Get IRS 8840 Form

For individuals who split their time between the United States and another country, navigating the complexities of tax obligations can be daunting. The IRS 8840 form, commonly known as the "Closer Connection Exception Statement for Aliens," serves as a crucial tool for such individuals to articulate their ties to a country outside the U.S., potentially exempting them from being taxed as U.S. residents. This form is particularly relevant for those who may inadvertently meet the Substantial Presence Test, thereby risking being considered U.S. residents for tax purposes. By submitting this form, individuals can assert a closer connection to another country, detailing significant ties such as the location of their permanent home, family, and personal belongings. Understanding the eligibility criteria, the specific timelines for submission, and the detailed documentation required is essential for effectively utilizing the IRS 8840 form to one's advantage. Failure to timely submit this form, when applicable, may result in unnecessary tax liabilities and complications with the Internal Revenue Service, underscoring the importance of early and accurate completion and submission.

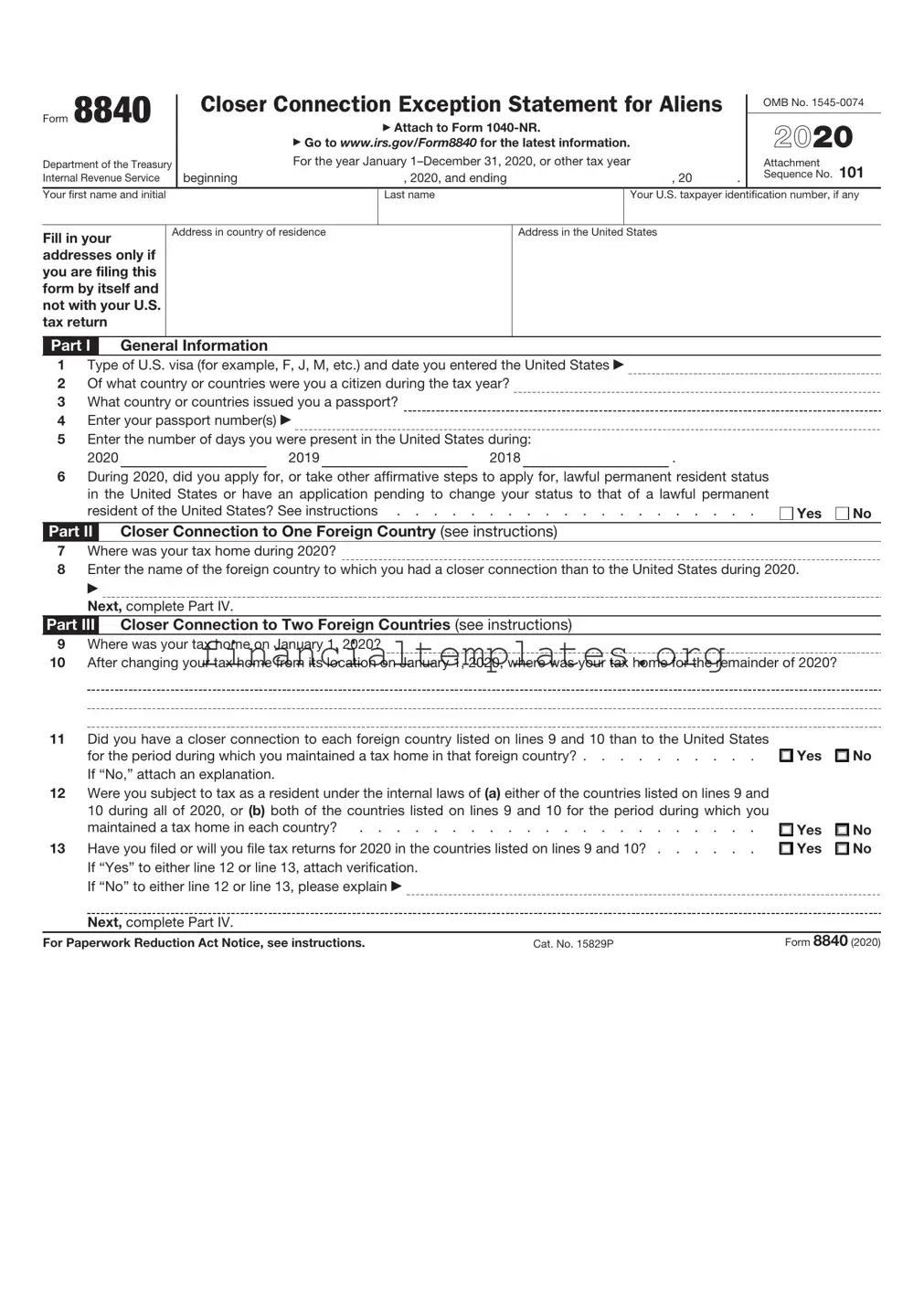

IRS 8840 Example

Form 8840 |

|

Closer Connection Exception Statement for Aliens |

|

OMB No. |

|||

|

|

||||||

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

▶ Attach to Form |

|

|

2021 |

|

|

|

|

▶ Go to www.irs.gov/Form8840 for the latest information. |

|

|||

|

|

|

|

|

|||

Department of the Treasury |

|

|

For the year January |

|

Attachment |

||

Internal Revenue Service |

|

beginning |

|

, 2021, and ending |

, 20 |

. |

Sequence No. 101 |

|

|

|

|||||

Your first name and initial |

|

|

|

Last name |

Your U.S. taxpayer identification number, if any |

||

|

|

|

|

|

|

|

|

Fill in your |

Address in country of residence |

|

|

addresses only if |

|

you are filing this |

|

form by itself and |

|

not with your U.S. |

|

tax return |

|

Part I General Information

Address in the United States

1Type of U.S. visa (for example, F, J, M, etc.) and date you entered the United States ▶

