Get IRS 8822-B Form

For businesses or individuals, maintaining accurate records with the Internal Revenue Service (IRS) is integral to ensuring compliance and avoiding potential issues. Whether due to a change in address, a shift in responsibility for a business, or an alteration in the identity of the responsible party, notifying the IRS promptly is not just recommended; it's a necessity. This is where the IRS 8822-B form comes into play. Designed to streamline the process of informing the IRS about significant changes, this form is critical for keeping an entity's information current and in accordance with IRS requirements. The completion and submission of this form play a vital role in the management of tax records and responsibilities, setting the stage for smoother interactions with the IRS. Failure to update the IRS using the 8822-B form can lead to missed communications, including but not limited to, tax notices or refunds, potentially complicating an entity's tax affairs. Understanding the purpose, requirements, and timing for submitting this form is essential for anyone responsible for managing tax reporting and compliance.

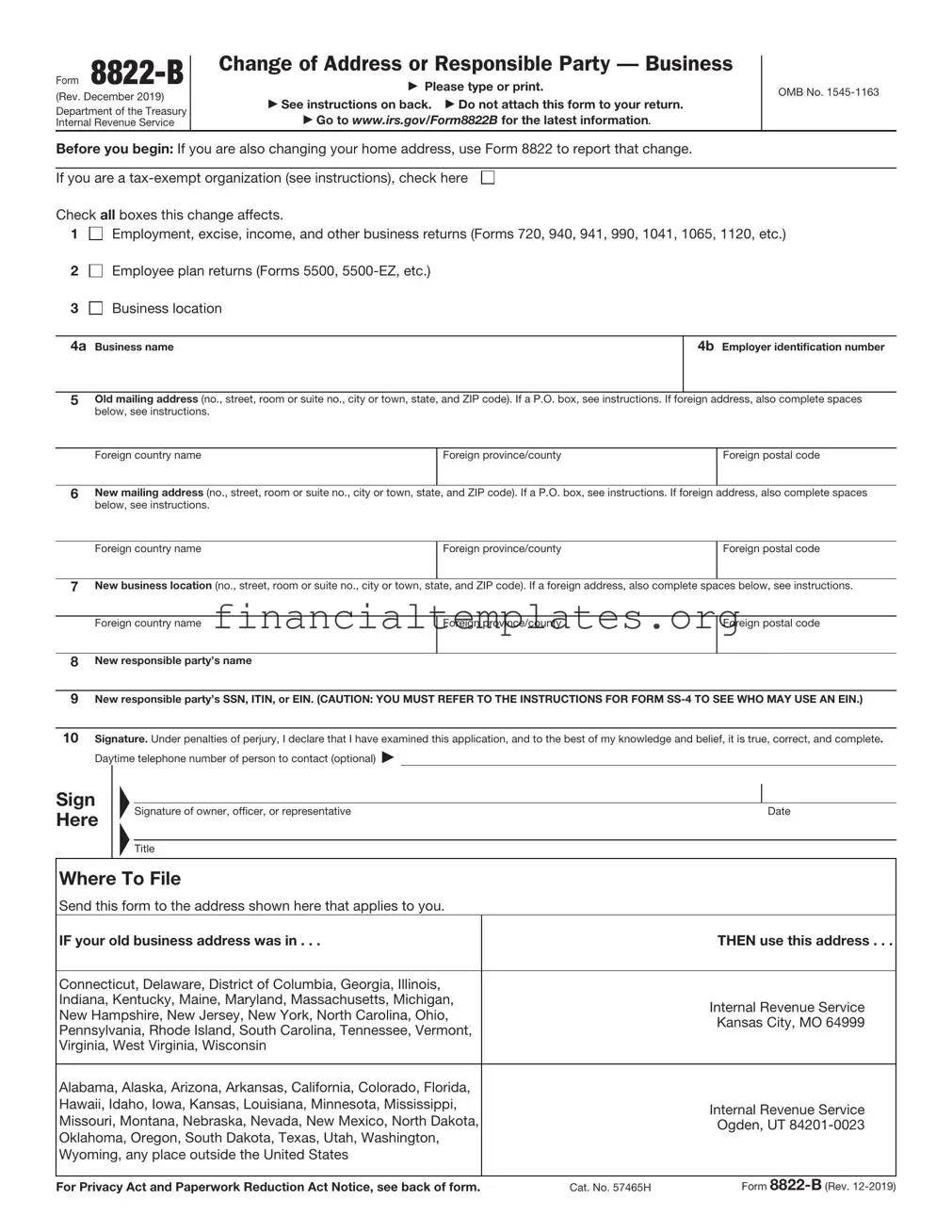

IRS 8822-B Example

Form

(Rev. December 2019)

Department of the Treasury

Internal Revenue Service

Change of Address or Responsible Party — Business

Please type or print.

See instructions on back. Do not attach this form to your return. Go to www.irs.gov/Form8822B for the latest information.

OMB No.

Before you begin: If you are also changing your home address, use Form 8822 to report that change.

If you are a

Check all boxes this change affects.

1

Employment, excise, income, and other business returns (Forms 720, 940, 941, 990, 1041, 1065, 1120, etc.)

Employment, excise, income, and other business returns (Forms 720, 940, 941, 990, 1041, 1065, 1120, etc.)

2

Employee plan returns (Forms 5500,

3

Business location

4a Business name

4b Employer identification number

5Old mailing address (no., street, room or suite no., city or town, state, and ZIP code). If a P.O. box, see instructions. If foreign address, also complete spaces below, see instructions.

Foreign country name

Foreign province/county

Foreign postal code

6New mailing address (no., street, room or suite no., city or town, state, and ZIP code). If a P.O. box, see instructions. If foreign address, also complete spaces below, see instructions.

