Get IRS 8843 Form

Navigating the complexities of the United States tax system can be a daunting task, especially for those who are not citizens but find themselves within the country, perhaps for study, work, or other reasons. One important document in the realm of tax filing for such individuals is IRS Form 8843. This form serves a critical role, albeit often misunderstood by those who are not familiar with its purpose. It is specifically designed for non-residents, including students, scholars, teachers, and researchers on F, J, M, or Q visas, to declare their presence in the U.S. and affirm their claim of exemption from certain taxes based on their non-resident status. The requirement to file this form applies even to those who do not have income from U.S. sources. Submitting this form is a necessary step in maintaining compliance with U.S. tax laws, ensuring that individuals accurately report their status and any income, as well as potentially mitigating future legal or financial complications. With this form playing a pivotal role in the fiscal responsibilities of non-residents, understanding its purpose, eligibility criteria, and the correct process for filling and submitting it is essential.

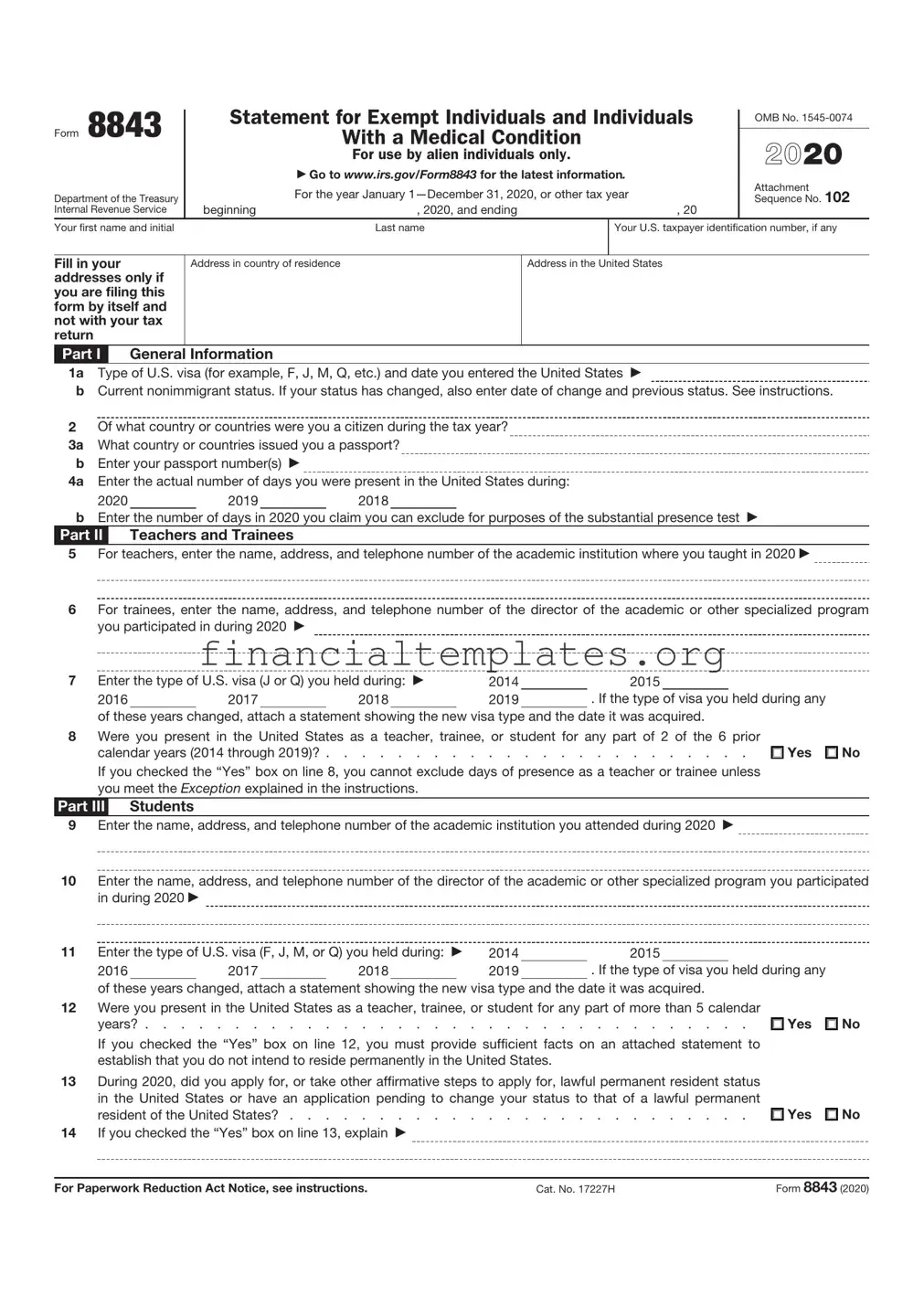

IRS 8843 Example

Form 8843 |

Statement for Exempt Individuals and Individuals |

OMB No. |

|

|

|||

With a Medical Condition |

|

||

2020 |

|||

|

For use by alien individuals only. |

||

|

|

Go to www.irs.gov/Form8843 for the latest information.

|

|

For the year January |

Attachment |

|

Department of the Treasury |

|

Sequence No. 102 |

||

Internal Revenue Service |

beginning |

, 2020, and ending |

|

, 20 |

Your first name and initial |

|

Last name |

Your U.S. taxpayer identification number, if any |

|

|

|

|

|

|

Fill in your addresses only if you are filing this form by itself and not with your tax return

Address in country of residence

Address in the United States

Part I General Information

1a Type of U.S. visa (for example, F, J, M, Q, etc.) and date you entered the United States

bCurrent nonimmigrant status. If your status has changed, also enter date of change and previous status. See instructions.

