Get IRS 8889 Form

Tackling taxes can seem daunting, especially when you're dealing with health savings accounts (HSAs). Fortunately, the IRS 8889 form is here to simplify the process. Designed specifically for HSA contributions, distributions, and deductions, this essential document ensures that taxpayers can accurately report their health savings activity throughout the tax year. From calculating deductions to reporting distributions, the IRS 8889 form plays a critical role in maximizing tax benefits associated with HSAs, while also ensuring compliance with federal regulations. Whether you're contributing to an HSA for the first time or are a seasoned saver, understanding how to properly complete and file this form is key to making the most of your healthcare savings and avoiding any potential penalties for incorrect reporting.

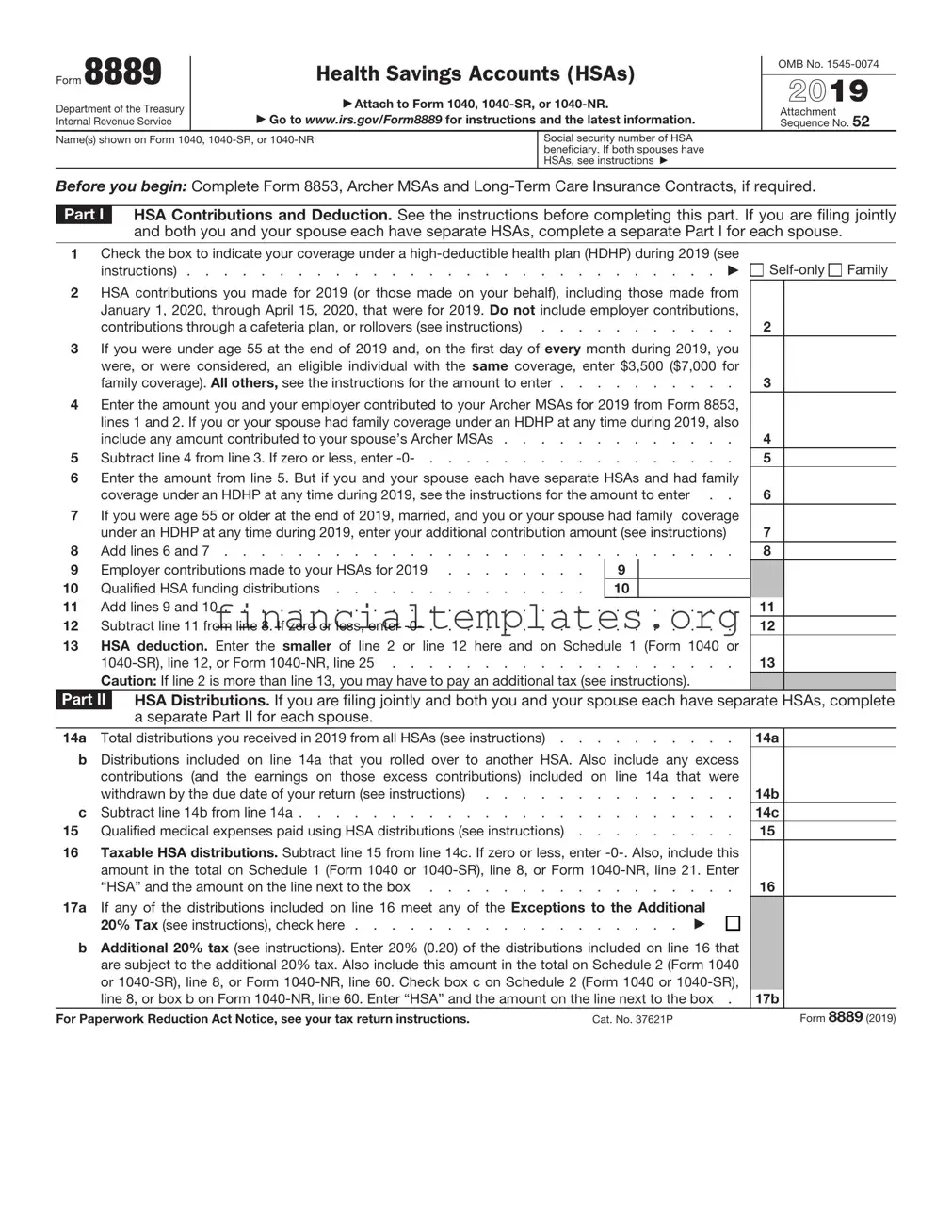

IRS 8889 Example

Form 8889 |

|

Health Savings Accounts (HSAs) |

OMB No. |

|

|

|

|||

|

2021 |

|||

Department of the Treasury |

|

▶ Attach to Form 1040, |

||

▶ Go to www.irs.gov/Form8889 for instructions and the latest information. |

Attachment |

|||

Internal Revenue Service |

Sequence No. 52 |

|||

Name(s) shown on Form 1040, |

|

Social security number of HSA |

|

|

|

|

|

beneficiary. If both spouses |

|

|

|

|

have HSAs, see instructions ▶ |

|

Before you begin: Complete Form 8853, Archer MSAs and

Part I HSA Contributions and Deduction. See the instructions before completing this part. If you are filing jointly and both you and your spouse each have separate HSAs, complete a separate Part I for each spouse.

1Check the box to indicate your coverage under a

See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . ▶ |

Family |

2HSA contributions you made for 2021 (or those made on your behalf), including those made from January 1, 2022, through April 15, 2022, that were for 2021. Do not include employer contributions,

contributions through a cafeteria plan, or rollovers. See instructions |

2 |

3If you were under age 55 at the end of 2021 and, on the first day of every month during 2021, you were, or were considered, an eligible individual with the same coverage, enter $3,600 ($7,200 for

family coverage). All others, see the instructions for the amount to enter |

3 |

4Enter the amount you and your employer contributed to your Archer MSAs for 2021 from Form 8853, lines 1 and 2. If you or your spouse had family coverage under an HDHP at any time during 2021, also

include any amount contributed to your spouse’s Archer MSAs |

