9b |

|

|

|

|

|||||

c |

Miscellaneous investment expenses (see instructions) |

. |

9c |

|

|

|

|

|||||

d |

Add lines 9a, 9b, and 9c |

. . |

. . . . . . . |

9d |

|

|||||||

10 |

Additional modifications (see instructions) |

. . |

. . . . . . . |

10 |

|

|||||||

11 |

Total deductions and modifications. Add lines 9d and 10 |

. . |

. . . . . . . |

11 |

|

|||||||

Part III |

Tax Computation |

|

|

|

|

|

|

|

|

|

||

12 |

Net investment income. Subtract Part II, line 11, from Part I, line 8. Individuals, complete lines |

|

|

|

||||||||

|

Estates and trusts, complete lines |

. . |

. . . . . . . |

12 |

|

|||||||

13 |

Individuals: |

|

|

|

|

|

|

|

|

|

||

Modified adjusted gross income (see instructions) |

. |

13 |

|

|

|

|

|

|||||

14 |

Threshold based on filing status (see instructions) |

. |

14 |

|

|

|

|

|

||||

15 |

Subtract line 14 from line 13. If zero or less, enter |

. |

15 |

|

|

|

|

|

||||

16 |

Enter the smaller of line 12 or line 15 |

. . |

. . . . . . . |

16 |

|

|||||||

17 |

Net investment income tax for individuals. Multiply line 16 by 3.8% (0.038). Enter here and include |

|

|

|

||||||||

|

on your tax return (see instructions) |

. . |

. . . . . . . |

17 |

|

|||||||

|

Estates and Trusts: |

|

|

|

|

|

|

|

|

|

||

18a |

Net investment income (line 12 above) |

. |

18a |

|

|

|

|

|||||

b Deductions for distributions of net investment income and deductions under |

|

|

|

|

|

|

||||||

|

section 642(c) (see instructions) |

. |

18b |

|

|

|

|

|||||

c |

Undistributed net investment income. Subtract line 18b from line 18a (see |

|

|

|

|

|

|

|||||

|

instructions). If zero or less, enter |

. |

18c |

|

|

|

|

|||||

19a |

Adjusted gross income (see instructions) |

. |

19a |

|

|

|

|

|||||

b |

Highest tax bracket for estates and trusts for the year (see instructions) . |

. |

19b |

|

|

|

|

|||||

c |

Subtract line 19b from line 19a. If zero or less, enter |

. |

19c |

|

|

|

|

|||||

20 |

Enter the smaller of line 18c or line 19c |

. . |

. . . . . . . |

20 |

|

|||||||

21 |

Net investment income tax for estates and trusts. Multiply line 20 by 3.8% (0.038). Enter here and |

|

|

|

||||||||

|

include on your tax return (see instructions) |

. . |

. . . . . . . |

21 |

|

|||||||

For Paperwork Reduction Act Notice, see your tax return instructions. |

Cat. No. 59474M |

|

|

Form 8960 (2022) |

||||||||

Document Specifics

| Fact Name | Description |

|---|---|

| Form Purpose | The IRS Form 8960 is used to calculate the Net Investment Income Tax (NIIT) individuals, estates, and trusts owe based on their investment income. |

| Applicable Taxpayers | This form must be filed by individuals, estates, and trusts that have Net Investment Income and meet certain income thresholds requiring them to pay an additional 3.8% tax on their investment income. |

| Tax Rate Applied | A rate of 3.8% is applied to the Net Investment Income or the excess of modified adjusted gross income (MAGI) over the statutory threshold amount, whichever is less. |

| Income Thresholds | The income thresholds for the NIIT depend on the taxpayer's filing status: $200,000 for single filers, $250,000 for married filing jointly, and $125,000 for married filing separately. |

| Governing Laws | The NIIT and Form 8960 are governed by the Internal Revenue Code, specifically the provisions enacted as part of the Health Care and Education Reconciliation Act of 2010. |

Guide to Writing IRS 8960

Filling out IRS Form 8960 is critical for individuals who must calculate and report their Net Investment Income Tax. This process, while detailed, is vital for ensuring compliance with tax laws and avoiding potential penalties. The task can be considerably streamlined with a clear breakdown of the necessary steps. Below is a guide designed to facilitate the completion of this form.

- Before beginning, gather all pertinent financial documents, including income statements, investment income reports, and any relevant expenses.

- Access the latest version of IRS Form 8960 from the official IRS website. Make sure to download any applicable instructions or guidance publications.

