Get IRS 8867 Form

The journey through the maze of tax preparation each year brings individuals and tax professionals face to face with numerous forms, each serving its unique purpose in ensuring the accuracy and legality of tax submissions. Among these forms, the IRS 8867, or the Paid Preparer's Due Diligence Checklist, plays a pivotal role, particularly for those claiming certain credits and refunds. Its design seeks to uphold the integrity of the tax system by requiring preparers to adhere to due diligence requirements meticulously. Essentially serving as a verification tool, the form mandates preparers to confirm the eligibility of taxpayers for specific tax benefits, such as the Earned Income Tax Credit (EITC), the Child Tax Credit (CTC), the Additional Child Tax Credit (ACTC), the American Opportunity Tax Credit (AOTC), and the Head of Household (HOH) filing status. The implications of the 8867 form are far-reaching, affecting not only the quality of service provided by preparers but also the overall accuracy of tax returns, thereby minimizing errors and potential fraud. Its comprehensive approach underscores a significant responsibility placed on preparers, guiding them through a series of inquiries to ensure that tax payers' claims are well-supported by factual information and compliant with the law.

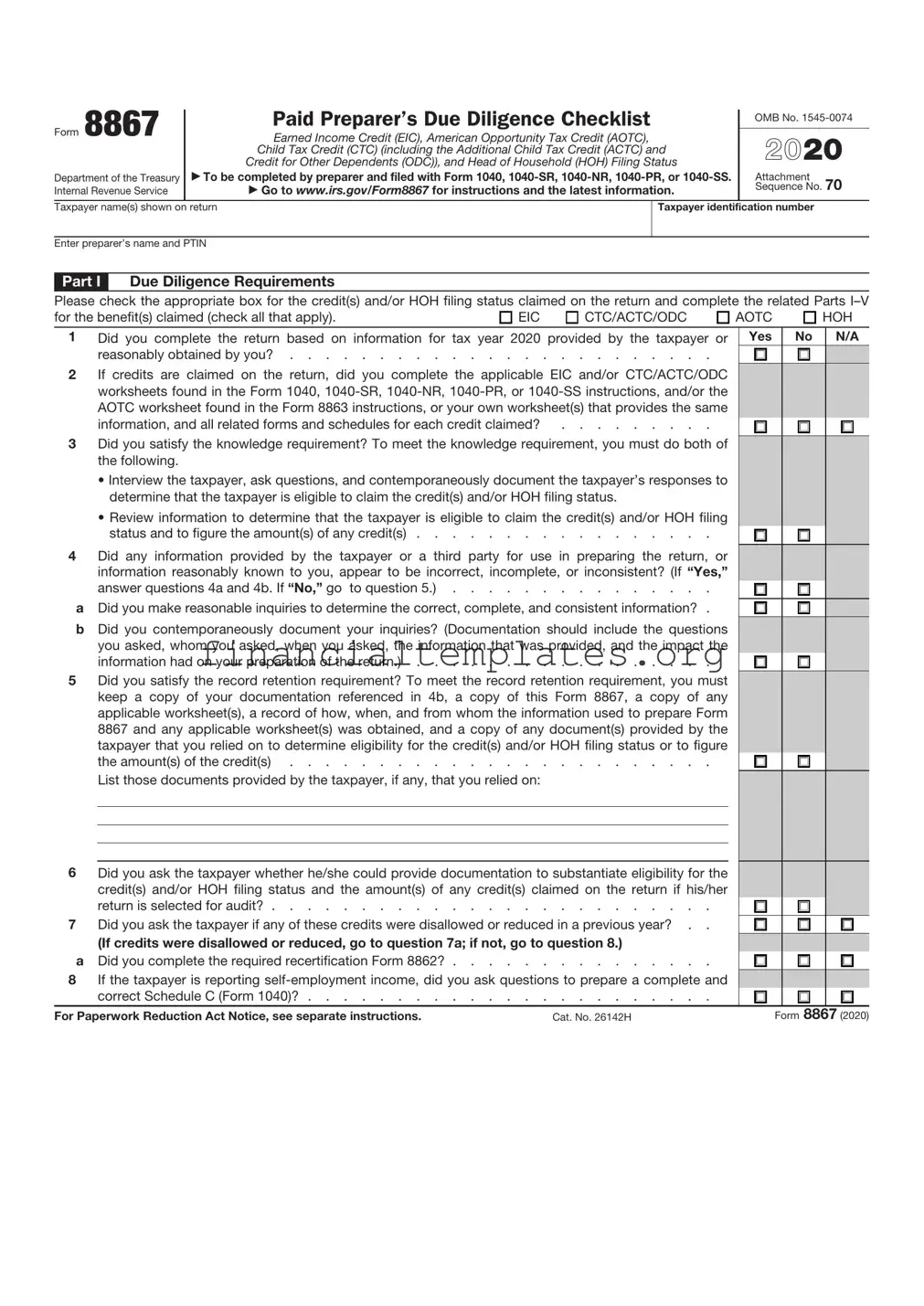

IRS 8867 Example

Form 8867 |

|

Paid Preparer’s Due Diligence Checklist |

|

OMB No. |

|||

|

|

||||||

|

Earned Income Credit (EIC), American Opportunity Tax Credit (AOTC), |

|

|||||

|

|

|

|

||||

(Rev. December 2021) |

|

Child Tax Credit (CTC) (including the Additional Child Tax Credit (ACTC) and |

|

|

|

||

|

Credit for Other Dependents (ODC)), and Head of Household (HOH) Filing Status |

|

Attachment |

|

|||

|

|

|

|

|

|||

Department of the Treasury |

▶ To be completed by preparer and filed with Form 1040, |

|

70 |

||||

Internal Revenue Service |

|

▶ Go to www.irs.gov/Form8867 for instructions and the latest information. |

|

Sequence No. |

|||

|

|

|

|

||||

|

|

|

|

|

|

|

|

Taxpayer name(s) shown on |

return |

|

Taxpayer identification number |

|

|||

|

|

|

|

|

|

||

Enter preparer’s name and PTIN |

|

|

|

|

|

||

|

|

|

|

|

|||

Part I |

Due Diligence Requirements |

|

|

|

|||

