Get IRS 8863 Form

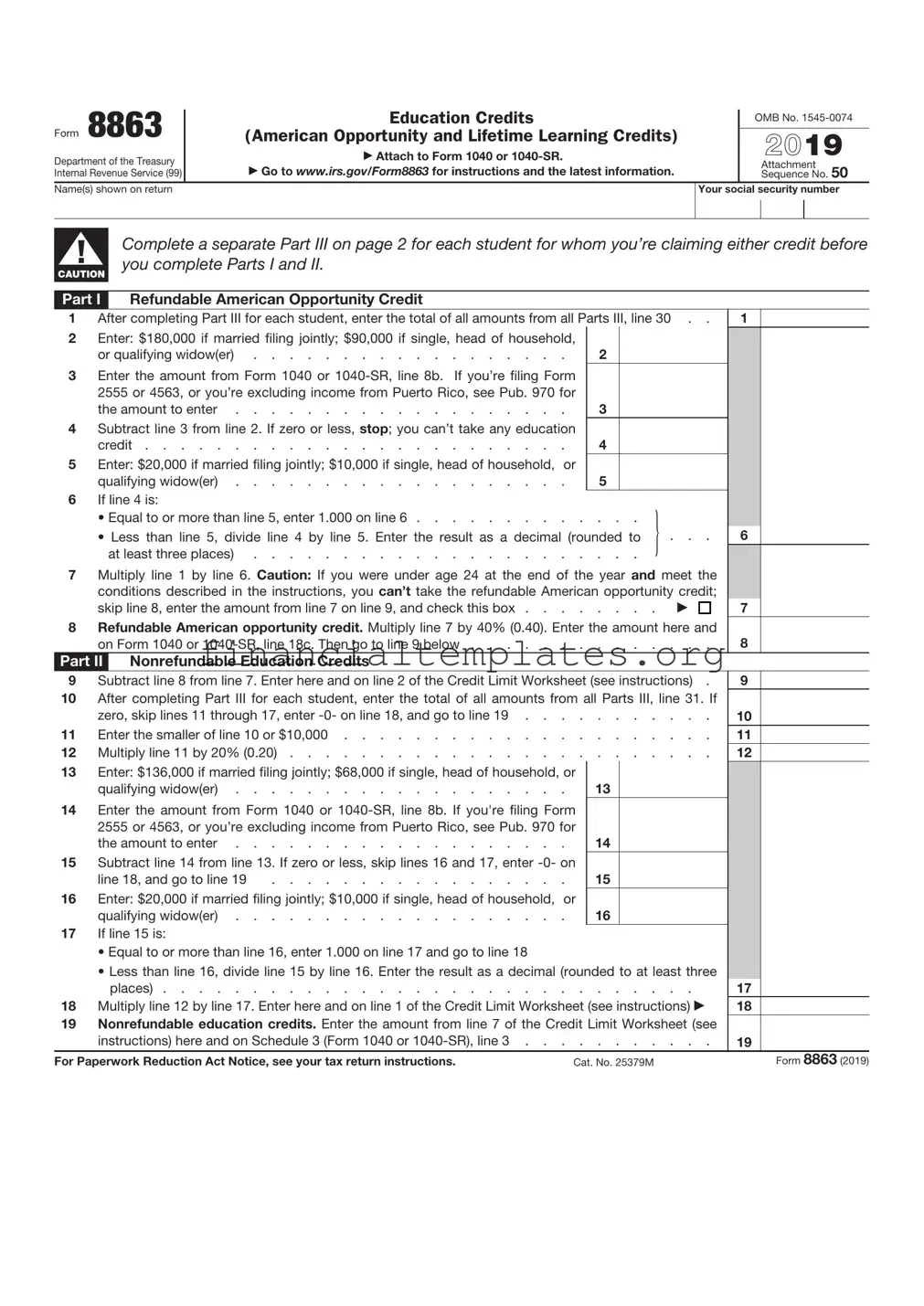

Filing taxes can feel like navigating through a labyrinth for many individuals, especially when education expenses come into the picture. For those looking to make the most out of their education investments, the IRS 8863 form serves as a crucial tool. This form is designed for taxpayers who are eligible for one of two valuable education credits—the American Opportunity Credit and the Lifetime Learning Credit. Both credits offer a way to lower your tax bill, providing relief based on the costs associated with higher education. Understanding the eligibility criteria, the differences between the two credits, and how to accurately complete and attach this form to your tax return could potentially save you a significant amount in taxes. The form itself requires a detailed breakdown of educational expenses, and navigating its requirements is essential for maximizing the benefits available. For students or parents bearing the costs of education, form 8863 opens the door to potential savings, making the process of claiming these credits a vital piece of the tax planning puzzle.

