Get IRS 8814 Form

Managing your taxes efficiently often involves understanding a wide array of forms and their purposes, especially when it comes to reporting income for dependents. One such form, the IRS 8814, plays a crucial role for parents and guardians who opt to include their child's income on their own tax return instead of filing a separate return for the child. This decision can simplify the tax-filing process and potentially save money. The form is designed for reporting a child's interest and dividends, allowing for a more streamlined approach to managing the tax implications of such earnings. It's essential for taxpayers to grasp the eligibility criteria, the benefits, and the potential drawbacks of using the IRS 8814 form. Understanding these aspects can lead to more informed decisions, ensuring compliance with tax laws while possibly enhancing one's financial strategy during tax season.

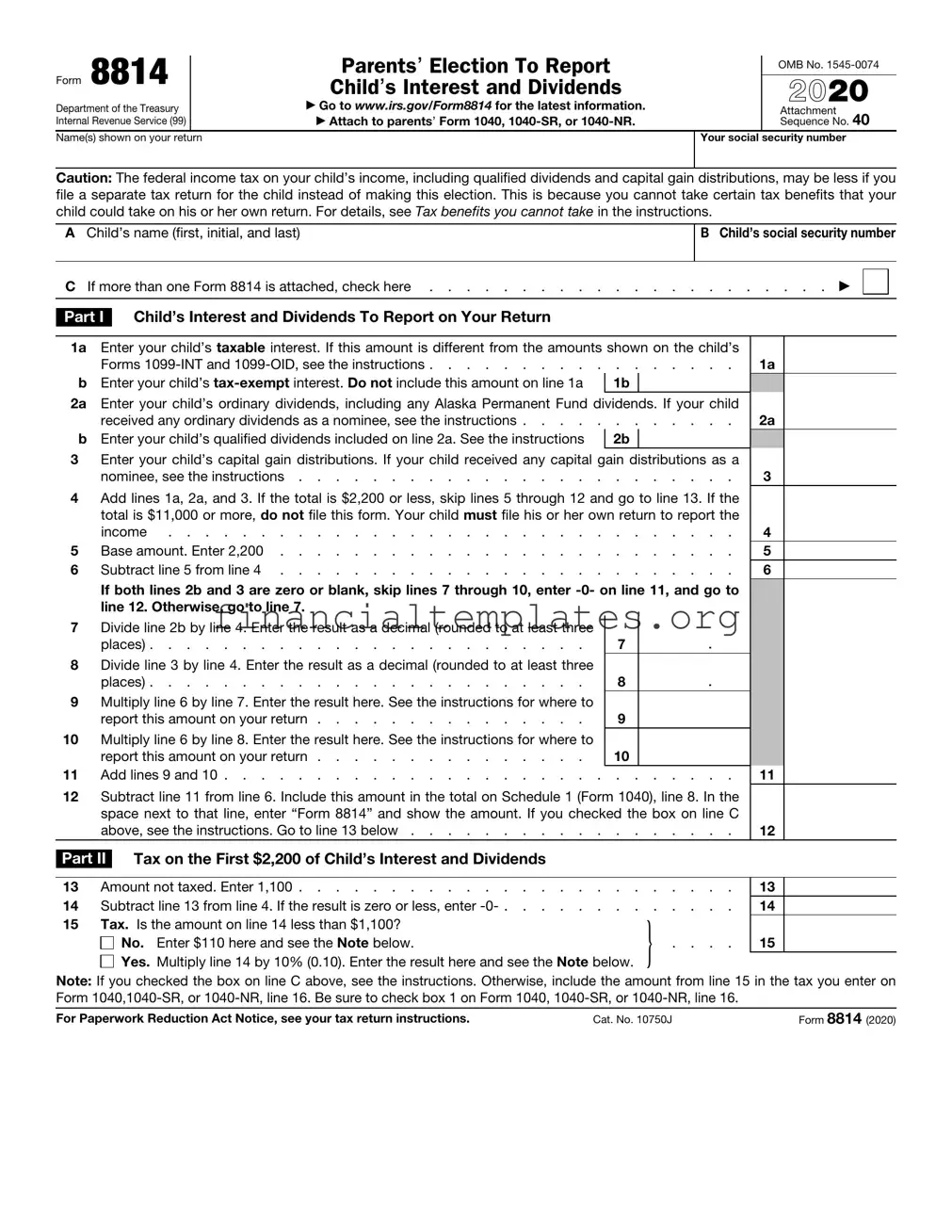

IRS 8814 Example

Form 8814 |

|

Parents’ Election To Report |

|

OMB No. |

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

Child’s Interest and Dividends |

|

|

|

|

▶ |

2021 |

||

Department of the Treasury |

|

|

Go to www.irs.gov/Form8814 for the latest information. |

|

Attachment |

Internal Revenue Service (99) |

|

|

▶ Attach to parents’ Form 1040, |

|

Sequence No. 40 |

Name(s) shown on your return |

|

|

Your social security number |

||

|

|

|

|

|

|

Caution: The federal income tax on your child’s income, including qualified dividends and capital gain distributions, may be less if you file a separate tax return for the child instead of making this election. This is because you cannot take certain tax benefits that your child could take on his or her own return. For details, see Tax benefits you cannot take in the instructions.

AChild’s name (first, initial, and last)

B Child’s social security number

C If more than one Form 8814 is attached, check here . . . . . . . . . . . . . . . . . . . . . . ▶

Part I Child’s Interest and Dividends To Report on Your Return

1a Enter your child’s taxable interest. If this amount is different from the amounts shown on the child’s Forms

b Enter your child’s |

1b |

|

2a Enter your child’s ordinary dividends, including any Alaska Permanent Fund dividends. If your child received any ordinary dividends as a nominee, see the instructions . . . . . . . . . . . .

b Enter your child’s qualified dividends included on line 2a. See the instructions |

2b |

|

