Get IRS 8917 Form

Navigating the nuances of educational tax benefits can significantly impact an individual's financial landscape, particularly when it comes to reducing taxable income through tuition and fees deductions. Among the various forms and documentation required by the Internal Revenue Service (IRS), the IRS Form 8917 is pivotal for taxpayers seeking to claim deductions for tuition and related expenses. This form allows for a straightforward way to deduct eligible education expenses from one's income, potentially lowering the overall tax bill. Understanding the eligibility criteria, such as enrollment status and the nature of the qualifying expenses, is essential for correctly utilizing this benefit. Moreover, it's important to note how this deduction interacts with other educational credits, ensuring taxpayers optimize their tax savings without violating any of the tax code's provisions. As such, the IRS Form 8917 emerges as a critical tool for students and their families, offering a financial reprieve that makes education more accessible.

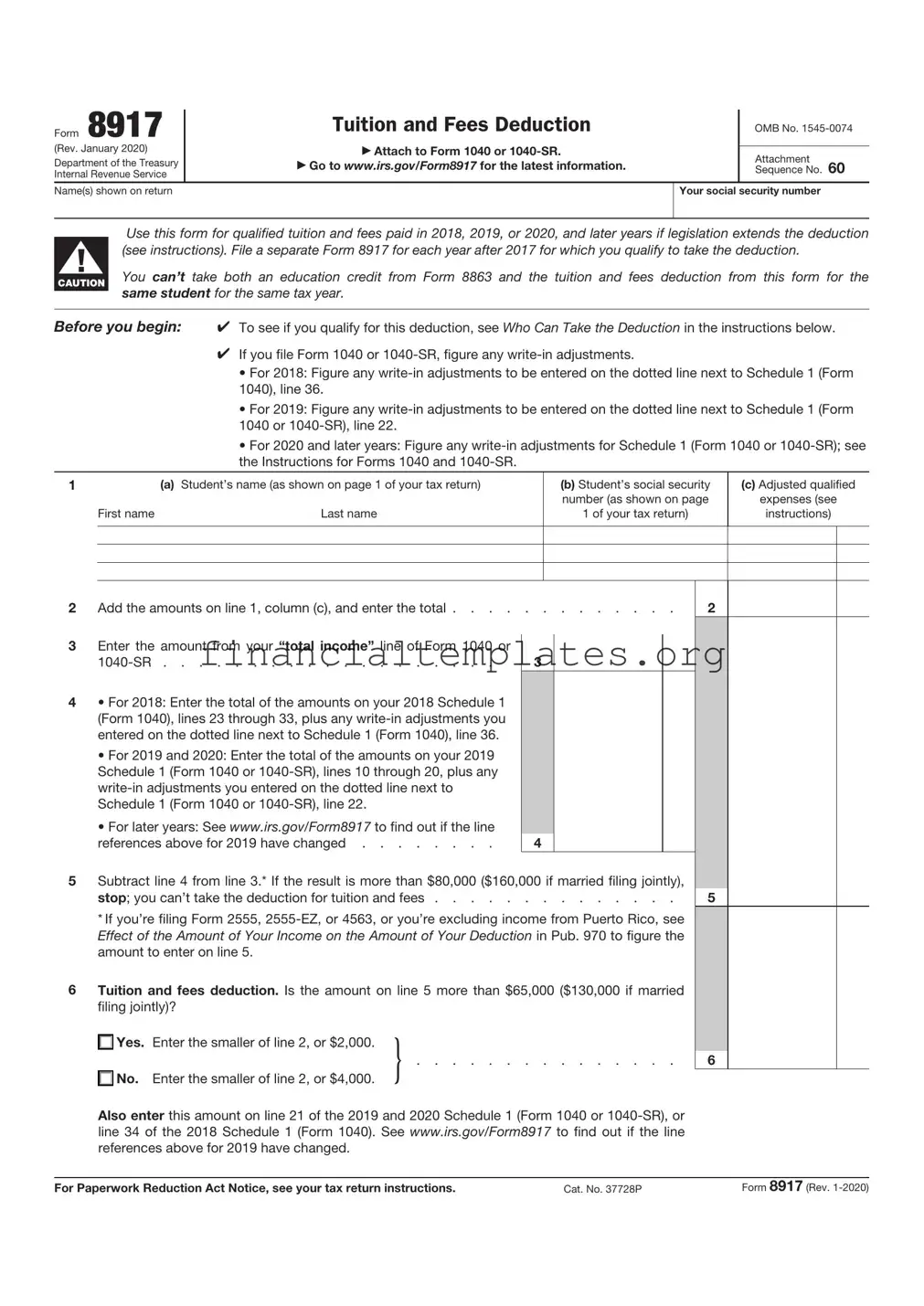

IRS 8917 Example

Form 8917 |

|

Tuition and Fees Deduction |

|

OMB No. |

|

|

|||

(Rev. January 2020) |

|

Attach to Form 1040 or |

|

|

|

|

Attachment |

||

Department of the Treasury |

|

Go to www.irs.gov/Form8917 for the latest information. |

|

|

|

|

Sequence No. 60 |

||

Internal Revenue Service |

|

|

||

|

|

|

|

|

Name(s) shown on return |

|

|

Your social security number |

|

|

|

|

|

|

F!

CAUTION

Use this form for qualified tuition and fees paid in 2018, 2019, or 2020, and later years if legislation extends the deduction (see instructions). File a separate Form 8917 for each year after 2017 for which you qualify to take the deduction.

You can’t take both an education credit from Form 8863 and the tuition and fees deduction from this form for the same student for the same tax year.

Before you begin: To see if you qualify for this deduction, see Who Can Take the Deduction in the instructions below.

If you file Form 1040 or

•For 2018: Figure any

•For 2019: Figure any

•For 2020 and later years: Figure any

1 |

|

(a) Student’s name (as shown on page 1 of your tax return) |

(b) Student’s social security |

(c) Adjusted qualified |

