Get IRS 8949 Form

The world of taxes can often seem daunting, with its myriad forms and rules that must be followed. Among these, the IRS Form 8949 plays a crucial role for individuals and entities alike when it comes to reporting capital gains and losses from various transactions. Whether you're selling stocks, bonds, or perhaps disposing of property, understanding how to correctly fill out and file this form is key to ensuring compliance with tax laws and possibly optimizing your tax situation. The form serves not just as a means to report the details of each transaction, but also guides the taxpayer through adjusting the gain or loss based on specific codes provided by the IRS. Furthermore, the information from Form 8949 is used to complete other necessary parts of your tax return, tying your reported transactions directly to your taxable income calculation. Given its importance, getting to grips with Form 8949 can provide peace of mind and a clearer path through the tax-filing process.

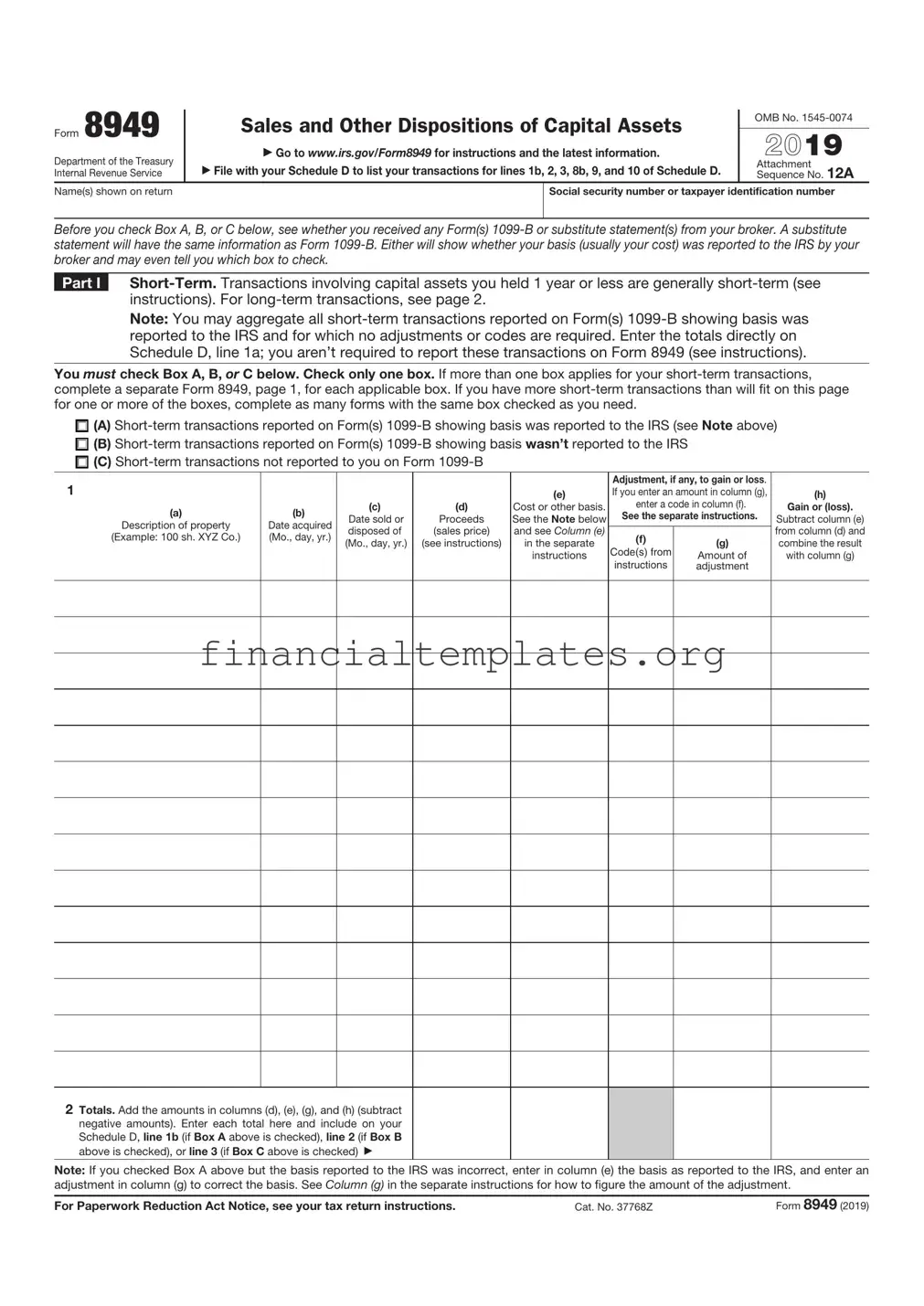

IRS 8949 Example

Form 8949 |

Sales and Other Dispositions of Capital Assets |

OMB No. |

||

|

||||

2021 |

||||

Department of the Treasury |

▶ Go to www.irs.gov/Form8949 for instructions and the latest information. |

|||

▶ File with your Schedule D to list your transactions for lines 1b, 2, 3, 8b, 9, and 10 of Schedule D. |

Attachment |

|||

Internal Revenue Service |

Sequence No. 12A |

|||

Name(s) shown on return |

|

Social security number or taxpayer identification number |

||

|

|

|

|

|

Before you check Box A, B, or C below, see whether you received any Form(s)

Part I

Note: You may aggregate all

You must check Box A, B, or C below. Check only one box. If more than one box applies for your

