Get IRS 8868 Form

For many organizations, navigating through the complexities of tax filings is a daunting task, especially when they are strapped for time. Recognizing this challenge, the IRS provides a lifeline in the form of the 8868 form, a critical document for non-profits, charities, and other tax-exempt entities. This form is essentially a request for an extension of time to file their tax-exempt status return. The importance of timely filing cannot be overstated, as it maintains the organization's compliance and upholds its integrity in the public eye. Breaking down the 8868 form reveals its dual function, offering an automatic 6-month extension for the initial request, followed by an option for an additional non-automatic extension under specific conditions. The accessibility of this form is a testament to the IRS’s effort to accommodate the diverse needs of organizations, providing them with the breathing room necessary to ensure their filings are accurate and complete. Consequently, understanding the nuances of the 8868 form is pivotal for any organization seeking to navigate the intricacies of tax exemption filings without compromising their operational duties.

IRS 8868 Example

Form 8868

(Rev. January 2022)

Department of the Treasury Internal Revenue Service

Application for Automatic Extension of Time To File an

Exempt Organization Return

▶File a separate application for each return.

▶Go to www.irs.gov/Form8868 for the latest information.

OMB No.

Electronic filing

Automatic

All corporations required to file an income tax return other than Form

Type or |

|

Name of exempt organization or other filer, see instructions. |

|

Taxpayer identification number (TIN) |

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

File by the |

|

Number, street, and room or suite no. If a P.O. box, see instructions. |

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

due date for |

|

|

|

|

|

|

|

|

|

filing your |

|

|

|

|

|

|

|

|

|

|

City, town or post office, state, and ZIP code. For a foreign address, see instructions. |

|

|

|

|||||

return. See |

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

instructions. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

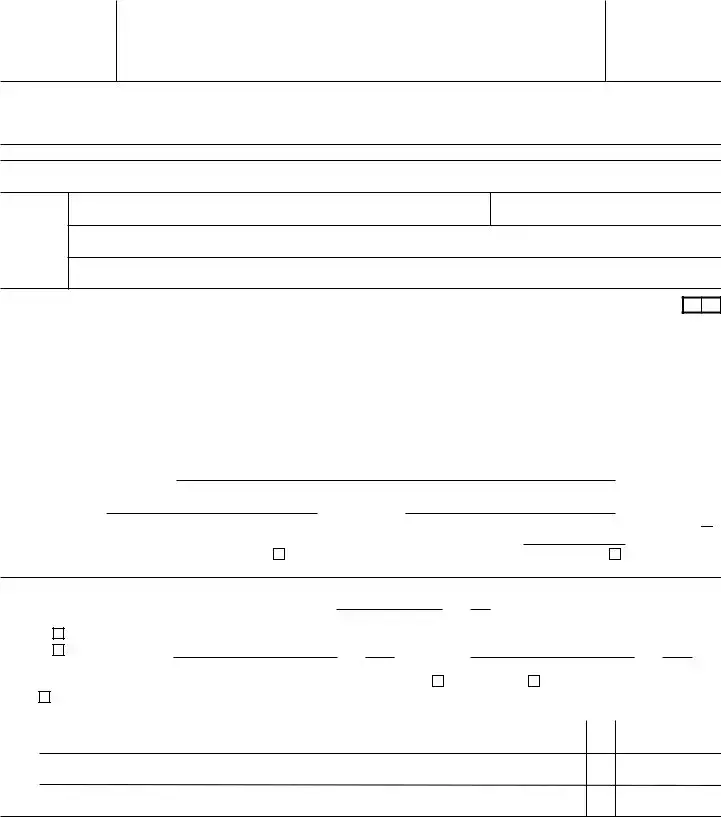

Enter the Return Code for the return that this application is for (file a separate application for each return) |

|

|

|

||||||

|

|

|

|||||||

|

|

|

|

|

|

|

|

||

Application |

|

Return |

Application |

|

Return |

||||

Is For |

|

Code |

Is For |

|

Code |

||||

Form 990 or Form |

01 |

Form |

|

08 |

|

||||

Form 4720 (individual) |

03 |

Form 4720 (other than individual) |

|

09 |

|

||||

Form |

04 |

Form 5227 |

|

10 |

|

||||

Form |

05 |

Form 6069 |

|

11 |

|

||||

Form |

06 |

Form 8870 |

|

12 |

|

||||

Form |

07 |

|

|

|

|

|

|

||

• The books are in the care of ▶

Telephone No. ▶ |

Fax No. ▶ |

•If the organization does not have an office or place of business in the United States, check this box . . . . .

