Get IRS 8936 Form

Many taxpayers each year take advantage of various federal tax credits available to them, aiming to reduce their tax liability and promote certain environmentally-friendly investments. Among these credits, the one for electric and plug-in hybrid vehicles, as captured in IRS Form 8936, stands out for its appeal to environmentally conscious consumers looking to make a difference while also benefiting financially. This form is key for individuals who have purchased qualifying vehicles and are looking to claim their deserved credit, potentially leading to significant savings on their tax bill. It covers various types of vehicles, including two- and three-wheeled vehicles, as well as four-wheeled vehicles, each with specific requirements and credit amounts. Navigating through the details of Form 8936 involves understanding eligible vehicles, determining the credit amount, and knowing how to properly claim it on tax returns. Equally important is staying updated with any changes to tax laws that may affect these credits. For those invested in making eco-friendly automotive choices, mastering the ins and outs of IRS Form 8936 can lead to rewarding benefits, making it a crucial aspect of their financial and environmental considerations.

IRS 8936 Example

Form 8936 |

|

Qualified |

|

OMB No. |

|

|

|

||||

|

(Including Qualified |

|

|

||

(Rev. January 2022) |

|

▶ Attach to your tax return. |

|

Attachment |

|

Department of the Treasury |

|

|

|||

|

▶ Go to www.irs.gov/Form8936 for instructions and the latest information. |

|

Sequence No. 69 |

||

Internal Revenue Service |

|

|

|||

Name(s) shown on return |

|

|

Identifying number |

||

|

|

|

|

|

|

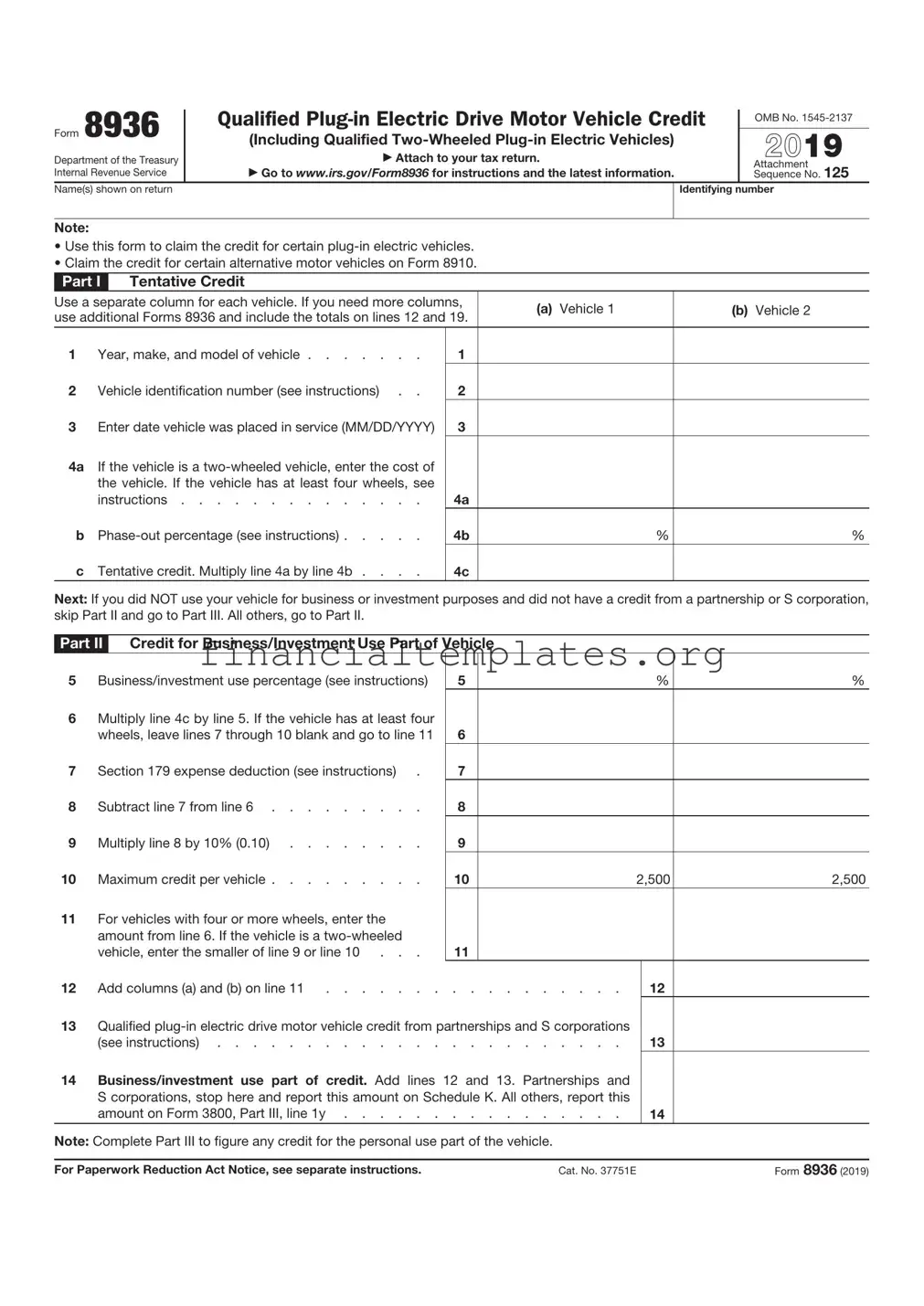

Note:

•Use this form to claim the credit for certain

•Claim the credit for certain alternative motor vehicles on Form 8910.

Part I |

Tentative Credit |

|

|

|

|

||

Use a separate column for each vehicle. If you need more columns, |

(a) |

Vehicle 1 |

(b) Vehicle 2 |

||||

use additional Forms 8936 and include the totals on lines 12 and 19. |

|||||||

|

|

|

|||||

|

|

|

|

|

|

||

1 |

Year, make, and model of vehicle |

1 |

|

|

|

||

2 |

Vehicle identification number (see instructions) . . |

2 |

|

|

|

||

3 |

Enter date vehicle was placed in service (MM/DD/YYYY) |

3 |

|

|

|

||

4a |

If the vehicle is a |

|

|

|

|

||

|

the vehicle. If the vehicle has at least four wheels, see |

|

|

|

|

