Get IRS 8959 Form

Navigating the complexities of tax forms becomes particularly critical when it comes to understanding additional Medicare taxes that certain income levels necessitate, a concept captured by the IRS 8959 form. This document is essential for taxpayers who earn above a specific threshold, requiring them to pay an extra Medicare tax on their wages, compensation, and self-employment income that surpasses predetermined limits. It serves as a tool to calculate this addition, ensuring those who fall into higher income brackets contribute their fair share towards Medicare funding. Not only does the form cater to individuals, but it also affects couples filing jointly, adjusting the income thresholds accordingly. Beyond its primary function, Form 8959 also interacts with other tax forms and provisions, such as the Foreign Earned Income Tax Worksheet, demonstrating its integral role in the broader tax reporting and payment landscape. Understanding this form is vital for eligible taxpayers aiming to comply with tax laws while optimizing their financial health.

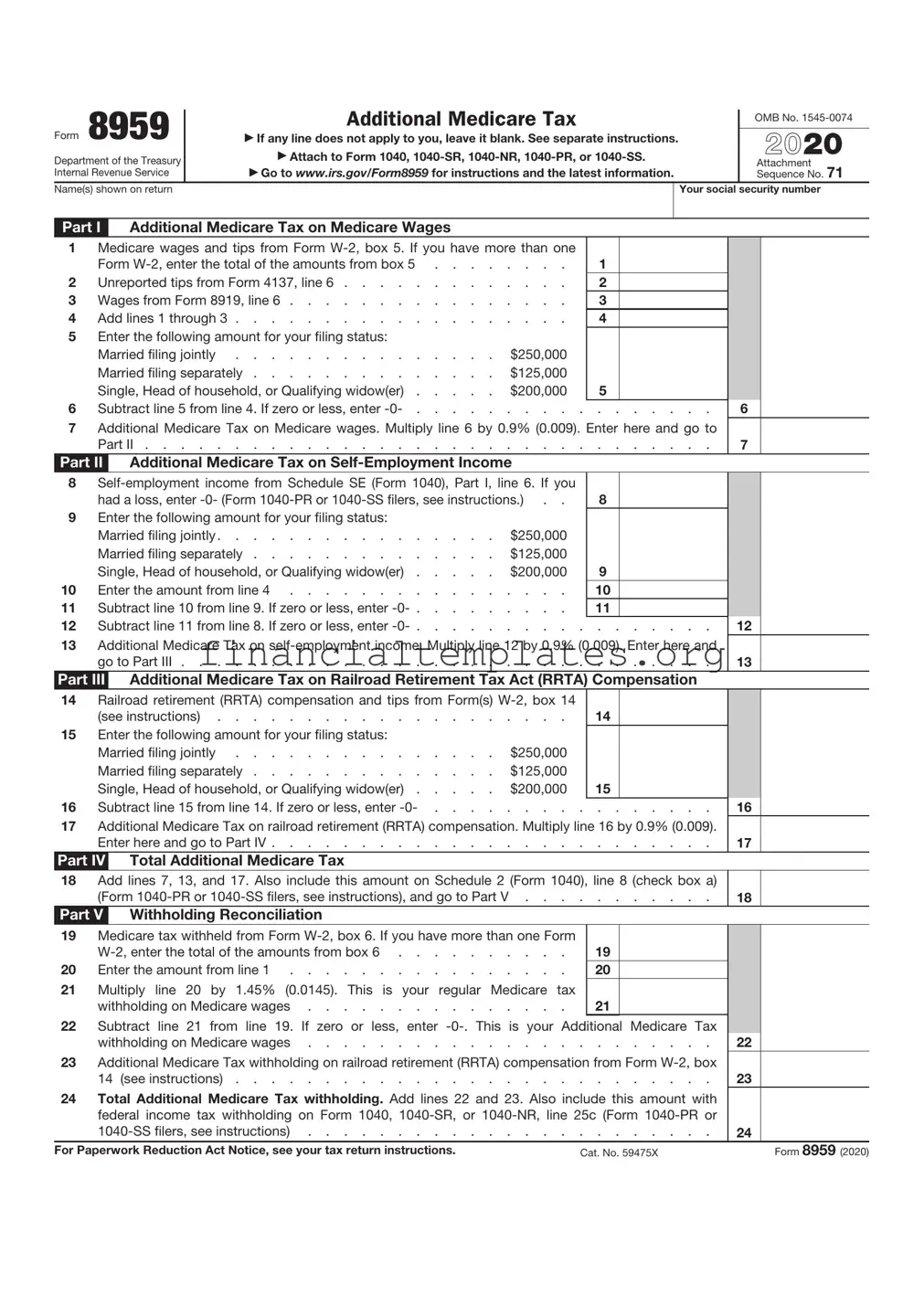

IRS 8959 Example

Form 8959 |

|

Additional Medicare Tax |

|

OMB No. |

|

|

|||

|

|

|

||

|

|

|

|

|

|

▶ If any line does not apply to you, leave it blank. See separate instructions. |

