Get Irs 8850 Form

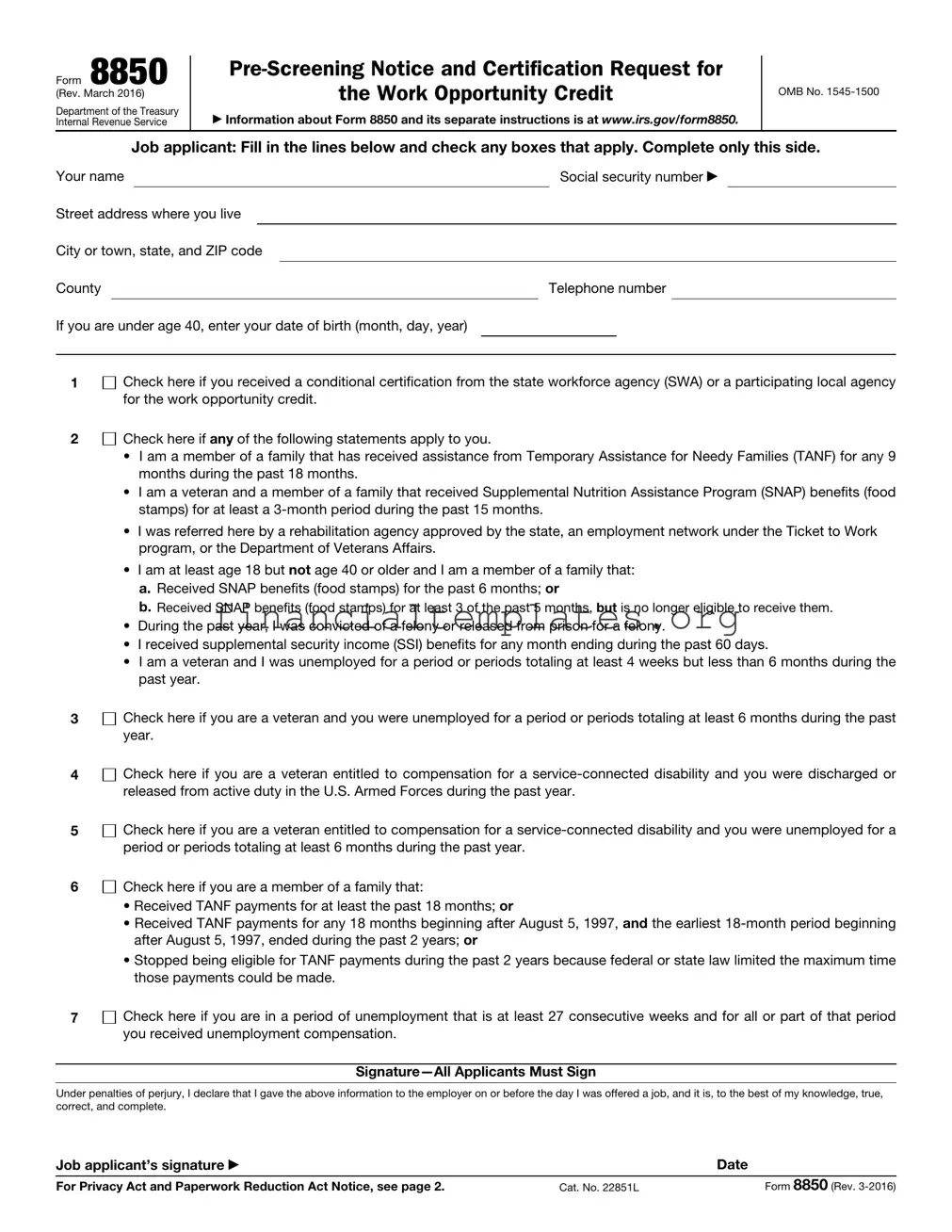

Navigating the complexities of the tax code and its implications for employment incentives allows us to glimpse into the proactive measures the US government employs to encourage workforce diversity and support underrepresented groups. The Internal Revenue Service Form 8850, titled "Pre-Screening Notice and Certification Request for the Work Opportunity Credit," is a pivotal instrument in this initiative. Revised in March 2016, this form serves a dual purpose. Initially, job applicants are invited to divulge specific personal information and circumstances that might qualify their potential employers for a tax credit, should they choose to hire them. This includes detailing their social security number, address, and whether they belong to certain groups facing barriers to employment, such as veterans, individuals with felony convictions within the last year, or those who have received government assistance like Temporary Assistance for Needy Families (TANF) or Supplemental Nutrition Assistance Program (SNAP) benefits. For employers, Form 8850 opens a path to claim the Work Opportunity Credit, contingent upon hiring individuals from these targeted groups. This tax incentive not only aims to stimulate job creation but also to foster a more inclusive labor market. Moreover, the form outlines the information exchange process between employers, job applicants, state workforce agencies, and the IRS, emphasizing its role in the intricate dance of tax policy and employment law. Beyond its practical applications, Form 8850 embodies a societal commitment to reducing employment disparities through fiscal policy.

Irs 8850 Example

Form 8850

(Rev. March 2016)

Department of the Treasury

Internal Revenue Service

the Work Opportunity Credit

▶Information about Form 8850 and its separate instructions is at www.irs.gov/form8850.

OMB No.

Job applicant: Fill in the lines below and check any boxes that apply. Complete only this side.

Your name |

|

Social security number ▶ |

|

|

|

Street address where you live

City or town, state, and ZIP code

County |

|

Telephone number |

|

|

|

If you are under age 40, enter your date of birth (month, day, year)

1

2

3

4

5

6

Check here if you received a conditional certification from the state workforce agency (SWA) or a participating local agency for the work opportunity credit.

Check here if you received a conditional certification from the state workforce agency (SWA) or a participating local agency for the work opportunity credit.

