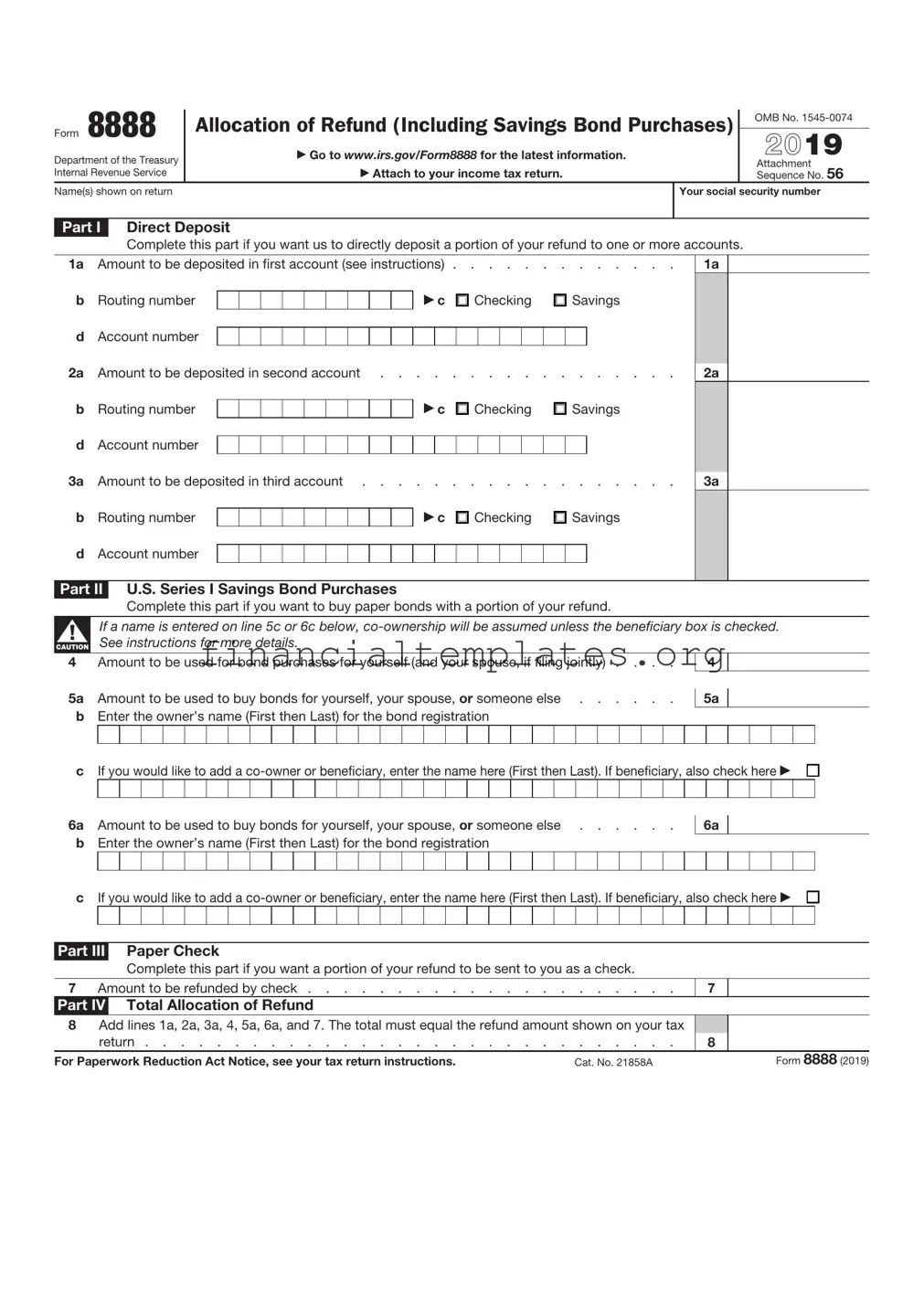

Get IRS 8888 Form

The ability to effectively manage and allocate tax refunds can play a pivotal role in personal financial planning. Among the tools provided by the Internal Revenue Service (IRS) for this purpose, the IRS Form 8888 stands out for its utility and flexibility. This form allows taxpayers to divide their refunds among up to three different bank accounts, including both checking and savings accounts. Furthermore, it offers the option to purchase U.S. Series I Savings Bonds, either for oneself or as a gift, directly with the refund amount. By using IRS Form 8888, individuals can streamline their tax refund process, ensuring that their funds are distributed according to their financial goals and needs. The form is particularly beneficial for those looking to build their savings, invest, or manage their refunds more efficiently. Given its significance, understanding the nuances and proper use of IRS Form 8888 is crucial for anyone looking to make the most of their tax refund.

