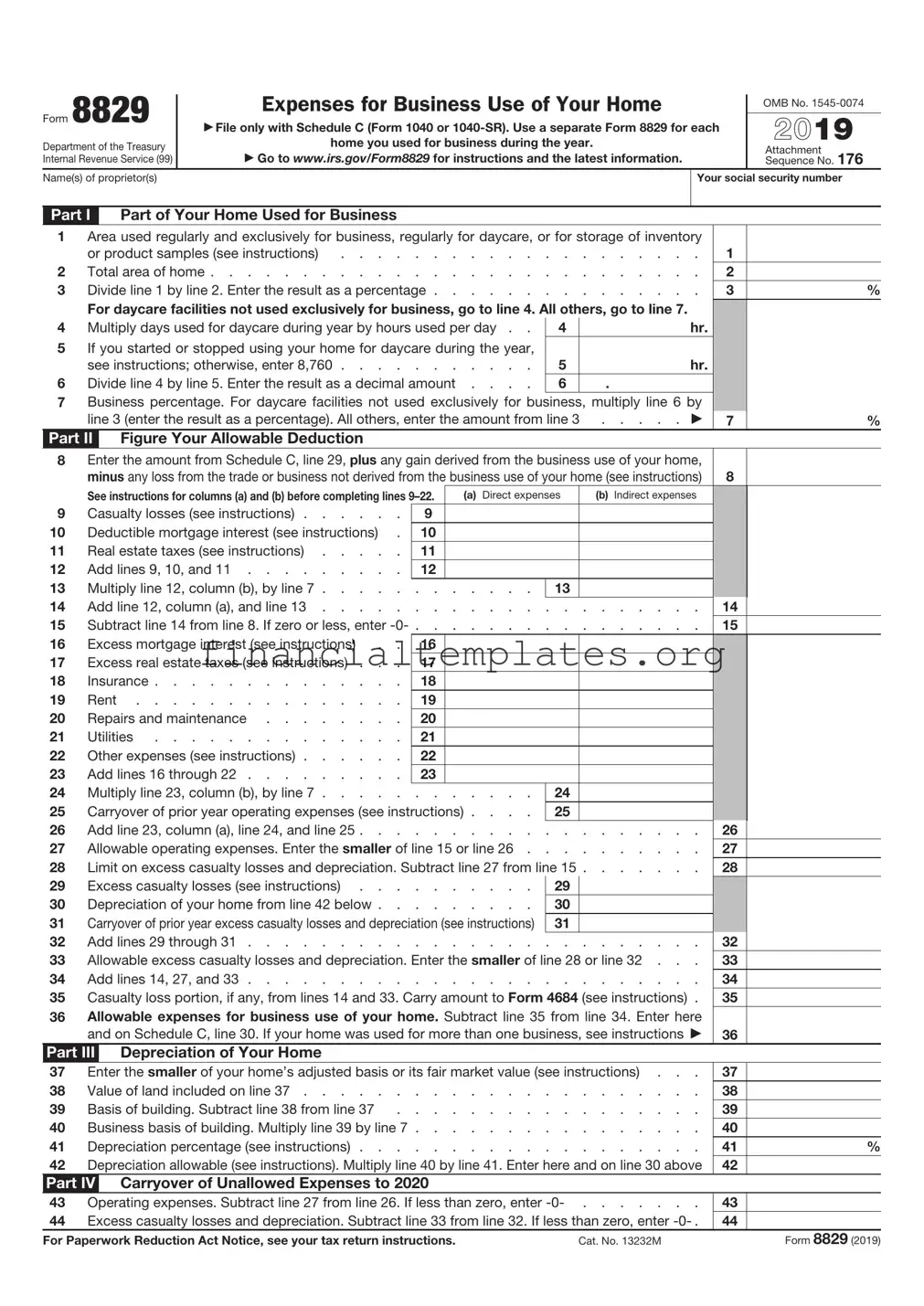

Get IRS 8829 Form

The intricacies of tax preparation for individuals who work from home can often present a maze of paperwork and regulations that seem daunting at first glance. Nestled among these complexities is the IRS Form 8829, a document that offers a pathway for many to deduct expenses related to the business use of a home. This form serves as a crucial tool for self-employed individuals, freelancers, and anyone else conducting business activities from their residence, allowing them to potentially lower their taxable income by claiming deductions on a portion of their housing expenses. Such deductions range from mortgage interest and insurance to utilities and repairs, directly tying the proportions of home used for business to the amount one can claim. However, navigating the eligibility criteria and accurately calculating the deduction requires a meticulous approach, as the Internal Revenue Service sets forth specific guidelines on what constitutes exclusive and regular business use, among other parameters. As taxpayers encounter the form during their tax preparation journey, understanding its nuances becomes not only beneficial for optimizing tax outcomes but also imperative to ensure compliance with tax laws.

IRS 8829 Example

|

Form 8829 |

|

Expenses for Business Use of Your Home |

|

|

OMB No. |

||||||

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

||||

|

▶ File only with Schedule C (Form 1040). Use a separate Form 8829 for each |

|

|

2021 |

||||||||

|

Department of the Treasury |

|

home you used for business during the year. |

|

|

|

||||||

|

|

▶ Go to www.irs.gov/Form8829 for instructions and the latest information. |

