Get IRS 8919 Form

Navigating the complexities of tax forms can often feel like a daunting task for many people. Among the myriad of forms the Internal Revenue Service (IRS) requires is the Form 8919, which serves a very specific and crucial purpose. It's designed for individuals who have been wrongly treated as independent contractors instead of employees, a situation that can significantly impact how taxes are reported and paid. Typically, employees have taxes withheld from their wages by their employers, who also contribute to Social Security and Medicare taxes. In contrast, independent contractors are responsible for paying these taxes themselves, often leading to a higher tax burden. The Form 8919 allows workers to calculate and report the Social Security and Medicare taxes that should have been covered by their employer, rectifying the potential misclassification and ensuring that their tax responsibilities are accurately met. This form stands as a critical tool for workers seeking to correct their employment status in the eyes of the IRS, thereby affecting how they contribute to and benefit from the tax system. Understanding the key aspects of this form is essential not only for the individuals directly affected but also for employers who may need to reassess the classification of their workers to comply with IRS guidelines and avoid potential penalties.

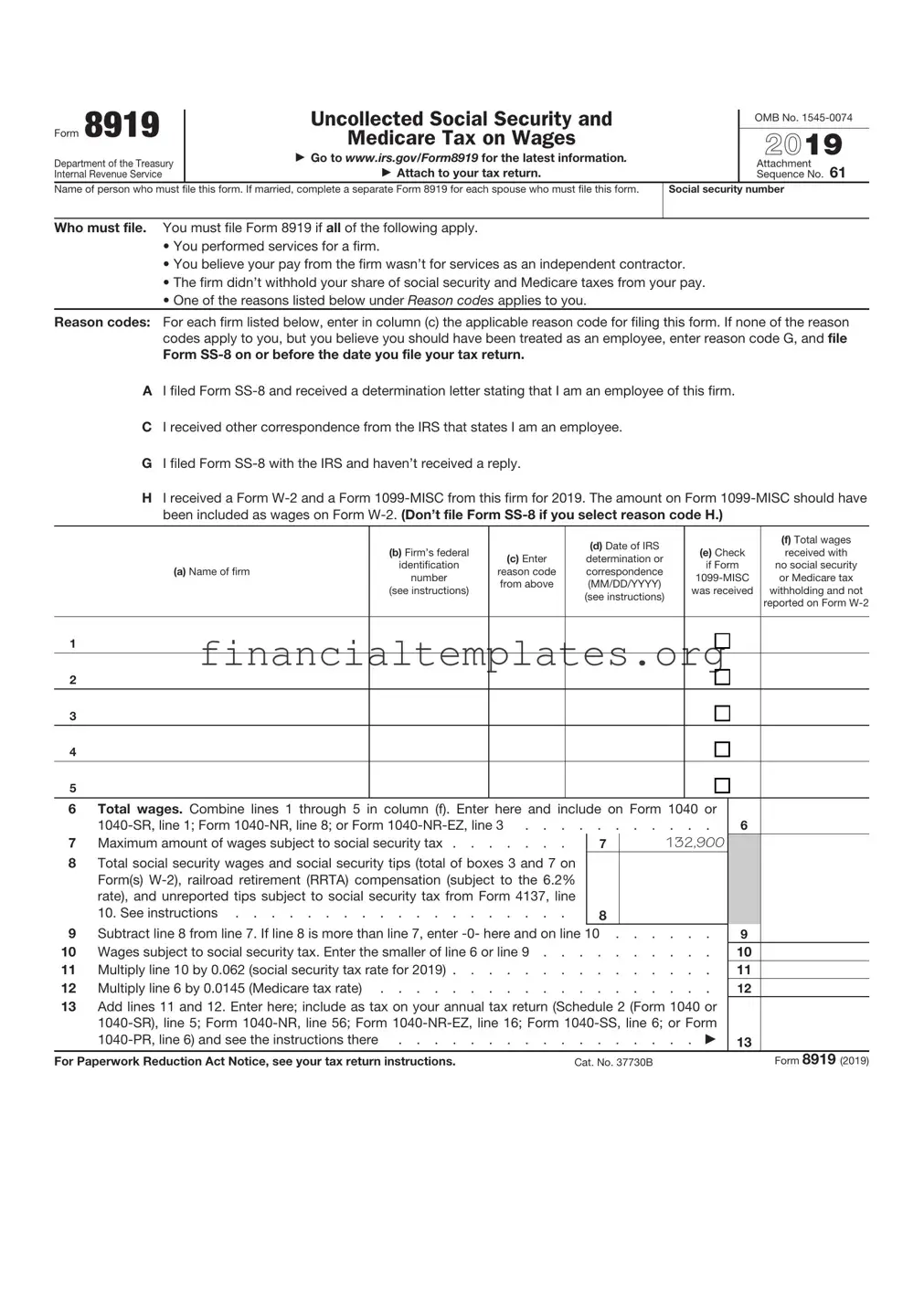

IRS 8919 Example

Form 8919 |

|

Uncollected Social Security and |

|

OMB No. |

|

|

|||

|

|

|

||

|

Medicare Tax on Wages |

|

|

|

|

|

2020 |

||

Department of the Treasury |

|

▶ Go to www.irs.gov/Form8919 for the latest information. |

|

|

|

▶ Attach to your tax return. |

|

Attachment |

|

Internal Revenue Service |

|

|

Sequence No. 61 |

|

Name of person who must |

|

file this form. If married, complete a separate Form 8919 for each spouse who must file this form. |

Social security number |

|

|

|

|

|

|

Who must file. You must file Form 8919 if all of the following apply.

•You performed services for a firm.

•You believe your pay from the firm wasn’t for services as an independent contractor.

•The firm didn’t withhold your share of social security and Medicare taxes from your pay.

•One of the reasons listed below under Reason codes applies to you.