IRS 8888 Example

Form |

8888 |

|

Allocation of Refund (Including Savings Bond Purchases) |

|

OMB No. |

||||||||||||||||||||||

|

|

||||||||||||||||||||||||||

|

|

2020 |

|||||||||||||||||||||||||

Department of the Treasury |

|

|

|

|

|

▶ Go to www.irs.gov/Form8888 for the latest information. |

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Attachment |

Internal Revenue Service |

|

|

|

|

|

|

|

|

▶ Attach to your income tax return. |

|

|

|

|

|

|

Sequence No. 56 |

|||||||||||

Name(s) shown on return |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Your social security number |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Part I |

Direct Deposit |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

Complete this part if you want us to directly deposit a portion of your refund to one or more accounts. |

|

||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

1a |

Amount to be deposited in first account (see instructions) |

. . . . . . |

|

1a |

|

||||||||||||||||||||||

b |

Routing number |

|

|

|

|

|

|

|

|

|

|

▶ c |

Checking |

Savings |

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

d |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

Account number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2a |

Amount to be deposited in second account |

. . . . . . |

|

2a |

|

||||||||||||||||||||||

b |

Routing number |

|

|

|

|

|

|

|

|

|

|

▶ c |

Checking |

Savings |

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

d |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

Account number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3a |

Amount to be deposited in third account |

. . . . . . |

|

3a |

|

||||||||||||||||||||||

b |

Routing number |

|

|

|

|

|

|

|

|

|

|

▶ c |

Checking |

Savings |

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

d |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

Account number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Part II U.S. Series I Savings Bond Purchases

Complete this part if you want to buy paper bonds with a portion of your refund.

▲! If a name is entered on line 5c or 6c below,

4 Amount to be used for bond purchases for yourself (and your spouse, if filing jointly) . . . .

4

5a Amount to be used to buy bonds for yourself, your spouse, or someone else . . . . . .

bEnter the owner’s name (First then Last) for the bond registration

5a

cIf you would like to add a

6a Amount to be used to buy bonds for yourself, your spouse, or someone else . . . . . .

bEnter the owner’s name (First then Last) for the bond registration

6a

c If you would like to add a

Part III |

Paper Check |

|

|

|

Complete this part if you want a portion of your refund to be sent to you as a check. |

|

|

|

|

|

|

7 Amount to be refunded by check |

7 |

|

|

Part IV |

Total Allocation of Refund |

|

|

8Add lines 1a, 2a, 3a, 4, 5a, 6a, and 7. The total must equal the refund amount shown on your tax

return |

8 |

|

For Paperwork Reduction Act Notice, see your tax return instructions. |

Cat. No. 21858A |

Form 8888 (2020) |

Form 8888 (2020) |

Page 2 |

Future Developments

Information about any future developments affecting Form 8888 (such as legislation enacted after we release it) will be posted on www.irs.gov/Form8888.

General Instructions

Purpose of Form

Use Form 8888 if:

•You want us to directly deposit your refund (or part of it) to either two or three accounts at a bank or other financial institution (such as a mutual fund, brokerage firm, or credit union) in the United States, or

•You want to use at least part of your refund to buy up to $5,000 in paper or electronic series I savings bonds.

An account can be a checking, savings, or other account such as:

•An individual retirement arrangement (IRA),

•A health savings account (HSA),

•An Archer MSA,

•A Coverdell education savings account (ESA), or

•A TreasuryDirect® online account.

You can’t have your refund deposited into more than one account or buy paper series I savings bonds if you file Form 8379, Injured Spouse Allocation.

Deposit of refund to only one account. If you want your refund deposited to only one account, don’t complete this form. Instead, request direct deposit on your tax return.

Account must be in your name. Don’t request a deposit of your refund to an account that isn’t in your name, such as your tax return preparer’s account. Although you may owe your tax return preparer a fee for preparing your return, don’t have any part of your refund deposited into the preparer’s account to pay the fee.

The number of refunds that can be directly deposited to a single account or prepaid debit card is limited to three a year. After this limit is reached, paper checks will be sent instead. Learn more at

Amended return. Don’t attach Form 8888 to Form

Why Use Direct Deposit?

•You get your refund faster by direct deposit than you do by check.

•Payment is more secure. There is no check that can get lost or stolen.

