Get Irs 8879 Eo Form

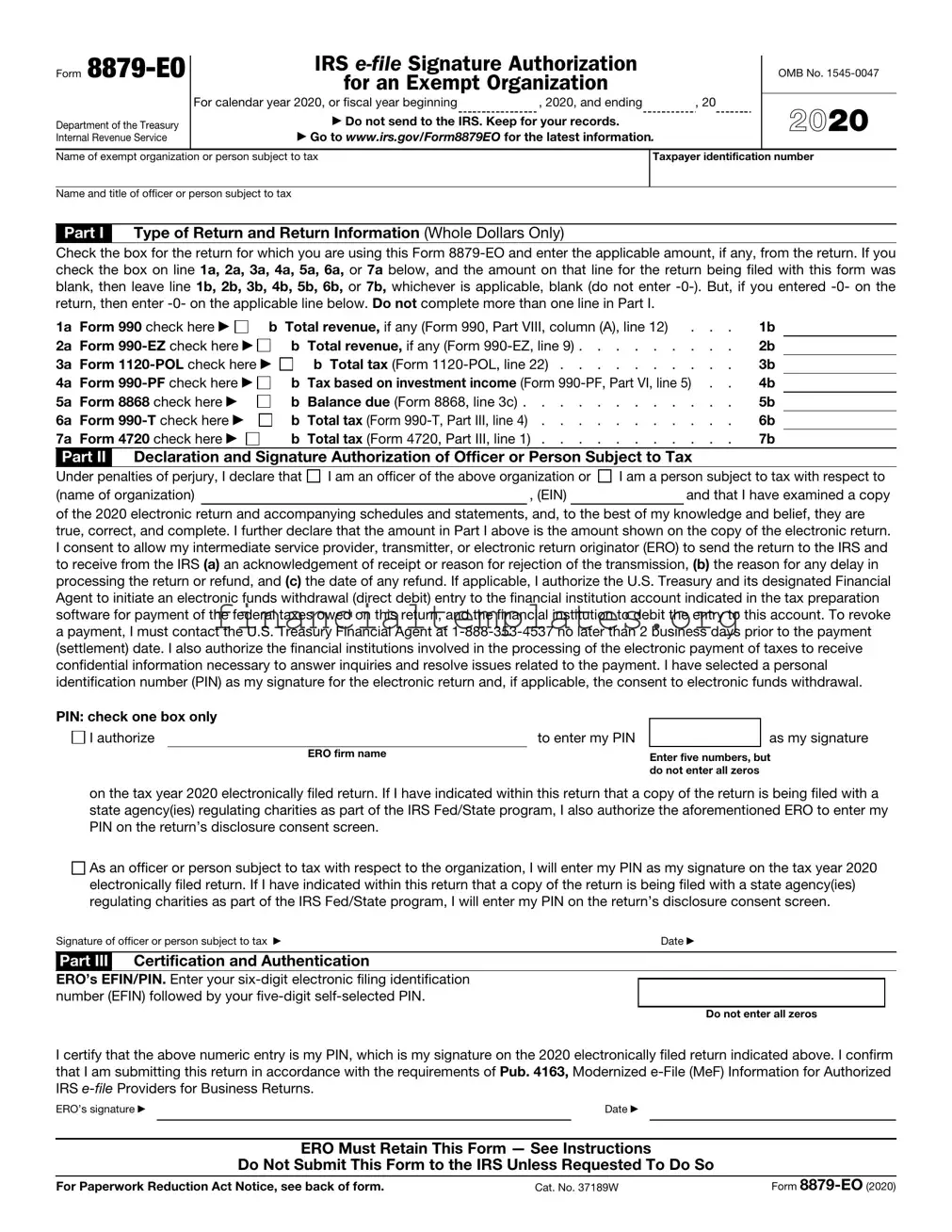

The Form 8879-EO serves as a crucial document for exempt organizations engaging in the electronic filing process with the Internal Revenue Service (IRS). This IRS e-file Signature Authorization form enables an officer of an exempt organization, or a person who is liable for tax, to approve the electronic submission of returns such as Forms 990, 990-EZ, 1120-POL, 990-PF, 8868, 990-T, and 4720 by using a Personal Identification Number (PIN) as their signature. Additionally, it authorizes electronic funds withdrawals for payment of federal taxes owed, when applicable. It's important to note that this form, which encapsulates significant details from the tax return being filed, is not sent to the IRS directly but retained for the organization’s records, with specific instructions for both the Electronic Return Originator (ERO) and the taxpaying entity in terms of responsibilities, including accuracy verification, form completion, and documentation retention. The document sets a framework for utilizing digital conveniences while maintaining rigorous standards of accuracy, documentation, and legal authorization, emphasizing the shift towards modern, electronic facilitation of tax administration for exempt organizations.

Irs 8879 Eo Example

Form

Department of the Treasury Internal Revenue Service

IRS

for an Exempt Organization

For calendar year 2020, or fiscal year beginning |

, 2020, and ending |

, 20 |

▶Do not send to the IRS. Keep for your records.

▶Go to WWW.IRS.GOV/FORM8879EO for the latest information.

OMB No.

2020

Name of exempt organization or person subject to tax

Taxpayer identification number

Name and title of officer or person subject to tax

Part I Type of Return and Return Information (Whole Dollars Only)

Check the box for the return for which you are using this Form

1a Form 990 check here ▶

b Total revenue, if any (Form 990, Part VIII, column (A), line 12) . . . |

1b |

2a |

Form |

b Total revenue, if any (Form |

2b |

|

|

3a |

Form |

b Total tax (Form |

3b |

|

|

4a |

Form |

b Tax based on investment income (Form |

4b |

|

|

5a |

Form 8868 check here ▶ |

b Balance due (Form 8868, line 3c) |

5b |

|

|

6a |

Form |

b Total tax (Form |

6b |

|

|

7a |