Reason codes. For each firm listed below, enter in column (c) the applicable reason code for filing this form. If none of the reason codes apply to you, but you believe you should have been treated as an employee, enter reason code G, and file

Form

AI filed Form

CI received other correspondence from the IRS that states I am an employee.

GI filed Form

HI received a Form

|

|

|

(d) Date of IRS |

(e) Check |

(f) Total wages |

|

|

(b) Firm’s federal |

|

if Form |

received with |

||

|

(c) Enter |

determination or |

||||

|

identification |

no social security |

||||

(a) Name of firm |

reason code |

correspondence |

||||

number |

and/or |

or Medicare tax |

||||

|

from above. |

(MM/DD/YYYY) |

||||

|

(see instructions) |

withholding and not |

||||

|

|

(see instructions) |

||||

|

|

|

was received. reported on Form |

|||

|

|

|

|

|||

1

2

3

4

5

6Total wages. Combine lines 1 through 5 in column (f). Enter here and include on Form 1040 or

line 1; or Form |

. . . . |

6 |

|

7 Maximum amount of wages subject to social security tax |

7 |

137,700 |

|

8Total social security wages and social security tips (total of boxes 3 and 7 on Form(s)

|

10. See instructions . |

. |

. . |

. . . . . . . . . . . . . . . |

8 |

|

|

9 |

Subtract line 8 from line 7. |

If line |

8 is more than line 7, enter |

|

9 |

||

10 |

Wages subject to social security tax. Enter the smaller of line 6 or line 9 |

|

10 |

||||

11 |

Multiply line 10 by 0.062 |

(social security tax rate) |

|

11 |

|||

12 |

Multiply line 6 by 0.0145 |

(Medicare tax rate) |

12 |

||||

13Add lines 11 and 12. Enter here. Include as tax on your annual tax return (Schedule 2 (Form 1040), line

5; Form |

13 |

|

For Paperwork Reduction Act Notice, see your tax return instructions. |

Cat. No. 37730B |

Form 8919 (2020) |

Form 8919 (2020) |

Page 2 |

Future Developments

For the latest information about developments related to Form 8919 and its instructions, such as legislation enacted after they were published, go to www.irs.gov/Form8919.

What’s New

Increase in wage amount subject to social security tax. On line 7, the maximum amount of wages subject to social security tax has increased from $132,900 to $137,700 for 2020.