•If this is for a Group Return, enter the organization’s four digit Group Exemption Number (GEN)

for the whole group, check this box . . . ▶ |

. If it is for part of the group, check this box . . . . ▶ |

a list with the names and TINs of all members the extension is for.

. . . . ▶

. If this is and attach

1 |

I request an automatic |

|

|

, 20 |

, to file the exempt organization return for |

|||||

|

the organization named above. The extension is for the organization’s return for: |

|

|

|

||||||

|

▶ |

calendar year 20 |

|

or |

|

|

|

|

|

|

|

▶ |

tax year beginning |

|

, 20 |

, and ending |

|

, 20 |

. |

||

2 |

If the tax year entered in line 1 is for less than 12 months, check reason: |

Initial return |

Final return |

|

||||||

|

|

Change in accounting period |

|

|

|

|

|

|

||

|

|

|

||||||||

3a |

If this application is for Forms |

|

||||||||

|

nonrefundable credits. See instructions. |

|

|

|

|

3a $ |

|

|||

bIf this application is for Forms

estimated tax payments made. Include any prior year overpayment allowed as a credit. |

3b $ |

cBalance due. Subtract line 3b from line 3a. Include your payment with this form, if required, by

using EFTPS (Electronic Federal Tax Payment System). See instructions. |

3c $ |

Caution: If you are going to make an electronic funds withdrawal (direct debit) with this Form 8868, see Form

For Privacy Act and Paperwork Reduction Act Notice, see instructions. |

Cat. No. 27916D |

Form 8868 (Rev. |

Form 8868 (Rev. |

Page 2 |

General Instructions

Section references are to the Internal Revenue Code unless otherwise noted.

Future Developments

For the latest information about developments related to Form 8868 and its instructions, such as legislation enacted after they were published, go to www.irs.gov/Form8868.

What’s New

Trusts required to file Form

Reminders

Automatic revocation. If an organization has not filed the required Form 990 series for 3 consecutive years, and if the due date (or extended due date) of the third year’s filing has passed, the

Taxpayer identification number. All users must enter their taxpayer identification number (TIN).

Return Code. A Return Code is assigned to each return type. Enter the Return Code of the form this application pertains to in the Return Code Box.

Electronic filing

|

If you are going to make an |

▲ |

|

! |

electronic funds withdrawal |

(direct debit) with this Form |

|

CAUTION |

8868, see Form |

|

Form

Purpose of Form

Form 8868 is used by an exempt organization to request an automatic

Also, the trustee of a trust required to file Form

Use this form to apply for an automatic

The automatic

|

You cannot use Form 8868 to |

▲ |

|

! |

extend the due date of Form |

CAUTION |

|

An organization will only be allowed an extension of 6 months for a return for a tax year.

When To File

File Form 8868 by the due date of the return for which you are requesting an extension.

Where To File

If you do not file electronically, send the application to:

Department of the Treasury Internal Revenue Service Center Ogden, UT

An application for extension of time to file Form 8870 must be sent in paper format to the address above.

Do not file for an extension of time by attaching Form 8868 to the exempt organization’s return when it is filed.

Filing Information

No blanket requests. File a separate Form 8868 for each return for which you are requesting an automatic extension of time to file. This extension will apply only to the specific return checked. It does not extend the time for filing any related returns. For example, an extension of time for filing a private foundation return will not apply to the return of certain excise taxes on charities (Form 4720).

Each Form 8868 filer who owes taxes for the year should file its own Form 8868, and pay only its share of the total tax liability due.

Exempt Organization Group Returns. A central organization may apply for an extension of time to file a group return. Enter the applicable Return Code and enter the Group Exemption Number (GEN) on the line provided. Check the applicable box to indicate whether the application applies to the whole group or part of the group. If the extension is not for all the organizations that are part of the group, you must

attach a schedule to Form 8868 showing the name, address, and taxpayer identification number of each organization that is included in this request for an extension.