2Of what country or countries were you a citizen during the tax year? 3a What country or countries issued you a passport?

b Enter your passport number(s)

4a Enter the actual number of days you were present in the United States during:

2020 |

|

2019 |

|

2018 |

bEnter the number of days in 2020 you claim you can exclude for purposes of the substantial presence test

Part II Teachers and Trainees

5 For teachers, enter the name, address, and telephone number of the academic institution where you taught in 2020

6For trainees, enter the name, address, and telephone number of the director of the academic or other specialized program you participated in during 2020

7 Enter the type of U.S. visa (J or Q) you held during: |

2014 |

|

2015 |

|

|

|||||

2016 |

|

2017 |

|

2018 |

|

2019 |

|

. If the type of visa you held during any |

||

of these years changed, attach a statement showing the new visa type and the date it was acquired.

8Were you present in the United States as a teacher, trainee, or student for any part of 2 of the 6 prior

calendar years (2014 through 2019)? |

Yes |

If you checked the “Yes” box on line 8, you cannot exclude days of presence as a teacher or trainee unless |

|

you meet the Exception explained in the instructions. |

|

No

Part III |

Students |

9Enter the name, address, and telephone number of the academic institution you attended during 2020

10Enter the name, address, and telephone number of the director of the academic or other specialized program you participated in during 2020

11 Enter the type of U.S. visa (F, J, M, or Q) you held during: |

2014 |

|

2015 |

|

|

|||||

2016 |

|

2017 |

|

2018 |

|

2019 |

|

. If the type of visa you held during any |

||

of these years changed, attach a statement showing the new visa type and the date it was acquired.

12Were you present in the United States as a teacher, trainee, or student for any part of more than 5 calendar

years? |

Yes |

If you checked the “Yes” box on line 12, you must provide sufficient facts on an attached statement to |

|

establish that you do not intend to reside permanently in the United States. |

|

13During 2020, did you apply for, or take other affirmative steps to apply for, lawful permanent resident status in the United States or have an application pending to change your status to that of a lawful permanent

resident of the United States? |

Yes |

14 If you checked the “Yes” box on line 13, explain |

|

No

No

For Paperwork Reduction Act Notice, see instructions. |

Cat. No. 17227H |

Form 8843 (2020) |

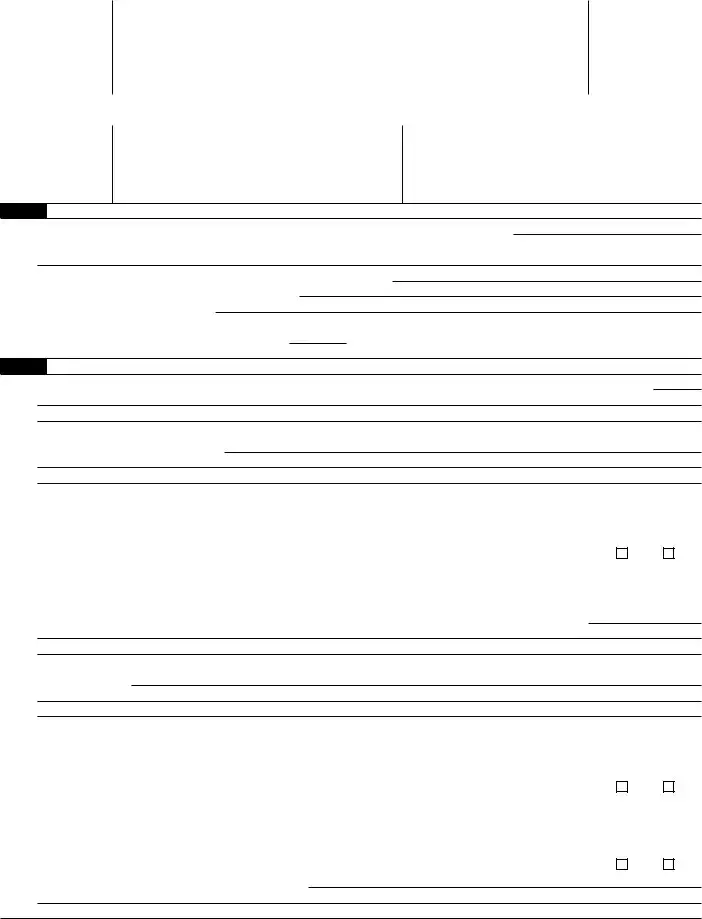

Form 8843 (2020) |

Page 2 |

|

Part IV |

Professional Athletes |

|

15Enter the name of the charitable sports event(s) in the United States in which you competed during 2020 and the dates of competition

16Enter the name(s) and employer identification number(s) of the charitable organization(s) that benefited from the sports event(s)

Note: You must attach a statement to verify that all of the net proceeds of the sports event(s) were contributed to the charitable organization(s) listed on line 16.