|

|

|

number (as shown on page |

expenses (see |

|

First name |

Last name |

1 of your tax return) |

instructions) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2 Add the amounts on line 1, column (c), and enter the total |

2 |

3Enter the amount from your “total income” line of Form 1040 or

3 |

4• For 2018: Enter the total of the amounts on your 2018 Schedule 1 (Form 1040), lines 23 through 33, plus any

•For 2019 and 2020: Enter the total of the amounts on your 2019 Schedule 1 (Form 1040 or

•For later years: See www.irs.gov/Form8917 to find out if the line

references above for 2019 have changed |

4 |

5Subtract line 4 from line 3.* If the result is more than $80,000 ($160,000 if married filing jointly),

stop; you can’t take the deduction for tuition and fees |

5 |

*If you’re filing Form 2555,

6Tuition and fees deduction. Is the amount on line 5 more than $65,000 ($130,000 if married filing jointly)?

Yes. |

Enter the smaller of line 2, or $2,000. |

} |

|

|

|

6 |

|

No. |

Enter the smaller of line 2, or $4,000. |

|

Also enter this amount on line 21 of the 2019 and 2020 Schedule 1 (Form 1040 or

For Paperwork Reduction Act Notice, see your tax return instructions. |

Cat. No. 37728P |

Form 8917 (Rev. |

Form 8917 (Rev. |

Page 2 |

General Instructions

Section references are to the Internal Revenue Code unless otherwise noted.

What’s New

Deduction extended. The tuition and fees deduction is extended for qualified tuition and fees paid in calendar years 2018, 2019, and 2020. Don’t claim the deduction for expenses paid after 2020 unless the credit is extended again. Use Form 8917 (Rev. January 2020) and these instructions for years after 2017, unless a newer revision is issued indicating it is succeeding this revision.

Periodic updating. Form 8917 will no longer be updated annually. Instead, it will only be updated when necessary. For previous years, use the applicable Form 8917 for that year.

Example 1. Use the 2017 Form 8917 for your 2017 qualified tuition and fees expenses deduction on your 2017 original or amended return.

Form

Future Developments

For the latest information about developments related to Form 8917 and its instructions, such as legislation enacted after they were published, go to www.irs.gov/Form8917.