Check here if any of the following statements apply to you.

Check here if any of the following statements apply to you.

•I am a member of a family that has received assistance from Temporary Assistance for Needy Families (TANF) for any 9 months during the past 18 months.

•I am a veteran and a member of a family that received Supplemental Nutrition Assistance Program (SNAP) benefits (food stamps) for at least a

•I was referred here by a rehabilitation agency approved by the state, an employment network under the Ticket to Work program, or the Department of Veterans Affairs.

•I am at least age 18 but not age 40 or older and I am a member of a family that:

a.Received SNAP benefits (food stamps) for the past 6 months; or

b.Received SNAP benefits (food stamps) for at least 3 of the past 5 months, but is no longer eligible to receive them.

•During the past year, I was convicted of a felony or released from prison for a felony.

•I received supplemental security income (SSI) benefits for any month ending during the past 60 days.

•I am a veteran and I was unemployed for a period or periods totaling at least 4 weeks but less than 6 months during the past year.

Check here if you are a veteran and you were unemployed for a period or periods totaling at least 6 months during the past year.

Check here if you are a veteran and you were unemployed for a period or periods totaling at least 6 months during the past year.

Check here if you are a veteran entitled to compensation for a

Check here if you are a veteran entitled to compensation for a

Check here if you are a veteran entitled to compensation for a

Check here if you are a veteran entitled to compensation for a

Check here if you are a member of a family that:

Check here if you are a member of a family that:

•Received TANF payments for at least the past 18 months; or

•Received TANF payments for any 18 months beginning after August 5, 1997, and the earliest

•Stopped being eligible for TANF payments during the past 2 years because federal or state law limited the maximum time those payments could be made.

7 Check here if you are in a period of unemployment that is at least 27 consecutive weeks and for all or part of that period you received unemployment compensation.

Check here if you are in a period of unemployment that is at least 27 consecutive weeks and for all or part of that period you received unemployment compensation.

Under penalties of perjury, I declare that I gave the above information to the employer on or before the day I was offered a job, and it is, to the best of my knowledge, true, correct, and complete.

