Get IRS 8832 Form

Embarking on the journey to start a business is an exhilarating milestone, yet it comes with its fair share of decisions and paperwork, crucial among them being the IRS 8832 form. This form carries significant weight as it allows an eligible entity to choose how it wishes to be classified for federal tax purposes. Whether a business opts to be viewed as a corporation, a partnership, or a disregarded entity, this election can have profound implications on its tax responsibilities and benefits. Completing the IRS 8832 form is not merely a bureaucratic step; it is a strategic decision that necessitates careful consideration and understanding of the tax landscape. The process involves outlining the entity's current classification, the desired classification, and affirming the consent of all members if a partnership or multi-member entity is opting for a change. This form is a testament to the flexibility offered by the U.S. tax system, allowing businesses the liberty to align their tax treatment with their operational needs and long-term objectives. However, the decision to change classification is not one to be taken lightly, as it can influence not only the amount of taxes owed but also how the IRS interacts with the entity. Therefore, familiarity with the nuances and potential ramifications of Form 8832 is indispensable for any entrepreneur steering through the initial stages of business formation or considering a shift in their business's tax classification.

IRS 8832 Example

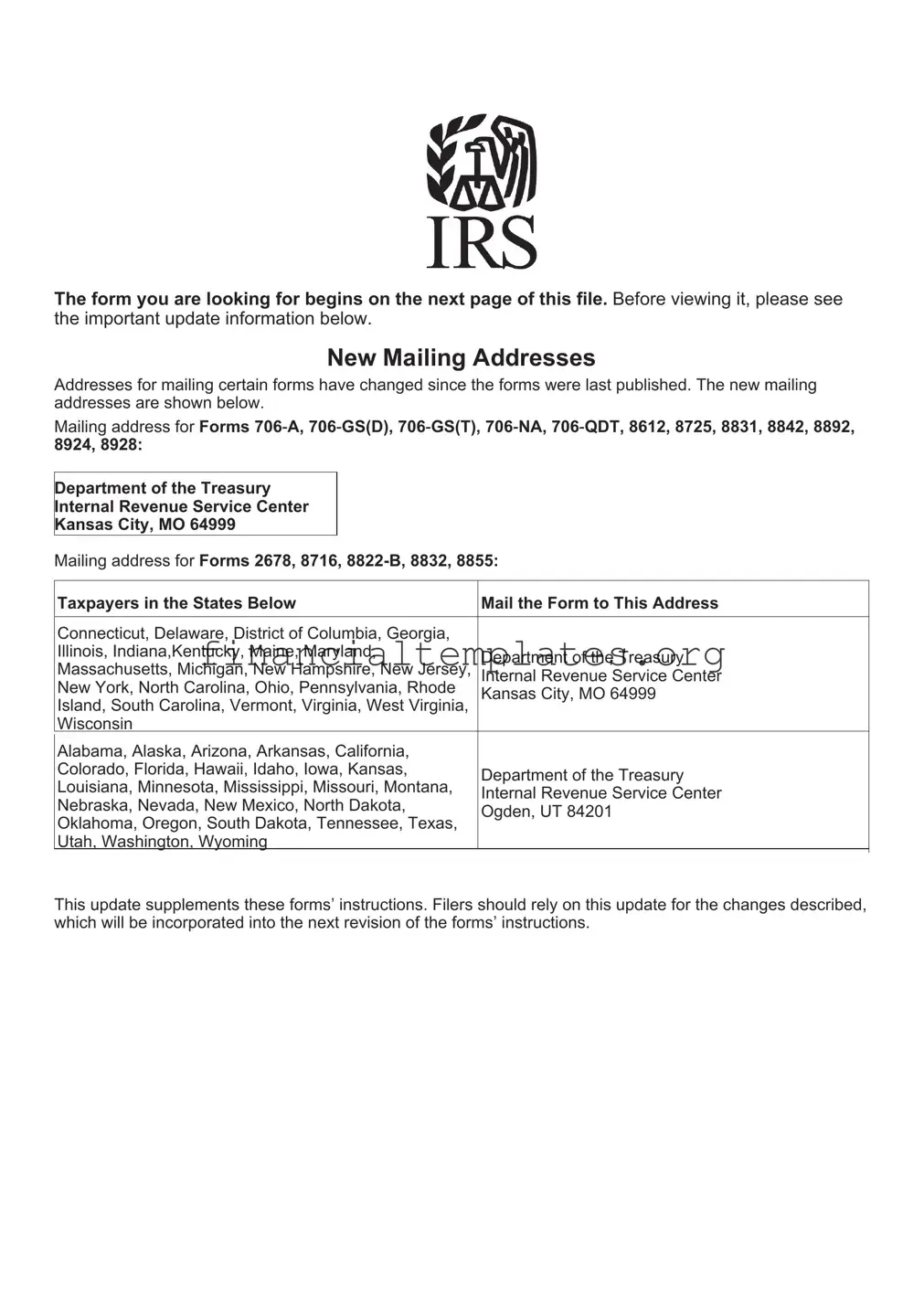

The form you are looking for begins on the next page of this file. Before viewing it, please see

the important update information below.

New Mailing Addresses

Addresses for mailing certain forms have changed since the forms were last published. The new mailing addresses are shown below.

