Get IRS 8879 Form

Navigating the complexities of tax filing season requires understanding various forms and their purposes to ensure compliance with Internal Revenue Service (IRS) regulations. Among these, the IRS 8879 form stands out as a crucial document for taxpayers who opt for electronic filing. This form serves as an electronic signature authorization, allowing tax preparers to file returns on behalf of taxpayers without obtaining a physical signature. It represents a pivotal element in the e-filing process, enabling a faster and more secure submission of tax returns. Additionally, the IRS 8879 form encompasses important details such as the taxpayer's name, social security number, and the tax year, ensuring the accuracy and integrity of the submitted information. By facilitating a streamlined filing process, this form not only enhances efficiency but also underscores the IRS's commitment to employing technology in simplifying tax administration. Understanding its role and requirements is essential for taxpayers seeking to navigate the e-filing landscape effectively.

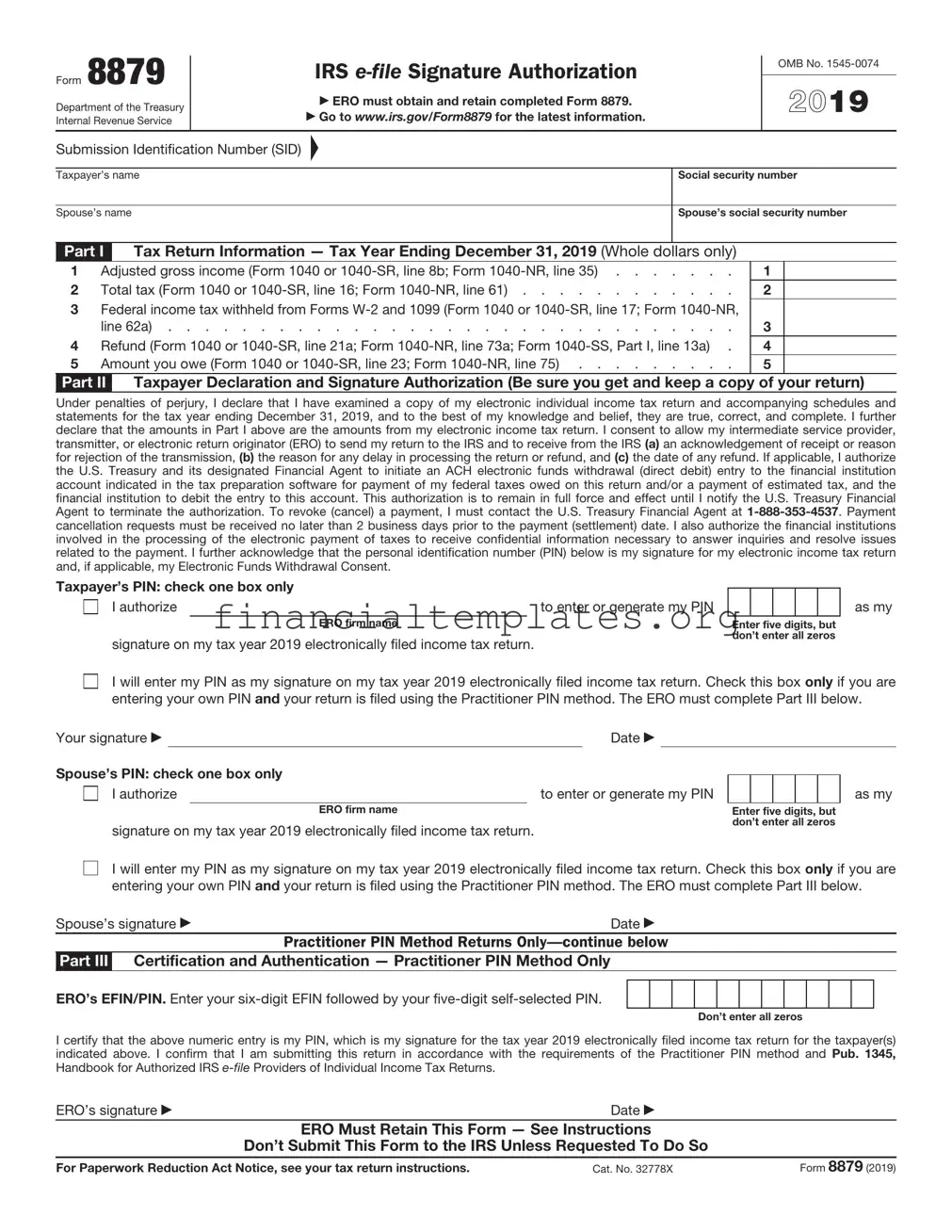

IRS 8879 Example

Form 8879

Department of the Treasury Internal Revenue Service

IRS

ERO must obtain and retain completed Form 8879.