Interest. Interest will be charged on any tax not paid by the regular due date of the return from the regular due date until the tax is paid. It will be charged even if the organization has been granted an extension or has shown reasonable cause for not paying on time.

Late payment penalty. Generally, a penalty of ½ of 1% of any tax not paid by the due date is charged for each month or part of a month that the tax remains unpaid. The penalty cannot exceed 25% of the amount due. The penalty will not be charged if you can show reasonable cause for not paying on time.

If you receive an extension of time to file, you will not be charged a late payment penalty if (a) the tax shown on line 3a (or the amount of tax paid by the regular due date of the return) is at least 90% of the tax shown on the return, and

(b)you pay the balance due shown on the return by the extended due date.

Late filing penalty. A penalty is charged if the return is filed after the due date (including extensions) unless you can show reasonable cause for not filing on time.

Different late filing penalties apply to information returns. See the specific form instructions for details.

Reasonable cause determinations. If you receive a notice about penalties after you file your return, send an explanation and we will determine if you meet reasonable cause criteria. Do not attach an explanation when you file your return. Explanations attached to the return at the time of filing will not be considered.

Tax Payments

General rule. Each

EFTPS is a free service provided by the Department of the Treasury. If you choose to use a tax professional, financial institution, payroll service, or other third party to make federal tax deposits on your behalf, you may be charged a fee for this service.

Form 8868 (Rev. |

Page 3 |

Visit www.eftps.gov, or call

Specific Instructions

Extending the time to file does TIP not extend the time to pay tax.

Name of exempt organization or other filer. The filer may be an exempt organization, a nonexempt organization (for example, a disqualified person or a foundation manager trustee), or an individual. The typical filer will be an exempt organization. Certain filers may not be an exempt organization. For example, Form 4720 filers may be one of the other entities listed above.

Address. Include the suite, room, or other unit number after the street address. If the Post Office does not deliver mail to the street address and the exempt organization has a P.O. box, show the box number instead of the street address.

If the organization receives its mail in care of a third party (such as an accountant or an attorney), enter on the street address line “C/O” followed by the third party’s name and street address or P.O. box.

If the address is outside the United States or its possessions or territories, in the space for “city or town, state, and ZIP code,” enter the information in the following order: city, province or state, and country. Follow the country’s practice for entering the postal code. Do not abbreviate the country’s name.

If the organization’s mailing address has changed since it filed its last return, use Form 8822, Change of Address, to notify the IRS of the change. A new address shown on Form 8868 will not update the organization’s record.

Enter the Return Code for the type of return to be filed. Enter the appropriate Return Code in the box to indicate the type of return for which you are requesting an extension. Enter only one Return Code. You must file a separate Form 8868 for each return.

Exempt organizations such as corporations, private foundations, and trusts must enter their taxpayer identification number. Individuals must also enter their taxpayer identification number.

Line 1. The date that is entered on line 1 cannot be later than 6 months from the original due date of the return.

Line 2. If you checked the box for change in accounting period, you must have applied for approval to change the organization’s tax year unless certain conditions have been met. See Form 1128, Application To Adopt, Change, or Retain a Tax Year, and Pub. 538, Accounting Periods and Methods, for details.

Note: All filers must complete lines 3a, b, and c, even if you are exempt from tax or do not expect to have any tax liability.

Line 3a. See the organization’s tax return and its instructions to estimate the amount of tentative tax reduced by any nonrefundable credits. If you expect this amount to be zero, enter

Line 3c. Balance due. Form 8868 does not extend the time to pay tax. To avoid interest and penalties, send the full balance due by the original due date of the return.

For information on EFTPS, see Tax Payments, above.

Note: Be sure to see any deposit rules that are in the instructions for the particular form you are getting an extension for to determine how payment must be made.

No signature is required for this form.