Mailing address for Forms 706͈A, 706͈GS(D), 706͈GS(T), 706͈NA, 706͈QDT, 8612, 8725, 8831, 8842, 8892, 8924, 8928:

Department of the Treasury

Internal Revenue Service Center

Kansas City, MO 64999

Mailing address for Forms 2678, 8716,

|

Taxpayers in the States Below |

Mail the Form to This Address |

|

Connecticut, Delaware, District of Columbia, Georgia, |

|

|

Illinois, Indiana,Kentucky, Maine, Maryland, |

Department of the Treasury |

|

Massachusetts, Michigan, New Hampshire, New Jersey, |

|

|

Internal Revenue Service Center |

|

|

New York, North Carolina, Ohio, Pennsylvania, Rhode |

Kansas City, MO 64999 |

|

Island, South Carolina, Vermont, Virginia, West Virginia, |

|

|

Wisconsin |

|

|

Alabama, Alaska, Arizona, Arkansas, California, |

|

|

|

|

|

Colorado, Florida, Hawaii, Idaho, Iowa, Kansas, |

Department of the Treasury |

|

Louisiana, Minnesota, Mississippi, Missouri, Montana, |

|

|

Internal Revenue Service Center |

|

|

Nebraska, Nevada, New Mexico, North Dakota, |

|

|

Ogden, UT 84201 |

|

|

Oklahoma, Oregon, South Dakota, Tennessee, Texas, |

|

|

|

|

|

Utah, Washington, Wyoming |

|

|

|

|

This update supplements these forms’ instructions. Filers should rely on this update for the changes described, which will be incorporated into the next revision of the forms’ instructions.

Form 8832

(Rev. December 2013)

Department of the Treasury Internal Revenue Service

Entity Classification Election

Information about Form 8832 and its instructions is at www.irs.gov/form8832.

OMB No.

Type

or

Name of eligible entity making election |

Employer identification number |

|

|

Number, street, and room or suite no. If a P.O. box, see instructions.

City or town, state, and ZIP code. If a foreign address, enter city, province or state, postal code and country. Follow the country’s practice for entering the postal code.

Check if:

Address change |

Late classification relief sought under Revenue Procedure |

Relief for a late change of entity classification election sought under Revenue Procedure

Part I Election Information

1Type of election (see instructions):

a Initial classification by a

Initial classification by a

b Change in current classification. Go to line 2a.

Change in current classification. Go to line 2a.

2a Has the eligible entity previously filed an entity election that had an effective date within the last 60 months?

Yes. Go to line 2b.

Yes. Go to line 2b.

No. Skip line 2b and go to line 3.

No. Skip line 2b and go to line 3.

2b

3

Was the eligible entity’s prior election an initial classification election by a newly formed entity that was effective on the date of formation?

Yes. Go to line 3.

Yes. Go to line 3.

No. Stop here. You generally are not currently eligible to make the election (see instructions).

No. Stop here. You generally are not currently eligible to make the election (see instructions).

Does the eligible entity have more than one owner?

Yes. You can elect to be classified as a partnership or an association taxable as a corporation. Skip line 4 and go to line 5.

No. You can elect to be classified as an association taxable as a corporation or to be disregarded as a separate entity. Go to line 4.

No. You can elect to be classified as an association taxable as a corporation or to be disregarded as a separate entity. Go to line 4.

4If the eligible entity has only one owner, provide the following information:

aName of owner

bIdentifying number of owner

5If the eligible entity is owned by one or more affiliated corporations that file a consolidated return, provide the name and employer identification number of the parent corporation:

aName of parent corporation

bEmployer identification number

For Paperwork Reduction Act Notice, see instructions. |

Cat. No. 22598R |

Form 8832 (Rev. |

Form 8832 (Rev. |

Page 2 |

|

Part I |

Election Information (Continued) |

|

6Type of entity (see instructions):

a

A domestic eligible entity electing to be classified as an association taxable as a corporation.

A domestic eligible entity electing to be classified as an association taxable as a corporation.

b

A domestic eligible entity electing to be classified as a partnership.

A domestic eligible entity electing to be classified as a partnership.

c

A domestic eligible entity with a single owner electing to be disregarded as a separate entity.

A domestic eligible entity with a single owner electing to be disregarded as a separate entity.

d

A foreign eligible entity electing to be classified as an association taxable as a corporation.

A foreign eligible entity electing to be classified as an association taxable as a corporation.

e

A foreign eligible entity electing to be classified as a partnership.

A foreign eligible entity electing to be classified as a partnership.

f

A foreign eligible entity with a single owner electing to be disregarded as a separate entity.

A foreign eligible entity with a single owner electing to be disregarded as a separate entity.

7If the eligible entity is created or organized in a foreign jurisdiction, provide the foreign country of organization

8 Election is to be effective beginning (month, day, year) (see instructions) . . . . . . . . . . . .

9Name and title of contact person whom the IRS may call for more information

10Contact person’s telephone number

Consent Statement and Signature(s) (see instructions)

Under penalties of perjury, I (we) declare that I (we) consent to the election of the

Signature(s)

Date

Title

Form 8832 (Rev.

Form 8832 (Rev. |

Page 3 |

|

Part II |

Late Election Relief |

|

11Provide the explanation as to why the entity classification election was not filed on time (see instructions).

Under penalties of perjury, I (we) declare that I (we) have examined this election, including accompanying documents, and, to the best of my (our) knowledge and belief, the election contains all the relevant facts relating to the election, and such facts are true, correct, and complete. I (we) further declare that I (we) have personal knowledge of the facts and circumstances related to the election. I (we) further declare that the elements required for relief in Section 4.01 of Revenue Procedure

Signature(s)

Date

Title

Form 8832 (Rev.

Form 8832 (Rev. |

Page 4 |

General Instructions

Section references are to the Internal Revenue Code unless otherwise noted.

Future Developments

For the latest information about developments related to Form 8832 and its instructions, such as legislation enacted after they were published, go to www.irs.gov/form8832.

What's New

For entities formed on or after July 1, 2013, the Croatian Dionicko Drustvo will always be treated as a corporation. See Notice

Purpose of Form

An eligible entity uses Form 8832 to elect how it will be classified for federal tax purposes, as a corporation, a partnership, or an entity disregarded as separate from its owner. An eligible entity is classified for federal tax purposes under the default rules described below unless it files Form 8832 or Form 2553, Election by a Small Business Corporation. See Who Must File below.

The IRS will use the information entered on this form to establish the entity’s filing and reporting requirements for federal tax purposes.

Note. An entity must file Form 2553 if making an election under section 1362(a) to be an S corporation

A new eligible entity should not file Form 8832 if it will be using its

TIP default classification (see Default Rules below).