IRS 8863 Example

Form 8863 |

|

Education Credits |

|

OMB No. |

||

|

|

|||||

|

(American Opportunity and Lifetime Learning Credits) |

|

|

|

|

|

|

|

2021 |

||||

Department of the Treasury |

|

▶ Attach to Form 1040 or |

|

|||

|

▶ Go to www.irs.gov/Form8863 for instructions and the latest information. |

|

|

Attachment |

||

Internal Revenue Service (99) |

|

|

|

|||

|

|

|

Sequence No. 50 |

|||

Name(s) shown on return |

|

|

Your social security number |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

▲!

CAUTION

Part I

Complete a separate Part III on page 2 for each student for whom you’re claiming either credit before you complete Parts I and II.

Refundable American Opportunity Credit

1 After completing Part III for each student, enter the total of all amounts from all Parts III, line 30 . .

2Enter: $180,000 if married filing jointly; $90,000 if single, head of household,

or qualifying widow(er) |

. . . . . . . . . . . . . . . . . . |

2 |

3Enter the amount from Form 1040 or

2555 or 4563, or you’re excluding income from Puerto Rico, see Pub. 970 for |

|

the amount to enter |

3 |

4Subtract line 3 from line 2. If zero or less, stop; you can’t take any education

credit |

4 |

5Enter: $20,000 if married filing jointly; $10,000 if single, head of household, or

|

qualifying widow(er) |

5 |

|

|

6 |

If line 4 is: |

|

} |

|

|

• Equal to or more than line 5, enter 1.000 on line 6 |

|

||

|

• Less than line 5, divide line 4 by line 5. Enter the result as a decimal (rounded to |

. . . |

||

|

at least three places) |

|

||

7Multiply line 1 by line 6. Caution: If you were under age 24 at the end of the year and meet the conditions described in the instructions, you can’t take the refundable American opportunity credit;

skip line 8, enter the amount from line 7 on line 9, and check this box . . . . . . . . ▶

8Refundable American opportunity credit. Multiply line 7 by 40% (0.40). Enter the amount here and on Form 1040 or

Part II Nonrefundable Education Credits

1

6

7

8

.

9 Subtract line 8 from line 7. Enter here and on line 2 of the Credit Limit Worksheet (see instructions) . |

9 |

10After completing Part III for each student, enter the total of all amounts from all Parts III, line 31. If

|

zero, skip lines 11 through 17, enter |

10 |

11 |

Enter the smaller of line 10 or $10,000 |

11 |

12 |

Multiply line 11 by 20% (0.20) |

12 |

13Enter: $180,000 if married filing jointly; $90,000 if single, head of household, or

qualifying widow(er) |

13 |

14Enter the amount from Form 1040 or

the amount to enter |

14 |

15Subtract line 14 from line 13. If zero or less, skip lines 16 and 17, enter

|

line 18, and go to line 19 |

. . . . . . . . . . . . . . . . |

. |

|

15 |

|

|

|

16 |

Enter: $20,000 if married filing jointly; $10,000 if single, head of household, |

or |

|

|

||||

|

qualifying widow(er) |

. |

16 |

|

|

|

||

17 |

If line 15 is: |

|

|

|

|

|

|

|

|

• Equal to or more than line 16, enter 1.000 on line 17 and go to line 18 |

|

|

|

|

|

|

|

|

• Less than line 16, divide line 15 by line 16. Enter the result as a decimal (rounded to at least three |

|

|

|||||

|

places) |

. . . . . . . . |

|

17 |

. |

|||

18 |

Multiply line 12 by line 17. Enter here and on line 1 of the Credit Limit Worksheet (see instructions) ▶ |

|

18 |

|

||||

19 |

Nonrefundable education credits. Enter the amount from line 7 of the Credit Limit Worksheet (see |