|

|

Attachment |

176 |

||||||

|

Internal Revenue Service (99) |

|

|

|

Sequence No. |

|||||||

|

Name(s) of proprietor(s) |

|

|

|

|

|

Your social security number |

|||||

|

|

|

|

|

|

|

|

|

|

|

||

|

Part I |

|

Part of Your Home Used for Business |

|

|

|

|

|

|

|

||

1 |

Area used regularly and exclusively for business, regularly for daycare, or for storage of inventory |

|

|

|

||||||||

|

|

or product samples (see instructions) |

. |

1 |

|

|

||||||

2 |

Total area of home |

. |

2 |

|

|

|||||||

3 |

Divide line 1 by line 2. Enter the result as a percentage |

. |

3 |

|

% |

|||||||

|

|

For daycare facilities not used exclusively for business, go to line 4. All others, go to line 7. |

|

|

|

|

||||||

4 |

Multiply days used for daycare during year by hours used per day . . |

4 |

|

|

hr. |

|

|

|

||||

5 |

If you started or stopped using your home for daycare during the year, |

|

|

|

|

|

|

|

||||

|

|

see instructions; otherwise, enter 8,760 |

5 |

|

|

hr. |

|

|

|

|||

6 |

Divide line 4 by line 5. Enter the result as a decimal amount . . . . |

6 |

|

. |

|

|

|

|

||||

7 |

Business percentage. For daycare facilities not used exclusively for business, multiply line 6 by |

|

|

|

||||||||

|

|

line 3 (enter the result as a percentage). All others, enter the amount from line 3 |

▶ |

7 |

|

% |

||||||

|

Part II |

|

Figure Your Allowable Deduction |

|

|

|

|

|

|

|

||

8Enter the amount from Schedule C, line 29, plus any gain derived from the business use of your home,

|

minus any loss from the trade or business not derived from the business use of your home. See instructions. |