Part V Individuals With a Medical Condition or Medical Problem

17a Describe the medical condition or medical problem that prevented you from leaving the United States. See instructions.

bEnter the date you intended to leave the United States prior to the onset of the medical condition or medical problem described on line 17a

cEnter the date you actually left the United States

18Physician’s Statement:

I certify that

Name of taxpayer

was unable to leave the United States on the date shown on line 17b because of the medical condition or medical problem described on line 17a and there was no indication that his or her condition or problem was preexisting.

Name of physician or other medical official

Physician’s or other medical official’s address and telephone number

Sign here only if you are filing this form by itself and not with your tax return

Physician’s or other medical official’s signature |

Date |

Under penalties of perjury, I declare that I have examined this form and the accompanying attachments, and, to the best of my knowledge and belief, they are true, correct, and complete.

F |

|

F |

|

Your signature |

Date |

Form 8843 (2020)

Form 8843 (2020) |

Page 3 |

General Instructions

Section references are to the Internal Revenue Code unless otherwise specified.

Future Developments

For the latest information about developments related to Form 8843 and its instructions, such as legislation enacted after they were published, go to www.irs.gov/Form8843.

What’s New

Who Must File

If you are an alien individual (other than a foreign

•Were an exempt individual, or

•Were unable to leave the United States because of a medical condition or medical problem. However, if you satisfy the requirements of, and are claiming relief pursuant to, the Rev. Proc.

When and Where To File

If you are filing a 2020 Form

If you don’t have to file a 2020 tax return, mail Form 8843 to the Department of the Treasury, Internal Revenue Service Center, Austin, TX

Rev. Proc.

Penalty for Not Filing Form 8843

If you don’t file Form 8843 on time, you may not exclude the days you were present in the United States as a professional athlete or because of a medical condition or medical problem that arose while you were in the United States. Failure to exclude days of presence in the United States could result in your being considered a U.S. resident under the substantial presence test.

You won’t be penalized if you can show by clear and convincing evidence that you took reasonable actions to become aware of the filing requirements and significant steps to comply with those requirements.

Substantial Presence Test

You are considered a U.S. resident if you meet the substantial presence test for 2020. You meet this test if you were physically present in the United States for at least:

•31 days during 2020; and

•183 days during the period 2020, 2019, and 2018, counting all the days of physical presence in 2020 but only 1/3 the number of days of presence in 2019 and only 1/6 the number of days in 2018.

Note: To claim the closer connection to a foreign country(ies) exception to the substantial presence test described in Regulations section

Days of presence in the United States. Generally, you are treated as being present in the United States on any day that you are physically present in the country at any time during the day. However, you don’t count the following days of presence in the United States for purposes of the substantial presence test.

1.Days you regularly commuted to work in the United States from a residence in Canada or Mexico.

2.Days you were in the United States for less than 24 hours when you were traveling between two places outside the United States.

3.Days you were temporarily in the United States as a regular crew member of a foreign vessel engaged in transportation between the United States and a foreign country or a possession of the United States unless you otherwise engaged in trade or business on such a day.

4.Days you were unable to leave the United States because of a medical condition or medical problem that arose while you were in the United States, including days you were unable to leave the United States due to travel disruptions, if you meet the requirements of the Rev. Proc.

5.Days you were an exempt individual.

Exempt Individuals

For purposes of the substantial presence test, an exempt individual includes anyone in the following categories.

•A teacher or trainee (defined on this page).

•A student (defined on the next page).

•A professional athlete temporarily present in the United States to compete in a charitable sports event.

The term “exempt individual” also includes an individual temporarily present in the United States as a foreign

Travel Exception (Rev. Proc.

Travel and related disruptions from the global outbreak of the

Individuals who do not have the

Form 8843 (2020) |

Page 4 |

Eligible individual. To be considered an eligible individual, you must satisfy the following requirements.

•You were not considered a U.S. resident at the end of 2019.

•You were not a lawful permanent resident (green card holder) at any time in 2020.

•You were present in the United States on each of the days of your

•You did not become a U.S. resident in 2020 due to days of presence in the United States outside of your

More information. For more information, including the impact of travel disruptions on treaty benefits, see Rev. Proc.

If you are an alien individual who intended, but was unable, to leave the United States for a continuous period of up to 30 days in 2020 because of a medical condition or medical problem that arose while you were in the United States, you may file Form 8843 without a physician’s statement in Part V to exclude these days of presence in the United States. This exception to the requirement to obtain a physician’s statement in order to claim a medical condition as a basis to exclude days of presence only applies to a single continuous period of up to 30 days, and any additional days in which you were unable to leave the United States due to a medical condition or medical problem that would require a physician’s statement in Part V.