|

|

|||||

|

instructions) here and on Schedule 3 (Form 1040), line 3 |

. . . . . . . . . |

|

19 |

|

|||

For Paperwork Reduction Act Notice, see your tax return instructions. |

|

Cat. No. 25379M |

|

Form 8863 (2021) |

||||

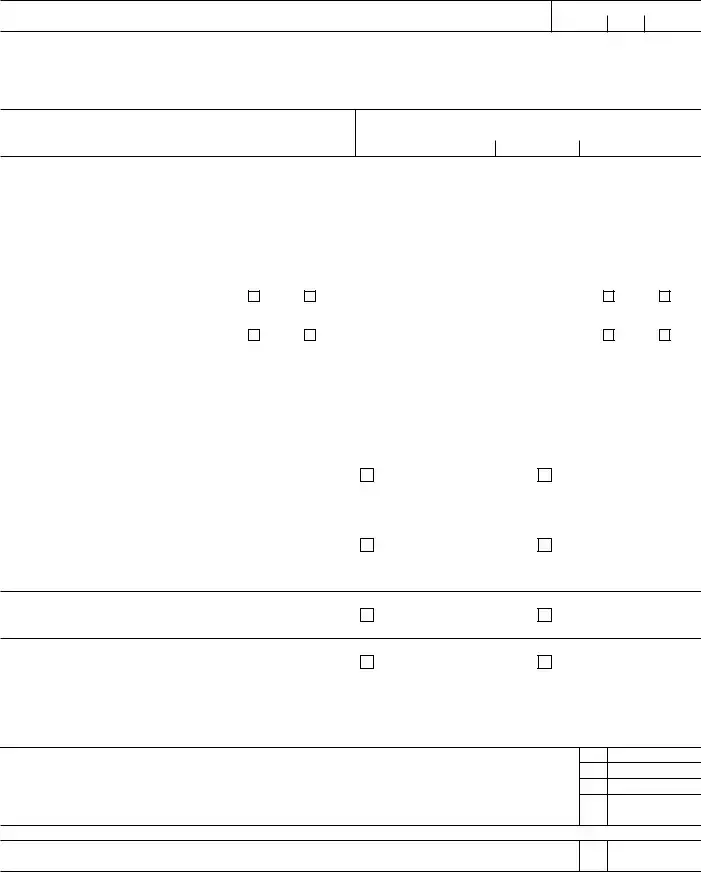

Form 8863 (2021) |

Page 2 |

Name(s) shown on return

Your social security number

▲!

CAUTION

Part III

Complete Part III for each student for whom you’re claiming either the American opportunity credit or lifetime learning credit. Use additional copies of page 2 as needed for each student.

Student and Educational Institution Information. See instructions.

20Student name (as shown on page 1 of your tax return)

21Student social security number (as shown on page 1 of your tax return)

22Educational institution information (see instructions)

a. Name of first educational institution |

|

|

|

|

|

|

|

|

b. Name of second educational institution (if any) |

|

|||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||

(1) Address. Number and street (or P.O. box). City, town or |

(1) Address. Number and street (or P.O. box). City, town or |

||||||||||||||||||||||||||||||||||||||||||||

|

post office, state, and ZIP code. If a foreign address, see |

|

post office, state, and ZIP code. If a foreign address, see |

||||||||||||||||||||||||||||||||||||||||||

|

instructions. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

instructions. |

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

(2) Did the student receive Form |

Yes |

|

No |

(2) Did the student receive Form |

Yes |

No |

|||||||||||||||||||||||||||||||||||||||

|

from this institution for 2021? |

|

|

|

|

|

from this institution for 2021? |

|

|

|

|

|

|||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||

(3) Did the student receive Form |

|

|

|

|

|

(3) Did the student receive Form |

|

|

|

|

|

||||||||||||||||||||||||||||||||||

|

from this institution for 2020 with box |

Yes |

|

No |

|

from this institution for 2020 with box |

Yes |

No |

|||||||||||||||||||||||||||||||||||||

|

7 checked? |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7 checked? |

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||

(4) Enter the institution’s employer identification number (EIN) |

(4) Enter the institution’s employer identification number |

||||||||||||||||||||||||||||||||||||||||||||

|

if you’re claiming the American opportunity credit or if you |

|

(EIN) if you’re claiming the American opportunity credit or |

||||||||||||||||||||||||||||||||||||||||||

|

checked “Yes” in (2) or (3). You can get the EIN from Form |

|

if you checked “Yes” in (2) or (3). You can get the EIN |

||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

from Form |

|

|

|

|

|

||||||||||||||||||||||||||||||

|

|

|

|

|

– |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

– |

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

23 Has the Hope Scholarship Credit or American opportunity |

Yes — Stop! |

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||

credit been claimed |

for this student for |

any |

4 tax years |

No — Go to line 24. |

|

||||||||||||||||||||||||||||||||||||||||

Go to line 31 for this student. |

|

||||||||||||||||||||||||||||||||||||||||||||

before 2021? |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

24 Was the student enrolled at least |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

academic period that began or is treated as having begun in |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

