Get IRS 8857 Form

Navigating the complexities of tax obligations can be challenging, especially when situations arise that aren't straightforward. For individuals who find themselves facing tax liabilities due to actions or decisions made by their spouse or former spouse, the Internal Revenue Service provides a form of relief known as the IRS 8857, or Request for Innocent Spouse Relief. This critical form offers a potential pathway to absolve oneself from tax debts under specific conditions, stemming from joint tax filings. Generally, when couples file their taxes together, each person is jointly and severally liable for any tax debt or discrepancies that might arise. However, circumstances such as divorce, separation, or other situations where one spouse may not have been fully aware or consenting to financial decisions can unjustly impact an individual's tax responsibilities. The 8857 form serves as a tool to appeal to the IRS, explaining why one should not be held liable for these debts based on information that was unknown or beyond their control. It's a crucial step for those seeking to disentangle themselves from tax issues not of their making, offering a beacon of hope for starting anew financially.

IRS 8857 Example

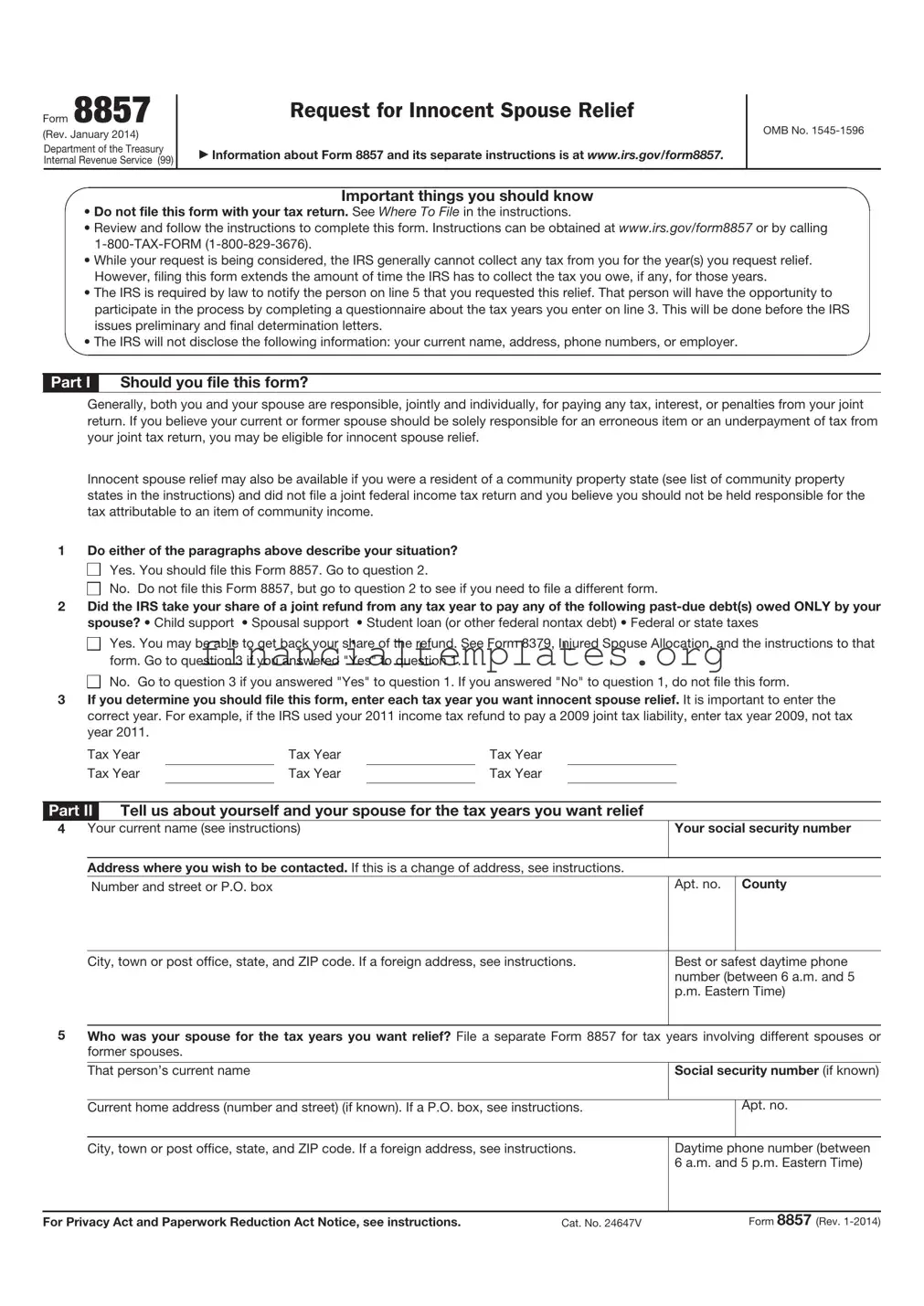

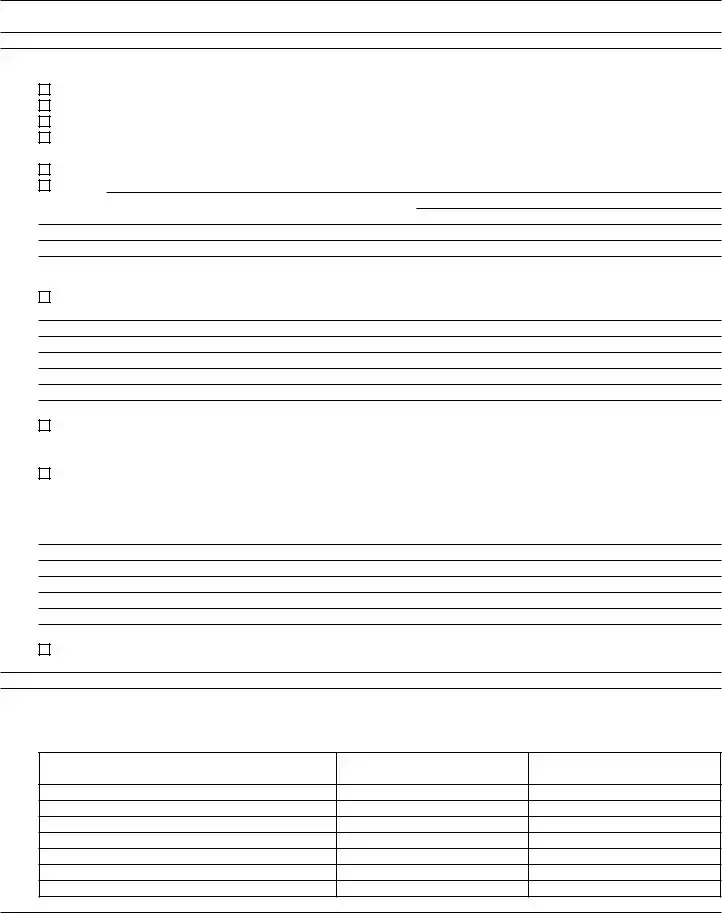

Form 8857

(Rev. June 2021)

Department of the Treasury

Internal Revenue Service (99)

Request for Innocent Spouse Relief

▶Go to www.irs.gov/Form8857 for instructions and the latest information.

OMB No.

IMPORTANT THINGS YOU SHOULD KNOW

•Do not file this form with your tax return. See Where To File in the instructions.

•See the instructions for this form and Pub. 971, Innocent Spouse Relief, for help in completing this form and for a description of the factors the IRS takes into account in deciding whether to grant innocent spouse relief. The Form 8857 instructions and Pub. 971 are available at www.irs.gov.

•Attach the complete copy of any document requested or that you otherwise believe will support your request for relief.

•The IRS is required by law to notify the person listed on line 6 that you have requested this relief. That person will have the opportunity to participate in the process by completing a questionnaire about the tax years you enter on line 3 (the years for which you want innocent spouse relief).

•The IRS will not disclose the following information: your current name, address, phone numbers, or employer(s).

