Get IRS 8862 Form

Navigating the landscape of tax forms can sometimes feel like traversing a maze, especially when it comes to understanding which forms are necessary for an individual's specific situation. Among the various forms issued by the Internal Revenue Service (IRS), Form 8862 stands out for taxpayers who are aiming to claim certain credits after a previous denial. This form serves as a statement to the IRS, allowing taxpayers to requalify for credits such as the Earned Income Credit (EIC), even after it has been previously disallowed. By properly completing and submitting this form, individuals are essentially informing the IRS of their eligibility and correcting any discrepancies that led to their initial claim being rejected. It acts as a critical step for taxpayers looking to make the most of the credits available to them, potentially resulting in a more favorable tax return outcome. Although the process may appear daunting at first, understanding the importance and the mechanics of IRS Form 8862 can significantly ease the journey toward reclaiming eligible tax credits.

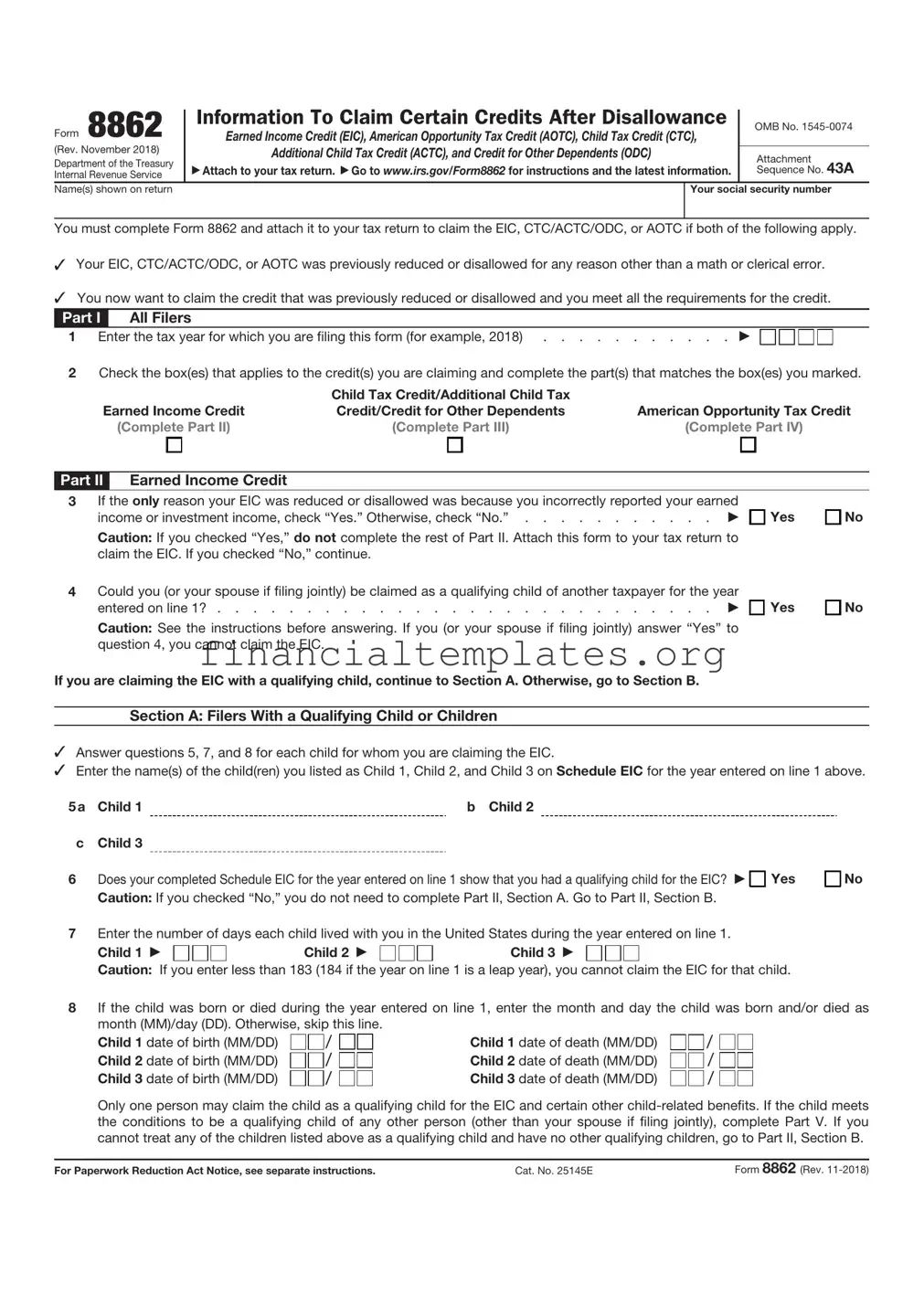

IRS 8862 Example

Form 8862 |

Information To Claim Certain Credits After Disallowance |

OMB No. |

||

Earned Income Credit (EIC), American Opportunity Tax Credit (AOTC), Child Tax Credit (CTC), |

|

|||

(Rev. November 2018) |

Additional Child Tax Credit (ACTC), and Credit for Other Dependents (ODC) |

|

||

Attachment |

||||

Department of the Treasury |

|

|

||

Attach to your tax return. Go to www.irs.gov/Form8862 for instructions and the latest information. |