(A)

(A)

(B)

(B)

(C)

(C)

1 |

|

|

|

|

Adjustment, if any, to gain or loss. |

|

||

|

|

|

(e) |

If you enter an amount in column (g), |

(h) |

|||

(a) |

(b) |

(c) |

(d) |

Cost or other basis. |

enter a code in column (f). |

Gain or (loss). |

||

Date sold or |

Proceeds |

See the Note below |

See the separate instructions. |

Subtract column (e) |

||||

Description of property |

Date acquired |

disposed of |

(sales price) |

and see Column (e) |

|

|

from column (d) and |

|

(Example: 100 sh. XYZ Co.) |

(Mo., day, yr.) |

(f) |

(g) |

|||||

(Mo., day, yr.) |

(see instructions) |

in the separate |

combine the result |

|||||

|

|

Code(s) from |

||||||

|

|

|

|

instructions |

Amount of |

with column (g) |

||

|

|

|

|

|

instructions |

adjustment |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2 Totals. Add the amounts in columns (d), (e), (g), and (h) (subtract |

|

|

|

|

|

|||

negative amounts). Enter each total here and include on your |

|

|

|

|

|

|||

Schedule D, line 1b (if Box A above is checked), line 2 (if Box B |

|

|

|

|

|

|||

above is checked), or line 3 (if Box C above is checked) ▶ |

|

|

|

|

|

|||

Note: If you checked Box A above but the basis reported to the IRS was incorrect, enter in column (e) the basis as reported to the IRS, and enter an adjustment in column (g) to correct the basis. See Column (g) in the separate instructions for how to figure the amount of the adjustment.

For Paperwork Reduction Act Notice, see your tax return instructions. |

Cat. No. 37768Z |

Form 8949 (2021) |

Form 8949 (2021) |

Attachment Sequence No. 12A |

Page 2 |

Name(s) shown on return. Name and SSN or taxpayer identification no. not required if shown on other side