•Note: If you petition the Tax Court to review your request for relief, the Tax Court may only be allowed to consider information you or the person on line 6 provided us before we made our final determination, additional information we included in our administrative file about your request for relief, and any information that is newly discovered or previously unavailable. Therefore, it is important that you provide us with all information you want us or the Tax Court to consider.

Note: If you need more room to write your answer for any question, attach more pages. Be sure to write your name and social security number on the top of all pages you attach.

Part I Should you file this form?

Generally, both taxpayers who file a joint return are responsible, jointly and individually, for paying any tax, interest, or penalties from your joint return. If you believe the person with whom you filed a joint return should be solely responsible for an erroneous item or an underpayment of tax from your joint tax return, you may be eligible for innocent spouse relief.

Innocent spouse relief may also be available if you were a resident of a community property state (see list of community property states in the instructions) and did not file a joint federal income tax return and you believe you should not be held responsible for the tax attributable to an item of community income.

1 Do either of the paragraphs above describe your situation?

Yes. You can file this Form 8857. Go to line 2.

No. Do not file this Form 8857, but go to line 2 to see if you can file a different form.

2Did the IRS take your share of a joint refund from any tax year to pay any of the following

• Child support |

• Spousal support |

• Student loan (or other federal nontax debt) |

• Federal or state taxes |

Yes. You may be able to get back your share of the refund. See Form 8379, Injured Spouse Allocation, and its instructions. Go to line 3 if you answered “Yes” to line 1.

No. Go to line 3 if you answered “Yes” to line 1. If you answered “No” to line 1, do not file this form.

3If you determine you should file this form, enter each tax year you want innocent spouse relief. It is important to enter the correct year. For example, if the IRS used your 2020 income tax refund to pay a 2018 joint tax liability, enter tax year 2018, not tax year 2020.

Tax Year |

|

Tax Year |

|

Tax Year |

Tax Year |

|

Tax Year |

|

Tax Year |

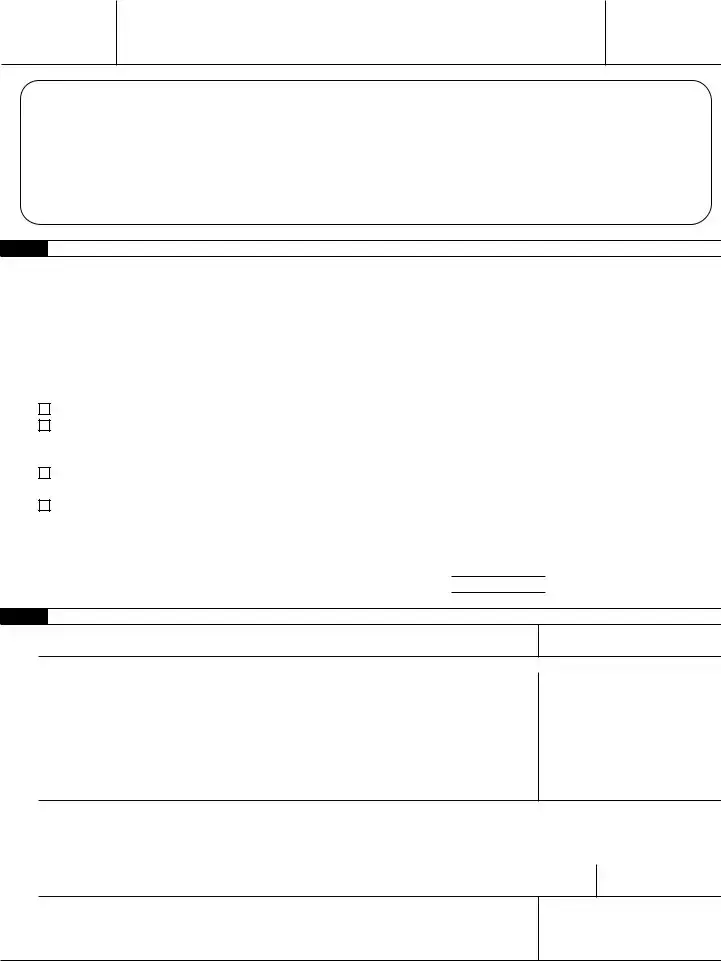

Part II Tell us about yourself and the person listed on line 6 for the tax years you want relief.