General Instructions

Purpose of form. Use Form 8919 to figure and report your share of the uncollected social security and Medicare taxes due on your compensation if you were an employee but were treated as an independent contractor by your employer. By filing this form, your social security earnings will be credited to your social security record. See https://www.irs.gov/businesses/

|

|

▲ |

|

! |

Don’t use this form: |

• For services you performed as an independent |

|

CAUTION |

contractor. Instead, use Schedule C (Form 1040), |

Profit or Loss From Business, to report the income. And use Schedule SE (Form 1040),

•To figure the social security and Medicare tax owed on tips you didn’t report to your employer, including any allocated tips shown on your Form(s)

Firm. For purposes of this form, the term “firm” means any individual, business enterprise, company, nonprofit organization, state, or other entity for which you performed services. This firm may or may not have paid you directly for these services.

Form

Form 8959, Additional Medicare Tax. A 0.9% Additional Medicare Tax applies to Medicare wages, Railroad Retirement Tax Act compensation, and

Specific Instructions

Lines 1 through 5. Complete a separate line for each firm. If you worked as an employee for more than five firms in 2020, attach additional Form(s) 8919 with lines 1 through 5 completed. Complete lines 6 through 13 on only one Form 8919. The line 6 amount on that Form 8919 should be the combined totals of all lines 1 through 5 of all your Forms 8919.

Column (a). Enter the name of the firm for which you worked. If you received a Form

Column (b). The federal identification number for a firm can be an employer identification number (EIN) or a social security number (SSN) (if the firm is an individual). An EIN is a

XXXX.If you received a Form

Column (c). Enter the reason code for why you are filing this form. Enter only one reason code on each line. If none of the reason codes apply to you, but you believe you should have been treated as an employee, enter reason code G, and file

Form

Enter reason code C if you were designated as a “section 530 employee” by the IRS. You are a section 530 employee, for these purposes, if you were determined to be an employee by the IRS prior to January 1, 1997, but your employer was granted relief from payment of employment taxes under section 530 of the Revenue Act of 1978.

Enter reason code H if you received both a Form

|

If you enter reason code G, you or the firm that paid |

▲ |

|

! |

you may be contacted for additional information. Use |

of this reason code isn’t a guarantee that the IRS will |

|

CAUTION |

agree with your worker status determination. If the |

|

IRS doesn’t agree that you are an employee, you may be billed for the additional tax, penalties, and interest resulting from the change to your worker status.

Column (d). Complete only if reason code A or C is entered in column (c).

Line 6. Also enter this amount on Form 8959, line 3, if you are required to file that form.

Line 8. For railroad retirement (RRTA) compensation, don’t include an amount greater than $137,700, which is the amount subject to the 6.2% rate for 2020.

Document Specifics

| Fact Number | Description |

|---|---|

| 1 | The IRS Form 8919 is used for workers who believe their employers have improperly classified them as independent contractors rather than employees. |

| 2 | It allows workers to calculate and report their share of uncollected Social Security and Medicare taxes due to their misclassification. |

| 3 | Using Form 8919 may result in a lower tax liability compared to self-employment taxes, as it only covers the employee's portion of Social Security and Medicare taxes. |

| 4 | To use Form 8919, a worker must meet one of the situations listed in the form’s instructions, which include receiving a determination from the IRS or Department of Labor regarding their employment status. |

| 5 | The form requires information such as the employer’s name, address, and the reason for filing under a specific situation code provided in the instructions. |

| 6 | Form 8919 is filed alongside the worker’s personal income tax return for the relevant tax year. |

| 7 | Filing Form 8919 does not automatically change a worker’s employment status; it is used solely for the purpose of computing taxes owed. |

| 8 | The IRS may conduct an investigation into the employment status claim, which can lead to changes in how the employer classifies and taxes its workers in the future. |

| 9 | There are no state-specific versions of Form 8919; however, incorrectly classified workers may need to file additional forms at the state level, depending on state law. |

Guide to Writing IRS 8919

Filling out the IRS Form 8919 is crucial for individuals who must pay taxes on wages not properly processed through their employer's payroll. This form allows taxpayers to calculate and report uncollected Social Security and Medicare taxes due to incorrectly classified employment status. Once completed, this document plays a significant role in ensuring that your tax responsibilities are accurately fulfilled, aligning with legal guidelines. The completion and submission process involves a series of steps designed to guide you through accurately providing the necessary information.

- Begin by gathering your personal information, including your Social Security Number and your employer’s name, address, and Employer Identification Number (EIN).

- Enter your full name and Social Security Number at the top of Form 8919.

- On line 1, enter your employer’s name, address, and EIN.