|

2021 |

|

Department of the Treasury |

|

▶ Attach to Form 1040, |

|

|

|

|

▶ Go to www.irs.gov/Form8959 for instructions and the latest information. |

|

Attachment |

Internal Revenue Service |

|

|

Sequence No. 71 |

|

Name(s) shown on return |

|

|

Your social |

security number |

Part I Additional Medicare Tax on Medicare Wages

1Medicare wages and tips from Form

|

Form |

1 |

2 |

Unreported tips from Form 4137, line 6 |

2 |

3 |

Wages from Form 8919, line 6 |

3 |

4 |

Add lines 1 through 3 |

4 |

5Enter the following amount for your filing status:

|

Married filing jointly |

$250,000 |

|

|

Married filing separately |

$125,000 |

|

|

Single, Head of household, or Qualifying widow(er) |

$200,000 |

5 |

6 |

Subtract line 5 from line 4. If zero or less, enter |

||

7Additional Medicare Tax on Medicare wages. Multiply line 6 by 0.9% (0.009). Enter here and go to

Part II . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Part II Additional Medicare Tax on

6

7

8

had a loss, enter |

8 |

9Enter the following amount for your filing status:

Married filing jointly . . . . . . . . . . . . . . . . $250,000

|

Married filing separately |

$125,000 |

|

|

Single, Head of household, or Qualifying widow(er) |

$200,000 |

9 |

10 |

Enter the amount from line 4 |

. . . . |

10 |

11 |

Subtract line 10 from line 9. If zero or less, enter |

. . . . |

11 |

12 |

Subtract line 11 from line 8. If zero or less, enter |

||

13Additional Medicare Tax on

Part III Additional Medicare Tax on Railroad Retirement Tax Act (RRTA) Compensation

12

13

14Railroad retirement (RRTA) compensation and tips from Form(s)

|

(see instructions) |

. . . . |

14 |

15 |

Enter the following amount for your filing status: |

|

|

|

Married filing jointly |

$250,000 |

|

|

Married filing separately |

$125,000 |

|

|

Single, Head of household, or Qualifying widow(er) |

$200,000 |

15 |

16 |

Subtract line 15 from line 14. If zero or less, enter |

||

17Additional Medicare Tax on railroad retirement (RRTA) compensation. Multiply line 16 by 0.9% (0.009). Enter here and go to Part IV . . . . . . . . . . . . . . . . . . . . . . . . .

Part IV Total Additional Medicare Tax

16

17

18Add lines 7, 13, and 17. Also include this amount on Schedule 2 (Form 1040), line 11 (Form

Part V Withholding Reconciliation

18

19Medicare tax withheld from Form

19 |

|

20 Enter the amount from line 1 |

20 |

21Multiply line 20 by 1.45% (0.0145). This is your regular Medicare tax

withholding on Medicare wages |

21 |

22Subtract line 21 from line 19. If zero or less, enter

withholding on Medicare wages |

22 |

23Additional Medicare Tax withholding on railroad retirement (RRTA) compensation from Form

14 (see instructions) |

23 |

24Total Additional Medicare Tax withholding. Add lines 22 and 23. Also include this amount with federal income tax withholding on Form 1040,