Job applicant’s signature ▶ |

|

Date |

|

|

|

For Privacy Act and Paperwork Reduction Act Notice, see page 2. |

Cat. No. 22851L |

Form 8850 (Rev. |

Form 8850 (Rev. |

|

|

|

|

|

|

Page 2 |

|||

|

|

|

|

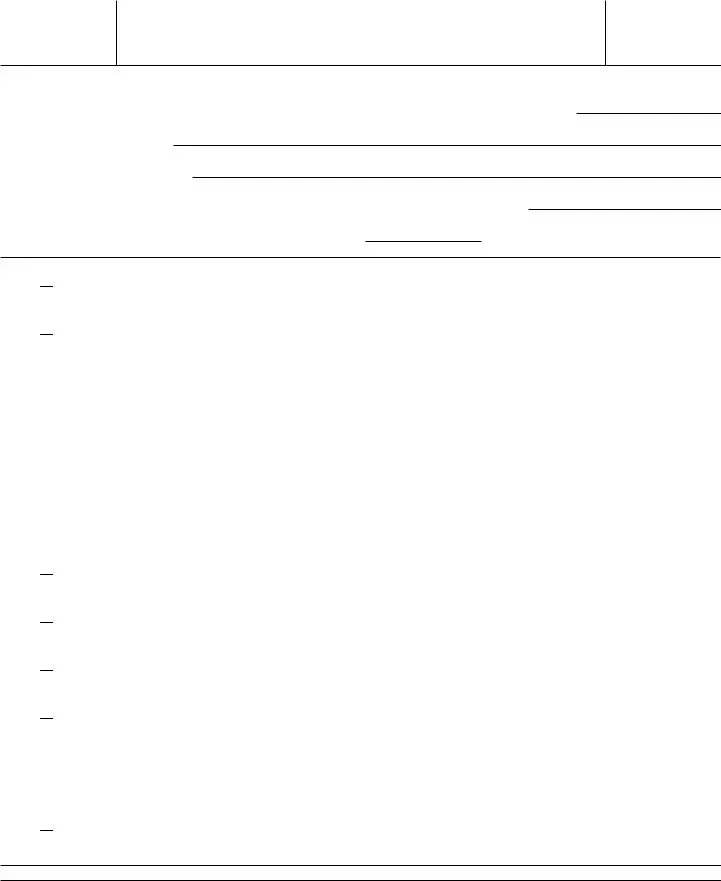

For Employer’s Use Only |

|

|

|

|

||

Employer’s name |

|

Telephone no. |

|

EIN ▶ |

||||||

|

|

|

|

|

|

|

|

|

|

|

Street address |

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

City or town, state, and ZIP code |

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

||||

Person to contact, if different from above |

|

|

|

Telephone no. |

||||||

Street address |

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

||

City or town, state, and ZIP code |

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

If, based on the individual’s age and home address, he or she is a member of group 4 or 6 (as described under Members of

Targeted Groups in the separate instructions), enter that group number (4 or 6) . . . |

. . . . . . . . . . . ▶ |

||||||||

Date applicant: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gave |

|

Was |

|

Was |

|

Started |

|||

information |

|

offered job |

|

hired |

|

|

job |

|

|

Under penalties of perjury, I declare that the applicant provided the information on this form on or before the day a job was offered to the applicant and that the information I have furnished is, to the best of my knowledge, true, correct, and complete. Based on the information the job applicant furnished on page 1, I believe the individual is a member of a targeted group. I hereby request a certification that the individual is a member of a targeted group.