Go to www.irs.gov/Form8879 for the latest information.

OMB No.

2019

Submission Identification Number (SID)

F

Taxpayer’s name |

|

Social security number |

|||||

|

|

|

|

|

|

|

|

Spouse’s name |

|

|

Spouse’s social security number |

||||

|

|

|

|

|

|

||

Part I |

|

Tax Return Information — Tax Year Ending December 31, 2019 (Whole dollars only) |

|

|

|||

1 |

Adjusted gross income (Form 1040 or |

. . . . . . . |

1 |

|

|||

2 |

Total tax (Form 1040 or |

. . . . . . . |

2 |

|

|||

3 |

Federal income tax withheld from Forms |

|

|

||||

|

line 62a) |

. . . . . . . |

3 |

|

|||

4 |

Refund (Form 1040 or |

4 |

|

||||

5 |

Amount you owe (Form 1040 or |

. . . . . . . |

5 |

|

|||

Part II |

|

Taxpayer Declaration and Signature Authorization (Be sure you get and keep a copy |

of |

your return) |

|||

Under penalties of perjury, I declare that I have examined a copy of my electronic individual income tax return and accompanying schedules and statements for the tax year ending December 31, 2019, and to the best of my knowledge and belief, they are true, correct, and complete. I further declare that the amounts in Part I above are the amounts from my electronic income tax return. I consent to allow my intermediate service provider, transmitter, or electronic return originator (ERO) to send my return to the IRS and to receive from the IRS (a) an acknowledgement of receipt or reason for rejection of the transmission, (b) the reason for any delay in processing the return or refund, and (c) the date of any refund. If applicable, I authorize the U.S. Treasury and its designated Financial Agent to initiate an ACH electronic funds withdrawal (direct debit) entry to the financial institution account indicated in the tax preparation software for payment of my federal taxes owed on this return and/or a payment of estimated tax, and the financial institution to debit the entry to this account. This authorization is to remain in full force and effect until I notify the U.S. Treasury Financial Agent to terminate the authorization. To revoke (cancel) a payment, I must contact the U.S. Treasury Financial Agent at

Taxpayer’s PIN: check one box only |

|

|

|

|

|

|

||

|

|

|

|

|

|

|||

I authorize |

|

|

to enter or generate my PIN |

|

|

|

|

|

|

ERO firm name |

|

Enter five digits, but |

|||||

signature on my tax year 2019 electronically filed income tax return. |

|

don’t enter all zeros |

||||||

|

|

|

|

|

|

|||

as my

I will enter my PIN as my signature on my tax year 2019 electronically filed income tax return. Check this box only if you are entering your own PIN and your return is filed using the Practitioner PIN method. The ERO must complete Part III below.

Your signature |

|

|

Date |

|||||||

Spouse’s PIN: check one box only |

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

||||

I authorize |

|

|

to enter or generate my PIN |

|

|

|

|

|

||

|

|

ERO firm name |

|

|

Enter five digits, but |

|||||

signature on my tax year 2019 electronically filed income tax return. |

|

|

don’t enter all zeros |

|||||||

|

|

|

|

|

|

|

||||

as my

I will enter my PIN as my signature on my tax year 2019 electronically filed income tax return. Check this box only if you are entering your own PIN and your return is filed using the Practitioner PIN method. The ERO must complete Part III below.