Please check the appropriate box for the credit(s) and/or HOH filing status claimed on the return and complete the related Parts

for the benefit(s) claimed (check all that apply). |

EIC |

CTC/ACTC/ODC |

AOTC |

|

HOH |

||

|

|

|

|

|

|

||

1 Did you complete the return based on information for the applicable tax year provided by the taxpayer |

|

Yes |

No |

|

N/A |

||

or reasonably obtained by you? (See instructions if relying on prior year earned income.) . . . . |

|

|

|

|

|

||

2If credits are claimed on the return, did you complete the applicable EIC and/or CTC/ACTC/ODC worksheets found in the Form 1040,

worksheet(s) that provides the same information, and all related forms and schedules for each credit claimed? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3Did you satisfy the knowledge requirement? To meet the knowledge requirement, you must do both of the following.

•Interview the taxpayer, ask questions, and contemporaneously document the taxpayer’s responses to determine that the taxpayer is eligible to claim the credit(s) and/or HOH filing status.

•Review information to determine that the taxpayer is eligible to claim the credit(s) and/or HOH filing

status and to figure the amount(s) of any credit(s) . . . . . . . . . . . . . . . . .

4Did any information provided by the taxpayer or a third party for use in preparing the return, or information reasonably known to you, appear to be incorrect, incomplete, or inconsistent? (If “Yes,”

answer questions 4a and 4b. If “No,” go to question 5.) . . . . . . . . . . . . . . .

a Did you make reasonable inquiries to determine the correct, complete, and consistent information? . |

|

||

b Did you contemporaneously document your inquiries? (Documentation should include the questions |

|

||

|

you asked, whom you asked, when you asked, the information that was provided, and the impact the |

|

|

|

information had on your preparation of the return.) |

|

|

5 Did you satisfy the record retention requirement? To meet the record retention requirement, you must |

|

||

|

keep a copy of your documentation referenced in question 4b, a copy of this Form 8867, a copy of any |

|

|

|

applicable worksheet(s), a record of how, when, and from whom the information used to prepare Form |

|

|

|

8867 and any applicable worksheet(s) was obtained, and a copy of any document(s) provided by the |