Employer’s signature ▶ |

Title |

|

Date |

|

|

|

|

|

|

||||

Privacy Act and |

criminal litigation, to the Department of |

The time needed to complete and file |

||||

Paperwork Reduction |

Labor for oversight of the certifications |

this form will vary depending on |

|

|||

performed by the SWA, and to cities, |

individual circumstances. The estimated |

|||||

Act Notice |

states, and the District of Columbia for |

average time is: |

|

|

|

|

|

|

|

|

|||

|

use in administering their tax laws. We |

Recordkeeping |

. . |

6 hr., 27 min. |

||

Section references are to the Internal |

may also disclose this information to |

|||||

Learning about the law |

|

|

||||

Revenue Code. |

other countries under a tax treaty, to |

|

|

|||

Section 51(d)(13) permits a prospective |

federal and state agencies to enforce |

or the form |

. |

. 24 min. |

||

federal nontax criminal laws, or to |

Preparing and sending this form |

|||||

employer to request the applicant to |

||||||

federal law enforcement and intelligence |

||||||

complete this form and give it to the |

to the SWA |

. |

. 31 min. |

|||

agencies to combat terrorism. |

||||||

prospective employer. The information |

If you have comments concerning the |

|||||

You are not required to provide the |

||||||

will be used by the employer to |

||||||

accuracy of these time estimates or |

||||||

complete the employer’s federal tax |

information requested on a form that is |

|||||

suggestions for making this form |

||||||

return. Completion of this form is |

subject to the Paperwork Reduction Act |

|||||

simpler, we would be happy to hear from |

||||||

voluntary and may assist members of |

unless the form displays a valid OMB |

|||||

you. You can send us comments from |

||||||

targeted groups in securing employment. |

control number. Books or records |

|||||

www.irs.gov/formspubs. Click on “More |

||||||

Routine uses of this form include giving |

relating to a form or its instructions must |

|||||

Information” and then on “Give us |

||||||

it to the state workforce agency (SWA), |

be retained as long as their contents |

|||||

feedback.” Or you can send your |

||||||

which will contact appropriate sources |

may become material in the |

|||||

comments to: |

|

|

|

|||

to confirm that the applicant is a |

administration of any Internal Revenue |

|

|

|

||

|

|

|

|

|||

member of a targeted group. This form |

law. Generally, tax returns and return |

Internal Revenue Service |

|

|

||

may also be given to the Internal |

information are confidential, as required |

Tax Forms and Publications |

|

|||

Revenue Service for administration of |

by section 6103. |

1111 Constitution Ave. NW, |

||||

the Internal Revenue laws, to the |

|

Washington, DC 20224 |

|

|

||

Department of Justice for civil and |

Do not send this form to this address. |

|

|

|

Instead, see When and Where To File in |

|

the separate instructions. |

Form 8850 (Rev.

Document Specifics

| Fact Number | Fact Name | Description |

|---|---|---|

| 1 | Purpose of Form 8850 | This form is used for pre-screening and certification request for the Work Opportunity Credit. |

| 2 | Information Source | Instructions and additional details about Form 8850 can be found on the IRS website. |

| 3 | OMB Number | The form is authorized under OMB No. 1545-1500. |

| 4 | Eligibility Criteria | Candidates must meet specific conditions, such as receiving assistance from TANF, being a veteran, or having faced unemployment, among others. |

| 5 | Targeted Groups | Form 8850 helps identify individuals from targeted groups that may benefit employers for tax credits. |

| 6 | Voluntary Disclosure | Completion of this form by job applicants is voluntary but can help them secure employment. |

| 7 | Routine Uses | The information collected can be shared with state workforce agencies, the IRS, and other entities for verifying eligibility for the Work Opportunity Credit. |

Guide to Writing Irs 8850

Filling out the IRS Form 8850 is a step forward for employers seeking to claim the Work Opportunity Credit. This form requires accurate and timely submission, both by the job applicant and the employer, to ensure compliance and secure potential benefits. It involves providing specific personal and eligibility information, aimed at identifying qualifying individuals under targeted groups for employment purposes. Below are the steps to successfully complete Form 8850.

- Begin with the job applicant's section by entering your full name as it appears on your social security card.

- Provide your Social Security Number.

- Fill in your home address, including street, city or town, state, and ZIP code. Be sure to include the county and telephone number.

- If you are under age 40, enter your date of birth in the format (month, day, year).

- Check the box if you received a conditional certification from the state workforce agency (SWA) or a participating local agency for the work opportunity credit.

- Go through the list provided from items 2 to 6, checking all boxes that apply to you. These items cover various eligibility criteria such as receiving Temporary Assistance for Needy Families (TANF), being a veteran, receiving SNAP benefits, having a felony conviction, receiving supplemental security income (SSI) benefits, unemployment status as a veteran, and other specific conditions.

- Sign and date the form to certify that the information provided is true, correct, and complete to the best of your knowledge. This action must be done on or before the day you were offered a job.