Reminders

Form

However, a taxpayer may claim one of these education benefits if the student doesn’t receive a Form

Purpose of Form

Use Form 8917 (Rev. January 2020) to figure and take the deduction for tuition and fees expenses paid in calendar years 2018, 2019, and 2020, and later years if the deduction is extended.

This deduction is based on adjusted qualified education expenses paid to an eligible educational institution (postsecondary). See Qualified Education Expenses, later, for more information.

You may be able to take the American opportunity credit TIP or lifetime learning credit for your education expenses

instead of the tuition and fees deduction. See Form 8863, Education Credits, and Pub. 970, Tax Benefits for Education, for more information about these credits.

Who Can Take the Deduction

You may be able to take the deduction if you, your spouse, or a dependent you claim on your tax return was a student enrolled at or attending an eligible educational institution. The deduction is based on the amount of qualified education expenses you paid for the student in the current year for academic periods beginning in the current year or beginning in the first 3 months of the following year.

Generally, in order to claim the deduction for education expenses for a dependent, you must have paid the expenses in the current year and must claim the student as a dependent on your current year tax return (the “Dependents” line of Form 1040 or

You can’t claim the tuition and fees deduction if any of the following apply.

•Your filing status is married filing separately.

•Another person can claim an exemption for you as a dependent on his or her tax return. You can’t take the deduction even if the other person doesn’t actually claim that exemption.

•Your modified adjusted gross income (MAGI), as figured on line 5, is more than $80,000 ($160,000 if filing a joint return).

•You were a nonresident alien for any part of the year and didn’t elect to be treated as a resident alien for tax purposes. More information on nonresident aliens can be found in Pub. 519, U.S. Tax Guide for Aliens.

You can’t claim a tuition and fees deduction for any student if you or anyone else claims an American opportunity or lifetime learning credit (Form 8863) in the current year for expenses of the student for whom the qualified education expenses were paid. However, a state tax credit won’t disqualify you from claiming a tuition and fees deduction.

Qualified Education Expenses

Generally, qualified education expenses are amounts paid in the current year for tuition and fees required for the student’s enrollment or attendance at an eligible educational institution. Required fees include amounts for books, supplies, and equipment used in a course of study if required to be paid to the institution as a condition of enrollment or attendance. It doesn’t matter whether the expenses were paid in cash, by check, by credit or debit card, or with borrowed funds.

Qualified education expenses include nonacademic fees, such as student activity fees, athletic fees, or other expenses unrelated to the academic course of instruction, only if the fee must be paid to the institution as a condition of enrollment or attendance. However, fees for personal expenses (described below) are never qualified education expenses.

Qualified education expenses don’t include amounts paid for the following.

•Personal expenses. This means room and board, insurance, medical expenses (including student health fees), transportation, and other similar personal, living, or family expenses.

•Any course or other education involving sports, games, or hobbies, or any noncredit course, unless such course or other education is part of the student’s degree program or helps the student acquire or improve job skills.

Qualified education expenses don’t include any expenses for which you take any other deduction, such as on Schedule A (Form 1040 or

Form 8917 (Rev. |

Page 3 |

You may receive Form

Qualified education expenses paid directly to the institution by someone other than you or the student are treated as paid to the student and then paid by the student to the institution.

Academic Period

An academic period is any quarter, semester, trimester, or any other period of study as reasonably determined by an eligible educational institution. If an eligible educational institution uses credit hours or clock hours and doesn’t have academic terms, each payment period may be treated as an academic period.

Prepaid Expenses

Qualified education expenses paid in the current year for an academic period that begins in the first 3 months of the following year can be used in figuring the tuition and fees deduction for the current year only.

Example 2. Qualified education expenses paid in 2018 for an academic period that begins in the first 3 months of 2019 can be used in figuring the tuition and fees deduction for 2018 only. See Academic Period, earlier.

Example 3. If you pay $2,000 in December 2019 for qualified tuition for the 2020 winter quarter that begins in January 2020, you can use that $2,000 in figuring the tuition and fees deduction for 2019 only (if you meet all the other requirements).

! |

You can’t use any amount you paid in the previous or |

future year to figure the qualified education expenses you |

|

F |

|

CAUTION |

use to figure your current year tuition and fees |

|

|

deduction. |

|

Example 4. You can’t use any amount you paid in 2017 or 2019 to figure the qualified deduction expenses you use to figure your 2018 tuition and fees deduction.