- Select the situation that applies to you by checking the appropriate box on line 2. Each code represents a different scenario related to your employment situation and why your employer did not withhold Social Security and Medicare taxes.

- Fill in your calendar year for which you are filing this form on line 3.

- Enter information about your wages received from the employer in question. Fill in the total amount of wages you received without Social Security and Medicare taxes withheld on line 4.

- Calculate the uncollected Social Security tax by multiplying the amount on line 4 by 6.2% (0.062), and enter the result on line 5.

- Calculate the uncollected Medicare tax by multiplying the amount on line 4 by 1.45% (0.0145), and enter the result on line 6.

- If applicable, enter any additional Medicare Tax amount in line 7. This is necessary if your wages exceeded a certain threshold amount, subjecting you to additional Medicare Tax at a rate of 0.9%.

- Add the amounts on lines 5, 6, and if applicable, line 7. Enter the total on line 8. This is the total uncollected Social Security and Medicare taxes due.

- Review your form to ensure all information is accurate and complete.

- Sign and date the form in the designated area.

- Attach Form 8919 to your tax return and submit it to the IRS following the instructions for your specific type of tax return.

After submitting Form 8919, the IRS will process your form and adjust your Social Security and Medicare records accordingly. It is important to retain a copy of this form and all related documentation for your records. Should any questions arise regarding your submitted form, being able to reference your documentation will be invaluable.

Understanding IRS 8919

-

What is the purpose of IRS Form 8919?

IRS Form 8919 is used by workers who believe they were incorrectly treated as independent contractors when they should have been classified as employees. By filing this form, individuals can compute and report the Social Security and Medicare taxes owed on their compensation, which are usually the responsibility of the employer.

-

Who needs to file IRS Form 8919?

This form should be filed by anyone who has received a Form W-2 and believes their employer misclassified them as an independent contractor, or by those who have not received a Form W-2 because their employer considered them independent contractors but they meet the criteria for being an employee under the common law rules.

-

What information do I need to complete Form 8919?

To complete Form 8919, you will need your personal information (such as your Social Security Number), the details of your employer, and the amount of your compensation not already covered by Social Security and Medicare taxes. Additionally, you need to know the reason for filing this form, which you indicate by selecting the correct code from the form's instructions.

-

Where can I find IRS Form 8919?

IRS Form 8919 can be downloaded from the Internal Revenue Service (IRS) website. It is also available at local IRS offices and can sometimes be obtained through tax preparation services.

-

Is there a deadline for filing Form 8919 with my tax return?

Yes, Form 8919 should be filed with your annual tax return by the regular due date, usually April 15. If you have received an extension for filing your tax return, the same extension applies to Form 8919.

-

Can I file Form 8919 electronically?

As part of your tax return, Form 8919 can be filed electronically with the IRS. Most modern tax preparation software supports electronic filing of this form along with your other tax documents.

-

What happens if I don't file IRS Form 8919?

If you do not file Form 8919 and you owe Social Security and Medicare taxes, you may be liable for the employee’s share of these taxes and potentially the employer's share as well. Additionally, interest and penalties could accrue on the unpaid taxes.

-

Can filing Form 8919 trigger an audit?

Filing Form 8919 in itself does not necessarily trigger an audit. However, it does inform the IRS of potential misclassification issues by an employer, which might lead to further examination. Always ensure your tax filings are accurate and complete to minimize the risk of audits.

-

What should I do if I’m uncertain about filing Form 8919?

If you are uncertain about whether you should file Form 8919 or how to fill it out, it may be beneficial to consult with a tax professional. They can provide guidance based on your specific situation and help ensure your taxes are filed correctly.

-

Can I amend a previously filed tax return to include Form 8919?

Yes, if you did not include Form 8919 with a previously filed tax return and believe you should have, you can amend your return by filing IRS Form 1040-X and including Form 8919. This should be done promptly to correct your tax liability and potentially reduce interest and penalties.

Common mistakes

The IRS 8919 form is a crucial document for taxpayers who need to report uncollected Social Security and Medicare taxes due to their incorrect classification as independent contractors instead of employees. Careful completion of this form is essential to ensure accurate tax processing and to avoid potential issues with the IRS. However, individuals often make mistakes when filling out this document. Here are 10 common errors to be aware of:

-

Not verifying eligibility criteria: Before filing Form 8919, one must ensure they meet the specific conditions set by the IRS, such as having a reasonable basis for not being treated as an employee or being a misclassified worker eligible for relief under Section 530. Overlooking these criteria can lead to the rejection of the form.

