Get IRS 8880 Form

Many people look for ways to secure their future, especially when it comes to retirement savings. The IRS 8880 form plays a pivotal role in assisting taxpayers who contribute to retirement plans. Designed to be accessible and beneficial for individuals aiming to save for their retirement, the form allows eligible taxpayers to claim a credit for contributions to their IRA, 401(k), and certain other retirement plans. This credit is known as the Saver’s Credit and is intended to encourage and reward low and moderate-income individuals for making contributions toward their retirement savings. The form navigates through eligibility criteria, calculation of the credit, and how it can be applied against the taxes owed. Understanding the nuances of the IRS 8880 form can reveal opportunities to reduce one's taxable income and enhance retirement savings, making it a critical piece of documentation for eligible taxpayers.

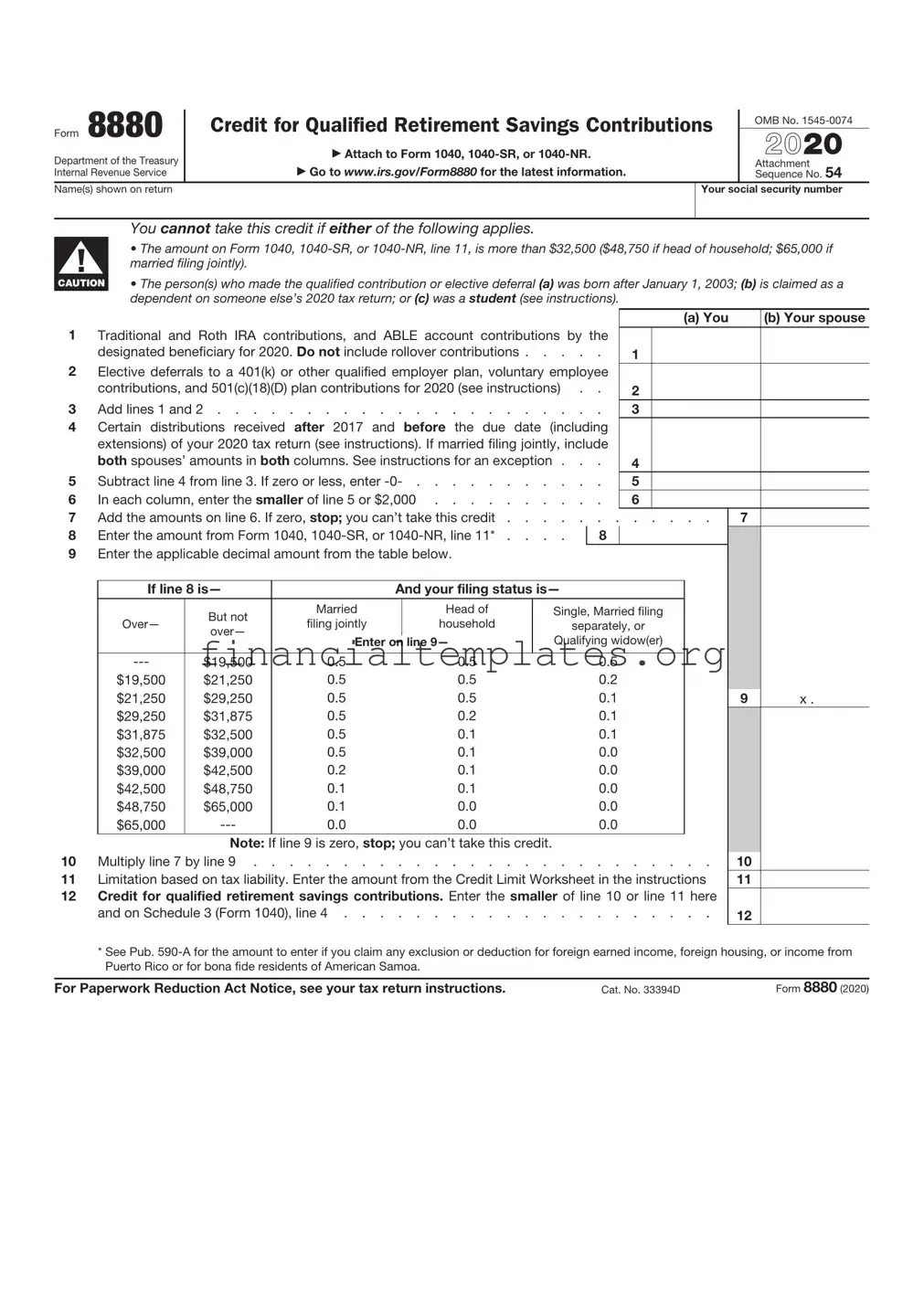

IRS 8880 Example

Form 8880 |

|

Credit for Qualified Retirement Savings Contributions |

|

OMB No. |

||||

|

|

|||||||

|

|

|

|

|

|

|

|

|

Department of the Treasury |

|

▶ Attach to Form 1040, |

|

|

|

2021 |

||

|

▶ Go to www.irs.gov/Form8880 for the latest information. |

|

|

|

Attachment |

|||

Internal Revenue Service |

|

|

|

|

Sequence No. 54 |

|||

Name(s) shown on return |

|

|

|

|

Your social security number |

|||

|

|

|

|

|

|

|

||

|

You cannot take this credit if either of the following applies. |

|

|

|

|

|||

▲ |

• The amount on Form 1040, |

|||||||

! |

married filing jointly). |

|

|

|

|

|||

|

|

|

|

|

||||

CAUTION |

• The person(s) who made the qualified contribution or elective deferral (a) was born after January 1, 2004; (b) is claimed as a |

|||||||

|

dependent on someone else’s 2021 tax return; or (c) was a student (see instructions). |

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(a) You |

|

(b) Your spouse |