3Enter your child’s capital gain distributions. If your child received any capital gain distributions as a

nominee, see the instructions . . . . . . . . . . . . . . . . . . . . . . . .

4Add lines 1a, 2a, and 3. If the total is $2,200 or less, skip lines 5 through 12 and go to line 13. If the total is $11,000 or more, do not file this form. Your child must file his or her own return to report the

|

income |

5 |

Base amount. Enter 2,200 |

6 |

Subtract line 5 from line 4 |

|

If both lines 2b and 3 are zero or blank, skip lines 7 through 10, enter |

|

line 12. Otherwise, go to line 7. |

1a

2a

3

4

5

6

7Divide line 2b by line 4. Enter the result as a decimal (rounded to at least three

places) . . . . . . . . . . . . . . . . . . . . . . . .

8Divide line 3 by line 4. Enter the result as a decimal (rounded to at least three

places) . . . . . . . . . . . . . . . . . . . . . . . .

9Multiply line 6 by line 7. Enter the result here. See the instructions for where to

report this amount on your return . . . . . . . . . . . . . . .

10Multiply line 6 by line 8. Enter the result here. See the instructions for where to report this amount on your return . . . . . . . . . . . . . . .

11Add lines 9 and 10 . . . . . . . . . . . . . . . . . . . . .

7.

8.

9

10

. . . . . . .

11

12Subtract line 11 from line 6. Include this amount in the total on Schedule 1 (Form 1040), line 8z. In the space next to that line, enter “Form 8814” and show the amount. If you checked the box on line C

above, see the instructions. Go to line 13 below . . . . . . . . . . . . . . . . . .

12

Part II Tax on the First $2,200 of Child’s Interest and Dividends

13 |

Amount not taxed. Enter 1,100 |

|||

14 |

Subtract line 13 from line 4. If the result is zero or less, enter |

|||

15 |

Tax. Is the amount on line 14 less than $1,100? |

} |

|

|

|

No. |

Enter $110 here and see the Note below. |

. . . . |

|

|

Yes. |

Multiply line 14 by 10% (0.10). Enter the result here and see the Note below. |

|

|

13

14

15

Note: If you checked the box on line C above, see the instructions. Otherwise, include the amount from line 15 in the tax you enter on Form

For Paperwork Reduction Act Notice, see your tax return instructions. |

Cat. No. 10750J |

Form 8814 (2021) |

THIS PAGE INTENTIONALLY LEFT BLANK

Form 8814 (2021) |

Page 3 |

General Instructions

Future Developments

For the latest information about developments related to Form 8814 and its instructions, such as legislation enacted after they were published, go to www.irs.gov/Form8814.