2Of what country or countries were you a citizen during the tax year?

3What country or countries issued you a passport?

4Enter your passport number(s) ▶

5Enter the number of days you were present in the United States during:

2021 |

2020 |

2019 |

. |

6During 2021, did you apply for, or take other affirmative steps to apply for, lawful permanent resident status in the United States or have an application pending to change your status to that of a lawful permanent

resident of the United States? See instructions |

Yes |

No |

Part II Closer Connection to One Foreign Country (see instructions)

7Where was your tax home during 2021?

8Enter the name of the foreign country to which you had a closer connection than to the United States during 2021.

▶

Next, complete Part IV.

Part III Closer Connection to Two Foreign Countries (see instructions)

9Where was your tax home on January 1, 2021?

10After changing your tax home from its location on January 1, 2021, where was your tax home for the remainder of 2021?

11Did you have a closer connection to each foreign country listed on lines 9 and 10 than to the United States

for the period during which you maintained a tax home in that foreign country? |

Yes |

No |

If “No,” attach an explanation. |

|

|

12Were you subject to tax as a resident under the internal laws of (a) either of the countries listed on lines 9 and 10 during all of 2021, or (b) both of the countries listed on lines 9 and 10 for the period during which you

maintained a tax home in each country? |

Yes |

No |

|

13 Have you filed or will you file tax returns for 2021 in the countries listed on lines 9 and 10? |

Yes |

No |

|

If “Yes” to either line 12 or line 13, attach verification. |

|

|

|

If “No” to either line 12 or line 13, please explain ▶ |

|

|

|

Next, complete Part IV. |

|

|

|

For Paperwork Reduction Act Notice, see instructions. |

Cat. No. 15829P |

Form 8840 (2021) |

|

Form 8840 (2021) |

Page 2 |

|

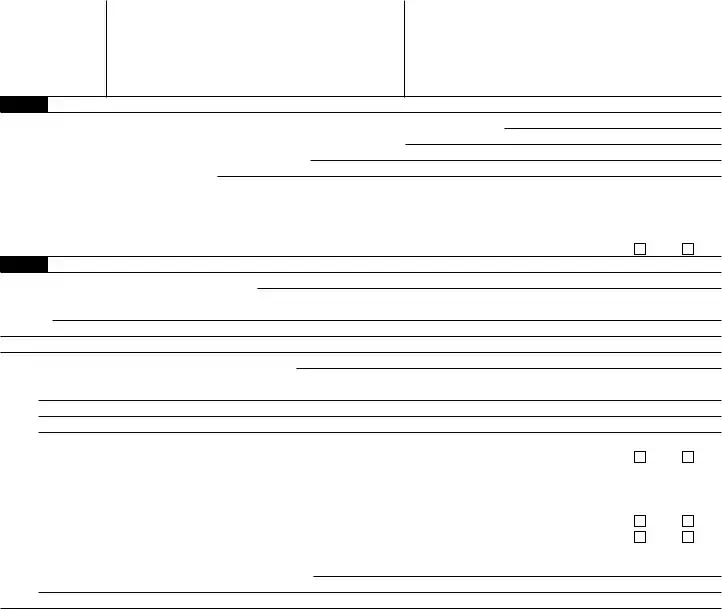

Part IV |

Significant Contacts With Foreign Country or Countries in 2021 |

|

14Where was your regular or principal permanent home located during 2021? See instructions.