||

|

instructions |

4a |

|

|

|

||

b |

4b |

|

% |

% |

|||

c |

Tentative credit. Multiply line 4a by line 4b . . . . |

4c |

|

|

|

||

Next: If you did NOT use your vehicle for business or investment purposes and did not have a credit from a partnership or S corporation, skip Part II and go to Part III. All others, go to Part II.

Part II Credit for Business/Investment Use Part of Vehicle

5Business/investment use percentage (see instructions)

6Multiply line 4c by line 5. If the vehicle has at least four wheels, leave lines 7 through 10 blank and go to line 11

7 |

Section 179 expense deduction (see instructions) . |

8 |

Subtract line 7 from line 6 |

9 |

Multiply line 8 by 10% (0.10) |

10Maximum credit per vehicle . . . . . . . . .

11For vehicles with four or more wheels, enter the

amount from line 6. If the vehicle is a

5

6

7

8

9

10

11

%

2,500

%

2,500

12 Add columns (a) and (b) on line 11 |

12 |

13Qualified

(see instructions) |

13 |

14Business/investment use part of credit. Add lines 12 and 13. Partnerships and S corporations, stop here and report this amount on Schedule K. All others, report this

amount on Form 3800, Part III, line 1y |

14 |

Note: Complete Part III to figure any credit for the personal use part of the vehicle.

For Paperwork Reduction Act Notice, see separate instructions. |

Cat. No. 37751E |

Form 8936 (Rev. |

Form 8936 (Rev. |

|

Page 2 |

||

Part III |

Credit for Personal Use Part of Vehicle |

|

|

|

|

|

|

(a) Vehicle 1 |

(b) Vehicle 2 |

15 |

If you skipped Part II, enter the amount from line 4c. If |

|

|

|

|

|

|||

|

you completed Part II, subtract line 6 from line 4c. If the |

|

|

|

|

vehicle has at least four wheels, leave lines 16 and 17 |

|

|

|

|

blank and go to line 18 |

15 |

|

|

16 |

Multiply line 15 by 10% (0.10) |

16 |

|

|

17Maximum credit per vehicle. If you skipped Part II, enter $2,500. If you completed Part II, subtract line 11

from line 10 |

17 |

18For vehicles with four or more wheels, enter the amount from line 15. If the vehicle is a

|

vehicle, enter the smaller of line 16 or line 17 . . . |

18 |

|

19 |

Add columns (a) and (b) on line 18 |

19 |

|

20 |

Enter the amount from Form 1040, |

20 |

|

21 |

Personal credits from Form 1040, |

21 |

|

22Subtract line 21 from line 20. If zero or less, enter

the personal use part of the credit |

22 |

23Personal use part of credit. Enter the smaller of line 19 or line 22 here and on