•It saves tax dollars because it costs the government less.

•It is more convenient. You don’t have to make a trip to the bank to deposit your check.

IRA

You can have your refund (or part of it) directly deposited to a traditional IRA, Roth IRA, or

You and your spouse, if filing ▲! jointly, each may be able to

contribute up to $6,000 ($7,000 CAUTION if age 50 or older at the end of

2020) to a traditional IRA or Roth IRA for 2020. You may owe a penalty if your total contributions exceed these limits, and these limits may be reduced depending on your compensation and income. For more information on IRA contributions, see Pub.

TreasuryDirect® Account

You can request a deposit of your refund (or part of it) to a TreasuryDirect® online account to buy U.S. Treasury marketable securities and savings bonds. For more information, go to http://go.usa.gov/3KvcP.

U.S. Series I Savings Bonds

You can request that your refund (or part of it) be used to buy up to $5,000 in series I savings bonds. You can buy them electronically by direct deposit into your TreasuryDirect® account. See instructions under Part I for details. Or, if you don’t have a TreasuryDirect® account, you can buy paper savings bonds. See the instructions under Part II for details.

Specific Instructions

Part I

If you are filing Form 8888 only TIP to buy paper series I savings

bonds, skip Part I and go to Part II.

If you file a joint return and ▲! complete Form 8888, your

spouse may get at least part of CAUTION the refund.

Lines 1a, 2a, and 3a

Enter the portion of your refund you want directly deposited to each account. Each deposit must be at least $1.

Your entire deposit may be deposited in one account. If there are any delays in the processing of your return by the IRS, your entire refund will be deposited in the first account listed on Form 8888. Make sure the first account you list on Form 8888 is an account you would want the entire refund deposited in if this happens.

An account can be a checking, savings, or other account such as an IRA, HSA, Archer MSA, ESA, or TreasuryDirect® online account.

Lines 1b, 2b, and 3b

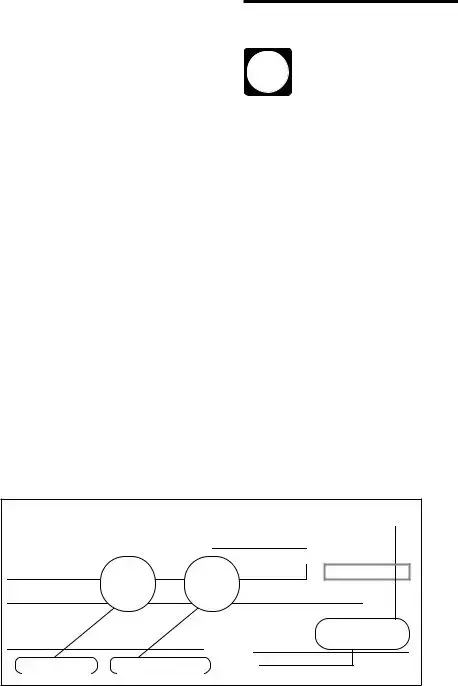

The routing number must be nine digits. The first two digits must be 01 through 12 or 21 through 32. On the sample check below, the routing number is 250250025. Tony and Jennifer Maple would use that routing number unless their financial institution instructed them to use a different routing number for direct deposits.

account or used to buy savings bonds.

Sample Check

TONY MAPLE |

|

SAMPLE |

1234 |

|

JENNIFER MAPLE |

|

▲ |

||

|

|

|||

123 Pear Lane |

|

|

|

|

Anyplace, GA 00000 |

|

|

|

|

PAY TO THE |

|

|

|

|

ORDER OF |

Routing |

Account |

|

$ |

|

|

|||

|

number |

number |

|

DOLLARS |

|

|

|

|

|

ANYPLACE BANK |

|

|

|

|

Anyplace, GA 00000 |

|

|

|

Don’t include |

|

|

|

|

|

For |

|

|

|

the check number. |

|

|

|

|

|

|:250250025 | :202020"'86". 1234 |

◀ |

|

||

Note: The routing and account numbers may be in different places on your check.

Form 8888 (2020) |

Page 3 |

Ask your financial institution for the correct routing number to enter if:

•The routing number on a deposit slip is different from the routing number on your checks,

•Your deposit is to a savings account that doesn’t allow you to write checks, or

•Your checks state they are payable through a financial institution different from the one at which you have your account.