Foreign country name

Foreign province/county

Foreign postal code

7New business location (no., street, room or suite no., city or town, state, and ZIP code). If a foreign address, also complete spaces below, see instructions.

Foreign country name

Foreign province/county

Foreign postal code

8New responsible party’s name

9New responsible party’s SSN, ITIN, or EIN. (CAUTION: YOU MUST REFER TO THE INSTRUCTIONS FOR FORM

10Signature. Under penalties of perjury, I declare that I have examined this application, and to the best of my knowledge and belief, it is true, correct, and complete. Daytime telephone number of person to contact (optional)

Sign |

FF |

Signature of owner, officer, or representative |

|

||

Here |

|

|

|

|

|

|

|

Title |

|

|

|

Where To File

Send this form to the address shown here that applies to you.

IF your old business address was in . . .

Connecticut, Delaware, District of Columbia, Georgia, Illinois, Indiana, Kentucky, Maine, Maryland, Massachusetts, Michigan, New Hampshire, New Jersey, New York, North Carolina, Ohio, Pennsylvania, Rhode Island, South Carolina, Tennessee, Vermont, Virginia, West Virginia, Wisconsin

Alabama, Alaska, Arizona, Arkansas, California, Colorado, Florida, Hawaii, Idaho, Iowa, Kansas, Louisiana, Minnesota, Mississippi, Missouri, Montana, Nebraska, Nevada, New Mexico, North Dakota, Oklahoma, Oregon, South Dakota, Texas, Utah, Washington, Wyoming, any place outside the United States

Date

THEN use this address . . .

Internal Revenue Service Kansas City, MO 64999

Internal Revenue Service Ogden, UT

For Privacy Act and Paperwork Reduction Act Notice, see back of form. |

Cat. No. 57465H |

Form |

Form |

Page 2 |

Future Developments

Information about any future developments affecting Form

Purpose of Form

Use Form

Changing both home and business addresses? Use Form 8822 to change your home address.

Check the box if you are a

Addresses

Be sure to include any apartment, room, or suite number in the space provided.

P.O. Box

Enter your box number instead of your street address only if your post office does not deliver mail to your street address.

Foreign Address

Follow the country’s practice for entering the postal code. Please do not abbreviate the country name.

