Get IRS 8822 Form

Changes in life such as moving to a new home can be exciting but they also bring administrative responsibilities, especially when it comes to taxes. If you’ve recently moved or plan to move, it's important to update your address with the IRS to ensure that you receive any tax refunds or correspondence in a timely manner. For this purpose, the IRS provides the 8822 form, a straightforward document designed to help taxpayers officially inform the agency of their new address. Completing this form is a critical step in maintaining clear communication with the IRS, avoiding delays in getting important tax documents or refunds. It's suitable not only for individuals but also for estates and trusts that need to report a change of address. The process is relatively simple, but it is important to provide accurate information to prevent any potential issues with your tax records. This form is a clear example of the IRS's attempt to streamline administrative processes for taxpayers, making it easier to keep personal information up-to-date.

IRS 8822 Example

Form 8822 |

Change of Address |

|

(Rev. February 2021) |

(For Individual, Gift, Estate, or |

|

|

||

Department of the Treasury |

▶ Please type or print. ▶ See instructions on back. ▶ Do not attach this form to your return. |

|

▶ Information about Form 8822 is available at www.irs.gov/form8822. |

||

Internal Revenue Service |

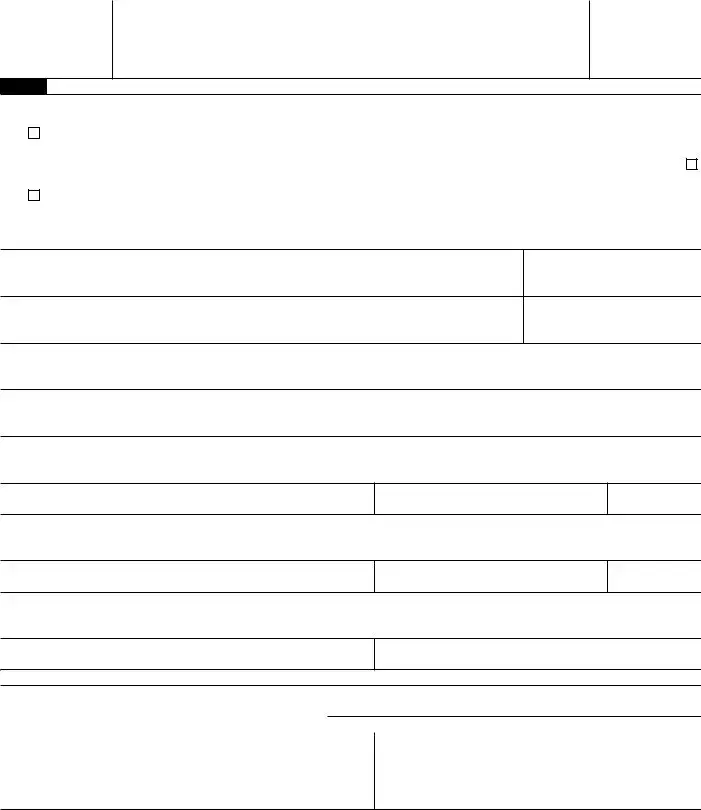

Part I Complete This Part To Change Your Home Mailing Address

OMB No.

Check all boxes this change affects:

1

Individual income tax returns (Forms 1040,

▶If your last return was a joint return and you are now establishing a residence separate from the spouse with whom

you filed that return, check here |

▶ |

2

Gift, estate, or

▶For Forms 706 and

▶ Decedent’s name |

▶ Social security number |

3a Your name (first name, initial, and last name)

3b Your social security number

4a Spouse’s name (first name, initial, and last name)

4b Spouse’s social security number

5a Your prior name(s). See instructions.

5b Spouse’s prior name(s). See instructions.