8 |

|||

|

See instructions for columns (a) and (b) before completing lines |

(a) Direct expenses |

(b) Indirect expenses |

|

|

9 |

Casualty losses (see instructions) |

9 |

|

|

|

10 |

Deductible mortgage interest (see instructions) . |

10 |

|

|

|

11 |

Real estate taxes (see instructions) |

11 |

|

|

|

12Add lines 9, 10, and 11 . . . . . . . . . 12

|

|

|

|

|

|

13 |

Multiply line 12, column (b), by line 7 |

. . . . . . |

13 |

|

|

14 |

Add line 12, column (a), and line 13 |

. . . . . . |

. . . . . . . . . |

14 |

|

15 |

Subtract line 14 from line 8. If zero or less, enter |

. . . . . . |

. . . . . . . . . |

15 |

|

16 |

Excess mortgage interest (see instructions) . . |

|

16 |

|

|

17Excess real estate taxes (see instructions) . . . 17

18Insurance . . . . . . . . . . . . . . 18

19 |

Rent |

19 |

20 |

Repairs and maintenance |

20 |

21 |

Utilities |

21 |

22Other expenses (see instructions) . . . . . . 22

23 |

Add lines 16 through 22 . . . . . . . . . 23 |

|

|

|

|

|

|

|

|

24 |

Multiply line 23, column (b), by line 7 |

24 |

|

|

25 |

Carryover of prior year operating expenses (see instructions) . . . . |

25 |

|

|

26 |

Add line 23, column (a), line 24, and line 25 |

. . . . . . . . . |

26 |

|

27 |

Allowable operating expenses. Enter the smaller of line 15 or line 26 . |

. . . . . . . . . |

27 |

|

28 |

Limit on excess casualty losses and depreciation. Subtract line 27 from line 15 |

28 |

||

29 |

Excess casualty losses (see instructions) |

29 |

|

|

30Depreciation of your home from line 42 below . . . . . . . . . 30

31 |

Carryover of prior year excess casualty losses and depreciation (see instructions) 31 |

|

|

32 |

|

|

32 |

Add lines 29 through 31 |

|||

33 |

Allowable excess casualty losses and depreciation. Enter the smaller of line 28 or line 32 . . . |

33 |

|

34 |

Add lines 14, 27, and 33 |

34 |

|

35 |

Casualty loss portion, if any, from lines 14 and 33. Carry amount to Form 4684. See instructions . |

35 |

|

36Allowable expenses for business use of your home. Subtract line 35 from line 34. Enter here

and on Schedule C, line 30. If your home was used for more than one business, see instructions. ▶ 36

Part III |

Depreciation of Your Home |

37 |

Enter the smaller of your home’s adjusted basis or its fair market value. See instructions . . . |

38 |

Value of land included on line 37 |

39 |

Basis of building. Subtract line 38 from line 37 |

40 |

Business basis of building. Multiply line 39 by line 7 |

41 |

Depreciation percentage (see instructions) |

42Depreciation allowable (see instructions). Multiply line 40 by line 41. Enter here and on line 30 above

Part IV |

Carryover of Unallowed Expenses to 2022 |

37

38

39

40

41

42

%

43 |

Operating expenses. Subtract line 27 from line 26. If less than zero, enter |

43 |

|

|

44 |

Excess casualty losses and depreciation. Subtract line 33 from line 32. If less than zero, enter |

44 |

|

|

For Paperwork Reduction Act Notice, see your tax return instructions. |

Cat. No. 13232M |

|

Form 8829 (2021) |

|

Document Specifics

| Fact | Description |

|---|---|

| Form Title | IRS Form 8829 |

| Purpose | To calculate the allowable expenses for business use of your home. |

| Who Must File | Individuals who use a portion of their home for business purposes and are self-employed. |

| Eligibility | Must meet specific criteria such as exclusive and regular use for business, and it must be the principal place of business. |

| Main Components | Part I calculates the percentage of your home used for business. Part II calculates the allowable expenses. |

| Types of Expenses | Direct expenses (only for the business area) and indirect expenses (for maintaining the whole house). |

| Limitations | Expense deductions may be limited based on the income generated from the business. |

| Documentation | Keep records of all relevant expenses and use of your home for business purposes to support your deductions. |

| Governing Law(s) | Federal tax law as administered by the Internal Revenue Service (IRS). |

Guide to Writing IRS 8829

Successfully completing an IRS 8829 form is a crucial step for many individuals who use part of their home for business purposes. This process does not only facilitate an accurate calculation of deductible expenses but also ensures compliance with the tax regulations governing home business operations. While the form may initially appear daunting, breaking it down into manageable steps can make the task less intimidating and more straightforward. The following guidelines provide a clear roadmap to navigate through the form.

Before beginning, ensure you have all necessary documents and information, such as your total home expenses, business-related expenses, and the square footage of your home and office space. Gathering these details in advance will streamline the process.

- Start by entering your name and social security number at the top of the form, ensuring they match the information on your tax return.