- Start by entering your name and Social Security number at the top of the form, ensuring that this information matches what is on your tax return.

- Read through each section of Form 8960 carefully. The form is divided into parts that guide you through calculating various types of investment income, adjustments, and deductions.

- In Part I, calculate your total investment income. This includes, but is not limited to, interest, dividends, annuities, royalties, and rents, less certain related expenses.

- Proceed to Part II, where you will adjust your investment income by subtracting any applicable deductions such as investment interest expenses, state income taxes, and other specific adjustments detailed in the form's instructions.

- Calculate your Net Investment Income (NII) in Part III by subtracting the total adjustments from your total investment income. This figure is crucial for determining the tax owed.

- Use the instructions provided alongside the form to determine the amount of Net Investment Income Tax you owe, based on your NII and any relevant tax thresholds that apply to your filing status.

- Carefully review each entry for accuracy. Errors can lead to processing delays or audits, so take the time to double-check your calculations and the completeness of your information.

- Once completed, attach Form 8960 to your federal tax return. If you are filing electronically, follow the software's instructions for including this form with your tax submission.

- Keep a copy of the completed Form 8960 for your records. It is important to have proof of your calculations and the information submitted with your tax return.

Through these steps, individuals can accurately complete IRS Form 8960, thereby ensuring they meet their tax obligations correctly. Attention to detail and a cautious review of all instructions and figures are paramount throughout this process. While the task may seem daunting initially, breaking it down into manageable steps can simplify the completion of this form. Remember, when in doubt, seeking assistance from a tax professional can help clarify any uncertainties and ensure the form is filled out correctly.

Understanding IRS 8960

-

What is the IRS Form 8960?

The IRS Form 8960 is used to calculate the Net Investment Income Tax (NIIT) that certain individuals, estates, and trusts must pay. The NIIT is a 3.8% tax on the lesser of your net investment income or the amount by which your modified adjusted gross income exceeds certain thresholds. This form helps determine how much of your investment income is subject to this additional tax.

-

Who needs to file Form 8960?

Individuals, estates, and trusts with a certain level of income might need to file Form 8960. For individuals, this includes those with net investment income and a modified adjusted gross income (MAGI) over the following thresholds: $200,000 for single filers or heads of households, $250,000 for married couples filing jointly, and $125,000 for married individuals filing separately. Estates and trusts are subject to different criteria, primarily based on their income and distributions.

-

What types of income are considered for the Net Investment Income Tax?

Net investment income for the purpose of the NIIT includes, but is not limited to, interest, dividends, capital gains, rental and royalty income, non-qualified annuities, and income from businesses involved in trading of financial instruments or commodities. Deductions allocable to such income are also considered when calculating net investment income.

-

Are there any exemptions to the NIIT?

Yes, certain types of income are exempt from the NIIT. These include wages, unemployment compensation, operating income from a non-passive business, Social Security Benefits, alimony, tax-exempt interest, and distributions from certain qualified retirement plans. Essentially, income that is not considered "investment income" is not subject to this tax.

-

How do I calculate the NIIT using Form 8960?

To calculate the NIIT, you must first determine your net investment income and then subtract any applicable thresholds based on your filing status. The Form 8960 provides line-by-line instructions for calculating your net investment income, factoring in various types of incomes and deductions. The 3.8% tax rate is then applied to the lesser of your net investment income or the amount your MAGI exceeds the threshold.

-

Can I deduct expenses related to my investment income?

Yes, certain expenses related to generating investment income can be deducted, such as investment interest expense, investment advisory and brokerage fees, expenses related to rental and royalty income, and state and local income taxes attributable to net investment income. These deductions must be properly allocated to your investment income on Form 8960.

-

What happens if I need to amend a previously filed Form 8960?

If you need to amend a previously filed Form 8960, you should file an amended tax return for the year in question, including a revised Form 8960. This is necessary to correct any errors or omissions on your original filing, such as underreported investment income or overlooked deductions. Amending your return can help avoid potential penalties and interest on any additional tax owed.

-

Where can I find more information about Form 8960 and the NIIT?

The best source for information on Form 8960 and the Net Investment Income Tax is the IRS website. There, you can find the form itself, detailed instructions for completing it, and comprehensive guides on the NIIT. Additionally, consulting with a tax professional can provide personalized advice and assistance tailored to your specific situation.