Social security number or taxpayer identification number

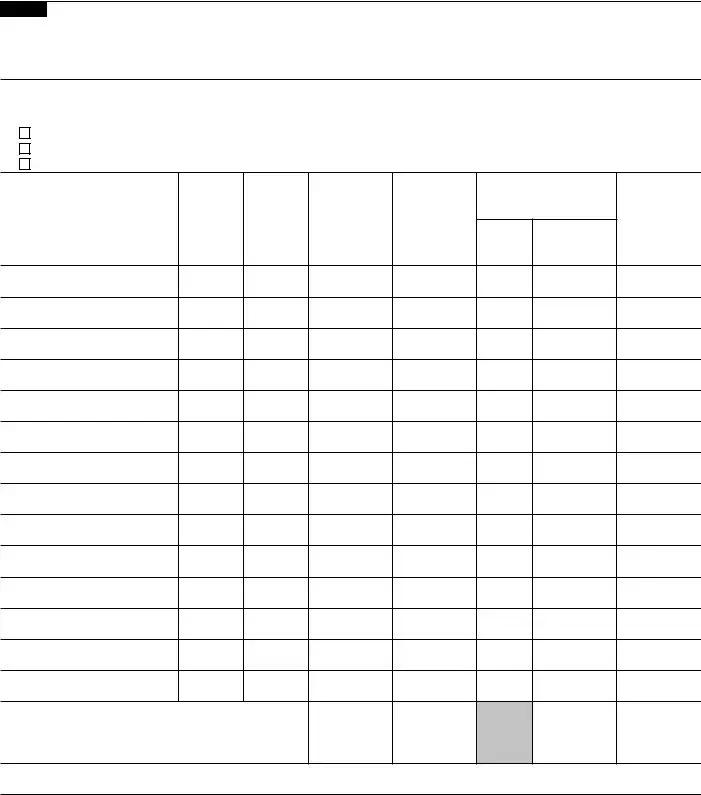

Before you check Box D, E, or F below, see whether you received any Form(s)

Part II

Note: You may aggregate all

You must check Box D, E, or F below. Check only one box. If more than one box applies for your

(D)

(D)

(E)

(E)

(F)

(F)

1 |

|

|

|

|

Adjustment, if any, to gain or loss. |

|

||

|

|

|

(e) |

If you enter an amount in column (g), |

(h) |

|||

(a) |

(b) |

(c) |

(d) |

Cost or other basis. |

enter a code in column (f). |

Gain or (loss). |

||

Date sold or |

Proceeds |

See the Note below |

See the separate instructions. |

Subtract column (e) |

||||

Description of property |

Date acquired |

disposed of |

(sales price) |

and see Column (e) |

|

|

from column (d) and |

|

(Example: 100 sh. XYZ Co.) |

(Mo., day, yr.) |

(f) |

(g) |

|||||

(Mo., day, yr.) |

(see instructions) |

in the separate |

combine the result |

|||||

|

|

Code(s) from |

||||||

|

|

|

|

instructions |

Amount of |

with column (g) |

||

|

|

|

|

|

instructions |

adjustment |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2 Totals. Add the amounts in columns (d), (e), (g), and (h) (subtract |

|

|

|

|

|

|||

negative amounts). Enter each total here and include on your |

|

|

|

|

|

|||

Schedule D, line 8b (if Box D above is checked), line 9 (if Box E |

|

|

|

|

|

|||

above is checked), or line 10 (if Box F above is checked) ▶ |

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

Note: If you checked Box D above but the basis reported to the IRS was incorrect, enter in column (e) the basis as reported to the IRS, and enter an adjustment in column (g) to correct the basis. See Column (g) in the separate instructions for how to figure the amount of the adjustment.

Form 8949 (2021)

