Get IRS 8821 Form

The world of tax documentation and compliance can often seem complex and daunting, particularly when managing permissions and access to sensitive information. Among the many tools available for navigating these waters, the IRS 8821 form plays a crucial role. This valuable form allows taxpayers to authorize any individual, corporation, firm, organization, or partnership to inspect and receive their confidential tax information. Designed to facilitate a smoother communication and information sharing process between taxpayers and third parties, the IRS 8821 form is instrumental in a variety of situations, from routine tax preparation and planning to more complex tax resolution cases. It is noteworthy that this authorization does not allow the appointee to represent the taxpayer before the IRS or to advocate on their behalf but strictly limits them to the access of information for the period specified on the form itself. Understanding the proper use and limitations of this form is essential for anyone looking to navigate their tax matters efficiently and securely.

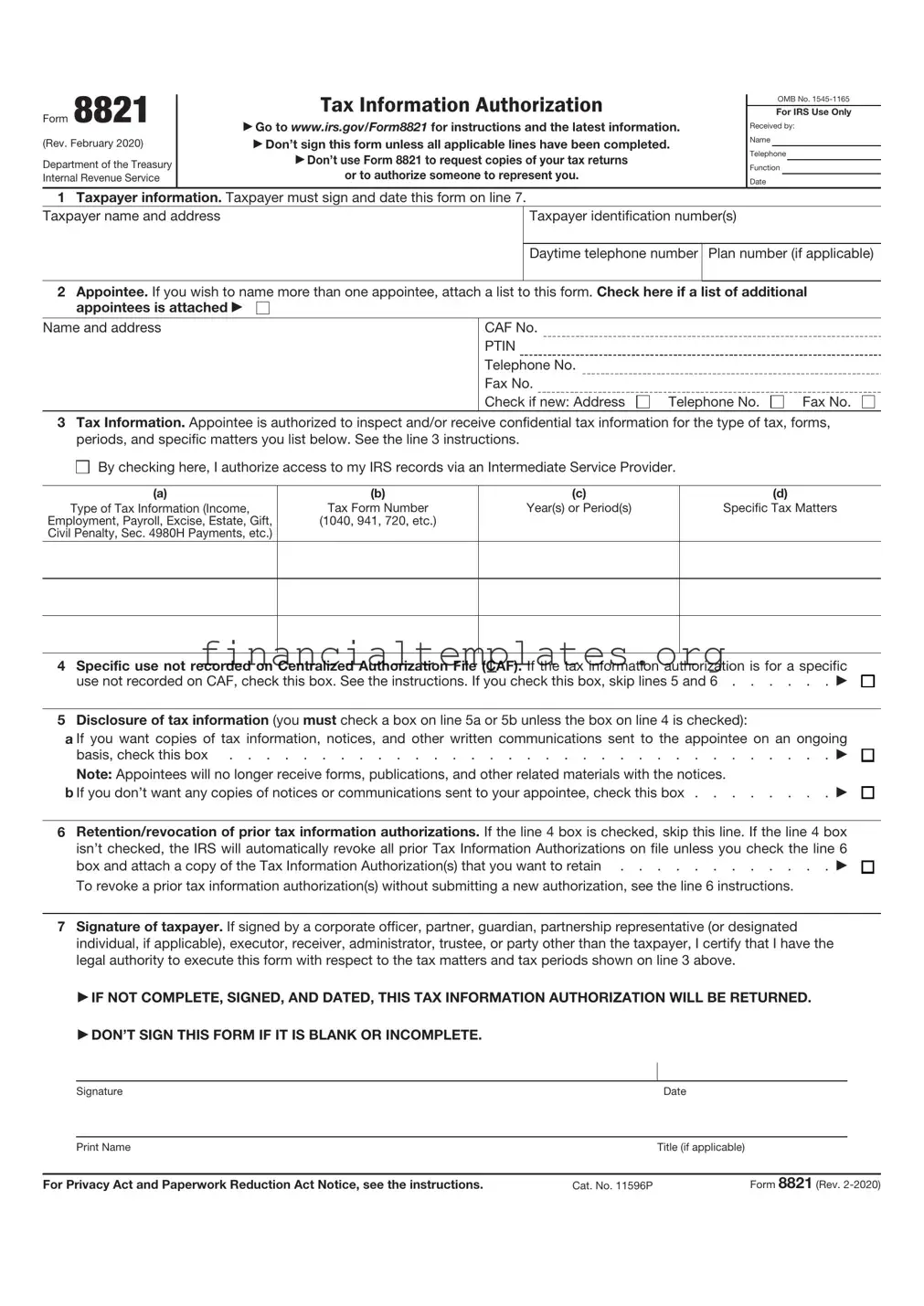

IRS 8821 Example

Form 8821

(Rev. January 2021)

Department of the Treasury Internal Revenue Service

Tax Information Authorization

▶Go to www.irs.gov/Form8821 for instructions and the latest information.