Form 4720 check here ▶ |

b Total tax (Form 4720, Part III, line 1) |

7b |

||

Part II |

Declaration and Signature Authorization of Officer or Person Subject to Tax |

|

|

||

Under penalties of perjury, I declare that

I am an officer of the above organization or

I am an officer of the above organization or

I am a person subject to tax with respect to

I am a person subject to tax with respect to

(name of organization), (EIN)and that I have examined a copy of the 2020 electronic return and accompanying schedules and statements, and, to the best of my knowledge and belief, they are true, correct, and complete. I further declare that the amount in Part I above is the amount shown on the copy of the electronic return. I consent to allow my intermediate service provider, transmitter, or electronic return originator (ERO) to send the return to the IRS and to receive from the IRS (a) an acknowledgement of receipt or reason for rejection of the transmission, (b) the reason for any delay in processing the return or refund, and (c) the date of any refund. If applicable, I authorize the U.S. Treasury and its designated Financial Agent to initiate an electronic funds withdrawal (direct debit) entry to the financial institution account indicated in the tax preparation software for payment of the federal taxes owed on this return, and the financial institution to debit the entry to this account. To revoke a payment, I must contact the U.S. Treasury Financial Agent at

PIN: check one box only

I authorize |

to enter my PIN |

ERO firm name

as my signature

Enter five numbers, but do not enter all zeros

on the tax year 2020 electronically filed return. If I have indicated within this return that a copy of the return is being filed with a state agency(ies) regulating charities as part of the IRS Fed/State program, I also authorize the aforementioned ERO to enter my PIN on the return’s disclosure consent screen.

As an officer or person subject to tax with respect to the organization, I will enter my PIN as my signature on the tax year 2020 electronically filed return. If I have indicated within this return that a copy of the return is being filed with a state agency(ies) regulating charities as part of the IRS Fed/State program, I will enter my PIN on the return’s disclosure consent screen.