Spouse’s signature |

Date |

|

Practitioner PIN Method Returns |

Part III Certification and Authentication — Practitioner PIN Method Only

ERO’s EFIN/PIN. Enter your

Don’t enter all zeros

I certify that the above numeric entry is my PIN, which is my signature for the tax year 2019 electronically filed income tax return for the taxpayer(s) indicated above. I confirm that I am submitting this return in accordance with the requirements of the Practitioner PIN method and Pub. 1345, Handbook for Authorized IRS

ERO’s signatureDate

ERO Must Retain This Form — See Instructions

Don’t Submit This Form to the IRS Unless Requested To Do So

For Paperwork Reduction Act Notice, see your tax return instructions. |

Cat. No. 32778X |

Form 8879 (2019) |

Form 8879 (2019) |

Page 2 |

General Instructions

Section references are to the Internal Revenue Code unless otherwise noted.

Future developments. For the latest information about developments related to Form 8879 and its instructions, such as legislation enacted after they were published, go to www.irs.gov/Form8879.

Purpose of Form

Form 8879 is the declaration document and signature authorization for an

F |

Don’t send this form to the IRS. |

|

! |

||

The ERO must retain Form 8879. |

||

CAUTION |

|

When and How To Complete

Use this chart to determine when and how to complete Form 8879.

IF the ERO is . . . |

THEN . . . |

|

|

|

|

Not using the Practitioner |

Don’t complete |

|

PIN method and the |

Form 8879. |

|

taxpayer enters his or her |

|

|

own PIN |

|

|

|

|

|

Not using the Practitioner |

Complete Form |

|

PIN method and is |

8879, Parts I and II. |

|

authorized to enter or |

|

|

generate the taxpayer’s |

|

|

PIN |

|

|

|

|

|

Using the Practitioner PIN |

Complete Form 8879, |

|

method and is authorized |

Parts I, II, and III. |

|

to enter or generate the |

|

|

taxpayer’s PIN |

|

|

|

|

|

Using the Practitioner PIN |

Complete Form 8879, |

|

Parts I, II, and III. |

||

method and the taxpayer |

||

|

||

enters his or her own PIN |

|

|

|

|

ERO Responsibilities

The ERO must:

1.Enter the name(s) and social security number(s) of the taxpayer(s) at the top of the form.

2.Complete Part I using the amounts (zeros may be entered when appropriate) from the taxpayer’s 2019 tax return. Form

3.Enter or generate, if authorized by the taxpayer, the taxpayer’s PIN and enter it in the boxes provided in Part II.

4.Enter on the authorization line in Part II the ERO firm name (not the name of the individual preparing the return) if the ERO is authorized to enter the taxpayer’s PIN.

5.Provide the taxpayer(s) Form 8879 by hand delivery, U.S. mail, private delivery service, email, Internet website, or fax.

6.Enter the

You must receive the completed F! and signed Form 8879 from the

taxpayer before the electronic CAUTION return is transmitted (or released

for transmission).

For additional information, see Pub. 1345.

Taxpayer Responsibilities

Taxpayers must:

1.Verify the accuracy of the prepared income tax return, including direct deposit information.

2.Check the appropriate box in Part II to authorize the ERO to enter or generate your PIN or to do it yourself.

3.Indicate or verify your PIN when authorizing the ERO to enter or generate it (the PIN must be five digits other than all zeros).

4.Sign and date Form 8879. Taxpayers must sign Form 8879 by handwritten signature, or electronic signature if supported by computer software.

5.Return the completed Form 8879 to the ERO by hand delivery, U.S. mail, private delivery service, email, Internet website, or fax.

Your return won’t be transmitted to the IRS until the ERO receives your signed Form 8879.

Refund information. You can check on the status of your 2019 refund if it has been at least 72 hours since the IRS acknowledged receipt of your

•Go to www.irs.gov/Refunds.

•Call

•Call

Important Notes for EROs

•Don’t send Form 8879 to the IRS unless requested to do so. Retain the completed Form 8879 for 3 years from the return due date or IRS received date, whichever is later. Form 8879 may be retained electronically in accordance with the recordkeeping guidelines in Rev. Proc.

•Confirm the identity of the taxpayer(s).

•Complete Part III only if you are filing the return using the Practitioner PIN method. You aren’t required to enter the taxpayer’s date of birth, prior year adjusted gross income, or PIN in the Authentication Record of the electronically filed return.