Eligible entity. An eligible entity is a business entity that is not included in items 1, or 3 through 9, under the definition of corporation provided under Definitions. Eligible entities include limited liability companies (LLCs) and partnerships.

Generally, corporations are not eligible entities. However, the following types of corporations are treated as eligible entities:

1.An eligible entity that previously elected to be an association taxable as a corporation by filing Form 8832. An entity that elects to be classified as a corporation by filing Form 8832 can make another election to change its classification (see the

2.A foreign eligible entity that became an association taxable as a corporation under the foreign default rule described below.

Default Rules

Existing entity default rule. Certain domestic and foreign entities that were in existence before January 1, 1997, and have an established federal tax classification generally do not need to make an election to continue that classification. If an existing entity decides to change its classification, it may do so subject to the

Domestic default rule. Unless an election is made on Form 8832, a domestic eligible entity is:

1.A partnership if it has two or more members.

2.Disregarded as an entity separate from its owner if it has a single owner.

A change in the number of members of an eligible entity classified as an association (defined below) does not affect the entity’s classification. However, an eligible entity classified as a partnership will become a disregarded entity when the entity’s membership is reduced to one member and a disregarded entity will be classified as a partnership when the entity has more than one member.

Foreign default rule. Unless an election is made on Form 8832, a foreign eligible entity is:

1.A partnership if it has two or more members and at least one member does not have limited liability.

2.An association taxable as a corporation if all members have limited liability.

3.Disregarded as an entity separate from its owner if it has a single owner that does not have limited liability.

However, if a qualified foreign entity (as defined in section 3.02 of Rev. Proc.

1.The qualified entity's owner and purported owners file amended returns that are consistent with the treatment of the entity as a disregarded entity;

2.The amended returns are filed before the close of the period of limitations on assessments under section 6501(a) for the relevant tax year; and

3.The corrected Form 8832, with the box checked entitled: Relief for a late change of entity classification election sought under Revenue Procedure

Also, if the qualified foreign entity (as defined in section 3.02 of Rev. Proc.

1.The qualified entity files information returns and the actual owners file original or amended returns consistent with the treatment of the entity as a partnership;

2.The amended returns are filed before the close of the period of limitations on assessments under section 6501(a) for the relevant tax year; and

3.The corrected Form 8832, with the box checked entitled: Relief for a late change of

entity classification election sought under Revenue Procedure

Definitions

Association. For purposes of this form, an association is an eligible entity taxable as a corporation by election or, for foreign eligible entities, under the default rules (see Regulations section

Business entity. A business entity is any entity recognized for federal tax purposes that is not properly classified as a trust under Regulations section

Corporation. For federal tax purposes, a corporation is any of the following:

1.A business entity organized under a federal or state statute, or under a statute of a federally recognized Indian tribe, if the statute describes or refers to the entity as incorporated or as a corporation, body corporate, or body politic.

2.An association (as determined under Regulations section

3.A business entity organized under a

state statute, if the statute describes or refers to the entity as a

4.An insurance company.

5.A

6.A business entity wholly owned by a state or any political subdivision thereof, or a business entity wholly owned by a foreign government or any other entity described in Regulations section

7.A business entity that is taxable as a corporation under a provision of the Code other than section 7701(a)(3).

8.A foreign business entity listed on page 7. See Regulations section

9.An entity created or organized under the laws of more than one jurisdiction (business entities with multiple charters) if the entity is treated as a corporation with respect to any one of the jurisdictions. See Regulations section

Disregarded entity. A disregarded entity is an eligible entity that is treated as an entity not separate from its single owner for income tax purposes. A “disregarded entity” is treated as separate from its owner for:

•Employment tax purposes, effective for wages paid on or after January 1, 2009; and

•Excise taxes reported on Forms 720, 730, 2290,

Form 8832 (Rev. |

Page 5 |

See the employment tax and excise tax return instructions for more information.

Limited liability. A member of a foreign eligible entity has limited liability if the member has no personal liability for any debts of or claims against the entity by reason of being a member. This determination is based solely on the statute or law under which the entity is organized (and, if relevant, the entity’s organizational documents). A member has personal liability if the creditors of the entity may seek satisfaction of all or any part of the debts or claims against the entity from the member as such. A member has personal liability even if the member makes an agreement under which another person (whether or not a member of the entity) assumes that liability or agrees to indemnify that member for that liability.

Partnership. A partnership is a business entity that has at least two members and is not a corporation as defined above under Corporation.

Who Must File

File this form for an eligible entity that is one of the following:

•A domestic entity electing to be classified as an association taxable as a corporation.

•A domestic entity electing to change its current classification (even if it is currently classified under the default rule).

•A foreign entity that has more than one owner, all owners having limited liability, electing to be classified as a partnership.

•A foreign entity that has at least one owner that does not have limited liability, electing to be classified as an association taxable as a corporation.

•A foreign entity with a single owner having limited liability, electing to be an entity disregarded as an entity separate from its owner.

•A foreign entity electing to change its current classification (even if it is currently classified under the default rule).

Do not file this form for an eligible entity that is:

•

•A real estate investment trust (REIT), as defined in section 856; or

•Electing to be classified as an S corporation. An eligible entity that timely files Form 2553 to elect classification as an S corporation and meets all other requirements to qualify as an S corporation is deemed to have made an election under Regulations section

All three of these entities are deemed to

have made an election to be classified as an association.

Effect of Election

The federal tax treatment of elective changes in classification as described in Regulations section

•If an eligible entity classified as a partnership elects to be classified as an association, it is deemed that the partnership contributes all of its assets and liabilities to the association in exchange for stock in the association, and immediately thereafter, the partnership liquidates by distributing the stock of the association to its partners.

•If an eligible entity classified as an association elects to be classified as a partnership, it is deemed that the association distributes all of its assets and liabilities to its shareholders in liquidation of the association, and immediately thereafter, the shareholders contribute all of the distributed assets and liabilities to a newly formed partnership.

•If an eligible entity classified as an association elects to be disregarded as an entity separate from its owner, it is deemed that the association distributes all of its assets and liabilities to its single owner in liquidation of the association.