Lines 1c, 2c, and 3c

Check the appropriate box for the type of account. Don’t check more than one box for each line. If your deposit is to an account such as an IRA, HSA, brokerage account, or other similar account, ask your financial institution whether you should check the “Checking” or “Savings” box. You must check the correct box to ensure your deposit is accepted. If your deposit is to a TreasuryDirect® online account, check the “Savings” box.

Lines 1d, 2d, and 3d

The account number can be up to 17 characters (both numbers and letters). Include hyphens but omit spaces and special symbols. Enter the number from left to right and leave any unused boxes blank. On the sample check in these instructions, the account number is 20202086. Don’t include the check number.

Reasons Your Direct Deposit Request Will Be Rejected

If any of the following apply, your direct deposit request will be rejected and a check will be sent instead.

•You are asking to have a joint refund deposited to an individual account, and your financial institution(s) won’t allow this. The IRS isn’t responsible if a financial institution rejects a direct deposit.

•The name on your account doesn’t match the name on the refund, and your financial institution(s) won’t allow a refund to be deposited unless the name on the refund matches the name on the account.

•Three direct deposits of tax refunds have already been made to the same account or prepaid debit card.

•You haven’t given a valid account number.

•You file your 2020 return after

November 30, 2021.

If your financial institution rejects one or two but not all of your direct deposit requests, you may get part of your refund as a paper check and part as a direct deposit.

Example. You complete lines 1 and 2 correctly but forget to enter an account number on line 3d. You will get a paper check for any amount shown on line 3a. The parts of your refund shown on lines

1a and 2a will be directly deposited to the accounts you indicated.

The IRS isn’t responsible for a ▲! lost refund if you enter the

wrong account information. CAUTION Check with your financial institution to get the correct routing and account numbers and to make sure your direct deposit will be accepted.

Changes in Refund Due to Math Errors or Refund Offsets

The rules below explain how your direct deposits may be adjusted.

Math Errors

The following rules apply if your refund is increased or decreased due to a math error.

Refund increased. If you made an error on your return and the amount of your refund is increased, the additional amount will be deposited to the last account listed. If you asked that your refund be split among three accounts, any increase will be deposited to the account on line 3. If you asked that your refund be split among two accounts, any increase will be deposited to the account on line 2.

Example. Your return shows a refund of $300 and you ask that the refund be split among three accounts with $100 to each account. Due to an error on the return, your refund is increased to $350. The additional $50 will be added to the deposit to the account on line 3.

Refund decreased. If you made an error on your return and the amount of your refund is decreased, the decrease will be taken first from any deposit to an account on line 3, next from the deposit to the account on line 2, and finally from the deposit to the account on line 1.

Example. Your return shows a refund of $300, and you ask that the refund be split among three accounts with $100 to each account. Due to an error on your return, your refund is decreased by $150. You won’t receive the $100 you asked us to deposit to the account on line 3, and the deposit to the account on line 2 will be reduced by $50.

Note: If you appeal the math error and your appeal is upheld, the resulting refund will be deposited to the account on line 1.

Refund Offset

The following rules apply if your refund is offset (used) to pay

Other offsets. If you owe other

If the deposit to one or more of ▲! your accounts is changed due to a math error or refund offset,

CAUTION and that account is subject to contribution limits, such as an IRA, HSA, Archer MSA, or Coverdell ESA, or the deposit was deducted as a contribution to a

Example. You deduct $1,000 on your 2020 tax return for an IRA contribution. The contribution is to be made from a direct deposit of your 2020 refund. Due to an offset by the Bureau of the Fiscal Service, the direct deposit isn’t made to your IRA. You need to correct your contribution by contributing $1,000 to the IRA from another source by the due date of your return (determined without regard to any extension) or file an amended return without the IRA deduction.

Part II

You may request up to three different savings bond registrations. However, each registration must be a multiple of $50, and the total of lines 4, 5a, and 6a can’t be more than $5,000 (or your refund amount, whichever is smaller).

You can skip line 4 if you want TIP to buy bonds for someone other

than yourself (and your spouse, if filing jointly).

Line 4

Enter the portion of your refund you want to use to buy bonds for yourself (and your spouse, if filing jointly). These bonds will be registered in the name(s) shown on your return.

Lines 5a and 6a

Enter the portion of your refund you want to use to buy bonds for yourself, your spouse, or someone else. This amount must be a multiple of $50.

Lines 5b and 6b

Enter the owner’s name for this bond registration. This can be you, your spouse, or someone else. However, enter only one name. Enter the first name followed by the

Form 8888 (2020) |

Page 4 |

last name and place one space in between them. Use the person’s given name and don’t use nicknames. Use only letters and print clearly. Don’t use symbols.