•If you aren’t using the Practitioner PIN method, enter the taxpayer(s) date of birth and either the adjusted gross income or the PIN, or both, from the taxpayer’s prior year originally filed return in the Authentication Record of the taxpayer’s electronically filed return. Don’t use an amount from an amended return or a math error correction made by the IRS.

•Enter the taxpayer’s PIN(s) on the input screen only if the taxpayer has authorized you to do so. If married filing jointly, it is acceptable for one spouse to authorize you to enter his or her PIN, and for the other spouse to enter his or her own PIN. It isn’t acceptable for a taxpayer to select or enter the PIN of an absent spouse.

•Taxpayers must use a PIN to sign their

•Provide the taxpayer with a copy of the signed Form 8879 for his or her records upon request.

•Provide the taxpayer with a corrected copy of Form 8879 if changes are made to the return (for example, based on taxpayer review).

•EROs can sign the form using a rubber stamp, mechanical device (such as a signature pen), or computer software program. See Notice

•Go to www.irs.gov/Efile for the latest information.

Document Specifics

| Fact Name | Description |

|---|---|

| Form Purpose | The IRS Form 8879 is used for the authorization of an electronic filing of an individual's tax return. |

| Usage | It serves as a declaration that the taxpayer has reviewed their return, the numerical entries are correct, and agrees to the return being filed electronically. |

| Applicability | This form is applicable for taxpayers using the services of a tax preparer to file their returns electronically. |

| Signatory Requirement | Both the taxpayer and the authorized ERO (Electronic Return Originator) must sign the form. |

| Retention Period | The tax preparer is required to retain the completed Form 8879 for three years. |

| Filing Method | Although designated for electronic filing authorization, the completed form itself is not submitted to the IRS but must be kept by the ERO. |

| State-Specific Versions | Some states have their own version of the Form 8879 for state tax return purposes, subject to the state's governing tax laws. |

| Amendment Filings | If a tax return is corrected or amended after initial filing, a new Form 8879 may be required to authorize the electronic filing of the amendment. |

Guide to Writing IRS 8879

After gathering your tax information and completing your return with a professional, the IRS 8879 form is your next step. This form is the IRS e-file Signature Authorization. It allows your tax preparer to file your return electronically on your behalf. Remember, even though your preparer submits the form, reviewing it for accuracy ensures your tax return is correctly filed. Here are the steps to fill out the IRS 8879 form.

- Start by entering your name and your spouse's name if you're filing jointly. Ensure the names match those on your tax return.

- Provide your Social Security Number (SSN), and if you're filing jointly, include your spouse's SSN as well.

- Enter your address, including the city, state, and ZIP code. This should match the address on your tax return.

- Confirm the tax year for the return you are authorizing.

- Look over the return information provided by your tax preparer. This includes your adjusted gross income (AGI) and total tax. Verify these numbers against your return to ensure they're correct.

- If you expect a refund or owe money, you'll see these amounts listed. Double-check these figures to make sure they match your tax return.

- Sign and date the form. If you're filing jointly, your spouse must also sign and date. Your signatures authorize your tax preparer to file your return electronically.

- Finally, provide the form to your tax preparer. They'll also sign and date it, completing the authorization process.

Once the IRS 8879 form is fully completed and signed, your preparer will proceed with e-filing your tax return. You'll then wait for confirmation from the IRS, indicating your return has been received and is being processed. Be sure to keep a copy of the signed form for your records. This completes the e-filing authorization process, getting you one step closer to finalizing your tax responsibilities for the year.

Understanding IRS 8879

-

What is the IRS 8879 form used for?

The IRS 8879 form serves a crucial role in the electronic filing process of an individual’s federal income tax return. It is essentially an electronic signature authorization form. By signing this document, taxpayers give their consent to tax preparers to electronically file their tax return. It is important to note that the form itself is not submitted to the IRS but must be retained by the preparer for a specified period, providing a record of the taxpayer's approval to e-file their return.

-

Who needs to sign the IRS 8879 form?

Every taxpayer who opts for their return to be filed electronically must sign the IRS 8879 form. This requirement also extends to joint returns, where both spouses are required to sign if they are filing together. The form acts as an acknowledgment that the information provided to the preparer for the electronic return is accurate and complete to the best of the taxpayer’s knowledge.