“In Care of” Address

If you receive your mail in care of a third party (such as an accountant or attorney), enter “C/O” followed by the third party’s name and street address or P.O. box.

Responsible Party

Any entity with an EIN is required to report a change in its “responsible party” on lines 8 and 9 within 60 days of the change. See Regulations section

Signature

An officer, owner, general partner or LLC member manager, plan administrator, fiduciary, or an authorized representative must sign. An officer is the president, vice president, treasurer, chief accounting officer, etc.

If you are a representative F! signing on behalf of the

taxpayer, you must attach to CAUTION Form

Privacy Act and Paperwork Reduction Act Notice. We ask for the information on this form to carry out the Internal Revenue laws of the United States. Our legal right to ask for information is Internal Revenue Code sections 6001 and 6011, which require you to file a statement with us for any tax for which you are liable. Section 6109 requires that you provide your identifying number on what you file. This is so we know who you are, and can process your form and other papers.

Generally, tax returns and return information are confidential, as required by section 6103. However, we may give the information to the Department of Justice and to other federal agencies, as provided by law. We may give it to cities,

states, the District of Columbia, and U.S. commonwealths or possessions to carry out their tax laws. We may also disclose this information to other countries under a tax treaty, to federal and state agencies to enforce federal nontax criminal laws, or to federal law enforcement and intelligence agencies to combat terrorism.

If you are an entity with an EIN and your responsible party has changed, use of this form is mandatory. Otherwise, use of this form is voluntary. You will not be subject to penalties for failure to file this form. However, if you fail to provide the IRS with your current mailing address or the identity of your responsible party, you may not receive a notice of deficiency or a notice of demand for tax. Despite the failure to receive such notices, penalties and interest will continue to accrue on any tax deficiencies.

You are not required to provide the information requested on a form that is subject to the Paperwork Reduction Act unless the form displays a valid OMB control number. Books or records relating to a form or its instructions must be retained as long as their contents may become material in the administration of any Internal Revenue law.

The time needed to complete and file this form will vary depending on individual circumstances. The estimated average time is 18 minutes.

Comments. You can send us comments from www.irs.gov/FormComments. Or you can write to the Internal Revenue Service, Tax Forms and Publications Division, 1111 Constitution Ave. NW,

Document Specifics

| Fact | Description |

|---|---|

| Form Title | IRS Form 8822-B |

| Purpose | To notify the IRS of a change in business mailing address, business location, or the identity of a responsible party. |

| Who Must File | Businesses that have changed their mailing address, location, or the identity of their responsible party. |

| When to File | As soon as possible after the change occurs. |

| Impact of Not Filing | Delays in correspondence from the IRS, which can affect tax filings and potential refunds. |

| Sections of the Form | Business name and information, old address, new address, signature of authorized individual. |

| Information Required | Business name, EIN, old and new addresses, date of change, and the signature of an individual authorized to represent the business. |

| Where to File | The form is mailed to the IRS. The exact address depends on the state where the business is located. |

| Processing Time | Varies, but it's important to allow several weeks for the update to take effect. |

| Governing Laws | There are no specific governing laws mentioned for IRS Form 8822-B, but it falls under the broader IRS regulations and federal tax law. |

Guide to Writing IRS 8822-B

Filling out the IRS 8822-B form is a necessary step when an individual or entity needs to report a change in address or a change of the responsible party to the IRS. This action ensures that all correspondence and important tax documents reach the right place or person. While the task may seem daunting at first, breaking it down into simple steps can make the process straightforward and stress-free. Here are the steps you need to follow:

- Start by gathering all necessary documents and information before filling out the form. This includes your previous address, new address, the Social Security Number (SSN), or Employer Identification Number (EIN) associated with the address change.

- Download the IRS 8822-B form from the official IRS website. Ensure you’re using the most current version of the form.

- Enter your full name or the name of the entity that is reporting the change. Ensure the information is accurate and matches the records held by the IRS.