Privacy Act and Paperwork Reduction Act Notice. We ask for the information on this form to carry out the Internal Revenue laws of the United States. You are required to give us the information. We need it to ensure that you are complying with these laws and to allow us to figure and collect the right amount of tax. You are not required to provide the information requested on a form that is subject to the Paperwork Reduction Act unless the form displays a valid OMB control number. Books or records relating to a form or its instructions must be retained as long as their contents may become material in the administration of any Internal Revenue law. Generally, tax returns and return information are confidential, as required by section 6103. However, certain returns and return information of tax exempt organizations and trusts are subject to public disclosure and inspection, as provided by section 6104. The time needed to complete and file this form will vary depending on individual circumstances. The estimated burden for tax exempt organizations filing this form is approved under OMB control number

We may disclose this information to the Department of Justice for civil and criminal litigation, and to cities, states, the District of Columbia, and U.S. commonwealths and possessions for use in administering their tax laws. We may also disclose this information to other countries under a tax treaty, to federal and state agencies to enforce nontax criminal laws, or to federal law enforcement and intelligence agencies to combat terrorism.

If you have comments concerning the accuracy of these time estimates or suggestions for making this form simpler, we would be happy to hear from you. You can send us comments through www.irs.gov/FormComments. Or you can write to Internal Revenue Service, Tax Forms and Publications Division, 1111 Constitution Ave. NW,

Document Specifics

| Fact Name | Description |

|---|---|

| Form Purpose | The IRS Form 8868 is used to request an automatic extension of time to file an organization's tax-exempt return or notice. |

| Extension Length | This form grants an automatic 6-month extension to the due date of the filing for most forms. |

| Eligible Filers | Organizations, including charities and non-profits, that are required to file returns in series 990, 990-EZ, 990-PF, 990-T, and 4720, among others, can use this form. |

| Filing Deadline | The form must be filed by the due date of the return for which the extension is being requested. |

| No Extension of Payment | It’s important to note that this form extends the time to file the return, not the time to pay any taxes that may be owed. |

| Electronic Filing | IRS Form 8868 can be filed electronically, which is encouraged for faster processing. |

Guide to Writing IRS 8868

After deciding to apply for an extension on your tax-exempt organization's return, the next step involves properly completing the IRS Form 8868. This form is specifically designed to request an automatic 6-month extension of time to file an organization's return. Accurately filling out this form is essential for ensuring that the request for an extension is approved without delay. By simply following the steps outlined below, an organization can confidently submit their application, knowing they have accurately provided all the necessary information.

- Begin by entering the organization's name and complete address, including the room or suite number if applicable, in the designated areas at the top of the form.

- Next, supply the organization's Employer Identification Number (EIN) in the space provided.

- Check the box for the specific form your organization is requesting an extension for (e.g., Form 990, 990-EZ, 990-PF, etc.).

- If the organization is filing for a group return, check the box in line 4, and ensure to provide the group exemption number in the space provided.

- For foreign organizations that don't have a U.S. address, enter the foreign country name, foreign province/county, and foreign postal code in the appropriate fields.

- State specifically the tax year period for which the extension is being requested by entering the begin and end dates.

- Determine if the organization is filing for an extension due to being affected by a federally declared disaster or terroristic or military action. If so, check the appropriate box in Part I.

- Complete Part II only if you're requesting additional time to file the forms listed in that section, providing all required details including the tentative total tax, total payments, and balance due.

- Finally, ensure a duly authorized person signs the form and includes their title, the date of the signature, and their phone number.

By completing these steps, your organization will have accurately filled out the IRS Form 8868, setting the stage for the processing of your extension request. It's important to review the form thoroughly before submission to avoid common errors that could delay the approval process. Remember, the extension is for filing time, not for payment due; hence, any estimated taxes owed should be paid by the original due date to avoid potential penalties.

Understanding IRS 8868

-

What is IRS Form 8868?

IRS Form 8868 is an application used by tax-exempt organizations to request an automatic 6-month extension of time to file their return.

-

Who needs to file Form 8868?

This form is designed for tax-exempt organizations, including charities, non-profits, and other entities exempt under section 501(a), who need additional time to file their annual information returns.

-

What type of returns can be extended using Form 8868?

Form 8868 is used to request an extension for filing forms such as:

- Form 990, Return of Organization Exempt from Income Tax

- Form 990-BL, Information and Initial Excise Tax Return for Black Lung Benefit Trusts and Certain Related Persons

- Form 990-PF, Return of Private Foundation

- Form 990-T, Exempt Organization Business Income Tax Return

- Form 1041-A, U.S. Information Return Trust Accumulation of Charitable Amounts

-

How do I file Form 8868?