|

|

|

taxpayer that you relied on to determine eligibility for the credit(s) and/or HOH filing status or to figure |

|

|

|

the amount(s) of the credit(s) |

|

|

|

List those documents provided by the taxpayer, if any, that you relied on: |

|

|

6 Did you ask the taxpayer whether he/she could provide documentation to substantiate eligibility for the |

|

||

|

credit(s) and/or HOH filing status and the amount(s) of any credit(s) claimed on the return if his/her |

|

|

|

return is selected for audit? |

|

|

7 Did you ask the taxpayer if any of these credits were disallowed or reduced in a previous year? . . |

|

||

|

(If credits were disallowed or reduced, go to question 7a; if not, go to question 8.) |

|

|

a |

Did you complete the required recertification Form 8862? |

|

|

8 If the taxpayer is reporting |

|

||

|

correct Schedule C (Form 1040)? |

|

|

For Paperwork Reduction Act Notice, see separate instructions. |

Cat. No. 26142H |

Form 8867 (Rev. |

|

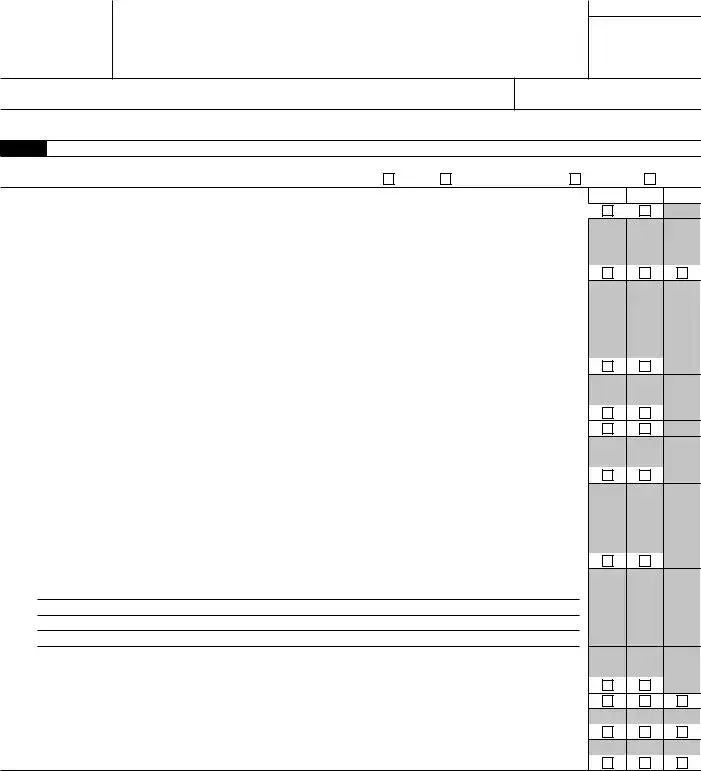

Form 8867 (Rev. |

Page 2 |

Part II Due Diligence Questions for Returns Claiming EIC (If the return does not claim EIC, go to Part III.)

9a Have you determined that the taxpayer is eligible to claim the EIC for the number of qualifying children |

Yes |

No |

N/A |

claimed, or is eligible to claim the EIC without a qualifying child? (If the taxpayer is claiming the EIC |

|

|

|

and does not have a qualifying child, go to question 10.) |

|

|

|

b Did you ask the taxpayer if the child lived with the taxpayer for over half of the year, even if the taxpayer |

|

|

|

has supported the child the entire year? |

|

|

|

cDid you explain to the taxpayer the rules about claiming the EIC when a child is the qualifying child of

more than one person (tiebreaker rules)? . . . . . . . . . . . . . . . . . . . .

Part III Due Diligence Questions for Returns Claiming CTC/ACTC/ODC (If the return does not claim CTC, ACTC,

or ODC, go to Part IV.)

10 Have you determined that each qualifying person for the CTC/ACTC/ODC is the taxpayer’s dependent who is Yes No N/A a citizen, national, or resident of the United States? . . . . . . . . . . . . . . . . . .

11Did you explain to the taxpayer that he/she may not claim the CTC/ACTC if the child has not lived with

the taxpayer for over half of the year, even if the taxpayer has supported the child, unless the child’s custodial parent has released a claim to exemption for the child? . . . . . . . . . . . .