- Fill in your old address exactly as it appeared on your previous tax return. If you’ve moved multiple times since your last filing with the IRS, use the most recent address the IRS has on file.

- Provide your new address, including the full street address, city, state, and ZIP code. Double-check for accuracy to avoid any delays in future correspondence.

- If you are changing the address for an estate or trust, check the appropriate box to indicate who is making the change.

- For changes in the responsible party, fill in the section labeled “New Responsible Party’s Name” with the current responsible individual's full name. You will also need to provide their SSN, ITIN, or EIN.

- Sign and date the form on the designated line. If you are filling this out on behalf of a business or entity, ensure that the individual signing the form has the authority to make such changes.

- Review the completed form for any errors or missing information. Correct any issues you find to ensure the process goes smoothly.

- Mail or fax the completed form to the IRS. You can find the appropriate mailing address or fax number in the form's instructions, based on your state and the nature of the change.

After submitting the IRS 8822-B form, expect to wait several weeks for the changes to be processed. The IRS may contact you if they need more information or if there are any issues with your form. Remember, this step is crucial for maintaining accurate records and ensuring you receive all necessary information and documents from the IRS. Take your time completing the form to ensure all changes are reported correctly the first time.

Understanding IRS 8822-B

-

What is the IRS 8822-B form?

The IRS 8822-B form is a document meant for businesses and organizations to inform the Internal Revenue Service (IRS) about a change in their mailing address or the identity of their responsible party. This form ensures that important tax-related communications are sent to the correct address and helps maintain updated information about who is responsible for tax matters within the entity.

-

Who needs to file the 8822-B form?

Businesses or organizations that have changed their mailing address or experienced a change in the person who is responsible for tax matters should complete the 8822-B form. It's important for any entity with an Employer Identification Number (EIN) to keep their contact information current with the IRS.

-

When should the 8822-B form be filed?

The 8822-B form should be filed promptly after any change in address or the responsible party's information. While there is no strict deadline, filing the form as soon as possible ensures that the IRS has the most current information, helping avoid any communication or compliance issues.

-

How can I obtain the 8822-B form?

The 8822-B form can be downloaded directly from the IRS website. It's available in PDF format, which you can print, fill out, and mail to the IRS. Make sure to download the latest version of the form to ensure it includes any recent updates or changes.

-

What information is required to fill out the 8822-B form?

To complete the 8822-B form, you'll need the entity's EIN, the previous address, the new address, and the name and social security number (SSN), individual taxpayer identification number (ITIN), or EIN of the new responsible party. Additionally, the form asks for the signature of an individual authorized to sign on behalf of the entity, such as an officer or trustee.

-

Is there a filing fee for the 8822-B form?

No, there is no fee to file the 8822-B form with the IRS. This allows businesses and organizations to update their information without incurring additional costs.

-

Where do I mail the completed 8822-B form?

The completed 8822-B form should be mailed to the IRS at the address indicated on the form itself. The appropriate mailing address can vary, so it's critical to check the latest form instructions to ensure the document is sent to the correct location.

-

How long does it take for the change to be processed?

Processing times for the 8822-B form can vary, but changes typically take within four to six weeks to be reflected in the IRS records. It's a good idea to plan accordingly and not wait until the last minute to submit this form, especially if expecting important tax documents.

-

What happens if I don't file the 8822-B form?

If you don't file the 8822-B form after a change in address or the responsible party, the IRS might not have your current contact information. This can lead to missed important notices or documents and potentially result in penalties or compliance issues. Keeping the IRS informed is essential for smooth tax-related processes.

-

Can I submit the 8822-B form electronically?

As of now, the 8822-B form cannot be submitted electronically. It must be printed, filled out, and mailed to the IRS. Always check the IRS website for the latest filing options and guidelines, as these procedures may change.

Common mistakes

Filling out the IRS 8822-B form, which is used to inform the Internal Revenue Service (IRS) of a change of address for a business or an individual associated with a business, can sometimes be a confusing process. As a result, mistakes are common but avoidable. Below are some of the most frequent errors made when completing this form.