2021 at |

|

an eligible |

educational institution |

in |

a program |

Yes — Go to line 25. |

No — Stop! Go to line 31 |

||||||||||||||||||||||||||||||||||||||

leading |

towards |

a |

postsecondary |

degree, |

certificate, or |

||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

for this student. |

|

||||||||||||||||||||||||||||||||

other recognized |

postsecondary |

educational |

credential? |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||

See instructions.

25Did the student complete the first 4 years of postsecondary education before 2021? See instructions.

Yes — Stop!

Go to line 31 for this student.

No — Go to line 26.

26Was the student convicted, before the end of 2021, of a felony for possession or distribution of a controlled substance?

Yes — Stop!

Go to line 31 for this student.

No — Complete lines 27 through 30 for this student.

▲ |

|

! |

You can't take the American opportunity credit and the lifetime learning credit for the same student in the same year. If |

you complete lines 27 through 30 for this student, don’t complete line 31. |

|

CAUTION |

|

American Opportunity Credit

27Adjusted qualified education expenses (see instructions). Don’t enter more than $4,000 . . . . .

28 |

Subtract $2,000 from line 27. If zero or less, enter |

29 |

Multiply line 28 by 25% (0.25) |

30If line 28 is zero, enter the amount from line 27. Otherwise, add $2,000 to the amount on line 29 and enter the result. Skip line 31. Include the total of all amounts from all Parts III, line 30, on Part I, line 1 .

Lifetime Learning Credit

27

28

29

30

31Adjusted qualified education expenses (see instructions). Include the total of all amounts from all Parts

III, line 31, on Part II, line 10 |

31 |

Form 8863 (2021)

Document Specifics

| Fact Name | Description |

|---|---|

| Purpose of Form 8863 | Form 8863 is utilized to calculate and claim educational credits, specifically the American Opportunity Credit and the Lifetime Learning Credit, which are devised to reduce the tax obligation for individuals paying for higher education expenses. |

| Eligible Individuals | This form is for taxpayers who have incurred education expenses, either for themselves, a spouse, or a dependent, at an eligible educational institution during the tax year. |

| Education Credits Offered | There are two main education credits: the American Opportunity Credit, offering up to $2,500 per eligible student, and the Lifetime Learning Credit, providing up to $2,000 per tax return, regardless of the number of students. |

| Eligible Educational Institutions | Eligible institutions include any college, university, vocational school, or other postsecondary educational institutions eligible to participate in a student aid program administered by the U.S. Department of Education. |

| Form 8863 Attachment | The completed Form 8863 should be attached to the taxpayer’s Form 1040 or Form 1040-SR, serving as the method to calculate and claim the educational credits. |

| Income Limits | The ability to claim either credit depends on the taxpayer's modified adjusted gross income (MAGI), which may reduce or phase out the credit amount for higher-income earners. |

| Qualifying Expenses | Qualifying expenses for the credits include tuition and certain related expenses required for enrollment or attendance at an eligible educational institution. |

| Documentation and Records | Taxpayers must keep receipts, Form 1098-T from the educational institution, and any other relevant documents to substantiate the claim of the credits, even though these documents are not filed with the tax return. |

Guide to Writing IRS 8863

Filling out IRS Form 8863 is a pivotal step for students or parents seeking to claim education credits, which can reduce the amount of tax owed on a dollar-for-dollar basis. This form is utilized to calculate and claim the American Opportunity Credit and the Lifetime Learning Credit. While the process might seem intricate at first glance, breaking it down into manageable steps can make it more approachable. The following instructions will guide you through preparing and completing this form accurately, ensuring you take full advantage of available education credits.

- Start by gathering all necessary documentation, including the student's financial information, tuition statements (Form 1098-T), and any records of education-related expenses not covered by scholarships or grants.

- Download the latest version of IRS Form 8863 from the Internal Revenue Service (IRS) website. Make sure it's for the correct tax year.

- Fill out the top section of the form with the taxpayer’s information, including name and social security number. If you are filing a joint return, include your spouse’s name and social security number as well.