Lines 5c and 6c

If you want to add a

If this is a beneficiary designation, also check the box on line 5c or 6c. Otherwise,

The bonds will be issued in the names you have requested and mailed to you.

If you have determined that the IRS processed your refund and placed the order for your bonds, you can contact the Treasury Retail Securities site at

When your bonds won’t be issued. Your

bonds won’t be issued if any of the following apply.

•The bond request isn’t a multiple of $50.

•Your refund is decreased because of a math error.

•You enter more than one name on line 5b, 5c, 6b, or 6c.

•Your refund is offset for any reason.

Instead, your refund will be sent to you in the form of a check.

Math errors that increase your refund. If you made an error on your return and the amount of your refund is increased, the additional amount will be sent to you in the form of a check. However, if you requested direct deposit in Part I, the rules under Changes in Refund Due to Math Errors or Refund Offsets will apply.

Part III

Line 7

If any portion of your refund remains after completing Parts I and II, you can request this portion be sent to you in the form of a check. Enter the amount on line 7 that you would like to be sent by check.

Part IV

Line 8

The total on line 8 must equal the total amount of the refund shown on your tax return. It must also equal the total of the amounts on lines 1a, 2a, 3a, 4, 5a, 6a, and

7.If the total on line 8 is different, a check will be sent instead.

Don’t file a Form 8888 on which ▲! you have crossed out or whited

out any numbers or letters. If CAUTION you do, the IRS will reject your allocation of refund and savings bond purchases, and send you a check instead.

Document Specifics

| Fact Name | Detail |

|---|---|

| Form Purpose | The IRS Form 8888 is used for allocating a federal tax refund among two or three different accounts at U.S. financial institutions or buying U.S. Series I Savings Bonds. |

| Eligibility | Any taxpayer expecting a federal income tax refund can use Form 8888, barring specific exceptions like owing past-due amounts such as federal tax, state income tax, child support, or student loans. |

| Limitations | Form 8888 cannot be used if the taxpayer files Form 8379, Injured Spouse Allocation, or if they wish to deposit their refund into a foreign bank account. |

| Direct Purchase of U.S. Savings Bonds | Through Form 8888, a taxpayer can purchase up to $5,000 in U.S. Series I Savings Bonds with their refund, either for themselves or as a gift. |

| Governing Law | Form 8888 is governed by federal tax law as it relates to the processing and allocation of federal income tax refunds by the Internal Revenue Service (IRS). |

Guide to Writing IRS 8888

Once you have your tax return ready, the next step is deciding what to do with your refund. If you're considering splitting your tax refund between different accounts, buying U.S. Series I Savings Bonds, or even allocating part of it to pay next year's taxes, IRS Form 8888 is what you need. This form allows for direct deposit of your refund into two or three different accounts at U.S. banks or financial institutions. It's a simple way to manage your refund effectively and put your money where you need it most. Below are the steps to fill out IRS Form 8888 ensuring your refund is distributed according to your plans.

- Start by gathering all necessary information including your tax return, bank account numbers, and routing numbers for the accounts you want to deposit into. Make sure to have the exact type of accounts (checking or savings) and their correct details.

- On the form, enter your name and social security number as they appear on your tax return. If you're filing a joint return, include both names and social security numbers.

- In Part I of Form 8888, assign how much of your refund you want to allocate to each account or to purchase U.S. Series I Savings Bonds. There are lines for three different accounts or bonds. If you're only using two, leave the third line blank.

- For direct deposit, fill out lines 1a, 2a, and 3a with the routing numbers of the respective financial institutions. Then, fill out lines 1b, 2b, and 3b with the account numbers. Make sure to check the box indicating whether each account is a checking or savings account.

- If you choose to use part of your refund to buy U.S. Series I Savings Bonds, indicate this in Part II section. Fill in the amount and provide the names for whom the bonds are being purchased if it's not just for yourself or your spouse.

- Review your form to ensure all information is accurate and matches your tax return details. Any discrepancies can delay your refund.

- Attach Form 8888 to your tax return before submitting it. If you're filing electronically, follow the prompts provided by your tax software to include the information from Form 8888.

After completing and attaching IRS Form 8888 to your tax return, the next step is simply to wait for your refund to be processed and distributed. It's a prudent choice to check your accounts to ensure the deposits match your instructions once your refund is processed. By using Form 8888, you're taking a proactive step in managing your finances by directing your refund to where it can best work for you.