Purpose of Form

Use this form if you elect to report your child’s income on your return. If you do, your child will not have to file a return. You can make this election if your child meets all of the following conditions.

•The child was under age 19 (or under age 24 if a

•The child’s only income was from interest and dividends, including capital gain distributions and Alaska Permanent Fund dividends.

•The child’s gross income for 2021 was less than $11,000.

•The child is required to file a 2021 return.

•The child does not file a joint return for 2021.

•There were no estimated tax payments for the child for 2021 (including any overpayment of tax from his or her 2020 return applied to 2021 estimated tax).

•There was no federal income tax withheld from the child’s income.

You must also qualify. See Parents who qualify to make the election below.

Student. A student is a child who for some part of each of 5 calendar months during the year was enrolled as a

Certain January 1 birthdays. A child born on January 1, 2003, is considered to be age 19 at the end of 2021. You cannot make this election for such a child unless the child was a

A child born on January 1, 1998, is considered to be age 24 at the end of 2021. You cannot make this election for such a child.

How to make the election. To make the election, complete and attach Form(s) 8814 to your tax return and file your return by the due date (including extensions). A separate Form 8814 must be filed for each child whose income you choose to report.

Parents who qualify to make the election. You qualify to make this election if you file Form 1040,

•You are filing a joint return for 2021 with the child’s other parent.

•You and the child’s other parent were married to each other but file separate returns for 2021 and you had the higher taxable income.

•You were unmarried, treated as unmarried for federal income tax purposes, or separated from the child’s other parent by a divorce or separate maintenance decree. The child must have lived with you for most of the year (you were the custodial parent). If you were the custodial parent and you remarried, you can make the election on a joint return with your new spouse. But if you and your new spouse do not file a joint return, you qualify to make the election only if you had higher taxable income than your new spouse.

Note: If you and the child’s other parent were not married but lived together during the year with the child, you qualify to make the election only if you are the parent with the higher taxable income.

Tax benefits you cannot take. If you elect to report your child’s income on your return, you cannot take certain deductions that your child could take on his or her own return such as:

•Additional standard deduction of $1,700 if the child is blind,

•Penalty on early withdrawal of child’s savings, and

•Itemized deductions such as the child’s charitable contributions.

If your child received qualified dividends or capital gain distributions, you may pay up to $110 more tax if you make this election instead of filing a separate tax return for the child. This is because the tax rate on the child’s income between $1,100 and $2,200 is 10% if you make this election. However, if you file a separate return for the child, the tax rate may be as low as 0% (zero percent) because of the preferential tax rates for qualified dividends and capital gain distributions.

If any of the above apply to your child, first figure the tax on your child’s income as if he or she is filing a return. Next, figure the tax as if you are electing to report your child’s income on your return. Then, compare the methods to determine which results in the lower tax.

Alternative minimum tax. If your child received

Net Investment Income Tax. For purposes of figuring any Net Investment Income Tax liability of the parents on Form 8960, the following rules apply.

1.All income reported on line 12 is included in the parents’ modified adjusted gross income, and

2.All net investment income included on line 12 (except for Alaska Permanent Fund dividends) is included in the parents’ net investment income.

For more information on Net Investment Income Tax, go to www.irs.gov/NIIT.

Investment interest expense. Your child’s income (other than qualified dividends, Alaska Permanent Fund dividends, and capital gain distributions) that you report on your return is considered to be your investment income for purposes of figuring your investment interest expense deduction. If your child received qualified dividends, Alaska Permanent Fund dividends, or capital gain distributions, see Pub. 550, Investment Income and Expenses, to figure the amount you can treat as your investment income.

Foreign accounts and trusts. You must complete Schedule B (Form 1040), Part III, and file it with your tax return if your child:

1.Had a foreign financial account, or

2.Received a distribution from, or was the grantor of, or transferor to, a foreign trust.