- Not using the correct form version. The IRS occasionally updates their forms. Using an outdated version can result in processing delays.

- Missing signatures. Every submitted form must be signed. A form without a signature is considered incomplete and will not be processed.

- Inaccurate Employer Identification Number (EIN). This number should match the business’s official records with the IRS.

- Failing to specify the type of address change. It's crucial to indicate whether the address change affects the mailing or business location address.

- Leaving out the old address. For the IRS to accurately update records, both the new and old addresses must be provided.

- Incorrectly dating the form. This can lead to confusion about when the change of address officially took place.

- Overlooking details for responsible parties. If there’s a new responsible party, their information must be clearly and accurately entered.

- Omitting contact information. Providing a current phone number ensures the IRS can contact you if there are questions or further information is needed.

- Assuming one form covers all tax forms. The IRS requires updates for each type of tax form separately, so one change of address form may not cover all tax obligations.

Keep in mind that these common mistakes can lead to delayed processing times and potential miscommunication with the IRS. Ensuring accuracy and completeness when filling out the IRS 8822-B form is crucial for maintaining up-to-date records and ensuring compliance with tax obligations.

Documents used along the form

When businesses or organizations undergo changes such as a change of address or a fundamental change in their entity, they often need to submit the IRS 8822-B form. This is a crucial document for ensuring that the Internal Revenue Service (IRS) has the most current information, allowing for accurate communication and the proper processing of tax documents. However, this form is frequently accompanied by several other forms and documents, creating a comprehensive package that reflects the entity's current status and ensures compliance with tax regulations. Here is a list of other forms and documents commonly used alongside the IRS 8822-B form, each serving its unique purpose in the tax filing and updating process.

- IRS Form 8832 - This form, "Entity Classification Election," allows an entity to select how it will be classified for federal tax purposes, such as a corporation, partnership, or disregarded entity.

- IRS Form 2848 - Known as "Power of Attorney and Declaration of Representative," this document grants an individual or organization the authority to represent the taxpayer before the IRS, allowing them to receive confidential tax information and make decisions.

- IRS Form SS-4 - The "Application for Employer Identification Number (EIN)" is essential for newly formed entities or those that need to update their EIN information due to changes in ownership or structure.

- IRS Form 990 - For nonprofit organizations, the "Return of Organization Exempt from Income Tax" is necessary to maintain tax-exempt status and report financial activities and governance to the IRS.

- IRS Form 1065 - This "U.S. Return of Partnership Income" form is used by partnerships to report their income, gains, losses, deductions, and credits to the IRS.

- IRS Form 1120 - Corporations use the "U.S. Corporation Income Tax Return" to report their income, losses, deductions, and credits, determining their federal income tax liability.

- IRS Form 1040 - For individuals involved in the organization, especially in single-member LLCs treated as disregarded entities, this "U.S. Individual Income Tax Return" is necessary for reporting personal income, deductions, and credits.

- IRS Form 5472 - Relevant for entities with foreign owners, "Information Return of a 25% Foreign-Owned U.S. Corporation or a Foreign Corporation Engaged in a U.S. Trade or Business" is used to report transactions between the reporting entity and related foreign parties.

- IRS Form 1099 - This series of documents reports various types of income from self-employment earnings to interest and dividends, essential for entities and individuals to report income not otherwise recorded on a W-2.

- State-Specific Registration Forms - Many entities also need to submit changes in address or entity status to state and local tax authorities, requiring a variety of state-specific forms that parallel the purpose of IRS 8822-B at the state level.

In summary, while the IRS 8822-B form plays a pivotal role in updating the IRS with current entity information, it is just the tip of the iceberg. Entities often need to navigate a complex landscape of additional forms and documents, each addressing different facets of tax and legal compliance. Understanding these documents and their interconnections is crucial for maintaining good standing with the IRS, ensuring tax compliance, and avoiding potential penalties. It's always advisable to consult with a tax professional to ensure proper filing and compliance with all applicable laws and regulations.