4 |

5 Subtract line 4 from line 3. If zero or less, enter |

5 |

6Enter the amount from line 5. But if you and your spouse each have separate HSAs and had family

coverage under an HDHP at any time during 2021, see the instructions for the amount to enter . . |

6 |

7If you were age 55 or older at the end of 2021, married, and you or your spouse had family coverage

|

under an HDHP at any time during 2021, enter your additional contribution amount. See instructions |

7 |

|

||

8 |

Add lines 6 and 7 |

8 |

|

||

9 |

Employer contributions made to your HSAs for 2021 |

9 |

|

|

|

10 |

Qualified HSA funding distributions |

10 |

|

|

|

11 |

Add lines 9 and 10 |

11 |

|

||

12 |

Subtract line 11 from line 8. If zero or less, enter |

12 |

|

||

13 |

HSA deduction. Enter the smaller of line 2 or line 12 here and on Schedule 1 (Form 1040), Part II, line 13 |

13 |

|

||

|

Caution: If line 2 is more than line 13, you may have to pay an additional tax. See instructions. |

|

|

||

Part II HSA Distributions. If you are filing jointly and both you and your spouse each have separate HSAs, complete a separate Part II for each spouse.

14a Total distributions you received in 2021 from all HSAs (see instructions) . . . . . . . . . . 14a

bDistributions included on line 14a that you rolled over to another HSA. Also include any excess contributions (and the earnings on those excess contributions) included on line 14a that were

|

withdrawn by the due date of your return. See instructions |

14b |

c |

Subtract line 14b from line 14a |

14c |

15 |

Qualified medical expenses paid using HSA distributions (see instructions) |

15 |

16Taxable HSA distributions. Subtract line 15 from line 14c. If zero or less, enter

amount in the total on Schedule 1 (Form 1040), Part I, line 8e |

. . . |

16 |

17a If any of the distributions included on line 16 meet any of the Exceptions to the Additional |

|

|

20% Tax (see instructions), check here |

▶ |

|

bAdditional 20% tax (see instructions). Enter 20% (0.20) of the distributions included on line 16 that are subject to the additional 20% tax. Also, include this amount in the total on Schedule 2 (Form

1040), Part II, line 17c |

. . . . . . . . . . . . . . . . . . . . . . . . . . |

17b |

Part III Income and Additional Tax for Failure To Maintain HDHP Coverage. See the instructions before completing this part. If you are filing jointly and both you and your spouse each have separate HSAs, complete a separate Part III for each spouse.