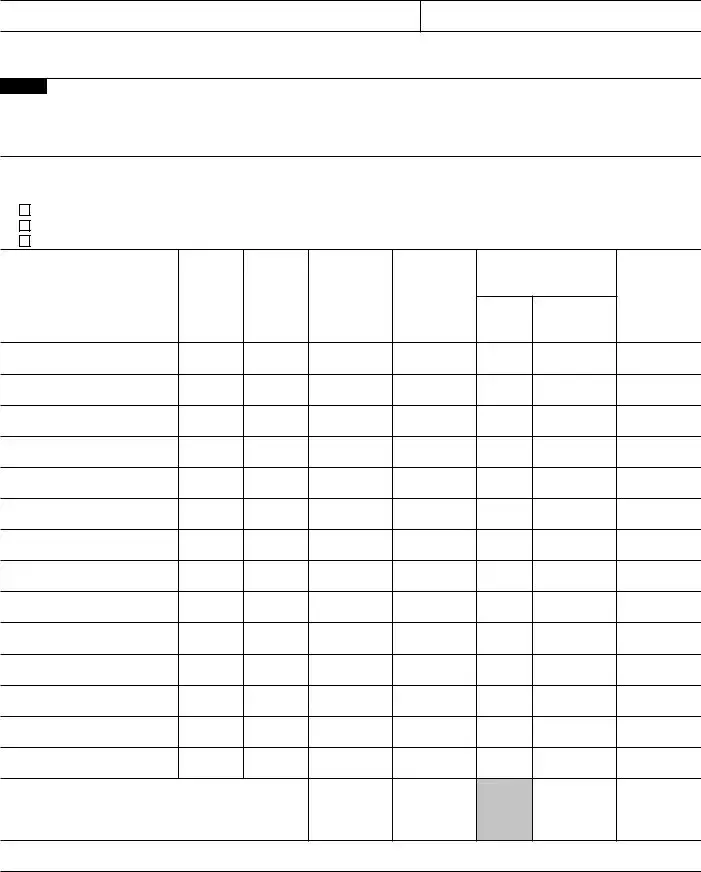

Document Specifics

| Fact Name | Description |

|---|---|

| Purpose of Form 8949 | Used to report sales and exchanges of capital assets, including stocks, bonds, and real estate. |

| Attachment to Other Forms | Must be filed along with Schedule D (Form 1040 or 1040-SR) for tax return purposes. |

| Types of Transactions | Divides transactions into short-term and long-term based on the duration the asset was held. |

| Reporting Requirements | Individuals are required to report both the sale price and the cost basis to calculate the gain or loss. |

| Special Adjustments | Includes columns for adjustments to gain or loss, such as for market discounts or nondeductible losses. |

| State-Specific Forms | Some states may require additional forms or reports. No federal form is universally applicable for state tax reporting. |

Guide to Writing IRS 8949

Completing the IRS Form 8949 is an essential step for individuals in the United States who need to report sales and other dispositions of capital assets on their federal income tax returns. This form serves as a detailed record, enabling taxpayers to calculate capital gains or losses, which then affects their tax obligations. The process involves several critical steps, from identifying transaction types to providing detailed information about each sale or disposition. Follow these instructions carefully to ensure accuracy and compliance with IRS requirements.

- Determine the need for Form 8949 by assessing whether you've sold or exchanged capital assets in the tax year. If so, you'll use this form to report these transactions.

- Download a current version of Form 8949 from the IRS website to ensure you're using the most up-to-date format.

- Identify which part of the form to use: Part I for short-term transactions or Part II for long-term transactions. Short-term transactions are those where the property was held for one year or less.

- For each transaction, fill in the required details in the appropriate section. This includes the description of the property, the date acquired, the date sold, the sales price, the cost or other basis, and the adjustment amount, if any.

- If a transaction is reported on a 1099-B form and the basis was reported to the IRS, check box A in the applicable section. If the basis was not reported to the IRS, check box B. If neither box A nor B applies, check box C.

- Calculate the gain or loss for each transaction. Subtract the cost or other basis, plus any adjustments, from the sales price.

- Summarize the totals for all short-term transactions in Part I and all long-term transactions in Part II. These totals will be transferred to Schedule D (Form 1040), which is used to calculate the overall capital gain or loss.

- Review the completed form for accuracy. Ensure all transactions are correctly reported and all calculations are accurate.

- Sign and date Form 8949 if required. Attach Form 8949 to your Form 1040 tax return or the tax return form appropriate for your filing status and submit it to the IRS by the filing deadline.

Accurately completing IRS Form 8949 is crucial for accurately reporting capital gains or losses, which can significantly affect your tax liability. Failing to report these transactions correctly can lead to penalties. If you have numerous transactions or complex situations, consider consulting a tax professional. This will help you navigate the complexities of tax law and ensure your returns are complete and accurate.