12Did you explain to the taxpayer the rules about claiming the CTC/ACTC/ODC for a child of divorced or separated parents (or parents who live apart), including any requirement to attach a Form 8332 or similar

statement to the return? . . . . . . . . . . . . . . . . . . . . . . . . . .

Part IV Due Diligence Questions for Returns Claiming AOTC (If the return does not claim AOTC, go to Part V.)

13 Did the taxpayer provide substantiation for the credit, such as a Form

Part V Due Diligence Questions for Claiming HOH (If the return does not claim HOH filing status, go to Part VI.)

14Have you determined that the taxpayer was unmarried or considered unmarried on the last day of the tax year and provided more than half of the cost of keeping up a home for the year for a qualifying person? . . . .

Part VI |

Eligibility Certification |

Yes No

▶You will have complied with all due diligence requirements for claiming the applicable credit(s) and/or HOH filing status on the return of the taxpayer identified above if you:

A.Interview the taxpayer, ask adequate questions, contemporaneously document the taxpayer’s responses on the return or in your notes, review adequate information to determine if the taxpayer is eligible to claim the credit(s) and/or HOH filing status and to figure the amount(s) of the credit(s);

B.Complete this Form 8867 truthfully and accurately and complete the actions described in this checklist for any applicable credit(s) claimed and HOH filing status, if claimed;

C.Submit Form 8867 in the manner required; and

D.Keep all five of the following records for 3 years from the latest of the dates specified in the Form 8867 instructions under Document Retention.

1.A copy of this Form 8867.

2.The applicable worksheet(s) or your own worksheet(s) for any credit(s) claimed.

3.Copies of any documents provided by the taxpayer on which you relied to determine the taxpayer’s eligibility for the credit(s) and/or HOH filing status and to figure the amount(s) of the credit(s).

4.A record of how, when, and from whom the information used to prepare this form and the applicable worksheet(s) was obtained.

5.A record of any additional information you relied upon, including questions you asked and the taxpayer’s responses, to determine the taxpayer’s eligibility for the credit(s) and/or HOH filing status and to figure the amount(s) of the credit(s).

▶If you have not complied with all due diligence requirements, you may have to pay a penalty for each failure to comply related to a claim of an applicable credit or HOH filing status (see instructions for more information).

15 Do you certify that all of the answers on this Form 8867 are, to the best of your knowledge, true, correct, and |

Yes |

No |

complete? |

|

|

Form 8867 (Rev. |

||

Document Specifics

| Fact Name | Description |

|---|---|

| Form Purpose | The IRS 8867 form is used for tax preparers to ensure they have met the due diligence requirements when claiming certain tax credits and/or head of household filing status for their clients. |

| Required Credits | This form is specifically associated with the earned income tax credit, the child tax credit/additional child tax credit, the American opportunity tax credit, and the head of household filing status. |

| Penalty for Non-Compliance | Failure to comply with the due diligence requirements as outlined by the IRS 8867 form can result in a penalty for the tax preparer. |

| Filing Method | The form must be filed with the IRS along with the tax return it pertains to, and can be filed either electronically or on paper. |

| Record Keeping | Tax preparers are required to keep a copy of the completed IRS 8867 form, along with any worksheets or records that support the due diligence checklist, for three years. |

| Governing Law | The requirements and penalties associated with the IRS 8867 form are governed by federal tax law, specifically under sections related to the respective tax credits. |

Guide to Writing IRS 8867

Filling out the IRS Form 8867 is a necessary step for tax preparers who claim the Earned Income Tax Credit (EITC), American Opportunity Tax Credit (AOTC), or the Child Tax Credit (CTC) on behalf of their clients. This form acts as a due diligence checklist to ensure that tax preparers have the correct information and are adhering to the necessary regulations when claiming these credits. The process requires attention to detail and accurate client data. Following a systematic approach will help simplify the process and ensure compliance with IRS requirements.

- Gather client information: Collect all necessary documentation from the client including income statements, social security numbers, and proof of eligibility for the credits.

- Access the form: Download the latest version of the IRS 8867 form from the IRS website to ensure you are using the most current form.