Adjusted Qualified Education Expenses

For each student, reduce the qualified education expenses paid by or on behalf of that student under the following rules. The result is the amount of adjusted qualified education expenses for each student.

1.The

2.The

3.Veterans’ educational assistance; and

4.Any other educational assistance that is excludable from gross income (tax free), other than as a gift, bequest, devise, or inheritance.

You may be able to increase the combined value of your TIP tuition and fees deduction and certain educational

assistance if the student includes some or all of the educational assistance in income in the year it is received. For details, see Pub. 970.

Generally, any scholarship or fellowship grant is treated as

•The scholarship or fellowship grant (or any part of it) must be applied (by its terms) to expenses (such as room and board) other than qualified education expenses as defined in Qualified education expenses in Pub. 970; or

•The scholarship or fellowship grant (or any part of it) may be applied (by its terms) to expenses (such as room and board) other than qualified education expenses as defined in Qualified education expenses in Pub. 970.

If this

Refunds. A refund of qualified education expenses may reduce adjusted qualified education expenses for the tax year or may require you to include some or all of the refund in your gross income for the year the refund is received. See Pub. 970 for more information. Some

Refunds received in the current year. For each student, figure the adjusted qualified education expenses for the current year by adding all the qualified education expenses paid in the current year and subtracting any refunds of those expenses received from the eligible educational institution during the current year.

Refunds received after the current year but before your income tax return is filed. If anyone receives a refund after the current year of qualified education expenses you paid on behalf of a student in the current year and the refund is received before you file your current year income tax return, reduce the amount of qualified education expenses for the current year by the amount of the refund.

Refunds received after the current year and after your income tax return is filed. If anyone receives a refund after the current year of qualified education expenses you paid on behalf of a student in the current year and the refund is received after you file your current year income tax return, you may need to include some or all of the refund in your gross income for the year the refund is received. See Pub. 970 for more information.

Coordination with Coverdell education savings accounts and qualified tuition programs. Reduce your qualified education expenses by any qualified education expenses used to figure the exclusion from gross income of (a) interest received under an education savings bond program, or (b) any distribution from a Coverdell education savings account or qualified tuition program (QTP). For a QTP, this applies only to the amount of

Form 8917 (Rev. |

Page 4 |

Eligible Educational Institution

An eligible educational institution is generally any accredited public, nonprofit, or proprietary (private) college, university, vocational school, or other postsecondary institution. Also, the institution must be eligible to participate in a student aid program administered by the Department of Education. Virtually all accredited postsecondary institutions meet this definition.

An eligible educational institution also includes certain educational institutions located outside the United States that are eligible to participate in a student aid program administered by the Department of Education.

TIP |

The educational institution should be able to tell you if it |

|

is an eligible institution. |

||

|

Additional Information

See Pub. 970 for more information about the tuition and fees deduction.

Specific Instructions

Line 1

Complete columns (a) through (c) on line 1 for each student for whom you elect to take the tuition and fees deduction.

Note: If you have more than three students who qualify for the tuition and fees deduction, enter “See attached” next to line 1 and attach a statement with the required information for each additional student. Include the amounts from line 1, column (c), for all students in the total you enter on line 2.

Column (c)

For each student, enter the amount of adjusted qualified education expenses. The expenses must have been paid for the student in the current year for academic periods beginning in the current year but before April 1 of the following year.

Document Specifics

| Name of Fact | Detail |

|---|---|

| Form Title | IRS Form 8917 |

| Purpose | To deduct tuition and fees for higher education on federal taxes. |

| Eligibility | Taxpayers who have incurred qualified education expenses for themselves, their spouse, or dependents. |

| Qualified Expenses | Tuition and fees required for enrollment or attendance at an eligible educational institution. |

| Limitations | The deduction is subject to income limitations and may be phased out based on the taxpayer's modified adjusted gross income. |

| Claiming the Deduction | Complete and attach Form 8917 to your federal tax return. |

| Impact on Other Credits | Cannot be used for the same student, in the same year, as the American Opportunity Credit or Lifetime Learning Credit. |

| Additional Requirements | Educational institution must be eligible, and expenses must be substantiated with receipts or other documentation. |

| Legal Authority | Guided by the IRS Tax Code, subject to change based on federal tax law updates. |