- Calculate the area of your home used for business, and enter this information in square feet in the designated line.

- Enter the total square footage of your home on the line provided. This information is crucial for determining the percentage of your home used for business purposes.

- Accurately fill in the direct and indirect expenses related to the business use of your home. Direct expenses are those solely for the business area of your home, while indirect expenses are for maintaining and running your entire home, which benefits your business space.

- If you have expenses that don’t belong in either the direct or indirect categories, list these in the appropriate section.

- Use the worksheet provided within the form to allocate and determine the deductible portion of indirect expenses based on the business-use percentage of your home.

- Sum up the total deductible amount of indirect expenses as calculated above and enter this figure in the designated line.

- Add any direct business expenses to the total from the previous step, and record the total business use of home expenses on the indicated line.

- If applicable, carry over any amounts from previous years that were not deductible and add them to this year's total deduction limit.

- Review the entire form for accuracy, ensuring all necessary sections are completed and calculations are correct. Pay special attention to limitations based on income, as detailed in the instructions for the form.

- Sign and date the form, attaching it to your tax return as directed in the filing instructions.

After submitting the IRS 8829 form along with your tax return, the next steps involve waiting for acknowledgment of receipt from the IRS. They may reach out if additional information is needed or to provide an update on the processing of your deduction claim. Keeping a copy of the completed form and all relevant documentation is important for your records, should any questions arise about the deduction in the future.

Understanding IRS 8829

- What is the IRS Form 8829?

IRS Form 8829 is a document utilized by individuals who operate their business from home, allowing them to calculate the deductible expenses of using their home for business purposes. This form is specifically for those who are self-employed, including independent contractors or sole proprietors. It serves to identify the amount of rent, utilities, mortgage interest, real estate taxes, and repairs that can be considered business expenses, thus reducing the taxpayer's overall taxable income.

- Who needs to file Form 8829?

This form is for individuals who have a home office or a specific area in their home used regularly and exclusively for business activities. To be eligible, you must be self-employed, either as a sole proprietor or an independent contractor. Employees who work from home may not use this form unless they are working in a home office for the convenience of their employer and not merely for their own preference or convenience.

- What information do I need to complete Form 8829?

Basic information about your home (size, office space used exclusively for business).

Total annual expenses associated with your home (mortgage interest, real estate taxes, rent, utilities, insurance, maintenance, and repairs).

Business income and the percentage of your home used for business to accurately allocate the deductible portion of your expenses.

- How do I determine the business use percentage of my home?

To determine the business percentage you use your home for, you must compare the size of the area used for business to the total size of your home. This calculation can be based on the number of rooms (if they are roughly equal in size) or the square footage. For example, if you use a 300 square foot room as an office in a 1,200 square foot home, your business use percentage would be 25%.

- Can I claim expenses for a shared space used for business in my home?

If you use part of your home for business on a regular basis but it is not exclusively used for business, you may face limitations. Shared use spaces do not qualify for home office deductions under the strict definition. The exclusive use test requires that the space is used only for business and nothing else. However, there are exceptions and nuances, so reviewing specific IRS guidelines or consulting a tax professional can provide clarity based on individual circumstances.

- What happens if my business has a loss for the year? Can I still deduct home office expenses?

Even if your business reports a loss, you may still be able to deduct some home office expenses. The IRS allows these deductions up to the amount of income generated by the business, with some exceptions. However, expenses that exceed the business income may be carried over to the next tax year, subject to certain limitations and rules. This carryover can provide tax relief in future profitable years. Consulting with a tax specialist is advisable to navigate these situations effectively.

Common mistakes

Filling out IRS Form 8829, Expenses for Business Use of Your Home, is a task that requires careful attention to detail. People often make mistakes on this form that can lead to issues with their tax returns. Understanding these common errors can help you avoid them. Below are ten mistakes frequently made on Form 8829:

Not meeting the exclusive and regular use criteria for claiming a home office deduction. The space must be used exclusively for business and on a regular basis.

Miscalculating the percentage of home used for business. This requires accurate measurement of the home office space and total living space.