Specific Instructions

Note: If you are claiming the Rev. Proc.

Part

If you are attaching Form 8843 to Form

In this case, enter “Information provided on Form

8843. Complete line 4b and the rest of Form 8843.

If Form 8843 is filed separately, you must complete all entries on the form.

Line 1b. Enter your current nonimmigrant status, such as that shown on your current Immigration Form

Part

A teacher or trainee is an individual who is temporarily present in the United States under a “J” or “Q” visa (other than as a student) and who substantially complies with the requirements of the visa.

If you were a teacher or trainee under a “J” or “Q” visa, you are considered to have substantially complied with the visa requirements if you haven’t engaged in activities that are prohibited by U.S. immigration laws that could result in the loss of your “J” or “Q” visa status.

Even if you meet these requirements, you can’t exclude days of presence in 2020 as a teacher or trainee if you were exempt as a teacher, trainee, or student for any part of 2 of the 6 prior calendar years. But see the Exception below.

If you qualify to exclude days of presence as a teacher or trainee, complete Parts I and II of Form 8843. If you have a “Q” visa, complete Part I and only lines 6 through 8 of Part II. On line 6, enter the name, address, and telephone number of the director of the cultural exchange program in which you participated.

Exception. If you were exempt as a teacher, trainee, or student for any part of 2 of the 6 prior calendar years, you can exclude days of presence in 2020 as a teacher or trainee only if all four of the following apply.

1.You were exempt as a teacher, trainee, or student for any part of 3 (or fewer) of the 6 prior calendar years.

2.A foreign employer paid all your compensation during 2020.

3.You were present in the United States as a teacher or trainee in any of the 6 prior years.

4.A foreign employer paid all of your compensation during each of those prior 6 years you were present in the United States as a teacher or trainee.

For more details, see Pub. 519.

If you meet this exception, you must attach information to verify that a foreign employer paid all the compensation you received in 2020 and all prior years that you were present in the United States as a teacher or trainee.

Part

A student is an individual who is temporarily present in the United States under an “F,” “J,” “M,” or “Q” visa and who substantially complies with the requirements of the visa.

If you were a student under an “F,” “J,” “M,” or “Q” visa, you are considered to have substantially complied with the visa requirements if you haven’t engaged in activities that are prohibited by U.S. immigration laws and could result in the loss of your visa status.

Even if you meet these requirements, you can’t exclude days of presence in 2020 as a student if you were exempt as a teacher, trainee, or student for any part of more than 5 calendar years unless you establish that you don’t intend to reside permanently in the United States. The facts and circumstances to be considered in determining if you have established that you don’t intend to reside permanently in the United States include, but aren’t limited to:

1.Whether you have maintained a closer connection to a foreign country than to the United States (for details, see Pub. 519), and

2.Whether you have taken affirmative steps to change your status from nonimmigrant to lawful permanent resident.

If you qualify to exclude days of presence as a student, complete Parts I and III of Form 8843. If you have a “Q” visa, complete Part I and only lines 10 through 14 of Part III. On line 10, enter the name, address, and telephone number of the director of the cultural exchange program in which you participated.

Part

A professional athlete is an individual who is temporarily present in the United States to compete in a charitable sports event.

For details on charitable sports events, see Pub. 519.

If you qualify to exclude days of presence as a professional athlete, complete Parts I and IV of Form 8843.

Part

For purposes of the substantial presence test, don’t count the days you intended to leave the United States but couldn’t do so because of a medical condition or medical problem that arose while you were in the United States. Whether you intended to leave the United States on a particular day is determined based on all the facts and circumstances. For more details, see Pub. 519.

Form 8843 (2020) |

Page 5 |

If you qualify to exclude days of presence because of a medical condition or medical problem, complete Part I and lines 17a through 17c of Part V. Have your physician or other medical official complete line 18.

However, if you are excluding up to 30 days of presence because of a medical condition or medical problem using the 30- Day Medical Condition (discussed earlier), and this is the only exception you are claiming in Part V, then complete Part I, and lines 17a through 17c of Part V. Before describing your medical condition or medical problem on line 17a, enter

18.You don’t need a physician’s signature to claim the

Note: You cannot exclude any days of presence in the United States under any of the following circumstances.

•You were initially prevented from leaving, were then able to leave, but remained in the United States beyond a reasonable period for making arrangements to leave.

•You entered or returned to the United States for medical treatment. It does not matter whether you intended to leave the United States immediately after the medical treatment but couldn’t do so because of unforeseen complications from the medical treatment.

•The medical condition existed before your arrival in the United States and you were aware of the condition. It does not matter whether you needed treatment for the condition when you entered the United States.

Rev. Proc.

If you are an eligible individual who meets the requirements of the Rev. Proc.