18 |

18 |

|

19 |

Qualified HSA funding distribution |

19 |

20Total income. Add lines 18 and 19. Include this amount on Schedule 1 (Form 1040), Part I, line 8z,

and enter “HSA” and the amount on the dotted line |

20 |

21Additional tax. Multiply line 20 by 10% (0.10). Include this amount in the total on Schedule 2 (Form

1040), Part II, line 17d |

21 |

|

For Paperwork Reduction Act Notice, see your tax return instructions. |

Cat. No. 37621P |

Form 8889 (2021) |

Document Specifics

| Fact Name | Description |

|---|---|

| Purpose of Form 8889 | Form 8889 is used to report Health Savings Account (HSA) contributions and distributions. It includes any contributions made by the account holder or someone else on their behalf, as well as any distributions taken from the HSA. |

| Tax Benefits | Contributions made to an HSA can be deducted on the account holder's federal tax return, potentially reducing taxable income. This form helps determine the deductible amount. |

| Eligibility Requirements | To be eligible to contribute to an HSA and thus need Form 8889, an individual must be covered under a high deductible health plan (HDHP) and have no other health coverage, among other qualifications. |

| Contribution Limits | The IRS sets annual contribution limits for HSAs, which can vary based on the account holder's coverage (individual or family) and age. Form 8889 requires reporting of contributions up to these limits. |

| Penalties for Improper Use | Distributions not used for qualified medical expenses are taxable and subject to an additional 20% tax penalty. Form 8889 helps track the use of HSA funds to ensure they are used properly. |

| Filing Requirements | Anyone who has made or received contributions to an HSA within the tax year, or has taken distributions, is required to file Form 8889 with their federal tax return. |

Guide to Writing IRS 8889

Navigating the paperwork required for managing health savings accounts (HSAs) can seem daunting, yet it's a vital step for ensuring these accounts serve their purpose without unnecessary tax implications. The IRS Form 8889 is critical for anyone utilizing an HSA, as it documents contributions, distributions, and the tax status of the account for a given year. Filling out this form accurately guarantees that contributions and withdrawals are reported correctly to the IRS, ensuring that account holders can claim appropriate deductions and avoid penalties. Here's a step-by-step guide to help demystify the process.

- Begin by gathering all necessary documents, including your HSA contributions for the year, distributions (payments or withdrawals), and the year-end balance. You may need statements from your HSA provider and receipts for relevant medical expenses.

- On the form, start with Part I, focused on HSA contributions and deductions. Enter your HSA contributions for the year (not including employer contributions) on line 2.

- Report employer contributions, including those made through a cafeteria plan, on line 9.

- Add any contributions made from January 1 of the following year that you designate for the current tax year to line 2.

- Calculate your allowable HSA deduction and write it on line 13. Make sure to follow the instructions carefully, as this amount can be affected by your coverage type (self-only or family) and any changes in contributions during the year.

- In Part II, focused on HSA distributions, report the total distributions from your HSA. This information can usually be found on Form 1099-SA provided by your HSA administrator.

- Itemize your qualified medical expenses not reimbursed by insurance or other sources. Subtract these expenses from your total distributions and enter this amount on line 15. If you only used your HSA for qualified medical expenses, this amount should be zero.

- If you spent any amount from your HSA on non-qualified expenses, you'll need to include this amount on line 16. These distributions may be subject to taxes and penalties.

- Complete the rest of Part II according to any additional instructions and based on your specific circumstances, such as funding distributions or excess contributions.

- Review the form for accuracy, ensuring that all contributions, distributions, and personal information are correctly reported. Verify your calculations to prevent any errors that could lead to an audit or penalties.