|

1Traditional and Roth IRA contributions, and ABLE account contributions by the

designated beneficiary for 2021. Do not include rollover contributions |

1 |

2Elective deferrals to a 401(k) or other qualified employer plan, voluntary employee

contributions, and 501(c)(18)(D) plan contributions for 2021 (see instructions) . . |

2 |

3 Add lines 1 and 2 |

3 |

4Certain distributions received after 2018 and before the due date (including

|

extensions) of your 2021 tax return (see instructions). If married filing jointly, include |

|

|

|

||

|

both spouses’ amounts in both columns. See instructions for an exception . |

. . |

4 |

|

|

|

5 |

Subtract line 4 from line 3. If zero or less, enter |

. . |

5 |

|

|

|

6 |

In each column, enter the smaller of line 5 or $2,000 |

. . |

6 |

|

|

|

7 |

Add the amounts on line 6. If zero, stop; you can’t take this credit . . . . |

. . . |

. . . . . |

|

7 |

|

8 |

Enter the amount from Form 1040, |

|

8 |

|

|

|

9Enter the applicable decimal amount from the table below.

If line 8 is— |

|

And your filing status is— |

|

|

|

|||

|

But not |

Married |

|

Head of |

Single, Married filing |

|

|

|

Over— |

filing jointly |

|

household |

separately, or |

|

|

|

|

over— |

|

|

|

|

||||

|

Enter on line 9— |

Qualifying widow(er) |

|

|

|

|||

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

$19,750 |

0.5 |

0.5 |

0.5 |

|

|

|

||

$19,750 |

$21,500 |

0.5 |

0.5 |

0.2 |

|

|

|

|

$21,500 |

$29,625 |

0.5 |

0.5 |

0.1 |

9 |

x 0 . |

||

$29,625 |

$32,250 |

0.5 |

0.2 |

0.1 |

|

|

|

|

$32,250 |

$33,000 |

0.5 |

0.1 |

0.1 |

|

|

|

|

$33,000 |

$39,500 |

0.5 |

0.1 |

0.0 |

|

|

|

|

$39,500 |

$43,000 |

0.2 |

0.1 |

0.0 |

|

|

|

|

$43,000 |

$49,500 |

0.1 |

0.1 |

0.0 |

|

|

|

|

$49,500 |

$66,000 |

0.1 |

0.0 |

0.0 |

|

|

|

|

$66,000 |

0.0 |

0.0 |

0.0 |

|

|

|

||

Note: If line 9 is zero, stop; you can’t take this credit.