- Determine which education credit you are eligible for: the American Opportunity Credit (for undergraduate students up to a maximum of four tax years) or the Lifetime Learning Credit (for post-secondary education and courses to acquire or improve job skills, with no limit on the number of years you can claim the credit).

- For Part I, you'll calculate the American Opportunity Credit. Enter information about each student for whom you're claiming the credit, including their name, social security number, and educational expenses. Make sure to answer the questions about the student’s academic period and status to confirm eligibility.

- In Part II, calculate the Lifetime Learning Credit, if applicable. This section is used for students not eligible for the American Opportunity Credit. Report the total amount of qualified tuition and related expenses, ensuring not to double-count expenses used for both credits.

- Follow the form’s line-by-line instructions to calculate the amount of credit you’re eligible for. The form will guide you through adjustments necessary for scholarship amounts, grants, and any other tax-free educational assistance.

- Carry the calculated credit amount over to your main tax return form, typically Form 1040 or 1040-SR, and include it in the appropriate section as instructed by Form 8863.

- Review the entire form to ensure all information is accurate and complete. Misinformation or errors could delay processing or result in a denial of the credit.

- Attach Form 8863 to your tax return. If you’re filing electronically, follow your software’s instructions for including IRS Form 8863 with your e-filed return.

- Finally, submit your tax return by the filing deadline. If using postal mail, consult the IRS website for the correct address to send your return, based on your state of residence and whether you are including a payment.

After submitting Form 8863 with your tax return, the next steps include waiting for the IRS to process your return. You can track the status of your return using the "Where's My Refund?" tool on the IRS website. This tool provides updates on the processing of your return and the estimated date of any refund you are due. It's important to allow time for processing, especially during peak periods. If the IRS requires more information or there are issues with your return, they will contact you directly. Successfully claiming education credits with Form 8863 can lead to significant tax savings, making it a valuable effort for eligible students and families.

Understanding IRS 8863

-

What is IRS Form 8863 and who needs to file it?

IRS Form 8863, titled "Education Credits (American Opportunity and Lifetime Learning Credits)," is used by taxpayers to claim education credits. These credits are aimed at reducing the tax liability for individuals who have incurred qualified education expenses for themselves, a spouse, or a dependent enrolled in an eligible educational institution. There are two main types of education credits available: the American Opportunity Tax Credit and the Lifetime Learning Credit. Taxpayers should file Form 8863 if they have paid for qualified tuition and related expenses within the tax year and meet the specific requirements for either or both of these credits.

-

What are the differences between the American Opportunity Tax Credit and the Lifetime Learning Credit?

The American Opportunity Tax Credit (AOTC) and the Lifetime Learning Credit (LLC) both provide benefits for education expenses, but they have key differences. The AOTC offers up to $2,500 per eligible student and is only available for the first four years of post-secondary education. It requires the student to be pursuing a degree or other recognized education credential and to be enrolled at least half time for one academic period during the tax year. Conversely, the LLC offers up to $2,000 per tax return (not per student), and is available for all years of post-secondary education and for courses to acquire or improve job skills. The LLC does not require a minimum enrollment level or pursuit of a degree. Importantly, taxpayers cannot claim both credits for the same student in the same year.

-

How do I determine if I'm eligible to claim education credits using Form 8863?

To be eligible to claim education credits with Form 8863, you must have paid qualified education expenses for higher education for yourself, your spouse, or a dependent for whom you claim an exemption on your tax return. The student must be enrolled in an eligible institution. For the AOTC, the student also needs to be pursuing a degree or certification and be enrolled at least half-time for at least one academic period beginning in the tax year. For the LLC, there is no requirement for a degree pursuit or enrollment level. Additionally, your modified adjusted gross income (MAGI) must fall below certain thresholds to qualify, which are subject to change each year. It's important to note that you cannot claim either credit if you are married filing separately.

-

Can I claim both the American Opportunity Tax Credit and the Lifetime Learning Credit?

No, you cannot claim both the American Opportunity Tax Credit (AOTC) and the Lifetime Learning Credit (LLC) for the same student in the same tax year. However, if you pay qualified education expenses for more than one student, you may be able to claim the AOTC for one student and the LLC for another. When deciding which credit to claim, consider which credit offers the greater tax benefit for your situation. The AOTC is partially refundable, which means if the credit brings the amount of tax you owe to zero, you could be eligible to receive up to 40% of the remaining amount of the credit as a refund. In contrast, the LLC is not refundable.