- For the employer's section, start by entering the employer’s name, telephone number, and Employer Identification Number (EIN).

- Provide the employer’s address, including street, city or town, state, and ZIP code. If there is a different person to contact about this form, include their name and telephone number along with their address.

- If applicable, identify the applicant’s membership in group 4 or 6, based on age and home address, by entering the group number.

- Complete the section detailing when the applicant provided information, was offered a job, was hired, and started the job.

- Employers should sign and date the form, certifying the accuracy of the information and the belief that the individual is a member of a targeted group and thereby requesting certification of this status.

Once completed, the form should not be sent to the IRS directly. Employers must follow specific submission guidelines detailed in the separate instructions for Form 8850, which typically involve sending the form to the relevant state workforce agency (SWA). Being prompt and accurate with these submissions is crucial for taking advantage of the Work Opportunity Credit.

Understanding Irs 8850

What is IRS Form 8850 and who needs to fill it out?

IRS Form 8850, titled "Pre-Screening Notice and Certification Request for the Work Opportunity Credit," is a document that employers must complete as part of the process to qualify for the Work Opportunity Tax Credit (WOTC). This federal tax credit incentivizes employers to hire individuals from certain groups who face barriers to employment. The 'job applicant' section of the form should be filled out by the individual applying for the job, preferably on or before the day they are offered employment. This includes providing personal information and checking boxes that apply to their eligibility for the WOTC, such as receiving government benefits or having a certain veteran status. Subsequently, the 'employer' section is completed by the hiring company, to request certification that the hired individual belongs to one of the targeted groups that qualify for the tax credit.

How does IRS Form 8850 help in securing employment for targeted groups?

IRS Form 8850 plays a crucial role in the WOTC by identifying job applicants who qualify as members of targeted groups before they are hired. By encouraging employers to hire individuals facing significant barriers to employment, the form facilitates the connection between these job seekers and potential employers. Once an employer determines that an applicant may make them eligible for the WOTC, it can create a strong incentive to hire that applicant. Additionally, the act of completing the form raises awareness among employers about the diverse challenges faced by job seekers in these groups, further promoting an inclusive workforce.

What are the targeted groups mentioned on IRS Form 8850?

The form outlines several categories of job seekers who are deemed to face significant barriers to employment, making employers who hire them eligible for the WOTC. These groups include:

- Veterans, including disabled veterans, those who have been unemployed for an extended period, and those belonging to a family receiving SNAP benefits.

- Individuals who have received Temporary Assistance for Needy Families (TANF) benefits or Supplemental Security Income (SSI).

- Ex-felons.

- Designated community residents living in Empowerment Zones or Rural Renewal Counties.

- Individuals referred to employment through rehabilitation programs.

These categories ensure that the tax credit benefits a wide range of job seekers who are often overlooked, providing tangible incentives for their employment.

What is the process for submitting IRS Form 8850?

The submission process involves both the job applicant and the employer. Initially, the job applicant must complete and sign their portion of the form on or before the day they are offered employment. After this, the employer reviews the information, completes the employer section of the form, and submits it to their State Workforce Agency (SWA) -- not directly to the IRS. The form must be submitted within 28 days after the eligible worker begins work. Employers can find specific submission details and address information for their SWA in the form's instructions or on the IRS website. This timely process is crucial for the employer to qualify for the Work Opportunity Tax Credit.

Is completion of IRS Form 8850 mandatory for job applicants?

While completing IRS Form 8850 is technically voluntary for job applicants, it greatly benefits those eligible for targeted groups by potentially increasing their employment opportunities. Employers are encouraged to facilitate the completion of this form to identify candidates who could qualify them for the Work Opportunity Tax Credit. However, job applicants should be aware that refusing to complete the form does not impact their rights or opportunities for employment. It's designed as a beneficial step for both parties, enabling employers to access tax credits while supporting the employment of individuals facing significant barriers to employment.

Common mistakes

Not providing accurate personal information: The first section of Form 8850 requires applicants to provide personal details such as name, social security number, address, county, telephone number, and date of birth if under age 40. Mistakes in this area, like incorrect or incomplete information, can lead to processing delays or even disqualification from eligibility for the Work Opportunity Credit. Ensuring accuracy in these personal details is crucial for smooth processing.