Signature of officer or person subject to tax ▶ |

Date ▶ |

Part III Certification and Authentication

ERO’s EFIN/PIN. Enter your

Do not enter all zeros

I certify that the above numeric entry is my PIN, which is my signature on the 2020 electronically filed return indicated above. I confirm that I am submitting this return in accordance with the requirements of Pub. 4163, Modernized

ERO’s signature ▶Date ▶

ERO Must Retain This Form — See Instructions

Do Not Submit This Form to the IRS Unless Requested To Do So

For Paperwork Reduction Act Notice, see back of form. |

Cat. No. 37189W |

Form |

Form |

Page 2 |

|

|

Future Developments

For the latest information about developments related to Form

Purpose of Form

An organization officer or person subject to tax and an electronic return originator (ERO) use Form

The ERO must retain Form

ERO Responsibilities

The ERO will:

•Enter the name and taxpayer identification number at the top of the form;

•Complete Part I by checking the box for the type of return being filed and using the amount, if any, from the 2020 return;

•Enter on the authorization line in Part II the ERO firm name (not the name of the individual preparing the return) if the ERO is authorized to enter the officer’s PIN;

•Give Form

•Complete Part III by entering the ERO’s EFIN/PIN and include a signature and date.

! |

Form |

completed and signed before |

|

▲ |

submission of the electronic |

CAUTION |

return. |

|

Responsibilities of Officer or Person Subject to Tax

The officer or person subject to tax has the following responsibilities.

•Verify the accuracy of the organization’s prepared return.

•Verify the type of return being filed in Part I.

•In the beginning of Part II, check the appropriate box for an officer or person subject to tax (and enter the name of the organization and employer identification number (EIN)).

•Check the appropriate box in Part II to either authorize the ERO to enter the PIN or to choose to enter it in person.

•Indicate or verify his or her

•Sign and date Form

•Return the completed Form

Important Notes for EROs

•Do not send Form

•Enter the PIN on the input screen only if you’re authorized to do so.

•Give a copy of the signed Form 8879- EO upon request to the officer or person subject to tax.

•Give a corrected copy of the Form

•See Pub. 4163, Modernized

Privacy Act and Paperwork Reduction Act Notice. We ask for the information on this form to carry out the Internal Revenue laws of the United States. You are required to give us the information. We need it to ensure that you are complying with these laws and to allow us to figure and collect the right amount of tax.

You are not required to provide the information requested on a form that is subject to the Paperwork Reduction Act unless the form displays a valid OMB control number. Books or records relating to a form or its instructions must be retained as long as their contents may become material in the administration of any Internal Revenue law. Generally, tax returns and return information are confidential, as required by section 6103. However, certain returns and return information of tax exempt organizations and trusts are subject to public disclosure and inspection, as provided by section 6104.

The time needed to complete and file this form will vary depending on individual circumstances. The estimated burden for tax exempt organizations filing this form is approved under OMB control number

Document Specifics

| Fact Name | Description |

|---|---|

| Form Purpose | Form 8879-EO is used for an officer of an exempt organization or a person subject to tax to authorize an electronic file signature and, if applicable, authorize an electronic funds withdrawal. |

| Non-Submission to the IRS | The completed Form 8879-EO should not be sent to the IRS but must be retained by the ERO, as it serves for records and verification purposes. |

| ERO and Officer Responsibilities | The ERO is responsible for filling out the form and obtaining the officer's or person's signature, while the officer or person must verify the return's accuracy and sign the form. |

| Record Retention | EROs must retain the completed Form 8879-EO for 3 years from the return's due date or the date the IRS received the return, whichever is later. The form can be retained electronically in accordance with Rev. Proc. 97-22. |

Guide to Writing Irs 8879 Eo

Embarking on the journey of filling out IRS Form 8879-EO can be a smooth process with the right guidance. This form plays a crucial role in authorizing an electronic signature for an exempt organization’s tax return. It signifies that the individual completing it has reviewed the return and believes it to be accurate. Like a digital handshake with the IRS, it facilitates a quicker submission process but doesn't travel to the IRS itself. Instead, it stays with the electronic return originator (ERO) as a record of authorization. Below is a step-by-step approach to ensure this authorization is correctly completed and stored.