Common mistakes

Filling out IRS Form 8960 is crucial for taxpayers who need to calculate Net Investment Income Tax (NIIT). However, navigating the complexities of this form can be challenging, leading to common mistakes. Recognizing and avoiding these errors can ensure accuracy and compliance with tax obligations.

Failing to understand the scope of Net Investment Income (NII) can lead to inaccuracies. NII encompasses various types of income, such as interest, dividends, and capital gains. It's important to comprehend what income qualifies as NII to accurately calculate the tax.

Incorrectly calculating Adjusted Gross Income (AGI) affects the NIIT calculation. AGI is a critical figure that influences the threshold for NIIT applicability. Taxpayers should ensure their AGI is accurately reported to determine if they owe NIIT.

Overlooking certain deductions or incorrectly claiming them. Some investment-related expenses are deductible when calculating NII. Ensuring that only allowable deductions are claimed is vital for an accurate net investment income total.

Not reporting income from all sources is a common mistake. This includes omitting or incorrectly reporting income from rental real estate, partnerships, and S corporations. Comprehensive reporting is crucial for an accurate NIIT calculation.

Misunderstanding the exemption rules can lead to incorrect filings. Certain types of income and taxpayers are exempt from NIIT. Familiarity with these exemptions helps prevent unnecessary tax liability.

Improperly allocating gains and losses from passive activities can distort the NIIT amount. Taxpayers should accurately report income and losses from passive activities to correctly calculate their investment income.

Failure to report carryover losses appropriately. Investment losses that exceed gains in a tax year can be carried over into future years. Accurately accounting for these carryovers is essential for calculating NII.

Miscalculating the deduction for self-employment tax. Taxpayers who owe both self-employment tax and NIIT may deduct a portion of their self-employment tax when computing their modified adjusted gross income (MAGI). Proper calculation is essential to avoid errors.

Not considering the impact of state and local taxes. While state and local taxes do not directly affect NIIT calculations, misunderstanding their role in the overall tax situation can lead to confusion and errors in other parts of the tax return.

Overlooking the Form 8960 instructions and IRS guidance. The IRS provides detailed instructions and frequently asked questions about Form 8960. Ignoring these resources can result in mistakes due to a lack of understanding of the form's requirements.

Addressing these common mistakes requires careful attention to the specifics of one's income and tax situation. Consulting the detailed instructions provided by the IRS for Form 8960, seeking clarification on complex issues, and possibly obtaining professional tax advice can help navigate these challenges effectively.

Documents used along the form

When it comes to managing taxes related to investment income, IRS Form 8960 plays a crucial role. This form is specifically designed for calculating the Net Investment Income Tax (NIIT) which applies to certain high-income earners. However, completing this form often requires additional documents and forms that provide necessary financial details. Understanding these documents can make the tax filing process smoother and ensure accurate calculations.

- Schedule A (Form 1040) – This form is used to itemize deductions instead of taking the standard deduction. It includes details on medical expenses, state and local taxes, charitable contributions, and more, which can impact the calculation of taxable income.

- Schedule B (Form 1040) – This schedule lists interest and ordinary dividend income, essential for accurately reporting investment income on Form 8960.

- Schedule D (Form 1040) – Used for reporting capital gains and losses from the sale or exchange of capital assets. Schedule D is crucial for calculating NIIT, as it includes information on gains that may be subject to the tax.

- Schedule E (Form 1040) – For reporting income from rental real estate, royalties, partnerships, S corporations, trusts, and estates. Since Form 8960 taxes some of these income types, Schedule E is often necessary.

- Schedule K-1 (Form 1065) – Provides a taxpayer's share of income, deductions, and credits from partnerships. It plays a vital role in determining the income subject to NIIT for individuals involved in partnerships.

- Schedule K-1 (Form 1120S) – Similar to the Schedule K-1 (Form 1065) but for S corporations. It shows the shareholder's share of income, deductions, and credits, which must be considered when calculating NIIT.

- Form 1099-DIV – Reports dividends and distributions from investments held by taxpayers. This form helps in identifying dividend income that could be subject to NIIT.

- Form 1099-INT – Reports interest income earned from various sources like bank accounts, which is necessary for calculating investment income on Form 8960.

- Form 4797 – Used to report the sale or exchange of business property. The results can affect NIIT calculations, especially for taxpayers with gains from these transactions.