Enter “Form 8814” on the dotted line next to line 7a or line 8, whichever applies. Complete line 7b if applicable.

Note: If you file Form 8814 with your income tax return to report your child’s foreign financial account, you have an interest in the assets from that account and may be required to file Form 8938, Statement of Specified Foreign Financial Assets. See the Form 8938 instructions for details.

Change of address. If your child filed a return for a previous year and the address shown on the last return filed is not your child’s current address, be sure to notify the IRS, in writing, of the new address. To do this, use Form 8822, Change of Address.

Additional information. See Pub. 929, Tax Rules for Children and Dependents, for more details.

Specific Instructions

Name and social security number. If you are filing a joint return, enter both names but enter the social security number of the person whose name is shown first on the return.

Line 1a. Enter all taxable interest income your child received in 2021. Do not include

Form 8814 (2021) |

Page 4 |

If your child received, as a nominee, interest that actually belongs to another person, enter the amount and “ND” (nominee distribution) on the dotted line next to line 1a. Do not include amounts received as a nominee in the total for line 1a.

If your child had accrued interest that was paid to the seller of a bond, amortizable bond premium (ABP) allowed as a reduction to interest income, or if any original issue discount (OID) is less than the amount shown on your child’s Form

Line 1b. If your child received any

Note: If line 1b includes

Line 2a. Enter the ordinary dividends your child received in 2021. Ordinary dividends should be shown in box 1a of Form

If your child received, as a nominee, ordinary dividends that actually belong to another person, enter the amount and “ND” on the dotted line next to line 2a. Do not include amounts received as a nominee in the total for line 2a.

Line 2b. Enter all qualified dividends your child received in 2021. Qualified dividends are the ordinary dividends that are eligible for the same lower tax rate as a net capital gain. Qualified dividends should be shown in box 1b of Form

Line 3. Enter the capital gain distributions your child received in 2021. Capital gain distributions should be shown in box 2a of Form

If your child received, as a nominee, capital gain distributions that actually belong to another person, enter the amount and “ND” on the dotted line next to line 3. Do not include amounts received as a nominee in the total for line 3.

Line 9. Include this amount on Form 1040,

If you file Schedule B, include this amount on line 5 and identify it as from “Form 8814.” Complete Schedule B as instructed. Also include this amount on Form 1040,

You must file Schedule B if this amount plus the parents’ dividends is more than $1,500.

Line 10. Include this amount on Schedule D (Form 1040), line 13; Form 1040,

If any of the child’s capital gain distributions were reported on Form

Line 12. If you checked the box on line C, add the amounts from line 12 of all your Forms 8814. Include the result on Schedule 1 (Form 1040), line 8z. Enter “Form 8814” and the total of the line 12 amounts in the space on that line.

Line 15. If you checked the box on line C, add the amounts from line 15 of all your Forms 8814. Include the total on Form 1040,

Document Specifics

| Fact Name | Description |

|---|---|

| Form Purpose | The IRS 8814 form is used by parents to report their child's income on their own tax return. |

| Who It's For | Parents with children who have investment income under a certain threshold can use this form. |

| Income Reporting | This form allows parents to include their child's investment income on their tax return rather than filing a separate return for the child. |

| Eligibility Criteria | The child's income must come from interest and dividends only, and it must fall below a specified limit. |

| Benefits | Using Form 8814 can simplify the tax filing process by avoiding the need for the child to file a separate return. |

| Limitations | If the child's income exceeds the set limit, they must file their own tax return. Additionally, certain types of income cannot be reported on Form 8814. |

| Required Information | Parents must provide detailed information about their child's income, such as the amount and sources of interest and dividends. |

| Governing Law | Form 8814 is governed by federal tax law, as it is an IRS form. There are no state-specific versions of this form. |

Guide to Writing IRS 8814

Filling out IRS Form 8814 is an important step for parents who opt to include their child's income on their own tax return instead of filing a separate return for the child. This choice can simplify the tax filing process and potentially save money on filing fees. This form is used specifically for reporting a child's interest and dividends on a parent's return. It's essential to complete it accurately to ensure compliance with tax laws and to make the most of this tax reporting option. Below are the steps you need to follow to fill out the form correctly.