Understanding IRS 8888

What is the IRS Form 8888?

IRS Form 8888 is a form used for allocating the refund of a taxpayer across multiple accounts. Taxpayers can directly deposit their refund into two or three different accounts, such as checking, savings, or retirement accounts. Additionally, taxpayers have the option to use their refund to purchase U.S. Series I Savings Bonds.

Who should use IRS Form 8888?

Any taxpayer expecting a federal tax refund and wishing to divide their refund into two or three different financial accounts or to purchase U.S. Series I Savings Bonds should use Form 8888. It is not required for those who wish their entire refund to go to a single account.

Can IRS Form 8888 be used to deposit a refund into someone else's account?

Yes, the IRS allows taxpayers to use Form 8888 to direct part or all of their refund to an account that is not in their name; for example, a taxpayer could choose to deposit funds into a spouse’s or child’s account. However, taxpayers should exercise caution and ensure the account information is accurate to avoid any processing delays or errors.

Is it possible to use Form 8888 for electronic filing?

Yes, Form 8888 can be used with electronic filing. Taxpayers who e-file their federal tax return can attach Form 8888 to direct their refunds according to their preferences. This process can be handled through most tax preparation software.

How can I purchase U.S. Series I Savings Bonds with my refund using Form 8888?

On Form 8888, there is a section dedicated to purchasing U.S. Series I Savings Bonds. Taxpayers can allocate all or part of their refund (in multiples of $50) to purchase these savings bonds. They can also choose to have the bonds issued in their name or as a gift for another individual.

What happens if the IRS cannot deposit my refund into one of the specified accounts?

If the IRS encounters an issue depositing a refund into one of the designated accounts on Form 8888, they will send a check to the taxpayer for the entire amount of the refund. Taxpayers will then be responsible for manually distributing the funds as intended.

Is there a charge for using IRS Form 8888?

No, there is no fee charged by the IRS for using Form 8888. This service is provided free of charge to help taxpayers conveniently distribute their refunds.

Can Form 8888 be used to route a refund to a foreign bank account?

No, Form 8888 cannot be used to direct a refund to a foreign bank account. It only supports deposits to U.S. bank accounts or the purchase of U.S. Series I Savings Bonds.

How does Form 8888 affect the processing time of my tax refund?

Using Form 8888 to split your refund among different accounts or to buy savings bonds should not significantly delay your refund. However, taxpayers should always provide accurate account information to avoid processing errors that could lead to delays.

What should I do if I make a mistake on Form 8888?

If a mistake is made on Form 8888 after filing, the IRS cannot redirect the refund to different accounts or change the method of delivery. Taxpayers should carefully review their form before submitting it to avoid any errors. If an error occurs, you may need to wait until the refund is processed and then manually transfer the funds as needed.

Common mistakes

Filling out the IRS 8888 form is crucial for taxpayers who want to allocate their refund in more than one way, such as splitting it between savings and checking accounts or buying U.S. Savings Bonds. However, it’s easy to make mistakes that can delay your refund or cause other complications. Here are six common errors people make on this form:

Not verifying account numbers carefully. The IRS will direct your refund exactly where you tell them to, so a single misplaced digit can send your money to the wrong place. Always double-check your routing and account numbers.

Forgetting to sign the form when filing by paper. A missing signature can invalidate your entire return, including the Form 8888 instructions for allocating your refund. This oversight will hold up processing until the issue is corrected.

Mixing up checking and savings account information. It’s critical to specify the correct type of account for your refund allocation. Misidentifying your account can prevent the deposit from going through.

Attempting to direct deposits to someone else’s account. The name on the direct deposit must match the name on the tax return. If not, banks may reject the deposit, causing delays in receiving your refund.

Entering an incorrect amount to be allocated to savings bonds. You need to ensure the amount you want to buy in bonds doesn’t exceed your refund amount after any other allocations are made. Mistakes here can complicate your filing.

Not using the form for its intended purpose. Form 8888 is specifically for direct deposit of refunds and cannot be used for any other payments or tax matters. Misusing the form can mean your refund isn’t processed as you’d hoped.

Avoiding these common mistakes on the IRS Form 8888 ensures that your refund is allocated exactly as you intend, without unnecessary delays or complications. Paying careful attention to detail and following the instructions can make all the difference.