▶Don’t sign this form unless all applicable lines have been completed.

▶Don’t use Form 8821 to request copies of your tax returns or to authorize someone to represent you. See instructions.

OMB No.

For IRS Use Only

Received by:

Name

Telephone

Function

Date

1Taxpayer information. Taxpayer must sign and date this form on line 6.

Taxpayer name and address |

Taxpayer identification number(s) |

|

|

|

|

|

Daytime telephone number |

Plan number (if applicable) |

|

|

|

2Designee(s). If you wish to name more than two designees, attach a list to this form. Check here if a list of additional

designees is attached ▶

Name and address |

CAF No. |

|

|

|

PTIN |

|

|

|

Telephone No. |

|

|

|

Fax No. |

|

|

Check if to be sent copies of notices and communications |

Check if new: Address |

Telephone No. |

Fax No. |

Name and address |

CAF No. |

|

|

|

PTIN |

|

|

|

Telephone No. |

|

|

|

Fax No. |

|

|

Check if to be sent copies of notices and communications |

Check if new: Address |

Telephone No. |

Fax No. |

3Tax information. Each designee is authorized to inspect and/or receive confidential tax information for the type of tax, forms, periods, and specific matters you list below. See the line 3 instructions.

By checking here, I authorize access to my IRS records via an Intermediate Service Provider.

By checking here, I authorize access to my IRS records via an Intermediate Service Provider.

(a)

Type of Tax Information (Income,

Employment, Payroll, Excise, Estate, Gift, Civil Penalty, Sec. 4980H Payments, etc.)

(b)

Tax Form Number

(1040, 941, 720, etc.)

(c)

Year(s) or Period(s)

(d)

Specific Tax Matters

4 Specific use not recorded on the Centralized Authorization File (CAF). If the tax information authorization is for a specific use not recorded on CAF, check this box. See the instructions. If you check this box, skip line 5 . . . . . . ▶

5Retention/revocation of prior tax information authorizations. If the line 4 box is checked, skip this line. If the line 4 box isn’t checked, the IRS will automatically revoke all prior tax information authorizations on file unless you check the line 5

box and attach a copy of the tax information authorization(s) that you want to retain . . . . . . . . . . . . ▶ To revoke a prior tax information authorization(s) without submitting a new authorization, see the line 5 instructions.

6Taxpayer signature. If signed by a corporate officer, partner, guardian, partnership representative (or designated individual, if applicable), executor, receiver, administrator, trustee, or individual other than the taxpayer, I certify that I have the legal authority to execute this form with respect to the tax matters and tax periods shown on line 3 above.

▶IF NOT COMPLETED, SIGNED, AND DATED, THIS TAX INFORMATION AUTHORIZATION WILL BE RETURNED.

▶DON’T SIGN THIS FORM IF IT IS BLANK OR INCOMPLETE.

|

Signature |

|

Date |

|

|

|

|

|

|

|

Print Name |

|

Title (if applicable) |

|

|

|

|

||

For Privacy Act and Paperwork Reduction Act Notice, see the instructions. |

Cat. No. 11596P |

Form 8821 (Rev. |

||

Document Specifics

| Fact Name | Description |

|---|---|

| Purpose of Form 8821 | Allows individuals and businesses to authorize any individual, corporation, firm, organization, or partnership to inspect and/or receive their confidential tax information from the IRS. |

| Authorization Limit | The form does not allow the appointee to advocate, negotiate, or act on behalf of the taxpayer; it's purely for information sharing. |

| Validity Period | The authorization generally remains in effect until the taxpayer revokes it or the expiration date passes, which the taxpayer specifies on the form. |

| Information Accessibility | This form grants access to information filed with the IRS for the type of tax, the tax form number, and the years or periods requested. |

| Revocation Process | Taxpayers can revoke the authorization at any time by submitting a written statement to the IRS or by filing a new Form 8821 with a more recent date. |

| No Legal Representation | Appointing someone on Form 8821 does not authorize them to represent the taxpayer in tax court or in any legal matters with the IRS. |

| IRS Acknowledgment | The IRS sends an acknowledgment of the authorization to the taxpayer and the appointee once Form 8821 is processed. |

| Use for Multiple Years | Taxpayers can specify if they want the authorization to cover a specific time frame, including multiple years or periods, as long as these are clearly stated on the form. |

| State-Specific Versions | Some states may have their own version of Form 8821 or a similar form for state tax information, each governed by state law. |