4Is English your primary or preferred language?

Yes.

Yes.

No. If “No,” what is your primary or preferred language?

No. If “No,” what is your primary or preferred language?

5 Your current name (see instructions) |

Your social security number |

Address where you wish to be contacted. Check here if you want the IRS to send all mail for you, including legal notices, to this address (see instructions): . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

|

Number and street or P.O. box |

|

Apt. no. |

County |

|

|

|

|

|

|

|

|

City, town or post office, state, and ZIP code. If a foreign address, see instructions. |

Best or safest daytime phone |

|||

|

|

|

number (between 6 a.m. and |

||

|

|

|

5 p.m. Eastern time) |

||

|

|

|

|

|

|

|

|

|

Check here if you consent to |

||

|

|

|

the IRS leaving a voicemail |

||

|

|

|

message at this number ▶ |

||

|

|

|

|

|

|

For Privacy Act and Paperwork Reduction Act Notice, see instructions. |

Cat. No. 24647V |

|

Form 8857 (Rev. 6- |

2021) |

|

Form 8857 (Rev. |

Page 2 |

Your current name |

Your social security number |

Note: If you need more room to write your answer for any question, attach more pages. Be sure to write your name and social security number on the top of all pages you attach.

6Who was your spouse for the tax years you want relief? File a separate Form 8857 for tax years involving different spouses or former spouses.

That person’s current name

Social security number (if known)

Current home address (number and street) (if known). If a P.O. box, see instructions.

Apt. no.

City, town or post office, state, and ZIP code. If a foreign address, see instructions.

Daytime phone number (between 6 a.m. and 5 p.m. Eastern time)

7 What is the current marital status between you and the person on line 6?

Married and still living together

Married and living apart since

|

MM/DD/YYYY |

|

Widowed since |

|

Attach a photocopy of the death certificate and will (if one exists). |

|

MM/DD/YYYY |

|

Legally separated since |

|

Attach a photocopy of your entire separation agreement. |

|

MM/DD/YYYY |

|

Divorced since |

|

Attach a photocopy of your entire divorce decree. |

|

MM/DD/YYYY |

|

Note: A divorce decree stating that your former spouse must pay all taxes does not necessarily mean you qualify for relief.

8What was the highest level of education you had completed when the return or returns were filed? If the answers are not the same for all tax years, explain below.

Did not complete high school

Did not complete high school

High school diploma or equivalent

High school diploma or equivalent

Some college

Some college

College degree or higher. List any degrees you have ▶

College degree or higher. List any degrees you have ▶

List any

9When any of the returns listed on line 3 were filed, did you have a mental or physical health problem or do you have a mental or physical health problem now? If the answers are not the same for all tax years, explain below.

Yes. Attach a statement to explain the problem and when it started. Provide photocopies of any documentation, such as medical bills or a doctor’s report or letter.

Yes. Attach a statement to explain the problem and when it started. Provide photocopies of any documentation, such as medical bills or a doctor’s report or letter.

No. Explain ▶

No. Explain ▶

10 Is there any information you are afraid to provide on this form, but are willing to discuss?

Yes

No

Part III Tell us if and how you were involved with finances and preparing returns for the tax years you want relief.

11Did you intend to file a joint return for the tax year(s) listed on line 3? See instructions. Explain why or why not ▶

Yes

No

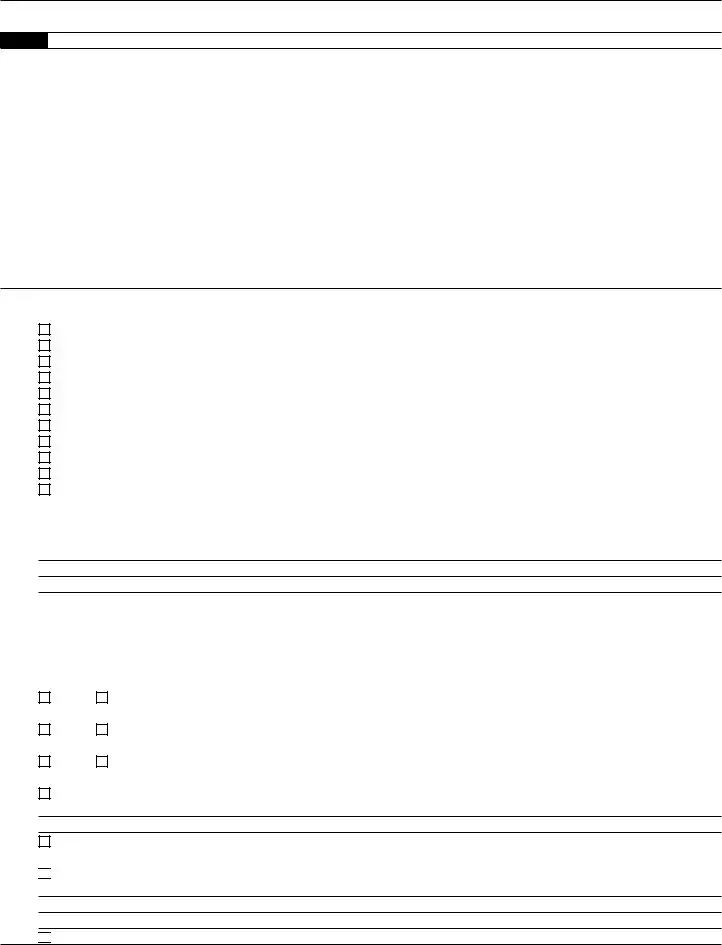

Form 8857 (Rev.