•If an eligible entity that is disregarded as an entity separate from its owner elects to be classified as an association, the owner of the eligible entity is deemed to have contributed all of the assets and liabilities of the entity to the association in exchange for the stock of the association.

Note. For information on the federal tax consequences of elective changes in classification, see Regulations section

When To File

Generally, an election specifying an eligible entity’s classification cannot take effect more than 75 days prior to the date the election is filed, nor can it take effect later than 12 months after the date the election is filed. An eligible entity may be eligible for late election relief in certain circumstances. For more information, see Late Election Relief, later.

Where To File

File Form 8832 with the Internal Revenue Service Center for your state listed later.

In addition, attach a copy of Form 8832 to the entity’s federal tax or information return for the tax year of the election. If the entity is not required to file a return for that year, a copy of its Form 8832 must be attached to the federal tax returns of all direct or indirect owners of the entity for the tax year of the owner that includes the date on which the election took effect. An indirect owner of the electing entity does not have to attach a copy of the Form 8832 to its tax return if an entity in which it has an interest is already filing a copy of the Form 8832 with its return. Failure to attach a copy of Form 8832 will not invalidate an otherwise valid election, but penalties may be assessed against persons who are required to, but do not, attach Form 8832.

Each member of the entity is required to file the member's return consistent with the entity election. Penalties apply to returns filed inconsistent with the entity’s election.

If the entity’s principal |

Use the following |

|

business, office, or |

Internal Revenue |

|

agency is located in: |

Service Center |

|

|

address: |

|

Connecticut, Delaware, |

|

|

District of Columbia, |

|

|

Florida, Illinois, Indiana, |

|

|

Kentucky, Maine, |

|

|

Maryland, Massachusetts, |

|

|

Michigan, New Hampshire, |

Cincinnati, OH 45999 |

|

New Jersey, New York, |

|

|

North Carolina, Ohio, |

|

|

Pennsylvania, Rhode |

|

|

Island, South Carolina, |

|

|

Vermont, Virginia, West |

|

|

Virginia, Wisconsin |

|

|

|

|

|

If the entity’s principal |

Use the following |

|

business, office, or |

Internal Revenue |

|

agency is located in: |

Service Center |

|

|

address: |

|

|

|

|

Alabama, Alaska, Arizona, |

|

|

Arkansas, California, |

|

|

Colorado, Georgia, Hawaii, |

|

|

Idaho, Iowa, Kansas, |

|

|

Louisiana, Minnesota, |

|

|

Mississippi, Missouri, |

Ogden, UT 84201 |

|

Montana, Nebraska, |

||

|

||

Nevada, New Mexico, |

|

|

North Dakota, Oklahoma, |

|

|

Oregon, South Dakota, |

|

|

Tennessee, Texas, Utah, |

|

|

Washington, Wyoming |

|

|

|

|

|

A foreign country or U.S. |

Ogden, UT |

|

possession |

Note. Also attach a copy to the entity’s federal income tax return for the tax year of the election.

Acceptance or Nonacceptance of Election

The service center will notify the eligible entity at the address listed on Form 8832 if its election is accepted or not accepted. The entity should generally receive a determination on its election within 60 days after it has filed Form 8832.

Care should be exercised to ensure that the IRS receives the election. If the entity is not notified of acceptance or nonacceptance of its election within 60 days of the date of filing, take

If the IRS questions whether Form 8832 was filed, an acceptable proof of filing is:

•A certified or registered mail receipt (timely postmarked) from the U.S. Postal Service, or its equivalent from a designated private delivery service;

•Form 8832 with an accepted stamp;

•Form 8832 with a stamped IRS received date; or

•An IRS letter stating that Form 8832 has been accepted.

Form 8832 (Rev. |

Page 6 |

Specific Instructions

Name. Enter the name of the eligible entity electing to be classified.

Employer identification number (EIN). Show the EIN of the eligible entity electing to be classified.

Do not put “Applied For” on F! this line.

CAUTION

Note. Any entity that has an EIN will retain that EIN even if its federal tax classification changes under Regulations section

If a disregarded entity’s classification changes so that it becomes recognized as a partnership or association for federal tax purposes, and that entity had an EIN, then the entity must continue to use that EIN. If the entity did not already have its own EIN, then the entity must apply for an EIN and not use the identifying number of the single owner.

A foreign entity that makes an election under Regulations section

(d)must also use its own taxpayer identifying number. See sections 6721 through 6724 for penalties that may apply for failure to supply taxpayer identifying numbers.

If the entity electing to be classified using Form 8832 does not have an EIN, it must apply for one on Form

F |

Do not apply for a new EIN for an |

|

existing entity that is changing its |

||

! |

||

classification if the entity already |

||

CAUTION |

has an EIN. |

Address. Enter the address of the entity electing a classification. All correspondence regarding the acceptance or nonacceptance of the election will be sent to this address. Include the suite, room, or other unit number after the street address. If the Post Office does not deliver mail to the street address and the entity has a P.O. box, show the box number instead of the street address. If the electing entity receives its mail in care of a third party (such as an accountant or an attorney), enter on the street address line “C/O” followed by the third party’s name and street address or P.O. box.

Address change. If the eligible entity has changed its address since filing Form

Relief for a late change of entity classification election sought under Revenue Procedure

Part I. Election Information

Complete Part I whether or not the entity is seeking relief under Rev. Proc.

Line 1. Check box 1a if the entity is choosing a classification for the first time (i.e., the entity does not want to be classified under the applicable default classification). Do not file this form if the entity wants to be classified under the default rules.

Check box 1b if the entity is changing its current classification.

Lines 2a and 2b.

