Get Irs 8823 Form

The IRS 8823 form plays a crucial role in the oversight of low-income housing tax credit properties. This document is utilized by housing credit agencies to report to the Internal Revenue Service any instances of noncompliance with the provisions of section 42 or when a building is disposed of. Agencies are required to file a separate Form 8823 for each building affected, ensuring the IRS is promptly informed about issues that could affect the integrity of the low-income housing program. It covers various types of noncompliance, from over-income occupants and failure to perform necessary recertifications to physical property inspections revealing noncompliance with the Uniform Physical Condition Standards or local codes. Additionally, the form is used to report changes in building ownership or catastrophic events leading to property unfitness. With penalties for perjury attached, the form serves as a serious declaration of a property's compliance status, necessitating accurate and timely submissions by agencies. Keeping the latest requirements and instructions in mind, accessible on the IRS website, is vital for agencies to maintain compliance and support the objective of providing low-income housing. This function underscores the form's role in the broader context of monitoring and enforcing compliance within federally supported housing projects.

Irs 8823 Example

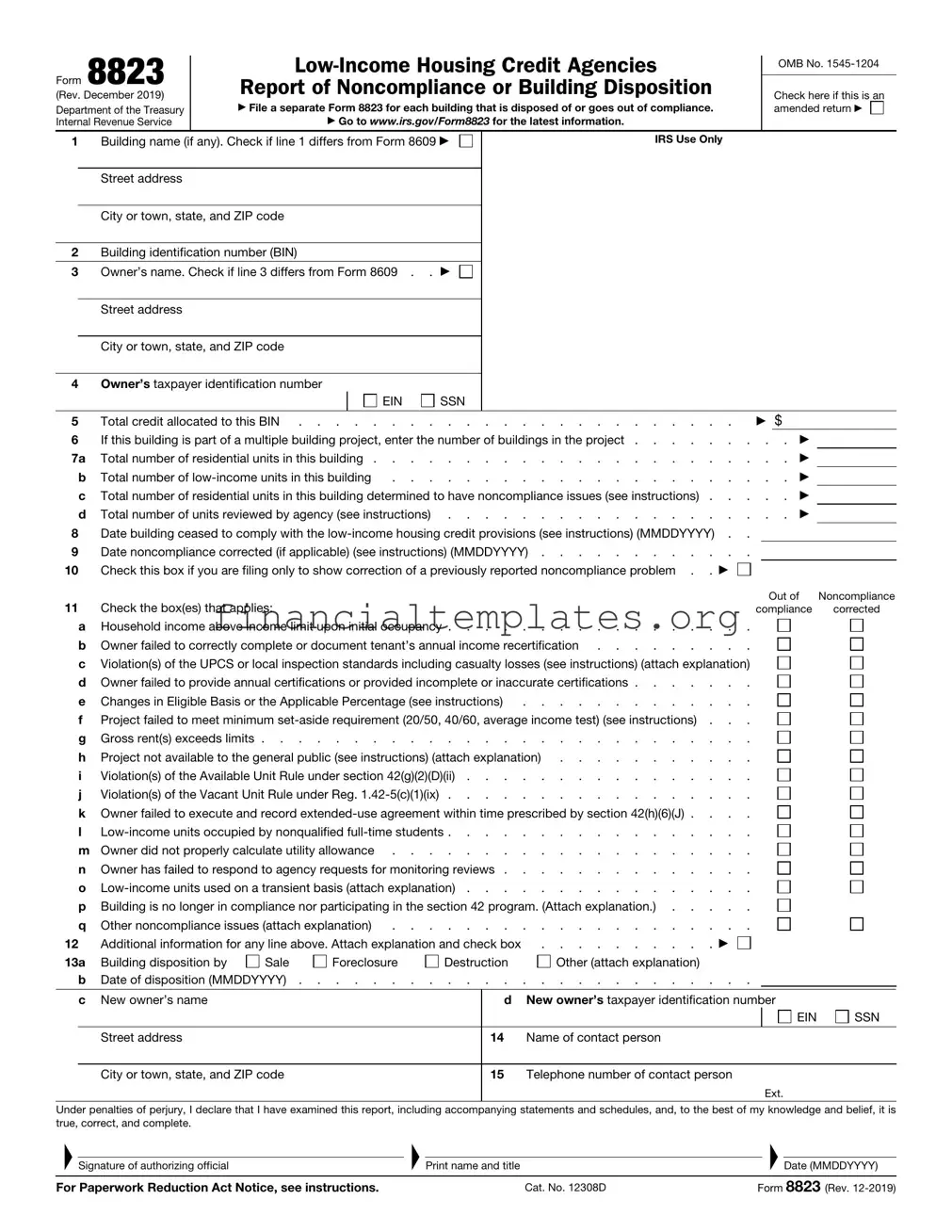

Form 8823

(Rev. December 2019)