Form 8857 (Rev. |

Page 3 |

Your current name |

Your social security number |

Note: If you need more room to write your answer for any question, attach more pages. Be sure to write your name and social security number on the top of all pages you attach.

12Describe your involvement in preparing the returns. Include details such as whether you prepared or assisted in the preparation of joint returns (for example, by providing Forms

13Explain what you knew about the income of the person on line 6 when the returns were filed. For example, describe each type of income that person had (such as wages, social security, gambling winnings, or

14Explain what you knew about any missing information on the returns when they were filed, and whether you asked about anything on the returns that you knew was missing. Also, explain what you knew about any incorrect information on the returns, even if you did not know the information was incorrect when the returns were filed, and whether you asked about anything on the returns that was incorrect. For example, if there was a deduction or credit on the returns, were you aware of any facts that made the item not allowable as a deduction or credit? If the answer is not the same for all tax years, explain below.

15If the returns showed a balance due to the IRS, explain when and how you thought the balance due would be paid. If you didn’t know the returns showed a balance due, explain why not.

16Describe any financial problems you were having when the returns were filed, such as bankruptcy or bills you could not pay. If the financial problems were not the same for all tax years, explain below.

17Describe how you were involved in the household finances and your role in deciding how money was spent. For example, explain whether you and the person on line 6 had joint accounts and how you or the person on line 6 used them (such as by making deposits, paying bills from those accounts, or reviewing the monthly bank statements). Explain what you knew about any separate accounts the person on line 6 had. If your involvement was not the same for all tax years, explain below.

18 For the years you want relief, did you or the person on line 6 incur any large purchases and/or expenses?

Yes

No

If “Yes,” describe any large expenses you or the person on line 6 incurred (such as trips, home improvements, or private schooling), or any large purchases you or the person on line 6 made (such as automobiles, appliances, jewelry, etc.). Include the types and amounts of the expenses and purchases and the years they were incurred or made.

Form 8857 (Rev.

Form 8857 (Rev. |

Page 4 |

Your current name |

Your social security number |

Note: If you need more room to write your answer for any question, attach more pages. Be sure to write your name and social security number on the top of all pages you attach.

19 Did the person on line 6 transfer any assets to you? |

Yes |

No |

If “Yes,” list the assets (money or property, such as real estate, stocks, bonds, or other property) the person on line 6 transferred to you. Include the dates they were transferred and their fair market value on the dates of transfer. If the property was secured by any debt (such as a mortgage on real estate), explain who was responsible for making payments on the debt, how much was owed on the debt at the time of transfer, and whether the debt has been satisfied. Explain why the assets were transferred to you. If you no longer possess or own the assets, explain what happened to the assets.

Part IV Tell us about your current financial situation.

20Tell us about your assets. Your assets are your money and property. Property includes real estate, motor vehicles, stocks, bonds, and other property that you own. In the table below, list the amount of cash you have on hand and in your bank accounts. Also, list each item of property, the fair market value (as defined in the instructions) of each item, and the balance of any outstanding loans you used to acquire each item.

Description of Asset

Fair Market Value

Balance of Any Outstanding Loans You Used To Acquire the Asset

21 How many people are you currently supporting, including yourself?

22 Tell us your current average monthly income and expenses for your entire household.

|

Monthly |

Amount |

|

Gifts |

|

|

Wages (gross pay) |

|

|

Pensions |

|

|

Unemployment |

|

|

Social security |

|

|

Government assistance, such as housing, food stamps, grants, etc |

|

|

Alimony |

|

|

Child support |

|

|

|

|

|

Rental income |

|

|

Interest and dividends |

|

|

Other income, such as disability payments, gambling winnings, etc. List each type below: |

|

|

Type |

|

|

Type |

|

|

Type |

|

|

Total Monthly Income |

|

|

|

Form 8857 (Rev. |

Form 8857 (Rev. |

Page 5 |

Your current name |

Your social security number |

Note: If you need more room to write your answer for any question, attach more pages. Be sure to write your name and social security number on the top of all pages you attach.

|

Monthly |

Amount |

|

|

Food and Personal Care: |

|

|

|

Food |

|

|

|

Housekeeping supplies |

|

|

|

Clothing and clothing services |

|

|

|

Personal care products and services |

|

|

|

Transportation: |

|

|

|

Auto loan/lease payment, gas, insurance, licenses, parking, maintenance, etc |

|

|

|

Public transportation |

|

|

|

Housing and Utilities: |

|

|

|

Rent or mortgage |

|

|

|

Real estate taxes and insurance |

|

|

|

Electric, oil, gas, water, trash, etc |

|

|

|

Telephone and cell phone |

|

|

|

Cable and Internet |

|

|

|

Medical: |

|

|

|

Health insurance premiums |

|

|

|

|

|

|

|

Other: |

|

|

|

Child and dependent care |

|

|

|

Caregiver expenses |

|

|

|

Income tax withholding (federal, state, and local) |

|

|

|

Estimated tax payments |

|

|

|

Term life insurance premiums |

|

|

|

Retirement contributions (employer required) |

|

|

|

Retirement contributions (voluntary) |

|

|

|

Union dues |

|

|

|

Unpaid state and local taxes (minimum payment) |

|

|

|

Student loans (minimum payment) |

|

|

|

|

|

|

|

garnishments). List each type below: |

|

|

|

Type |

|

|

|

Type |

|

|

|

Type |

|

|

|

Miscellaneous |

|

|

|

Total Monthly Expenses |

|

|

Part V Complete this part if you were (or are now) a victim of domestic violence or abuse.

This information is not mandatory. See Pub. 971 for assistance. If you have concerns about your safety, please consider contacting the confidential

23a Were you or a member of your family a victim of abuse or domestic violence by the person on line 6? (Abuse includes physical, psychological, sexual, emotional, or financial abuse, and can include the abuser making you afraid to disagree with him or her or causing you to fear for your safety.)