Schedule 3 (Form 1040), line 6f. If line 22 is smaller than line 19, see instructions . . |

23 |

Form 8936 (Rev.

Document Specifics

| Fact Name | Description |

|---|---|

| Purpose of Form 8936 | This form is used to claim the plug-in electric drive motor vehicle credit, a federal tax credit available for purchasers of qualified vehicles. |

| Eligible Vehicles | Qualified vehicles include those with a plug-in electric drive that have been acquired for use or lease by the taxpayer, and not for resale. |

| Credit Amount | The credit amount can vary, up to $7,500, depending on the battery capacity and the gross vehicle weight rating. |

| Limitations | The full credit is only available until the manufacturer reaches 200,000 qualified vehicles sold in the United States. Afterward, the credit begins to phase out for vehicles from that manufacturer. |

Guide to Writing IRS 8936

After deciding to apply for the tax credit provided by the IRS 8936 form, individuals should gather all necessary information and documents related to the qualified plug-in electric drive motor vehicle. Accuracy and completeness in filling out this form are crucial for the timely processing of your tax credit. Once the form is submitted, the IRS will review it as part of your tax return. If any additional information is required, you may be contacted. Properly submitted, this form can lead to significant tax savings, making it essential to follow the instructions carefully.

- Start by obtaining the most current version of the IRS 8936 form from the official IRS website.

- Enter your name and social security number at the top of the form, ensuring they match the information on your tax return.

- In Part I, specify the year your qualified vehicle was placed in service.

- Provide the vehicle's make, model, and year in the designated lines.

- For line 4, if your vehicle is a two- or three-wheeled vehicle, enter the kilowatt-hours of capacity directly. For four-wheeled vehicles, this information is not necessary.

- On lines 5 through 12, calculate the tentative credit amount. This will involve some math, including figuring percentages of the vehicle's cost. It may be helpful to refer to the instructions provided by the IRS for specific line entries.

- In Part II, calculate the credit for business/investment use part of the vehicle if applicable.

- Part III is for four-wheeled vehicles only. If your vehicle qualifies, carry the credit from Part I, line 12, to line 15. If not applicable, skip this part.

- Finally, append the total credit amount to your tax return, as indicated in the instructions specific to your tax situation.

- Review the form for accuracy, sign it if required, and attach it to your federal tax return.

Completing and submitting the IRS 8936 form is a step towards claiming your credit. It's essential to ensure all information is accurate and that the form is attached to your tax return correctly. This careful attention to detail will help in the smooth processing of your claim, allowing you to benefit from the tax savings available for owners of qualified plug-in electric drive motor vehicles.

Understanding IRS 8936

-

What is IRS Form 8936?

IRS Form 8936, also known as the Qualified Plug-in Electric Drive Motor Vehicle Credit, is a document used to claim a tax credit for the purchase of a qualified electric vehicle. This form calculates the amount of credit a taxpayer is eligible for, which can reduce the amount of tax owed to the federal government.

-

Who can file IRS Form 8936?

Form 8936 can be filed by individuals, businesses, and estates or trusts that have purchased a new qualified electric vehicle and placed it in service during the tax year for use in their trade or business or for personal use.

-

What types of vehicles qualify for the credit?

Vehicles that qualify for the credit include new vehicles that draw propulsion using a traction battery with at least 4 kilowatt hours of capacity and are capable of being recharged from an external source of electricity. This includes certain plug-in electric vehicles and plug-in hybrids.

-

How much is the credit worth?

The credit amount can range from $2,500 to $7,500, depending on the vehicle's battery capacity and the gross weight of the vehicle. In some cases, additional credits are available based on manufacturer sales.

-

Can the credit be carried forward or back?