- At the top of the form, enter the Name of the exempt organization along with its Taxpayer identification number.

- Under Name and title of officer, input the information for the person responsible for tax matters within the organization.

- In Part I - Type of Return and Return Information, you'll find several checkboxes that correspond to different forms (like Form 990 or 990-EZ). Check the box next to the type of return your organization is filing. Enter the applicable dollar amount from your return in the space provided next to the checkbox you selected. If the line on the return is blank, leave it blank here too. If it's zero on the return, write "-0-".

- Proceed to Part II - Declaration and Signature Authorization of Officer or Person Subject to Tax. Here, affirm that you've reviewed the electronic return and it’s accurate to the best of your knowledge. Choose either you will enter your PIN as the officer or person subject to tax, or you authorize the ERO to do so on your behalf. If selecting the latter, you'll need to provide the ERO firm name.

- Create a five-digit PIN that doesn’t include all zeros, and enter it in the space provided. This PIN will serve as your electronic signature.

- Sign and date the form in the designated area at the end of Part II.

- In Part III, the ERO will complete their section, adding their electronic filing identification number (EFIN) and their five-digit self-selected PIN. They must also sign and date the form.

Once this form is completed by both parties, it's important to keep things moving efficiently. The officer or the person subject to tax must provide the ERO with the finished Form 8879-EO. Remember, this form isn't sent to the IRS but retained by the ERO. This retention is crucial, as it may be requested by the IRS in future, to confirm the authorization of the e-filed return. The ERO is responsible for keeping this form on file for a specific period, ensuring compliance and readiness for any IRS inquiries. Ensuring the form's accurate completion and secure storage underscores the commitment to maintaining a detailed, compliant financial documentation process for all parties involved.

Understanding Irs 8879 Eo

What is Form 8879-EO and who needs to use it?

Form 8879-EO, titled "IRS e-file Signature Authorization for an Exempt Organization," is a document used by the officer of an exempt organization or a person subject to tax to authorize the electronic filing of their return using a Personal Identification Number (PIN). This form is necessary for those who opt to e-file any of the following returns: Form 990, Form 990-EZ, Form 1120-POL, Form 990-PF, Form 8868, Form 990-T, or Form 4720, and wish to authorize an electronic funds withdrawal. If an organization opts not to use Form 8879-EO for electronic signature, they must use Form 8453-EO instead. The form should be kept for records and not sent to the IRS.

How does an officer or person subject to tax sign the e-filed return?

By using Form 8879-EO, an officer or person subject to tax can sign their e-filed return electronically. They must select a PIN as their signature for the e-filed return. This PIN is a five-digit number, which should not be all zeros. The individual can either authorize an Electronic Return Originator (ERO) to enter their PIN or choose to enter the PIN themself. Once the PIN choice is made and the form is duly signed and dated, it serves as the authorization for the electronic filing and, if applicable, the electronic funds withdrawal for tax payments.

What are the responsibilities of the Electronic Return Originator (ERO) regarding Form 8879-EO?

The ERO is responsible for ensuring the proper completion of Form 8879-EO. They must enter specific information such as the taxpayer's name and identification number, check the correct type of return box, and complete the authorization line in Part II with the ERO firm name if they are authorized to enter the officer's PIN. It's crucial for the ERO to give the form to the officer or person subject to tax for review and signature. Additionally, the ERO must retain the completed form for three years from the return due date or the IRS receipt date, whichever is later. The form may be kept electronically according to IRS guidelines.

Can Form 8879-EO be submitted electronically to the IRS?