24 |

||

For Paperwork Reduction Act Notice, see your tax return instructions. |

Cat. No. 59475X |

Form 8959 (2021) |

Document Specifics

| Fact Number | Description |

|---|---|

| 1 | The IRS Form 8959 is used to calculate Additional Medicare Tax on earned income above certain thresholds. |

| 2 | This form applies to individuals earning more than $200,000 in a year, or $250,000 for married couples filing jointly. |

| 3 | The Additional Medicare Tax rate calculated using Form 8959 is 0.9% of the earnings that exceed the predefined thresholds. |

| 4 | Employers are responsible for withholding the Additional Medicare Tax from wages exceeding $200,000 regardless of the employee's filing status or other income. |

| 5 | IRS Form 8959 does not require state-specific versions as it deals with federal tax obligations. |

| 6 | Self-employed individuals also need to file Form 8959 for their earned income above the threshold, and calculate the tax as part of their self-employment tax liabilities. |

| 7 | Taxpayers must attach Form 8959 to their standard Form 1040 federal tax return. |

| 8 | There are no additional penalties for owing Additional Medicare Tax if sufficient tax has been withheld during the year or estimated tax payments have been made. |

Guide to Writing IRS 8959

Filling out IRS Form 8959 is a critical step for certain taxpayers who are subject to Additional Medicare Tax. It's important to accurately complete each section to ensure compliance with tax regulations. The process involves a few key stages: calculating your Medicare wages, determining any Additional Medicare Tax owed, and reporting this on your income tax return. By carefully following the steps below, you can successfully fill out the form and avoid potential issues with the IRS.

- Start by gathering all necessary documentation, including your W-2 forms and any self-employment income records. This information is crucial for calculating your Medicare wages and self-employment income accurately.

- Review the instructions for IRS Form 8959 to familiarize yourself with the form's requirements. The instructions provide detailed information on who must file the form, how to calculate Additional Medicare Tax, and where to report the tax on your return.

- Enter your name and social security number at the top of the form. This information should match what is on your income tax return.

- Calculate your total Medicare wages and self-employment income. Enter these amounts in the corresponding sections of the form. Be sure to include wages received from all employers, as well as any self-employment income.

- Determine if your income exceeds the threshold for your filing status. The IRS provides specific thresholds for single filers, married filing jointly, married filing separately, and head of household. If your income exceeds the threshold applicable to your filing status, you will need to calculate the Additional Medicare Tax owed.

- Use the formulas provided in the IRS Form 8959 instructions to calculate the amount of Additional Medicare Tax. This calculation involves subtracting the applicable threshold from your total Medicare wages and self-employment income, and then applying a 0.9% tax rate to the result.

- Enter the calculated Additional Medicare Tax on the form. There are specific lines designated for reporting the tax owed based on wages and self-employment income.

- If you had any nonrefundable credits that apply to the Additional Medicare Tax, report these on the form as well. The instructions for Form 8959 detail which credits are applicable and how to report them.

- Double-check your calculations and the information entered on the form. Errors can lead to delays in processing or a notice from the IRS.

- Attach Form 8959 to your federal income tax return. Make sure all other sections of your return are completed before attaching this form.

- Review the entire tax return one last time to ensure everything is accurate and complete. Once you're satisfied, submit your return by the filing deadline to avoid penalties.

After submitting your tax return with Form 8959 attached, you have completed your obligation for reporting Additional Medicare Tax. Make sure to keep copies of the form and any supporting documents for your records. If the IRS has any questions or requires additional information, being organized and having your documents readily available will make the process smoother.

Understanding IRS 8959

If you've ever glanced through your tax return forms and scratched your head in confusion, you're not alone. One form that often raises questions is the IRS Form 8959. This document is essential for certain taxpayers, and understanding it can make a significant difference when filing your taxes. Let's tackle some of the most common questions surrounding this form to help demystify the process.

- What is IRS Form 8959, and who needs to file it?

- What types of income are subject to the Additional Medicare Tax?

- How do I calculate the Additional Medicare Tax on Form 8959?

- What should I do if I've paid too much or too little Additional Medicare Tax?

IRS Form 8959 is used to calculate Additional Medicare Tax. Some individuals, estates, and trusts may need to pay this tax if their income exceeds certain thresholds. Specifically, you're required to file Form 8959 if your income from wages, self-employment, and railroad retirement (RRTA) compensation combined exceed the prescribed limits. These limits vary depending on your filing status, such as single, married filing jointly, or married filing separately.

The Additional Medicare Tax applies to Medicare wages, self-employment income, and railroad retirement (RRTA) compensation that exceed the applicable threshold for your filing status. It's important to note that different types of income, such as investment income, are not subject to this specific tax. However, individuals with high investment income might be subject to the Net Investment Income Tax (NIIT), which is a different matter.