- Part I - Taxpayer Information: Enter the taxpayer's name and social security number. This section identifies the client for whom you're claiming the credit(s).

- Part II - EITC: If applicable, answer all questions related to the Earned Income Tax Credit. This includes the taxpayer's eligibility based on income, relationship, and residency requirements.

- Part III - CTC/ACTC/ODC: Complete this section if you are claiming the Child Tax Credit (CTC), Additional Child Tax Credit (ACTC), or Other Dependent Credit (ODC). Provide information on the qualifying children or dependents.

- Part IV - AOTC: If claiming the American Opportunity Tax Credit, fill out the required information about educational expenses and the student's enrollment status.

- Part V - Due Diligence: This section is for the tax preparer to attest that they have met the due diligence requirements by asking the right questions, obtaining the necessary information, and keeping records as mandated by the IRS.

- Signature: The preparer must sign and date the form, certifying that the information is accurate to the best of their knowledge. Include the Preparer Tax Identification Number (PTIN).

- Attach to the return: Once completed, attach Form 8867 to the tax return for which the credits are being claimed.

After submitting the IRS Form 8867 with the tax return, the next steps involve patiently waiting for any correspondence from the IRS. They might request additional documentation or clarification on the credits claimed. It’s crucial to respond promptly to any IRS inquiries and maintain detailed records of the information and documentation provided during the tax preparation process. This proactive approach will assist in resolving any issues swiftly, ensuring that the taxpayer receives the rightful credits and minimizing the risk of penalties for the preparer.

Understanding IRS 8867

-

What is the IRS 8867 form used for?

The IRS 8867 form, known as the "Paid Preparer's Due Diligence Checklist," is used by tax preparers to ensure they have conducted the necessary due diligence when claiming certain tax credits or deductions for their clients. These include the Earned Income Credit, the Child Tax Credit, the American Opportunity Tax Credit, and the Head of Household filing status. Completing this form is a way to help prevent mistakes and ensure tax returns are filed accurately.

-

Who is required to fill out the 8867 form?

Any tax preparer who is compensated for preparing tax returns and claims any of the credits or deductions mentioned above must complete the form 8867. It's important for these professionals to follow through with this requirement to avoid penalties and to uphold the integrity of the tax filing process.

-

What happens if I don't use Form 8867?

Failure to include Form 8867 with a tax return that claims any of the relevant tax credits or deductions can result in penalties imposed on the tax preparer. These penalties can be substantial and are intended to encourage compliance with due diligence requirements. It's crucial for tax preparers to understand these implications to avoid unnecessary costs and to maintain their professional standards.

-

Are there any penalties for not completing Form 8867 accurately?

Yes, there are penalties for not completing Form 8867 accurately. If the IRS finds that a tax preparer has failed to meet the due diligence requirements, or has inaccurately completed the form, they may impose penalties. These penalties can apply for each incidence of non-compliance, which underscores the importance of thorough and accurate completion of the form.

-

How can I obtain the IRS 8867 form?

The IRS 8867 form can be easily obtained from the IRS's official website. Tax preparers can download it directly to ensure they are using the latest version. Additionally, many tax preparation software programs include the form within their applications, streamlining the process for professional preparers.

-

Can the IRS 8867 form be filed electronically?

Yes, the IRS 8867 form can be filed electronically, which is often the preferred method for many tax preparers. Filing electronically helps to simplify the submission process and ensures the form is processed more quickly by the IRS. It also allows for an easier record-keeping process for the tax preparer.

-

What are the key deadlines for submitting Form 8867?

Form 8867 should be submitted with the tax return it pertains to. Therefore, the key deadline for submitting Form 8867 aligns with the tax return filing deadline, typically April 15th. However, if an extension is granted for the tax return, the same extension applies to the Form 8867. It's crucial for tax preparers to keep track of these deadlines to ensure compliance and avoid penalties.

Common mistakes

When filling out the IRS 8867 form, individuals often encounter a number of pitfalls. These mistakes can delay the processing of the form or even result in unwanted penalties. Below is a detailed exploration of ten common errors that are made:

Not verifying the taxpayer's eligibility for tax credits: People frequently skip the essential step of confirming their eligibility for the credits claimed. This mistake can lead to incorrect claims being filed.