10 |

Multiply line 7 by line 9 |

10 |

11 |

Limitation based on tax liability. Enter the amount from the Credit Limit Worksheet in the instructions |

11 |

12 |

Credit for qualified retirement savings contributions. Enter the smaller of line 10 or line 11 here |

|

|

and on Schedule 3 (Form 1040), line 4 |

12 |

*See Pub.

For Paperwork Reduction Act Notice, see your tax return instructions. |

Cat. No. 33394D |

Form 8880 (2021) |

Form 8880 (2021) |

Page 2 |

General Instructions

Section references are to the Internal Revenue Code.

Reminder

Contributions by a designated beneficiary to an Achieving a Better Life Experience (ABLE) account. A retirement savings contribution credit may be claimed for the amount of contributions you, as the designated beneficiary of an ABLE account, make before January 1, 2026, to the ABLE account. See Pub. 907, Tax Highlights for Persons With Disabilities, for more information.

Future Developments

For the latest information about developments related to Form 8880 and its instructions, such as legislation enacted after they were published, go to www.irs.gov/Form8880.

Purpose of Form

Use Form 8880 to figure the amount, if any, of your retirement savings contributions credit (also known as the saver’s credit).

TIP |

This credit can be claimed in addition to any IRA deduction |

claimed on Schedule 1 (Form 1040), line 20. |

Who Can Take This Credit

You may be able to take this credit if you, or your spouse if filing jointly, made (a) contributions (other than rollover contributions) to a traditional or Roth IRA; (b) elective deferrals to a 401(k), 403(b), governmental 457(b), SEP, SIMPLE, or to the federal Thrift Savings Plan (TSP); (c) voluntary employee contributions to a qualified retirement plan, as defined in section 4974(c) (including the federal TSP); (d) contributions to a 501(c)(18)(D) plan; or (e) contributions, as a designated beneficiary of an ABLE account, to the ABLE account, as defined in section 529A.

However, you can’t take the credit if either of the following applies.

•The amount on Form 1040,

•The person(s) who made the qualified contribution or elective deferral

(a) was born after January 1, 2004; (b) is claimed as a dependent on someone else’s 2021 tax return; or (c) was a student.

You’ll need to refigure the amount on Form 1040 or ▲!

you’re excluding income from Puerto Rico. See Pub.

You were a student if during any part of 5 calendar months of 2021 you:

•Were enrolled as a

•Took a

A school includes technical, trade, and mechanical schools. It doesn’t include

Specific Instructions

Column (b)

Complete column (b) only if you’re filing a joint return.

Line 2

Include on line 2 any of the following amounts.

•Elective deferrals (including designated Roth contributions under section 402A, if applicable) to a 401(k), 403(b), governmental 457(b), SEP, SIMPLE, or to the federal TSP.

•Voluntary employee contributions to a qualified retirement plan, as defined in section 4974(c) (including the federal TSP).

•Contributions to a 501(c)(18)(D) plan.

These amounts may be shown in box 12 of your Form(s)

Note: Contributions designated under section 414(h)(2) are treated as employer contributions and, as such, they aren’t voluntary contributions made by the employee. They don’t qualify for the credit and shouldn’t be included on line 2.

Line 4

Enter the total amount of distributions you, and your spouse if filing jointly, received after 2018 and before the due date of your 2021 return (including extensions) from any of the following types of plans.

•Traditional or Roth IRAs, or ABLE accounts.

•401(k), 403(b), governmental 457(b), 501(c)(18)(D), SEP, SIMPLE, or to the federal TSP.

•Qualified retirement plans, as defined in section 4974(c).