Once an eligible entity makes an election to change its classification, the entity generally cannot change its classification by election again during the 60 months after the effective date of the election. However, the IRS may (by private letter ruling) permit the entity to change its classification by election within the

Note. The

Line 4. If an eligible entity has only one owner, provide the name of its owner on line 4a and the owner’s identifying number (social security number, or individual taxpayer identification number, or EIN) on line 4b. If the electing eligible entity is owned by an entity that is a disregarded entity or by an entity that is a member of a series of tiered disregarded entities, identify the first entity (the entity closest to the electing eligible entity) that is not a disregarded entity. For example, if the electing eligible entity is owned by disregarded entity A, which is owned by another disregarded entity B, and disregarded entity B is owned by partnership C, provide the name and EIN of partnership C as the owner of the electing eligible entity. If the owner is a foreign person or entity and does not have a U.S. identifying number, enter “none” on line 4b.

Line 5. If the eligible entity is owned by one or more members of an affiliated group of corporations that file a consolidated return, provide the name and EIN of the parent corporation.

Line 6. Check the appropriate box if you are changing a current classification (no matter how achieved), or are electing out of a default classification. Do not file this form if you fall within a default classification that is the desired classification for the new entity.

Line 7. If the entity making the election is created or organized in a foreign jurisdiction, enter the name of the foreign country in which it is organized. This information must be provided even if the entity is also organized under domestic law.

Line 8. Generally, the election will take effect on the date you enter on line 8 of this form,

or on the date filed if no date is entered on line 8. An election specifying an entity’s classification for federal tax purposes can take effect no more than 75 days prior to the date the election is filed, nor can it take effect later than 12 months after the date on which the election is filed. If line 8 shows a date more than 75 days prior to the date on which the election is filed, the election will default to 75 days before the date it is filed. If line 8 shows an effective date more than 12 months from the filing date, the election will take effect 12 months after the date the election is filed.

Consent statement and signature(s). Form

8832 must be signed by:

1.Each member of the electing entity who is an owner at the time the election is filed; or

2.Any officer, manager, or member of the electing entity who is authorized (under local law or the organizational documents) to make the election. The elector represents to having such authorization under penalties of perjury.

If an election is to be effective for any period prior to the time it is filed, each person who was an owner between the date the election is to be effective and the date the election is filed, and who is not an owner at the time the election is filed, must sign.

If you need a continuation sheet or use a separate consent statement, attach it to Form 8832. The separate consent statement must contain the same information as shown on Form 8832.

Note. Do not sign the copy that is attached to your tax return.

Part II. Late Election Relief

Complete Part II only if the entity is requesting late election relief under Rev. Proc.

An eligible entity may be eligible for late election relief under Rev. Proc.

1.The entity failed to obtain its requested classification as of the date of its formation (or upon the entity's classification becoming relevant) or failed to obtain its requested change in classification solely because Form 8832 was not filed timely.

2.Either:

a.The entity has not filed a federal tax or information return for the first year in which the election was intended because the due date has not passed for that year's federal tax or information return; or

b.The entity has timely filed all required federal tax returns and information returns (or if not timely, within 6 months after its due date, excluding extensions) consistent with its requested classification for all of the years the entity intended the requested election to be effective and no inconsistent tax or information returns have been filed by or with respect to the entity during any of the tax years. If the eligible entity is not required to file a federal tax return or information return, each affected person who is required to file a federal tax return or information return must have timely filed all such returns (or if not timely, within 6 months after its due date, excluding extensions) consistent with the

Form 8832 (Rev. |

Page 7 |

entity's requested classification for all of the years the entity intended the requested election to be effective and no inconsistent tax or information returns have been filed during any of the tax years.

3.The entity has reasonable cause for its failure to timely make the entity classification election.

4.Three years and 75 days from the requested effective date of the eligible entity's classification election have not passed.

Affected person. An affected person is either:

•with respect to the effective date of the eligible entity's classification election, a person who would have been required to attach a copy of the Form 8832 for the eligible entity to its federal tax or information return for the tax year of the person which includes that date; or

•with respect to any subsequent date after the entity's requested effective date of the classification election, a person who would have been required to attach a copy of the Form 8832 for the eligible entity to its federal tax or information return for the person's tax year that includes that subsequent date had the election first become effective on that subsequent date.

For details on the requirement to attach a copy of Form 8832, see Rev. Proc.

To obtain relief, file Form 8832 with the applicable IRS service center listed in Where To File, earlier, within 3 years and 75 days from the requested effective date of the eligible entity's classification election.

If Rev. Proc.

entity may seek relief for a late entity election by requesting a private letter ruling and paying a user fee in accordance with Rev. Proc.

Line 11. Explain the reason for the failure to file a timely entity classification election.

Signatures. Part II of Form 8832 must be signed by an authorized representative of the eligible entity and each affected person. See Affected Persons, earlier. The individual or individuals who sign the declaration must have personal knowledge of the facts and circumstances related to the election.

Foreign Entities Classified as Corporations for Federal Tax Purposes:

American

People’s Republic of

Youxian Gongsi

Republic of China (Taiwan)

Costa

Anonima

El

European Economic Area/European Union

Hong

New

Northern Mariana

Puerto

Obshchestvo

Saudi

Slovak

South

Switzerland— Aktiengesellschaft

Trinidad and

United

United States Virgin

Anonima

See Regulations section F!

exceptions and inclusions to items CAUTION on this list and for any revisions made to this list since these instructions were printed.

Paperwork Reduction Act Notice

We ask for the information on this form to carry out the Internal Revenue laws of the United States. You are required to give us the information. We need it to ensure that you are complying with these laws and to allow us to figure and collect the right amount of tax.

You are not required to provide the information requested on a form that is subject to the Paperwork Reduction Act unless the form displays a valid OMB control number. Books or records relating to a form or its instructions must be retained as long as their contents may become material in the administration of any Internal Revenue law. Generally, tax returns and return information are confidential, as required by section 6103.

The time needed to complete and file this form will vary depending on individual circumstances. The estimated average time is:

Recordkeeping . . . . 2 hr., 46 min.

Learning about the

law or the form . . . . 3 hr., 48 min.

Preparing and sending

the form to the IRS . . . . . 36 min.