Department of the Treasury

Internal Revenue Service

Report of Noncompliance or Building Disposition

▶File a separate Form 8823 for each building that is disposed of or goes out of compliance.

▶Go to WWW.IRS.GOV/FORM8823 for the latest information.

OMB No.

Check here if this is an amended return ▶

1Building name (if any). Check if line 1 differs from Form 8609 ▶

Street address

City or town, state, and ZIP code

2Building identification number (BIN)

3 |

Owner’s name. Check if line 3 differs from Form 8609 . . ▶ |

|

|

|

|

|

|

Street address |

|

|

|

|

|

City or town, state, and ZIP code |

4Owner’s taxpayer identification number

EIN |

SSN |

IRS Use Only

5 |

Total credit allocated to this BIN |

. . . . . . . . . . |

. . |

▶ $ |

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|||||

6 |

If this building is part of a multiple building project, enter the number of buildings in the project . . . . |

. . . |

. . |

▶ |

|

|||||||||

7a |

Total number of residential units in this building |

. . . . . . . . . . |

. . . |

. . |

▶ |

|

||||||||

|

b |

Total number of |

. . . . . . . |

. . . . . . . . . . |

. . . |

. . |

▶ |

|

||||||

|

c |

Total number of residential units in this building determined to have noncompliance issues (see instructions) |

. . . |

. . |

▶ |

|

||||||||

|

d |

Total number of units reviewed by agency (see instructions) . . . . |

. . . . . . . . . . |

. . . . . ▶ |

|

|||||||||

8 |

Date building ceased to comply with the |

|

|

|

|

|

||||||||

9 |

Date noncompliance corrected (if applicable) (see instructions) (MMDDYYYY) |

|

|

|

|

|

||||||||

10 |

Check this box if you are filing only to show correction of a previously reported noncompliance problem . |

. ▶ |

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

Out of |

|

Noncompliance |

|

11 |

Check the box(es) that applies: |

|

|

|

|

|

|

compliance |

corrected |

|||||

|

a |

Household income above income limit upon initial occupancy |

|

|

|

|

|

|||||||

|

b |

Owner failed to correctly complete or document tenant’s annual income recertification |

|

|

|

|

|

|||||||

|

c |

Violation(s) of the UPCS or local inspection standards including casualty losses (see instructions) (attach explanation) |

|

|

|

|

|

|||||||

|

d |

Owner failed to provide annual certifications or provided incomplete or inaccurate certifications |

|

|

|

|

|

|||||||

|

e |

Changes in Eligible Basis or the Applicable Percentage (see instructions) |

|

|

|

|

|

|||||||

|

f |

Project failed to meet minimum |

|

|

|

|

|

|||||||

|

g |

Gross rent(s) exceeds limits |

|

|

|

|

|

|||||||

|

h |

Project not available to the general public (see instructions) (attach explanation) |

|

|

|

|

|

|||||||

|

i |

Violation(s) of the Available Unit Rule under section 42(g)(2)(D)(ii) |

|

|

|

|

|

|||||||

|

j |

Violation(s) of the Vacant Unit Rule under Reg. |

|

|

|

|

|

|||||||

|

k |

Owner failed to execute and record |

|

|

|

|

|

|||||||

|

l |

|

|

|

|

|

||||||||

|

m |

Owner did not properly calculate utility allowance |

|

|

|

|

|

|||||||

|

n |

Owner has failed to respond to agency requests for monitoring reviews |

|

|

|

|

|

|||||||

|

o |

|

|

|

|

|

||||||||

|

p |

Building is no longer in compliance nor participating in the section 42 program. (Attach explanation.) |