Understanding IRS 8949

What is the IRS Form 8949 used for?

IRS Form 8949 is used to report the sale or exchange of capital assets. This includes stocks, bonds, real estate, and other investments. Taxpayers use this form to calculate their capital gains or losses from these transactions, which are then reported on Schedule D of their tax return.

Who needs to fill out the IRS Form 8949?

Any individual, partnership, corporation, trust, or estate that has sold or exchanged capital assets during the tax year should complete Form 8949. If you've received forms 1099-B or 1099-S, or any similar statement showing the sale or exchange of these assets, you'll likely need to prepare Form 8949.

What information do I need to complete Form 8949?

To properly fill out Form 8949, you'll need details of each sale or exchange, including:

- The date you acquired the asset

- The date you sold the asset

- How much you received from the sale

- The cost or other basis plus any adjustments

- Codes to indicate any adjustments to gains or losses

How do I report the sale of my home on Form 8949?

If you sold your home, you might not have to report the sale on Form 8949 if you're eligible to exclude all or part of the gain. If you do need to report the sale, you'll list the details of the sale and any adjustments, including the exclusion, on Form 8949.

Can I file Form 8949 electronically?

Yes, Form 8949 can be filed electronically along with your other tax forms. Many tax software programs will guide you through filling out Form 8949 and submit it electronically with your tax return. You can also have a tax professional file it electronically on your behalf.

What if I have too many transactions to report on Form 8949?

If you have a large number of transactions, you can attach statements to your Form 8949 instead of listing each transaction individually on the form. These statements must follow the same format as Form 8949. You must still fill out the summary information on Form 8949 and check the box that indicates you have attached statements.

How does Form 8949 affect my tax return?

After you fill out Form 8949, you'll use the information to complete Schedule D (Form 1040), which calculates your total capital gains or losses. This total impacts your income tax liability by either increasing your tax owed for gains or decreasing your tax owed if you have losses.

What should I do if I receive a corrected 1099 after I've already filed my tax return?

If you receive a corrected Form 1099 after you've filed your tax return, you may need to amend your return using Form 1040-X. You'll need to correct your Form 8949 and Schedule D with the new information provided in the corrected 1099, then submit these with your amended return.

Are there any penalties for incorrectly filing Form 8949?

If you fail to properly report a transaction or provide inaccurate information on Form 8949, the IRS may impose penalties. This can include penalties for underpayment of tax, and in some cases, accuracy-related penalties or fraud penalties. It’s important to carefully review your Form 8949 before submitting it to avoid these penalties.

Common mistakes

When preparing tax documents, accuracy is of the utmost necessity, especially when dealing with forms related to financial transactions. The IRS Form 8949, used for reporting sales and other dispositions of capital assets, often poses challenges to individuals aiming for precision in their tax filings. Notable mistakes can compromise the integrity of the tax return, potentially leading to audits, penalties, or delays in processing. Below are four common errors made when completing this crucial document.

Failing to report all transactions: Some individuals mistakenly believe they only need to report transactions resulting in significant gains or those for which they have received a Form 1099-B. It is crucial to report every transaction of capital assets, regardless of the outcome or if the broker has already submitted documentation to the IRS. This encompasses all sales and exchanges of stocks, bonds, real estate, and other asset types.

Not separating short-term and long-term transactions: Transactions must be divided based on the duration the asset was held. Short-term transactions involve assets held for one year or less, while long-term transactions concern those held for more than a year. Proper classification is important because these transactions are taxed differently, with long-term gains typically incurring lower tax rates. Mishandling this separation can lead to inaccuracies in calculated tax due.

Mixing up the columns for cost or other basis and proceeds: A frequent oversight is the incorrect entry of amounts in the columns designated for the cost (or other basis) and the proceeds from the sale of an asset. This mistake directly impacts the calculated gain or loss. Ensuring that each amount is placed in the correct column is critical for reflecting the true nature of the transaction.