6a |

Your old address (no., street, apt. no., city or town, state, and ZIP code). If a P.O. box, see instructions. If foreign address, also complete spaces below, |

|

see instructions. |

Foreign country name

Foreign province/county

Foreign postal code

6b |

Spouse’s old address, if different from line 6a (no., street, apt. no., city or town, state, and ZIP code). If a P.O. box, see instructions. If foreign address, also |

||

|

complete spaces below, see instructions. |

|

|

|

|

|

|

Foreign country name |

Foreign province/county |

Foreign postal code |

|

|

|

|

|

7New address (no., street, apt. no., city or town, state, and ZIP code). If a P.O. box, see instructions. If foreign address, also complete spaces below, see instructions.

Foreign country name

Part II |

Signature |

Foreign province/county

Foreign postal code

Daytime telephone number of person to contact (optional) ▶

Sign |

▲▲ |

|

|

|

Your signature |

Date |

|||

|

||||

Here |

|

|

|

|

|

|

If joint return, spouse’s signature |

Date |

For Privacy Act and Paperwork Reduction Act Notice, see back of form.

▲▲

Signature of representative, executor, administrator/if applicable Date

Title |

|

Cat. No. 12081V |

Form 8822 (Rev. |

Form 8822 (Rev. |

Page 2 |

Future Developments

Information about developments affecting Form 8822 (such as legislation enacted after we release it) is at www.irs.gov/form8822.

Purpose of Form

You can use Form 8822 to notify the Internal Revenue Service if you changed your home mailing address. If this change also affects the mailing address for your children who filed income tax returns, complete and file a separate Form 8822 for each child. If you are a representative signing for the taxpayer, attach to Form 8822 a copy of your power of attorney. Generally, it takes 4 to 6 weeks to process a change of address.

Changing both home and business addresses? Use Form

Prior Name(s)

If you or your spouse changed your name because of marriage, divorce, etc., complete line 5. Also, be sure to notify the Social Security Administration of your new name so that it has the same name in its records that you have on your tax return. This prevents delays in processing your return and issuing refunds. It also safeguards your future social security benefits.

Addresses

Be sure to include any apartment, room, or suite number in the space provided.

P.O. Box

Enter your box number instead of your street address only if your post office does not deliver mail to your street address.

Foreign Address

Follow the country’s practice for entering the postal code. Please do not abbreviate the country.

“In Care of” Address

If you receive your mail in care of a third party (such as an accountant or attorney), enter “C/O” followed by the third party’s name and street address or P.O. box.

Signature

The taxpayer, executor, donor, or an authorized representative must sign. If your last return was a joint return, your spouse must also sign (unless you have indicated by checking the box on line 1 that you are establishing a separate residence).

|

|

▲ |

If you are a representative signing |

! |

on behalf of the taxpayer, you |

must attach to Form 8822 a copy |

|

CAUTION |

of your power of attorney. To do |

this, you can use Form 2848. The Internal Revenue Service will not complete an address change from an “unauthorized” third party.

Where To File

•If you checked the box on line 2, send Form 8822 to: Department of the Treasury, Internal Revenue Service Center, Kansas City, MO

•If you did not check the box on line 2, send Form 8822 to the address shown here that applies to you:

IF your old home mailing |

THEN use this |

address was in . . . |

address . . . |

|

|

Alabama, Arkansas, |

Department of the |

Delaware, Georgia, Illinois, |

Treasury |

Indiana, Iowa, Kentucky, |

Internal Revenue |

Maine, Massachusetts, |

Service |

Minnesota, Missouri, New |

Kansas City, MO |

Hampshire, New Jersey, |

|

New York, North Carolina, |

|

Oklahoma, South Carolina, |

|

Tennessee, Vermont, |

|

Virginia, Wisconsin |

|

|

|

Florida, Louisiana, |

Department of the |

Mississippi, Texas |

Treasury |

|

Internal Revenue |

|

Service |

|

Austin, TX |

|

|

|

|

Alaska, Arizona, California, |

Department of the |

Colorado, Connecticut, |

Treasury |

District of Columbia, |

Internal Revenue |

Hawaii, Idaho, Kansas, |

Service |

Maryland, Michigan, |

Ogden, UT |

Montana, Nebraska, |

|

Nevada, New Mexico, |

|

North Dakota, Ohio, |

|

Oregon, Pennsylvania, |

|

Rhode Island, South |

|

Dakota, Utah, Washington, |

|

West Virginia, Wyoming |

|

|

|

A foreign country, |

Department of the |

American Samoa, or |

Treasury |

Puerto Rico (or are |

Internal Revenue |

excluding income under |

Service |

Internal Revenue Code |

Austin, TX |

section 933), or use an |

|

APO or FPO address, or |

|

file Form 2555, |

|

or 4563, or are a dual- |

|

status alien or non bona |

|

fide resident of Guam or |

|

the Virgin Islands. |

|

|

|

Guam: |

Department of |

bona fide residents |

Revenue and |

|

Taxation |

|

Government of |

|

Guam |

|

P.O. Box 23607 |

|

GMF, GU 96921 |

Virgin Islands: |

V.I. Bureau of |

bona fide residents |

Internal Revenue |

|

6115 Estate |

|

Smith Bay, |

|

Suite 225 |

|

St. Thomas, VI 00802 |

|

|

Privacy Act and Paperwork Reduction Act Notice. We ask for the information on this form to carry out the Internal Revenue laws of the United States. Our legal right to ask for information is Internal Revenue Code sections 6001 and 6011, which require you to file a statement with us for any tax for which you are liable. Section 6109 requires that you provide your social security number on what you file. This is so we know who you are, and can process your form and other papers.

Generally, tax returns and return information are confidential, as required by section 6103. However, we may give the information to the Department of Justice and to other federal agencies, as provided by law. We may give it to cities, states, the District of Columbia, and U.S. commonwealths or possessions to carry out their tax laws. We may also disclose this information to other countries under a tax treaty, to federal and state agencies to enforce federal nontax criminal laws, or to federal law enforcement and intelligence agencies to combat terrorism.

The use of this form is voluntary. However, if you fail to provide the Internal Revenue Service with your current mailing address, you may not receive a notice of deficiency or a notice and demand for tax. Despite the failure to receive such notices, penalties and interest will continue to accrue on the tax deficiencies.

You are not required to provide the information requested on a form that is subject to the Paperwork Reduction Act unless the form displays a valid OMB control number. Books or records relating to a form or its instructions must be retained as long as their contents may become material in the administration of any Internal Revenue law.

The time needed to complete and file this form will vary depending on individual circumstances. The estimated average time is 16 minutes.

Comments. You can send comments from www.irs.gov/FormComments. Or you can write to the Internal Revenue Service, Tax Forms and Publications Division, 1111 Constitution Ave. NW,

Document Specifics

| Fact Name | Description |

|---|---|

| Purpose of Form 8822 | This form is used by taxpayers to notify the Internal Revenue Service (IRS) of a change in home or business mailing address. |

| Timeline for Submission | It is recommended that Form 8822 be submitted to the IRS promptly after any change of address to ensure timely receipt of tax refunds and correspondence. |

| State-specific Versions | Form 8822 is a federal form and does not have state-specific versions. Address changes for state taxes must be reported separately to the appropriate state tax agency. |

| Governing Law | The procedures and requirements for Form 8822 are governed by federal tax law, as the form is used to communicate with the United States Internal Revenue Service. |

Guide to Writing IRS 8822

When individuals change their home or business address, it is crucial to update this information with the IRS to ensure they receive timely updates and correspondence. The IRS Form 8822 serves as the tool for facilitating this important update. Following the prescribed steps to fill out this form accurately ensures that the IRS can maintain effective communication with the taxpayer, minimizing the risk of missed notices or important tax documents, which could lead to complications with one's tax filings. Here's a step-by-step guide to completing IRS Form 8822, instructed to streamline the process and enhance understanding.

- Start by downloading the latest version of the IRS Form 8822 from the official IRS website to ensure you're using the most current form.

- Read the instructions provided on the form carefully to familiarize yourself with the information required.

- Enter your full name as displayed on your last tax return. If you filed jointly with a spouse and both of you are moving, include both names in the same order as they appeared on the tax return.

- If you have a different mailing address from your home address, or if your mailing address has changed as well, be sure to fill in the section asking for your old mailing address.