|

|

|

|

|

|||||||

|

q |

Other noncompliance issues (attach explanation) |

|

|

|

|

|

|||||||

12 |

Additional information for any line above. Attach explanation and check box |

. . . . . . . . . |

. ▶ |

|

|

|

|

|

||||||

13a |

Building disposition by |

Sale |

Foreclosure |

Destruction |

Other (attach explanation) |

|

|

|

|

|

|

|||

|

b |

Date of disposition (MMDDYYYY) |

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

c |

New owner’s name |

|

|

|

|

d |

New owner’s taxpayer identification number |

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

EIN |

SSN |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Street address |

|

|

|

|

14 |

Name of contact person |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

City or town, state, and ZIP code |

|

|

|

15 |

Telephone number of contact person |

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

Ext. |

|

|

|

Under penalties of perjury, I declare that I have examined this report, including accompanying statements and schedules, and, to the best of my knowledge and belief, it is true, correct, and complete.

▲

Signature of authorizing official

▲

Print name and title

▲

Date (MMDDYYYY)

For Paperwork Reduction Act Notice, see instructions. |

Cat. No. 12308D |

Form 8823 (Rev. |

Form 8823 (Rev. |

Page 2 |

|

|

General Instructions

Section references are to the Internal Revenue Code unless otherwise noted.

Future developments. For the latest information about developments related to Form 8823 and its instructions, such as legislation enacted after they were published, go to www.irs.gov/Form8823.

Purpose of Form

Housing credit agencies use Form 8823 as part of their compliance monitoring responsibilities under section 42(m)(1)(B)(iii) to notify the IRS of any building disposition or noncompliance with the

The housing credit agency should also give a copy of Form 8823 to the owner(s).

Who Must File

Any authorized housing credit agency that becomes aware that a

When To File

File Form 8823 no later than 45 days after (a) the building was disposed of, or (b) the end of the time allowed the building owner to correct the condition(s) that caused noncompliance. For details, see Regulations section

Where To File

File Form 8823 with the:

Department of the Treasury

Internal Revenue Service Center

Philadelphia, PA

Specific Instructions

Amended return. If you are filing an amended return to correct previously reported information, check the box at the top of page 1.

Line 2. Enter the building identification number (BIN) assigned to the building by the housing credit agency as shown on Form 8609.

Lines 3, 4, 13c, and 13d. If there is more than one owner (other than as a member of a

Both the EIN and the SSN have nine digits. An EIN has two digits, a hyphen, and seven digits. An SSN has three digits, a hyphen, two digits, a hyphen, and four digits, and is issued only to individuals.

Line 7d. “Reviewed by agency” includes physical inspection of the property, tenant file inspection, or review of documentation submitted by the owner. Regulations section

Note: If the only noncompliance issue identified by the physical inspection of the property on line 11c relates to

a common area, then the number of units identified on line 7c should be

Line 8. Enter the date that the building ceased to comply with the

Line 9. Enter the date that the noncompliance issue was corrected. If there are multiple issues, enter the date the last correction was made.

Line 10. Do not check this box unless the sole reason for filing the form is to indicate that previously reported noncompliance problems have been corrected.

Lines 11a through 11p. Check only the “Out of compliance” box if the issue causing the noncompliance remains uncorrected at the end of the correction period. Check both the “Out of compliance” and “Noncompliance corrected” boxes if the noncompliance was corrected within the correction period. Check only the “Noncompliance corrected” box if the noncompliance was previously reported to the IRS on a separate Form 8823.

Line 11c. Housing credit agencies must use either (a) the local health, safety, and building codes (or other habitability standards); or (b) the Uniform Physical Condition Standards (UPCS) (24 C.F.R. section 5.703) to inspect the project, but not in combination. The UPCS does not supersede or preempt local codes. Thus, if a housing credit agency using the UPCS becomes aware of any violation of local codes, the agency must report the violation. Attach a statement describing either (a) the deficiency and its severity under the UPCS (that is, minor (level 1), major (level 2), and severe (level 3)); or (b) the health, safety, or building violation under the local codes. The Department of Housing and Urban Development’s Real Estate Assessment Center has developed a comprehensive description of the types and severities of deficiencies entitled “Revised Dictionary of Deficiency Definitions” found at www.hud.gov. Under Regulations section

Line 11d. Report the failure to provide annual certifications or the provision of certifications that are known to be incomplete or inaccurate as required by Regulations section

Form 8823 (Rev. |

Page 3 |

|

|

Line 11e. For buildings placed in service after July 30, 2008, report any federal grant used to finance any costs that were included in the eligible basis of any building. Report changes in common areas when they become commercial, when fees are charged for facilities, etc. For buildings placed in service after July 30, 2008, report any obligation the interest on which is exempt from tax under section 103 that is or was used (directly or indirectly) with respect to the building or its operation during the compliance period and that was not taken into account when determining eligible basis at the close of the first year of the credit period.