Common mistakes

When applying for education credits, the IRS Form 8863, specifically tied to the American Opportunity Credit and the Lifetime Learning Credit, is crucial. However, it's common to encounter mistakes that can delay these benefits or impact the amount you can claim. Here are seven common errors to avoid:

-

Not checking eligibility criteria. Before filling out the form, ensure you meet the criteria for the American Opportunity Credit or the Lifetime Learning Credit. Each has specific requirements related to expenses, student status, and income levels.

-

Incorrectly reporting education expenses. It's essential to accurately report qualified education expenses. This includes tuition and necessary fees but doesn't cover room and board, transportation, or insurance.

-

Mixing up student names and Social Security numbers (SSNs). The student’s name and SSN must match what's on their Social Security card. Mixing up details between parents and children or entering a wrong SSN can cause processing delays.

-

Failing to include the school’s Employer Identification Number (EIN). Every educational institution has an EIN, necessary for the IRS to process your credit. Forgetting this number or entering it incorrectly can invalidate your claim.

-

Claiming the wrong credit. Understand the difference between the American Opportunity Credit and the Lifetime Learning Credit. They cater to different types of students and educational circumstances. Selecting the wrong one can lead to a denied claim.

-

Not attaching Form 8863 to your tax return. This form should accompany your tax return if you're claiming either credit. Failing to attach it can result in your education credits being overlooked.

-

Omitting relevant educational institutions. If you or the student attended more than one qualified educational institution, you must provide information for all of them. Overlooking an institution can lead to a reduced credit.

Here are some additional tips to help you navigate this process:

-

Double-check all information for accuracy before submitting your form.

-

Keep records of all educational expenses and financial documents in case the IRS requires further documentation.

-

If you're unsure about your eligibility or how to fill out the form, consider consulting a tax professional. They can provide personalized advice based on your specific situation.

Documents used along the form

Filing taxes can often feel like assembling a complex puzzle, especially when education credits are involved. The IRS Form 8863 is essential for students or parents hoping to claim education credits, specifically the American Opportunity Credit and the Lifetime Learning Credit. However, to accurately fill out this form and ensure you're optimizing your tax return, a series of other documents and forms often come into play. Here’s a comprehensive look at ten such documents that frequently accompany Form 8863, each playing a vital role in painting the full picture of your educational expenses and credits for the IRS.

- Form 1040 or 1040-SR: Often considered the cornerstone of personal tax filings, this form is where you'll summarize your income, deductions, and credits, including those calculated on Form 8863.

- Form 1098-T: Issued by educational institutions, this form provides details about tuition and related expenses paid during the tax year. It's crucial for filling out Form 8863 accurately.

- Form W-2: This wage and tax statement shows the income you've earned from employment, which is necessary to determine your eligibility for certain education credits based on income thresholds.

- Schedule 3 (Form 1040): This schedule is used to claim various credits, including those from Form 8863. It acts as a bridge, transferring your education credit amounts to your main tax return.

- Form 1098-E: If you're paying interest on student loans, this document outlines the amount of interest paid that could be deductible, affecting your tax liability and potential refunds.

- Receipts for Qualified Educational Expenses: While these aren't formally submitted to the IRS, keeping detailed receipts and records of tuition, books, supplies, and other school-related costs is crucial for completing Form 8863.

- Form 1099-INT: For students or parents who have earned interest from savings accounts or other investments, this form must be included to report this income to the IRS.

- Form 8862: If you've previously been disallowed an education credit and wish to claim it again, this form is necessary to demonstrate eligibility for the current tax year.

- State Tax Return Forms: Depending on your state, you might need information from your federal return—including figures from Form 8863—to accurately complete your state tax return.

- Form 8917: Prior to tax year 2021, this form was used to claim tuition and fees deductions. While it's largely obsolete due to recent tax law changes, some taxpayers may still reference it for specific situations carried over from previous years.

When it comes to claiming education credits on your tax return, the devil is truly in the details. Accurately completing Form 8863 and assembling the necessary supporting documents can lead to significant tax savings. However, this process can be complex and nuanced. Keeping organized records and understanding how each of these forms and documents relates to your educational expenses and potential credits is key. When in doubt, consulting with a tax professional can provide personalized guidance tailored to your unique situation, ensuring that you're maximizing your educational credits and complying with IRS regulations.