If you have comments concerning the accuracy of these time estimates or suggestions for making this form simpler, we would be happy to hear from you. You can write to the Internal Revenue Service, Tax Forms and Publications, SE:W:CAR:MP:TFP,

1111 Constitution Ave. NW,

Document Specifics

| Fact Number | Description |

|---|---|

| 1 | The IRS Form 8832 is used by eligible entities to choose how they are classified for federal tax purposes. |

| 2 | An eligible entity can use Form 8832 to elect its classification as either a corporation, a partnership, or an entity disregarded as separate from its owner. |

| 3 | This form is critical for businesses as the chosen classification affects tax rates, filing requirements, and eligibility for tax benefits. |

| 4 | Once filed, the election remains in effect until it is actively changed by filing Form 8832 again with a new election. |

| 5 | Generally, a single-member LLC can elect to be treated as a corporation or as a disregarded entity. |

| 6 | If no election is made using Form 8832, an eligible entity is automatically classified by default under IRS rules. |

| 7 | The form must be filed with the Internal Revenue Service Center designated for the entity’s legal address. |

| 8 | For entities making an initial classification election, the form must be filed within 75 days of the effective date of the election. |

| 9 | State-specific effects: Some states require a copy of Form 8832 for state tax purposes, and governance may vary based on state tax law. |

| 10 | IRS provides detailed instructions for Form 8832, including definitions, filing addresses, and processing instructions, to assist filers. |

Guide to Writing IRS 8832

When an entity opts to change how it is classified for federal tax purposes, it must complete Form 8832. The form serves as a critical notification to the Internal Revenue Service (IRS), signaling the desired change. Accuracy and thoroughness in completing the form are paramount to avoid any delays or issues with the IRS recognizing the change. The steps to fill out Form 8832 are detailed below, designed to guide the entity through each section, ensuring all necessary information is provided.

- Provide the name of the eligible entity making the election.

- Enter the employer identification number (EIN) of the entity.

- Fill out the mailing address of the entity, including the city, state, and ZIP code.

- Indicate the type of entity by checking the appropriate box in Part I, question 1. If "Other" is selected, specify the type in the space provided.

- In question 2 of Part I, describe the business entity’s primary business activity. Provide a detailed description, including products or services offered.

- Complete question 3 of Part I by indicating the number of owners the entity has.

- In Part I, question 4, provide the date the election is to take effect. Ensure this date aligns with the regulatory guidelines for the timing of elections.

- For entities electing to change to a partnership or disregarded entity, answer questions 5 through 8 in Part I, providing additional details about the election and previous classifications.

- Part II requires the signature of an officer, manager, or member of the entity, validating that they have the authority to make the election and that all provided information is accurate.

- Date the form on the line provided in Part II to confirm when the election is being made.

Once the form is fully completed, it should be mailed to the appropriate IRS service center, as specified in the instructions for Form 8832. It is essential to keep a copy of the completed form and any correspondence from the IRS regarding the election for the entity's records. Anticipate a response from the IRS acknowledging the receipt and processing of the form. This acknowledgement will confirm the entity's new tax classification and the effective date of the change.

Understanding IRS 8832

-

What is IRS Form 8832?

IRS Form 8832 is known as the "Entity Classification Election" form. It allows eligible entities, such as a limited liability company (LLC) or a foreign entity, to choose how they are classified for federal tax purposes. Options include being taxed as a partnership, corporation, or as a disregarded entity if it's a single-member LLC. This classification has significant implications for tax rates, filing requirements, and eligibility for certain tax benefits.

-

Who needs to file IRS Form 8832?

Entities that wish to change their current tax classification or newly formed entities deciding their classification for the first time need to file IRS Form 8832. This includes LLCs, both domestic and foreign, and other entities that are not automatically classified as a corporation by the IRS.

-

How does filing Form 8832 affect taxes?

Choosing a tax classification affects how an entity is taxed on its income, what tax forms it must file, and its eligibility for certain deductions and credits. For example, being taxed as a corporation involves paying income tax at the corporate rate, possibly resulting in double taxation of dividends. In contrast, partnership or disregarded entity status allows for pass-through taxation, where the income is taxed only at the individual level.

-

When should Form 8832 be filed?

Form 8832 should be filed when an entity is first being formed or when an existing entity wishes to change its tax classification. There is a window of time for the election to be effective, either 75 days before or 12 months after the form is filed. It's crucial to file timely to ensure the desired classification is honored for the relevant tax period.

-

Where do I file IRS Form 8832?

The filing address for IRS Form 8832 depends on the entity's location. The IRS provides different addresses for domestic and foreign entities, which can be found in the instructions for Form 8832. Electronically filing is not an option for this form, so it must be mailed to the correct IRS address.

-

Can an entity change its classification more than once?

Yes, but restrictions apply. An entity that changes its tax classification is generally required to wait five years before making another change. There are exceptions, such as if the change is due to a significant change in the business or with IRS consent. These restrictions ensure that entities do not frequently change classifications to gain a tax advantage.

-

What happens if I don't file Form 8832?

If Form 8832 is not filed, the entity will be classified according to default IRS rules. For domestic LLCs with more than one member, the default classification is a partnership. For a single-member LLC, it's a disregarded entity, and for entities that meet certain criteria, the default is corporation. Not filing Form 8832 relinquishes control over the entity's tax classification, possibly resulting in less favorable tax treatment.

-

Is there a penalty for filing Form 8832 late?

While there isn't a specific penalty for filing Form 8832 late, failing to file on time can prevent the desired classification from being applied retroactively to the beginning of the tax year. This can lead to discrepancies in tax filings and potentially result in audits or interest and penalties related to incorrect tax payments.

Common mistakes

Filling out the IRS 8832 form, which allows an entity to choose how it wishes to be classified for federal tax purposes, can be a complex process. There are several common errors that people make when completing this form. Recognizing these mistakes can help ensure the form is filled out accurately, avoiding potential complications with the IRS.

Not checking the eligibility of the entity to file Form 8832. Certain entities, due to their structure or location, may not be eligible to make an election.

Failing to provide all required identifying information, such as the name of the entity, the Employer Identification Number (EIN), and the entity’s address, can lead to processing delays.