If the credit amount exceeds the taxpayer's tax liability, the excess amount cannot be carried back to a previous tax year but can be carried forward to the next year. It is important to consult with a tax professional for personal tax advice.

-

Is the credit available for used vehicles?

No, the credit is only available for new vehicles that are purchased and used for the first time. Used vehicles, even if they are electric, do not qualify for the credit.

-

How do I claim the credit?

To claim the credit, complete IRS Form 8936 and include it with your federal income tax return. The form requires details about the vehicle, such as make, model, and year, along with its identification number and the date of purchase.

-

What documentation is needed to support the claim?

While the form itself must be filed with your tax return, it's essential to keep documentation such as the purchase agreement or sales receipt, the vehicle identification number (VIN), and proof of the vehicle's use within the United States as support for the claim.

-

Can the credit be transferred?

The credit is not transferrable to another party. The original purchaser of the vehicle is the only person eligible to claim the credit on their tax return.

-

Where can I find more information?

For more detailed information about qualifying vehicles and additional FAQs, visit the official IRS website or consult a tax professional. The IRS also provides instructions for Form 8936, which include detailed guidance on how to complete and file the form.

Common mistakes

When filling out the IRS Form 8936, which is used for claiming the Qualified Plug-in Electric Drive Motor Vehicle Credit, there are common mistakes that individuals frequently make. These errors can lead to delays in processing or even denial of the credit. Understanding and avoiding these mistakes can ensure a smoother and more efficient process.

-

Not checking the vehicle's eligibility. It's vital to verify that the vehicle meets all the IRS requirements for the credit.

-

Incorrectly reporting the vehicle's year, make, or model. This information must be accurate and match the vehicle’s registration documents.

-

Failing to include the date of purchase. The credit is only available for vehicles placed in service during the tax year.

-

Misunderstanding the basis of the vehicle for the credit calculation. It's important to correctly determine the cost of the vehicle that's eligible for the credit.

-

Omitting the vehicle identification number (VIN). The VIN is essential for verifying the vehicle's eligibility.

-

Missing signatures or dates. The IRS requires a complete and signed form. Missing signatures or dates can result in processing delays.

-

Not attaching required documentation. Supporting documents, such as the purchase agreement, may be required to substantiate the claim.

-

Claiming the credit for a leased vehicle. Generally, the leasing company, not the lessee, is entitled to the credit.

-

Forgetting to update personal information, such as address or name changes. Up-to-date personal information ensures the IRS can properly process the form.

By paying close attention to these details when completing IRS Form 8936, individuals can avoid common pitfalls. Accurate and complete information contributes to a smoother process for claiming the electric vehicle tax credit.

Documents used along the form

When filing for tax incentives related to electric and plug-in hybrid vehicles, the IRS 8936 form is essential. However, alongside this form, individuals may need to gather and complete additional documents to ensure their application is thorough and compliant with IRS requirements. These documents support the claim, verify the information, and sometimes even provide necessary details that the IRS 8936 form alone doesn't capture. Here's an overview of some of these documents.

- Form 1040 - The individual income tax return form is crucial as it integrates the credits or deductions claimed on Form 8936 into the taxpayer's overall tax situation. It helps in calculating the final tax liability or refund.

- Form 1098 - This document is significant for those claiming a credit for a vehicle used for business purposes. It includes information about mortgage interest and could also encompass details about properties used in business, which can be relevant for establishing business use percentages.

- Sales Receipt or Bill of Sale - Not an IRS form, but it's essential to keep this document handy as proof of the vehicle's purchase or lease during the tax year in question. It verifies the eligibility of the vehicle for the credit.

- Manufacturer's Certification - Another non-IRS document which acts as a certificate from the vehicle manufacturer. It confirms that the vehicle qualifies for the credit and mentions the maximum allowable credit amount.

- Form 4562 - Utilized for detailing depreciation and amortization, including the vehicle in question. This form is primarily relevant for business use vehicles, helping to calculate depreciation deductions if the taxpayer uses the vehicle for business purposes and claims a credit on Form 8936.

Gathering these documents is a crucial step towards leveraging the benefits offered by the IRS for eco-friendly vehicle purchases. It not only enhances the clarity and compliance of one's tax filings but also maximizes the potential refunds or credits obtainable. Always ensure the accuracy and completeness of all supplementary forms and documents when submitting your tax returns.