Organizations can file Form 8868 electronically through an IRS-approved e-file provider or submit a paper form by mail.

-

When should Form 8868 be filed?

Form 8868 should be filed by the due date of the return for which the extension is requested. This date varies depending on the type of form and fiscal year of the filing organization.

-

Does filing Form 8868 extend the time to pay taxes due?

No, filing Form 8868 only extends the time to file the return, not the time to pay any taxes owed. Organizations should estimate and pay any owed taxes by the original due date to avoid penalties and interest.

-

Can Form 8868 be filed if the original filing due date has passed?

No, Form 8868 must be filed by the original due date of the return. Extensions cannot be granted after the return's due date has passed.

-

Is there a penalty for filing a form late if an extension was granted?

Yes, if the return is filed after the extended due date, penalties may be incurred. However, having an extension may reduce the penalties compared to not filing an extension.

-

Where can I get more information and assistance with Form 8868?

For more information on Form 8868, individuals can visit the IRS website or consult with a tax professional familiar with tax-exempt organizations and their filing requirements.

Common mistakes

When filling out the IRS 8868 form, which is the application for an extension of time to file an exempt organization return, certain common mistakes can lead to processing delays, rejections, or further inquiries. Being mindful of these errors can save both time and unnecessary hassle.

Incorrect Identification Information: One of the most standardized errors includes incorrect or incomplete Taxpayer Identification Numbers (TINs) or Employer Identification Numbers (EINs). These numbers are crucial for the IRS to properly identify the entity requesting the extension.

Missing Forms or Schedules: Failing to attach necessary forms or schedules that are required in conjunction with Form 8868 can delay processing. It's critical to ensure all required documentation is complete and attached.

Omission of Required Signatures: An unsigned form is equivalent to not filing it at all. Ensure that the form is properly signed by an authorized individual before submission.

Miscalculation of Tax Due: If there is tax due with the form, incorrect calculation of these amounts can lead to penalties or interest charges. It's advised to double-check all calculations or seek professional help if uncertain.

Incorrect Tax Year Noted: Entering the wrong tax year can cause confusion and might result in the extension being applied to the incorrect year. Always verify the tax year corresponds to the year for which the extension is needed.

Filing Late Without Reason: Filing Form 8868 late without a reasonable cause can result in a denial of the extension request. It's important to file the extension request before the deadline of the return.

Using the Wrong Form Version: Using an outdated version of Form 8868 can lead to a rejection of the extension request. The IRS updates forms regularly, so it's critical to use the most current version available from the IRS website.

Failure to Provide a Reasonable Cause for Extension: When applicable, not providing a detailed explanation for the need for an extension can lead to a denial of the request. If the IRS requires an explanation, ensure it is thorough and justified.

Attention to detail when completing the IRS Form 8868 and adherence to IRS guidelines and deadlines can significantly streamline the process of requesting an extension. This proactive approach can ensure that organizations remain compliant and avoid unnecessary penalties.

Documents used along the form

The IRS Form 8868 is an essential document for tax-exempt organizations, including charities and nonprofit entities, allowing them to request an extension of time to file their returns. This form simplifies the process for organizations needing extra time to compile their financial information accurately. However, to complete the tax filing process, other forms and documents are frequently used in conjunction with Form 8868. Each of these plays a unique role in ensuring tax compliance and financial transparency.

- IRS Form 990: This is the primary form used by tax-exempt organizations to provide the IRS with annual financial information. It details an organization's income, expenses, and operational activities over the past year. Organizations filing Form 8868 typically need to submit Form 990 by the extended due date.

- IRS Form 990-EZ: Serves as a shorter version of the Form 990 and is designed for smaller tax-exempt organizations. Its simpler layout is beneficial for organizations with gross receipts less than $200,000 and total assets less than $500,000 at the end of the year.

- IRS Form 990-PF: Required for private foundations, regardless of financial size. This form includes information on charitable distributions, finances, and trustees. It ensures foundations comply with IRS rules regarding charitable distributions and financial transparency.