Line 11f. Failure to satisfy the minimum

Failure to maintain the minimum

In 2018, Congress revised section 42(g) to add a third minimum

Line 11h. All units in the building must be for use by the general public (as defined in Regulations section

It also mandates specific design and construction requirements for multifamily housing built for first occupancy after March 13, 1991, in order to provide accessible housing for individuals with disabilities. The failure of

Individuals with questions about the accessibility requirements can obtain the Fair Housing Act Design Manual through www.huduser.org.

Line 11i. The owner must rent to

Line 11k. Section 42(h)(6) requires owners of

credits to the project. Building owners must agree to a

The extended use agreement must (1) specify that the applicable fraction for the building for each year in the extended use period will not be less than the applicable fraction specified in the extended use agreement and prohibit the eviction or the termination of tenancy (other than for good cause) of an existing tenant of any low- income unit or any increase in the gross rent with respect to such unit not otherwise permitted under section 42, (2) allow INDIVIDUALS (whether prospective, present, or former occupants) who meet the income limitations applicable to the building under section 42(g) the right to enforce in state court the requirements and prohibitions under section 42 (h)(6)(B)(i) throughout the extended use period, (3) prohibit the disposition to any person of any portion of the building unless all of the building is disposed of to that person, (4) prohibit the refusal to lease to section 8 voucher holders because of the status of the prospective tenant as such a holder, and (5) provide that the agreement is binding on all successors of the taxpayer. The extended use agreement must be recorded as a restrictive covenant with respect to the property under state law.

Noncompliance should be reported if an extended use agreement is not executed and recorded as a restrictive COVENANT with respect to the property under state law or the owner failed to correct the noncompliance within the

The

Line 11q. Check this box for noncompliance events other than those listed on lines 11a through 11p. Attach an explanation. For projects with allocations from the nonprofit

Paperwork Reduction Act Notice. We ask for the information on this form to carry out the Internal Revenue laws of the United States. You are required to give us the information. We need it to ensure that you are complying with these laws and to allow us to figure and collect the right amount of tax.

You are not required to provide the information requested on a form that is subject to the Paperwork Reduction Act unless the form displays a valid OMB control number. Books or records relating to a form or its instructions must be retained as long as their contents may become material in the administration of any Internal Revenue law. Generally, tax returns and return information are confidential, as required by section 6103.

Form 8823 (Rev. |

Page 4 |

|

|

The time needed to complete and file this form will vary depending on individual circumstances. The estimated average time is:

Recordkeeping . . . . . . . . . 11 hr., 43 min.

Learning about the law

or the form . . . . . . . . . . . . 1 hr., 35 min.

Preparing and sending

the form to the IRS . . . . . . . . . 1 hr., 51 min.

If you have comments concerning the accuracy of these time estimates or suggestions for making this form simpler, we would be happy to hear from you. You can send your comments to www.irs.gov/FormComments. Or you can write to the Internal Revenue Service, Tax Forms and Publications Division, 1111 Constitution Ave. NW,

Document Specifics

| Fact Name | Description |

|---|---|

| Form Identification | Form 8823, titled "Low-Income Housing Credit Agencies Report of Noncompliance or Building Disposition." |

| Revision Date | The form was last revised in December 2019. |

| Purpose | Used by housing credit agencies to report noncompliance with the low-income housing tax credit provisions or the disposition of a building. |

| Filing Requirement | Must be filed by any authorized housing credit agency aware of a disposal or noncompliance situation in low-income housing buildings. |

| Filing Deadline | No later than 45 days after the building was disposed of or at the end of the period allowed for the owner to correct the noncompliance condition. |

| Where to File | Directed to the Department of the Treasury, Internal Revenue Service Center, Philadelphia, PA 19255-0549. |

| Amended Return Check Box | Provides an option to file an amended return to correct previously reported information. |

| Noncompliance and Correction | Includes multiple checkboxes to identify specific noncompliance issues and whether they have been corrected. |

| Building Disposition Information | Collects details about the disposition of the building, including sale, foreclosure, or destruction. |

Guide to Writing Irs 8823

Filling out IRS Form 8823 is a critical process for housing credit agencies to report any noncompliance or disposition of buildings within low-income housing projects. This form ensures that the necessary information is conveyed to the IRS, allowing for proper oversight and maintenance of the standards set forth for low-income housing. Below are the detailed steps needed to accurately complete Form 8823.