-

Incorrectly reporting the employer's information: Accurate employer details are crucial. Mistakes in the employer's name, address, or Employer Identification Number (EIN) can delay processing and affect proper attribution of taxes.

-

Failing to use the correct code: The form requires a reason code to explain why the filer believes taxes were not withheld. Choosing an incorrect code can result in the IRS questioning the submission.

-

Not including all required forms: Form 8919 should be filed alongside your tax return. Failing to include all necessary accompanying documents can lead to processing delays and possible penalties.

-

Omitting wages: Every dollar earned must be reported. Omitting or inaccurately reporting wages can lead to an audit and penalties for unpaid taxes.

-

Miscalculating taxes: It's essential to accurately calculate the uncollected Social Security and Medicare taxes. Errors in calculation can either leave you owing more to the IRS or mistakenly overpaying.

-

Not filing electronically when possible: While paper filing is an option, electronic submissions are processed faster and are less prone to error. Avoiding the e-file option can unnecessarily delay tax processing.

-

Ignoring the form's instructions: The IRS provides detailed instructions for Form 8919. Not thoroughly reading and following these instructions can increase the risk of mistakes.

-

Failure to sign and date the form: An unsigned or undated form is considered incomplete by the IRS and will not be processed until corrected, delaying tax resolution.

-

Not seeking professional help when needed: For individuals unsure about how to correctly fill out Form 8919 or their eligibility, consulting a tax professional can prevent costly errors and ensure compliance with IRS rules.

Awareness and avoidance of these mistakes can guide individuals through the correct filing of Form 8919, contributing to a smoother tax filing process and helping to safeguard against complications with the Internal Revenue Service.

Documents used along the form

The IRS Form 8919 is utilized for reporting uncollected Social Security and Medicare taxes due to incorrect worker classification. This matter of classification often involves determining whether an individual was an employee rather than an independent contractor. Achieving clarity on this distinction is crucial because it affects tax responsibilities and benefits. Alongside Form 8919, several other documents and forms frequently come into play. These documents support or are necessary for the process of rectifying or understanding worker status and associated tax implications.

- Form SS-8: This form is crucial for individuals and firms seeking to determine the correct classification of a worker for federal employment taxes and income tax withholding purposes. By completing Form SS-8, either an employer or a worker can request the IRS to officially determine the worker's status, providing clarity and helping to avoid potential tax disputes.

- Form W-2: Essential for employees, Form W-2 reports an individual's annual wages and the amount of taxes withheld from their paycheck. It's vital for tax filing purposes and is often used in conjunction with Form 8919 to provide evidence of an employment relationship and the associated tax withholdings.

- Form 1099-NEC: This form is used to report non-employee compensation. It is relevant for independent contractors or self-employed individuals who have been incorrectly classified and have filled out Form 8919, as it shows the income they received as non-employees.

- Form 1040: The U.S. Individual Income Tax Return form is the baseline document for most tax filers. Individuals who file Form 8919 will need to reference their Form 1040, as adjustments to their income and tax liabilities made by Form 8919 will be reported on Form 1040.

- Schedule SE (Form 1040): For those who have self-employment income, this form is used to calculate the tax owed on that income. Individuals who have determined that they were incorrectly classified and use Form 8919 may also need to adjust their Schedule SE filings.

- Schedule C (Form 1040): This form is used by sole proprietors and single-member LLCs to report profits and losses from a business. If an individual improperly filed as an independent contractor instead of an employee, their income reporting through Schedule C might be impacted after filing Form 8919.

Understanding and properly filling out these forms are fundamental steps in ensuring tax compliance and in protecting the rights of workers. Whether correcting classification errors with the IRS Form 8919, determining employment status, or calculating taxes owed, each form plays a critical role in the broader context of employment taxes and worker rights. It’s imperative for individuals and businesses to be familiar with these documents to navigate tax obligations accurately and efficiently.

Similar forms

The IRS 8919 form is closely related to the W-2 form. Workers typically receive a W-2 form from their employers. This form reports an employee's annual wages and the amount of taxes withheld from their paycheck. Similarly, the IRS 8919 form is used by workers who believe their employers have misclassified them as independent contractors rather than employees. Both forms are essential for accurately determining tax obligations and ensuring correct social security and Medicare contributions.