Omitting adjustments, when necessary: Certain situations require adjustments to the cost basis or proceeds, such as for inherited assets, gifts, or when applying specific wash sale rules. Neglecting to make these adjustments can result in the inaccurate reporting of the capital gain or loss. It is imperative to apply and report any required adjustments to accurately conform to IRS regulations and to ensure the correct tax liability is assessed.

In the pursuit of accuracy in tax reporting, attentiveness to detail and a thorough understanding of the IRS Form 8949 instructions can mitigate the risk of these and other errors. Whether preparing taxes personally or with the help of a professional, ensuring the correct and complete reporting on Form 8949 is a step towards maintaining compliance with IRS requirements and achieving peace of mind during tax season.

Documents used along the form

When you're working with the IRS Form 8949, which is used to report sales and exchanges of capital assets, there are several other documents and forms you might need to complete your tax return accurately. Understanding these additional forms can make the filing process smoother and help ensure you comply with IRS requirements.

- Schedule D (Form 1040): This form is essential for summarizing the capital gains and losses from all transactions reported on Form 8949. Schedule D helps determine if you owe taxes on your gains or can deduct your losses, and it must be filed with your Form 1040 tax return.

- Form 1099-B: Brokers and mutual fund companies use Form 1099-B to report the sale of stocks, bonds, and mutual funds to investors and the IRS. This form provides necessary information such as the date of sale, the purchase price, and the sale price, which are needed to complete Form 8949.

- Form 1099-S: For real estate transactions, Form 1099-S is used by the person responsible for closing the deal to report the sale or exchange of real estate. This form provides details that are necessary for filling out Form 8949, especially when reporting the sale of property.

- Form 4562: If you're claiming depreciation on assets that resulted in a capital gain or loss, you'll need to fill out Form 4562. This form details the depreciation and amortization allowances and is used alongside Form 8949 when reporting the sale of depreciated property.

Together, these forms provide a comprehensive reporting system for capital transactions. Accurately completing and filing these forms with the IRS ensures that all capital gains and losses are correctly recorded, helping to avoid potential issues and ensuring compliance with tax laws.

Similar forms

The IRS 8949 form, pivotal for reporting sales and other dispositions of capital assets, resonates with several other tax documents through its purpose and structure. One such document is the Schedule D (Form 1040), which directly interacts with Form 8949. The Schedule D is utilized to summarize capital gains and losses from transactions reported on Form 8949, presenting a streamlined way to calculate the tax impact of these gains or losses. Both forms work in tandem to ensure individuals accurately report their investment activity during the fiscal year.

Similarly, Form 1099-B, often issued by brokers or mutual fund companies, shares characteristics with Form 8949. Form 1099-B provides details of sales and other transactions to both the taxpayer and the IRS, including information necessary to complete Form 8949, such as dates of transactions and the amounts. It's a primary document that taxpayers use as a reference when filling out the 8949, ensuring that all pertinent details of their capital transactions are accurately captured and reported.

Another document, Form 4797, used for reporting the sale or exchange of business property, also shares a conceptual kinship with Form 8949. Though Form 4797 is specifically for business assets, unlike the more general application of Form 8949, both require detailed reporting of transactions, including sales dates, amounts, and gain or loss calculations. This detailed reporting is crucial for assessing tax obligations related to asset disposition.

Form 6252, which is employed for reporting income from installment sales, parallels the IRS 8949 in its need for transactional detail and its role in recognizing revenue from sales over time. While Form 6252 is tailored toward the specific financing arrangement of installment sales, both forms are integral to determining the timing and magnitude of income recognition for tax purposes.

The Schedule E (Form 1040) is another document sharing similarities with Form 8949, especially in the realm of reporting income from rental properties, royalties, partnerships, S corporations, trusts, and estates. Although Schedule E focuses on passive income and loss, as opposed to the capital gains and losses of Form 8949, both forms contribute to a comprehensive view of an individual's tax situation through detailed income reporting.