Don’t include any of the following.

•Distributions not taxable as the result of a rollover or a

•Distributions that are taxable as the result of an

•Distributions from your eligible retirement plan (other than a Roth IRA) rolled over or converted to your Roth IRA.

•Loans from a qualified employer plan treated as a distribution.

•Distributions of excess contributions or deferrals (and income allocable to such contributions or deferrals).

•Distributions of contributions made to an IRA during a tax year and returned (with any income allocable to such contributions) on or before the due date (including extensions) for that tax year.

•Distributions of dividends paid on stock held by an employee stock ownership plan under section 404(k).

•Distributions from a military retirement plan (other than the federal TSP).

•Distributions from an inherited IRA by a nonspousal beneficiary.

If you’re filing a joint return, include both spouses’ amounts in both columns.

Exception. Don’t include your spouse’s distributions with yours when entering an amount on line 4 if you and your spouse didn’t file a joint return for the year the distribution was received.

Example. You received a distribution of $5,000 from a qualified retirement plan in 2021. Your spouse received a distribution of $2,000 from a Roth IRA in 2019. You and your spouse file a joint return in 2021, but didn’t file a joint return in 2019. You would include $5,000 in column

(a)and $7,000 in column (b).

Line 7

Add the amounts from line 6, columns (a) and (b), and enter the total.

Line 11

Before you complete the following worksheet, figure the amount of any credit for the elderly or the disabled you’re claiming on Schedule 3 (Form 1040), line 6d. See Schedule R (Form 1040) to figure the credit.

Credit Limit Worksheet

Complete this worksheet to figure the amount to enter on line 11.

1.Enter the amount from Form 1040,

1. |

|

|

|

|

|

2. Form 1040,

the total of your credits from Schedule 3, lines 1 |

2. |

||

through 3, 6d, and 6l |

|||

|

|

||

3.Subtract line 2 from line 1. Also enter this amount on Form 8880, line 11. But if zero or less, stop;

you can’t take the |

3. |

|

|

|

|

Document Specifics

| Fact Name | Description |

|---|---|

| Form Purpose | The IRS Form 8880 is used for claiming the Credit for Qualified Retirement Savings Contributions. |

| Eligibility | It is available to individuals who make eligible contributions to their retirement accounts and whose adjusted gross income falls within certain limits. |

| Credit Amount | The credit can be worth up to $1,000 for single filers and $2,000 for married couples filing jointly, depending on the filer's income and contribution amount. |

| Filing Status | Both single filers and married couples filing jointly can use Form 8880 to claim the credit. There are specific thresholds for adjusted gross income that vary by filing status. |

| Contributions Counts | Eligible retirement accounts include traditional and Roth IRAs, 401(k)s, certain 403(b) and 457 plans, and other qualifying retirement plans. |

| Governing Law | Federal tax law governs the IRS Form 8880, as it is a tax form used for federal income tax purposes. State-specific laws do not apply to this form. |

Guide to Writing IRS 8880

Filing taxes can often seem like navigating a labyrinth, especially when it comes to ensuring that you're taking advantage of all the credits and deductions available to you. The IRS Form 8880 is a crucial document for individuals looking to claim the Credit for Qualified Retirement Savings Contributions. This credit is designed to reward those who are saving for their retirement, offering a boost to those who are putting money into eligible retirement accounts. While the task of filling out tax forms might feel daunting, breaking it down into manageable steps can make the process more approachable. Here's a concise guide to help you fill out the IRS 8880 form, ensuring you don't miss out on potential tax savings.

- Start by gathering all the necessary documentation. This includes your W-2 forms, any 1099 forms, and details of any contributions to qualified retirement plans such as an IRA, 401(k), or other eligible plans.

- Download the IRS 8880 form from the Internal Revenue Service website. Make sure you're using the most current version of the form.

- Enter your name and social security number at the top of the form. If you're filing jointly, you'll also need to include your spouse's name and social security number.

- Calculate your total contributions to eligible retirement accounts during the tax year. This amount should be entered on line 1 of the form.