- Provide your new mailing address in the space designated. Ensure all details are accurate, including street name, number, apartment or suite number, city, state, and ZIP code.

- For those also needing to update their business address, use the appropriate section on the form to include the old and new business addresses. The same level of detail is required as for the mailing address.

- Indicate the specific type of tax forms (e.g., Form 1040, 1040-ES) for which the address change applies. If the change affects multiple forms, ensure all applicable forms are listed.

- Date and sign the form. If you are filing jointly, both spouses must sign the form to validate the address change for joint filings.

- After completing the form, check for accuracy to ensure all information is correct and complete.

- Mail the completed form to the appropriate IRS address. The correct mailing address can vary depending on your state, so refer to the instructions on the IRS Form 8822 or the IRS website for the specific address.

Once the IRS processes the Form 8822, they will update their records with your new address. This ensures that all future correspondence and documents from the IRS will reach you at your new location. It may take up to four to six weeks for the change to be reflected in the IRS systems, so plan accordingly when waiting for confirmation or any tax-related documentation post submission.

Understanding IRS 8822

-

What is the IRS 8822 form used for?

The IRS 8822 form is specifically designed for notifying the Internal Revenue Service (IRS) about a change in your home or business mailing address. It ensures that you receive important tax documents and correspondence from the IRS at your new address.

-

Who needs to fill out the IRS 8822 form?

Anyone who has changed their home or business address and has previously filed a tax return with the IRS should complete and submit the 8822 form to update their address with the agency.

-

Is there a deadline for submitting the IRS 8822 form?

There isn’t a specific deadline for submitting the form. However, it's recommended to file it as soon as possible after you move to avoid any delays in receiving important tax information or refunds.

-

Can the IRS 8822 form be submitted electronically?

Currently, the IRS does not accept the 8822 form electronically. It must be printed and mailed to the address stated on the form for your specific location.

-

Is there a fee to submit the IRS 8822 form?

No, there is no fee to submit the 8822 form to the IRS. It's a free process aimed at updating your address information in the agency's records.

-

What information do I need to provide on the IRS 8822 form?

You'll need to provide your full name, old address, new address, and Social Security number or Employer Identification Number. If you're filing for a joint return, you should also include your spouse's name and Social Security number.

-

How long does it take for the address change to take effect?

After the IRS processes your 8822 form, it can take up to 4 to 6 weeks for the address change to be fully integrated into their system.

-

Should I notify the IRS if I move temporarily?

Yes, if your temporary relocation lasts more than a year, you should notify the IRS by filing the 8822 form. This ensures that you don't miss any crucial tax information or notifications.

-

What if I don’t use the IRS 8822 form to update my address?

It might lead to missed critical communications, including tax refund checks or notices. It's always better to keep your address updated with the IRS to avoid any potential complications.

-

Can I use the IRS 8822 form to change the address of more than one tax return?

You will need to complete and submit separate forms if you are updating addresses for different types of returns, such as personal and business. Each tax entity or individual return requires its own notification process.

Common mistakes

When it comes to alerting the IRS about a change of address, the IRS Form 8822 is the go-to document. It seems straightforward, but errors can creep in if you're not careful. Recognizing and avoiding these mistakes can ensure that your address update goes smoothly, sidestepping potential delays in receiving important tax documents or refunds. Here’s what to look out for:

Not using the most current form – The IRS occasionally updates its forms. Using an outdated version can lead to processing delays or even a non-acceptance of the form.

Incorrect Social Security Numbers (SSNs) or Employer Identification Numbers (EINs) – Mistyping these critical numbers can lead to the IRS not being able to match the form with the right taxpayer account.

Filling in the form with ineligible ink color – The IRS has specific requirements, typically black ink, to ensure forms are readable by scanning equipment.

Omitting previous address details – Failing to provide your exact previous address can make it difficult for the IRS to verify your identity and update their records accurately.

Leaving signature date blank – The form must be signed and dated to be valid. An undated signature may result in the IRS considering the form incomplete.