Incorrect information: Entering wrong information, such as Social Security numbers or income details, is a common error. This can lead to processing delays or the rejection of the form.

Overlooking the due diligence checklist: The form includes a checklist to ensure due diligence is met. Ignoring this part can result in failing to meet the necessary compliance standards.

Not signing the form: Omitting the signature at the end of the form renders it invalid. Despite completing all other sections accurately, an unsigned form will not be processed.

Forgetting to check the applicable tax years: Failing to indicate the correct tax year for which the credits are being claimed can lead to the application being processed for the wrong year.

Providing incomplete information: Leaving sections incomplete, especially those requiring detailed documentation of eligibility, is a frequent oversight that can hinder the successful processing of the form.

Skipping questions: Every question on the form is vital for determining eligibility and tax credit amounts. Skipping any question can lead to an incomplete understanding of the taxpayer’s situation.

Miscalculating the credit amount: Incorrectly calculating the amount of credit can result in either the taxpayer receiving less than they are entitled to or owing money back to the IRS.

Failing to attach required documentation: Certain parts of the form require supporting documentation. Neglecting to attach this documentation is a mistake that can prevent the form from being processed.

Using outdated forms: The IRS updates their forms periodically. Using an outdated version of form 8867 can lead to incorrect or incomplete filings.

It's important for individuals to approach the process of completing the IRS 8867 form with attention to detail and care. By avoiding these common mistakes, taxpayers can ensure smoother processing and avoid potential penalties.

Documents used along the form

When preparing taxes, especially those involving credits like the Earned Income Credit (EIC), Child Tax Credit (CTC), or American Opportunity Tax Credit (AOTC), tax professionals and individuals often utilize the IRS Form 8867, Paid Preparer's Due Diligence Checklist, to ensure compliance with tax laws. This form is just one component of a comprehensive tax preparation process that may involve several other forms and documents. Understanding these additional forms and documents can streamline the filing process, ensuring accuracy, and compliance.

- Form 1040: The U.S. Individual Income Tax Return is the starting point for personal tax filing. It's where you report your income, deductions, and credits to the IRS.

- Schedule C: For those who are self-employed or sole proprietors, Schedule C is attached to Form 1040 to report profits or losses from a business.

- Form W-2: This form is issued by employers to report an employee's annual wages and the amount of taxes withheld from their paycheck.

- Form 1099-MISC: Independent contractors, freelancers, and others who have received at least $600 in payments from a business or individual must report this income through Form 1099-MISC.

- Form 1098: This mortgage interest statement is crucial for homeowners looking to claim mortgage interest deductions.

- Form 8863: For those claiming education credits, such as the Lifetime Learning Credit or the AOTC, Form 8863 will need to be completed.

- Schedule EIC: If claiming the Earned Income Credit and you have qualifying children, Schedule EIC provides the necessary information about those children to the IRS.

- Form 2441: For individuals seeking to claim child and dependent care expenses, Form 2441 is required to detail those expenses.

Accurately preparing and filing taxes involves more than just completing the forms listed above. Tax filers must also ensure they have all necessary supporting documentation, such as income statements, expense receipts, and eligibility documents. By utilizing these forms and understanding their purpose, individuals can navigate the complexities of tax preparation with greater ease and confidence. Ensuring that all information is complete and accurate on these forms can help avoid delays or issues with the IRS, leading to a smoother tax filing experience.

Similar forms

The IRS Form 1040, often known as the U.S. Individual Income Tax Return, shares similarities with Form 8867 in that both are central to the tax filing process. While Form 8867 is specifically designed for tax preparers to ensure they have covered all necessary due diligence requirements for claiming certain credits, the Form 1040 collects an individual's income, deductions, and credit information. Both forms are integral in determining the amount of tax owed or refund due to the taxpayer, with Form 8867 acting as a compliance measure to prevent incorrect claims.

Form W-7, Application for IRS Individual Taxpayer Identification Number (ITIN), is somewhat similar to Form 8867 in its function of ensuring taxpayer identity and eligibility for tax benefits. Where Form 8867 ensures tax preparers have conducted due diligence for certain tax credits, Form W-7 is used by individuals who are not eligible for a Social Security Number but need an ITIN to comply with U.S. tax laws. Both forms serve as gatekeepers for tax compliance and benefits; however, they cater to different needs in the tax filing process.