Sequence No. 43A |

|||

Internal Revenue Service |

||||

|

|

|

||

Name(s) shown on return |

|

Your social security number |

||

|

|

|

|

|

You must complete Form 8862 and attach it to your tax return to claim the EIC, CTC/ACTC/ODC, or AOTC if both of the following apply.

Your EIC, CTC/ACTC/ODC, or AOTC was previously reduced or disallowed for any reason other than a math or clerical error.

You now want to claim the credit that was previously reduced or disallowed and you meet all the requirements for the credit.

Part I |

All Filers |

|

1 |

Enter the tax year for which you are filing this form (for example, 2018) |

|

2Check the box(es) that applies to the credit(s) you are claiming and complete the part(s) that matches the box(es) you marked.

|

Child Tax Credit/Additional Child Tax |

|

Earned Income Credit |

Credit/Credit for Other Dependents |

American Opportunity Tax Credit |

(Complete Part II) |

(Complete Part III) |

(Complete Part IV) |

Part II Earned Income Credit

3If the only reason your EIC was reduced or disallowed was because you incorrectly reported your earned

income or investment income, check “Yes.” Otherwise, check “No.” |

Yes |

Caution: If you checked “Yes,” do not complete the rest of Part II. Attach this form to your tax return to |

|

claim the EIC. If you checked “No,” continue. |

|

No

4Could you (or your spouse if filing jointly) be claimed as a qualifying child of another taxpayer for the year entered on line 1? . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Caution: See the instructions before answering. If you (or your spouse if filing jointly) answer “Yes” to question 4, you cannot claim the EIC.

If you are claiming the EIC with a qualifying child, continue to Section A. Otherwise, go to Section B.

Yes

No

Section A: Filers With a Qualifying Child or Children

Answer questions 5, 7, and 8 for each child for whom you are claiming the EIC.

Enter the name(s) of the child(ren) you listed as Child 1, Child 2, and Child 3 on Schedule EIC for the year entered on line 1 above.

5a Child 1 |

b Child 2 |

c |

Child 3 |

|

6 |

Does your completed Schedule EIC for the year entered on line 1 show that you had a qualifying child for the EIC? |

Yes |

|

Caution: If you checked “No,” you do not need to complete Part II, Section A. Go to Part II, Section B. |

|

7Enter the number of days each child lived with you in the United States during the year entered on line 1.

Child 1 |

Child 2 |

Child 3 |

Caution: If you enter less than 183 (184 if the year on line 1 is a leap year), you cannot claim the EIC for that child.

No

8If the child was born or died during the year entered on line 1, enter the month and day the child was born and/or died as month (MM)/day (DD). Otherwise, skip this line.

Child 1 date of birth (MM/DD) |

/ |

Child 1 date of death (MM/DD) |

/ |

Child 2 date of birth (MM/DD) |

/ |

Child 2 date of death (MM/DD) |

/ |

Child 3 date of birth (MM/DD) |

/ |

Child 3 date of death (MM/DD) |

/ |

Only one person may claim the child as a qualifying child for the EIC and certain other

For Paperwork Reduction Act Notice, see separate instructions. |

Cat. No. 25145E |

Form 8862 (Rev. |

Form 8862 (Rev.