Not notifying the IRS of a foreign address change – If you move to or from a foreign country, the IRS requires specific information to process your address change appropriately.

Using the form for purposes other than address changes – The 8822 form is exclusively for address updates. Trying to communicate other changes will not be processed.

Forgetting to mail the form to the correct IRS address – There are different processing centers depending on where you live. Sending your form to the wrong address can delay the update.

To sidestep these missteps, here's a checklist to use before submitting the IRS Form 8822:

- Confirm you have the latest version of the form.

- Double-check your SSN and EIN for accuracy.

- Use black ink for clear legibility.

- Ensure your previous address is correctly filled.

- Sign and date the form.

- Include any foreign address details if applicable.

- Remember, the form is solely for address changes.

- Mail it to the correct IRS processing center based on your location.

By avoiding these common mistakes, you help ensure that your form is processed efficiently, keeping your tax records up to date and maintaining seamless communication with the IRS.

Documents used along the form

When individuals need to report a change of address to the Internal Revenue Service (IRS), they often use the Form 8822. However, this form does not exist in isolation. There are several other documents and forms that are commonly used alongside it, especially when dealing with tax matters that go beyond a simple address update. Understanding these documents can help ensure that all necessary information is up-to-date with the IRS, facilitating smoother interactions and preventing potential issues with tax returns or correspondence.

- Form 1040 - The U.S. Individual Income Tax Return is arguably the most well-known tax form. It's used by individuals to file their annual income tax return. Changes in address, reportable on Form 8822, often coincide with updates that need to be reported on the Form 1040, especially if the change affects state taxes or potential refunds.

- Form 4868 - This is the Application for Automatic Extension of Time To File U.S. Individual Income Tax Return. If a taxpayer is unable to complete their tax return by the typical April 15 deadline, Form 4868 can be used to request an extension. Ensuring the IRS has the correct address on file via Form 8822 is crucial when expecting any correspondence regarding an extension.

- Form 8821 - Tax Information Authorization allows a third party to access and view a taxpayer’s information. When submitting a Form 8822 for a change of address, it may be necessary to update or submit a new Form 8821 to ensure that the authorized party can continue to access the taxpayer's information without interruption.

- Form 8903 - This document is used to calculate the Domestic Production Activities Deduction. Individuals or businesses that claim this deduction and change their address should consider submitting Form 8822 to avoid any potential disruption in communication or processing related to the deduction.

- Form 4506-T - Request for Transcript of Tax Return allows taxpayers to request past tax returns and tax information. If an individual has recently changed their address using Form 8822, it’s important to use the updated address on Form 4506-T to ensure the requested information is sent to the correct location.

It's integral for taxpayers to be aware of how various tax documents and forms interact with each other. An update made on one form, like the IRS Form 8822 for a change of address, may necessitate corresponding updates or considerations on related documents. Staying informed and proactive in managing these documents helps in maintaining accurate records with the IRS, paving the way for a more straightforward tax filing process and efficient communication.

Similar forms

The IRS 8822 form, essential for notifying the Internal Revenue Service (IRS) of a change in address, shares characteristics with several other documents. Among them, the IRS Form 8822-B stands out for its specific function of updating information for businesses or entities that have experienced a change in address or responsible party. Much like its counterpart, this form ensures that important tax documents and notifications reach the right location, maintaining the flow of communication between the IRS and the entity in question.

Similarly, IRS Form 1040, the U.S. individual income tax return, aligns with the 8822 form in its necessity for accurate personal information. While primarily used for reporting annual income and calculating taxes owed or refunded, the 1040 form requires current address details to ensure taxpayers receive all correspondence. This highlights the importance of up-to-date information across different tax-related forms to keep taxpayers in compliance and informed.

The Change of Address form provided by the United States Postal Service (USPS) mirrors the intent behind the IRS 8822 form. When individuals move, completing this form ensures that their mail is forwarded to the new address. This process prevents important documents, like tax returns or refund checks, from getting lost, underscoring the importance of notifying relevant organizations about address changes.