- If you received any distributions from retirement plans or accounts, make sure to account for these on line 2. Subtract this amount from your total contributions when instructed by the form. This step ensures that only nondistributed contributions are considered for the credit.

- Using the information on your tax return, find your adjusted gross income (AGI) and enter it on line 3. Your AGI helps determine the rate at which your contributions can be credited.

- Follow the instructions on the form to calculate your credit. This will involve looking up the correct percentage in the instructions based on your adjusted gross income and applying it to your eligible contributions.

- Enter the calculated credit on line 7 of the form, and make sure this also gets included on the specific line of your 1040 form that deals with credits from Form 8880.

- Review the completed form for accuracy. Double-check your math and the information you've entered against your financial records and tax return. Errors can delay processing or impact the credit you're eligible for.

- Once satisfied with the accuracy of the form, attach it to your tax return. Remember, Form 8880 needs to be included with your other tax documents if you are mailing your return. If you're e-filing, follow the instructions provided by your tax software for including attachments.

Completing the IRS Form 8880 is a straightforward process when approached methodically. Ensuring that you've accurately reported your contributions and income can lead to substantial tax savings, making it worth the careful attention to detail. After submitting your tax return with the attached Form 8880, your next steps include monitoring for any correspondence from the IRS and preparing for your next tax year by continuing to make eligible contributions to your retirement accounts. Remember, the key to a stress-free tax season lies in organization and early preparation.

Understanding IRS 8880

-

What is the IRS Form 8880?

IRS Form 8880 is titled "Credit for Qualified Retirement Savings Contributions." This form is used to calculate and claim a tax credit for eligible contributions individuals make to their retirement accounts, such as IRAs, 401(k) plans, and certain other qualified retirement plans. The credit is intended to encourage and reward lower and middle-income individuals for making contributions to their retirement savings. The amount of the credit depends on the taxpayer's income and the total contributions made.

-

Who is eligible to claim the credit on Form 8880?

To be eligible for the credit, individuals must:

- Be 18 years of age or older,

- Not be claimed as a dependent on someone else's tax return,

- Not be a full-time student,

- Have made contributions to a qualified retirement savings account during the year,

- And have an adjusted gross income (AGI) below a certain threshold, which is adjusted annually for inflation.

-

How much can the credit be worth?

The credit is worth between 10% to 50% of your eligible contributions to your retirement accounts, up to a maximum of $2,000 for individuals and $4,000 for married couples filing jointly. Therefore, the maximum credit amount is $200 to $1,000 for individuals and $400 to $2,000 for couples, depending on your AGI and your contribution amount.

-

How do I calculate the credit on Form 8880?

To calculate the credit, you will need to fill out Form 8880 by entering your contributions to all eligible retirement accounts. The form guides you through calculating your credit based on your contributions and your AGI. The instructions on the form clearly lay out the steps and the percentage of your contributions that qualify for the credit based on your income level.

-

Is the credit refundable?

No, the credit for qualified retirement savings contributions is not refundable. This means that it can lower your tax bill to $0, but you won't receive the difference as a refund if the credit is more than the amount of taxes you owe.

-

How do I claim the credit?

To claim the credit, you must file Form 8880 with your tax return. You will include the calculated credit from Form 8880 on your Form 1040 (or Form 1040NR) in the credits section. It's important to ensure that you also keep records of your retirement savings contributions should the IRS require proof of your eligibility for the credit.

-

Can I still claim the credit if I receive a retirement plan distribution?

Yes, but with conditions. Receiving a distribution from a retirement plan may affect the amount of credit you can claim. Distributions received during the testing period (which is two years before the year the credit is claimed and up to the filing deadline, including extensions, for the return) may reduce the contribution amount you can count towards the credit. There are detailed rules on how these distributions affect the credit, so reviewing the instructions on Form 8880 or consulting with a tax professional is advisable.