Guide to Writing IRS 8821

Filling out the IRS Form 8821 can seem like a daunting task. Yet, with the right approach, you can easily navigate through it. This form is used to authorize someone else, be it a professional or a family member, to access your tax records from the IRS. Though it might appear complex at first glance, breaking it down into steps can simplify the process. Here is a step-by-step guide to help you complete the form accurately.

- Begin with your personal information: At the top of the form, you will find spaces designated for your name and your Social Security Number (SSN) or Employer Identification Number (EIN). Make sure to fill these out correctly to avoid any issues with your form processing.

- Appoint your tax information recipient: In the sections that follow, you'll be asked to provide the name and address of the individual or organization you're authorizing to receive your tax information. Ensure that the details are accurate to prevent miscommunication.

- Specify the tax forms: You will need to specify which tax forms and years you're granting access to. This portion requires attention to detail, as you must list each form and the tax periods clearly. If you're allowing access to all periods, you can simply state "All Years."

- Determine the extent of authority: This part of the form asks you to outline the specific tax matters, including types of tax and periods, your appointee can inquire about. It’s your responsibility to define the scope of authority clearly to ensure it aligns with your intentions.

- Signature and date: Once all sections are completed, you must sign and date the form. If you're filing jointly, your spouse must also sign. A clear signature is crucial here as it validates the authorization you're granting.

- Mail or fax the completed form: Lastly, after double-checking the form for accuracy and completeness, you can either mail or fax it to the IRS. The address and fax number are provided on the form. Make sure to send it to the correct location based on your state, which is also specified on the form instructions.

After the form is submitted, the next steps are pretty straightforward. The IRS will process your Form 8821 and grant the specified access to your appointee. This authorization will allow them to view or receive your tax information as outlined in your form. It's important to remember that this form does not allow your appointee to represent you to the IRS or sign any documents on your behalf. It's strictly limited to accessing tax information. If you ever need to revoke this authorization, you can do so by filing a new Form 8821 with the "Revoke" box checked.

Understanding IRS 8821

-

What is IRS Form 8821, and why would someone use it?

IRS Form 8821 is a document that authorizes an individual or an organization to request and inspect a person’s tax information from the IRS. People typically use this form to allow tax professionals, attorneys, or others to access their tax records. This authorization can help in preparing tax returns, addressing tax issues, or for financial planning purposes. Unlike the Power of Attorney granted by IRS Form 2848, Form 8821 does not allow the appointed individual to represent the taxpayer before the IRS or to execute refunds, but it does facilitate the sharing of valuable tax information.

-

How does one fill out and submit IRS Form 8821?

To fill out IRS Form 8821, the taxpayer must provide the name and taxpayer identification number of the individual or entity being authorized. It’s also necessary to specify the type of tax information being requested, the tax form numbers, and the years or periods for which access is granted. After completing the form, it should be signed and dated before submission. The form can be submitted by fax or mail to the applicable IRS office based on the state listed in the form's instructions.

-

Are there any restrictions on who can be appointed using Form 8821?

While IRS Form 8821 allows taxpayers to authorize any individual or entity to inspect their tax records, there are some practical considerations to keep in mind. It is generally advisable to appoint someone who has experience handling tax matters, such as a certified tax professional, attorney, or accountant. However, it's important to ensure that the appointed individual or organization is trustworthy and understands the taxpayer’s requests and needs concerning their tax information.

-

How long does the authorization granted by Form 8821 last?

The authorization granted by IRS Form 8821 remains in effect until it is revoked by the taxpayer. This revocation can be done at any time by the taxpayer, who must provide written notification to the IRS, specifying that the authorization is to be revoked. Additionally, the form automatically expires after the third anniversary of the due date for the return for the last year listed on the form, unless specified otherwise.

-

Can one use IRS Form 8821 to authorize someone to represent them in IRS matters?