Claiming expenses that are not eligible. Some attempt to deduct expenses that do not fall under IRS regulations for business use of a home.

Failure to carry over or properly apply the carryover of unallowed expenses to future years when expenses exceed gross income limits.

Incorrectly reporting expenses shared between personal and business use, such as utilities and internet, without properly allocating the costs.

Not keeping adequate records of expenses and use of the home office. This documentation is crucial in case of an IRS audit.

Using the wrong year’s form or not updating information, leading to errors based on outdated standards or rates.

Entering information in the wrong lines or sections, which can result in miscalculations of allowable deductions.

Overlooking the depreciation of the home, which can be a significant deduction for many home offices.

Not understanding the implication of the deduction on the future sale of the home, as the deprecation recapture may impact the taxable amount when the home is sold.

Avoiding these mistakes can lead to a smoother tax filing process and ensure that you maximize your eligible home office deductions. Each part of Form 8829 plays a significant role in determining your tax obligations and benefits accurately.

Documents used along the form

When filing taxes, specifically for those who use part of their home for business, IRS Form 8829 is often necessary. However, this form doesn't stand alone. To accurately fill it out and ensure a comprehensive tax return, several other documents and forms are frequently required. Whether these documents are used to calculate expenses, report income, or provide necessary proof for deductions, each plays a crucial role in the filing process. Below is a list of forms and documents commonly used in tandem with IRS Form 8829.

- Form 1040: This is the standard IRS form for individual income tax returns. Taxpayers use it to report their annual income, claim tax credits, and calculate the amount of tax owed or refund due.

- Schedule C (Form 1040): Specifically for those who are self-employed or small business owners, this schedule is used to report the income or loss from a business. It's critical for anyone claiming business use of home expenses.

- Schedule E (Form 1040): This form is used by taxpayers to report income and expenses from rental real estate, royalties, partnerships, S corporations, estates, trusts, and residual interests in REMICs.

- Form 4562: This form is used for claiming depreciation and amortization. It includes information on the business assets that are being depreciated, which can also affect the home office deduction.

- Utility Bills: Utility bills for electricity, gas, water, and other services are necessary to calculate the proportion of these expenses that can be attributed to business use of the home.

- Mortgage Interest Statements (Form 1098) or rental receipts: These documents are crucial for determining the portion of mortgage interest or rent that can be deducted for the business use of the home.

- Property Tax Statements: Property taxes paid on the home can also be partially deducted when calculating the home office deduction.

- Home Insurance Receipts: Homeowners insurance premiums that relate to the business portion of a home are partially deductible.

- Receipts for Home Improvements and Repairs: Costs for repairs and improvements directly related to the business portion of your home may be deductible.

- Form 1099-MISC or Form 1099-NEC: These forms report income received as an independent contractor or from other various sources. This income may affect the overall tax situation and the use of the home for business purposes.

When preparing your tax return, it's important to gather all relevant documents and forms beforehand. This not only makes the process smoother but also ensures you're taking advantage of all deductions and credits available to you. Keeping detailed records and understanding the interplay between different forms, such as IRS Form 8829 and those listed above, can help maximize your benefits while remaining in compliance with tax laws.

Similar forms

The IRS 8829 form is used for Expenses for Business Use of Your Home. It's quite unique but shares similarities with several other IRS forms and documents related to business and personal financial management. Understanding these similarities helps to navigate the complexities of tax preparations and financial declarations.

The Schedule C (Form 1040) or "Profit or Loss From Business" is notably similar to the IRS 8829 form. Both are pivotal for self-employed individuals or small business owners aiming to report their business income and expenses. While the IRS 8829 focuses on home office deductions, Schedule C encompasses the broader spectrum of business-related financial activities. They complement each other in tax filings where home office deductions are part of the business expenses.

Similarly, the Schedule E (Form 1040), "Supplemental Income and Loss," also bears resemblance. This form is utilized for reporting income from rental real estate, royalties, partnerships, S corporations, trusts, and more. Like the IRS 8829, it deals with deductions pertinent to the operation of these income-generating activities, albeit in different realms. Both forms ensure taxpayers account for and deduct expenses appropriately to reduce taxable income.