15If you had more than one permanent home available to you at all times during 2021, list the location of each and explain.

▶

16Where was your family located?

17Where was your automobile(s) located?

18Where was your automobile(s) registered?

19Where were your personal belongings, furniture, etc., located?

20Where was the bank(s) with which you conducted your routine personal banking activities located?

a |

|

c |

|

|

|

b |

|

d |

|

|

|

21 |

Did you conduct business activities in a location other than your tax home? |

Yes |

No |

||

|

If “Yes,” where? |

|

|

||

22a |

Where was your driver’s license issued? |

|

|

||

bIf you hold a second driver’s license, where was it issued?

23Where were you registered to vote?

24When completing official documents, forms, etc., what country do you list as your residence?

25Have you ever completed:

a |

Form |

Yes |

No |

b Form |

Yes |

No |

|

c |

Any other U.S. official forms? If “Yes,” indicate the form(s) ▶ |

Yes |

No |

26In what country or countries did you keep your personal, financial, and legal documents?

27From what country or countries did you derive the majority of your 2021 income?

28 |

Did you have any income from U.S. sources? |

Yes |

No |

|

If “Yes,” what type? |

|

|

29 |

In what country or countries were your investments located? See instructions. |

|

|

30 |

Did you qualify for any type of “national” health plan sponsored by a foreign country? |

Yes |

No |

|

If “Yes,” in what country? |

|

|

If “No,” please explain ▶

If you have any other information to substantiate your closer connection to a country other than the United States or you wish to explain in more detail any of your responses to lines 14 through 30, attach a statement to this form.

Sign here only if you are filing this form by itself and not with your U.S. tax return

Under penalties of perjury, I declare that I have examined this form and the accompanying attachments, and to the best of my knowledge and belief, they are true, correct, and complete.

▲ |

|

▲ |

|

|

Your signature |

Date |

|||

|

|

|||

|

|

|

Form 8840 (2021) |

Form 8840 (2021) |

Page 3 |

Section references are to the U.S. Internal Revenue Code, unless otherwise specified.

Future Developments

For the latest information about developments related to Form 8840 and its instructions, such as legislation enacted after they were published, go to www.irs.gov/Form8840.

General Instructions

Purpose of Form

Use Form 8840 to claim the closer connection to a foreign country(ies) exception to the substantial presence test. The exception is described later and in Regulations section

Note: You are not eligible for the closer connection exception if any of the following apply.

•You were present in the United States 183 days or more in calendar year 2021.

•You are a lawful permanent resident of the United States (that is, you are a green card holder).

•You have applied for, or taken other affirmative steps to apply for, a green card; or have an application pending to change your status to that of a lawful permanent resident of the United States.

Steps to change your status to that of a permanent resident include, but are not limited to, the filing of the following forms.

•Form

•Form

•Form

•Form

•Form

•Form

Note: These forms are available at

Even if you are not eligible for the closer connection exception, you may qualify for nonresident status by reason of a treaty. See the instructions for line 6 for more details.

Who Must File

If you are an alien individual and you meet the closer connection exception to the substantial presence test, you must

file Form 8840 with the IRS to establish your claim that you are a nonresident of the United States by reason of that exception. Each alien individual must file a separate Form 8840 to claim the closer connection exception.

For more details on the substantial presence test and the closer connection exception, see Pub. 519.

Note: You can download forms and publications at www.irs.gov.

Substantial Presence Test

You are considered a U.S. resident if you meet the substantial presence test for 2021. You meet this test if you were physically present in the United States for at least:

•31 days during 2021; and

•183 days during the period 2021, 2020, and 2019, counting all the days of physical presence in 2021 but only 1/3 the number of days of presence in 2020 and only 1/6 the number of days in 2019.

Days of presence in the United States.

Generally, you are treated as being present in the United States on any day that you are physically present in the country at any time during the day.

However, you do not count the following days of presence in the United States for purposes of the substantial presence test.

1.Days you regularly commuted to work in the United States from a residence in Canada or Mexico.

2.Days you were in the United States for less than 24 hours when you were traveling between two places outside the United States.