Another document related to the IRS 8919 form is the 1099-MISC form. Independent contractors, freelancers, and others who earn income outside of traditional employment might receive a 1099-MISC form from their clients. The key difference between this form and the IRS 8919 is that the latter is used to contest one's employment status. The 1099-MISC acknowledges non-employee compensation, while the 8919 seeks to reclassify the worker to receive employee benefits, including tax withholdings.

Form W-4 is also related to IRS 8919 in its role in the employment relationship. Form W-4 is completed by employees to indicate their tax situations to their employers, determining how much federal income tax should be withheld from their paychecks. While the W-4 form assumes employment status, the IRS 8919 challenges the absence of such status and its consequent withholding benefits, underscoring the worker's right to be recognized as an employee for tax purposes.

The Schedule SE form, used for reporting self-employment taxes, shares a connection with the IRS 8919 form. Individuals fill out Schedule SE to pay taxes on net earnings from self-employment, including Social Security and Medicare taxes. In contrast, the IRS 8919 form is used by individuals who believe they are incorrectly classified and should not be responsible for the self-employment tax rate, seeking instead to have taxes withheld by an employer.

Form SS-8 determines worker status for purposes of federal employment taxes and income tax withholding. Workers or firms may submit this form if they are uncertain about the worker's status as an employee or independent contractor. This determinative process directly relates to the context of the IRS 8919 form, which is used after a worker concludes they have been misclassified based on the criteria for employment.

The IRS Form 4852, a substitute for Form W-2 or Form 1099-R, is used when an employer or payer has not issued the original forms or when the issued forms are incorrect. Like the IRS 8919, Form 4852 deals with discrepancies in employment documentation that affect tax reporting and withholding calculations. It serves as a corrective measure for individuals to accurately report their earnings and taxes owed.

Form 1040, the U.S. Individual Income Tax Return, is the primary form used by individuals to file their annual income tax returns. It is indirectly related to the IRS 8919 form through the individual’s tax reporting process. While the 1040 form covers the broader filing of taxes, the 8919 form specifically addresses the issue of tax withholding due to employment misclassification, affecting how earnings and taxes are reported on the 1040.

The W-9 form, Request for Taxpayer Identification Number and Certification, is another document in the tax reporting process, used by companies to gather information from vendors, independent contractors, and other payees to prepare information returns (e.g., 1099 forms). While the W-9 assumes a non-employee status, the IRS 8919 questions and seeks to amend this status to that of an employee, highlighting a fundamental disagreement in worker classification.

Finally, the Form 940, Employer's Annual Federal Unemployment (FUTA) Tax Return, relates to the IRS 8919 form in the context of employer tax responsibilities. Form 940 is used by employers to report their annual Federal Unemployment Tax Act obligation. This form is pertinent because the reclassification of a worker from independent contractor to employee (via the IRS 8919) may affect an employer's FUTA responsibilities, reflecting the intertwined nature of employment classification and tax obligations.

Dos and Don'ts

Filling out IRS Form 8919 is crucial for accurately reporting taxes, especially for those who are categorizing their work status. Here’s a comprehensive guide to help navigate common do's and don'ts when completing this form.

Do's:

- Review the form instructions carefully before starting, to understand the specific requirements and conditions.

- Ensure you meet the criteria for using Form 8919, which is typically for workers who believe they were incorrectly treated as independent contractors instead of employees.

- Gather all necessary documentation, such as W-2s and any correspondence regarding your employment status, to support your situation.

- Use the correct reason code from the form's instructions that best fits your situation for why you are filing Form 8919.

- Double-check your Social Security Number and other personal details to avoid delays or issues with your tax return.

- Accurately calculate the total taxes owed based on the wages not reported on a W-2 form to ensure correct payment to the IRS.

- If you have questions or need assistance, consult with a tax professional who can provide guidance specific to your situation.

Don'ts:

- Don't guess on any answers. If you're unsure about a response, seek clarification from a tax professional or the IRS to avoid making errors.

- Avoid delaying your tax filing because you’re waiting on a determination from the IRS regarding your employment status. It's essential to file on time to avoid penalties.