1.On line 17a, enter

MEDICAL CONDITION TRAVEL EXCEPTION.”

2.On line 17b, enter the start date of your

3.On line 17c, enter the end date of your

4.Leave line 18 blank. There is no need for a physician’s statement if you are claiming the Rev. Proc.

See

Note: Travel disruptions will not be considered

Multiple Medical Conditions

If you are claiming multiple medical conditions or medical problems in Part V (the Rev. Proc.

Paperwork Reduction Act Notice. We ask for the information on this form to carry out the Internal Revenue laws of the United States. Section 7701(b) and its regulations require that you give us the information. We need it to determine if you can exclude days of presence in the United States for purposes of the substantial presence test.

You aren’t required to provide the information requested on a form that is subject to the Paperwork Reduction Act unless the form displays a valid OMB control number. Books or records relating to a form or its instructions must be retained as long as their contents may become material in the administration of any Internal Revenue law. Generally, tax returns and return information are confidential, as required by section 6103.

The average time and expenses required to complete and file this form will vary depending on individual circumstances. For the estimated averages, see the instructions for your income tax return.

If you have suggestions for making this form simpler, we would be happy to hear from you. See the instructions for your income tax return.

Document Specifics

| Fact Name | Description |

|---|---|

| Form Purpose | The IRS 8843 form is used by foreign nationals to demonstrate they are exempt from the substantial presence test for U.S. tax purposes. |

| Who Must File | Nonresident aliens in the U.S. under F, J, M, or Q visas who are exempt from being counted towards the substantial presence test must file this form. |

| Due Date | The form is usually due by April 15, following the tax year in question. If you earned income in the U.S., it should be filed along with your income tax return. |

| No Requirement for a Social Security Number | Filing Form 8843 does not require a Social Security Number (SSN) or an Individual Taxpayer Identification Number (ITIN). |

| Not a Tax Return | It's important to understand that Form 8843 is not a tax return; it's a statement for exempt individuals and individuals with a medical condition. |

Guide to Writing IRS 8843

After gathering all the necessary information required to fill out the IRS 8843 form, individuals find themselves at the starting line of a process that plays a crucial role in complying with U.S. tax laws for certain nonresidents. It's important to approach each section with care, ensuring that every detail is accurate and complete. This diligence not only aids in avoiding potential issues with the IRS but also streamlines the individual's record-keeping process for future reference. With a clear understanding of what lies ahead, let's walk step-by-step through the filling out process.

- Start with your basic information. At the top of the form, you'll need to provide your full name, as it appears on your passport, and your U.S. Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN).

- Input your present address. Include the address where you currently reside. If it's different from your permanent address in your home country, you'll need to list both.

- Fill in your visa information. Indicate your U.S. visa type, the number of your visa, and the date of your current U.S. entry. This information is found in your passport or travel documents.

- Detail your substantial presence test. Calculate the number of days you've been present in the U.S. over the last three years. This test helps determine your tax residency status.

- Explain the purpose of your U.S. visit. Specify the purpose of your visit, whether it was for study, teaching, research, or other reasons. Depending on your reason, you might need to provide details about your institution or employer.

- Sign and date the form. Review your form for any mistakes or missing information. Once satisfied, sign and date it at the bottom, certifying that all information is true and correct.

Filling out the IRS 8843 form is not just about compliance; it is about maintaining one's standing and ensuring a smooth stay or study period in the United States. With this guide, individuals can confidently navigate through the form, filling out each section with the precision and care required. Remember, while this process may seem daunting at first, it's a critical step in ensuring your obligations are met in a timely and accurate manner.

Understanding IRS 8843

-

What is an IRS 8843 form?

The IRS 8843 form is an essential document for certain nonresident individuals, specifically those who are in the United States under F, J, M, or Q visas. Its primary purpose is to demonstrate that an individual is exempt from the substantial presence test. This test normally determines if someone is considered a resident for tax purposes. By filing Form 8843, students, scholars, and others can confirm their exemption based on their particular visa category, ensuring they are taxed appropriately.

-

Who needs to file the IRS 8843 form?

Generally, if you are a foreign individual in the U.S. under F, J, M, or Q visa status, you are required to file IRS Form 8843. This includes students, teachers, trainees, researchers, and cultural exchange visitors who are exempt from the substantial presence test for a certain period. Even if you had no income in the U.S. for the year, you need to file this form to validate your exemption from being considered a U.S. resident for tax purposes.

-

When is the deadline to file the IRS 8843 form?

The deadline to file Form 8843 aligns with the U.S. tax year, which typically means it must be filed by April 15th of the following year. For example, to report for the 2023 tax year, the form should be filed by April 15th, 2024. If you're filing a federal income tax return, you can submit Form 8843 alongside your tax return. However, if you're not filing a tax return for any reason, you must still submit Form 8843 by the April 15th deadline.

-

How do I file the IRS 8843 form?