Documents used along the form

When it comes to managing your tax refund, the IRS Form 8888 is a useful tool for directing how and where your funds should be distributed. Whether you're splitting your refund among different accounts or buying U.S. Savings Bonds, having the right documents on hand is essential for a smooth process. Besides the Form 8888, there are several other forms and documents that can play critical roles in managing your taxes and refunds effectively. Here's a look at some commonly used forms that often accompany or are necessary in conjunction with Form 8888.

- Form 1040: The U.S. Individual Income Tax Return form is the cornerstone of personal tax filing. It is used to report your annual income, calculate taxes owed, and most importantly, determine your refund, which you can then allocate using Form 8888.

- Form 1099: This document is issued by all entities that pay you interest, dividends, and certain other types of income. It’s crucial for accurately reporting your income on Form 1040, which then affects your tax refund.

- Schedule B (Form 1040): Specifically for those who receive a significant amount of interest or dividends, this schedule is used to itemize and total these income sources. Accurate reporting on Schedule B ensures the correct refund amount on Form 1040.

- Form W-2: Issued by employers, the W-2 form reports your annual wages and the amount of taxes withheld. This information is essential for completing Form 1040 and affects your refund calculation.

- Form 1098: Mortgage interest, property taxes, and other deductible home expenses are reported on this form. It’s key for homeowners looking to maximize deductions and, subsequently, their refund.

- Form 4868: For those who need a bit more time to file their tax return, Form 4868 grants an extension. While it doesn’t extend the time to pay taxes owed, it gives extra time to gather documents and properly file.

- Direct Deposit Authorization Form: Although not an IRS document, many banks offer a form to facilitate setting up direct deposits. This comes in handy when allocating your refund to specific accounts through Form 8888.

- Identity Verification Documents: While not forms in the strict sense, documentation like your Social Security card, driver’s license, or state ID is often needed to verify your identity when setting up accounts for your refund.

Understanding and preparing the appropriate forms and documents before diving into Form 8888 and your tax return helps ensure a smoother process and maximizes your potential benefits. Careful attention to these elements can make a significant difference in the management and optimization of your tax refund. As always, consulting with a tax professional can provide personalized advice tailored to your particular financial situation.

Similar forms

The IRS 8888 form, primarily used for the direct deposit of tax refunds into multiple bank accounts, shares similarities with several other documents in its purpose and structure. One such document is the W-9 form, utilized to collect taxpayer identification number and certification. Like the IRS 8888, the W-9 ensures proper handling of an individual’s tax information, though it focuses on gathering data from contractors or freelancers for reporting purposes, rather than distributing funds.

Another comparable document is the 1040 form, the U.S. individual income tax return. It's similar to the IRS 8888 in that it deals directly with an individual's tax details, but instead of allocating refunds, it's used to calculate and report yearly income tax to the IRS. Both forms play critical roles in the management of an individual's taxes, yet they serve different stages of the tax process.

Form 1099, especially relevant for self-employed individuals, also bears resemblance to the IRS 8888. Form 1099 is issued to report income from various sources other than wages, salaries, and tips. While the IRS 8888 form directs where and how a refund should be distributed, the 1099 form tracks sources of income, highlighting the complementary nature of these forms in personal financial management.

The Direct Deposit Sign-Up Form (SF 1199A), used by the Treasury Department, shares a functional similarity with the IRS 8888 form. It allows federal payments to be directly deposited into a bank account, mirroring the direct deposit feature of the IRS 8888. However, the SF 1199A is broader in scope, applying to various types of federal payments beyond tax refunds.

Form 8862, another IRS document, is required when a taxpayer needs to claim certain credits after disallowance. The link to the IRS 8888 form comes through the tax refund process, as claiming these credits correctly can affect the amount of a refund. Though the 8862 does not deal with the allocation of funds like the 8888, it impacts the computations leading to a refund's determination.

Lastly, the Change of Address Form (8822) shares an administrative similarity with the IRS 8888, as both forms involve updating personal information with the IRS to ensure accurate handling of tax-related documents. While the 8822 form specifically addresses changes in address, the IRS 8888 form deals with the financial side of personal information, directing where refunds should be accurately sent.

Overall, each of these documents intertwines with the financial and tax responsibilities of individuals, contributing to the broader ecosystem of tax administration and personal finance management. While their purposes may vary, ranging from income reporting to fund allocation, their successful implementation ensures smoother, more accurate tax processing and personal financial oversight.

Dos and Don'ts

When filling out the IRS Form 8888, it is important to follow specific guidelines to ensure the process is completed accurately. This form allows taxpayers to allocate their refund among different accounts. Here are essential dos and don'ts to consider:

Do:- Verify your account numbers and routing numbers before entering them on the form to prevent any errors in depositing your refund.