Form 1040-ES, Estimated Tax for Individuals, parallels Form 8867 in that both involve tax calculations and considerations for specific financial situations. While Form 8867 helps tax preparers verify eligibility for certain credits, Form 1040-ES is used by taxpayers to calculate and pay estimated tax on income that is not subject to withholding. This might include earnings from self-employment, interest, dividends, and more. Each form requires careful consideration of the taxpayer's financial circumstances to ensure proper compliance with tax laws.

Form 2441, Child and Dependent Care Expenses, and Form 8867 share a common objective of ensuring taxpayers receive appropriate credits. Form 8867 requires tax preparers to verify qualifications for credits like the Earned Income Credit, while Form 2441 is specifically used by taxpayers to calculate the credit amount for child and dependent care expenses. Both documents necessitate accurate reporting of personal and financial information to ensure taxpayers can legally claim their entitled benefits.

Form 8962, Premium Tax Credit (PTC), resembles Form 8867 in its relation to tax credits and the necessity for precise information. Form 8962 is utilized to calculate the amount of premium tax credit a taxpayer is eligible for, based on their income and household size, to assist with health insurance costs. Just like Form 8867 ensures compliance with credit qualifications, Form 8962 enforces accuracy in claiming health insurance-related tax credits, making both critical for accurate tax returns.

Lastly, the Schedule C (Form 1040), Profit or Loss from Business, while not directly related to tax credits, is somewhat akin to Form 8867 in the context of necessitating detailed financial scrutiny. Form 8867 requires tax preparers to confirm due diligence in tax credit eligibility, whereas Schedule C is utilized by sole proprietors to report earnings and expenses from a business or profession. Both forms are essential in determining the accurate tax obligations of taxpayers, ensuring they pay or receive the correct amounts based on their financial activities.

Dos and Don'ts

Filling out form IRS 8867, required for those claiming certain credits on their tax return, demands precision and awareness. Here’s a mix of dos and don'ts to help navigate the process.

- Do thoroughly review the taxpayer's information. Accurate and complete details pave the way for a smooth process.

- Don't rush through questions. Each question is designed to ensure eligibility and accuracy for the credits being claimed.

- Do utilize the IRS instructions for Form 8867. These guidelines provide crucial insights meant to assist in filling out the form correctly.

- Don't omit any required documentation. Supporting documents are key to validating the claims made on the form.

- Do verify the eligibility criteria for the credits. Understanding who qualifies for them avoids errors and possible audits.

- Don't guess on answers. If you're uncertain about a detail, it's better to look it up or consult with a professional.

- Do ensure all applicable parts of the form are completed. Skipping sections can lead to rejection or delays.

- Don't use pencil to fill out the form. All entries should be made in ink to ensure they are permanent and legible.

- Do keep a copy of the completed form. Having a record is useful for future reference and in case questions arise from the IRS.

Misconceptions

Understanding the IRS Form 8867, also known as the Paid Preparer's Due Diligence Checklist for Earned Income Credit, American Opportunity Credit, and Child Tax Credit, is crucial. This document is not just a formality but a necessary step to ensure tax preparers are thorough in their claims for certain credits on behalf of their clients. However, several misconceptions surround the IRS Form 8867, which if not clarified, may lead to errors in tax preparation. Let's debunk some of the most common myths.

The IRS Form 8867 is only for professional tax preparers. This is incorrect. While the form is indeed meant to be completed by paid preparers, it serves as a checklist to ensure they meet the due diligence requirements set by the IRS when claiming certain tax credits. It's an essential part of the process for any preparer charging for their services, including both professionals and those who might not consider themselves as such but are compensated for their work.

Filling out the form is optional. This is a common misunderstanding. The IRS mandates the completion of Form 8867 for every tax return or claim for refund that includes the Earned Income Tax Credit, American Opportunity Tax Credit, Child Tax Credit/Additional Child Tax Credit/Other Dependent Credit. Failure to complete and submit this form can result in penalties.