Yes. Complete the questions below. We will put a code on your separate account. This will enable us to respond appropriately and be sensitive to your situation.

Note: We will remove the code from your account if you request it. If you do not want us to put the code on your account check here.

No. If “No,” go to Part VI.

Form 8857 (Rev.

Form 8857 (Rev. |

Page 6 |

Your current name |

Your social security number |

Note: If you need more room to write your answer for any question, attach more pages. Be sure to write your name and social security number on the top of all pages you attach.

bDescribe the abuse you experienced, including approximately when it began and how it may have affected you, your children, or other members of your family. Explain how this abuse affected your ability to question the reporting of items on your tax return or the payment of the tax due on your return. Please attach a written statement, if needed.

cAre you afraid of the person listed on line 6?

Yes

No

dDoes the person listed on line 6 pose a danger to you, your children, or other members of your family?

Yes

No

To properly evaluate your claim, please attach copies of documentation you may have, for example:

•Protection and/or restraining order;

•Police reports;

•Medical records, including those of therapists or counselors;

•Doctor’s report or letter;

•Injury photographs;

•A statement from someone who was a victim of or witnessed the abuse or the results of the abuse; and

•Any other documentation you may have.

Part VI |

Additional information |

24Please provide any other information you want us to consider from the years that this form is about or any other years during which you filed a joint return with the person you listed on line 6 in determining whether it would be unfair to hold you liable for the tax.

Part VII Tell us if you would like a refund.

25 By checking this box and signing this form, you are indicating that you would like a refund if you qualify for relief and if you already paid the tax. See instructions . . . . . . . . . . . . . . . . . . . . . . . .

Reminder: Please attach the complete copy of any document requested or that you otherwise believe will support your request for innocent spouse relief.

Caution:

By signing this form, you understand that, by law, we must contact the person on line 6. See instructions for details.

Sign Here

Under penalties of perjury, I declare that I have examined this form and any accompanying schedules and statements, and to the best of my knowledge and belief, they are true, correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

Keep a copy for your records.

Paid

Preparer

Use Only

▲ |

Your signature |

|

|

|

|

|

Date |

|

|

|

|

|

|

|

|

|

|

|

|

||

Print/Type preparer’s name |

|

Preparer’s signature |

|

Date |

|

Check |

if |

|

PTIN |

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

Firm’s name ▶ |

|

|

|

|

Firm’s EIN ▶ |

|

|

|

||

Firm’s address ▶ |

|

|

|

|

Phone no. |

|

|

|

||

Form 8857 (Rev.

Document Specifics

| Fact Name | Description |

|---|---|

| Purpose of Form 8857 | The primary purpose of IRS Form 8857, Request for Innocent Spouse Relief, is to allow a taxpayer to request relief from joint tax liabilities if they believe holding them responsible would be unfair. |

| Eligibility Criteria | To qualify for innocent spouse relief, one must meet specific IRS criteria, such as not knowing and having no reason to know of the understated tax or erroneous items attributed to their spouse or former spouse. |

| Types of Relief Available | Form 8857 covers three types of relief: innocent spouse relief, separation of liability relief, and equitable relief. Each type addresses different scenarios and offers distinct paths for tax liability relief. |

| Time Frame for Filing | A request for innocent spouse relief must be filed no later than two years after the date the IRS first attempted to collect the tax. This deadline is critical for those seeking relief. |

| Impact of Community Property Laws | In some states, community property laws may affect how taxes are allocated between spouses. While Form 8857 is a federal form, the laws of community property states can influence the determination of relief eligibility and the apportionment of tax liabilities. |

Guide to Writing IRS 8857

When addressing matters of tax liability, particularly in instances where relief is sought due to a spouse's actions, the IRS Form 8857 becomes a critical document. This form is used to request relief from tax liability under the stipulations that allow for separation of debt between individuals who were married or are currently married but are seeking independence from tax burdens not of their own making. Successfully navigating the completion of this form is vital for individuals aiming to protect their financial interests and ensure a fair assessment of tax responsibilities.

To fill out the IRS Form 8857 correctly, follow these steps:

- Download the latest version of the form from the official Internal Revenue Service website to ensure all information is current and accurate.

- Begin by entering your full name and Social Security Number (SSN) at the top of the form in the spaces provided.

- Follow this by entering the full name and SSN of your spouse or former spouse, associated with the tax liability from which you are seeking relief.

- Detail your current mailing address, including city, state, and ZIP code, to ensure any correspondence or decisions can be correctly directed to you.

- Answer all questions on the form related to your tax filing status, the years for which you are requesting relief, and specifics about your situation. This includes information about residency, financial dependency, and any incidents of abuse or financial control exerted by the spouse related to the tax dispute.

- Provide detailed information about the tax liability in question, including the amount owed and the reasons you believe you should not be held responsible for this debt.

- Sign and date the form. If you are filing jointly with your spouse for relief, ensure that both parties sign and date accordingly.

- Attach any required supporting documentation. This may include tax returns, statements of account, letters or correspondences from the IRS, and any other relevant materials that support your case for relief.

- Review the form and attached documentation to ensure completeness and accuracy before submission.

- Mail the completed form and any supporting documents to the IRS at the address provided in the form's instructions. Ensure to use certified mail or another service that provides a receipt or tracking option to confirm delivery.

After submitting the form, the next phase involves a thorough review by the IRS. During this period, the agency may reach out for additional information or clarification. It is essential to respond promptly and fully to any such requests. The decision-making process can take some time, as it involves a detailed analysis of the circumstances surrounding the tax liability and the merits of the relief request. Once a decision has been reached, the IRS will notify the applicant in writing of the outcome. Depending on the decision, there might be further steps to take, which will be outlined in the correspondence received from the IRS.

Understanding IRS 8857

-

What is Form 8857?