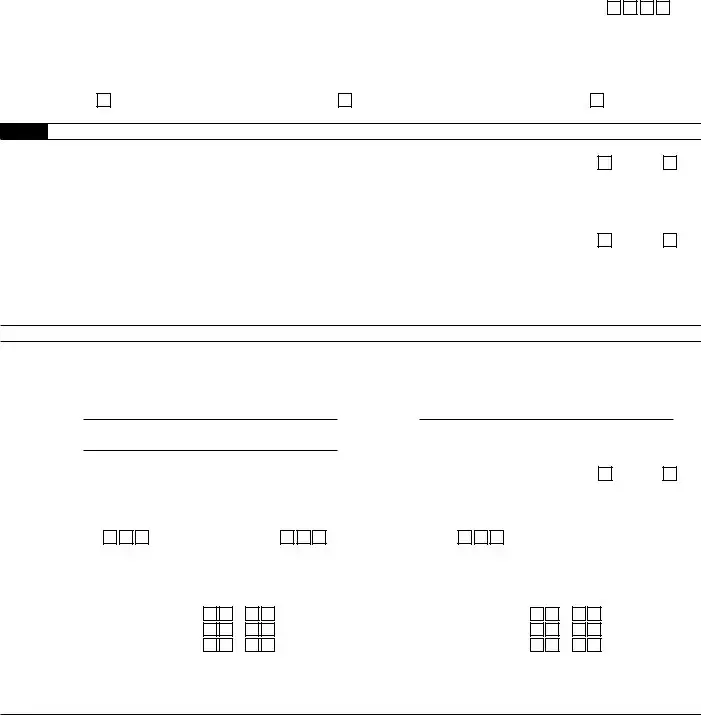

Section B: Filers Without a Qualifying Child or Children

9a Enter the number of days during the year entered on line 1 that your main home was in the United States . . .

bIf married filing jointly, enter the number of days during the year entered on line 1 that your spouse’s main home was

|

in the United States |

|

|

Caution: Members of the military stationed outside the United States during the year entered on line 1, see the instructions |

|

|

before answering. If you enter less than 183 (184 if the year on line 1 is a leap year) on either line 9a or 9b (if filing jointly), you |

|

|

cannot claim the EIC. |

|

10a |

Enter your age at the end of the year on line 1 |

|

b |

Enter your spouse’s age at the end of the year on line 1 |

|

|

Caution: If your spouse died during the year entered on line 1 or you are preparing a return for someone who died during the |

|

|

year entered on line 1, see the instructions before answering. If neither you (nor your spouse if filing jointly) were at least age 25 |

|

|

but under age 65 at the end of the year on line 1, you cannot claim the EIC. |

|

11a Can you be claimed as a dependent on another taxpayer’s return? . . . . . . . . . . . .

bCan your spouse (if filing jointly) be claimed as a dependent on another taxpayer’s return? . . . .

Caution: If either you (or your spouse if filing jointly) answer “Yes” to question 11, you cannot claim the EIC.

Yes Yes

No No

Part III Child Tax Credit/Additional Child Tax Credit/Credit for Other Dependents

12Enter the name(s) of each child for whom you are claiming the child tax credit/additional child tax credit (CTC/ACTC). If you are claiming the CTC/ACTC for more than four qualifying children, attach a statement also answering questions 12 and

a |

Child 1 |

b |

Child 2 |

c |

Child 3 |

d |

Child 4 |

13Enter the name(s) of each person for whom you are claiming the credit for other dependents (ODC). If you are claiming the credit for more than four dependents, attach a statement answering questions 13, 16, and 17 for those dependents.

a |

Other dependent 1 |

b |

Other dependent 2 |

c |

Other dependent 3 |

d |

Other dependent 4 |

14For each child listed in response to question 12, did the child live with you for more than half of the year or meet an exception described in the instructions?

Child 1

Yes

No |

Child 2 |

Yes

No |

Child 3 |

Yes

No |

Child 4 |

Yes

No

15For each child listed in response to question 12, did the child meet the requirements to be a qualifying child for the CTC/ACTC?

Child 1

Yes

No |

Child 2 |

Yes

No |

Child 3 |

Yes

No |

Child 4 |

Yes

No

16For each person claimed as a qualifying child or other dependent for the CTC/ACTC/ODC, is that person your dependent?