Common mistakes

Filing tax forms can often feel like navigating a maze, and the IRS Form 8880, used for claiming the Credit for Qualified Retirement Savings Contributions, is no exception. People aiming to take advantage of this tax credit to lower their bill or boost their refund can sometimes stumble on common pitfalls. Recognizing these mistakes before submitting your form can save both time and money. Here's a breakdown of typical errors to avoid:

Not meeting the income requirements. The IRS sets specific income limits for eligibility on the Retirement Savings Contributions Credit. Overlooking these thresholds can lead to the disqualification of your credit claim.

Incorrectly calculating the contribution amount. It’s vital to accurately tally the amounts contributed to retirement accounts during the year. Errors here can either leave money on the table or, conversely, result in a claim for a credit amount higher than what's legally permitted.

Failing to identify all qualifying retirement accounts. Many individuals don't realize that contributions to various types of retirement accounts are eligible for the credit, not just traditional IRAs or 401(k)s. This oversight means they might miss out on claiming the credit for contributions to accounts like 403(b)s, 457 plans, or SIMPLE IRAs.

Overlooking the form entirely. Some taxpayers aren’t aware that the credit exists or believe they won’t qualify, so they skip filling out Form 8880 altogether. This mistake can result in missing out on a valuable tax benefit.

Not including the form with your tax return. Once you've correctly filled out Form 8880, it's crucial to attach it to your tax return. Failing to do so means the IRS won’t process it, and you won’t receive the credit.

In addition, here are some quick tips to remember when working on the IRS Form 8880:

Review the instructions provided by the IRS carefully to ensure you understand the eligibility criteria and how to calculate your credit properly.

Double-check your numbers. A simple math mistake can alter the outcome of your credit eligibility or the amount.

Keep records of all your retirement contributions. Having this documentation can be a lifesaver if the IRS has questions or if you need to amend your return.

By avoiding these common mistakes and following the tips provided, you can navigate the process of claiming your Retirement Savings Contributions Credit more smoothly and potentially enhance your financial situation come tax time.

Documents used along the form

When preparing taxes and looking to take advantage of the Credit for Qualified Retirement Savings Contributions, also known as the Saver's Credit, IRS Form 8880 becomes essential. This is just one piece of a larger puzzle when dealing with tax documentation, especially for those looking to maximize their deductions and credits. To fully benefit from the tax code’s offerings, several other forms and documents often accompany the filing of IRS Form 8880.

- Form 1040: The U.S. Individual Income Tax Return is the foundation for individual filing. It's where you'll summarize your income, deductions, and credits, including the total from Form 8880.

- Form 1040-SR: A version of Form 1040 for seniors, offering the same functionality but with a focus on retirement income and a larger print for easier reading.

- Form 1099-R: This form reports distributions from pensions, annuities, retirement or profit-sharing plans, IRAs, and insurance contracts. It’s vital for calculating taxable amounts on retirement savings.

- W-2 Forms: These documents from employers show the total earnings and taxes withheld throughout the year. They are fundamental in understanding your taxable income and potential deductions.

- Schedule 1 (Form 1040): It's used to report additional income or adjustments to income that can’t be entered directly on Form 1040, affecting your adjusted gross income and possibly the credit amount on IRS Form 8880.

- Form 5498: IRA Contribution Information reports IRA contributions to the IRS, including those that might qualify for the credit on Form 8880. The form can help prove the eligibility of contributions.

- Form 5329: Additional Taxes on Qualified Plans (Including IRAs) and Other Tax-Favored Accounts. This form helps calculate possible taxes or penalties that could reduce the savings intended from using Form 8880.

- Schedule 3 (Form 1040): Where you claim nonrefundable tax credits, including the credit from Form 8880. It helps ensure that the credit appropriately affects the overall tax responsibility.

- Form 4506-T: Request for Transcript of Tax Return. It might be necessary if you need past tax documents to verify the information or eligibility for the Saver's Credit.

- Form 4868: Application for Automatic Extension of Time To File U.S. Individual Income Tax Return. If more time is needed to gather documents or handle complex filings including Form 8880, this form is crucial.