Form 8824, concerning Like-Kind Exchanges, also bears resemblance to Form 8949 in its emphasis on the specifics of exchanges involving business or investment properties. Though Form 8824 deals with deferring tax on exchanges that qualify under specific criteria, it requires detailed record-keeping and reporting of these transactions, akin to the level of detail demanded by Form 8949 for capital asset transactions.

The Schedule B (Form 1040) is pertinent to the discussion for its role in reporting interest and ordinary dividends. While Schedule B focuses on a different type of income than Form 8949, the precision in reporting and the necessity to disclose detailed information about income sources are parallel themes in both documents, illustrating their importance in the accurate completion of tax returns.

Form 1040, U.S. Individual Income Tax Return itself, while being the umbrella document under which many of the forms, including Form 8949, are filed, shares a connection through its comprehensive nature. It's the summative document that requires integration of information from various sources, including capital gains and losses reported on Form 8949, underscoring the interrelatedness of these forms in the broader tax reporting ecosystem.

Last, but certainly not least, Form 8938, Statement of Specified Foreign Financial Assets, also parallels Form 8949 in its requirement for detailed reporting. Though geared towards reporting of foreign assets, Form 8938's emphasis on thorough disclosure resonates with the meticulous nature of reporting demanded by Form 8949, underlining the importance of precision in tax documentation.

In conclusion, although the IRS 8949 form serves a unique purpose in the landscape of tax reporting, it shares common ground with a variety of other tax documents. These connections underscore the complexity and interconnectedness of tax reporting, highlighting the importance of accuracy and detail across all forms of income and asset reporting.

Dos and Don'ts

The Internal Revenue Service (IRS) Form 8949 is crucial for reporting the sales and exchanges of capital assets. Completing this form accurately is essential for taxpayers to comply with tax reporting requirements and to ensure they accurately report capital gains or losses. Here are essential dos and don'ts to consider when filling out Form 8949:

Do:- Ensure all the information entered matches the data on your 1099-B forms. It's crucial for the information on Form 8949 to align with what your brokerage or financial institution reports to the IRS.

- Separate transactions based on whether they result in long-term or short-term capital gains or losses. This distinction is important because long-term and short-term transactions are taxed differently.

- Use the correct codes in column (f) to indicate any adjustments to gains or losses. These codes are necessary to explain why the amounts reported to the IRS may differ from the proceeds recorded on your 1099-B.

- Check your math carefully, especially when calculating the cost basis and the adjustment amounts. Incorrect calculations can lead to reporting errors, resulting in either underpayment or overpayment of taxes.

- Consult the IRS instructions for Form 8949 or a tax professional if you encounter difficulties or have questions about specific transactions. It's better to seek guidance than to make an error on your tax return.

- Remember to sign and date the form if you're filing a paper return. While this might seem basic, an unsigned tax return is considered invalid and can lead to delays in processing.

- Attempt to abbreviate or consolidate transactions in an effort to save space. Each transaction needs its own line to ensure clarity and accuracy in reporting.

- Overlook reporting transactions for which you did not receive a 1099-B form. You're required to report all sales and exchanges of capital assets, regardless of whether you've received a form.

- Forget to report adjustments to the cost basis of sold assets. This can include improvements to real estate or fees and commissions related to the sale. Failing to report these adjustments could lead to an incorrect calculation of capital gains or losses.

- Misclassify the type of asset sold, as this could affect the tax treatment of your gains or losses. For instance, special rules apply to the sale of collectibles and certain small business stocks.

- Ignore errors from previous years. If you discover a mistake in how you reported transactions on Form 8949 in the past, it's important to submit an amended return to correct it.

- Underestimate the importance of keeping records. Documentation for every transaction reported on Form 8949 should be retained for at least three years after the due date of the return or the date it was filed, whichever is later.

Misconceptions

Many taxpayers find the IRS 8949 form a bit confusing, leading to common misunderstandings about its purpose and how it is used. Let's address some of these misconceptions to clear the air.

It's only for reporting stocks and bonds. A common misconception is that Form 8949 is only used to report transactions related to stocks and bonds. However, this form is used to report all sales and exchanges of capital assets, including real estate, cryptocurrencies, and art, among others. The scope of what must be reported is much broader than many believe.