Form 8879-EO should not be submitted to the IRS directly. The primary purpose of the form is to authorize the electronic filing and signature for an exempt organization's return. It is the responsibility of the Electronic Return Originator (ERO) to retain the form. However, if the IRS specifically requests it, then it must be submitted. For recordkeeping, the ERO must retain the completed form as per the described guidelines, but under regular circumstances, there's no need to send it to the IRS.

How does one revoke a payment authorization on Form 8879-EO if needed?

If there's a need to revoke a payment authorization that was made via Form 8879-EO, the officer or person subject to tax must contact the U.S. Treasury Financial Agent directly. This needs to be done no later than 2 business days before the payment settlement date. The designated phone number for revocation is 1-888-353-4537. This action will stop the electronic funds withdrawal from the indicated financial institution account for federal tax payments authorized through this form.

Common mistakes

Filling out the IRS Form 8879-EO is a critical step for exempt organizations to authorize an electronic return filing. However, people commonly make mistakes during this process, which can lead to delays or complications. Here are ten of these frequent errors:

- Not verifying the exempt organization's name and taxpayer identification number at the top of the form, which could lead to misidentification.

- Incorrectly or not checking the box for the type of return being filed in Part I, which is crucial for the IRS to process the form accurately.

- Failing to enter the correct amount from the return in Part I, if applicable, which could reflect inaccurately on the records.

- Overlooking to check the appropriate box in Part II to indicate whether the officer or person subject to tax is authorizing the ERO to enter the PIN or if they will enter it themselves.

- Selecting a PIN that is not allowed, such as one containing all zeros, which could invalidate the authorization.

- Forgetting to sign and date the form, which is a common yet critical oversight that prevents the form from being processed.

- Omitting necessary information in Part III, where the ERO certifies the PIN entry, leaving the electronic filing authorization incomplete.

- Not providing the form to the ERO in an acceptable delivery method, causing delays or failure in submission.

- Ignoring the requirement to keep the form for their records instead of sending it to the IRS, which could lead to issues in future documentation or audits.

- Assuming the role of the ERO without proper authorization or understanding of their responsibilities, potentially leading to errors in the electronic filing process.

When completing the IRS Form 8879-EO, paying close attention to detail and following all instructions can prevent these common mistakes. It's also beneficial to review the form carefully before submitting it to ensure that all information is accurate and complete.

Documents used along the form

When handling the IRS Form 8879-EO, it is often part of a broader suite of documents vital for exempt organizations managing their tax responsibilities. These documents play a crucial role in ensuring compliance with tax laws, providing detailed financial insights, or requesting additional time to file. Understanding each document can simplify the process for organizations and tax preparers alike.

- Form 990: This is the primary form that non-profit organizations use to provide the IRS with annual financial information. It includes details on the organization’s mission, programs, and finances.

- Form 990-EZ: A shorter version of Form 990, designed for smaller non-profits with gross receipts of less than $200,000 and total assets of less than $500,000 at the end of the year.

- Form 990-PF: Used by private foundations, regardless of financial status. It details assets, receipts, expenditures, and grants to other organizations.

- Form 990-T: This form is filed by organizations that have taxable income from unrelated business activities, regardless of their exemption status.

- Form 1120-POL: Required from political organizations that have taxable income exceeding specific thresholds.

- Form 8868: An application for extension of time to file an exempt organization return. It can give an organization an extra six months to submit their forms.

- Form 4720: This is used by managers and self-dealing individuals within private foundations to report certain excise taxes.

- Form 8453-EO: The Exempt Organization Declaration and Signature for Electronic Filing. It accompanies an electronic filing when the Form 8879-EO isn’t used.

- Form W-9: Request for Taxpayer Identification Number and Certification. This may be necessary for setting up accounts or financial relationships where reporting to the IRS is required.

- Bank Authorization Form: While not an IRS form, it's often used alongside Form 8879-EO for organizations setting up direct debit for any taxes due.