Child 1

Yes

No |

Child 2 |

Yes

No |

Child 3 |

Yes

No |

Child 4 |

Yes

No

Other dependent 1

Yes

No |

Other dependent 2 |

Yes

No

Other dependent 3

Yes

No |

Other dependent 4 |

Yes

No

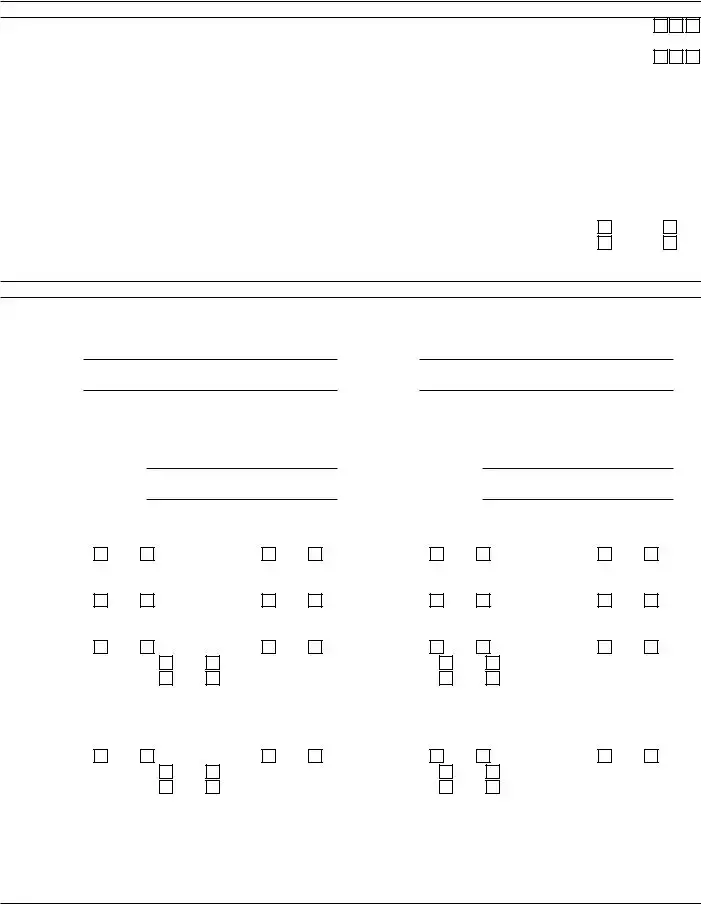

17For each person claimed as a qualifying child or other dependent for the CTC/ACTC/ODC, is that person a citizen, national, or resident of the United States? See Pub. 519 for more information on when a person is a resident of the United States or is treated as a resident of the United States.

Child 1 |

Yes |

Other dependent 1 Other dependent 3

No

Yes

Yes

Child 2

No

No

Yes

No |

Child 3 |

Other dependent 2 Other dependent 4

Yes

Yes

Yes

No |

Child 4 |

No |

|

No |

|

Yes

No

Caution: If the answer is “No” for questions 14, 15, 16, or 17, you cannot claim the CTC/ACTC/ODC for that child or other dependent.

Only one person can claim the child as a qualifying child for the CTC/ACTC/ODC. If the child meets the conditions to be a qualifying child of any other person (other than your spouse if filing jointly), complete Part V. If you cannot treat any of the children listed above as a qualifying child and have no other qualifying children, you cannot claim the CTC/ACTC or the ODC based on having a qualifying child. If you are a noncustodial parent who is entitled to treat the child as a qualifying child, you do not need to complete Part V.

Form 8862 (Rev.

Form 8862 (Rev. |

Page 3 |

|

Part IV |

American Opportunity Tax Credit |

|

Answer the following questions for each student for whom you are claiming the AOTC. If you have more than three students, attach a statement also answering questions 18 and 19 for those students.

Enter the name(s) of the student(s) as listed on Form 8863.

18a Student 1 |

b Student 2 |

cStudent 3

19a Did the student meet the requirements to be an eligible student for purposes of the AOTC for the year entered on line 1? See Pub. 970 for more information.

Student 1

Yes

No |

Student 2 |

Yes

No |

Student 3 |

Yes

No

bHas the Hope Scholarship Credit or AOTC been claimed for the student for any 4 tax years before the year entered on line 1?

Student 1

Yes

No |

Student 2 |

Yes

No |

Student 3 |

Yes

No

Caution: If you answered “No” to question 19a or “Yes” to question 19b, you cannot claim the credit for that student.

Part V Qualifying Child of More Than One Person

Answer the following questions for each child who meets the conditions to be a qualifying child of any other person (other than your spouse if filing jointly). If you have more than four qualifying children, attach a statement also answering questions

20a |

Child 1 |

b |

Child 2 |

c |

Child 3 |

d |

Child 4 |

21Enter the address where you and the child lived together during the year entered on line 1. If you lived with the child at more than one address during the year, attach a list of the addresses where you lived.

Child 1 Number and street

City or town, state, and ZIP code

Child 2 If same as shown for Child 1, check this box

Number and street

City or town, state, and ZIP code

Child 3 If same as shown for Child 1, check this box

Number and street

City or town, state, and ZIP code

Child 4 If same as shown for Child 1, check this box

Number and street

City or town, state, and ZIP code

Otherwise, enter below.

Otherwise, enter below.

Otherwise, enter below.

Form 8862 (Rev.