- Ensure you accurately specify the amount you want deposited into each account, especially if you're splitting your refund among different accounts.

- Use the form for direct deposit into checking, savings, or other specified accounts, including IRAs, health savings accounts (HSAs), or Coverdell Education Savings Accounts (ESAs).

- Review the entire form for accuracy before submission to avoid delays in receiving your refund.

- Attempt to use Form 8888 if you’re filing Form 1040-NR; this form is not eligible for splitting your refund using Form 8888.

- Forget to sign and date your tax return; an unsigned return can lead to processing delays.

- Overlook the IRS’s guidelines for specific accounts (like IRAs, HSAs, and Coverdell ESAs), which might have special instructions for direct deposit.

- Use Form 8888 if you’re allocating funds to pay a third party directly; this is not an intended use of the form.

Misconceptions

When it comes to tax refunds, the IRS Form 8888 is a valuable tool for taxpayers. However, several misconceptions surround its use and benefits. Understanding what the IRS Form 8888 can and cannot do is crucial for making the most out of your tax refunds. Below are four common misunderstandings about the form.

- Form 8888 can only be used for savings accounts. Many believe that the IRS Form 8888 is strictly for depositing refunds into savings accounts. This is not the case. Taxpayers can use the form to allocate their refund among up to three different accounts, which can include savings, checking, or even retirement accounts, such as an IRA. Furthermore, part of the refund can also be applied toward purchasing Series I savings bonds.

- The form is complicated and time-consuming. Another misconception is that filling out the IRS Form 8888 is a complex and lengthy process. In reality, the form is straightforward and easy to complete. It simply requires the details of the accounts into which you want the refund distributed, such as account numbers and the respective financial institutions’ routing numbers.

- Using Form 8888 delays your tax refund. Some taxpayers hesitate to use Form 8888 out of fear that it will cause delays in receiving their refunds. It's important to note that opting to split your refund through the use of Form 8888 does not typically result in significant delays. The processing times are similar to standard refund processing, so taxpayers can expect their refunds in a timely manner, assuming there are no other issues with their tax return.

- You cannot use Form 8888 if you file electronically. There's a common belief that Form 8888 is not available to taxpayers who file their returns electronically. This is incorrect. Whether submitting your return by mail or electronically, you can use Form 8888 to direct your refund to multiple accounts. This accessibility ensures that all taxpayers can take advantage of this beneficial option, regardless of how they choose to file their tax returns.

Key takeaways

The IRS 8888 form allows taxpayers to direct deposit their refund into multiple checking or savings accounts and buy U.S. Savings Bonds. Understanding how to properly fill out and make use of this form ensures you can allocate your refund according to your financial planning needs.

Eligibility for Use: The IRS 8888 form can be used by any taxpayer expecting a refund on their federal income tax return. However, it cannot be used if you file Form 8379, Injured Spouse Allocation, or if your refund is being applied to a past due obligation such as child support, past due federal debts, state income tax, or unemployment compensation debts.

Multiple Accounts Allocation: You can divide your refund into up to three different bank accounts. These accounts can include savings, checking, or even individual retirement accounts (IRAs). Properly allocating your refund can help you manage your finances by earmarking funds for specific purposes like saving, investing, or immediate expenses.

Purchasing U.S. Savings Bonds: Form 8888 allows you to use your refund to purchase U.S. Savings Bonds, either for yourself or as a gift. You can buy up to $5,000 in bonds in multiples of $50. This option provides a reliable, low-risk investment opportunity for you or to gift to someone else.

Direct Deposit Over Paper Checks: Using Form 8888 to opt for direct deposit instead of receiving a paper check has several benefits. Direct deposit is faster, often making funds available sooner than a mailed check. It's also more secure, as it reduces the risk of checks being lost or stolen.

Accuracy is Crucial: When filling out Form 8888, ensuring the accuracy of all information, especially account numbers and routing numbers, is essential. Errors can lead to the IRS sending a paper check instead, delaying access to your refund. Double-check all entries before submitting your tax return to avoid any issues.

Popular PDF Documents

W8 Bene - Filling out the form requires detailed information about the work relationship, including specifics of the job performed, degree of control, and payment agreements.

IRS 1310 - By clarifying the recipient of the deceased's tax refund, Form 1310 helps mitigate potential disputes among heirs or beneficiaries.

Nj St-50 - Designed with online filing in mind, the worksheet streamlines the process, making tax compliance more manageable for businesses.