To file Form 8843, fill out the form accurately, providing details about your visa status, type of exemption, and days of presence in the U.S., among other required information. Once completed, the form should be mailed to the address listed in the form instructions for your specific situation. It is important to keep a copy of the form and any correspondence for your records. Electronic filing is not currently available for Form 8843.

-

What information do I need to complete the form?

To complete Form 8843 properly, you should gather the following information:

- Your personal and visa details, such as full name, Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN), and visa type.

- The dates of your current and past visits to the U.S., especially if you have been in the U.S. on F, J, M, or Q visas in past years.

- Details about the institution or program that is sponsoring your stay in the U.S., including names and addresses.

- Specific information about your academic or occupational activities in the U.S. and any qualifications you might have.

-

What happens if I don't file the IRS 8843 form?

Failure to file Form 8843 if you're required to can result in penalties and affect your tax exemption status in the U.S. While there are no specific penalties for not filing Form 8843, not submitting the form can lead to the IRS determining that you may owe taxes due to being considered a U.S. resident for tax purposes. Additionally, it could potentially impact your ability to benefit from the U.S. tax treaty benefits or to change or renew your visa in the future. It's best to file the form as required to avoid such complications.

-

Can I get help with filling out the IRS 8843 form?

Yes, you can seek assistance if you need help filling out Form 8843. Many universities and colleges offer free tax assistance to international students and scholars. Additionally, you can consult with a professional tax advisor who is familiar with nonresident tax issues. The IRS website also provides instructions and resources that can guide you through the process of preparing the form. It's important to ensure that whoever assists you is knowledgeable about the specific tax rules for nonresident aliens.

Common mistakes

Filling out the IRS Form 8843 is a necessary step for certain nonresident aliens, including students and scholars in the United States. While it may seem straightforward, errors in this process can lead to unnecessary complications or delays in the submission process. Here are seven common mistakes people make:

Not filing at all: Often, individuals are unaware that they need to file Form 8843 if they are in the U.S. under certain visas, even if they have not earned income in the tax year. This omission can lead to complications with immigration status and potential issues with the IRS.

Omitting required information: Leaving sections blank because the information seems irrelevant or because individuals are unsure what to provide can result in the rejection of the form. It’s important to complete every required field to the best of one’s ability.

Incorrect tax year information: It's crucial to ensure that the form corresponds to the correct tax year. Sometimes, filers accidentally use a form for the wrong year, leading to processing delays or the need to re-submit the entire document with the correct information.

Missing signatures and dates: A surprisingly common oversight is forgetting to sign and date the form. An unsigned or undated form is considered incomplete by the IRS and will not be processed until corrected and submitted again.

Not using the right filing status: Understanding one's filing status is crucial. The Form 8843 is for specific nonresident aliens, including students and scholars, and not understanding whether one falls into these categories—or mistakenly thinking one does not—can lead to not filing when required.

Failing to attach required supporting documents: Depending on individuals’ circumstances, additional documentation may need to be submitted alongside Form 8843. Not including these documents can result in processing delays or the form being returned.

Providing incorrect tax identification numbers: Tax Identification Numbers (TIN), including Social Security Numbers (SSN) or Individual Taxpayer Identification Numbers (ITIN), must be accurately provided. Mistakes in these numbers can lead to processing errors and delays in form processing.

In conclusion, these mistakes, while common, are mostly avoidable with careful attention to detail and a thorough understanding of the form’s requirements. Ensure to review the form in its entirety before submission and seek guidance if any uncertainty arises. A clear and accurately filled Form 8843 is key to maintaining compliance with U.S. tax obligations.

Documents used along the form

Filing taxes in the United States can seem like a complex process, especially for those who are not citizens but are required to pay or report income. The IRS Form 8843 is one such document designed for foreign nationals to report their presence in the U.S. Understanding this form is easier when you're aware of other documents that are often used in conjunction with it. These documents help streamline the tax reporting process for individuals who are navigating their tax obligations in the United States.

- Form 1040-NR: This is the U.S. Nonresident Alien Income Tax Return form. It is used by nonresident aliens to report income earned in the U.S. It's often filed along with Form 8843 if the individual has received income in the U.S. during the tax year.

- Form W-2: The Wage and Tax Statement is issued by employers to report an employee's annual wages and the amount of taxes withheld from their paycheck. Foreign nationals who have worked in the U.S. would need this form when filing their tax returns.

- Form 1099: There are several forms in the 1099 series, including 1099-INT for interest earned, 1099-DIV for dividends received, and 1099-MISC for miscellaneous income. These forms report various types of income that might not be subject to withholding.

- Form 8233: This form, Exemption From Withholding on Compensation for Independent (and Certain Dependent) Personal Services of a Nonresident Alien Individual, is used by individuals who wish to claim a tax treaty benefit to exempt part of their income from U.S. withholding tax.

- Form 1042-S: Foreign Person’s U.S. Source Income Subject to Withholding is issued to report amounts paid to foreign persons, including nonresident aliens, foreign partnerships, and corporations, that are subject to income tax withholding.

- State Tax Returns: Depending on the state where a nonresident alien lives or works, they may be required to file a state tax return in addition to federal tax forms. Requirements and forms vary by state.