- Once complete, attach Form 8889 to your Form 1040 or Form 1040-NR and submit it to the IRS by the tax filing deadline for that year.

Correctly filling out and submitting IRS Form 8889 is essential for anyone with an HSA to stay in compliance with tax regulations. By methodically following these steps, individuals can confidently manage their contributions and distributions, potentially saving money on taxes and avoiding penalties. Should you have doubts or need clarification on specific aspects of your situation, consulting with a tax professional or financial advisor can provide personalized guidance and peace of mind.

Understanding IRS 8889

-

What is IRS Form 8889?

IRS Form 8889 is a tax form used in the United States to report Health Savings Account (HSA) contributions, distributions, and to calculate the tax benefits associated with those HSAs. It must be filed by anyone who has an HSA and takes deductions for contributions or receives distributions during the tax year.

-

Who needs to file IRS Form 8889?

Anyone who has made contributions to, or taken distributions from, a Health Savings Account (HSA) during the tax year is required to file Form 8889. This applies whether the contributions were made by an individual, an employer, or both. The form is also necessary for those who must report certain types of HSA funding distributions, including rollovers and transfers.

-

How do contributions and distributions affect my taxes?

Contributions to an HSA are potentially tax-deductible, meaning they can reduce your taxable income for the year, thus potentially lowering your overall tax liability. Distributions from an HSA are tax-free if they are used for qualified medical expenses. However, distributions not used for these qualifying expenses may be subject to both income tax and an additional 20% penalty, making accurate reporting on Form 8889 crucial.

-

Can I file IRS Form 8889 electronically?

Yes, you can file IRS Form 8889 electronically as part of your tax return. Most tax preparation software will guide you through the process of completing Form 8889 when you input information about your HSA contributions and distributions. Electronic filing can be faster and more secure than paper filing.

-

What happens if I make a mistake on my Form 8889?

If a mistake is made on Form 8889, it's crucial to correct it to ensure your tax liabilities and benefits are accurately represented. You can correct the error by filing an amended tax return using Form 1040-X, along with a corrected Form 8889. It's important to act promptly to minimize potential interest and penalties.

-

Where can I get help with IRS Form 8889?

Help with IRS Form 8889 is available from several sources. The IRS website offers instructions and resources. A qualified tax professional or accountant, proficient in tax laws and familiar with Health Savings Accounts, can provide personalized assistance. Additionally, many tax preparation software programs offer guidance in completing Form 8889 as part of the tax filing process.

Common mistakes

-

Not reporting all contributions. Sometimes, individuals forget to report contributions made by their employers or those made through a cafeteria plan. All contributions, regardless of the source, must be included on the form to accurately report the total HSA contribution for the year.

-

Failing to properly distinguish between funded and unfunded contributions. Contributions that are promised but not actually deposited into the HSA by the tax filing deadline need to be reported correctly. Understanding the difference between contributions that are effectively made and those that are merely pledged is crucial.

-

Misreporting distributions. Taxpayers sometimes mistakenly report their HSA distributions as taxable income. It's important to remember that distributions used for qualified medical expenses are tax-free. Proper documentation and careful record-keeping are essential to ensure distributions are reported correctly.

-

Overlooking the Last-month rule and testing period. The Last-month rule allows taxpayers to contribute up to the maximum limit if they are HSA-eligible on the first day of the last month of their tax year (generally December 1 for individuals). However, they must remain HSA-eligible for the entire next calendar year (the testing period). This rule is often misunderstood or overlooked, leading to incorrect contributions.

-

Not understanding the contribution limits. The IRS sets annual contribution limits for HSAs, which can change from year to year. These limits also vary based on coverage (individual vs. family) and age (additional catch-up contributions are allowed for individuals aged 55 and older). Failing to adhere to these limits can result in excess contributions, which are subject to penalties if not corrected timely.

Making sure to avoid these mistakes requires careful attention to detail and a good understanding of IRS regulations concerning HSAs. When in doubt, consulting with a tax professional or meticulously reviewing the IRS's guidelines for Form 8889 can help prevent these common errors and ensure accurate tax reporting.