- IRS Form 990-T: Used by tax-exempt organizations to report and pay tax on unrelated business income. If an organization generates income from activities not related to its exempt purposes, this income may be subject to taxation, requiring Form 990-T to be filed.

- IRS Form 1023: Although not an annual filing, Form 1023 is critical for organizations seeking recognition of tax-exempt status under section 501(c)(3). It is often referenced when filling out the annual forms to ensure consistency in the organization's stated mission, activities, and financial planning.

- IRS Form 1024: Similar to Form 1023, Form 1024 is used by organizations seeking tax-exempt status under sections other than 501(c)(3), such as 501(c)(4) (social welfare organizations) or 501(c)(6) (business leagues). This form helps clarify the organization's purpose and operations for tax purposes.

In summary, while the IRS Form 8868 is a crucial starting point for tax-exempt organizations to manage their filing extensions, it is just one of several forms and documents necessary for maintaining compliance and transparency. Understanding each document's purpose and requirements allows these organizations to navigate the complexities of nonprofit taxation effectively, promoting better financial management and organizational trustworthiness.

Similar forms

The IRS Form 990 is akin to the IRS 8868 form in that both are required by tax-exempt organizations. While Form 8868 is used to request an extension of time to file an organization's tax return, Form 990 serves as the actual annual return that provides the IRS with details about the organization's operations, finances, and compliance with tax obligations. Therefore, the completion of Form 990 is often the next step after an extension is granted with Form 8868.

Similarly, the IRS Form 4868, which is used by individuals to apply for an extension of time to file their personal income tax returns, parallels the IRS 8868 form's purpose for organizations. Both forms do not extend the time to pay any taxes due but do provide additional time for filing the required documentation, reducing the risk of penalties for late filing.

The IRS Form 7004 is the corporate counterpart to the IRS 8868 form, serving businesses that need more time to file their income tax returns. While Form 8868 addresses tax-exempt organizations, Form 7004 applies to a wide range of businesses, including partnerships, corporations, and trusts, reflecting the broad spectrum of entities that may require extensions for their tax filing obligations.

IRS Form 8809 is used to request an extension for filing information returns, similar to how the IRS 8868 form is used to obtain more time for tax-exempt entities to submit their tax returns. This form is critical for entities that must file various types of information returns and need additional time to gather or verify the necessary information to ensure accuracy.

The IRS Form 1120-POL is another document that shares similarities with the 8868 form, specifically for political organizations that need to file income tax returns. Like tax-exempt groups using Form 8868 to extend their filing deadline, political organizations utilize Form 1120-POL to report their annual financial activities to the IRS, emphasizing the diverse range of entities that operate within the tax-exempt spectrum.

Form 1040, the U.S. individual income tax return, while distinct in its application for personal taxes, shares the foundational principle of compliance and reporting with the IRS 8868 form. Individuals use Form 1040 to detail their income, calculate taxes owed, and report any credits or deductions annually, mirroring the structured reporting requirement that Form 8868 extends for organizations.

IRS Form 5500, required for employee benefit plans, is similar to Form 8868 in that it ensures accountability and compliance with federal regulations. This form is filed by administrators of pension plans and other employee benefit plans to report plan information, finances, and operations, highlighting the regulation and oversight across different types of entities and their reporting responsibilities to the IRS.

Dos and Don'ts

Filing IRS Form 8868, an application for an extension of time to file an exempt organization return, requires careful attention to detail and adherence to specific guidelines. To help navigate this process smoothly, here are eight essential do's and don'ts you should keep in mind:

- Do ensure that you have all the necessary information about your organization ready before you start filling out the form. This includes the organization's full legal name, address, and Employer Identification Number (EIN).

- Do double-check the specific form your organization needs to file. Form 8868 is used for applying for an extension on forms such as 990, 990-EZ, 990-PF, and others related to tax-exempt entities.

- Do submit the form before the due date of your return to avoid penalties. The IRS is strict about deadlines, and timely filing for an extension is crucial.

- Do use the electronic filing option if available, as it's faster and you can receive immediate confirmation of your submission.

- Don't forget to sign the form if you're sending it by mail. An unsigned form is considered incomplete and can lead to unnecessary delays.