3.Days you were temporarily in the United States as a regular crew member of a foreign vessel engaged in transportation between the United States and a foreign country or a possession of the United States unless you otherwise engaged in trade or business on such a day.

4.Days you were unable to leave the United States because of a medical condition or medical problem that arose while you were in the United States.

5.Days you were an exempt individual.

In general, an exempt individual is

(a)a foreign

Note: If you qualify to exclude days of presence in the United States because you were an exempt individual (other than a foreign

Closer Connection

Exception

Even though you would otherwise meet the substantial presence test, you will not be treated as a U.S. resident for

2021 if:

•You were present in the United States for fewer than 183 days during 2021;

•You establish that, during 2021, you had a tax home in a foreign country; and

•You establish that, during 2021, you had a closer connection to one foreign country in which you had a tax home than to the United States, unless you had a closer connection to two foreign countries.

Closer Connection to Two Foreign Countries

You can demonstrate that you have a closer connection to two foreign countries (but not more than two) if all five of the following apply.

1.You maintained a tax home as of January 1, 2021, in one foreign country.

2.You changed your tax home during 2021 to a second foreign country.

3.You continued to maintain your tax home in the second foreign country for the rest of 2021.

4.You had a closer connection to each foreign country than to the United States for the period during which you maintained a tax home in that foreign country.

5.You are subject to tax as a resident under the tax laws of either foreign country for all of 2021 or subject to tax as a resident in both foreign countries for the period during which you maintained a tax home in each foreign country.

Tax Home

Your tax home is the general area of your main place of business, employment, or post of duty, regardless of where you maintain your family home. Your tax home is the place where you permanently or indefinitely work as an employee or a

Form 8840 (2021) |

Page 4 |

place where you regularly live. If you have neither a regular or main place of business nor a place where you regularly live, you are considered an itinerant and your tax home is wherever you work. For determining whether you have a closer connection to a foreign country, your tax home must also be in existence for the entire year, and must be located in the foreign country (or countries) in which you are claiming to have a closer connection.

Establishing a Closer Connection

You will be considered to have a closer connection to a foreign country than to the United States if you or the IRS establishes that you have maintained more significant contacts with the foreign country than with the United States.

Your answers to the questions in Part IV will help establish the jurisdiction to which you have a closer connection.

When and Where To File

If you are filing a 2021 Form

If you do not have to file a 2021 tax return, mail Form 8840 to the Department of the Treasury, Internal Revenue Service Center, Austin, TX

Penalty for Not Filing Form 8840

If you do not timely file Form 8840, you will not be eligible to claim the closer connection exception and may be treated as a U.S. resident.

You will not be penalized if you can show by clear and convincing evidence that you took reasonable actions to become aware of the filing requirements and significant steps to comply with those requirements.

Specific Instructions

Part I

Line 1

If you had a visa on the last day of the tax year, enter your visa type and the date you entered the United States. If you do not have a visa, enter your U.S. immigration status on the last day of the tax year and the date you entered the United States. For example, if you entered under the Visa Waiver Program, enter “VWP,” the name of the Visa Waiver Program country, and the date you entered the United States.

Line 6

If you checked the “Yes” box on line 6, do not file Form 8840. You are not eligible for the closer connection exception. However, you may qualify for nonresident status by reason of a treaty. See Pub. 519 for details. If so, file Form 8833 with your Form

Parts II and III

If you had a tax home in the United States at any time during the year, do not file Form 8840. You are not eligible for the closer connection exception. Otherwise, complete Part II or Part III (but not both) depending on the number of countries to which you are claiming a closer connection. If you are claiming a closer connection to one country, complete Part II. If you are claiming a closer connection to two countries, complete Part III. After completing Part II or Part III, complete Part IV.

Part IV

Line 14

A “permanent home” is a dwelling unit (whether owned or rented, and whether a house, an apartment, or a furnished room) that is available at all times, continuously and not solely for short stays.

Line 29

For stocks and bonds, indicate the country of origin of the stock company or debtor. For example, if you own shares of a U.S. publicly traded corporation, the investment is considered located in the United States, even though the shares of stock are stored in a safe deposit box in a foreign country.

Paperwork Reduction Act Notice. We ask for the information on this form to carry out the Internal Revenue laws of the United States. Section 7701(b) and its regulations require that you give us the information. We need it to determine if you meet the closer connection exception to the substantial presence test.