Failing to correctly identify eligibility categories: In the second section, applicants must check boxes that apply to their situation, identifying them as members of targeted groups eligible for the credit. Common mistakes include overlooking applicable categories or incorrectly identifying one's eligibility status. Each checkbox corresponds to different eligibility criteria, so it's important for applicants to thoroughly review their situations and check all boxes that apply.

Overlooking the signature and date: A seemingly minor, yet critical, part of the form is the applicant's signature and the date at the end of the first page. This section, under penalties of perjury, confirms the truthfulness and completeness of the information provided. Sometimes, applicants forget to sign or date the form, or they might provide an incorrect date. This oversight can nullify the entire submission, as an unsigned or undated form is not valid for processing.

Neglecting the employer section: The second page of Form 8850 is for the employer's use only and requires the employer to fill out their information, including their name, EIN (Employer Identification Number), contact information, and details about the job offer and hiring. Employers might mistakenly skip relevant sections or fill in incorrect information. This part of the form is crucial for verifying the applicant's claim and facilitating the employer's request for certification that the individual is a member of a targeted group. Accurate completion by the employer is essential for the applicant to potentially benefit from the Work Opportunity Credit.

Documents used along the form

Completing IRS Form 8850 is an important step for employers seeking to claim the Work Opportunity Tax Credit (WOTC). Alongside Form 8850, several other related documents and forms are frequently used to ensure compliance and maximize eligibility for the credit. Understanding these additional forms can streamline the process and ensure that all necessary information is accurately reported to the IRS and state agencies.

- Form 9061: Individual Characteristics Form (ICF) - This form gathers detailed information about the job applicant's background to further support their eligibility for the WOTC.

- Form 9062: Conditional Certification Form - Used when an applicant presents a pre-filled form from an employment agency, indicating they may be part of a WOTC target group.

- Form 1040: U.S. Individual Income Tax Return - While not directly related to the WOTC, employers might need information from a candidate's tax return to determine eligibility for certain target groups.

- Form 941: Employer’s Quarterly Federal Tax Return - Employers need to report the WOTC on their federal tax returns, making Form 941 a necessary document for claiming the credit.

- Form 3800: General Business Credit - Employers must file this form to claim the WOTC, among other credits, on their federal income tax return.

- Form 8850 Instructions: Detailed guidance on how to complete the Pre-Screening Notice and Certification Request for the Work Opportunity Credit, helping employers understand the eligibility criteria, how to fill out the form, and submission deadlines.

- ETA Form 9061 Instructions: Provides comprehensive instructions on how to accurately complete the Individual Characteristics Form, necessary for certifying the eligibility of the new hire.

- Letter of Explanation: In some cases, a letter accompanying Form 8850 might be required to clarify unique circumstances about the applicant's eligibility or to provide additional information.

- State-specific WOTC Forms: Some states may have additional forms or documents required for processing the WOTC. It's critical to check with state workforce agencies to ensure compliance with local requirements.

This collection of forms and documents, used in conjunction with IRS Form 8850, serves as a comprehensive toolkit for employers aiming to benefit from the Work Opportunity Tax Credit. Proper completion and timely submission of these documents are pivotal in making the most of the tax credit opportunities provided by hiring eligible job applicants. Remember, consulting with a tax professional can provide personalized advice and ensure that your documentation is accurately prepared and submitted.

Similar forms

The IRS Form W-9, "Request for Taxpayer Identification Number and Certification," shares similarities with Form 8850 in that it is also a preliminary step for tax-related processes. Both forms are used to collect necessary information from individuals upfront, which is then used for tax purposes. While Form 8850 focuses on determining eligibility for the Work Opportunity Credit, Form W-9 is primarily for gathering a taxpayer's correct TIN for reporting purposes, such as income or real estate transactions.