Form 8862 (Rev. |

Page 4 |

|

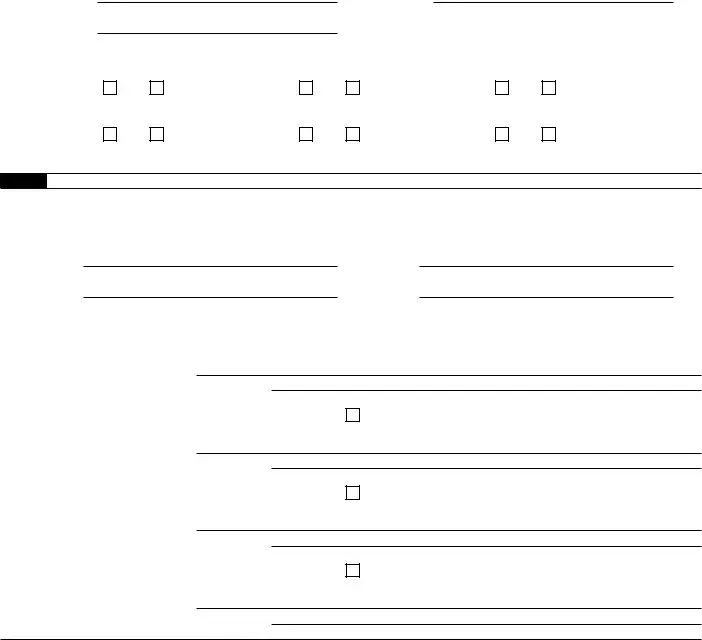

Part V |

Qualifying Child of More Than One Person (continued) |

|

22Did any other person (except your spouse, if filing jointly, and your dependents claimed on your return)

live with Child 1, Child 2, Child 3, or Child 4 for more than half the year? |

Yes |

If “Yes,” enter the relationship of each person to the child on the appropriate line below. |

|

No

Other person living with Child 1: Name

Relationship to Child 1

Other person living with Child 2: If same as shown for Child 1, check this box

Name

Relationship to Child 2

Other person living with Child 3: If same as shown for Child 1, check this box

Name

Relationship to Child 3

Other person living with Child 4: If same as shown for Child 1, check this box

Name

Relationship to Child 4

Otherwise, enter below.

Otherwise, enter below.

Otherwise, enter below.

To determine which person can treat the child as a qualifying child for the EIC and CTC/ACTC, see Qualifying Child of More Than One Person in Pub. 501.

Note: The IRS may ask you to provide additional information to verify your eligibility to claim each credit.

Form 8862 (Rev.

Document Specifics

| Fact Name | Description |

|---|---|

| Form Purpose | The IRS Form 8862 is used to claim the Earned Income Credit (EIC) after it was previously denied or reduced by the IRS. |

| Eligibility Requirement | To file Form 8862, the applicant must have been previously disallowed the EIC for reasons other than a mathematical or clerical error. |

| Filing Frequency | Form 8862 is only required to be filed once to become eligible for EIC again, unless specifically instructed by the IRS to file it again. |

| Attachment to Other Forms | This form must be attached to a tax return where the Earned Income Credit is being claimed. |

| Filing Deadline | The filing deadline for Form 8862 aligns with the tax return it is attached to, typically April 15th of each year. |

| Resubmission | If the EIC is denied in a subsequent year for a reason other than a math or clerical error, Form 8862 must be filed again. |

| Governing Law(s) | Form 8862 and the Earned Income Credit are governed by the U.S. federal tax law, not state-specific laws. |

Guide to Writing IRS 8862

Filling out the IRS 8862 form is a necessary step for taxpayers who wish to claim certain credits after being previously disallowed. This process can be approached carefully to ensure accuracy and compliance with tax regulations. Once completed, this form serves as part of your tax return documentation, signaling to the Internal Revenue Service that you are eligible to claim the desired credits once again. The following steps are designed to guide you through the completion of the IRS 8862 form efficiently and accurately.

- Start by gathering all required information, including your Social Security Number, the tax year you are filing for, and details about the credits you were previously disallowed.

- Obtain the latest version of the IRS 8862 form from the Internal Revenue Service website to ensure you are using the most up-to-date document.

- Read the form's instructions carefully to familiarize yourself with the specific information and documentation needed to fill out the form properly.

- Enter your full name as it appears on your tax return, along with your Social Security Number, at the top of the form.

- Specify the tax year for which you are filing the IRS 8862 form.

- Check the box that corresponds to the tax credit you are claiming. If you are claiming more than one credit, make sure to check all applicable boxes.

- Provide detailed information about the credit you are claiming. This may include the amount of the credit, the reason it was previously disallowed, and any other relevant details.

- Review the form thoroughly to ensure all provided information is accurate and complete. Making sure every detail is correct now can save time and prevent issues later.

- Sign and date the form, verifying that all the information you've provided is true and correct to the best of your knowledge.

- Attach the completed IRS 8862 form to your tax return. Make sure to include it with any other necessary documentation when you file your taxes.

After submitting your tax return with the attached IRS 8862 form, the next steps involve waiting for the Internal Revenue Service to process your documents. They may reach out if additional information is needed. Successfully completing and submitting this form can reinstate your eligibility for the credits you're claiming, potentially impacting your tax refund or liability. Patience is key, as the review process may take some time. Keep a copy of all submitted documents for your records.