Incorrectly selecting the classification desired. This selection determines how the entity will be taxed, and making an incorrect choice can have significant financial implications.

Missing the signature of an authorized person. The form must be signed by someone who has the authority to bind the entity, such as an executive officer in a corporation.

Omitting the effective date of the election or choosing an effective date that does not comply with IRS regulations. The IRS has strict rules about when an election can take effect.

Misunderstanding the late election relief provisions and assuming that late elections will automatically be accepted. There are specific circumstances under which late elections can be made.

Forgetting to attach a statement explaining the reasons for the election and detailing the ownership of the entity. This supporting statement is crucial for the IRS to understand the context of the election.

Not realizing that additional forms or filings may be required by states or other regulatory bodies, depending on the new classification of the entity.

Assuming that one form fits all situations and not seeking advice when a unique situation arises. Entities with complex structures or with entities in multiple states or countries may face additional considerations.

Failure to keep a copy of the filled-out form for their records. Keeping a copy is important for future reference and for preparing future tax returns.

Avoiding these mistakes requires careful attention to detail and, often, consultation with a tax professional. Properly completing and submitting Form 8832 is crucial for entities wishing to change their tax classification, affecting their tax treatment and obligations.

Documents used along the form

When businesses or entities choose to change their tax classification, they often use IRS Form 8832 for this purpose. However, this pivotal document does not stand alone in the modification process. To ensure a smooth transition and compliance with tax laws, several other forms and documents are typically required. Each serves a specific function in affirming the entity's new tax status, maintaining legal documentation, or updating the entity's financial and operational records.

- IRS Form SS-4: This is the Application for Employer Identification Number (EIN). It's necessary for newly formed entities or those that are changing their structure and may need a new EIN to reflect their updated tax classification.

- IRS Form 2553: Known as the Election by a Small Business Corporation, this form is used by entities that wish to be taxed as an S Corporation. It requires information about the corporation's eligibility and the consent of all shareholders.

- IRS Form 1065: Used by partnerships to report their income, deductions, gains, losses, etc. Entities changing to a partnership tax status will need to file this form annually.

- IRS Form 1120: Corporations file this U.S. Corporation Income Tax Return to report their income, losses, and dividends. This form is relevant for entities electing to be taxed as C Corporations.

- Operating Agreement: Though not a federal tax form, an updated operating agreement is crucial for LLCs changing their tax classification. It outlines the operational aspects and member roles within the LLC, reflecting any changes in management or ownership structure.

- Articles of Amendment: Entities that undergo a change in their legal or tax structure might need to file Articles of Amendment with their state's secretary of state. This document formally records changes in the entity’s name, purpose, or management in public records.

- Financial Statements: Including balance sheets and income statements. Changes in tax status can impact financial reporting requirements. Entities must prepare updated financial statements to reflect their new classification.

- Board Resolution or Consent: For corporations, a formal resolution or written consent from the board of directors may be necessary to approve the change in tax classification. This document serves as an official record of the decision.

Together, these documents form a comprehensive suite to support the transition of an entity’s tax status using IRS Form 8832. Navigating the complexities of tax law and ensuring all requisite forms and documents are properly filled out and submitted is essential for legal compliance and the successful reclassification of any business entity.

Similar forms

The IRS 8832 form, also known as the "Entity Classification Election" form, allows entities to choose their tax classification. A similar form is the IRS 2553, or "Election by a Small Business Corporation", used by S corporations to elect their tax status under Subchapter S. Both forms serve the purpose of electing a tax classification, but the 2553 is specific to S corporations, while the 8832 covers a broader range of entities.

Another comparable document is the IRS Form W-9, "Request for Taxpayer Identification Number and Certification". Like the 8832, the W-9 is a critical form for tax reporting, used to provide a taxpayer identification number to entities that pay them income. While the W-9 is more about identification than tax classification, both forms are fundamental in the compliance with IRS regulations.

The IRS Form 1120, "U.S. Corporation Income Tax Return", is related in its involvement with corporate tax matters. Corporations file this form to report their income, gains, losses, deductions, and credits. The election made on Form 8832 influences the tax obligations and filing requirements, which encompasses the need for Form 1120 by C corporations, underlining their interconnectedness.

Form 1065, "U.S. Return of Partnership Income", also pairs with the 8832 form because entities electing to be treated as partnerships for tax purposes must file it. This form is used to report the income, deductions, gains, losses, etc., of partnerships. The tax classification election made on Form 8832 directly affects whether an entity needs to file Form 1065, showcasing their close relationship.

The IRS Form SS-4, "Application for Employer Identification Number (EIN)", though primarily for obtaining an EIN, shares a connection with Form 8832 through the establishment of a business entity's formal identity with the IRS. Entities often need to secure an EIN before making a classification election on Form 8832, making the forms sequential steps in entity setup and tax compliance processes.

Form 5472, "Information Return of a 25% Foreign-Owned U.S. Corporation or a Foreign Corporation Engaged in a U.S. Trade or Business", is indirectly related to Form 8832 through its focus on foreign entities' U.S. tax obligations. Entities that have made specific elections on Form 8832 that affect their tax treatment concerning foreign ownership or business activities may need to file Form 5472, linking the forms by the scope of their reporting requirements.

The IRS Form 1040, "U.S. Individual Income Tax Return", connects with the 8832 in the context of sole proprietors and single-member LLCs that elect to be disregarded as separate entities for tax purposes. This choice on Form 8832 affects how income is reported, potentially requiring it to be reported on the owner’s Form 1040, thereby demonstrating how these forms can be interrelated based on the entity’s tax election.

Form 8865, "Return of U.S. Persons With Respect to Certain Foreign Partnerships", has ties to Form 8832 through its focus on international partnerships and tax reporting. U.S. persons who are part of a foreign partnership may need to file Form 8865, depending on the entity classification decisions made on Form 8832, emphasizing the global dimension of tax compliance and entity structuring.