- At the top of the form, check the box if this is an amended return.

- Enter the Building name in line 1, and check the box if it differs from Form 8609.

- Fill in the Building identification number (BIN) as shown on Form 8609 in line 2.

- Provide the Owner's name in line 3, checking the box if this information differs from what is on Form 8609.

- Include the Owner's street address, city or town, state, and ZIP code.

- Fill in the Owner’s taxpayer identification number (EIN or SSN) in line 4.

- Enter the Total credit allocated to this BIN in line 5, stated in dollars.

- If the building is part of a multiple building project, specify the number of buildings in line 6.

- In line 7, provide the total number of:

- Residential units (line 7a)

- Low-income units (line 7b)

- Units with noncompliance issues (line 7c)

- Units reviewed by the agency (line 7d)

- Enter the Date the building ceased to comply with the low-income housing credit provisions in line 8 (format MMDDYYYY).

- If applicable, specify the Date noncompliance was corrected in line 9 (format MMDDYYYY).

- Check the box in line 10 if filing only to show correction of a previously reported noncompliance issue.

- In lines 11a through 11p, check the applicable box(es) to indicate the specific noncompliance issue(s).

- For additional information or to provide explanations for any line above, attach a statement and check the box in line 12.

- For building disposition, complete line 13 with details of the disposition action, including the sale date (line 13b), new owner’s name (line 13c), and new owner’s taxpayer identification number (line 13d).

- Provide the Name and Telephone number of a contact person in lines 14 and 15 respectively, including the extension if applicable.

- The authorizing official must sign and date the form, and print their name and title at the bottom of the form.

After completing Form 8823, it should be filed with the Department of the Treasury, Internal Revenue Service Center, Philadelphia, PA 19255-0549, no later than 45 days after the triggering event. Filing this form in a timely and accurate manner is crucial for maintaining the integrity of the low-income housing program and ensuring that compliance issues are suitably addressed.

Understanding Irs 8823

- What is the purpose of IRS Form 8823?

Form 8823 is used by housing credit agencies to notify the IRS of noncompliance with the low-income housing tax credit provisions or a building disposition. This form plays a crucial role in the compliance monitoring responsibilities of agencies under section 42(m)(1)(B)(iii). - Who must file Form 8823?

Any authorized housing credit agency that becomes aware of a disposal of a low-income housing building or noncompliance with section 42 provisions must file Form 8823. - When should Form 8823 be filed?

This form should be filed no later than 45 days following the date the building was disposed of or the deadline for the building owner to correct the condition(s) causing noncompliance. - Where should Form 8823 be filed?

Form 8823 should be sent to the Department of the Treasury, IRS Center in Philadelphia, PA 19255-0549. - How does one report amended information on Form 8823?

If filing an amended return to correct previously reported information, the filer should check the box at the top of page 1 of Form 8823. - What information is required for building identification on Form 8823?

The Building Identification Number (BIN), assigned by the housing credit agency as shown on Form 8609, is required. If the building has more than one owner, a schedule listing the owners, their addresses, and taxpayer identification numbers should be attached. - How does one report noncompliance regarding inspection standards?

Agencies must use either local codes or the Uniform Physical Condition Standards (UPCS) for inspections, not both. Any deficiency or violation should be detailed in an attached statement, indicating its severity according to the UPCS or local codes. - What should be done if the building is no longer in compliance or participating in the Section 42 program?

This situation requires the box on line 11p to be checked, and an explanation of the noncompliance or situation leading to the end of participation must be attached. - How is disposal of a building reported?

In the case of building disposition through sale, foreclosure, destruction, or other means, details regarding the disposition and new ownership must be provided in section 13 of Form 8823. - What are the consequences of noncompliance?

Failure to comply with the low-income housing tax credit provisions can result in the recapture of previously claimed credits and loss of future credits. Accurate reporting and prompt correction of noncompliance issues are crucial to maintaining the financial benefits of participating in the program.