Documents used along the form

When dealing with Health Savings Accounts (HSAs), the Internal Revenue Service (IRS) Form 8889 is a critical document for taxpayers. This form helps individuals report contributions, distributions, and determine the tax treatment of their HSA. Completing this form accurately requires specific information that might prompt the need for other documents and forms. Here is a selection of related documents often used in conjunction with Form 8889. These documents provide the essential details needed or offer a way to report related financial activities effectively.

- Form 1040 - The U.S. Individual Income Tax Return is vital for taxpayers. It's where they report their annual income, calculate taxes owed or refunds due, and where information from Form 8889 ultimately connects to the broader picture of an individual’s tax situation.

- Form 1099-SA - This form reports distributions from HSAs, Archer Medical Savings Accounts, or Medicare Advantage MSAs. Taxpayers need this information to complete Form 8889, specifically regarding the distributions section.

- Form 5498-SA - It provides details on contributions made to an HSA, Archer MSA, or Medicare Advantage MSA. This information is crucial for accurately reporting contributions on Form 8889.

- W-2 Form - The Wage and Tax Statement may sometimes include information on HSA contributions made through an employer. This data can also be relevant when filling out Form 8889.

- Form 1040-SR - This is a version of Form 1040 that caters to seniors. It has a larger print and a format that's easier to navigate for older taxpayers who must also report their HSA activities on Form 8889.

- Form 5329 - Additional Taxes on Qualified Plans (Including IRAs) and Other Tax-Favored Accounts can sometimes intersect with HSA issues, especially if there are excess contributions or distributions that need to be reported.

- Schedule 1 (Form 1040) - This form is for additional income and adjustments to income. It might be used alongside Form 8889 if the taxpayer needs to make adjustments based on their HSA contributions or distributions.

- Schedule 2 (Form 1040) - This form covers additional taxes, including any related to HSAs that might not be fully covered in Form 8889.

- Form 8853 - Archer MSAs and Long-Term Care Insurance Contracts form provides information similar to Form 8889 but for Archer MSAs. Individuals with both types of accounts will find both forms necessary.

- Instruction Booklets - For all the above forms, the respective IRS instruction booklets offer comprehensive guidance on completing each document. This resource is invaluable for understanding the specifics of each form and ensuring accurate and compliant submissions.

Navigating the various forms and documents related to Health Savings Accounts and tax reporting can be complex. Each document plays a specific role in ensuring that individuals meet their reporting obligations and make the most of their HSA benefits. By understanding how these documents work together, taxpayers can ensure they are fully compliant while optimizing their tax situations.

Similar forms

The IRS 8889 form, related to Health Savings Accounts (HSAs), has several analogs in the realm of tax documentation, concerning its purpose, structure, and the kind of information it collects. One such document is the IRS 1040 form, which is the standard federal income tax form used to report an individual's annual income. Like the IRS 8889, the 1040 form gathers detailed financial information, although it covers a broader spectrum of income and deductions, serving as the main document that individuals use to complete their tax returns.

Similarly, the IRS 5329 form, which relates to additional taxes on IRAs and other tax-favored accounts, mirrors the IRS 8889 in terms of its focus on specific accounts. Though the IRS 5329 form covers a wider variety of accounts and potential penalties, both forms require taxpayers to report on the nuances of their tax-advantaged savings, ensuring compliance with contribution limits and tax implications of distributions.

The IRS 1099-SA form is another document closely related to the IRS 8889. This form is used to report distributions from HSAs, Archer Medical Savings Accounts (MSAs), or Medicare Advantage MSAs. It provides the necessary information that is then reported on the IRS 8889 form, detailing withdrawals made from these accounts throughout the tax year, highlighting their interconnectedness in reporting HSA activity.

Form W-2, the Wage and Tax Statement, bears relevance as well, particularly Box 12 codes that can include contributions to an employee’s HSA. This parallels the IRS 8889 form's concern with contributions to HSAs but from the perspective of income and tax withholding information provided by employers, hence contributing to the financial picture that influences HSA reporting.