Similar forms

The IRS 8822-B form is designed for notifying the Internal Revenue Service (IRS) about a change in address or the identity of a responsible party within an organization. Similarly, the IRS Form 8822 serves the same purpose but for individuals or families. This form ensures that any correspondence from the IRS reaches the taxpayer at their new location, thus preventing missed notices or delayed refunds. Both forms are crucial for maintaining up-to-date information with the IRS, though one targets individual taxpayers while the other is directed at entities.

Another comparable document is the USPS Change of Address form, officially known as PS Form 3575. When people move, they use this form to update their address with the United States Postal Service. This ensures mail is forwarded to their new address. Like the IRS 8822-B, it's about updating contact information, albeit with a different organization. The aim is to maintain a smooth flow of communication and prevent important documents from being lost or delayed.

The Form SS-4, Application for Employer Identification Number (EIN), shares a link with the IRS 8822-B in terms of updating entity information. When a new entity is formed, it uses Form SS-4 to apply for an EIN. If the address or responsible party information changes after obtaining the EIN, the entity would then file Form 8822-B to report these changes to the IRS. This connection ensures the IRS has current details for proper identification and communication.

The DMV Change of Address form, used with state Department of Motor Vehicles, is another analogous document. When drivers relocate, they must update their address to receive vehicle registration renewals and any traffic citations. While the focus is on driving and vehicle records, this form, like the IRS 8822-B, ensures governmental bodies have the correct address for critical communications.

Bank account update forms also mirror the function of the IRS 8822-B. When account holders change their address, banks require them to fill out a form to ensure that all statements and notifications are sent to the right location. The underlying principle is the same: to keep contact information current and protect against fraud or misdirected mail.

For businesses, the Articles of Amendment can be somewhat similar to the IRS 8822-B. When a business entity needs to change its name, address, or other vital details post-incorporation, it files Articles of Amendment with the state in which it's registered. This keeps the state and other interested parties informed of its current legal standing, much as the 8822-B informs the IRS about address or responsible party changes.

The Change of Registered Agent form also parallels the IRS 8822-B, but it specifically pertains to changing the entity's registered agent or registered office. Businesses need to keep this information up to date for service of process and official communications. By updating this information, the entity ensures that it remains in good standing and that it can be reliably contacted by the state.

Educational institutions' Change of Address forms are in a similar vein. Students are required to keep their contact information up to date with their school's administrative offices. These updates help maintain the accuracy of records and ensure students receive vital information about their enrollment, courses, and any institutional notices, analogous to how tax entities use Form 8822-B with the IRS.

The Medicaid Change of Address form is another similar document. Recipients of Medicaid must keep their address current with the Medicaid office to receive essential communications about their benefits and coverage. This requirement reflects the same principle of maintaining updated contact information for the smooth delivery of services.

Lastly, voter registration address update forms share a common purpose with the IRS 8822-B. When voters move, they need to update their address to ensure they are registered correctly for local elections. This helps maintain the integrity of the electoral process by ensuring voters receive the correct ballots and voting information, thereby facilitating their civic duty.

Dos and Don'ts

When it comes to updating your address or business location with the Internal Revenue Service (IRS), the 8822-B form is the document you need. Accuracy and attention to detail can streamline the process, making sure that your tax information is correctly updated in the IRS systems. Here are six do's and don'ts to consider when filling out this form:

Do:

- Ensure all information is accurate and complete, including your Employer Identification Number (EIN) and the old and new addresses.

- Specify the date of the change to help the IRS update your records in a timely manner.

- Sign and date the form; it’s crucial for validating the change request.

- Use blue or black ink if you are filling out the form by hand.

- Review the form thoroughly before submission to check for mistakes or omissions.

- Keep a copy of the filled-out form for your records.

Don't:

- Leave any required fields blank. Incomplete forms may not be processed.

- Submit the form without reviewing it for accuracy.

- Forget to notify other relevant departments or agencies about your address change.