Form 8867 should be attached to the client's tax return. Actually, while preparers must complete the form, it is not supposed to be filed with the tax return. Instead, preparers should keep the form and any worksheets/documentation for a period of three years, as these may be requested by the IRS to verify due diligence was followed.

There is no penalty for not submitting Form 8867. Unfortunately, this is not correct. The IRS imposes a penalty for each failure to meet the due diligence requirements, including the failure to submit Form 8867, which can result in significant financial penalties for the preparer.

Form 8867 is only relevant at the time of tax filing. While it's true that the form is part of the tax filing process, its relevance extends beyond this period. Preparers should use the checklist as a guide throughout the tax preparation process to ensure compliance with due diligence requirements and to protect against possible penalties.

Preparers only need to fill out parts that seem relevant to them. This misconception could lead to non-compliance. The IRS requires that all relevant sections of Form 8867 be completed based on the tax credits claimed on the tax return. Selective completion can result in inaccuracies and penalties.

The form is too complicated and requires legal assistance to complete correctly. While thoroughness is required, the form is designed to be straightforward. It serves as a checklist to ensure that preparers have covered all necessary due diligence aspects related to the credits being claimed. Many preparers complete the form without legal assistance.

Once filled, there's no need to revisit the form. This notion could lead to issues if information changes or if an error is discovered. Preparers should review the form as part of their final review process before filing and update it if necessary to ensure all information remains accurate and complete.

The same information from last year can be reused for the current year. Each tax year can bring changes to a taxpayer's situation and to tax law. Relying on previous year's information without verification is risky and might not meet the IRS's requirement for current tax year due diligence.

It's just a formality and doesn't really affect the outcome of the tax return. This is a grave misunderstanding. The IRS Form 8867 is a critical tool in the prevention of improper claims. It ensures that both the preparer and taxpayer adhere to tax law, affecting the accuracy of the tax return and the legitimacy of the credits claimed.

In conclusion, dispelling these misconceptions about IRS Form 8867 is vital for all tax preparers. Understanding and correctly applying the requirements of this form can not only prevent costly penalties but also enhance the quality and accuracy of tax preparation services provided to clients. When in doubt, paid preparers should refer to the latest IRS guidelines or seek advice from a tax professional to ensure compliance.

Key takeaways

The IRS Form 8867, or the Paid Preparer's Due Diligence Checklist, plays a pivotal role in ensuring the accuracy and integrity of certain tax credit claims. By adhering to the guidelines and filling out this form meticulously, taxpayers and preparers can avoid potential penalties and ensure that eligible taxpayers receive the correct tax benefits. Here are four key takeaways concerning the preparation and utilization of the IRS Form 8867:

- Thoroughly Understand Eligible Credits: It's imperative to have a comprehensive understanding of the tax credits that require Form 8867, including the Earned Income Credit (EIC), Child Tax Credit (CTC), Additional Child Tax Credit (ACTC), Credit for Other Dependents (ODC), and the American Opportunity Tax Credit (AOTC). This knowledge ensures that the preparers can accurately determine eligibility and calculate the correct amount of the credits.

- Complete All Required Sections: Every question on Form 8867 must be answered thoroughly. This form serves as a checklist to guide the preparer through the due diligence requirements mandated by the IRS. By meticulously addressing each query, the preparer affirms that they have made inquiries about the taxpayer’s eligibility and credit qualification and have on hand the information to back up the claims made on the tax return.

- Retain Records Appropriately: After completing Form 8867, it's crucial for the paid preparer to keep a copy of the form, along with any worksheets or records that support the due diligence claims, for a minimum of three years. This documentation is vital in case the IRS requires evidence of the preparer's due diligence in claiming these tax credits.

- Understand the Penalties for Non-Compliance: Failing to meet the due diligence requirements outlined in Form 8867 can result in significant penalties. For each failure to comply, the preparer may face a monetary penalty. This emphasizes the importance of accurately completing and submitting the form as part of the tax return to prevent any financial repercussions.

Popular PDF Documents

Power of Attorney Form Nh - Its role in empowering agents to request and receive confidential tax information makes it a vital component of effective tax management and planning.

Irs Power of Attorney - Must be completed accurately to ensure the IRS accepts the designated representative’s authority.

Form 50-244 - It serves as an official record for the sale and tax liability of each motor vehicle.