To calculate the Additional Medicare Tax, you'll start by adding up all applicable income types: wages (from your W-2 form, box 5), self-employment income (from your Schedule SE), and railroad retirement (RRTA) compensation. If the total exceeds the threshold for your filing status, you would apply a 0.9% tax rate to the amount exceeding the threshold. Form 8959 provides a step-by-step guide to help you through this calculation process.

If you've overpaid your Additional Medicare Tax, you can claim a refund when you file your tax return. On the other hand, if you haven't paid enough, you may owe an additional amount when you file. It's crucial to accurately report all income and calculate the tax correctly to avoid potential penalties. If you're uncertain about your calculations or how much you owe, consider seeking guidance from a tax professional.

Common mistakes

Filling out the IRS Form 8959, which relates to Additional Medicare Tax, often proves challenging for taxpayers, leading to several common mistakes. The form is used to calculate the 0.9% Medicare surtax on earnings exceeding a threshold amount based on filing status, an aspect of the Affordable Care Act. Missteps in completing this form can result in errors in tax calculation, potentially leading to underpayments, overpayments, and the risk of penalties.

Not recognizing when the form is required: Taxpayers sometimes overlook the necessity of filing Form 8959 entirely. If an individual's income exceeds the prescribed threshold based on their filing status, this form is essential to calculate and report the Additional Medicare Tax owed.

Incorrectly calculating the threshold income: It's pivotal to understand the income thresholds that trigger the Additional Medicare Tax. These thresholds vary significantly depending on filing status, such as single, married filing jointly, or married filing separately. Errors in identifying the correct threshold can lead to miscalculations of tax owed.

Failure to include all sources of income: For the purposes of Form 8959, all applicable income must be considered. This includes wages, self-employment income, and railroad retirement (RRTA) compensation. Excluding any relevant income sources can result in incorrect calculation of the tax.

Overlooking additional Medicare tax on self-employment income: Individuals often miss adding the taxable portion of self-employment income to their total income. This oversight can affect the Additional Medicare Tax calculation, as both wage and self-employment income above the threshold are subject to this tax.

Misunderstanding how to allocate spousal income: In cases where both spouses receive wages that individually do not surpass the threshold for married filing jointly but do so when combined, there is often confusion. Allocation of income between spouses and understanding the combined threshold is crucial to avoid inaccuracies.

Incorrectly claiming adjustments: Taxpayers sometimes miscalculate the allowable adjustments to self-employment income or wages. Correctly determining adjustments is vital to ensure accurate computation of the Additional Medicare Tax.

Entering information in the wrong lines or sections: Due to the form's complexity, individuals may inadvertently place information in the incorrect sections, leading to potential errors in calculation. Paying close attention to the detailed instructions for each line is necessary to avoid this mistake.

Failing to consider the impact of foreign earned income: For those who have foreign earned income and claim the Foreign Earned Income Exclusion, recalculating the excluded income in the context of Additional Medicare Tax is a step that is frequently missed. This can lead to inaccurate tax calculations and potential issues with the IRS.

In summary, understanding the specific requirements and properly calculating the applicable figures on IRS Form 8959 are critical to ensure accurate Additional Medicare Tax payments. Avoiding these common mistakes can help taxpayers comply with tax laws, thus preventing potential penalties. It's advisable for individuals who are unsure about their obligations or how to complete this form to consult with a tax professional.

Documents used along the form

When handling taxes, particularly those related to Additional Medicare Tax, IRS Form 8959 is necessary. This form is a crucial document for individuals subject to this tax, but it's seldom the only one needed during the tax filing process. We'll explore other forms and documents commonly used alongside Form 8959 to provide a comprehensive overview of what might be required.

- Form 1040: The U.S. Individual Income Tax Return is the primary form used by individuals to file their annual income tax returns. It's essential for reporting income, claiming deductions, and calculating the total tax liability or refund due.

- Form 1040-SS: This form is for individuals who are self-employed in U.S. territories. It's used to report self-employment income and calculate the self-employment tax, which could impact the calculations on Form 8959.

- Form W-2: Wage and Tax Statement provided by employers, detailing an employee's annual wages and the amount of taxes withheld from their paycheck. Form W-2 is key to completing Form 8959 because it provides necessary income numbers.

- Form 1099-MISC: This document reports payments made to freelancers, independent contractors, and other non-employees. If someone has received income reported on a Form 1099-MISC, it may affect the calculations on Form 8959.

- Form 1099-NEC: This form has replaced Form 1099-MISC for reporting nonemployee compensation. It's essential for individuals who have received contractor payments or have freelance income.