Navigating the complexities of the Net Investment Income Tax requires a thorough understanding of how different types of income and deductions are reported. The forms and documents listed above are often used alongside IRS Form 8960 to provide a complete picture of an individual's tax obligations related to investment income. By effectively organizing these forms, taxpayers and their advisors can ensure accurate reporting and compliance with tax laws.

Similar forms

The IRS 8960 form, concerning the Net Investment Income Tax, shares similarities with a variety of other tax documents, each serving distinct aspects of tax filing and reporting in the United States. One such document is the Schedule D (Form 1040), used to report capital gains and losses. Similar to Form 8960, Schedule D helps taxpayers calculate their tax liability related to investments but focuses more narrowly on the profits and losses from asset disposals. Both forms deal with investment outcomes, although in different tax contexts.

Another document akin to IRS Form 8960 is Form 1040, the U.S. Individual Income Tax Return. This comprehensive form serves as the foundation for personal tax reporting, into which Form 8960's calculated Net Investment Income Tax contributes. Taxpayers must report their total income, deductions, and credits on Form 1040, and Form 8960 complements this process by determining additional taxes owed on investment income, thereby integrating into the broader tax calculation and reporting process.

Form 6251, Alternative Minimum Tax—Individuals, also parallels Form 8960. It is designed to ensure that individuals who benefit from certain exclusions, deductions, or credits pay at least a minimum amount of tax. Both forms address alternative calculations to ensure taxpayers contribute a fair share to public revenues, with Form 8960 focusing on investment income and Form 6251 on broader income adjustments and tax preference items.

Form 1099-INT, Interest Income, shares a commonality with Form 8960 in its focus on investment income, specifically interest earnings. Taxpayers receiving more than a nominal amount of interest from savings, bonds, or other interest-bearing investments receive this form from payers. It relates to Form 8960 by providing necessary details to report investment income that could be subject to additional taxation under the Net Investment Income Tax.

Similarly, Form 1099-DIV, Dividends and Distributions, is related to Form 8960 as it reports dividends and distributions received by an investor. The information from Form 1099-DIV is essential for completing Form 8960, as dividends are a component of net investment income. Both forms are integral for investors in calculating the tax implications of their investment income correctly.

The Schedule E (Form 1040), Supplemental Income and Loss, also occasions comparison. This schedule is used by taxpayers to report income and losses from rental real estate, royalties, partnerships, S corporations, trusts, and residual interests in REMICs. Some of the income reported on Schedule E may be subject to the Net Investment Income Tax, making the information filed on this schedule also pertinent to the preparation of Form 8960.

Lastly, Form 8829, Expenses for Business Use of Your Home, demonstrates a more indirect connection to Form 8960. While principally concerned with the deduction of home office expenses for self-employed individuals, it impacts the calculation of taxable income, part of which might constitute investment income as defined by Form 8960. In cases where a home office deduction affects overall taxable income, it may, in turn, affect the calculation of investment income, underscoring the interconnectedness of these forms.

Dos and Don'ts

Filling out the IRS 8960 form, which pertains to the Net Investment Income Tax, requires careful attention to detail and adherence to tax laws to ensure accurate reporting and compliance. Here are eight essential dos and don'ts to guide you through the process:

- Do thoroughly read the instructions provided by the IRS for filling out Form 8960. Understanding the guidelines will help you correctly calculate your Net Investment Income and accurately complete the form.

- Do gather all necessary documents related to your investment income before starting the form. This includes statements from brokers, banks, and financial institutions, as well as records of dividends, interest, rents, royalties, and capital gains.

- Do use the correct tax year for which you are filing. The Net Investment Income Tax may be subject to changes, so always refer to the instructions for the specific tax year you are reporting.

- Do double-check your calculations. Errors in arithmetic can lead to inaccuracies in your reported investment income or tax liability, potentially resulting in penalties or interest charges from the IRS.

- Do consult with a tax professional if you have questions or if your investment situation is complex. Tax laws can be complicated, and professional guidance can be invaluable.

- Don't overlook deductions that are allowable against your Net Investment Income. This may include certain investment expenses, state taxes, and other deductions specific to your situation.

- Don't mix up Net Investment Income with earned income. The Net Investment Income Tax applies only to certain investment income and not to wages, salaries, or other forms of earned income.

- Don't file the form late. Ensure you are aware of the filing deadline to avoid penalties and interest for late submission. If you need more time, consider filing for an extension.

By carefully following these dos and don'ts, you can navigate the complexities of the IRS 8960 form with greater confidence and accuracy. Remember, keeping meticulous records and taking the time to understand the nuances of Net Investment Income Tax will serve you well during tax season and beyond.