- Start by gathering all necessary documentation, including your child's 1099 forms and any relevant investment statements that detail the child's interest and dividend income for the year.

- Enter your child’s name and Social Security number at the top of Form 8814.

- Calculate the total amount of your child's unearned income. Include this amount in Part I, making sure to differentiate between interest, dividends, and any capital gain distributions.

- If your child has received a portion of their income from qualified dividends or capital gain distributions, you will need to determine if any portion of this income qualifies for tax benefits. Follow the instructions on the form to calculate this and enter the information accordingly.

- Input the total amount of your child's interest and dividend income in Part II of the form. This section also requires you to adjust this income by subtracting any related expenses, such as investment fees or broker's commissions that were necessary to produce or collect this income.

- Calculate your child's taxable income by combining their interest and dividends, then subtracting any standard deductions that apply. Form 8814 has a worksheet to guide you through this process.

- Once you have determined the taxable amount of your child's unearned income, transfer this amount to your own tax return, following the instructions provided on Form 8814 for where to report this income.

- Review the form and your calculations to ensure accuracy. Mistakes could delay processing or result in penalties.

- Attach Form 8814 to your federal income tax return. Submit both documents to the IRS by the filing deadline.

Completing IRS Form 8814 accurately is crucial for parents electing to report their child's income on their tax return. By following these steps, parents can ensure they comply with IRS regulations while possibly benefiting from a simpler tax process. Remember, this form is specific to interest and dividends, and other types of income might require separate forms or reporting methods. Always refer to the latest IRS guidelines or consult a tax professional if you're unsure about any steps in the process.

Understanding IRS 8814

-

What is an IRS 8814 form?

The IRS 8814 form, also known as the "Parents' Election To Report Child's Interest and Dividends," is a document used by parents to report their child’s investment income on their own tax return. This form allows a parent to include a child's interest and dividends on the parent's tax return if the income is less than a certain amount, which helps to simplify the filing process. It's important because it can potentially reduce the need for the child to file a separate tax return.

-

Who can use the IRS 8814 form?

The IRS 8814 form can be used by parents or guardians under certain conditions. The child whose income is being reported must be under 19 years old, or under 24 if a full-time student, and have earned interest and dividend income only, totaling less than the specified limit for the tax year. The child cannot have any income from wages or salaries or any deductions or credits to claim. Parents considering this should also not be subject to the alternative minimum tax (AMT) for the year they choose to report their child’s income on their return.

-

How does filing the IRS 8814 form affect taxes?

Filing the IRS 8814 form can have various effects on a parent's taxes. By reporting the child’s income on their return, the parent may be subject to a higher tax rate on the child’s income due to the “kiddie tax.” This is designed to prevent parents from shifting large amounts of investment income to their children to take advantage of their lower tax rates. However, it can simplify the filing process and may result in lower overall taxes than if the child were required to file a separate return, depending on individual circumstances.

-

Where can I find the IRS 8814 form and how do I file it?

The IRS 8814 form can be found and downloaded from the official IRS website. Taxpayers can also request a paper copy by mail. To file it, complete the form according to the instructions provided, including it with your standard Form 1040 tax return. Make sure to report your child's investment income accurately and calculate the additional tax owed, if any, according to the guidelines. For electronic filers, tax preparation software will guide you through the process of including your child’s income on your tax return using the IRS 8814 form.

Common mistakes

Filling out IRS Form 8814, which pertains to the tax options for parents of children with investment income, can seem straightforward at first glance. However, certain common mistakes can complicate the process, potentially leading to errors on a tax return. Recognizing these mistakes can help ensure accurate reporting and potentially save time and money.

- Not checking if the child’s income meets the criteria for Form 8814 to be used. This form is specifically for children who have investment income below a certain threshold.

- Incorrectly reporting the child's income. Sometimes, parents may report their child’s income as higher or lower than it actually is, due to misunderstanding what counts as investment income.