Understanding IRS 8862

-

What is the IRS Form 8862?

IRS Form 8862, "Information To Claim Certain Refundable Credits After Disallowance," is used by taxpayers who have previously had certain tax credits, such as the Earned Income Credit, Additional Child Tax Credit, and American Opportunity Credit, disallowed. This form allows them to re-qualify and claim these credits on future tax returns, provided they meet specific criteria.

-

Who needs to file the IRS Form 8862?

Any taxpayer whose claim for a specific credit was previously disallowed and now wishes to claim the same credit must file Form 8862. This requirement does not apply if the disallowance was due to a mathematical or clerical error.

-

When should IRS Form 8862 be filed?

This form should be filed with your tax return in the year you wish to claim the credit, after it was disallowed. Make sure you meet all other eligibility requirements for the credit you're claiming.

-

Is IRS Form 8862 needed every year?

No, Form 8862 does not need to be filed every year. It's only necessary when you are reapplying for a credit that was previously disallowed. Once approved, you do not need to file Form 8862 for subsequent years unless the same credit gets disallowed again in the future.

-

What information is required on Form 8862?

To complete Form 8862, you'll need your personal information and details about the credit that was disallowed. This includes the tax year the disallowance occurred, the specific credit you're claiming, and information supporting your eligibility for the credit.

-

How does the IRS decide if someone is ineligible for a credit after filing Form 8862?

The IRS evaluates your eligibility based on the information provided on Form 8862 and your tax return. If the IRS determines that you do not meet the requirements for the credit, your claim will be disallowed. In some cases, the IRS may request additional documentation to verify your eligibility.

-

What happens if Form 8862 is not filed when required?

If you do not file Form 8862 when it's required, the IRS will not allow you to claim the tax credit you're seeking. This means you could miss out on a potentially significant refundable credit.

-

Can Form 8862 affect the processing time of a tax return?

Yes, including Form 8862 with your tax return can potentially increase the processing time. This is because the IRS may need additional time to verify the information on the form and determine your eligibility for the claimed credit.

-

How can someone get help with filling out Form 8862?

If you need help with Form 8862, consider consulting with a tax professional. You can also find instructions and resources on the IRS website or seek assistance from community programs offering free tax help to eligible taxpayers.

-

Is there a deadline for filing IRS Form 8862?

Form 8862 should be filed with your tax return for the year in which you wish to claim the credit. Therefore, the deadline matches the tax filing deadline for that year, typically April 15th, unless an extension is filed.

Common mistakes

When filing the IRS 8862 form, which is used to claim the Earned Income Credit (EIC) after it was previously denied, many individuals inadvertently make errors that can lead to delays or further disqualifications. Understanding and avoiding these common mistakes are crucial for a smooth processing of the claim. Here are six frequent errors encountered:

-

Not updating personal information: Often, filers forget to update their personal information such as address, marital status, or number of dependents. This can lead to discrepancies in the claim that may result in its rejection.

-

Failing to include all required documents: The IRS mandates that specific documents accompany the 8862 form to validate the claim. Neglecting to attach all necessary paperwork, especially documents that evidence income or dependent information, is a common oversight.

-

Inaccurately reporting income: Misreporting income, whether by underreporting, overreporting, or failing to report all sources of income, can significantly impact the eligibility and calculation of the EIC.

-

Overlooking the eligibility criteria: Each year, the criteria for the EIC might change. Filers often overlook these changes and submit the form under outdated eligibility assumptions, leading to a denial.

-

Math errors in calculation: Even small mathematical errors in calculating the credit can cause the IRS to scrutinize or adjust the claim. Accuracy in all calculations is paramount.

-

Submitting the form for the wrong tax year: It’s not uncommon for filers to inadvertently use the form for the wrong tax year. This mistake can automatically disqualify the claim, requiring the individual to restart the process with the correct form.

Being diligent in reviewing the form for accuracy and completeness can greatly enhance the likelihood of the Earned Income Credit claim being accepted. Equally important is ensuring that all information provided aligns with the IRS requirements for the current filing year.

Documents used along the form

The IRS Form 8862 is a critical document for taxpayers who need to claim certain credits after previously being disallowed. Often, navigating the tax landscape requires more than just one form, especially when you're trying to correct or clarify past issues. Alongside the 8862, there are several other forms and documents that you might find yourself needing to ensure everything is complete and accurate. Here’s a rundown of these essential documents.

- IRS Form 1040: This is the standard Federal Income Tax Return form. It's used by individuals to report their annual income and calculate taxes owed or refunds due. It's fundamental because it serves as the base document that other forms and schedules attach to, establishing your tax situation.