Form 8857, Request for Innocent Spouse Relief, is a document that allows taxpayers to seek relief from joint tax liabilities. When married taxpayers file a joint income tax return, both individuals are equally responsible for the tax debt and any penalties or interest. However, there are situations where one spouse may not be fairly held responsible for these debts. In these instances, Form 8857 is used to request relief from the IRS, thereby potentially freeing them from the obligation to pay part or all of the joint tax liability.

-

Who should file Form 8857?

Form 8857 should be filed by any individual who believes they should not be held responsible for tax, interest, and penalties on a joint tax return due to circumstances beyond their control. This may apply in cases such as divorce, separation, or when one spouse was unaware of or did not understand the financial matters leading to the tax debt.

-

When is the deadline to file Form 8857?

Generally, Form 8857 must be filed within two years after the date the IRS first attempted to collect the tax debt from you. However, there are exceptions to these rules that may extend the time you have to file. Because determining the precise deadline can be complex, it is advisable to file as soon as you believe you qualify for innocent spouse relief.

-

How does one file Form 8857?

To file Form 8857, you must complete the form by providing detailed information about your tax situation, income, and the reasons why you believe you qualify for relief. Once completed, the form must be mailed to the IRS at the address provided in the form's instructions. It is not possible to file online. Providing thorough explanations and supporting documents can help the IRS process your request more efficiently.

-

What information is required on Form 8857?

Form 8857 requires a comprehensive breakdown of your tax situation. This includes your personal information, tax year(s) for which you are requesting relief, details about your current financial situation, and a thorough explanation of why you believe you qualify for innocent spouse relief. Additionally, you may need to provide information on your household income and expenses and details about your relationship with your spouse during the time the tax debt was incurred.

-

Can Form 8857 affect my divorce proceedings?

While Form 8857 itself is a tax document unrelated to the legal aspects of divorce, the outcome of an innocent spouse relief request can indirectly impact divorce proceedings. This is particularly true in matters concerning the division of assets and liabilities. If relief is granted, it could alter financial responsibilities as previously determined by a divorce decree. Therefore, it’s essential to consider how seeking innocent spouse relief interacts with your overall legal situation.

-

What are the possible outcomes after filing Form 8857?

The IRS can respond to your Form 8857 request in several ways. You may be granted complete relief from the tax debt, partial relief, or no relief at all. The determination will depend on a thorough review of your circumstances, including your involvement in the financial matters that led to the tax issue, any benefit you received from the underreported income or unpaid tax, and your current financial situation.

-

Is there a cost to file Form 8857?

There is no fee to file Form 8857 with the IRS. However, if you decide to seek professional advice or representation to help you with your innocent spouse relief request, you may incur costs associated with those services.

-

What happens if my request for relief is denied?

If your request for innocent spouse relief is denied, you retain the right to appeal the IRS decision. The denial letter from the IRS will include instructions on how to file an appeal. An appeal gives you the opportunity to present additional information and argue your case before an independent office within the IRS.

-

Can I file Form 8857 if I am now remarried?

Yes, your current marital status does not affect your eligibility to file Form 8857. You can request innocent spouse relief regardless of whether you are now divorced, widowed, or remarried. The key factor is your tax situation during the year(s) for which you are requesting relief, not your current marital status.

Common mistakes

Filling out the IRS Form 8857, or the Request for Innocent Spouse Relief, requires careful attention to detail. This form provides the opportunity for individuals to be relieved of responsibility for paying tax, interest, and penalties if their spouse (or former spouse) improperly reported or omitted items on their joint tax return. However, errors can complicate or even jeopardize the request. Below are seven common mistakes to avoid:

Not providing enough information: One of the most frequent errors is the lack of detail regarding the situation. The IRS requires comprehensive explanations and documentary evidence to support the claim.

Filling out the form too late: There's a strict timeline for filing Form 8857 – no more than two years after the IRS's first attempt to collect the tax. Missing this window can result in a denied request.

Incorrect filing status: Applicants sometimes mistakenly claim innocent spouse relief when their filing status does not qualify. It's essential to verify eligibility before submission.

Omitting required signatures: Both parties must sign the form if they are jointly requesting relief. An unsigned form will not be processed.

Not attaching necessary documentation: Failure to include relevant financial documents, legal papers, or other supporting materials can significantly weaken the case.

Misunderstanding the type of relief sought: The IRS offers three types of relief under the innocent spouse rules. Misidentifying the appropriate relief can lead to unnecessary delays or denials.

Assuming automatic qualification: Simply filing the form does not guarantee relief. Applicants often mistakenly believe that their circumstances will automatically qualify them for relief. The IRS evaluates each case on its own merits.

Avoiding these mistakes can strengthen one's case for innocent spouse relief and maximize the chance of a favorable outcome. It's often beneficial to consult with a tax professional or legal advisor familiar with the intricacies of tax law and IRS procedures to ensure the best possible preparation of Form 8857.

Documents used along the form

When dealing with the IRS 8857 form, which is primarily used to request relief from joint tax liabilities under the "Innocent Spouse Relief" provisions, individuals often find that additional forms and documents are required to support their case. These documents and forms play critical roles in providing a comprehensive understanding of an individual's financial situation, thereby enabling the IRS to make a well-informed decision. The process can seem daunting, but being prepared with the right documentation can streamline the procedure and facilitate a more favorable outcome.

- Form 1040: The US Individual Income Tax Return is a fundamental document that provides a snapshot of the taxpayer's financial status, including income, deductions, and tax liability. It is often required to contextualize the tax year in question for Innocent Spouse Relief requests.

- Form 4506: This form is a Request for Copy of Tax Return. It is crucial for individuals who do not have copies of their tax returns and need to provide exact copies to the IRS to support their relief request.

- Form 2848: Power of Attorney and Declaration of Representative. This document allows individuals to grant a certified professional the authority to represent them before the IRS, making it easier to navigate the intricate process of seeking tax relief.