Guide to Writing IRS 8917

Filling out the IRS Form 8917 can be a straightforward process when approached methodically. This form is used for deducting tuition and fees for education directly from taxable income. It helps taxpayers reduce their taxable income by the amount they've spent on certain education expenses, which can lead to significant savings during tax season. Before starting, gather all necessary documents such as tuition receipts or statements from educational institutions to ensure accurate reporting. Here's a step-by-step guide to help you fill out the form correctly.

- Start by entering your name and Social Security number at the top of the form. These should match the information on your tax return.

- Move to Line 1, where you will list the total amount of qualified education expenses you paid for the tax year. This can include tuition and any fees required for your enrollment or attendance at an eligible educational institution. Do not include personal, living, or family expenses.

- On Line 2, you will calculate the allowable deduction. In most cases, this will be the amount from Line 1. However, the form provides instructions for adjustments that might need to be made, depending on your specific situation.

- Line 3 is where you may need to make adjustments based on other educational benefits you've received during the tax year. The form provides guidelines on how to adjust your deduction if you've also received a Pell Grant, employer-provided educational assistance, or other types of educational aid.

- Once you have the adjusted amount on Line 3, enter this figure on Line 4. This is the amount of the tuition and fees deduction you are claiming.

- Finally, follow the instructions to transfer the amount from Line 4 to the appropriate line on your tax return. For instance, the amount from Line 4 might be transferred to a specific line on Form 1040 or 1040-SR, depending on which form you are using to file your taxes.

After completing the form, review it to make sure all information is accurate and properly documented. Make sure that all numerical entries are correct and that the form is signed if required. This step is crucial to ensure that your deduction is processed correctly and that you receive the correct adjustment to your taxable income. Once reviewed, attach Form 8917 to your tax return and proceed with filing your taxes as normal. If you encounter any difficulties or have questions, consulting with a tax professional or the IRS directly can provide additional guidance.

Understanding IRS 8917

What is the IRS Form 8917?

IRS Form 8917, or the Tuition and Fees Deduction Form, is a document used for taxpayers to calculate and claim a deduction for tuition and fees expenses paid for themselves, a spouse, or dependents. This form is leveraged to lower taxable income, based on qualified education expenses, potentially leading to a reduced tax bill.

Who is eligible to use IRS Form 8917?

Eligibility to use Form 8917 largely rests on specific criteria. Taxpayers who have incurred education expenses for higher education can use this form provided they are filing a return for themselves, their spouse, or dependents and the expenses are not covered by scholarships, grants, or waived. The filer’s Modified Adjusted Gross Income (MAGI) must also fall below a certain threshold, which is subject to change annually.

What types of expenses qualify for deduction using Form 8917?

- Tuition payments made directly to the education institution.

- Required fees for enrollment or attendance.

- Certain course-related expenses, however, are not included as qualified expenses like books, supplies, and equipment unless they are required to be paid to the institution as a condition of enrollment or attendance.

How does the deduction affect my tax return?

The deduction available through Form 8917 directly reduces your taxable income. It does not reduce your income tax dollar for dollar but lowers your overall taxable income, which could result in a lower tax bracket or reduced tax liability. The maximum deduction amounts are subject to annual adjustments. It is essential to note, this deduction may not be combined with other education tax benefits such as the American Opportunity Credit or the Lifetime Learning Credit for the same student in the same year.

How and when can I file IRS Form 8917?

Form 8917 should be filed with your annual tax return. It gets attached to Form 1040 or Form 1040-SR, and you should file it by the tax return deadline, typically April 15. If you are using tax software, it will guide you through the process of filing this form if you qualify. For those using a tax preparer, ensure they are aware of your eligible education expenses to take advantage of this deduction.