Understanding and gathering the correct forms and documents is crucial to effectively filing your taxes and taking full advantage of potential credits and deductions. For those working through their retirement contributions and hoping to qualify for the Saver's Credit with IRS Form 8880, ensuring all relevant information is correctly reported on these accompanying forms is key. Proper preparation can lead to favorable outcomes and potentially larger refunds, highlighting the importance of thorough and knowledgeable tax filing.

Similar forms

The IRS Form 1040, also known as the U.S. Individual Income Tax Return, shares similarities with IRS Form 8880 since both are essential for taxpayers during tax season. The Form 1040 is a comprehensive form used to report an individual's annual income, and it provides sections to claim deductions and credits, similar to how the Form 8880 is used to claim credits for retirement savings contributions. Where Form 8880 focuses specifically on retirement savings, the Form 1040 encompasses a broader range of tax situations but also includes lines where the outcome of Form 8880 would be reported.

Form 5498, IRA Contribution Information, is akin to Form 8880 in that it deals with retirement savings. However, Form 5498 is filled out by the trustees of IRA accounts to report contributions to the IRS, while Form 8880 is completed by individual taxpayers claiming a credit for those contributions. Both forms play a crucial role in the reporting and claiming of retirement savings, yet from different perspectives within the tax ecosystem, highlighting the importance of accurate record-keeping and reporting for retirement contributions.

Similar to Form 8880, the Form 8863, titled "Education Credits (American Opportunity and Lifetime Learning Credits)," is designed for taxpayers to claim specific tax credits. While Form 8880 focuses on retirement savings contributions, Form 8863 is geared towards expenses paid for education. Both forms assist taxpayers in reducing their tax liability by allowing them to claim credits for certain types of personal investments, thus encouraging the pursuit of higher education and retirement savings through tax incentives.

Form W-2, Wage and Tax Statement, also relates to IRS Form 8880, albeit more indirectly. Form W-2 is issued by employers to report an employee's annual wages and the amount of taxes withheld from their paycheck. The relevance to Form 8880 comes into play where an individual's W-2 shows contributions to a retirement plan, potentially qualifying the taxpayer to claim a retirement savings contributions credit on Form 8880. This demonstrates the interconnectedness of employment, income reporting, and eligibility for tax benefits related to retirement savings.

Similarly, the Schedule 3 (Form 1040), which is used for reporting non-refundable tax credits, is connected to Form 8880. Taxpayers who fill out Form 8880 to claim a credit for retirement savings contributions would report this credit on Schedule 3, integrating it into their broader tax return filed with Form 1040. This link emphasizes the role of both forms in applying specific tax credits to reduce overall tax liability, showcasing how various forms interact to paint a complete picture of an individual's tax situation.

Lastly, the Child Tax Credit form, officially known as Schedule 8812 (Form 1040), has parallels to Form 8880 due to its purpose of providing tax relief to taxpayers, though in this case, for those supporting eligible children rather than saving for retirement. Both forms demonstrate the IRS's effort to offer financial incentives for personal decisions that have long-term benefits, whether it's investing in one's retirement or providing for a child's wellbeing. The structure of claiming these credits within each taxpayer's return illustrates the broader strategy of using tax policy to encourage beneficial societal behaviors.

Dos and Don'ts

Filling out IRS Form 8880, which is used to claim the Credit for Qualified Retirement Savings Contributions, requires careful attention to detail. Here are important dos and don'ts that can help ensure the process is completed correctly and efficiently.

- Do gather all necessary documentation before starting, including W-2 forms and any records of retirement contributions.

- Do double-check your Social Security Number and other personal information to avoid processing delays due to incorrect data.

- Do consult with a tax professional if you are unsure about your eligibility for the credit.

- Do use the instructions provided by the IRS for Form 8880 to help guide you through each part of the form.

- Don't overlook the income limits for eligibility; make sure your income does not exceed the maximum allowed to claim the credit.