- W-2s and/or 1099s: These documents show earnings from employment (W-2) or other income such as freelance work (1099) for the relevant tax years. They help establish the accuracy of income reported on the tax return.

- Bank Statements: Monthly bank statements may be necessary to corroborate financial hardship or substantiate expenses and financial transactions, adding credibility to the relief application.

- Credit Card Statements: Similar to bank statements, credit card statements provide evidence of financial transactions and can help illustrate financial management and hardship levels over time.

- Legal Documents: In some cases, relevant legal documents, such as divorce decrees or domestic violence restraining orders, can offer critical context and support the narrative for requesting relief.

- Medical Records: If applicable, medical records can serve as proof of extraordinary circumstances impacting the taxpayer's financial situation, such as significant medical expenses or disability.

It's important for individuals seeking innocent spouse relief to understand that each case is unique, and the necessity of specific forms and documents can vary. The key is to provide thorough and accurate documentation to support your request. Gathering and organizing these documents upfront can significantly ease the process, allowing for a clearer presentation of the facts and circumstances surrounding the tax liability issue. In navigating these complex waters, patience and attention to detail are your best allies.

Similar forms

The IRS Form 8857 is a request for innocent spouse relief, designed to provide financial protection to individuals who were unaware of errors made on joint tax returns. Similar in its intent to offer safeguards, the IRS Form 656, Offer in Compromise, allows taxpayers to settle their tax debt for less than the full amount owed. Both forms share the goal of providing taxpayers with avenues to rectify or mitigate tax issues, although they cater to different circumstances. Form 656 focuses on an inability to pay the full debt, while Form 8857 seeks relief from joint liability.

Another document sharing common ground with the IRS Form 8857 is the IRS Form 8379, Injured Spouse Allocation. This form is designed for individuals who wish to protect their portion of a tax refund from being applied to their spouse's past due obligations. Both forms deal with the financial complexities of joint finances in a marriage, yet they serve opposite sides of a similar issue: Form 8379 protects a taxpayer's share of a refund, whereas Form 8857 seeks relief from joint liability on erroneous tax filings.

IRS Form 2848, Power of Attorney and Declaration of Representative, is akin to Form 8857 in that it involves designating someone else to take specific actions on one's behalf. While Form 2848 allows taxpayers to authorize an individual to represent them before the IRS, Form 8857 enables a spouse to request relief without the other's involvement. Both documents empower individuals to manage their tax matters effectively, though they operate in different domains of tax representation and personal responsibility.

Form 14653, Certification by U.S. Persons Residing Outside of the United States for Streamlined Foreign Offshore Procedures, shares with Form 8857 the aspect of remedial action in tax matters. Form 14653 allows taxpayers living abroad to certify that their failure to report foreign financial assets and pay all tax due in respect of those assets did not result from willful conduct. Like Form 8857, it provides a pathway to rectify tax problems, emphasizing the taxpayer's innocent or non-willful involvement in the non-compliance.

Similarly, Form 8992, U.S. Shareholder Calculation of Global Intangible Low-Taxed Income (GILTI), relates to Form 8857 through its involvement in complex tax situations that require specific disclosures. While Form 8992 deals with the intricacies of international tax obligations for U.S. shareholders of controlled foreign corporations, Form 8857 addresses domestic tax liability concerns. Both forms are essential for taxpayers navigating their responsibilities under the U.S. tax code's intricate rules.

Form 843, Claim for Refund and Request for Abatement, shares a purpose with Form 8857 in that it allows taxpayers to seek adjustments to their tax obligations. Where Form 8857 provides relief from joint liability for innocent spouses, Form 843 can be used to request refunds or abatements for a variety of reasons, including penalties and interest. Both forms represent tools in the taxpayer's arsenal for correcting or challenging tax liabilities.

The Taxpayer Bill of Rights, while not a form, aligns closely with the principles underlying Form 8857. It embodies a set of fundamental protections for taxpayers, including the right to privacy, the right to challenge the IRS's position, and the right to be informed. Form 8857, in offering relief from joint tax liabilities, essentially upholds these rights by ensuring that individuals are not unfairly held responsible for their spouse's tax mistakes.

Lastly, IRS Form 433-F, Collection Information Statement, parallels Form 8857 in its role in assessing the taxpayer's financial situation to determine payment solutions for outstanding tax liabilities. While Form 433-F is used to gather comprehensive financial information to establish payment plans or settlements, Form 8857 addresses the financial implications of being unfairly held liable for a spouse's tax errors. Both documents are critical in the process of resolving tax liabilities in a way that considers the taxpayer's ability to pay.

Dos and Don'ts

Filing out the IRS Form 8857, also known as the Request for Innocent Spouse Relief, is an important process for individuals seeking relief from joint tax liabilities. This form allows taxpayers to request relief if they believe they should not be held responsible for their spouse's (or former spouse's) tax error. Correctly completing this form is crucial for a successful application. Here are key dos and don'ts to consider:

Do:

- Read the instructions provided by the IRS for Form 8857 carefully to understand the criteria for innocent spouse relief and the specific information required.

- Gather all relevant documentation, such as tax returns, correspondence from the IRS, and any evidence showing why you should not be held liable for the tax error, before you start filling out the form.

- Provide detailed explanations. When the form asks for explanations, offer clear, comprehensive details about your situation to help the IRS understand your position.

- Use additional sheets of paper if necessary. If you need more space than provided on the form to explain your situation or to list your income and expenses, attach separate sheets, making sure each is signed and dated.

- Check your state laws. Some states have their own forms for requesting innocent spouse relief. Ensure you're also compliant with state tax regulations.

- Consult a tax advisor or legal professional. If you're unsure about how to complete the form or your eligibility for relief, professional advice can be invaluable.

- File promptly. Pay attention to IRS guidelines for the timeframe in which the Form 8857 must be submitted to ensure your request is considered.