- IRS Schedule EIC: If you're claiming the Earned Income Credit (after being disallowed in a prior year, hence Form 8862), Schedule EIC helps provide detailed information about your qualifying children. This allows the IRS to determine eligibility and the correct amount of your credit.

- IRS Form 1040-SR: For taxpayers who are age 65 or older, Form 1040-SR offers a simplified way to file their taxes. It covers the same information as the standard 1040 but is designed to be easier for seniors to use.

- IRS Form 1099-MISC: This document is essential if you’re self-employed or have earned income other than a salary. It reports non-employment income, which could affect your eligibility for certain credits claimed on Form 8862.

- IRS Form W-2: The W-2 is crucial as it reports your wage and tax information from your employer. It's necessary for accurately filling out your 1040 form and supports any claim made on Form 8862 regarding earned income.

- IRS Form 8863: If you're looking to claim education credits such as the American Opportunity Credit or Lifetime Learning Credit, Form 8863 will be required. These credits have specific eligibility criteria that must be met.

- IRS Form 2441: For taxpayers claiming child and dependent care expenses, this form is essential. It helps calculate the allowable amount of your credit, which can also impact the credits being claimed with Form 8862.

Understanding and filling out these documents can seem daunting, but they are crucial steps in managing your taxes effectively, particularly if you're addressing past disallowances with Form 8862. Each form serves a unique purpose in painting a complete picture of your financial situation to the IRS, ensuring you receive any credits you're entitled to while complying with tax laws. Approaching this process with care and thoroughness will help streamline your tax filing experience.

Similar forms

The IRS 1040 form, commonly known as the U.S. individual income tax return, showcases similarities to the IRS 8862 form in its purpose of reconciling an individual’s tax liability with income, deductions, and credits claimed. Both forms are integral to calculating taxes owed or refunds due, but the 8862 is specifically used to claim certain credits after disallowance.

The IRS Schedule EIC (Earned Income Credit) accompanies a tax return to provide specific information about dependents which is necessary for claiming the Earned Income Tax Credit, akin to how form 8862 is used to reinstate eligibility for this credit if previously disallowed.

Form 8863, Education Credits (American Opportunity and Lifetime Learning Credits), resembles the 8862 in its function to claim specific tax benefits, focusing on education credits rather than the Earned Income Credit or child tax credits, highlighting the tailored approach of the IRS forms towards specific tax benefits.

Similar to form 8862, the IRS Form 2441, Child and Dependent Care Expenses, is used for claiming specific tax benefits directly related to child and dependent care. Both forms contribute to tax filers' eligibility for particular credits based on personal and family expenses.

Form 5695, Residential Energy Credits, parallels Form 8862 by targeting a particular area of tax credits, this time for energy-efficient home improvements. While form 8862 pertains to the reinstatement of eligibility for certain credits, form 5695 addresses the claiming process for different types of incentives.

IRS Form W-7, Application for IRS Individual Taxpayer Identification Number, shares a commonality with Form 8862 in regard to its specific audience and purpose. While Form W-7 is used by individuals requiring an ITIN to file U.S. tax returns, the 8862 form is specifically for those needing to requalify for tax credits previously denied.

Form 8839, Qualified Adoption Expenses, is designed for taxpayers to claim adoption-related expenses, showing a similarity to form 8862 in the sense that both deal with personal family situations that impact tax liabilities and potential credits.

Form 8962, Premium Tax Credit (PTC), is akin to form 8862, in that both are used to navigate the complexities of claiming tax credits. Form 8962 is specific to the Affordable Care Act, helping taxpayers reconcile or claim the premium tax credit, just as 8862 helps with the Earned Income Credit and child tax credits.

Lastly, Form 8857, Request for Innocent Spouse Relief, although not a direct analog to form 8862 in terms of subject matter, resembles it in the sense of serving individuals in specific tax situations seeking relief or reinstatement of certain tax benefits or relief from joint tax liabilities.

Dos and Don'ts

When preparing to fill out the IRS Form 8862, individuals should take certain steps to ensure accuracy and compliance with tax laws. Form 8862 is used to claim the Earned Income Credit (EIC) after it was previously disallowed. Paying attention to detail and following IRS instructions can prevent errors and delays with your tax return. Below are essential do's and don'ts to consider:

Do:- Read the instructions provided by the IRS for Form 8862 carefully to understand the criteria for eligibility.

- Ensure all personal information, including your Social Security Number (SSN) and that of any dependents, is accurate and matches records with the Social Security Administration.

- Provide detailed and accurate information about your income to calculate the correct amount of Earned Income Credit.

- Check the box in Part I only if the IRS told you to file Form 8862, unless another exception applies as described in the form instructions.

- Use the IRS’s tax tables and the Earned Income Credit (EIC) instructions to determine the correct amount of credit you're claiming.