The Social Security Administration (SSA) Change of Address form parallels the IRS 8822 in its purpose. For beneficiaries of Social Security or Medicare, updating their address through this form is crucial to receiving essential notices and checks. This form, like the 8822, safeguards the continuity of benefits and information flow between the government and citizens.

Form W-9, Request for Taxpayer Identification Number and Certification, shares a connection with the 8822 form through its role in the accurate reporting and withholding of taxes. Independent contractors and entities use this document to provide their Taxpayer Identification Number (TIN) or Social Security Number (SSN) to entities that will pay them. Address accuracy on this form is vital for receiving tax documents such as the Form 1099, which reports income earned outside of traditional employment.

The voter registration update form, used across many states in the U.S., echoes the importance of current address information as seen with the IRS 8822 form. Updating one’s address ensures that individuals remain on the electoral roll for their correct precinct, thereby maintaining their eligibility to vote in local, state, and federal elections. It’s a civic parallel to the financial reporting accuracy promoted by the 8822 form.

Form 4868, Application for Automatic Extension of Time To File U.S. Individual Income Tax Return, shares a procedural similarity with the IRS 8822 in that it provides taxpayers additional time to file their tax return. However, just as with the change of address form, ensuring that the IRS has the correct address is crucial to receive the confirmation of the extension and any other correspondence.

The Department of Motor Vehicles (DMV) change of address form in many states offers a practical counterpart to the IRS 8822 form. Drivers need to update their address to receive renewal notices for their driver's license and vehicle registration on time. This form, akin to the 8822, prevents misrouted important notifications and legal documents, maintaining legal driving status.

Form I-9, Employment Eligibility Verification, utilized by employers within the United States, requires up-to-date personal information, including the employee's address. While its primary purpose is to verify the legal authorization to work in the U.S., accuracy in personal information is crucial for compliance and verification purposes, mirroring the IRS 8822's emphasis on current address details.

Lastly, the Health Insurance Marketplace application form, used by individuals seeking health insurance through the Affordable Care Act (ACA) exchanges, demands accurate personal and address information for applicants. Similar to the IRS 8822 form, this ensures that all correspondence, including vital insurance coverage information and notices, reaches the applicant. This is critical for maintaining coverage and fulfilling health care law requirements.

Dos and Don'ts

When you need to update your address with the Internal Revenue Service (IRS), using Form 8822 is the right step. It's crucial to follow specific guidelines to ensure the process goes smoothly and avoids any potential issues. Here are some important dos and don'ts when filling out the IRS Form 8822:

Do:- Read the form instructions carefully before you start filling it out. This ensures you understand every requirement and reduces the risk of mistakes.

- Use your legal name and the name that appears on your tax return. Consistency with official documents is key to avoiding processing delays.

- Provide your old and new addresses clearly. The IRS needs both to update their records and make sure future communications reach you.

- Include your Social Security Number (SSN), Individual Taxpayer Identification Number (ITIN), or Employer Identification Number (EIN). This information helps the IRS accurately identify your tax records.

- Double-check all information for accuracy before submitting. Errors can complicate or delay the change of address process.

- Keep a copy of the form for your records. Having proof of submission and the details you provided can be helpful if there are questions later on.

- Rush through the process. Taking your time reduces the chance of making mistakes.

- Use nicknames or abbreviations. The information you provide should match your legal documents and tax records.

- Leave out any required information, such as your previous address. Incomplete forms may not be processed.

- Forget to sign and date the form. An unsigned form is considered incomplete and won’t be processed by the IRS.

- Ignore the specific mailing instructions. Sending your form to the wrong IRS office can delay the update of your address.

- Assume the change is immediate. It can take the IRS several weeks to process a change of address, so allow ample time for the update to take effect.

Misconceptions

When it comes to understanding IRS forms, misconceptions can complicate what should be a straightforward process. The IRS Form 8822, used to report a change of address, is no stranger to such misconceptions. Let's elucidate some common myths surrounding this form:

- Only individuals need to file Form 8822. This is a misconception. Both individuals and businesses must inform the IRS of address changes. The appropriate form for businesses is Form 8822-B.