- Use pencil or colors other than blue or black ink; this can make the form invalid.

- Assume the address change will update all of your tax records; some updates may need to be made separately.

- Rely solely on this form for updating addresses related to other IRS obligations, such as excise tax or employment tax accounts.

Misconceptions

When dealing with the IRS 8822-B form, which is used to notify the Internal Revenue Service (IRS) of a change in address or the identity of a responsible party, numerous misconceptions can lead to confusion. Here are nine common misconceptions that taxpayers should be aware of:

- It’s only for Businesses: Many individuals believe that the Form 8822-B is exclusively for businesses. However, it is also applicable to trusts, estates, and certain individuals acting in capacities that require notification to the IRS of address changes or updates to the identity of the responsible party.

- Using the Form Updates All IRS Records: A common misconception is that once you submit Form 8822-B, all your records with the IRS are updated. In reality, this form is specifically for changing the official address or responsible party. Other forms or notifications may be required for different types of updates.

- There’s No Deadline: Some people think that there isn’t a deadline for submitting Form 8822-B. However, the IRS advises submitting this form within 60 days of the change to ensure timely updates to your records, although penalties for late notification are not typically enforced.

- Electronic Submission is Available: As of the last update, Form 8822-B cannot be submitted electronically. The form must be printed and mailed to the IRS, which is an important consideration for meeting the suggested 60-day notification period.

- Not Necessary for PO Box Changes: Whether you’re changing to a physical address or to/from a PO Box, the IRS requires notification through Form 8822-B. Any change of address, regardless of type, should be reported.

- It’s a Complicated Process: Filling out Form 8822-B might seem daunting, but it’s relatively straightforward. It requires basic information such as the old address, new address, and taxpayer identification number (TIN), along with some additional details depending on the filer's status.

- No Confirmation from the IRS: Another misconception is that the IRS will not acknowledge receipt of Form 8822-B. While it’s true that you may not receive individualized confirmation, the IRS does process these forms and update their records accordingly. Checking your IRS account online or contacting them directly are ways to verify changes.

- Must be Completed by the Responsible Party Only: It is often misunderstood that only the responsible party can complete and sign the Form 8822-B. In reality, a duly authorized person, such as an accountant or attorney, can also complete the form on behalf of the responsible party, provided they have the proper authorization.

- Affects Tax Return Processing Times: Some taxpayers are under the impression that updating their address or responsible party information with Form 8822-B will delay the processing of their tax returns. This is generally not the case, as the form is processed separately from tax returns and is intended to ensure that future communications reach the taxpayer efficiently.

Key takeaways

When it comes to updating the Internal Revenue Service (IRS) about a change in address or the identity of the responsible party, the IRS 8822-B form is crucial. Here are the key takeaways everyone should know about filling out and using this form:

- Timeliness is Key: Submit the form as soon as possible after your address changes or when there's a new responsible party. This ensures that any tax-related communications reach you in a timely manner, avoiding possible complications or misunderstandings.

- Correct Information is Crucial: Make sure all the information you provide on the form is accurate. This includes spelling, tax identification numbers, and previous address details. Mistakes can delay processing or lead to misrouted correspondence.

- Identifying the Responsible Party: For businesses, the responsible party is the person who controls, manages, or directs the entity and the disposition of its funds and assets. If this individual changes, the IRS must be notified with this form.

- Keep a Copy for Your Records: After you've filled out and submitted the IRS 8822-B form, ensure you retain a copy. This will be useful for your records and can serve as proof of submission in case any issues arise.

- Understand the Instructions: Carefully read the instructions provided by the IRS for filling out the form. These instructions can answer many common questions and guide you through the process, making it smoother and less prone to errors.

Popular PDF Documents

Form 285 - Enables individuals to take back control of their financial situation by having an expert deal with the IRS.

1099b What Is It - Adjustments for stock splits or dividends are taken into account on the 1099-B form.

IRS 8959 - This document is crucial for the accurate enforcement of tax laws related to the Additional Medicare Tax on certain income levels.