- Don't overlook IRS notifications or letters regarding your Form 8919 filing. Respond promptly to any requests for additional information or clarification.

- Don't submit the form without reviewing it for accuracy. A simple oversight can lead to processing delays or incorrect tax calculations.

By following these guidelines, individuals can navigate Form 8919 more effectively, ensuring their taxes are reported correctly and minimizing the risk of errors or issues with the IRS.

Misconceptions

Only full-time employees can use Form 8919. This is incorrect. Both full-time and part-time workers can use Form 8919 if they were treated as independent contractors but believe they were employees based on their work situation. The critical factor is not the hours worked but the nature of the control a business has over the worker.

Form 8919 is for disputing your income. This misunderstands the form's purpose. Form 8919 is used to calculate and report the employee's share of uncollected Social Security and Medicare taxes due to their employer's misclassification, not to dispute the amount of income earned.

You need permission from the IRS to file Form 8919. This is not true. Individuals do not need prior approval from the IRS to use Form 8919. They need to meet the specific criteria outlined by the IRS for misclassified workers and have a reasonable basis for believing they were misclassified.

Using Form 8919 will automatically trigger an audit. There's no evidence to suggest that using Form 8919 will directly cause an IRS audit. However, it may bring to the IRS's attention issues concerning employment tax compliance. An audit can be initiated based on a variety of factors, but there is no automatic trigger tied to Form 8919.

Form 8919 is only for disputing taxes when leaving a job. This misconception assumes that the form's use is tied to the end of employment. In reality, you can use Form 8919 for any tax year in which you were misclassified, regardless of whether you're still working for the same employer or not.

Filing Form 8919 will get your employer in legal trouble. While using Form 8919 can alert the IRS to potential misclassification issues, the form alone does not initiate legal action against an employer. The IRS uses the information to correct tax discrepancies. Separate actions or investigations determine whether an employer will face penalties or legal consequences.

If you file Form 8919, you cannot receive a refund for overpaid taxes. This is a misunderstanding. If as a result of filing Form 8919 and correcting your employment status you have overpaid taxes (for instance, paid self-employment tax when you shouldn’t have), you may be eligible for a refund of the overpayment. The primary aim is to ensure the correct amount of Social Security and Medicare taxes are paid.

Key takeaways

The IRS Form 8919 is crucial for taxpayers who need to report wages from an employer who did not withhold Medicare and Social Security taxes. Understanding when and how to use this form properly is essential to ensure compliance and avoid potential issues with the IRS. Here are key takeaways regarding filling out and using the IRS Form 8919:

- Purpose of Form 8919: It's used to calculate and report uncollected Social Security and Medicare taxes due to incorrectly classified employment status. This typically applies when an individual should have been treated as an employee rather than an independent contractor.

- Determining Eligibility: Individuals must meet specific criteria to use Form 8919. The most common scenario is if one received a Form W-2 and the employer did not withhold these taxes, or if one is covered under a Section 3121(q) Notice and Demand, which pertains to unreported tips.

- Required Information: This form requires the taxpayer to input accurate information about earnings, employer details, and the reason for submitting the form (using codes listed on the form).

- Use of Reason Codes: The form includes various codes to indicate the specific situation that led to the incorrect classification of employment status. It is vital to choose the correct code that most closely fits the individual's scenario.

- Impact on Future Social Security Benefits: Filing Form 8919 allows earnings to be credited to the taxpayer's Social Security record, which can affect future Social Security benefits.

- Attaching to Tax Return: Form 8919 must be filed with the individual's tax return for the year the wages were received. It cannot be submitted independently.

- Correction of Employment Status: While Form 8919 addresses the tax implications of misclassification, it does not change an individual's employment status. Workers may need to take additional steps to correct their status with their employer or through legal avenues.

- Consulting a Professional: Given the complexities surrounding employment misclassification and its tax implications, individuals may benefit from consulting with a tax professional or legal advisor to ensure proper filing and to explore all available options.

Popular PDF Documents

Pennsylvania Tax Clearance Certificate - Strategies to ensure that all supporting documents required by SARS are accurately submitted along with the application form.

Schedule M-3 1120 Instructions - Part I of the form focuses on net income per income statement, requiring adjustments to reconcile with tax return figures.

What Is Form 1095-a - Tax filers use form 1095-A to report health insurance coverage information when filing their annual tax returns.