The IRS form 5498-SA is akin to the 8889, serving the role of reporting contributions to an HSA, along with the total market value of the account. Though it is the financial institutions that file form 5498-SA, and the information is used by the taxpayer to ensure the accuracy of what's reported on form 8889, both documents are integral to the accurate accounting and reporting of HSA contributions and year-end value.

Another comparable document is the IRS form 1040-SR, a variant of the standard 1040 form designed for senior citizens. It shares similarities with the IRS 8889 form in terms of purpose—reporting income and calculating tax liability—though tailored to seniors, with considerations for social security and retirement distributions that might indirectly affect HSA contributions and deductions.

Form 8880, Credit for Qualified Retirement Savings Contributions, also shares common ground with IRS 8889, as both involve reporting contributions to tax-advantaged accounts. While form 8880 focuses on retirement savings contributions and offers a tax credit, reflecting on the encouragement of saving for retirement, the IRS 8889 form deals specifically with HSA contributions and their tax implications.

The Schedule A (Form 1040) is used to itemize deductions, including medical and dental expenses, that might not directly relate but certainly affects decisions around HSAs, and by extension, the reporting on form 8889. Contributions to an HSA can reduce taxable income, and thus, the information reported on these two forms influences each other in the broader context of tax planning and reporting.

Finally, form 8853, Archer MSAs and Long-Term Care Insurance Contracts, is another document closely related to form 8889. Both are used by individuals to report contributions and distributions related to specific savings accounts designed for healthcare expenses. While form 8853 expands the scope to include long-term care insurance contracts, it parallels the IRS 8889 form's focus on the interplay between savings accounts and healthcare expenditures.

Dos and Don'ts

When preparing to fill out the IRS Form 8889, which is essential for Health Savings Account (HSA) contributions and distributions, attention to accuracy and detail is crucial. Missteps can lead to audits, penalties, or missed tax benefits. Here’s a guide to some dos and don’ts to bear in mind:

Do:

- Ensure all personal information is accurate. Double-check your Social Security Number (SSN) and basic information to prevent processing delays or issues.

- Report all contributions, including those made by employers and those made personally, in the correct sections. This ensures you get the maximum tax advantage.

- Keep accurate records of all medical expenses that qualify for HSA spending. This documentation is crucial if the IRS requests verification of your HSA distributions.

- Diligently calculate your maximum contribution limit, especially if you change your high-deductible health plan (HDHP) coverage or age during the tax year. Overcontributing can lead to penalties.

Don’t:

- Forget to include the form with your tax return if you have HSA contributions or distributions. Failing to do so can result in penalties and missed tax benefits.

- Overlook the importance of Form 5498-SA, which your HSA trustee or custodian should send you, detailing contributions made to your HSA. This form is essential for accurate reporting.

- Mistake distributions for non-qualified medical expenses as tax-free. These are subject to taxation and a potential additional 20% penalty if you're under 65 and not disabled.

- Ignore the deadline for prior year contributions. You have until the tax filing deadline (typically April 15) to make contributions for the previous year. Missing this deadline means losing the opportunity to maximize your deductions for that year.

Misconceptions

Filing taxes involves numerous forms and a complex array of regulations, leading to widespread misconceptions, especially about specific documents like the IRS 8889 form. This form, crucial for those with Health Savings Accounts (HSAs), often confuses filers due to its detailed nature. Below, we address some common misunderstandings to help clarify its purpose and requirements.

- Only the Account Holder Needs to File Form 8889: It's a common belief that only the primary HSA holder needs to file Form 8889. In reality, anyone who made contributions to or took distributions from an HSA during the tax year must file this form, including those marked as family members on the account.

- Form 8889 is Only for Deducting Contributions: While Form 8889 is used to report HSA contributions, its purpose extends beyond simply deducting these contributions. It also accounts for distributions, calculates taxes on non-qualified distributions, and reports any excess contributions.

- Employer Contributions Don’t Need to be Reported: Many believe that contributions from an employer can be excluded from their tax return. This is not true; all contributions, whether from the individual or their employer, must be reported on Form 8889 to ensure accurate tax liability calculations.