The Schedule SE (Form 1040), "Self-Employment Tax," is akin to IRS 8829 in that both affect self-employed individuals. Where IRS 8829 helps reduce taxable income through home office deductions, Schedule SE calculates the amount owed for self-employment tax, showing the interplay between income deductions and tax responsibilities for the self-employed.

The Form 4562, "Depreciation and Amortization," shares common ground with IRS 8829 through its focus on deductions. While IRS 8829 enables deductions for business use of a home, Form 4562 is utilized for depreciation and amortization deductions on business assets. Both forms serve to lower taxable income by accounting for the costs associated with business operations.

The Form 2106, "Employee Business Expenses," is akin to IRS 8829 for individuals who incur business expenses while employed. Though IRS 8829 is designed for business use of one's home, both forms cater to the documentation of work-related expenses. However, Form 2106 is specific to employees rather than self-employed individuals or entrepreneurs.

The Form 1040-ES, "Estimated Tax for Individuals," while not directly about deductions, relates to IRS 8829 in the broader context of tax planning and payments. Users of IRS 8829 might also need to file Form 1040-ES if their home business adjustments lead to a significant change in their tax obligations, necessitating adjusted quarterly estimated tax payments.

The Form W-9, "Request for Taxpayer Identification Number and Certification," interconnects with the IRS 8829 indirectly. Freelancers or independent contractors who deduct home office expenses on IRS 8829 often provide a W-9 to their clients for tax reporting purposes. Both forms are staples in the financial toolkit of independent professionals managing their tax responsibilities.

Lastly, the Form 1099-MISC, "Miscellaneous Income," often complements the IRS 8829 for those receiving income outside of traditional employment. This form reports incomes such as rents, royalties, and non-employee compensation. Users filing IRS 8829 for home office deductions may also deal with Form 1099-MISC when reporting diverse sources of income, emphasizing the multifaceted aspects of personal and business finances.

Dos and Don'ts

Filing out the IRS 8829 form, which is used for claiming the home office deduction for business use of a home, can be a bit tricky. However, understanding what you should and shouldn't do can help streamline the process and ensure you're making the most out of your deductions while remaining compliant with IRS rules. Here's a guide to help you navigate filling out the form.

The Dos:

- Do ensure you meet the eligibility criteria for claiming a home office deduction. Your home office must be used regularly and exclusively for business, and it must be your principal place of business.

- Do accurately measure your home office space to calculate the percentage of your home used for business. This will determine how much of your home-related expenses can be deducted.

- Do gather all necessary documentation regarding your home expenses, such as mortgage interest, insurance, utilities, repairs, and maintenance. These records are crucial for correctly filling out the form.

- Do carefully allocate shared expenses between personal and business use. Only the portion of expenses that relate to the business use of your home can be deducted.

- Do keep detailed records of all the expenses you're claiming on Form 8829. In the event of an audit, you will need to provide proof of these expenses.

- Do review the form and instructions provided by the IRS thoroughly before filling it out. The IRS often updates forms and guidelines, so it's essential to use the most current version.

The Don'ts:

- Don't claim areas that are not used exclusively for business. For example, a kitchen or area that doubles as a personal space and a workspace does not qualify.

- Don't guess or approximate the size of your home office or your expenses. Use actual measurements and real numbers to ensure accuracy.

- Don't forget to adjust your deductions if your business use of the home is not for a full year. You need to prorate the expenses based on the actual period of business use.

- Don't overlook indirect expenses. These are expenses for your entire home that can be partially deducted, such as insurance and general repairs.

- Don't attempt to deduct expenses that have been reimbursed by your employer or are unrelated to the business use of your home.

- Don't hesitate to seek professional advice if you're unsure about how to fill out the form or if your situation is complex. Consulting with a tax professional can prevent costly mistakes.

Misconceptions

The IRS Form 8829 is a document used by individuals who operate a business from their home, allowing them to deduct expenses related to its use. However, several misconceptions surround this form, affecting how it is utilized by taxpayers. This article will address and explain eight common misconceptions about the IRS 8829 form.