- Don't mistakenly claim contributions that are not qualified; only certain types of retirement contributions are eligible for the credit.

- Don't forget to sign and date the form if you are filing a paper return; electronic filings will require an electronic signature.

- Don't assume the credit amount without calculating it according to the instructions; it's based on your contributions and adjusted gross income.

Misconceptions

Many people have misconceptions about the IRS 8880 form, which can often lead to confusion or mistakes when trying to claim the Credit for Qualified Retirement Savings Contributions. To help clarify some of these misunderstandings, here is a list of seven common misconceptions.

All taxpayers are eligible to use Form 8880. In reality, eligibility to use Form 8880 is dependent on the taxpayer's adjusted gross income, filing status, and whether they have made eligible contributions to a qualified retirement plan or IRA.

Form 8880 is only for traditional IRA contributions. This is incorrect; contributions to various retirement accounts, including Roth IRAs, 401(k) plans, and others, can qualify for the credit provided they meet certain requirements.

There is no income limit for claiming the saver's credit. The credit is actually phased out at certain income levels, which vary depending on your filing status. Higher earners may find they are ineligible for the credit.

You can claim the credit for contributions made anytime during the year. While generally true, for a contribution to count for a specific tax year, it must be made by the due date of your tax return for that year, not including extensions.

The credit is refundable. The saver’s credit is a non-refundable credit, meaning it can reduce your tax bill to zero, but you won't receive a refund on any portion of the credit that exceeds your tax liability.

You can claim the credit without any earned income. Eligibility for the saver's credit does require earned income, such as wages, salaries, tips, or other taxable employee compensation. Certain other types of income, like investment income, do not qualify.

Form 8880 should be filed separately from your tax return. This is not the case; Form 8880 must be attached to your Form 1040 or 1040-SR when you file your federal tax return. It is not a standalone document and is necessary for claiming the saver's credit.

Key takeaways

The IRS Form 8880 is used for a very specific purpose: to help individuals claim the Credit for Qualified Retirement Savings Contributions. This form can offer valuable tax savings, empowering those who are building their retirement savings. Here are key takeaways everyone should know when it comes to filling out and using this form:

Eligibility Matters: To use Form 8880, you must have made contributions to a qualified retirement plan, such as an IRA, 401(k), or similar accounts during the tax year.

Income Limits Apply: There are income thresholds that determine your eligibility for the credit. These limits vary annually, so it's important to check the current year's guidelines.

Calculating the Credit: The credit is a percentage of your qualifying retirement contributions, up to $2,000 for single filers, and $4,000 for married couples filing jointly. The exact percentage depends on your adjusted gross income.

Nonrefundable Credit: This is a nonrefundable credit, meaning it can lower your tax bill to zero, but you won't receive a refund on any amount of the credit that exceeds your tax owed.

Form Completion: Accurately completing Form 8880 is crucial. This includes entering your personal information, the amount of eligible contributions, and calculating the credit according to the instructions.

Importance of Records: Keeping detailed records of your retirement contributions is essential. These records will support the amounts you claim on Form 8880.

Filing Status Impact: Your filing status can affect your credit. Married couples filing jointly often have higher income limits and potential credit amounts compared to single filers.

Use With Other Forms: Form 8880 is filed with your Form 1040 or 1040-SR. You must fill out your income tax return to determine your credit.

Seeking Professional Help: If you're unsure about your eligibility or how to fill out Form 8880, consulting with a tax professional can ensure you maximize your credit and comply with tax laws.

Remember, taking advantage of the Credit for Qualified Retirement Savings Contributions can make a significant difference in your tax situation and support your long-term financial health. Always stay informed about the latest tax laws and guidelines to make the most of your retirement savings efforts.

Popular PDF Documents

IRS 4868 - Submitting Form 4868 does not extend the time to pay any taxes owed; it only extends the filing deadline.

Sc Sos Annual Report - An attached Property Owner’s Acknowledgement of Rights and Obligations document is necessary for complete submission.