Common mistakes

When filling out the IRS Form 8917, which is used for deducting tuition and fees for education, individuals often encounter various pitfalls that can impact their tax returns. Identifying these common mistakes is essential to ensure that taxpayers can take full advantage of the potential deductions and avoid unnecessary errors. Below is an expanded list of 10 mistakes commonly made during this process:

Failing to confirm eligibility before claiming the deduction. Not every taxpayer or their dependents qualify for the tuition and fees deduction based on their filing status, income level, or enrollment status.

Not including all required supporting documents, such as form 1098-T from the educational institution, which verifies the tuition expenses paid.

Misunderstanding which expenses are deductible. Only certain types of educational expenses, like tuition and mandatory enrollment fees, are eligible while others, such as room and board, are not.

Claiming the deduction for non-eligible educational institutions. The IRS requires the institution to be an eligible educational entity.

Overlooking the deduction because of receiving tax-free educational assistance. Taxpayers need to adjust their deductible educational expenses if they have received grants, scholarships, or employer assistance.

Incorrectly filling out income information, leading to an inaccurate calculation of the deduction. The amount of the tuition and fees deduction can be phased out based on the taxpayer's modified adjusted gross income (MAGI).

Double-dipping by claiming both the tuition and fees deduction and other education credits like the American Opportunity Credit or Lifetime Learning Credit for the same expenses, which is not allowed.

Failing to claim the deduction for eligible dependents. Parents often miss out on deductions for tuition and fees paid for their dependents' education.

Not updating the form to reflect any refunds received from the educational institutions after the form was filed. Adjustments may be necessary if the taxpayer receives a refund of previously deducted expenses.

Submitting the form with incomplete or inaccurate personal information, such as incorrect taxpayer identification numbers or addresses, which can delay processing or result in a rejection of the deduction claim.

Avoiding these mistakes can significantly influence the outcome of the tax reporting process, ensuring that taxpayers maximize their eligible deductions while complying with IRS regulations. For more detailed guidance, consulting the official IRS guidelines or seeking professional tax advice is recommended.

Documents used along the form

When preparing taxes, particularly with an emphasis on educational expenses, the IRS Form 8917, "Tuition and Fees Deduction," is frequently utilized. This form is designed to help taxpayers claim deductions for tuition and fees paid for themselves, a spouse, or dependents. However, to accurately complete and substantiate the claims made on Form 8917, individuals often need to gather and fill out additional forms and documents. The following are among the most commonly used forms alongside IRS Form 8917.

- Form 1040 or 1040-SR: This is the U.S. Individual Income Tax Return form. It's the primary form used by individuals to file their annual income tax returns. Details about your income, tax deductions, and credits are reported here. Information from Form 8917 is directly entered onto Form 1040, impacting the filer’s adjusted gross income.

- Form 1098-T: Also known as the "Tuition Statement," this form is issued by educational institutions. It reports amounts paid for tuition, enrolled students, and scholarships or grants received. Taxpayers use it to fill out Form 8917, as it provides the necessary information to claim education deductions.

- Form W-2: This Wage and Tax Statement is provided by employers and details the employee's annual wages and the amount of taxes withheld from their paycheck. While not directly related to education expenses, it is essential for completing income information on Form 1040.

- Form 8863: Titled "Education Credits (American Opportunity and Lifetime Learning Credits)," this form is used to calculate and claim education credits. While Form 8863 and Form 8917 serve different purposes, both require information about educational expenses. Taxpayers must decide which benefits are more advantageous, as they cannot claim both a deduction and a credit for the same expenses.

When filing taxes and taking advantage of educational benefits, it is crucial to accurately complete and submit all relevant forms and documents. Understanding how these forms interact enhances a taxpayer’s ability to maximize potential deductions and credits, thus improving their overall tax situation. Each of these documents plays a specific role in detailing personal, educational, and financial information that is critical to determining the correct tax obligations and benefits.

Similar forms

The IRS 8917 form, designated for tuition and fees deduction, shares similarities with several other IRS forms, all designed to assist taxpayers in claiming various deductions or credits related to education expenses. One of these forms is the IRS Form 8863, titled "Education Credits (American Opportunity and Lifetime Learning Credits)." Both forms assist in reducing taxable income based on qualified education expenses, but while Form 8917 offers a deduction from income directly, Form 8863 provides for education-related credits, which could directly reduce the amount of tax owed rather than just taxable income. This subtle distinction marks how the benefits of each are realized by the taxpayer.