Last but not least, the IRS Form 990, "Return of Organization Exempt from Income Tax", is somewhat linked to Form 8832 as it pertains to tax-exempt organizations. Entities that have elected to be treated in a manner that necessitates filing a Form 990 must adhere to specific compliance standards, highlighting the variation in documentation requirements based on the entity’s tax classification choices. While focused on nonprofit organizations, the choice on Form 8832 can influence whether or not an entity is subject to the filing requirements of Form 990.

Dos and Don'ts

Filling out the IRS 8832 form, also known as the Entity Classification Election form, is a critical task that must be handled with precision and care. The choices you make on this form will determine how your entity is taxed. To guide you, below are five things you should do and five things you shouldn't do when completing this form.

What you should do:

- Review the form instructions carefully to ensure you understand the qualification criteria and the implications of your election.

- Gather all necessary information, including the Employer Identification Number (EIN), the date of formation, and the country of organization, before starting to fill out the form.

- Consult with a tax professional or advisor to discuss the tax implications of the entity classification options available to your business.

- Ensure that all members or owners of the entity sign the form to consent to the election, if required.

- Retain a copy of the completed form and any correspondence from the IRS regarding your election for your records.

What you shouldn't do:

- Don't rush through the form without fully understanding the consequences of your entity classification choice.

- Don't neglect to verify the accuracy of all entered information, including names, addresses, and EINs.

- Don't choose a classification without considering the future growth and potential changes in the structure of your business.

- Don't forget to submit the form within the required time frame if you are making an election for a newly formed entity.

- Don't hesitate to seek professional advice if there are any doubts or complexities related to your situation.

Misconceptions

Understanding the intricacies of tax forms is crucial for businesses in the U.S., and the IRS Form 8832, often surrounded by confusion, serves as a prime example. This form allows an eligible entity to choose how it wants to be classified for federal tax purposes, but misconceptions abound. Dispelling these myths is essential to ensure businesses make informed decisions and comply with tax regulations effectively.

Let's address some common misunderstandings:

- Only large corporations need to file Form 8832: This is a widespread myth. In reality, any eligible entity, including small businesses and startups that wish to change their tax classification, can file Form 8832. This flexibility can benefit businesses of all sizes by allowing them to choose a tax classification that aligns with their strategic goals.

- Filing Form 8832 is a one-time decision: While it's true that you cannot constantly flip-flop between classifications, the IRS does allow entities to reclassify themselves, subject to certain restrictions. Specifically, after an entity makes an election, it generally must wait 60 months before making another election unless there's a significant change in ownership.

- Form 8832 only applies to domestic entities: This misconception overlooks the form's global applicability. Foreign entities can also use Form 8832 to select their U.S. tax classification, which is crucial for foreign businesses engaging in U.S. operations. This selection can significantly affect how they are taxed in the United States.

- The default classification cannot be changed: Every business has a default federal tax classification depending on its structure (e.g., corporations, partnerships, disregarded entities). However, entities often wrongly believe that this classification is permanent. Form 8832 exists precisely to offer the flexibility to choose a different classification better suited to their tax planning strategies.

- Filing Form 8832 results in immediate tax benefits: While changing your tax classification can be advantageous, it's essential to understand that the benefits are not always immediate. The election can affect various aspects of taxation, and the overall impact depends on numerous factors, including the entity's income, deductions, and credits. Thus, it's advisable to consult with a tax professional to fully comprehend the implications.

- The process is simple and straightforward: Although the IRS has made efforts to streamline tax filings, deciding whether to file Form 8832 involves complex considerations. The entity's ownership structure, business activities, and long-term goals must all be taken into account. Moreover, the ramifications of this decision extend beyond taxes, potentially impacting financing, legal liability, and operations. Therefore, it's rarely as straightforward as it appears.

In conclusion, navigating the complexities of Form 8832 necessitates a thorough understanding and careful planning. By debunking these common misconceptions, businesses are better equipped to make informed decisions that align with their tax strategy and operational objectives.

Key takeaways

The IRS 8832 form, pivotal for entities choosing their federal tax classification, navigates a critical crossroads for businesses determining how they wish to be taxed. Understanding the nuances of this form can significantly impact a business's fiscal responsibilities and opportunities.

- Entity Classification Choice: The core function of the IRS 8832 form is to allow eligible entities to choose or change their classification for federal tax purposes. This choice directly influences taxation rates, filing requirements, and eligibility for certain tax benefits.

- Eligible Entities: Not all businesses can use form 8832. Primarily, the form is available to LLCs, foreign entities, and partnerships wishing to be taxed differently than their default classification. Sole proprietorships and corporations having made a previous classification election may not use this form for reclassification.

- Filing Deadlines: Timeliness matters. To have the desired classification effective for the entire tax year, the form must be filed within 75 days of the date the election is to take effect, or up to 12 months after that date. Failing to meet these deadlines could result in a default classification for the entire year.

- Signature Requirements: All members or partners of the entity must consent to the election by signing the form. This collective agreement ensures that the tax classification decision is unanimous among the entity's stakeholders.

- Impact on Taxation: A change in classification can alter how a company is taxed. For example, an entity classified as a corporation is subject to corporate tax rates and potential double taxation on distributions. Conversely, entities classified as partnerships or disregarded entities pass income, deductions, credits, etc., directly to their members, affecting personal tax returns.

- Reclassification Limitations: Once an entity makes an election, it cannot change its classification again for 60 months without IRS approval. This limitation underscores the importance of thoughtful deliberation and strategic planning before filing Form 8832.

Consequently, the IRS 8832 form not only offers businesses a critical choice but demands careful consideration and timely action. Ensuring compliance and maximizing tax advantages requires attention to detail and, often, consultation with tax professionals.

Popular PDF Documents

IRS Schedule 1 1040 or 1040-SR - Schedule 1 is crucial for accurately reporting tips that aren’t reported to your employer, ensuring all your income is properly taxed.

Do Military Pay Taxes While Deployed - Learn how Fort Leavenworth's tax services emphasize the taxpayer's responsibility in reviewing and approving their return.