- Form 4868: Application for Automatic Extension of Time To File U.S. Individual Income Tax Return. This form is crucial for individuals who need extra time to file their taxes, impacting when other forms, including Form 8959, are submitted.

- Form 8959 Instructions: Not a form per se, but the instruction booklet for Form 8959 is essential. It provides detailed guidelines on how to complete Form 8959 accurately, ensuring compliance with tax laws.

- Schedule SE (Form 1040 or 1040-SR): Self-Employment Tax calculation form. This schedule is essential for anyone who must file Form 8959 because it helps calculate the Medicare portion that may be subject to the Additional Medicare Tax.

Together, these forms and documents play a vital role in the accurate and law-abiding completion of tax returns involving Additional Medicare Tax. It's crucial to understand how each form interacts with the others to ensure a seamless tax filing experience. While Form 8959 may be the focus, each document has its significance, contributing pieces to the larger puzzle of an individual's tax responsibilities.

Similar forms

The IRS Form 8959 is used to calculate and report Additional Medicare Tax on earnings above a certain threshold. It serves a purpose similar to the IRS Form 941, Employer's Quarterly Federal Tax Return. The Form 941 is where employers report income taxes, social security tax, or Medicare tax withheld from employee's paychecks, and they also pay their portion of social security or Medicare tax. Both forms deal with Medicare contributions, but while Form 8959 is for individual taxpayers, Form 941 is utilized by employers to report payroll taxes.

Similarly, IRS Form 8960, Net Investment Income Tax—Individuals, Estates, and Trusts, shares common ground with Form 8959. Form 8960 is used to calculate the Net Investment Income Tax which applies to individuals, estates, and trusts with income above specified thresholds. Both forms involve additional taxes for higher-income earners, but they focus on different sources of income: Form 8959 targets earnings and self-employment income, whereas Form 8960 centers on investment income.

Form 1040, the U.S. Individual Income Tax Return, is another document closely associated with Form 8959. The Form 1040 is the standard federal income tax form used by citizens or residents of the United States to file an annual income tax return. It encompasses all types of income, deductions, and credits. Earnings that may be subject to Additional Medicare Tax and need to be reported on Form 8959 are initially documented on Form 1040, making Form 8959 a supplementary form for taxpayers who exceed the earnings threshold for additional Medicare contributions.

The W-2 form, Wage and Tax Statement, also relates to the IRS Form 8959. Employers issue W-2 forms to report an employee's annual wages and the amount of taxes withheld from their paycheck. This information is crucial for individuals in filling out their 1040 forms and, accordingly, determining whether they owe Additional Medicare Tax as calculated on Form 8959. The W-2 form provides a basis for understanding one's earnings in relation to the thresholds that trigger the Additional Medicare Tax, necessitating the use of Form 8959 for eligible taxpayers.

Dos and Don'ts

When filling out the IRS 8959 form, taxpayers must adhere to guidelines that ensure accuracy and compliance with tax laws. It's essential to understand both the dos and don'ts to avoid common pitfalls and potential penalties. Below are lists of recommended practices and common mistakes to avoid.

Things You Should Do

- Ensure that all your information is accurate and up-to-date, especially your Social Security Number and the Medicare wages and tips reported.

- Calculate Additional Medicare Tax accurately using the instructions provided with the form to avoid either underpayment or overpayment.

- Double-check the amounts entered on the form, especially when calculating the tax owed, as errors could result in penalties or delays.

- Keep a copy of the completed form and all relevant documents for your records in case the IRS has queries or you need to amend the form later.

Things You Shouldn't Do

- Do not disregard instructions about when to file Form 8959. The form is necessary for individuals with wages or self-employment income exceeding specific thresholds.

- Avoid guessing amounts or entering figures without proper documentation; all entries should be supported by accurate records.

- Don't submit the form without reviewing it for common errors, such as transposed numbers or incorrect calculations.

- Never ignore IRS notices regarding discrepancies or requests for additional information about your Form 8959. Respond promptly to avoid further issues.

Misconceptions

When it comes to taxes, understanding the purpose and requirements of different forms can often be confusing. One such form that frequently befuddles taxpayers is the IRS Form 8959. This form deals with the Additional Medicare Tax, a topic surrounded by various misconceptions. Let’s clear up some of the most common misunderstandings regarding this form.