You are not required to provide the information requested on a form that is subject to the Paperwork Reduction Act unless the form displays a valid OMB control number. Books or records relating to a form or its instructions must be retained as long as their contents may become material in the administration of any Internal Revenue law. Generally, tax returns and return information are confidential, as required by section 6103.

The average time and expenses required to complete and file this form will vary depending on individual circumstances. For the estimated averages, see the instructions for your income tax return.

If you have suggestions for making this form simpler, we would be happy to hear from you. See the instructions for your income tax return.

Document Specifics

| Fact Name | Description |

|---|---|

| Purpose | The IRS Form 8840, also known as the "Closer Connection Exception Statement for Aliens," is used by nonresident aliens to assert closer connections to a foreign country than the U.S., potentially exempting them from being treated as U.S. residents for tax purposes. |

| Who Must File | Nonresident aliens who meet the substantial presence test but believe they have a closer connection to a foreign country and spent less than 183 days in the U.S. in the current year. |

| Deadline for Filing | Typically, the form must be filed by June 15 of the year following the calendar year in which the substantial presence test is met. |

| Substantial Presence Test | This test determines whether someone meets the criteria for being considered a U.S. resident for tax purposes based on the number of days they were present in the U.S. over a three-year period. |

| Required Information | Filers must provide information about their presence in the U.S. and foreign countries, including days spent in each, tax homes, and significant ties to those countries. |

| Impact on Tax Status | Filing Form 8840 correctly can ensure that a nonresident alien is not treated as a U.S. resident for tax purposes, potentially affecting their tax liability. |

| Consequences of Not Filing | Failing to file Form 8840 if required can result in a nonresident alien being treated as a U.S. resident and subject to U.S. income tax on their worldwide income. |

| Relation to Tax Treaties | In some cases, tax treaties between the U.S. and other countries may override or affect the need to file Form 8840. |

| How to File | Form 8840 must be mailed to the IRS. It is not currently accepted electronically. |

Guide to Writing IRS 8840

After completing and submitting the IRS 8840 form, the next steps typically involve waiting for processing by the IRS. This form is pivotal for individuals who need to establish their ties closer to a foreign jurisdiction rather than the United States. The review of this document can take some time, and individuals should ensure all information is accurate before submission to avoid delays. Remember, this is part of ensuring your tax obligations are correctly assessed, reflecting your precise situation regarding your residency status.

To fill out the IRS 8840 form, follow these steps:

- Provide your personal information, including your full name, social security number (SSN), or individual taxpayer identification number (ITIN), and your present home address in the United States or abroad.

- Answer the questions in Part I regarding the substantial presence test, which determines if you meet the criteria based on the days you were physically present in the U.S.

- In Part II, detail your tax home and closer connection to a foreign country. You'll need to specify the country you have a closer connection with and provide evidence supporting this claim, such as the location of your permanent home, family, and personal belongings.

- Answer the additional questions in Part III about your tax filings, including whether you have filed a U.S. income tax return for the current year, if you are filing the form by itself, and if you have applied for a green card.

- Complete the Closer Connection Exception Statement in Part IV if applicable. This section requires information on your significant contacts with the foreign country you claim a closer connection with.

- Sign and date the form at the bottom, certifying that all the information provided is true, correct, and complete. If you're filing jointly, your spouse must also sign and date.

Once submitted, keep a copy of the form for your records. It's vital to monitor your mail or the method of communication you've chosen with the IRS for any follow-up questions or the outcome regarding your submission. Being proactive and responsive to any IRS inquiries can help expedite the review process.

Understanding IRS 8840

-

What is the purpose of the IRS Form 8840?

IRS Form 8840, also known as the "Closer Connection Exception Statement for Aliens," is utilized by individuals who are not U.S. citizens to claim they have a closer connection to a foreign country than to the U.S. for a specific tax year. This form helps non-residents prove they should not be taxed as U.S. residents despite meeting the substantial presence test, due to their closer ties to another country.

-

Who needs to file Form 8840?

Form 8840 should be filed by non-U.S. citizens who have spent a significant amount of time in the U.S. but do not consider the U.S. their primary place of residence. If an individual meets the substantial presence test, which typically means being present in the U.S. for 183 days or more over a three-year period, but maintains a closer connection to another country where they have a tax home, they should file this form.

-

When is the deadline to file Form 8840?