-

How long should the tax preparer keep the signed IRS 8879 form?

Tax preparers are legally required to retain the signed IRS 8879 form for a period of three years from the return due date or the date the return was filed electronically, whichever is later. This retention period ensures that the authorization form can be produced upon request by the IRS, providing evidence of the taxpayer's consent to electronically file their tax return. It is advisable for tax preparers to securely store these forms to protect taxpayer information.

-

Can the IRS 8879 form be signed electronically?

Yes, the IRS allows the 8879 form to be signed electronically, aligning with the modern push towards digital processing. This provision enables tax preparers and taxpayers to operate more efficiently, reducing the need for in-person meetings or physical paperwork. Electronic signatures must comply with IRS regulations ensuring they are valid and verifiable. Taxpayers should check with their tax preparer to understand their process for electronic signatures.

Common mistakes

Filing taxes is a responsibility that comes with a keen eye for detail, especially when dealing with forms such as the IRS 8879. This form, essential for the e-filing process, authorizes an Electronic Return Originator (ERO) to file a tax return on behalf of an individual. A mistake on this form can delay your tax processing or lead to an unwanted audit. Understanding the common pitfalls can help taxpayers navigate this process more smoothly. Here are four mistakes often made:

Incorrect Taxpayer Information: One of the most straightforward yet commonly overlooked aspects is ensuring that all personal details are accurate. This includes the taxpayer’s Social Security Number (SSN), name, and address. An incorrect SSN or misspelling a name can lead to processing delays or the IRS being unable to match the form with the taxpayer.

Failing to Review the Entire Form: It's crucial to review the entire form before submission. This not only includes the figures reported but also making sure that any applicable boxes are checked and that no sections have been missed. An incomplete form will likely be returned or put on hold.

Overlooking the PIN or Electronic Signature: The IRS 8879 form requires a Personal Identification Number (PIN) or an electronic signature to authenticate the taxpayer’s identity. Forgetting to include this critical piece of information can lead to rejection of the e-filed return. Ensure that the PIN or signature provided matches the IRS records.

Incorrect Tax Year or Filing Status: With the hustle and bustle of tax season, it's easy to mistakenly choose the incorrect tax year or filing status. This error can have significant implications for your tax obligations and refunds. Double-check these fields to ensure they align with your current filing requirements.

Avoiding these common mistakes requires a meticulous approach to filing your taxes. Let’s make tax season less daunting by keeping these tips in mind:

Always double-check your personal information against official documents.

Take your time to review the entire form, even if it means going through it multiple times.

Ensure your PIN or electronic signature is ready and accurately entered on the form.

Verify the tax year and filing status to reflect your current situation accurately.

Remember, precautions and careful review are your best defenses against the common mistakes on IRS forms. Your attention to detail can make a significant difference in how smoothly your tax filing process goes. If in doubt, consulting with a professional can provide clarity and peace of mind.

Documents used along the form

When you're navigating the complexities of filing your taxes, understanding the various forms and documents that accompany the IRS Form 8879 can be quite helpful. The IRS Form 8879 is the IRS e-file Signature Authorization form, used for taxpayers to authorize electronic filing of their tax returns by an ERO (Electronic Return Originator). Along with this form, there are several others that may be required or useful to ensure your tax preparation process is thorough and compliant. Let’s go over some key documents often seen in the mix with Form 8879.

- Form 1040: This is the U.S. Individual Income Tax Return form. It’s the primary form used by individuals to file their annual income tax returns. You might need to refer to it in conjunction with Form 8879 for details like your adjusted gross income.

- W-2: The Wage and Tax Statement is issued by employers to document an employee's annual earnings and tax withholdings. This is crucial for verifying income information on your tax return.

- 1099 Forms: These forms report various types of income other than wages, salaries, and tips. For example, Form 1099-MISC reports miscellaneous income, while 1099-DIV reports dividends and distributions.

- Schedule A: Used for itemizing deductions instead of taking the standard deduction, this form is often required if you're detailing things like mortgage interest, property taxes, or charitable donations.

- Schedule C: This form is for reporting income or loss from a business you operated or a profession you practiced as a sole proprietor.