- Filing Form 8822 updates your address for all IRS correspondence. In reality, Form 8822 updates your address mainly for mailing purposes. Specific forms or issues, such as business taxes or estate matters, may require separate notifications.

- Form 8822 is complicated and requires professional help to fill out. This form is relatively straightforward and comes with instructions that make it possible for most people to complete on their own, without needing to hire a professional.

- The IRS immediately processes Form 8822. Though the IRS endeavors to update addresses promptly, it may take four to six weeks for the change to be reflected in all systems. Immediate processing is not guaranteed.

- You must submit Form 8822 before filing your next tax return. While updating your address with the IRS as soon as possible is advisable, you can also report a new address directly on your next tax return.

- If you inform the USPS, you don't need to file Form 8822. Informing the United States Postal Service (USPS) of an address change is helpful, but it does not update your address with the IRS. Form 8822 or Form 8822-B is still necessary.

- There is a fee to file Form 8822. There is no fee associated with filing Form 8822. The IRS provides this service free of charge to ensure they have your current address for correspondences and paper returns.

- Form 8822 can also be used to update your name. Form 8822 is strictly used for address changes. For a name change, different procedures and forms, often involving Social Security Administration paperwork, are required.

- Filing Form 8822 automatically updates your state tax records. Filing Form 8822 updates your address with the federal IRS only. You must separately notify your state tax agency of an address change.

- Electronic filing of Form 8822 is an option. As of the last known update, Form 8822 cannot be filed electronically. It must be printed and mailed to the IRS. Always check the latest IRS guidelines in case this changes in the future.

Understanding these points about IRS Form 8822 can help streamline the process of reporting an address change, ensuring timely and accurate communication with the IRS. Always refer to the most current instructions provided by the IRS or consult a tax professional for the most accurate guidance.

Key takeaways

The Internal Revenue Service (IRS) Form 8822 is essential for taxpayers who need to report a change of address. Whether it's a result of relocating for work, personal reasons, or receiving important tax-related information at a new location, ensuring that the IRS has your current address is crucial for a variety of reasons. Below are seven key takeaways about filling out and using the IRS 8822 form:

- Form 8822 is specifically designed for taxpayers to inform the IRS about a change in address. Using this form ensures that any correspondence or confidential tax documents from the IRS reach you at your new address.

- Timeliness Matters: It is important to submit Form 8822 promptly after moving. This proactive approach helps avoid delays in receiving tax refunds or crucial communication from the IRS.

- There are two versions of the form: Form 8822, Change of Address, and Form 8822-B, Change of Address or Responsible Party — Business. It’s crucial to use the correct form depending on whether the address change is for an individual, or a business entity.

- Form 8822 requires basic information but it's important to fill it out accurately. This includes your full name, old address, new address, and Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN). Couples who file jointly should include information for both individuals.

- One cannot submit Form 8822 online. The completed form must be printed and mailed to the IRS. The specific address to which you should send the form can vary, so it's necessary to verify the correct mailing address for your location by consulting the latest IRS instructions.

- Keep Records: After submitting Form 8822, it's advisable to keep a copy for your records. This documentation can be helpful if there are any questions or issues regarding your address change in the future.

- Changing your address with the IRS by using Form 8822 does not update your address on all types of tax documents or with other state or federal agencies. You may need to notify other agencies or departments separately, such as the U.S. Postal Service or your state tax agency.

In summary, the IRS Form 8822 is a critical tool for keeping your records up to date with the Internal Revenue Service. Ensuring that this form is filled out correctly and submitted in a timely manner can help prevent miscommunications, delays in receiving important documents, and potential interruptions to your tax-related obligations.

Popular PDF Documents

How to Report a Workplace Injury - Employer and employee classification codes, along with employer's NAICS code, are captured for accurate categorization and processing of the claim.

940 Taxes - Comprehensive instructions support employers in accurately completing the form, promoting compliance with federal unemployment tax regulations.

Form 3911 Instructions - A crucial document for companies dealing with the international shipment of U.S.-manufactured goods.