- Misconception 1: Only the wealthy need to file Form 8959.

One common misconception is that Form 8959 is only for the wealthy, but this isn't entirely accurate. While it's true that the Additional Medicare Tax applies to individuals whose income exceeds a certain threshold, these thresholds can occasionally apply to middle-class taxpayers as well, especially those who may have had a significant one-time income increase such as a bonus, a profitable investment sale, or substantial self-employment income in a given year.

- Misconception 2: Form 8959 calculations are integrated into the standard 1040 form.

Another misunderstanding is that the calculations for the Additional Medicare Tax are directly integrated into the standard 1040 income tax return form. In reality, taxpayers must calculate their Additional Medicare Tax on Form 8959 and report this tax separately on their 1040 form, under the "Other Taxes" section. This separation emphasizes the specific calculations needed for the Additional Medicare Tax, which are not accounted for in the standard 1040 form.

- Misconception 3: Only earned income is subject to Additional Medicare Tax.

Many taxpayers believe that only earned income, such as wages and self-employment income, is subject to the Additional Medicare Tax. However, the tax actually applies to a broader range of income, including railroad retirement (RRTA) compensation and, in certain instances, earnings derived from abroad. Understanding the comprehensive nature of income subject to this tax is crucial for correctly completing Form 8959.

- Misconception 4: If no Additional Medicare Tax is owed, filing Form 8959 is unnecessary.

A final misconception is that if a taxpayer calculates their income and determines that no Additional Medicare Tax is owed, they do not need to file Form 8959 with their tax return. In truth, if a taxpayer's income exceeds the threshold that subjects them to the Additional Medicare Tax, they must file Form 8959 even if no tax is owed after deductions and exemptions are applied. This requirement ensures accurate reporting and allows the IRS to verify the taxpayer's calculations.

Correctly understanding and applying the rules of IRS Form 8959 is crucial for taxpayers who meet the income thresholds. By clearing up these misconceptions, taxpayers can avoid common mistakes and ensure they comply with tax laws, potentially avoiding unintended consequences like audits, penalties, or fines.

Key takeaways

The IRS Form 8959 is used to calculate and report Additional Medicare Tax for individuals whose income exceeds a certain threshold. This form serves as a crucial tool for ensuring taxpayers adequately cover their tax liabilities. Here are five key takeaways on how to effectively fill out and use the IRS 8959 form.

- Determine if you are required to file: Before filling out Form 8959, individuals should determine whether their income exceeds the threshold set for their filing status. This includes considering wages, self-employment income, and compensation that is subject to Medicare Tax. It's important to assess all sources of income to accurately determine filing necessity.

- Understand the income thresholds: The Additional Medicare Tax applies to individual incomes that surpass a certain level, which varies based on filing status. For instance, the threshold for single filers and married individuals filing separately is different from that of married couples filing jointly or qualifying widows(er)s with dependent children. Being aware of these thresholds is crucial for accurate form completion.

- Accurately report wages and self-employment income: Form 8959 requires detailed reporting of wages and self-employment income that are subject to the Additional Medicare Tax. This includes, but is not limited to, wages received as an employee and business income for those who are self-employed. Proper documentation and careful calculation are necessary to ensure all applicable income is reported.

- Calculate the Additional Medicare Tax owed: Based on the reported income, taxpayers use Form 8959 to calculate the amount of Additional Medicare Tax they owe. This requires a precise understanding of the calculation instructions provided within the form to ensure the tax is computed correctly.

- Include Form 8959 with your tax return: After completing Form 8959, it must be attached to your federal tax return when filed. The calculated Additional Medicare Tax becomes part of the total tax liability reported on your tax return. Ensuring that Form 8959 is completed accurately and included with your tax return is essential for compliance with tax laws and avoidance of potential penalties.

By thoroughly understanding these key aspects, taxpayers can navigate the complexities of Form 8959 with greater confidence and accuracy, ensuring they meet their tax responsibilities without issue.

Popular PDF Documents

IRS 1040-X - This form is part of the taxpayer's responsibility to report accurately and pay the correct amount of tax.

Pay Sales Tax Colorado - Before setting up shop in Denver, complete your Sales, Use, and Lodger’s Tax License application to comply with city tax laws.

Borrowing From Tsp - Under certain circumstances, where obtaining a spouse's signature is not feasible, applicants must provide the spouse's Social Security Number and may need to submit additional documentation.