The deadline to file Form 8840 is typically June 15 of the year following the tax year in which you are claiming a closer connection to a foreign country. However, it is important to verify the exact due date as it may change due to holidays or extensions issued by the IRS.

-

What information do I need to complete Form 8840?

To complete Form 8840, individuals will need to provide personal information, including their name, U.S. taxpayer identification number (SSN or ITIN), and address. Additionally, they must detail their ties to the foreign country they claim a closer connection with. This includes information on their residence, locations of family and personal belongings, social ties, and where they conduct regular personal or business activities.

-

How do I submit Form 8840?

Form 8840 must be printed and mailed to the IRS at the address provided in the instructions for the form. Currently, electronic filing is not an option for this form. It is essential to ensure the form is fully completed and signed before mailing to avoid any processing delays.

Common mistakes

-

Not thoroughly reading the instructions can lead to errors. Each question must be understood and answered accurately to ensure compliance.

-

Leaving sections blank that are applicable to their situation. Every relevant section must be completed to avoid processing delays or questions from the IRS.

-

Miscalculating the number of days spent in the U.S. This is a common mistake that can have significant implications on one's tax status.

-

Providing incorrect personal information, such as a wrong Social Security Number or date of birth. This can lead to the rejection of the form.

-

Failing to sign and date the form. An unsigned form is invalid and will not be processed.

-

Not attaching required additional documentation or statements, which provide necessary information not covered in the form itself.

-

Using outdated forms, as tax laws and form requirements can change from year to year. Always use the latest version of the IRS 8840 form.

-

Waiting until the last minute to file, which risks missing the deadline and possibly facing penalties.

Documents used along the form

When filing IRS Form 8840, "Closer Connection Exception Statement for Aliens," several other documents may also be required or beneficial depending on an individual's specific tax situation. This form is typically used by non-resident aliens to assert a closer connection to a foreign country than the U.S., potentially exempting them from being taxed as a U.S. resident. Understanding the various forms and documents that are often used in conjunction with Form 8840 can help ensure that individuals comply with U.S. tax law while maximizing their tax benefits.

- Form 1040-NR: U.S. Nonresident Alien Income Tax Return. This document is used by non-resident aliens to report income earned in the U.S. It may be required alongside Form 8840 if the individual has U.S.-sourced income.

- Form W-8BEN: Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding. This form is often used by non-residents to claim tax treaty benefits and confirm they are not subject to standard withholding tax rates on income.

- Form 8938: Statement of Foreign Financial Assets. If the non-resident has certain foreign financial assets exceeding the reporting threshold, this form must be filed to report those assets to the IRS.

- Form 8833: Treaty-Based Return Position Disclosure Under Section 6114 or 7701(b). This is required for taxpayers who take positions that a tax treaty overrules or modifies the provisions of the U.S. tax law.

- Form W-9: Request for Taxpayer Identification Number and Certification. Used by U.S. persons to provide their Social Security Number (SSN) or Employer Identification Number (EIN) to entities that are required to file information returns with the IRS.

- Form 5471: Information Return of U.S. Persons With Respect to Certain Foreign Corporations. Required for certain U.S. citizens and residents who are officers, directors, or shareholders in certain foreign corporations.

- Form 8621: Information Return by a Shareholder of a Passive Foreign Investment Company or Qualified Electing Fund. It applies to taxpayers with shares in passive foreign investment companies (PFICs).

- Form 3520: Annual Return To Report Transactions With Foreign Trusts and Receipt of Certain Foreign Gifts. This form is used to report transactions with foreign trusts, receipt of large gifts or bequests from certain foreign persons.

- Form 2555: Foreign Earned Income Exclusion. For U.S. citizens or resident aliens who earn income while living abroad, this form can help them claim the foreign earned income exclusion, potentially reducing their U.S. tax liability.

Through a comprehensive understanding and proper use of these forms and documents, individuals can navigate the complexities of U.S. tax law more effectively, ensuring compliance and optimizing their tax situation in relation to Form 8840 filings. It's always recommended to consult with a tax professional to understand the specific requirements and benefits for one's personal situation.

Similar forms

The IRS 8840 form, also known as the "Closer Connection Exception Statement for Aliens," is similar to the IRS 1040NR form, which is the U.S. Nonresident Alien Income Tax Return. Both forms are used by individuals who are not citizens or lawful permanent residents of the United States to report their U.S. income and establish their tax status. While the 8840 form is utilized to assert that an individual has a closer connection to a foreign country than to the U.S., thereby exempting them from being considered a U.S. resident for tax purposes, the 1040NR form is specifically for reporting income and calculating taxes owed on U.S. sources of income.