This collection of documents ensures that exempt organizations can maintain their status, report accurately on their financials, and comply with various IRS requirements. Each form has its specific purpose, and together, they provide a comprehensive overview of an organization's financial health and compliance status. It’s crucial for organizations to be familiar with these forms and prepare them with accuracy to avoid potential issues with the IRS.

Similar forms

The IRS Form 8453-EO, titled "Exempt Organization Declaration and Signature for Electronic Filing," shares a fundamental similarity with the IRS Form 8879-EO as both serve as electronic signature authorization forms for tax returns. However, while the 8879-EO is used primarily when an officer or individual associated with a tax-exempt organization opts to utilize a PIN for signature on electronically filed returns, the 8453-EO is necessary for organizations that don't use the PIN method but still need to authorize e-filing. Both forms are critical in the digital submission process, enabling the Internal Revenue Service (IRS) to efficiently process returns while maintaining accurate records of authorizations.

Another document related to Form 8879-EO is the Form 8879, "IRS e-file Signature Authorization." This document is for individual taxpayers and operates under a similar premise. It authorizes an electronic return originator (ERO) to e-file a tax return using a personal identification number (PIN) as the taxpayer's signature. Like the 8879-EO, it's a step towards modernizing the filing process, making it faster and more secure for taxpayers to submit their tax obligations electronically. The primary difference lies in the audience it serves, with Form 8879 catering to individual filers whereas 8879-EO is designed expressly for exempt organizations and related entities.

The Form 8868, "Application for Automatic Extension of Time To File an Exempt Organization Return," bears connection to Form 8879-EO in that it can also involve an electronic filing component for tax-exempt organizations seeking extensions on their filing deadline. While the 8879-EO is a signature authorization, the 8868 facilitates a different, though somewhat related, need: more time to gather information and complete filings accurately. When these forms accompany electronic submissions, they underscore the IRS's capacity to manage various electronically processed requests, from extending deadlines to authorizing e-file signatures.

Lastly, Form 2320, "Signature Authorization," used within various business contexts, parallels the 8879-EO in its role of authorizing actions through signatures, albeit in a non-tax context. Although not an IRS form per se, it reflects the broader utilitarian need across different fields for documented consent or approval, exemplifying the importance of signature authorizations in both financial and legal processes. While its application varies significantly from the tax-centric nature of the 8879-EO, both underscore the critical role that formal authorization plays in organizational operations and compliance.

Dos and Don'ts

When it comes to filling out the IRS Form 8879-EO, there are several best practices to follow, as well as common pitfalls to avoid. This form, which serves as the e-file signature authorization for exempt organizations, is crucial for the electronic filing process. Below is a list of do's and don'ts that can help ensure the form is completed accurately and efficiently.

- Do thoroughly review the form instructions available on the IRS website before you start filling out the form. This will provide you with the most current guidelines and requirements.

- Do ensure that the correct Taxpayer Identification Number (TIN) of the exempt organization or person subject to tax is entered at the top of the form.

- Do carefully check the box for the type of return you are filing in Part I and make sure to enter the applicable amount, if any, from the return.

- Do select a PIN that is five numbers, excluding all zeros, as your signature for the electronic return and, if applicable, for the consent to electronic funds withdrawal.

- Don't send the completed Form 8879-EO to the IRS unless specifically requested. This form should be retained for your records.

- Don't use all zeros as your PIN. The PIN must be a five-digit number other than all zeros to be valid.

- Don't overlook the requirement to verify the accuracy of the information on the prepared electronic return before signing Form 8879-EO. This includes verifying the total revenue or tax amounts entered in Part I.

- Don't forget to retain a copy of the signed Form 8879-EO for at least three years from the return due date or the date the return was filed, whichever is later. EROs should adhere to this requirement as well.

Following these guidelines can help streamline the filing process for exempt organizations, ensuring compliance with IRS regulations and reducing the risk of errors on Form 8879-EO.