If I didn’t make a profit, I don’t need to file. Another misunderstanding is the belief that transactions resulting in a loss or no profit do not need to be reported. In reality, all transactions, whether they result in a gain or a loss, must be reported on Form 8949. Reporting losses can actually be beneficial as they may offset other capital gains or even ordinary income, subject to certain limits.

The IRS already knows about my transactions, so I don’t need to report them. Many assume that because financial institutions report transactions to the IRS, individual taxpayers do not need to report these on their own. While it's true that institutions report many transactions, taxpayers are still responsible for reporting all transactions on Form 8949. This ensures all information is accurate and any discrepancies can be addressed.

Filing Form 8949 is the same as paying taxes on capital gains. Simply submitting Form 8949 is not equivalent to paying the taxes owed on capital gains. This form is used to calculate the capital gains or losses, which are then reported on your tax return, determining the tax owed. Additional steps must be taken to actually pay any taxes due.

You only need to report transactions in the year they are sold. This misunderstanding revolves around the timing of reporting. Specifically, transactions must be reported in the year they are completed, not merely initiated. Even if a transaction started in one year and completed in the next, it must be reported for the year in which it was finalized.

Form 8949 is too complex to file without professional help. While the form can seem daunting at first, the IRS provides instructions that guide you through the process of completing it. Many tax software programs simplify the process further, making it accessible to individuals who wish to prepare their own taxes. However, seeking professional advice can be beneficial, especially for complex situations.

Understanding these misconceptions can make dealing with IRS Form 8949 less intimidating. Whether you're handling it on your own or with professional help, clarity about what's expected can lead to greater confidence and, potentially, a smoother tax filing process.

Key takeaways

The IRS 8949 form is an essential document for individuals who buy and sell securities, as it helps them report their capital gains and losses during a tax year. Understanding how to properly fill out and utilize this form is key to ensuring accurate tax reporting and potentially reducing your tax liability. Here are five essential takeaways about filling out and using the IRS 8949 form.

- Identification of transactions: You must report each sale or exchange of capital assets not reported on another form to the IRS on Form 8949. This includes stocks, bonds, and mutual funds among other assets. It's crucial to accurately describe each item by including details such as the date of acquisition and sale, the proceeds from the sale, and the cost or other basis.

- Separation of short-term and long-term transactions: Form 8949 requires you to categorize your capital gains and losses as either short-term or long-term. This classification is based on how long you held the asset before selling it. Assets held for a year or less are considered short-term, whereas those held for more than a year are long-term. The distinction is important because short-term and long-term transactions are taxed differently.

- Understanding how to apply adjustments: In some cases, you may need to make certain adjustments to the cost basis of your sold assets. This could include adding costs associated with acquiring or selling an asset, or adjustments due to wash sales, inheritance, gifts, etc. Properly applying these adjustments on Form 8949 is crucial for accurately calculating your capital gains or losses.

- Usage of multiple Forms 8949: If you have a large number of transactions or if your transactions fall into different categories (for example, some are short-term and some are long-term), you might need to fill out multiple Forms 8949. This helps maintain clarity and organization in your tax reporting.

- Connecting Form 8949 to Schedule D: After completing Form 8949, you need to transfer the summarized information to Schedule D of your tax return. Schedule D is where you combine the totals from all your Forms 8949 and calculate your overall capital gains or losses. This step integrates the detailed entries from Form 8949 into the broader context of your tax return, influencing your tax liability.

Properly understanding and applying the guidelines for Form 8949 can simplify the process of reporting capital transactions while helping individuals comply with tax regulations effectively.

Popular PDF Documents

Equity Bank Loan - Prioritizes convenience for TSC staff, integrating employment details directly into the loan application process.

Innocent Spouse Tax Relief - Designed to ensure taxpayers understand the urgency and importance of complying with IRS requests in a timely manner.

IRS 7200 - It is specifically designed for employers looking to quickly access employee retention and paid leave credits.