No, IRS Form 8821 does not grant the authority to represent the taxpayer in IRS matters, negotiate payment arrangements, or otherwise act on the taxpayer’s behalf. Its purpose is strictly limited to allowing the appointed person or organization to inspect and receive confidential tax information. For representation in front of the IRS, including discussing tax matters, presenting information, or negotiating on behalf of the taxpayer, IRS Form 2848, Power of Attorney and Declaration of Representative, must be used.

Common mistakes

Filling out the IRS Form 8821, which grants someone permission to access your tax records, can seem straightforward. Yet, many individuals make errors during this process. Recognizing and avoiding these mistakes is crucial for a smooth handling of your tax information.

Not double-checking the taxpayer information: It's essential to ensure that all personal information, including the Social Security Number (SSN) or Employer Identification Number (EIN), is accurate and matches the records with the IRS.

Appointing an ineligible representative: The IRS has specific criteria for who can be appointed. Mistakenly assigning someone who does not meet these criteria can result in the form being rejected.

Omitting the specific tax forms and periods: The form requires you to specify which tax records can be accessed and for what time frame. Generalization or leaving these fields blank may lead to unnecessary delays or denial.

Failing to specify the purpose of the authorization: Although not always mandatory, adding a clear purpose can help the IRS understand why the representative needs access, potentially speeding up the process.

Overlooking the need for a new form for additional representatives: If you want more than one person to have access to your records, you must fill out a separate form for each individual. Some people mistakenly believe that listing multiple names on a single form is acceptable.

Signing without dating the form: An undated signature can render the form invalid because it doesn't provide a clear start date for the authorization.

Ignoring the renewal requirement: Authorizations granted via Form 8821 automatically expire after a certain period. Failure to renew the authorization can lead to an unexpected loss of access for the representative.

Not keeping a copy: Once submitted, having a personal copy of the form can help you manage your records and serve as proof of authorization, should any disputes arise.

Avoiding these mistakes when filling out the IRS Form 8821 can help ensure that your tax information management goes smoothly. It’s always a good practice to review the form in its entirety before submission to ensure all information is complete and correct.

Documents used along the form

When navigating the complexities of tax information handling, IRS Form 8821 plays a crucial role by authorizing individuals or entities to request and inspect your tax information from the Internal Revenue Service. However, this form is often part of a broader suite of documents utilized in various tax situations or for comprehensive financial planning. Each document serves a distinct purpose, fitting into the puzzle of tax management and personal finance like a unique piece. Here's a look at six other forms and documents frequently used alongside Form 8821, shedding light on their functions and importance.

- IRS Form 2848, Power of Attorney and Declaration of Representative: This form grants an individual the authority to represent the taxpayer before the IRS, allowing them to make decisions and take actions with respect to the taxpayer's tax matters. Unlike Form 8821, which is for disclosure purposes only, Form 2848 enables representation.

- IRS Form 4506-T, Request for Transcript of Tax Return: Often used for loan applications or to verify income, this form allows taxpayers to request a transcript of their tax returns. These transcripts are frequently needed when more detailed tax documentation is necessary for financial analysis or lending decisions.

- IRS Form 9465, Installment Agreement Request: For taxpayers unable to pay their full tax debt immediately, Form 9465 is used to request a payment plan that fits their financial situation. This form is crucial for negotiating manageable payments while avoiding further penalties and interest.

- IRS Form 433-F, Collection Information Statement: Required in situations involving payment plans or offers in compromise, this form provides the IRS with detailed information about the taxpayer's financial situation. It helps the agency determine the taxpayer’s ability to pay outstanding taxes.

- IRS Form 656, Offer in Compromise: This form is for taxpayers who believe they have legitimate circumstances that affect their ability to pay the full amount of taxes owed. Submitting Form 656 allows them to negotiate a settlement for less than the total due, providing a path to financial recovery.

- IRS Form 1040, U.S. Individual Income Tax Return: As the primary form used by individuals to file their annual income tax returns, Form 1040 is the cornerstone of personal tax documentation. While it does not directly share purposes with Form 8821, it often contains information that necessitates the use of 8821 for further actions or clarifications regarding the tax account.

In essence, each of these forms complements the others within an ecosystem of tax documentation and financial management. Understanding the specific role and proper use of these documents can significantly streamline the process of managing one's taxes, providing clarity and control over one’s financial and tax affairs. Together with IRS Form 8821, these documents enable individuals and businesses to navigate their tax responsibilities with greater confidence and efficiency.