Form W-4, "Employee's Withholding Certificate," is akin to Form 8850 in its role of gathering preliminary information from individuals for tax reasons. However, the purpose of Form W-4 is for employees to inform their employers of their withholding allowances and marital status, which affects the amount of federal income tax withheld from their paychecks. Like Form 8850, it's filled out by the individual, but it targets withholding rates rather than tax credits.

The IRS Form I-9, "Employment Eligibility Verification," while not a tax form, shares a commonality with Form 8850 in the pre-employment process. Both forms are completed as part of the hiring process, with Form I-9 being used to verify the legal identity and work eligibility of new employees in the U.S. Unlike Form 8850, which is focused on tax credit eligibility, Form I-9 is a requirement for all U.S. employers to ensure their workforce is legally permitted to work.

IRS Form 1040, "U.S. Individual Income Tax Return," although a comprehensive tax document, overlaps with Form 8850 in its use for tax-related purposes. Form 8850's eligibility information could impact the tax calculations and credits claimed on Form 1040, highlighting their connection through the tax reporting and filing process. Both forms require accurate personal information to ensure proper tax treatment and benefits.

IRS Form 941, "Employer's Quarterly Federal Tax Return," is connected to Form 8850 through the employer's tax reporting responsibilities. While Form 8850 is used to pre-screen employees for tax credit eligibility, Form 941 is where employers report wages paid, tips earned by employees, and the accompanying payroll taxes. The potential tax credits identified through Form 8850 could be reflected in the calculations made for Form 941 filings.

IRS Form SS-4, "Application for Employer Identification Number (EIN)," is related to Form 8850 in the context of employer tax obligations. An EIN obtained through Form SS-4 is necessary for employers to report federal taxes, including claiming tax credits for which Form 8850 determines eligibility. Both forms are integral parts of managing and fulfilling tax-related responsibilities for businesses.

The Work Opportunity Tax Credit (WOTC) Certification Request form, which often accompanies Form 8850 submissions, directly parallels the purpose of Form 8850. This certification request is the next step after the pre-screening process, aiming to certify the eligibility for tax credits based on the information collected via Form 8850. Together, they facilitate employers in obtaining tax credits for hiring individuals from certain target groups.

Lastly, Form 5500, "Annual Return/Report of Employee Benefit Plan," while broadly focusing on reporting requirements for employee benefit plans, intersects with Form 8850 through the lens of employment and tax reporting. Employers who offer benefit plans and also seek tax credits for employing certain target groups must navigate both forms diligently to maintain compliance and optimize their tax positions.

Dos and Don'ts

When filling out the IRS Form 8850, it's important to follow certain guidelines to ensure the process is smooth and error-free. Here are seven things you should and shouldn't do:

Things You Should Do:

Read the instructions carefully before starting to fill out the form. This helps in understanding the requirements and how to correctly provide the needed information.

Ensure the information provided, such as your name, social security number, and address, is accurate and matches the information on your official documents.

Check the appropriate boxes that apply to you under the job applicant section, as these details are crucial for your eligibility for the Work Opportunity Credit.

Sign and date the form. Your signature is required to verify that the information you provided is true, correct, and complete to the best of your knowledge.

If you are unsure about any part of the form, seek clarification from a professional or the hiring employer. It's important to have a clear understanding to avoid mistakes.

Make a copy of the completed form for your records before handing it to your potential employer. Keeping a record can be helpful for future reference.

Submit the form on or before the day you were offered a job. Timeliness is crucial for your form to be considered valid.

Things You Shouldn't Do:

Do not leave any relevant sections incomplete. Incomplete forms may result in delays or your application being considered invalid.

Avoid making assumptions about your eligibility without thoroughly checking each of the listed criteria under the job applicant section.

Do not provide false information. Falsifying information on a federal document can lead to serious consequences.

Do not skip reading the Privacy Act and Paperwork Reduction Act Notice. Understanding your rights and the purpose of the information collection is important.

Do not ignore the separate instructions available at www.irs.gov/form8850. These instructions can provide additional guidance and clarity.

Do not forget to check for the latest version of the form. Using an outdated form can result in processing errors.

Do not submit the form to the wrong address or department. Ensure it is sent to the correct place as indicated in the instructions for the form.