Together, these forms and documents ensure comprehensive reporting and compliance with U.S. tax laws for nonresident aliens and foreign nationals. Understanding each form’s purpose and how they interrelate can demystify the filing process, making it more approachable for those who might be filing U.S. taxes for the first time.

Similar forms

The IRS 1040NR form shares a notable similarity with the IRS 8843 in that both are used by non-resident aliens in the United States for tax purposes. While the IRS 8843 form focuses on the assertion of a closer connection to a foreign country to exempt the individual from being treated as a resident for tax purposes, the 1040NR form is used by these individuals to report their income from U.S. sources. Both forms are crucial for non-resident aliens to comply with U.S. tax laws and delineate their tax residency status.

The IRS W-8BEN form, similar to the IRS 8843, is designed for non-U.S. individuals and helps establish their foreign status. This similarity lies in their use to ensure the correct U.S. tax treatment of payments made to foreign individuals by claiming a reduced rate of, or exemption from, withholding as a result of an income tax treaty. However, the W-8BEN form specifically relates to income such as dividends or interest from stocks and bonds, contrasting the IRS 8843's broader focus on physical presence and connections to a foreign country.

The IRS 1042-S form parallels the IRS 8843 in its application to non-resident aliens, specifically in relation to their U.S. source income and related tax withholdings. Non-resident aliens use the 1042-S to report amounts paid to them from U.S. sources, but it is typically prepared by the payer, not the recipient. The link between the two forms emerges in the context of tax obligations on U.S. source income and the necessity for non-residents to navigate their tax reporting responsibilities.

The Form 8833 is required for taxpayers to treat a foreign income as per the provisions of a U.S. tax treaty differently from how it would generally be treated under U.S. tax laws. This form, like the IRS 8843, relates to the international taxation domain, specifically around treaty-based positions that could influence an individual's tax obligations in the U.S. Both forms serve to clarify the individual's stance on their U.S. tax obligations through the lens of international agreements and presence.

Form 8233 is another document closely related to IRS 8843, aimed at non-resident aliens and requiring information to claim a tax treaty exemption from U.S. withholding tax on income earned in the United States. The similarity between Form 8233 and IRS 8843 lies in their focus on non-resident aliens trying to assert their eligibility for certain tax benefits based on their status. However, while IRS 8843 highlights a closer connection to a foreign country for residency purposes, Form 8233 is directly concerned with income exemption under a tax treaty.

The Form W-7 bears resemblance to the IRS 8843 as it involves non-U.S. citizens in its application process. Its primary purpose is for individuals who are not eligible for a Social Security Number (SSN) but need an Individual Taxpayer Identification Number (ITIN) to comply with U.S. tax laws. While the IRS 8843 form deals with the residency aspect for tax purposes, the W-7's main role is in identity verification for tax processing, showcasing how both forms cater to non-citizen requirements within the U.S. tax system.

The Form 2555 is akin to the IRS 8843 in that both pertain to U.S. taxpayers with international ties; however, Form 2555 is used by U.S. citizens or resident aliens to claim the Foreign Earned Income Exclusion. This similarity underscores the broader theme of considering international presence and foreign income in U.S. tax filings. While the 8843 form assists in establishing a taxpayer's foreign connections to avoid residency status, the 2555 directly addresses earnings and the potential for tax advantages stemming from working abroad.

The Schedule OI (Form 1040NR) has parallels with the IRS 8843, oriented towards providing specific information related to the tax status and filing requirements for non-resident aliens. This schedule, attached to Form 1040NR, asks detailed questions about the taxpayer’s visa status, presence in the U.S., and intentions to leave, which is crucial for determining the correct tax treatment. The connection with IRS 8843 comes from both documents' emphasis on understanding the taxpayer's residency status and international ties for accurate tax reporting and obligation assessment.

Dos and Don'ts

Filing the IRS Form 8843 is an essential process for certain nonresidents in the United States, including students, scholars, teachers, and researchers, who need to report their presence in the U.S. Even though there is no tax liability associated with Form 8843, it's crucial to complete it accurately to comply with U.S. tax laws. Below is a list of dos and don'ts to guide you through this process.

- Do gather all necessary information before beginning to fill out the form. This includes your passport, visa, Form I-20 (for F visa holders), DS-2019 (for J visa holders), and a record of your travel history to and from the United States during the relevant tax year.

- Do use your legal name as it appears on your passport. Consistency in how you present your name on official documents is important for ensuring that your Form 8843 is properly processed.

- Do provide a clear explanation of your "Substantial Presence Test" in Part III, if applicable. This section determines your tax residency status and is crucial for your Form 8843 filing.

- Do sign and date your form. An unsigned form is not valid and will not be accepted by the IRS.

- Do make a copy of your completed Form 8843 for your records. Keeping a copy can be helpful if there are any questions about your filing in the future.

- Don't leave fields blank. If a question does not apply to you, it's better to write "N/A" (not applicable) than to leave a blank space. This demonstrates that you did not overlook the question.