Similar forms

The IRS 8821 form is quite similar to the IRS Form 2848, Power of Attorney and Declaration of Representative. Both serve the purpose of authorizing individuals to access private tax information, although they function differently in scope and application. The Form 2848 specifically grants an individual, typically a tax professional, the authority to represent a taxpayer before the IRS. It allows them to perform acts such as signing agreements or consents to disclose, whereas Form 8821 is limited to information sharing without the authority to represent.

Another document akin to the IRS 8821 is the IRS Form 4506, Request for Copy of Tax Return. This form allows taxpayers or third parties to request copies of tax returns from the IRS, similar to how the 8821 form permits access to tax information. However, the Form 4506 is used to obtain actual copies of filed tax returns, and the authority is given directly to the individual or entity making the request, not to someone else to act on behalf of the requester.

The IRS Form 4506-T, Request for Transcript of Tax Return, also shares similarities with the 8821 form in that it is used to request tax return information. The primary difference lies in the type of information obtained; the Form 4506-T is for transcripts, which summarize tax returns, while Form 8821 can allow access to a broader array of tax documents. Both forms are tools for accessing tax information, yet they serve different needs depending on the detail and type of information required.

Comparable to the IRS 8821 form is the Form 9465, Installment Agreement Request. While Form 8821 facilitates access to a taxpayer's records, Form 9465 is used to request a payment plan for paying off outstanding tax liabilities. Both forms are crucial for tax management and resolution strategies but serve distinctly different functions within that process. The 9465 directly impacts how a taxpayer can fulfill their tax obligations, whereas the 8821 impacts who can view the taxpayer's information to make informed decisions.

The Form W-9, Request for Taxpayer Identification Number and Certification, is another document related to the IRS 8821, albeit indirectly. Form W-9 is primarily used to provide information to entities that will pay you income, ensuring the correct reporting to the IRS. In contrast, the 8821 form would allow a designated individual to view such information as reported to the IRS. Both forms are essential for the accurate and lawful reporting and access of tax information.

Similarly, the IRS Form SS-4, Application for Employer Identification Number (EIN), bears a relation to the 8821 form. The Form SS-4 is used by entities to apply for an EIN, necessary for tax administration purposes. While Form SS-4 is about the creation of a tax identity, Form 8821 concerns the access to information related to that identity. Both play significant roles in the lifecycle of tax-related administration and compliance.

The Form 1099-MISC, Miscellaneous Income, and the IRS 8821 form also share a connection through the lens of tax information disclosure. The Form 1099-MISC is used to report various types of income to the IRS, which may then be accessed through the authorization granted by Form 8821. These documents combined ensure that income is properly reported and that authorized individuals can access this information as needed for further tax processing or advice.

Another document in this context is the IRS Form 706, United States Estate (and Generation-Skipping Transfer) Tax Return. This form is utilized to report the estate tax due to the federal government. While the 8821 form does not directly relate to estate taxes, an authorized individual can access such tax forms and related information of a decedent, enabling them to manage tax affairs more effectively posthumously. This highlights the versatile use of Form 8821 in various tax matters, including estate planning and compliance.

The Form 1040, U.S. Individual Income Tax Return, the cornerstone of personal tax filing, connects with Form 8821 through the comprehensive access it allows to one's tax filings. While individuals use Form 1040 to file their annual income taxes, the 8821 can grant designated persons access to these filings, among other tax documents. This access can be crucial for tax planning, resolution of tax issues, and understanding one’s financial standings with the IRS.

Lastly, the Application for Automatic Extension of Time To File U.S. Individual Income Tax Return, known as Form 4868, has an indirect relationship with the IRS 8821 form. While Form 4868 is used to request more time to file the Form 1040, the IRS 8821 could allow an authorized individual to access records pertaining to such an extension. This is indicative of how the authorization granted by Form 8821 can cover a wide array of tax-related documents and actions taken by or for the taxpayer.

Dos and Don'ts

When completing the IRS Form 8821, Tax Information Authorization, there are specific guidelines to follow. This form grants permission for individuals or organizations to access or receive your tax information from the IRS. Understanding what to do and what to avoid can streamline the process, ensuring your information is handled correctly.

Do:

Ensure all information is accurate and legible. Double-check taxpayer identification numbers, addresses, and the specifics of the tax information requested.