- Sign and date the form, as an unsigned form may lead to processing delays or denial of the EIC.

- Attach Form 8862 to your tax return if filing by paper.

- Keep a copy of Form 8862 and your tax return for your records.

- Review the entire form before submission to ensure there are no mistakes.

- Consult a tax professional if you encounter difficulties or have questions about your eligibility for the EIC.

- Attempt to claim the EIC if you do not meet the eligibility requirements, as this can lead to errors or an audit.

- Forget to update your personal information if there have been changes since you last filed your taxes.

- Omit any income, as all earnings must be accurately reported to calculate the EIC.

- File Form 8862 if you were not specifically instructed by the IRS to do so, unless you meet other criteria outlined in the instructions.

- Guess on figures or information; always use actual numbers from your financial records.

- Overlook the need for a valid SSN for you, your spouse (if filing jointly), and any qualifying children listed on the form.

- Submit the form without reviewing it for accuracy, as errors can delay processing and affect your credit.

- Ignore IRS notices regarding your EIC claim, as failing to respond can result in denial of the credit.

- Forget to attach the form to your tax return if filing a paper return, as this will result in processing delays.

- Hesitate to seek help from a tax professional or the IRS if you are unsure about any part of the process.

Misconceptions

The IRS Form 8862 is often misunderstood, leading to a variety of misconceptions. Clarifying these can provide a clearer roadmap for taxpayers regarding its purpose, necessity, and implications.

It's only for those who have never filed taxes before. This is incorrect. The IRS Form 8862 is specifically designed for taxpayers who have previously claimed the Earned Income Tax Credit (EITC) but were disallowed for any reason other than a mathematical or clerical error. It serves as a mechanism to request the IRS to reconsider eligibility for the EITC.

Filling out Form 8862 automatically restores the EITC. Merely submitting this form does not guarantee that the Earned Income Tax Credit (EITC) will be reinstated. The IRS evaluates the form along with your tax return to determine eligibility based on current financial and dependency information.

Form 8862 is a one-time requirement. Not necessarily. You may need to file Form 8862 again if, after being approved for the EITC post-disallowance, you subsequently have the credit denied in future years for reasons other than a mathematical error on your return.

If you've been denied the EITC, you can't claim the credit until you file Form 8862. This assertion misses a crucial nuance. If the IRS denies your EITC and requires Form 8862, you must submit it with your next tax return to possibly reclaim the credit. However, if the denial was due to a different issue (like income adjustments not related to the EITC), you might not need to file Form 8862 to claim the EITC in future years.

Form 8862 is only for claiming the EITC. While the primary use of Form 8862 is indeed related to the EITC, it's worth noting that the form sometimes intersects with other tax credits and benefits eligibility reviews. However, its primary association is with reclaiming the EITC after a previous disallowance.

Everyone who files a tax return needs to fill out Form 8862. This statement is not true. Only individuals who have been specifically disallowed from claiming the EITC due to reasons beyond simple clerical errors need to consider filing Form 8862. It is not a general requirement for all taxpayers.

Understanding the specific conditions and requirements of IRS Form 8862 is crucial for accurately navigating its implications and ensuring rightful eligibility for the EITC is assessed and potentially reclaimed.

Key takeaways

The IRS Form 8862 is used by individuals who need to claim the Earned Income Credit (EIC) after it was previously denied or reduced. Here are key takeaways regarding the completion and use of this form:

- Eligibility Reevaluation: Filing IRS Form 8862 is necessary when a taxpayer’s claim for the Earned Income Credit (EIC) has been disallowed in a previous year, and they wish to claim it again. This form serves as a request to the IRS to reevaluate their eligibility for the EIC.

- Accuracy is Crucial: When filling out Form 8862, it is imperative that all information provided is accurate and complete. Errors or omissions can lead to delays in processing or further disallowance of the EIC.

- Documentation: Taxpayers should gather all relevant financial documents and records that support their eligibility for the EIC before filling out Form 8862. This includes income statements, investment records, and documents related to qualifying children, if applicable.

- Filing Status: It’s important for taxpayers to review their filing status and ensure it’s correct before submitting Form 8862. The EIC is affected by the taxpayer's filing status, and an incorrect status can result in the denial of the credit.

- IRS Notices: If the IRS sends a notice requesting the completion of Form 8862, taxpayers should respond promptly to avoid losing their eligibility for the EIC in the current tax year.

Popular PDF Documents

Is Income Averaging Still Allowed by the Irs - This form helps people in farming or fishing businesses smooth out their taxes, considering the ups and downs in their income.

What Does G Mean on Costco Receipt - Highlighting the essential steps and documentation needed for processing a sales tax exemption claim with Costco Wholesale.