Common mistakes

Filing Form 8823, the IRS form for Low-Income Housing Credit Agencies Report of Noncompliance or Building Disposition, is a critical process for housing credit agencies. However, mistakes can occur during this filing. Below are some common errors that one should be cautious to avoid:

- Not filing a separate Form 8823 for each building that is disposed of or has gone out of compliance, as mandated.

- Omitting to check the box at the top of page 1 if submitting an amended return to correct previously reported information.

- Inaccurately entering the building identification number (BIN), which should match the number assigned by the housing credit agency as shown on Form 8609.

- Failure to attach a schedule listing all owners (if more than one, excluding members of a pass-through entity), their addresses, and their taxpayer identification numbers, along with specifying whether the identification number is an EIN or SSN.

- Incorrectly calculating or entering the total number of low-income units, the total number of residential units, or failing to accurately report units determined to have noncompliance issues.

- Not properly documenting or misstating the date the building ceased to comply with low-income housing credit provisions or the date noncompliance was corrected.

- Misidentifying or failing to correctly check the specific noncompliance issues that apply from the list provided in section 11 of the form.

- Overlooking the requirement to attach an explanation for certain types of noncompliance, such as those necessitating detailed descriptions of violations under section 11c, or failures under other sections that require additional information.

- Neglecting to include additional necessary information or explanations when applicable, as indicated in various sections of the form and the final section regarding building disposition.

Being thorough and attentive to the details of each section can prevent these common errors. This approach ensures accurate reporting and compliance with IRS regulations and requirements.

Documents used along the form

When working with the IRS Form 8823, "Low-Income Housing Credit Agencies Report of Noncompliance or Building Disposition," other documents and forms often play a crucial role in ensuring compliance and accurate reporting to the Internal Revenue Service. These documents each serve unique functions, from establishing eligibility for the Low-Income Housing Tax Credit (LIHTC) program to reporting annual income and expenses related to the property. Understanding these forms can help stakeholders navigate the complexities of monitoring and compliance in the LIHTC program.

- Form 8609, Low-Income Housing Credit Allocation and Certification: This document grants the official allocation of the low-income housing tax credit to property owners. It establishes the initial compliance period for the property.

- Form 8586, Low-Income Housing Credit: Used annually by property owners to claim the LIHTC, this form calculates the credit amount for which they are eligible based on the property's ongoing compliance.

- Form 8703, Annual Certification of a Residential Rental Project: Property owners must submit this form annually to certify that they are meeting the low-income occupancy threshold required to maintain compliance with the LIHTC program.

- Form 8821, Tax Information Authorization: This document authorizes individuals or organizations to request and inspect confidential tax information on behalf of the property owner. It's useful for third-party professionals assisting with compliance.

- Schedule E (Form 1040), Supplemental Income and Loss: Property owners use Schedule E to report income, expenses, and depreciation for each rental property. This can include properties eligible for the LIHTC.

- Form 4562, Depreciation and Amortization: Involves reporting the depreciation of the property, an important aspect of managing assets within the LIHTC program. It supports calculations made in Schedule E.

Together, these forms contribute to a comprehensive system for monitoring, reporting, and maintaining compliance within the LIHTC program. Accurate and timely submission of these documents ensures the successful administration of the tax credits and supports the overarching goal of providing affordable housing. For stakeholders involved in the LIHTC program, familiarization with these forms and their respective roles is essential for navigating the program's requirements effectively.

Similar forms

The IRS Form 8609, "Low-Income Housing Credit Allocation and Certification," serves a complementary role to Form 8823 in the administration of the Low-Income Housing Tax Credit (LIHTC) program. Form 8609 is issued to property owners as an official allocation of the LIHTC, providing essential information such as the amount of the tax credit allocated to the building and the first year of the credit period. Both forms are integral to monitoring and ensuring compliance with the LIHTC program's requirements, with Form 8823 specifically used to report instances of noncompliance or building disposition that could affect the allocated credit.

Form 1099-MISC, "Miscellaneous Income," is akin to Form 8823 in that it serves a reporting function, but for different types of transactions. While Form 8823 reports noncompliance or disposition within the LIHTC program, Form 1099-MISC is used by businesses to report payments made in the course of a trade or business to others, such as rents or royalties. Both forms are critical to the IRS's ability to collect accurate information on financial transactions relevant to taxation.