Similar forms

The IRS Form 8936 is closely related to Form 8911, which is used for the Alternative Fuel Vehicle Refueling Property Credit. Both forms are designed for taxpayers who want to claim a credit, but they serve different purposes within the realm of energy-efficient investments. While Form 8936 is specifically for the credit for purchasing plug-in electric drive vehicles, Form 8911 targets the costs associated with installing alternative fuel vehicle refueling stations. Their similarity lies in encouraging environmentally friendly practices through tax incentives, though their focus diverges into different aspects of energy efficiency.

Another document sharing a purpose with IRS Form 8936 is Form 5695, Residential Energy Credits. This form is utilized by homeowners to claim credits for residential energy-efficient improvements, including solar, wind, geothermal, and fuel-cell technology. The common thread between Form 8936 and Form 5695 is the government's initiative to encourage energy conservation and the use of renewable energy through financial incentives. While Form 8936 focuses on plug-in electric vehicles, Form 5695 encompasses a broader range of residential energy upgrades.

Form 8864, Biodiesel and Renewable Diesel Fuels Credit, also parallels IRS Form 8936 in its encouragement of environmentally friendly energy use, albeit in the fuel sector. Taxpayers use Form 8864 to claim a credit for biodiesel, renewable diesel, and related fuels used in their business or farming activities. Like Form 8936, which supports the adoption of electric vehicles, Form 8864 promotes the use of alternative fuels to lessen dependence on fossil fuels, reinforcing the government's commitment to clean energy and reduced emissions.

Finally, Form 8908, Energy Efficient Home Credit, is akin to Form 8936 in its support for green energy solutions, but it focuses on the construction and renovation of energy-efficient homes. Builders of new homes that meet certain energy-saving criteria are eligible for this credit. Through Form 8908, the initiative is to decrease the overall energy consumption of new homes, much like Form 8936's aim to increase the use of electric vehicles. Both forms are part of a larger government effort to incentivize energy efficiency and sustainability in different sectors.

Dos and Don'ts

When filling out the IRS Form 8936, which is designed to claim the Qualified Plug-in Electric Drive Motor Vehicle Credit, attention to detail cannot be overstressed. Provided below are essential do's and don'ts to ensure accuracy, compliance, and maximization of your potential tax benefits. These guidelines will help avoid common pitfalls, ensuring your claim is processed smoothly.

- Do ensure you're eligible for the credit before starting. This means verifying that your electrical vehicle (EV) is indeed qualified according to the IRS's specifications.

- Do read the instructions provided by the IRS for Form 8936 thoroughly. These instructions contain critical information about how to properly fill out the form, including definitions and numerous provisions that could affect the credit amount.

- Do double-check your vehicle's make, model, and year against the IRS list of qualified vehicles. This verification step is crucial to confirm that your vehicle is eligible for the credit for the tax year in which you're filing.

- Do gather and organize all requisite documentation before starting the form. This includes purchase agreements, vehicle identification numbers (VIN), and certification that your vehicle qualifies for the credit.

- Don't rush through the process. Take your time to accurately enter information to ensure every detail is correct. Mistakes could delay processing or lead to an outright denial of the credit.

- Don't guess on details. If you’re unsure about any information, verify it through reliable sources or consult a tax professional. Incorrect information could be considered fraudulent.

- Don't overlook the section that requires you to calculate the phase-out reduction if applicable. For popular EV models, as their sales numbers grow, the available credit reduces and eventually phases out.

- Don't attempt to claim the credit for a used vehicle or a vehicle that is not primarily used in the United States. The IRS stipulates that only new vehicles purchased for use or lease in the U.S. qualify for this credit.

Adhering to these pointers can significantly streamline the process of completing Form 8936. It's about being meticulous, patient, and proactive. Remember, when in doubt, seeking assistance from a tax professional can provide clarity and ensure your filing is in compliance with current tax laws.

Misconceptions

The discussion around the IRS 8936 form is often shrouded in misconceptions. This form, vital for those seeking the Qualified Plug-in Electric Drive Motor Vehicle Credit, is subject to a variety of misunderstandings. Let's dispel some of these myths, ensuring a clear understanding of what the form entails and whom it benefits.