Misconceptions

The IRS Form 8960, officially known as the "Net Investment Income Tax—Individuals, Estates, and Trusts," can be a source of confusion for many taxpayers. Misunderstandings about its purpose, who needs to fill it out, and its impact on one's tax obligations can lead to unnecessary stress and errors. Here are six common misconceptions about Form 8960 clarified for better understanding.

- Only the Wealthy Need to File Form 8960: While it's true that the Net Investment Income Tax (NIIT) primarily affects those in higher income brackets, not all high earners will need to file Form 8960. The requirement to file depends on specific criteria related to one's net investment income and modified adjusted gross income exceeding certain thresholds, not merely the fact of being wealthy.

- Form 8960 Applies to All Types of Investment Income: Some might think that all investment income falls under the purview of the NIIT. However, certain types of investments are exempt. Generally, the NIIT applies to income such as dividends, interest, capital gains, rental and royalty income, and non-qualified annuities. Income from qualified retirement accounts like IRAs and 401(k)s are not subject to this tax.

- All Real Estate Income is Subject to NIIT: Although rental income is generally subject to NIIT, there are exceptions. Active participation in property management can lead to exemptions under specific circumstances, and the sale of a primary residence may also be partially or fully exempt depending on capital gain limits.

- Only Individuals File Form 8960: While it's commonly associated with individual taxpayers, Form 8960 must also be filed by estates and trusts with income exceeding certain thresholds. This highlights the wider applicability of the NIIT beyond just individual taxpayers.

- Filing Form 8960 Significantly Increases Tax Liability: Filing Form 8960 and paying the NIIT may not have as large an impact on an individual's overall tax liability as feared. The tax applies at a rate of 3.8% only on the lesser of one's net investment income or the amount by which their adjusted gross income exceeds the filing status threshold. Proper tax planning can help manage this liability.

- The IRS Automatically Calculates NIIT for You: Lastly, a common misconception is that the IRS will figure out whether you owe the NIIT and calculate it for you. Taxpayers are responsible for determining their own liability for the NIIT, completing Form 8960 as necessary, and including it with their tax return. While the IRS does review filings, the initial responsibility lies with the taxpayer.

In summary, the IRS Form 8960 and the NIIT involve a complex set of rules that may not apply uniformly across all investment scenarios or to all taxpayers. Understanding these common misconceptions can help taxpayers navigate their obligations more effectively and possibly alleviate concerns about complying with this aspect of the tax code.

Key takeaways

Understanding the IRS 8960 form is essential for anyone subject to the Net Investment Income Tax (NIIT). Below are key takeaways to help you correctly fill out and utilize this form:

The IRS 8960 form is used to calculate the Net Investment Income Tax, which applies to individuals, estates, and trusts with investment income above certain threshold amounts.

Investment income includes, but is not limited to, interest, dividends, capital gains, rental and royalty income, and non-qualified annuities.

Deductions related to your investment income can be subtracted when calculating your net investment income. This includes certain investment expenses, state and local taxes, and advisory fees.

The threshold amounts triggering the NIIT vary: for married couples filing jointly, it’s $250,000; for single or head of household filers, it’s $200,000; and for married individuals filing separately, it’s $125,000.

To accurately complete the IRS 8960 form, you need to gather all your income statements, such as 1099s and 1098 forms, as well as records of all deductible expenses.

The Net Investment Income Tax rate is 3.8%. This rate applies only to the lesser of your net investment income or the amount by which your modified adjusted gross income exceeds the statutory threshold that applies to you.

Filing the IRS 8960 form does not replace or eliminate the need to file an annual tax return; it’s an additional form required for those who meet the criteria for the NIIT.

If you use tax preparation software, make sure it supports the IRS 8960 form. This can simplify the process by automatically calculating your net investment income tax based on the information you enter.

Seeking the advice of a tax professional is advisable if you are unsure about your obligation to pay the Net Investment Income Tax or how to properly fill out the IRS 8960 form. They can provide guidance specific to your financial situation.

Popular PDF Documents

Housing Payment - Find out about NYCHA's endorsed rent payment avenues, allowing for a variety of payment points including PAYOMATIC and more.

Social Security Taxed - Simplifies the process of managing tax withholdings on government payments to prevent underpayment penalties.

Ifta Oregon - Monthly compliance document for transportation businesses to report and remit highway use taxes in Oregon.