Misconceptions

Understanding the IRS Form 8850, or the Pre-Screening Notice and Certification Request for the Work Opportunity Credit, can sometimes be challenging due to various misconceptions surrounding its purpose and use. Let's clarify some of these misconceptions to ensure both employers and job applicants have the correct understanding of the form.

Misconception 1: The form is only for the benefit of the employer. While it's true that employers use Form 8850 to claim the Work Opportunity Tax Credit, it also benefits job applicants by making them more attractive candidates if they belong to certain groups. This can lead to increased employment opportunities for individuals who might face barriers to employment.

Misconception 2: All job applicants must complete this form. In reality, completing Form 8850 is voluntary for job applicants. It's designed for individuals who are members of targeted groups eligible for the Work Opportunity Tax Credit. Employers cannot require all applicants to fill it out.

Misconception 3: The form is complicated and time-consuming to fill out. The form is actually quite straightforward and requires basic information from the job applicant, such as name, social security number, address, and details about their eligibility as a member of a targeted group. The process is designed to be simple for both the applicant and the employer.

Misconception 4: Personal information provided on the form is not protected. The Privacy Act and Paperwork Reduction Act Notice on the form assures applicants that their information is protected under federal law. The information can only be used for specific purposes related to the Work Opportunity Tax Credit and must be kept confidential.

Misconception 5: The form alone is enough to qualify an employer for the tax credit. Employers must also receive certification from the state workforce agency (SWA) that the individual is a member of a targeted group. Form 8850 is a pre-screening step in the process and does not guarantee qualification for the credit.

Misconception 6: Only unemployed individuals can be considered for the credit. While unemployment is one of the criteria for some targeted groups, there are several other categories, such as being a veteran, having a disability, or being a member of a family that receives certain types of government assistance, that can also qualify an applicant.

Misconception 7: Employers must submit the form for every job applicant. Employers only need to submit Form 8850 to the SWA for individuals who have been offered a job and have completed the form indicating they may be part of a targeted group. This documentation is part of ensuring compliance with the Work Opportunity Tax Credit requirements.

By dispelling these misconceptions, employers and job applicants can more effectively navigate the process of claiming the Work Opportunity Tax Credit, ultimately benefiting both parties and supporting employment among those who face significant barriers to finding work.

Key takeaways

The IRS Form 8850 is essential for employers intending to claim the Work Opportunity Credit, a federal tax credit available to employers for hiring individuals from certain targeted groups that have consistently faced significant barriers to employment. Here are six key takeaways regarding this form:

- The primary purpose of Form 8850 is to pre-screen and certify job applicants as members of a targeted group before an employer can claim the Work Opportunity Credit.

- To potentially qualify for the credit, employers must submit Form 8850 to the appropriate state workforce agency (SWA) not later than 28 days after the eligible worker begins employment.

- The form requires information from the job applicant, such as name, social security number, address, and details regarding their eligibility under one of the targeted groups.

- Employers are responsible for completing their portion of the form with details such as the date the job offer was made, the start date of employment, and verifying that the information provided by the applicant is to the best of their knowledge, true, correct, and complete.

- Confidentiality of the information submitted on Form 8850 is protected under federal law, specifically outlined in the Privacy Act and Paperwork Reduction Act Notice. However, information may be shared with certain federal and state agencies for the administration of tax laws and other legal purposes.

- Completion of Form 8850 is voluntary for both the employer and job applicant. However, failing to complete and submit this form within the prescribed timeframe may result in the employer being ineligible to claim the Work Opportunity Credit for that applicant.

Understanding the nuances of Form 8850 is critical for employers to ensure compliance and maximize their potential benefit under the Work Opportunity Credit program. Diligent record-keeping and prompt submission of the form can facilitate a smoother process in securing this advantageous tax credit.

Popular PDF Documents

IRS Schedule K-1 1041 - This form also deals with the distribution of estate and trust income, making it vital for finalizing estate settlements.

IRS 5498 - It ensures transparency of information between the IRS, the account trustee or issuer, and the individual taxpayer.

Idr Application - Complete this form for an initial determination of your IBR eligibility or the annual reevaluation of your payment amount.