Clearly specify the type of tax information authorized for release, including the type of tax, tax form number, and the years or periods covered. This precision helps in avoiding any general or vague authorizations that might not serve your intended purpose.

Remember to sign and date the form. An unsigned form is invalid and will be rejected by the IRS, delaying the authorization process.

Keep a copy of the completed form for your records. This practice is recommended for any official documentation, especially when it involves granting others access to your sensitive tax information.

Don't:

Do not leave any required fields blank. Incomplete forms can result in processing delays or outright rejection.

Avoid using the form to authorize disclosure to someone who does not have a valid need to know the information. Be discerning in selecting whom you grant authorization.

Don't forget to specify an expiration date for the authorization. Without this, the form will default to the IRS standard of one year from the date of signature, which might not align with your needs.

Do not neglect to notify the IRS if you decide to revoke the authorization before its expiration date. Submitting a written statement of revocation ensures that your tax information is no longer accessible under the previously granted authorization.

Misconceptions

The IRS 8821 form, also known as Tax Information Authorization, often comes with several misconceptions. Understanding these can ensure taxpayers and their representatives handle tax information correctly and efficiently.

Misconception 1: The IRS 8821 form grants the same rights as the Power of Attorney.

Unlike the Power of Attorney, the IRS 8821 form does not allow the appointed individual to act on the taxpayer's behalf. It simply authorizes them to inspect and receive confidential tax information.

Misconception 2: Once filed, the form has an indefinite effect.

The authorization given through the IRS 8821 form typically expires after the third year from the date of filing. Taxpayers need to renew it to maintain their representative's access to their tax information.

Misconception 3: Any tax information can be obtained with this form.

The IRS 8821 form allows access to specific types of tax information, not all. The form requires clear specification of the tax matters and years for which information is requested.

Misconception 4: It’s unnecessary to file a new form if the taxpayer’s address changes.

Even if the taxpayer's address changes, a new IRS 8821 form needs to be filed. Address changes can lead to miscommunication and misdirection of confidential tax information.

Misconception 5: The form can be used for tax filing purposes.

The authorization through the IRS 8821 form does not include the power to file tax returns on behalf of the taxpayer. It is strictly limited to obtaining tax information.

Misconception 6: Electronic signatures are not accepted on the IRS 8821 form.

The IRS does accept electronic signatures on the IRS 8821 form, making it more convenient for taxpayers and their representatives to submit the necessary authorization efficiently.

Misconception 7: There’s no limit to the number of representatives that can be appointed.

While the IRS 8821 form allows the taxpayer to appoint multiple representatives, it is important to specify each representative's scope and duration of access to the tax information.

Key takeaways

The IRS Form 8821 is a document that allows taxpayers to authorize any individual, corporation, firm, organization, or partnership to inspect and/or receive their confidential tax information. Understanding its purpose and how to use it effectively is crucial for managing your tax-related matters with ease. Here are four key takeaways about filling out and using the IRS Form 8821:

- Specifying Tax Information: When you're completing Form 8821, being specific about the type of tax information you want shared and for which years is crucial. You can authorize access to information regarding your income tax, employment tax, or any other tax types, but you must clearly identify these preferences on the form.

- Choosing Your Appointee Wisely: The individual or entity you grant access to your tax records should be someone you trust completely. This could be a tax attorney, accountant, or even a family member. Remember, this appointee will have access to sensitive tax information, so choose wisely.

- Understanding the Form's Duration: It's important to note that Form 8821 does not authorize your appointee to represent you to the IRS, nor does it allow them to advocate on your behalf. The authorization generally remains in effect until the termination date you specify on the form, or until you actively revoke it. Without a specified end date, the authorization could continue indefinitely.

- Revoking Authorization: Should you decide to revoke the authorization at any point, you must inform the IRS. This can be done by submitting a written statement to the IRS office handling your matters or by filing a new Form 8821 with the "Revoke" box checked in line 4. Be aware that revoking authorization does not remove the previous appointee's access to your tax information already disclosed by the IRS based on your prior authorization.

Properly completing and using Form 8821 can ensure that your tax information is shared safely and with only those you've personally authorized. Always keep a record of whom you've given this authorization to and actively manage revocations to maintain control over your tax information.

Popular PDF Documents

4506-t Vs 4506-c - It simplifies the process of obtaining tax return information for purposes such as loan applications.

IRS 2210 - Form 2210 includes scenarios where taxpayers made estimated payments or had taxes withheld but need to verify if these were sufficient.