- You Don’t Have to File if You Didn’t Use Your HSA: This misconception can lead to problems with the IRS. Regardless of whether HSA funds were used or not, anyone with an HSA must file Form 8889, as it reports both contributions to and distributions from the account.

- All HSA Distributions are Tax-Free: While many HSA distributions for qualified medical expenses are tax-free, non-qualified distributions are taxable and subject to an additional 20% penalty. Form 8889 helps determine the taxability of these distributions.

- The Form is Complicated and Requires a Professional: Many filers immediately seek professional help due to the form's perceived complexity. While professional assistance can be beneficial, particularly for complicated tax situations, many taxpayers can accurately complete Form 8889 by attentively reading the instructions and using available IRS resources.

- Form 8889 Must be Filed Separately: Some taxpayers think Form 8889 needs to be filed independently of their tax return. However, it should be filed as part of an individual's federal income tax return, directly affecting their adjusted gross income.

- Contributions for the Following Year Cannot be Included: IRS regulations allow HSA contributions for a specific tax year to be made up until the tax filing deadline of the following year. These contributions can and should be included on that tax year's Form 8889, not deferred to the next.

- Only Medical Expenses Can be Paid from an HSA: It's true that HSAs are primarily intended for qualified medical expenses, but after the age of 65, funds can be withdrawn for any purpose without penalty, although non-medical withdrawals are subject to income tax. This distinction is crucial for accurate reporting on Form 8889.

Understanding the intricacies of the IRS 8889 form is crucial for correctly reporting HSA contributions and distributions. Dispelling these misconceptions ensures taxpayers can avoid penalties and make the most of their HSA benefits. Always consult the latest IRS guidelines or a tax professional when in doubt to ensure compliance and maximize your tax benefits.

Key takeaways

The IRS 8889 form is an essential document for anyone with a Health Savings Account (HSA). It's used to report contributions, distributions, and to figure out your HSA deduction. To ensure accuracy and maximize benefits, here are key takeaways about filling out and using this form:

- Know Your Contributions: It's important to report all contributions to your HSA, including those made by your employer and any other person on your behalf. This information helps in determining the deduction you can claim on your tax return.

- Determine Your Deduction: The IRS 8889 form is used to figure out the HSA deduction you can claim on your tax return. This can reduce your taxable income, potentially leading to significant tax savings.

- Report Distributions: All distributions (withdrawals) from your HSA must be reported on Form 8889. This includes money used for qualified medical expenses as well as any funds not used for these expenses, which may be taxable.

- Understand Qualified Medical Expenses: It's crucial to know what the IRS considers qualified medical expenses. Only distributions used for these expenses are tax-free. Misclassification can lead to taxes and penalties.

- Calculate Your Tax Liability: If you use HSA funds for non-qualified expenses, you'll need to calculate the tax owed. Form 8889 helps in determining this amount, which includes income tax and an additional 20% penalty for those under 65 not using the funds for qualified medical expenses.

- Keep Good Records: Maintain thorough records of your HSA contributions, distributions, and receipts for qualified medical expenses. These records are crucial for completing Form 8889 correctly and verifying deductions and distributions if audited.

- Meet the Deadlines: The IRS 8889 form is filed with your annual tax return. Therefore, it's subject to the same deadline, typically April 15 of the year following the tax year. Submitting your form on time helps avoid penalties and interest for late filing.

Completing and filing IRS Form 8889 accurately is vital for anyone with an HSA. It ensures compliance with tax laws, helps maximize tax benefits, and avoids unnecessary penalties. If you're unsure about any part of the process, consulting with a tax professional can provide clarity and peace of mind.

Popular PDF Documents

How to File Power of Attorney in California - Changes in the taxpayer’s decision regarding their representative require the submission of a new 3520-PIT form to update the records with the tax authorities.

Closing Agreement - Defines the scope of agreement, including applicability to future tax periods and implications of new laws.

City of Owensboro - Ensures businesses operating across jurisdictional lines accurately report their income and fees.