- Schedule D: Used to report capital gains or losses from the sale or exchange of capital assets. Essential for taxpayers who've sold stocks, bonds, or real estate.

- Schedule E: Taxpayers use this to report income or loss from rental real estate, royalties, partnerships, S corporations, trusts, and estates.

- Schedule SE: This form is for self-employed individuals to calculate the tax due on net earnings from self-employment.

Filing your taxes is a multi-step process that often requires various documents to accurately report your income, deductions, and credits. By familiarizing yourself with these forms and their purposes, you can make tax season a less daunting task. Remember, each document plays a crucial role in ensuring the completeness and accuracy of your tax return. Whether you’re handling this task on your own or enlisting the aid of a professional, having a good handle on these documents can streamline the filing process.

Similar forms

The IRS 8879 form serves as an electronic signature authorization form that taxpayers use to e-file their tax returns. A document that shares similarities with the IRS 8879 form is the Form 1040, the U.S. Individual Income Tax Return. Both documents are integral to the tax filing process, requiring accurate taxpayer information and being directly linked to the Internal Revenue Service (IRS). While the 1040 form is used to calculate and report an individual's annual income tax, the 8879 form authorizes the electronic submission of the 1040, among other forms.

Another related document is the W-2 form, which employers use to report their employees' annual wages and the amount of taxes withheld from their paychecks. Like the IRS 8879, the W-2 is fundamental in the filing of taxes, providing essential information needed to complete the Form 1040. The critical similarity lies in their role in ensuring taxpayers' compliance with the IRS requirements for accurate and timely tax reporting.

The 1099-MISC form, used to report miscellaneous income, also shares similarities with the IRS 8879. Both are crucial for accurate tax reporting and compliance with IRS regulations. While the 1099-MISC documents income from sources other than a traditional employer, the 8879 ensures that these details, among other reported incomes, are electronically submitted to the IRS correctly.

Form 4868, the Application for Automatic Extension of Time To File U.S. Individual Income Tax Return, is another document comparable to the IRS 8879. Both these forms assist taxpayers in managing their filing obligations – the 4868 by providing additional time to file and the 8879 by facilitating the electronic filing process. They are designed to aid in adherence to IRS deadlines and requirements.

The IRS Form 8822, Change of Address, though seemingly distinct, is closely tied to the procedural aspects of filing taxes, much like the 8879 form. It ensures the IRS has current taxpayer information, crucial for the proper processing and filing of forms like the IRS 8879 and others within the tax reporting framework.

Akin to the IRS 8879 is the Form 7004, Application for Automatic Extension of Time to File Certain Business Income Tax, Information, and Other Returns. Though one serves individual taxpayers and the other businesses, both are aimed at streamlining compliance with tax deadlines through extensions (Form 7004) or electronic filing facilitation (Form 8879).

Form 8962, the Premium Tax Credit, shares a connection with IRS 8879 in its use within the tax filing system, particularly for individuals obtaining health insurance through the marketplace. This form's role in calculating the premium tax credit complements the 8879’s function in electronically filing tax returns that claim such credits.

The Schedule C, Profit or Loss from Business, is a form used by sole proprietors to report their business earnings and expenses. Its relationship with the IRS 8879 form lies in the necessity of both for self-employed individuals engaging in electronic filing. The accurate reporting on Schedule C is essential for the 8879 to authorize the tax return’s submission correctly.

Form 8889, Health Savings Accounts (HSAs), parallels the IRS 8879 in the sense that both deal with specific tax-related circumstances – the 8889 with HSA contributions and distributions, and the 8879 with electronic filing authorization. Each plays a pivotal role in managing particular aspects of taxpayers' obligations and benefits.

Lastly, the W-9 form, Request for Taxpayer Identification Number and Certification, correlates with the IRS 8879 through their collective requirement in the tax filing process. While the W-9 is often used to ensure that the correct taxpayer information is on file for various transactions, the 8879 leverages this information to authenticate and electronically submit tax documents to the IRS.

Dos and Don'ts

Filling out the IRS Form 8879 is a critical process as it is the IRS e-file Signature Authorization form. Here are some dos and don'ts you should follow to ensure the process is smooth and error-free:

- Do thoroughly review all the information on your tax return before signing Form 8879. Errors in your tax return can lead to delays or audits.