- Don't use pencil to fill out the form. All entries should be made in black or blue ink to ensure they are clear and legible.

- Don't forget to review the form for mistakes before submitting it. Errors can delay processing or even lead to the rejection of your Form 8843.

- Don't miss the filing deadline. Submit your Form 8843 on time to avoid any issues. The typical deadline is April 15 for the previous tax year, but it may be extended in certain situations.

Misconceptions

The IRS Form 8843 is one that often gives rise to misunderstandings. This form, integral to the tax filing process for certain nonresidents in the U.S., is surrounded by myths that can lead to unnecessary confusion. Here, we aim to debunk six common misconceptions to clarify who needs to file this form and under what circumstances.

Every nonresident must file Form 8843. This is not entirely accurate. Form 8843 is required for specific nonresident aliens, particularly those who are in the U.S. under certain visas, such as F, J, M, or Q categories, and are exempt from the substantial presence test for a given tax year. If a nonresident does not fall into these categories, they might not need to file Form 8843.

Filing Form 8843 exempts one from paying U.S. taxes. Filing this form does not, in itself, exempt one from paying U.S. taxes. The primary purpose of Form 8843 is to explain why someone is exempt from the substantial presence test, potentially affecting one's tax status, but it does not exempt income from taxation. Nonresidents with U.S. income may still need to file a tax return and pay any taxes due.

Only those who earn income in the U.S. need to file Form 8843. This misconception could lead many to inadvertently fail to comply with U.S. tax laws. Independent of earning U.S. income, nonresidents present in the U.S. under the applicable visas are required to file Form 8843 to substantiate their tax status. This requirement is about immigration status, not financial earnings.

Form 8843 is complicated and requires professional assistance to complete. While tax matters can be complex, Form 8843 is relatively straightforward. It serves to capture basic information about one’s presence in the U.S. and substantiate claims relating to tax status. Most individuals can fill it out on their own by following the instructions provided by the IRS.

You can file Form 8843 at any time during the year. While there is flexibility, there are deadlines for filing Form 8843. Typically, this form should be filed by the tax filing deadline in mid-April of the following year, along with other tax forms, if applicable. Waiting until after the deadline can lead to complications or inquiries from the IRS.

If you didn't file Form 8843 on time, it's too late to correct the mistake. It's better to file Form 8843 late than never. The IRS encourages individuals to file required forms even if they are past the original deadline. While late filing could potentially lead to questions or minor penalties, the act of filing can help maintain compliance with U.S. tax regulations.

In summary, understanding the purpose and requirements of IRS Form 8843 is crucial for nonresidents in the U.S. By debunking these misconceptions, we hope to provide clearer guidance and encourage compliance, avoiding unnecessary confusion or complications with U.S. tax obligations.

Key takeaways

The IRS Form 8843 is an essential document for certain nonresidents in the United States, including students, scholars, teachers, and researchers who may have different tax implications. Understanding the key aspects of this form can streamline the process of compliance with U.S. tax laws. Here are eight key takeaways to consider:

- The primary purpose of Form 8843 is to assert the tax filer’s exemption from the substantial presence test. This means it helps nonresidents claim a closer connection to a foreign country, preventing them from being considered a U.S. resident for tax purposes.

- It is important for any nonresident alien in the U.S. under F, J, M, or Q visas to fill out this form if they are in the U.S. for any part of the year and do not have a need to file a regular tax return.

- Even if an individual had no income in the U.S., the Form 8843 is still required to maintain compliance with immigration and tax laws. It serves as a declaration of nonresidency for tax purposes.

- The deadline for filing Form 8843 is usually April 15 for those who received income in the U.S. during the previous year, and June 15 for those who did not receive any U.S. source income. These deadlines can change if they fall on a weekend or a public holiday.

- Filling out the form involves providing detailed information about one's visa type, the duration of stay in the U.S., the institution attended or employer in the U.S., and the capacity in which one is visiting. Accuracy is crucial to avoid issues with the IRS.

- No Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN) is required to file Form 8843 if the individual did not earn income in the U.S. However, if an SSN or ITIN is available, it should be included on the form.

- Submitting Form 8843 late can lead to unnecessary complications with U.S. tax authorities. In some cases, it may affect one's visa status or future visits to the United States.

- Form 8843 must be mailed to the Internal Revenue Service; it cannot be filed electronically. Keeping a copy of the form and any correspondence with the IRS is strongly advised for personal records.

Adhering to these guidelines not only ensures compliance with U.S. tax laws but also safeguards the visa status of nonresident individuals in the U.S. Always verify the most current form and submission requirements on the IRS website or consult with a tax professional for guidance.

Popular PDF Documents

Irs Power of Attorney - Form M-2848 requires detailed information about the representative’s qualifications and authorization, ensuring only qualified persons can act on behalf of the taxpayer.

2848 Poa - Through the D-2848 form, the designated representative can perform actions such as receiving confidential tax information and negotiating with the IRS on your behalf.