- Don't overlook the need to estimate and report any tax liability your organization may owe. Form 8868 requires that you make a payment of the estimated tax due if applicable.

- Don't assume that the extension gives you more time to pay taxes owed. The extension is only for filing the return, not for the payment of any taxes that your organization may owe.

- Don't ignore the IRS notices or correspondence regarding your extension request. If there are any issues or additional information required, responding promptly can prevent further complications.

By following these guidelines, you can make the process of requesting an extension for your organization's tax return as straightforward as possible. Remember, the key to a smooth filing process is preparation and attention to the IRS's rules and deadlines.

Misconceptions

When it comes to filing IRS Form 8868, it's easy to find yourself tangled in a web of misunderstandings and myths. To set the record straight, here’s a list of misconceptions that need clarification:

Form 8868 automatically grants an extension to pay taxes: The truth is, Form 8868 only extends the deadline for filing the tax return, not for any taxes owed. If taxes are due, they should be paid by the original deadline to avoid penalties and interest.

It extends the filing date by six months for all filers: While Form 8868 does provide an extension, the duration can vary depending on the specific tax form and the organization’s tax year. It’s not always a six-month extension.

Filing this form can attract IRS audits: There's no evidence to suggest that filing for an extension using Form 8868 increases your chances of being audited. The IRS audits are based on other criteria, not the fact that an extension was filed.

Electronic filing of Form 8868 is optional: In most cases, the IRS requires Form 8868 to be filed electronically. Paper filing is only acceptable in certain circumstances, which are increasingly rare.

Form 8868 is for individual tax filers: Actually, Form 8868 is specifically designed for tax-exempt organizations, not for individual taxpayers. Individuals use a different form (Form 4868) to request an extension.

There's a penalty for filing Form 8868: Simply filing Form 8868 does not trigger any penalty. Penalties would only apply if taxes are owed and not paid by the original deadline, not for filing the extension itself.

Any organization can file Form 8868, regardless of status: Form 8868 is meant for certain tax-exempt organizations, not all entities. Organizations must typically have a recognized tax-exempt status under sections 501(c), 527, or 4947(a)(1) of the Internal Revenue Code to use this form.

Understanding these misconceptions is crucial for organizations to manage their tax responsibilities effectively and avoid unnecessary penalties.

Key takeaways

Understanding the IRS 8868 form is crucial for organizations seeking an extension on their tax return filing. This form is designed to provide a straightforward path for tax-exempt entities to gain additional time, ensuring they can compile their necessary documentation accurately and thoroughly. Below are seven key takeaways to consider when dealing with the IRS 8868 form:

- Purpose: The IRS 8868 form is used exclusively by tax-exempt organizations, such as charities and nonprofit entities, to request an automatic 6-month extension to file their specific tax returns.

- Eligibility: Not all tax filings are eligible for extensions using this form. It's pivotal to verify which types of returns can be extended using the 8868 form, typically Form 990 series among others.

- No More Paper Filing for Most: The IRS encourages, and in many cases requires, the electronic filing of Form 8868. This shift aims to streamline the submission process and reduce paper consumption.

- Deadlines Matter: To successfully receive an extension, the 8868 must be submitted by the original due date of the return. Failing to submit on time might lead to penalties or denial of the extension request.

- Automatic Extension: Upon submission, the extension is automatically granted. There's no need to wait for a formal approval, allowing organizations to pivot their focus to gathering necessary documentation.

- No Extension for Payment: It’s critical to understand that Form 8868 only extends the time to file, not the time to pay any owed taxes. Estimated payments should still be submitted by the original deadline to avoid penalties.

- Sign and Date: The legitimacy of Form 8868 depends on it being properly signed and dated. Unsigned or incorrectly dated forms may be considered invalid, potentially jeopardizing the extension.

By keeping these key points in mind, organizations can navigate the extension process more smoothly and ensure they remain compliant with IRS regulations. It’s always wise to consult with a tax professional to ensure that all obligations are met accurately and on time.

Popular PDF Documents

Borrowing From Tsp - Loan disbursements and repayments are handled proportionately between traditional (non-Roth) and Roth balances within the participant's account.

Federal Form 2441 - Families with multiple dependents have to consolidate all care expenses when filling out Form 2441.