Anyone who buys an electric vehicle (EV) can claim the credit. This is a common misconception. The reality is that the IRS 8936 form is designed for those who purchase qualified vehicles, which must meet specific criteria set forth by the IRS. Factors such as the battery size and the vehicle's weight, among others, play a role in determining qualification for the credit.

It's possible to claim the credit for a used EV. Originally, the credit was only available for the initial purchase of a new qualifying vehicle. However, legislation changes can alter eligibility and it's important to consult the latest tax guidelines or a tax professional to understand current qualifications for used EVs.

The credit amount is the same for every vehicle. The actual credit amount varies based on several factors, including the battery capacity of the vehicle. It's a common mistake to assume every vehicle qualifies for the maximum credit. The IRS outlines specific thresholds that determine the credit's value, which can range significantly.

If I lease an electric vehicle, I can claim the credit. This misconception overlooks who benefits from the credit in a lease scenario. In fact, the credit goes to the leasing company as the vehicle's owner. They often pass on the savings to the lessee in the form of lower lease payments, but the lessee themselves does not directly claim the credit on their taxes.

You can claim the credit every year. The credit is only applicable to the purchase or lease (under specific conditions as noted above) of a qualified vehicle and cannot be claimed annually. It's a one-time credit for each qualifying vehicle purchase, intended to lower the initial cost barrier of electric vehicles. Therefore, Understanding when and how the credit can be applied is crucial for potential EV buyers or lessees.

It's essential for individuals considering the purchase or lease of an electric vehicle to deeply understand the specifics of the IRS 8936 form. Clarifying these misconceptions not only helps in making informed decisions but also ensures that one can accurately benefit from the available tax credits. For the most up-to-date information, consult the IRS website or a qualified tax professional.

Key takeaways

Filling out and using IRS Form 8936, which is utilized for claiming the Qualified Plug-in Electric Drive Motor Vehicle Credit, involves specific steps and an understanding of certain regulations. This form is integral for individuals and businesses looking to receive a tax credit for acquiring a qualifying electric vehicle. The following key takeaways highlight essential points to ensure accuracy and compliance when dealing with Form 8936.

- Form 8936 is designed for taxpayers to figure out and claim their credit for qualified plug-in electric drive motor vehicles, including passenger vehicles and light trucks.

- The credit amount for qualifying vehicles can vary, reaching up to $7,500, depending on the battery capacity and the vehicle's weight. Calculating the correct amount is crucial.

- Both individuals and businesses are eligible to claim the credit; however, the form's completion and the credit's application may differ slightly between personal and business use vehicles.

- To correctly fill out Form 8936, taxpayers must have the Vehicle Identification Number (VIN) of the electric vehicle, proof of purchase, and information regarding the vehicle's weight and battery capacity.

- One key section of the form requires detailing the vehicle's make, model, year, and date of acquisition, ensuring that only qualifying vehicles are claimed for the credit.

- For vehicles used for both business and personal purposes, the credit must be apportioned accordingly. Detailed records should be kept to substantiate the use percentage claimed on the form.

- Form 8936 must be filed with the taxpayer’s federal income tax return for the year the vehicle was placed in service. Amending a prior year's tax return may be necessary if the vehicle was purchased in a previous year and the credit was not claimed at that time.

- The credit is non-refundable, which means it can reduce the tax owed to $0, but the remaining amount of the credit (if any) is not paid out as a refund.

- If IRS Form 8936 is filed incorrectly, the taxpayer may receive a notice from the IRS. Responding promptly and accurately to any IRS inquiry is important to correct any issues.

Properly utilizing IRS Form 8936 not only provides a financial incentive for the purchase of electric vehicles but also supports environmental sustainability. Accurate and careful completion of this form ensures that taxpayers can fully benefit from the available tax credits.

Popular PDF Documents

Joint Tactical Airstrike Request - Ensures consistent and coordinated efforts in air support requests, fostering operational synergy and effectiveness.

940 Taxes - The form acts as a bridge between state unemployment tax contributions and federal unemployment tax credits, balancing an employer’s tax due.

How to Get Power of Attorney in Tennessee - Granting someone tax power of attorney through this form can be crucial for complex tax strategies requiring professional handling.