Don't:

- Rush through the form without understanding each section. Incorrect or incomplete forms can lead to delays or denials.

- Assume you're not eligible without exploring all your options. Many people mistakenly think their situation doesn't qualify for relief when it might.

- Omit details about your financial situation. The IRS requires comprehensive information to make a decision on your request for relief.

- Forget to sign and date the form. An unsigned form is considered incomplete and will not be processed.

- Disregard the importance of providing evidence. Supporting documents are crucial to validating your claim for relief.

- Fail to keep a copy of the completed form and all documents submitted for your records. This will be important if there are any questions or disputes later.

- Ignore IRS notices about your request. Stay engaged with the process and respond promptly to any inquiries or requests for additional information.

Misconceptions

Understanding the IRS Form 8857 can be complicated, leading to various misconceptions. This form is a crucial component for individuals seeking relief from joint tax liabilities under the Innocent Spouse Relief provisions. Clarifying these misconceptions can help taxpayers navigate their situations more effectively.

It's only for currently married individuals. Contrary to what some believe, IRS Form 8857 can also be used by individuals who are divorced, separated, or widowed, not just by those who are currently married. The key criterion is seeking relief from joint tax liabilities incurred during the time of the marriage.

You can file Form 8857 anytime. While it's vital to seek advice as soon as possible, there are specific time frames for filing this form. Typically, the request must be made within two years from the date the IRS first attempted to collect the tax debt from you.

Filing automatically grants relief. Filing Form 8857 is just the first step in the process. The IRS conducts a thorough review of the application, considering various factors and circumstances before granting relief.

Only one spouse can file for relief. There's a common misconception that only one spouse can request relief under the provisions of Form 8857. In reality, either spouse can submit a request for innocent spouse relief for the same tax debt, but each request is evaluated on its own merits.

It's only for errors your spouse made. Form 8857 is not exclusively for errors or incorrect items your spouse or former spouse reported. It also applies to correct items on the tax return that were underreported or not paid with the tax return.

The form is too complicated to fill out without a lawyer. While having legal advice can be beneficial, especially in complex cases, individuals can fill out Form 8857 on their own. The IRS provides instructions and even offers assistance through their helpline.

Relief is only for income taxes. This misconception overlooks that Innocent Spouse Relief can also apply to self-employment taxes, penalties, and interest related to the joint tax return, not just income taxes.

All debts are eligible for relief. Some tax debts may not qualify for innocent spouse relief. For instance, certain penalties or interest that accrue after separation may not be eligible. Each case is unique, and eligibility depends on specific circumstances and IRS guidelines.

Filing for bankruptcy will negate the need for Form 8857. Bankruptcy and the Innocent Spouse Relief are two distinct legal processes. While bankruptcy might discharge certain tax debts, it doesn’t automatically resolve joint tax liabilities or eliminate the need for Form 8857 in seeking relief.

The IRS decides immediately. The process for reviewing a request for Innocent Spouse Relief is thorough and can be time-consuming. It involves reviewing documentation, correspondences, and potentially interviews. Therefore, the IRS does not make immediate decisions upon receiving Form 8857.

Correcting these misconceptions empowers individuals to make informed decisions and pursue the appropriate course of action when dealing with joint tax liabilities. Understanding the nuances of IRS Form 8857 and seeking appropriate advice or assistance can significantly impact the outcome of an Innocent Spouse Relief request.

Key takeaways

The IRS 8857 form, commonly known as the Request for Innocent Spouse Relief, plays a vital role for individuals seeking relief from tax liabilities caused by their spouse or former spouse. Understanding the nuances of filling out and using this form is essential for those who find themselves in complex tax situations due to actions taken by their partner. Here are key takeaways to guide you through the process:

- Eligibility Criteria: Before filling out the form, ensure that you meet the eligibility criteria for requesting innocent spouse relief. This includes not being aware of the erroneous tax filing and having no reason to know that the tax wasn't accurately reported or paid.

- Timely Filing: The IRS 8857 must be filed no later than two years after the date the IRS first attempted to collect the tax from you. Understanding the timeframe is essential to protect your rights.

- Detailed Explanation: The form requires a detailed explanation of why you believe you qualify for innocent spouse relief. Providing a clear and concise narrative can significantly affect the outcome.

- Documentation: Supporting documents play a crucial role in substantiating your claim. These may include financial statements, divorce decrees, or evidence of financial abuse.

- Joint Filing Status: The form is applicable for those who filed a joint tax return. If you filed separately, other forms and relief options may be more suitable for your situation.

- IRS Review Process: After submission, the IRS reviews the form and all accompanying documentation. They may contact both you and your spouse or former spouse for additional information. This process can be lengthy, so patience is key.

- Impact on Both Spouses: Filing for innocent spouse relief could affect the tax liability of both parties. The IRS may allocate the tax burden differently based on the relief granted.

- Legal Assistance: Consider seeking legal advice or assistance from a tax professional when filling out the form. Their expertise can prove invaluable in navigating the complexities of innocent spouse relief.

- Appealing a Decision: If the IRS denies your request, you have the right to appeal the decision. Knowing the steps and deadlines for filing an appeal is crucial.

- Tax Account Status: Keep in mind that while your request is under review, your tax account remains in its current status. However, you can request a collection hold to temporarily stop collection activities.

- Confidentiality: The IRS takes measures to respect your confidentiality during the process. Information provided on the form will be used to determine eligibility without compromising your privacy.

Filling out the IRS 8857 form and successfully navigating the process requires attention to detail and a thorough understanding of your rights and responsibilities. These key takeaways are intended to offer guidance but do not replace professional advice tailored to your specific situation.

Popular PDF Documents

Reseller Permit Renewal - An incomplete JT-1 application will not be processed, emphasizing the importance of providing all required information.

I-9 Verification - The list of acceptable documents for I-9 completion is divided into three categories: documents that establish identity and employment authorization, documents that establish identity, and documents that establish employment authorization.