Similar forms

The IRS Form 1040, the individual income tax return, shares a fundamental connection with Form 8863, Education Credits. Both serve crucial roles in the annual tax filing process, providing taxpayers avenues to report income, deductions, and applicable credits. Form 8863 specifically complements Form 1040 by allowing taxpayers to claim two significant education credits – the American Opportunity Credit and the Lifetime Learning Credit – directly impacting the final tax liability or refund on their 1040 form.

Form 1098-T, Tuition Statement, is closely aligned with Form 8863 in the tax filing process. Educational institutions issue Form 1098-T to students, detailing the amounts billed for tuition and qualified expenses, and scholarships or grants received. Taxpayers use this information to accurately complete Form 8863 and determine their eligibility for education credits, making these documents interdependent in claiming education-based tax benefits.

Form 1040 Schedule 3, Non-refundable Credits, also shares similarities with Form 8863. While Form 8863 is dedicated to calculating education credits, Schedule 3 encompasses a broader range of non-refundable credits, including the education credits calculated on Form 8863. This makes Schedule 3 a consolidating document that incorporates various credits, including those from Form 8863, to adjust income tax owed on the main 1040 form.

IRS Form 8862, Information To Claim Certain Refundable Credits After Disallowance, is indirectly related to Form 8863. If a taxpayer’s claim for the education credits on Form 8863 is denied due to a math or clerical error in a prior year, they may need to file Form 8862 to reinstate their eligibility for these credits. This creates a procedural link between the two forms, highlighting the need for accuracy and compliance in claiming tax benefits.

Form 8917, Tuition and Fees Deduction, is another document that operates in the realm of education-related tax benefits, akin to Form 8863. Prior to its expiration, Form 8917 allowed taxpayers to reduce their taxable income by up to $4,000 for qualified tuition and fees, an alternative to claiming education credits. Although the tuition and fees deduction is not currently available, when it was, taxpayers had to choose between it and the credits on Form 8863, emphasizing the strategic decisions taxpayers make based on their individual circumstances.

IRS Form W-2, Wage and Tax Statement, although primarily a document for reporting wages and taxes withheld by employers, has an indirect relationship with Form 8863. Information from Form W-2 helps taxpayers determine their total income, which in turn affects eligibility for education credits. The total income reported on Form W-2 can influence the phase-out calculations for the American Opportunity and Lifetime Learning Credits on Form 8863, demonstrating their interconnectedness in the tax preparation process.

Form 1099-Q, Payments from Qualified Education Programs, while primarily focused on distributions from 529 plans and Coverdell ESAs, interacts with Form 8863 since it reports payments that may cover qualified education expenses. Taxpayers need to account for these funds when calculating education credits, as using tax-advantaged distribution to pay for expenses can affect the amount of credit claimed on Form 8863.

Lastly, IRS Form 4506-T, Request for Transcript of Tax Return, though more procedural in nature, is a vital tool for taxpayers when dealing with Form 8863. If discrepancies arise or there’s a need to substantiate education credits claimed in prior years, Form 4506-T allows taxpayers to request a copy of their past tax returns. This proves critical for verifying previously claimed education credits and ensuring ongoing eligibility or correcting errors related to Form 8863 submissions.

Dos and Don'ts

Filling out the IRS Form 8863, which relates to education credits, is a crucial process for claiming your entitled benefits accurately. It's imperative to approach this task with diligence and an understanding of the best practices and common pitfalls. Here are essential dos and don'ts to navigate this form successfully.

Dos:

Ensure eligibility before starting: Confirm that you, or the student for whom you are claiming, meet the eligibility criteria for the American Opportunity Credit or Lifetime Learning Credit. This involves evaluating aspects such as enrollment status, academic period, and qualified expenses.

Gather necessary documentation: Before filling out IRS Form 8863, collect all relevant financial documents, such as Form 1098-T from educational institutions, receipts for textbooks, and other academic materials that are not billed directly by the institution but are essential for enrollment or attendance.

Review publication 970: This publication provides detailed guidance on tax benefits for education. It's an invaluable resource for understanding which expenses can be claimed and how to calculate the credits accurately.

Correctly allocate expenses: When dealing with multiple eligible family members, it's crucial to allocate qualified education expenses carefully and accurately among the beneficiaries to maximize the tax benefits.

Keep records: Maintain thorough records of all educational expenses and IRS Form 8863 filed. In case the IRS needs verification or there is a need to amend past returns, having organized records will be invaluable.

Don'ts:

Do not overlook the income phase-out ranges: Being unaware of the adjusted gross income limits could mistakenly lead you to claim an incorrect amount of credit. Ensure to verify the applicable phase-out ranges for your filing status.