IRS Form 4562, "Depreciation and Amortization," shares similarities with Form 8823 in its reporting function, specifically in the context of investment in property. Form 4562 is used by taxpayers to claim depreciation on property, which is significant for properties within the LIHTC program as it affects the property's eligible basis and, consequently, the amount of tax credit available. In this way, both forms interact with the tax implications of property investment and management.

Form 5472, "Information Return of a 25% Foreign-Owned U.S. Corporation or a Foreign Corporation Engaged in a U.S. Trade or Business," is related to Form 8823 through its role in reporting transactions that have tax implications. Though Form 5472 focuses on transactions between a U.S. corporation and its foreign owners, and Form 8823 deals with compliance in affordable housing, both forms are essential to the IRS's enforcement of tax laws and regulations across different contexts.

The HUD-1 Settlement Statement, used in real estate transactions, parallels Form 8823's function of providing detailed information on transactions, but in the realm of buying and selling real estate. The HUD-1 outlines the financial transactions involved in real estate closings. Similar to Form 8823, which reports specific compliance-related details of the LIHTC properties, both documents serve to ensure transparency and adherence to regulatory requirements.

Form 926, "Return by a U.S. Transferor of Property to a Foreign Corporation," is analogous to Form 8823 in that it documents specific transactions impacting tax responsibilities. Form 926 is filed when a U.S. person transfers property to a foreign corporation, capturing information critical for determining tax liabilities. Like Form 8823, which records noncompliance affecting tax credits for affordable housing, both forms aid in maintaining lawful and transparent reporting for tax purposes.

IRS Form 3115, "Application for Change in Accounting Method," intersects with Form 8823 in its role in ensuring accurate tax reporting. Form 3115 is utilized when a taxpayer needs to make a change in their accounting method, which could have implications for income recognition or deduction timing. Though its focus differs from Form 8823's compliance reporting in the LIHTC program, both forms are crucial for reflecting changes that impact tax calculations and compliance.

Form 8283, "Noncash Charitable Contributions," serves a purpose similar to Form 8823 by documenting specific information relevant to tax deductions, though for charitable contributions rather than LIHTC compliance. Taxpayers use Form 8283 to report non-cash donations over certain thresholds, which impacts their deductible amounts. Both forms require detailed reporting to substantiate claims made on tax returns, enhancing transparency and compliance with tax regulations.

Lastly, the IRS Form 7004, "Application for Automatic Extension of Time to File Certain Business Income Tax, Information, and Other Returns," shares a procedural similarity with Form 8823 as both involve the submission of information to the IRS under specific conditions. Form 7004 is used to request extensions for filing various business-related tax returns, aligning with Form 8823's role in ensuring timely reporting of compliance or disposition issues within the LIHTC program. Each form facilitates adherence to tax filing deadlines and requirements, though serving distinct functions within the tax code framework.

Dos and Don'ts

When dealing with the IRS Form 8823, it's crucial to approach the task with a clear understanding of the do's and don'ts to avoid common mistakes and ensure accurate reporting. Here is a comprehensive guide:

- Do: Fill out a separate Form 8823 for each building that is disposed of or found to be out of compliance. This ensures that every instance of noncompliance or disposition is properly documented and reported to the IRS.

- Do: Check the box at the top of the page if you are filing an amended return. This is important for the IRS to distinguish between original submissions and corrections to previously submitted information.

- Do: Ensure that the Building Identification Number (BIN) on line 2 matches the number assigned by the housing credit agency as shown on Form 8609. This consistency is critical for accurate tracking and record-keeping.

- Do: Include a schedule listing all owners (if there is more than one), along with their addresses and taxpayer identification numbers, when necessary. This information helps the IRS to accurately assess the ownership structure of the property in question.

- Do: Report the date that noncompliance was corrected on line 9, if applicable. Providing this date confirms that the identified issues have been addressed, which is crucial for compliance monitoring.

- Don't: Leave the date line 8 blank for building dispositions. Instead, skip to line 13 to fill out the disposition details directly, as line 8 is reserved for documenting when the building ceased to comply with low-income housing credit provisions due to reasons other than disposition.

- Don't: Fail to attach a detailed explanation when reporting violations of the UPCS (Uniform Physical Condition Standards) or local inspection standards on line 11c. Detailed documentation is necessary for the IRS to understand the nature and severity of the noncompliance.

- Don't: Check the box on line 10 unless the sole reason for filing the form is to indicate that previously reported noncompliance problems have been corrected. This box should not be checked if the form is being used to report new or ongoing issues.