- Do understand that by signing Form 8879, you are authorizing an ERO (Electronic Return Originator) to e-file your tax return. Know who you are entrusting with this responsibility.

- Do keep a copy of the signed Form 8879 for your records. It's crucial to have proof of your authorization for e-filing.

- Do ensure that both the taxpayer and the spouse sign the form if filing jointly. The IRS requires both signatures for joint returns.

- Do provide an accurate taxpayer identification number (TIN). This usually means your Social Security Number (SSN).

- Don't sign Form 8879 before your tax return is completed. Signing a blank or incomplete form is against IRS regulations.

- Don't forget to check the tax year and other relevant dates on Form 8879. Using the form for the wrong tax year can invalidate your e-filing authorization.

- Don't ignore discrepancies between your records and what's on the form. If there are any differences, resolve them with your ERO before signing.

- Don't use digital signatures unless your ERO is equipped to handle them according to IRS regulations. Always verify the correct process with your ERO.

Misconceptions

The IRS Form 8879 is often surrounded by misconceptions that can confuse taxpayers and professionals alike. It is essential to debunk these myths to ensure compliance and accuracy in tax filing processes. Here are five common misconceptions about the IRS Form 8879:

- It’s only for electronic filing. While Form 8879 is primarily used to authorize the electronic filing of tax returns, it's crucial to understand that its role isn’t limited to just acting as permission for e-filing. It also serves as a record of the taxpayer's consent to their tax preparer’s actions, detailing the agreement on the tax return's accuracy and completeness before submission.

- The taxpayer doesn't need to check it once signed. A common misunderstanding is that once Form 8879 is signed, the taxpayer has no further responsibility. In fact, it is imperative that taxpayers review their return for accuracy and completeness, even after signing Form 8879, to ensure all information is correct and to prevent future complications with the IRS.

- Form 8879 negates the need for Form 1040. Some taxpayers mistakenly believe that completing and signing Form 8879 means they don't have to deal with Form 1040. However, Form 8879 is a consent document, not a tax return. Taxpayers still need to complete and, if necessary, adjust their Form 1040 and any other required tax documents. Form 8879 does not replace these documents but works alongside them.

- Signing Form 8879 means immediate acceptance of your return by the IRS. Signing and submitting Form 8879 does not guarantee immediate acceptance of your tax return by the IRS. The form simply authorizes the electronic filing of the return. The IRS may still review the return and request additional documentation or corrections, if necessary.

- There’s no need to retain a copy once it’s submitted. Another misconception is that once Form 8879 is filed with the IRS, there’s no need to keep a copy. On the contrary, it is advisable for both taxpayers and their tax preparers to retain copies of filed forms, including Form 8879. Keeping records is crucial for reference in case of discrepancies, questions, or audits in future tax years.

Understanding these misconceptions about IRS Form 8879 is crucial for taxpayers and professionals to navigate the complexities of tax filing. Ensuring knowledge is up to date can facilitate smoother interactions with tax laws and the IRS, minimizing errors and misunderstandings.

Key takeaways

The IRS 8879 form is a critical document used to electronically authorize the filing of your tax return. Here are key takeaways to ensure you understand its importance and use it correctly:

IRS 8879 acts as an electronic signature. By filling out this form, you're giving your tax preparer permission to e-file your taxes. This step is necessary because the IRS requires your consent to electronically submit your return.

You must verify your identity when using the form. This typically involves providing your taxpayer identification number, such as your Social Security Number (SSN), and possibly answering additional security questions if your tax preparer requires it.

Keep a copy for your records. Once you've signed the IRS 8879 form, ensure you receive a copy from your tax preparer. It's essential to keep this for at least three years as proof of your authorization for the e-filing.

Understand the deadline implications. Submitting your signed IRS 8879 form promptly is crucial because it directly impacts the timeliness of your tax return submission. Failure to submit on time can lead to late filing penalties.

Popular PDF Documents

Types of Non Profits - Tax revenues and government-provided services or facilities benefits must be reported on Form 8734.

How to File Power of Attorney in California - This form is used to grant someone else the power to handle your tax responsibilities.