Avoid guessing when unsure: If you're uncertain about how to answer a specific question or calculate the credit, seek help. Misreporting or incorrect calculations can lead to audits or penalties.

Do not forget non-tuition expenses: Qualifying educational expenses extend beyond tuition. They can include course materials or supplies required for enrollment or attendance. However, room and board, transportation, and medical expenses are not eligible.

Do not leave sections incomplete: Failing to fully complete the form or neglecting necessary sections can delay processing or lead to denial of the claimed education credits.

Resist the temptation to inflate expenses: Report the qualifying expenses accurately. Inflating expenses to maximize the credit may result in penalties, interest, and a potential audit from the IRS.

Misconceptions

When it comes to taxes, especially those involving education credits, the IRS Form 8863 plays a vital role. However, many people hold misconceptions about this form, sometimes leading to missed opportunities or filing errors. Let's clarify some of these misunderstandings.

Only traditional college students qualify for credits. Many people think that only young adults attending a four-year college qualify for the education credits Form 8863 covers. However, a wide range of students, including those at community colleges, vocational schools, and even older adults returning to education, can be eligible.

Form 8863 is only for the person who pays the tuition. This misconception could prevent eligible family members from claiming a credit. In reality, if a parent or guardian pays for the education expenses, they might be the one eligible to claim the credit, assuming the student is listed as a dependent on their tax return.

You can claim expenses paid with loan money. Some believe that money borrowed for education doesn't count toward eligible expenses on Form 8863. However, as long as the expenses meet the eligibility criteria, it doesn't matter if they were paid out-of-pocket or with borrowed funds.

Every educational expense is eligible for a credit. Not all expenses directly contribute to tuition fees or school needs, such as room and board, transportation, and health fees, are eligible for education credits. Form 8863 focuses on expenses directly related to education, like tuition and required fees.

Form 8863 is hard to fill out. People often feel intimidated by tax forms. But with the right information at hand, including details about relevant educational expenses and student status, completing Form 8863 can be straightforward.

You can claim credits for unlimited years. Education credits have limitations. For instance, the American Opportunity Tax Credit is claimable for only four tax years per eligible student. After this period, you may need to look into the Lifetime Learning Credit, but it's crucial to understand the specifics for each credit.

If you're not due a refund, there's no point in filing Form 8863. This misunderstanding might make people leave money on the table. Even if you owe no taxes, education credits, especially refundable ones like a portion of the American Opportunity Tax Credit, could result in a refund.

Only full-time students are eligible for education credits. While full-time enrollment may maximize eligibility for certain credits, part-time students are not automatically disqualified. The key is to understand the requirements for the American Opportunity and the Lifetime Learning Credits, both of which have different criteria regarding enrollment status.

With these clarifications, it's easier to see how Form 8863 can benefit a broader array of students and families than many initially believe. When in doubt, consulting with a tax professional or carefully reading the instructions for Form 8863 can help ensure that you're making the most of educational tax credits.

Key takeaways

The IRS Form 8863 is used to claim the American Opportunity Credit and the Lifetime Learning Credit, which are education tax credits that can reduce your tax liability.

Taxpayers who pay post-secondary education expenses for themselves, a spouse, or a dependent are eligible to use Form 8863.

Accuracy is crucial when filling out Form 8863; ensuring all information is correct can prevent processing delays or an audit.

To complete Form 8863, you need to have financial information on hand, such as tuition and fees paid, and scholarships or grants received.

The American Opportunity Credit is partially refundable up to a maximum of $2,500 per eligible student, while the Lifetime Learning Credit is non-refundable and offers up to $2,000 per tax return.

Eligibility requirements vary between the two credits; for example, the American Opportunity Credit is only available for the first four years of post-secondary education.

Form 8863 must be attached to your tax return if you're claiming either of these education credits.

The IRS provides detailed instructions for Form 8863, which include examples and definitions to help filers understand eligibility and how to calculate their credits.

Popular PDF Documents

How to Look Up Property Taxes - Massachusetts Tax 128 form is key for property owners seeking an abatement based on inaccurate tax assessments.

Form 4684 Instructions 2022 - For those eligible, Form 4684 offers a pathway to recoup some financial losses when tax season arrives.

IRS 1065 - Form 1065 includes sections for reporting income from various sources, such as sales or services, and deductions such as business expenses.