This guide offers a clear path to fill out the IRS Form 8823 correctly. Paying attention to these details will streamline the process of reporting to the IRS and help avoid potential complications arising from errors or omissions.

Misconceptions

Understanding the IRS Form 8823, the "Low-Income Housing Credit Agencies Report of Noncompliance or Building Disposition," can sometimes be confusing. Here are ten common misconceptions about this crucial form and explanations that aim to set the record straight.

8823 is only for reporting negative outcomes: A common misunderstanding is that Form 8823 is solely for discussing noncompliance or problems. While it's used to report noncompliance, it also covers the disposition of the property, which can be a neutral or even positive development, depending on circumstances.

Any staff member can complete it: Not everyone within an organization is qualified to complete Form 8823 accurately. This form requires a deep understanding of Section 42 of the IRC, detailed property information, and specific compliance issues—it's typically a task for someone with specialized knowledge or training.

One form per property: It's essential to note that Form 8823 must be filed separately for each building within a project that is disposed of or has compliance issues. This detail means that larger projects could necessitate multiple forms.

No need to inform the property owner: The housing credit agency is required not only to file Form 8823 with the IRS but also to provide a copy to the property owner(s). This step ensures that owners are aware of potential issues and can take corrective action.

Only about current noncompliance: While much of Form 8823 concerns identifying and reporting current noncompliance, it also allows for reporting corrections to previously identified noncompliance. This aspect is vital for maintaining compliance and potentially avoiding penalties.

Compliance issues are only about tenant income limits: Although tenant income limits are a significant factor in compliance, they're not the only one. Form 8823 covers a range of potential noncompliance issues, from building standards violations to improper use of units.

Immediate filing upon discovering noncompliance: The form should be filed no later than 45 days after the building was disposed of or after the end of the allowed correction period for noncompliance, not immediately upon discovery.

Form 8823 is the final step in the process: Filing Form 8823 isn't always the end of dealing with a compliance issue. Depending on the situation, further action, documentation, or correction may be necessary even after the form is filed.

Only significant issues need to be reported: Any known noncompliance, no matter how minor it may seem, should be reported using Form 8823. Even small issues can have implications for a property's compliance status and eligibility for tax credits.

Reporting noncompliance negatively impacts the agency: Some may believe that reporting noncompliance reflects poorly on the agency itself. In reality, accurate and timely reporting using Form 8823 demonstrates the agency's commitment to ensuring the integrity of the low-income housing tax credit program.

Dispelling these misconceptions can help housing credit agencies, property owners, and others involved more effectively navigate the complexities of IRS Form 8823 and the broader landscape of low-income housing tax credits. By understanding and accurately applying the requirements of this form, stakeholders contribute to the program's success and support affordable housing development.

Key takeaways

Filling out and using the IRS Form 8823 is essential for reporting noncompliance or building disposition-related to the Low-Income Housing Credit. Here are five key takeaways:

- Separate Forms: A distinct Form 8823 must be filed for each building that has been disposed of or has become noncompliant. This meticulous reporting ensures accurate records for each property or project.

- Filing Deadline: The form should be filed no later than 45 days following the event that led to the disposition or noncompliance. This deadline is crucial for maintaining compliance with IRS requirements and avoiding potential penalties.

- Amended Returns: If correcting previously reported information, it's necessary to indicate that the submission is an amended return. This clarity helps the IRS process the information accurately and recognizes the effort to correct or update prior submissions.

- Detailed Information Required: Form 8823 requires detailed information about the building, including the total number of residential and low-income units, building identification number (BIN), and specifics related to the noncompliance issue. Such comprehensive reporting aids in the thorough monitoring of compliance with low-income housing provisions.

- Physical Inspections and Noncompliance: The form includes space to report results from physical inspections and any identified noncompliance issues, underscoring the importance of maintaining buildings to set standards. Housing credit agencies must use appropriate codes or standards to inspect properties, highlighting agency responsibility in monitoring and reporting.

Correct and timely filing of Form 8823 ensures that housing credit agencies fulfill their obligations under Section 42, helping maintain the integrity and purpose of the Low-Income Housing Credit program.

Popular PDF Documents

Kentucky Composite Return - The form must be filed with the specific tax office handling the taxpayer’s accounts.

IRS 1120 - The form also includes sections for calculating the corporation's tax liability on dividends, interest, and other types of income.