- Only full-time business owners can use Form 8829. Many people believe that only those who operate their business full-time from their home can benefit from the deductions on Form 8829. In reality, part-time business owners who use part of their home regularly and exclusively for business can also take advantage of this form.

- Every type of home expense is deductible. While Form 8829 allows for many home-related expenses to be deducted, not all costs are covered. For instance, expenses must be directly related to the business use of the home, such as utilities, insurance, and repairs. Personal living expenses cannot be deducted using this form.

- The home office deduction is a red flag for an audit. It's a common myth that claiming a home office deduction automatically increases the odds of being audited by the IRS. As long as the deductions are legitimate, and the taxpayer can provide evidence of the business use of the home, there should be no additional risk of an audit.

- Only one room can be claimed. Some taxpayers think they can only deduct expenses for one room used for business. However, the form allows for deductions based on the percentage of the home used for business, which can include multiple rooms or separated areas, provided they meet the criteria for exclusive and regular business use.

- Renters cannot use Form 8829. This misconception prevents many who rent their homes from seeking deductions they are entitled to. Regardless of whether you rent or own your home, if you use part of it for business, you can use Form 8829 to claim appropriate deductions.

- Expenses must exceed a certain percentage of income to qualify. There is no minimum income percentage that your home office expenses must exceed to be deductible. The key factor is that the expenses are for the business use of your home and are not personal expenses.

- Form 8829 must be filed separately from your tax return. Another misunderstanding is that Form 8829 needs to be submitted as a standalone document. In reality, it is an integral part of the individual's tax return, specifically Schedule C for sole proprietors, and is submitted with the tax return.

- You can claim the entire amount of your home expenses. Finally, a common mistake is assuming you can deduct 100% of your home expenses. The deduction is proportionate to the percentage of your home used for business, which means not all expenses can be claimed in full.

Understanding the actual rules and guidelines surrounding IRS Form 8829 can help taxpayers accurately claim deductions for business use of their home, ensuring they maximize their tax benefits without misunderstanding the form’s intentions or misinterpreting its requirements.

Key takeaways

The IRS Form 8829 is essential for individuals who use part of their home for business purposes. It allows them to calculate and deduct expenses for business use of their home on their tax return. Understanding how to fill out and utilize this form correctly can lead to substantial tax savings. Here are key takeaways to guide you through the process:

- Determine Eligibility: Before you fill out Form 8829, ensure you meet the criteria for business use of your home. The space must be used regularly and exclusively for business activities.

- Know What Expenses You Can Deduct: Common deductible expenses include mortgage interest, insurance, utilities, repairs, and depreciation. Direct expenses solely for the business area and indirect expenses for maintaining the whole house are deductible.

- Calculate Your Business Percentage: The form requires you to determine the percentage of your home used for business. This is usually based on the area of your home dedicated to business activities compared to the total area of your home.

- Understand Depreciation: Form 8829 allows you to deduct depreciation for the portion of your home used for business. This deduction requires you to calculate the basis of your home and the percentage used for business to determine the allowable depreciation deduction.

- Carry Over Unallowed Expenses: If your gross income from the business use of your home is less than your total home office expenses, you may not be able to deduct the full amount. However, you can carry over these unallowed expenses to the next year.

- Keep Accurate Records: Maintaining accurate and detailed records of all expenses related to the use of your home for business is crucial. These records are necessary to substantiate your deductions in case of an IRS audit.

Form 8829 plays a pivotal role in maximizing your home office deduction, thus reducing your tax liability. Proper understanding and meticulous attention to detail in filling out this form can provide significant benefits at tax time.

Popular PDF Documents

4952 Instructions - A necessary document for individuals seeking to deduct any interest paid on borrowed funds invested.

Irs Form 14242 - Play a part in fighting tax fraud by using Form 14242 to report suspicious activities.

IRS 8867 - While the IRS 8867 is specifically for tax preparers, understanding its requirements can also benefit taxpayers by familiarizing them with the qualifications for certain tax benefits.