Another document similar to the IRS 8840 form is the IRS Form 8833, "Treaty-Based Return Position Disclosure Under Section 6114 or 7701(b)." This form is used by taxpayers to disclose positions taken on a tax return that are based on a tax treaty between the United States and another country, which affects how they report their income and determine their tax liabilities. Like Form 8840, Form 8833 is used to navigate the complexities of tax liability for individuals with tax obligations in more than one country, focusing on the utilization of treaties to define tax status.

The W-8BEN form, "Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding," bears similarities to the 8840 form in that it is also used by non-U.S. residents. However, the W-8BEN form is specifically designed to certify foreign status in order to claim exemptions from certain IRS withholdings on income such as dividends, interest, and royalties. While the 8840 form establishes a broader claim about residency status over the tax year, the W-8BEN form is more narrowly focused on tax withholding for specific types of income.

The IRS Form 2555, "Foreign Earned Income," is used by U.S. citizens and resident aliens who live abroad to report earned income from foreign sources and to claim the foreign earned income exclusion. Similar to the 8840 form, which establishes a closer connection to a foreign country, Form 2555 is based on the taxpayer’s foreign residency or physical presence in a foreign country. Both forms are pivotal for individuals navigating the tax implications of international living, focusing on different aspects of their financial connection to other countries.

The W-9 form, "Request for Taxpayer Identification Number and Certification," is primarily used within the United States by citizens and resident aliens to provide their Taxpayer Identification Number (TIN) to entities that will pay them income. While the primary purpose and use case of the W-9 form differ significantly from those of the 8840 form, both forms involve the declaration of tax status to the IRS, albeit in significantly different contexts. The W-9 is for domestic tax reporting, while the 8840 is for international status clarification.

Form 5471, "Information Return of U.S. Persons With Respect to Certain Foreign Corporations," shares conceptual ground with the 8840 form in terms of its international scope. Required from certain U.S. citizens and residents who are officers, directors, or shareholders in certain foreign corporations, Form 5471 collects detailed financial information to comply with U.S. tax regulations. While Form 5471 deals more with foreign corporate relations and control, both it and the 8840 form play crucial roles in the international tax compliance framework.

The FBAR (Foreign Bank and Financial Accounts Report), technically known as FinCEN Form 114, also parallels the IRS 8840 form in terms of addressing international financial accounts. U.S. persons must file an FBAR if they have financial interest in or signature authority over foreign financial accounts exceeding certain thresholds. Though the FBAR is more focused on the reporting of foreign financial accounts and the 8840 on establishing tax residency status, both forms address the overarching theme of U.S. persons’ international financial involvement.

Dos and Don'ts

Filling out the IRS 8840 form, commonly known as the "Closer Connection Exception Statement for Aliens," is a crucial process for certain non-residents who spend a significant amount of time in the United States but want to avoid being considered as U.S. residents for tax purposes. Here are essential dos and don'ts to keep in mind to ensure the process is smooth and error-free.

Do:

- Read the instructions carefully before filling out the form. This ensures that you understand each section and its requirements.

- Double-check your personal information, such as your name, date of birth, and taxpayer identification number, to ensure accuracy.

- Accurately calculate the days you were present in the U.S. for the current and past years. This is critical for the Substantial Presence Test.

- Provide detailed information about your tax home and closer connections to a foreign country. Specificity helps clarify your situation.

- Sign and date the form. An unsigned form is considered incomplete and will not be processed.

- Keep a copy of the form and any supporting documents for your records. This can be helpful if questions arise later.

- Mail the form to the correct IRS address. Ensuring it goes to the appropriate office is crucial for timely processing.

- Complete the form if your circumstances change in a way that affects your eligibility for the closer connection exception.

- Consult with a tax professional if you are unsure about any part of the form. Professional advice can prevent costly mistakes.

- File the form on time, ideally well before the deadline, to avoid any potential issues or delays.

Don't:

- Don’t ignore the detailed instructions provided by the IRS for each part of the form. Overlooking these instructions can lead to errors.

- Don’t provide false or misleading information. Doing so can result in penalties or legal action.

- Don’t forget to include relevant attachments or supporting documents. These are often required to substantiate your claims.

- Don’t submit the form if you don’t meet the specific requirements for the closer connection exception. Review eligibility criteria first.