The IRS Form 1040, the U.S. Individual Income Tax Return, is another document closely related to Form 8917. Essentially, the deductions reported on Form 8917 are transferred to Form 1040 or its variants. Specifically, the adjustment to income for tuition and fees deducted on Form 8917 can directly affect the adjusted gross income reported on Form 1040. This underscores the interconnectedness of these forms in the filing process, as adjustments made on one can significantly impact the outcomes of another.

Another document to consider in this context is the IRS Form 1098-T, known as the "Tuition Statement." Education institutions issue Form 1098-T to students, detailing the amounts paid for tuition and related expenses. This form is crucial because the information it provides serves as the basis for filling out Form 8917 and determining the amount of deduction a taxpayer is eligible for. Without the Form 1098-T as proof of educational expenses, accurately completing Form 8917 would be challenging.

The IRS Form 1099-Q is also related to Form 8917 but from a different angle. Form 1099-Q reports payments from qualified education programs, including distributions from 529 plans and Coverdell Education Savings Accounts. Although it focuses on distributions rather than direct tuition payments, it's relevant because the amounts withdrawn and used for education purposes can interact with the deductions claimed on Form 8917, especially considering that certain qualifications and restrictions apply to how these funds are used in relation to claiming deductions.

IRS Form 970, "Tax Benefits for Education," though not a form used for filing, contains detailed information and guidelines on claiming education-related deductions and credits, including those related to Form 8917. It serves as a comprehensive resource for taxpayers looking to understand how various educational expenses can impact their taxes, encompassing both deductions and credits, and providing examples that clarify the eligibility requirements and potential benefits of each.

Last but not least, the IRS Schedule 3 (Form 1040), which covers "Additional Credits and Payments," plays into the broader landscape of credits and deductions for which a taxpayer might be eligible. Despite its primary focus on credits, some of the adjustments and deductions claimed on Form 8917 could influence the calculations and entries on Schedule 3, specifically in sections related to other credits or adjustments to income. It's an example of how various elements of tax filing interplay, with one form potentially affecting another's outcomes.

Dos and Don'ts

When completing the IRS Form 8917, which is used for deducting tuition and fees for education, it's vital to pay close attention to the details to ensure you maximize your potential deductions while staying within the rules. Below are important dos and don'ts to keep in mind:

- Do gather all necessary documents related to your tuition and education expenses before starting the form. This includes receipts, Form 1098-T, and records of any scholarships or grants received.

- Do double-check whether you are eligible for the deduction. The IRS has specific guidelines on who can claim education deductions based on income, filing status, and educational program.

- Do carefully read the instructions provided by the IRS for filling out Form 8917 to ensure you understand each part of the form.

- Do use the correct tax year’s form. The IRS updates forms annually, so it's crucial to use the form for the tax year you're filing for.

- Don't forget to include the school’s Employer Identification Number (EIN). You can usually find this on Form 1098-T.

- Don't claim expenses that are not allowed. Only certain types of education expenses, such as tuition and mandatory enrollment fees, are deductible.

- Don't overlook the income phase-out limits. If your modified adjusted gross income (MAGI) is above a certain threshold, your deduction amount may be reduced or eliminated.

- Don't hesitate to consult with a tax professional if you’re unsure about how to fill out the form or if you qualify for the deduction. Sometimes the rules can be complex, and professional advice can ensure you get the maximum benefit.

Misconceptions

The Internal Revenue Service (IRS) Form 8917, Tuition and Fees Deduction, is associated with multiple misconceptions. This form is used to determine the deductible amount of tuition and fees for higher education. Understanding the facts can help taxpayers accurately claim this deduction and potentially save money. Below are ten common misconceptions about IRS Form 8917 and the explanations to correct them.

- Only full-time students qualify for the deduction. This is incorrect. Both part-time and full-time students can qualify for the tuition and fees deduction, as long as they are enrolled in an eligible institution and the expenses meet the requirements.

- You can claim tuition and fees deduction for any educational expenses. This isn't true. The deduction is limited to tuition and certain related expenses required for enrollment or attendance. Expenses for room, board, insurance, or transportation, among others, do not qualify.