Misconceptions

Understanding the IRS Form 8879-EO is crucial for exempt organizations. However, there are several misconceptions that often lead to confusion. Highlighting these misconceptions can help ensure accurate and efficient handling of this form.

Form 8879-EO needs to be sent to the IRS: Contrary to this common belief, Form 8879-EO should not be sent to the IRS but instead retained for records. This form authorizes electronic filing and is meant for record-keeping purposes.

Any organizational officer can sign Form 8879-EO: Only specific officers or individuals subject to tax who have examined the return and are familiar with its contents should sign the form, as this process attests to the accuracy of the return.

Form 8879-EO is optional for electronic filing: In reality, for organizations choosing to e-file certain returns and making payments electronically, Form 8879-EO is a required part of the process to authorize e-file and, in certain cases, electronic funds withdrawal.

Organizations can choose any number as a PIN: When selecting a PIN for electronic filing authorization, it must be a five-digit number that cannot include all zeros. This is a critical security feature.

Electronic Return Originators (EROs) automatically know how to handle Form 8879-EO: EROs play a key role, but organizations must ensure they provide accurate information and proper authorization to EROs for filing. Guidelines are in place for both parties to ensure accuracy and compliance.

The form allows any amount of tax payment to be authorized for withdrawal: The electronic funds withdrawal must correspond with the tax liability reflected in the filed return. The organization must ensure the correct amount is authorized for withdrawal.

Submission date is flexible: Form 8879-EO must be completed and signed before the electronic return is submitted. This requirement emphasizes the authorization aspect of the form.

Every exempt organization must use Form 8879-EO: Not all exempt organizations are required to use this form. It's specifically for those who choose to electronically file and, in certain cases, authorize an electronic funds transfer.

Form 8879-EO serves as a public document: This form is confidential and is not subject to public disclosure. It should be kept securely by the organization and only provided to the IRS upon request.

Dispelling these misconceptions is essential for the accurate preparation and submission of the IRS Form 8879-EO. Understanding and following the specific guidelines will help exempt organizations comply with IRS requirements while safeguarding their information.

Key takeaways

Filling out and using the IRS Form 8879-EO, the IRS e-file Signature Authorization for Exempt Organizations, is a crucial step for exempt organizations looking to file their returns electronically. The form allows an organization's authorized officer or an individual subject to tax to electronically sign a tax return. Here are eight key takeaways to guide you through this process:

- The IRS Form 8879-EO should not be sent to the IRS but must be kept for the organization's records.

- It is used when an exempt organization's officer or another individual subject to tax decides to use a Personal Identification Number (PIN) to e-sign an electronic tax return.

- Various return types can be filed using this form, including Form 990, Form 990-EZ, and others, ensuring its versatility across different exempt filing needs.

- The form also facilitates the authorization of an electronic funds withdrawal for payment of federal taxes owed, when applicable.

- An Electronic Return Originator (ERO) is involved in the process, responsible for entering specific information, completing several parts of the form, and retaining it for a designated period.

- The authorized officer or person subject to tax must verify the accuracy of the prepared return, authorize the use of a PIN for signature, and finally sign and date the form.

- Form 8879-EO must be completed and signed before the electronic submission of the return, emphasizing the order of operations in the e-filing process.

- The ERO must retain the completed form for 3 years from the due date of the return or the date it was received by the IRS, whichever is later, adhering to specific recordkeeping guidelines.

Adhering to these guidelines ensures that exempt organizations can navigate the e-filing process smoothly, maintaining compliance and accuracy in their tax filings.

Popular PDF Documents

Where's My Refund Maine - Identifying whether the property is located in multiple municipalities is important for correct filing.

Irs 8948 - IRS Form 8948 is essential for maintaining record-keeping standards, allowing preparers to document the rationale for paper filing thoroughly.

T2200 Tax Form - Facilitates the reconciliation of outstanding balances or credits from previous reporting periods to maintain accurate accounts.