- Don’t overlook the importance of the “Significant Contacts” section. Be thorough in your explanations of ties to another country.

- Don’t use pencil or erasable ink. Fill out the form in blue or black ink to ensure permanence and legibility.

- Don’t hesitate to amend a previously filed form if you discover an error. Correcting inaccuracies is important for compliance.

- Don’t mail the form without ensuring all sections are complete and accurate. Incomplete or incorrect forms will be returned or delayed.

- Don’t underestimate the IRS timelines for processing. Plan ahead to accommodate these windows, especially during peak periods.

- Don’t forget to update your form annually if your situation continues to meet the criteria for the closer connection exception.

Misconceptions

The IRS 8840 form, often referred to as the "Closer Connection Exception Statement for Aliens," is a topic surrounded by misconceptions. This crucial form allows certain non-residents to assert a closer connection to a foreign country than to the U.S., which can affect their tax status. Understanding the facts can dispel common myths and ensure compliance with tax regulations.

- Misconception 1: The 8840 form exempts you from paying U.S. taxes.

This is incorrect. The form does not exempt an individual from paying U.S. taxes. Instead, it is used by non-residents to claim that they have a closer connection to another country and therefore should not be considered a U.S. resident for tax purposes. This can affect the amount of income on which they are taxed by the U.S., but it does not exempt income earned in the U.S. from U.S. taxation.

- Misconception 2: Only Canadian citizens need to file the 8840 form.

While it's true that many Canadians file the IRS 8840 form due to the common scenario of spending winter months in the U.S., the requirement is not limited to Canadian citizens. Any non-resident alien spending a significant amount of time in the U.S. and meeting the substantial presence test might need to file the form to clarify their tax residency status.

- Misconception 3: You don't need to file the form if you haven't earned income in the U.S.

This misunderstanding could lead to compliance issues. The filing requirement for Form 8840 is not directly tied to whether you've earned income in the U.S. but to your physical presence and connections to the U.S. versus another country. Therefore, even if you haven't earned U.S. income, you may still need to file the form if you meet the substantial presence test and wish to claim a closer connection to another country to avoid being considered a U.S. resident for tax purposes.

- Misconception 4: Filing Form 8840 is a one-time requirement.

Filing the IRS 8840 form is an annual requirement, not a one-time task. Eligible individuals need to file the form every tax year in which they meet the criteria for the substantial presence test but want to claim a closer connection to another country. Failing to file annually can lead to taxation as a U.S. resident and the imposition of related tax obligations.

Understanding these key points can help dispel myths and ensure that those who are affected comply with U.S. tax laws while protecting their interests.

Key takeaways

Filling out the IRS 8840 form, commonly referred to as the "Closer Connection Exception Statement for Aliens," is essential for specific non-residents who spend a considerable amount of time in the U.S. but want to assert that they have a closer connection to a foreign country and thus are not subject to U.S. taxes on their worldwide income. Here are key takeaways to ensure you properly complete and utilize the form.

- Determine your eligibility first. You must meet the Substantial Presence Test criteria, which calculates the number of days you were physically present in the U.S. over the last three years. However, if you believe you maintain a closer connection to another country, filling out Form 8840 is crucial to claim this exception.

- Provide detailed information about your ties to the foreign country. The form requires you to list significant ties such as the location of your permanent home, family, personal belongings, social connections, and where you conduct routine personal banking. These details support your claim of having a closer connection to another country.

- Timeliness matters. Submit the Form 8840 by the due date for filing your tax return, generally April 15th of the year following the year you are claiming a closer connection for. Failing to file on time can invalidate your claim for the exception, possibly making you liable for U.S. income tax on your worldwide income.

- Keep records and understand it’s an annual requirement. Every year you meet the criteria of the Substantial Presence Test and wish to claim the closer connection exception, you must file Form 8840. Keeping copies of your submitted forms and the supporting documents is critical in case the IRS requires proof of your claims.

Utilizing the IRS 8840 form is a vital step for certain non-residents to avoid being taxed as U.S. residents. Accurate and timely filing, along with robust documentation of your ties to a foreign country, are essential aspects of successfully claiming the closer connection exception.

Popular PDF Documents

Is Social Security Taxed in Maryland - The form allows retirees to update their withholding amounts as their financial situations or tax laws change.

I-9 Verification - Employers are required to complete the I-9 form for each individual they hire, including citizens and noncitizens, to verify employment authorization.