- The tuition and fees deduction is the same as the education credits. They are not the same. The tuition and fees deduction reduces your taxable income, whereas education credits like the American Opportunity Credit and the Lifetime Learning Credit reduce your tax bill dollar-for-dollar.

- There's no income limit to qualify for the deduction. Actually, there is an income limit. The ability to claim the deduction phases out at higher income levels, and it’s completely phased out for taxpayers with adjusted gross income above certain thresholds.

- You can claim the deduction without any documentation. This is not the case. While you don't need to submit documentation with your tax return, you should keep receipts and other records in case the IRS requires proof.

- The deduction can be claimed for an unlimited number of years. Incorrect. There is a limit on the number of years you can claim the deduction. As of the latest tax guidelines, the deduction can no longer be claimed for tax years after 2020 unless the law is extended or changed.

- You can claim the deduction for your dependents' education expenses. This is true, but often misunderstood. You can claim the deduction for tuition and fees paid for your dependents, provided other qualifications are met, such as the dependency status and income limits.

- Non-accredited programs qualify for the deduction. This is false. The educational institution must be eligible, generally meaning it must be accredited and recognized by the U.S. Department of Education to qualify for the deduction.

- The form is complicated to fill out. This misconception could prevent taxpayers from taking advantage of the deduction. In reality, Form 8917 is straightforward, requiring basic information about the taxpayer, educational institution, and the amount of qualified expenses.

- Only undergraduate courses are eligible for the deduction. Both undergraduate and graduate-level courses can qualify for the tuition and fees deduction, as long as all other eligibility requirements are met.

Understanding these misconceptions about IRS Form 8917 can lead to better-informed decisions when filing taxes, ensuring that eligible taxpayers do not miss out on potential deductions for education expenses. Always consult with a tax professional or refer to the latest IRS guidelines to ensure compliance and maximize tax benefits.

Key takeaways

The IRS 8917 form, also known as the "Tuition and Fees Deduction" form, is an essential document for individuals looking to claim deductions for tuition and related expenses during the tax year. As taxpayers navigate through the complexities of tax preparation, understanding the key aspects of utilizing this form can significantly affect their financial outcomes. Below are ten critical takeaways regarding filling out and using the IRS 8917 form.

- Eligibility is restricted to those paying qualified education expenses for higher education for themselves, a spouse, or a dependent.

- The form allows for a deduction of qualified education expenses, reducing the amount of taxable income, rather than providing a tax credit.

- Qualified education expenses include tuition and fees required for enrollment or attendance at an eligible educational institution. These do not encompass expenses related to room and board, transportation, insurance, or equipment.

- The maximum deduction amount has been subject to change over tax years; hence, taxpayers should verify the current year's limit to calculate their deduction accurately.

- Filing status impacts eligibility and the deduction amount. For example, married individuals filing separately cannot claim this deduction.

- There is an income threshold, with phase-outs beginning at certain adjusted gross income (AGI) levels, which vary each tax year. Taxpayers above the phase-out range are ineligible.

- To fill out the form, one must first complete Form 1040 or 1040-SR, as the deduction directly affects the adjusted gross income reported on these forms.

- The IRS does not allow double-dipping. Expenses used for this deduction cannot also be used for another credit or deduction, such as the American Opportunity Credit or the Lifetime Learning Credit.

- Detailed records of educational expenses and proof of payment should be maintained to support the deduction if audited by the IRS.

- Changes in tax law can affect the availability and specifics of the deduction. Taxpayers should consult the most recent IRS guidance or a tax professional to ensure compliance and optimize tax benefits.

In conclusion, carefully considering these key takeaways when preparing to use the IRS 8917 form can aid individuals in maximizing their potential tax benefits while ensuring compliance with tax laws. As regulations and individual circumstances vary, consulting with a tax professional or advisor can provide personalized advice tailored to one’s unique financial situation.

Popular PDF Documents

Rc66 Form - Find out how cooperative owners can check their property's eligibility for tax benefits through their managing agent.

Driver Contract Agreement With Vehicle Owner - Encourages keeping a copy of all leases for records and reporting any lease overcharge complaints to authorities.