- Failing to include all of the child's investment income. This includes interest, dividends, and capital gain distributions that may be overlooked.

- Miscalculating the tax due on the child’s income. Form 8814 requires calculations that take into account the child’s tax rate and the parents' tax rate, which can sometimes lead to errors.

- Omitting to check if any special tax rates apply to the child's investment income. Certain types of investment income are taxed at different rates, and these must be properly applied.

- Incorrectly claiming the standard deduction for the child on the parents' return. The standard deduction for a child’s investment income has specific rules that can be misunderstood.

- Forgetting to include Form 8814 with the tax return. This form needs to be filed along with the parents' tax return if they choose to report their child's income on it.

- Not considering the potential impact on financial aid. Reporting a child’s income on the parents' tax return might affect eligibility for financial aid.

- Overlooking the potential for the “kiddie tax” to apply. If certain conditions are met, the child’s income may be subject to higher tax rates, commonly known as the "kiddie tax."

- Misunderstanding how to use Form 8814 in conjunction with other tax forms. There are specific sequences and relationships between forms that, if not followed, can lead to mistakes in reporting.

Avoiding these mistakes requires careful reading of the form instructions and potentially seeking guidance from a tax professional. Accurate completion of Form 8814 can save parents from unexpected tax bills and ensure compliance with tax laws.

Documents used along the form

In the realm of personal and family taxation, several documents often accompany the IRS Form 8814, a form used by parents to report their children's income. This process helps streamline tax reporting for families, particularly when children have investment income. The intricacies of this form intertwine with various other documents, ensuring a comprehensive approach to tax filing. The following forms and documents often form part of this tax reporting journey, each serving its unique role in the broader tax narrative.

- Form 1040 or 1040-SR: The U.S. Individual Income Tax Return is the cornerstone document for personal tax filing. It aggregates an individual's income sources, deductions, and credits, determining the total tax liability or refund due. For parents filing Form 8814, Form 1040 serves as the primary document where the child's income reported on Form 8814 is included.

- Form 8606: This document is pertinent for individuals who have made nondeductible contributions to their IRA or have taken distributions from an IRA. If the child’s investment income includes distributions from a traditional, SEP, or SIMPLE IRA, Form 8606 helps track the taxable portion of these distributions.

- Schedule D (Form 1040): For families with children engaging in the sale of stocks or other investments, Schedule D becomes relevant. This document reports capital gains or losses, which are integral to calculating the tax due, particularly when this activity falls under the child's income reported on Form 8814.

- Form 6251: Alternative Minimum Tax (AMT) requires calculation under specific conditions. If the inclusion of the child’s income on the parent's return triggers the AMT, Form 6251 is necessary. It ensures that taxpayers pay at least a minimum amount of tax.

- Form 8960: Net Investment Income Tax calculations are reported through this form. Certain individuals, estates, and trusts with income above specified thresholds need to file Form 8960, which could be relevant for parents reporting significant investment income on behalf of their children through Form 8814.

The tapestry of tax forms extends far beyond the IRS Form 8814, painting a fuller picture of a family's financial dynamics. Each document integrates within the tax filing ecosystem, performing its role to ensure accuracy and compliance. Navigating through these forms, individuals can adeptly manage their tax obligations, often finding paths to optimize their financial well-being within the bounds of tax regulations. Understanding the interplay and purpose of these documents demystifies the tax filing process, making it a more navigable journey for taxpayers.

Similar forms

The IRS Form 8814, often used by parents to report their child's income on their own tax returns, shares similarities with the IRS Form 1040, U.S. Individual Income Tax Return. The Form 1040 is the primary form used by individuals to file their annual income tax returns. Both forms are crucial during the tax season, enabling taxpayers to consolidate household incomes, calculate due taxes, or determine refunds. While Form 8814 focuses on a specific type of income, Form 1040 encompasses a broader overview of an individual's financial activities for the year.

Another document related to IRS Form 8814 is Schedule D (Form 1040), Capital Gains and Losses. This schedule is used to report the sale or exchange of capital assets not reported on another form or schedule. Similar to Form 8814, which might include a child's capital gains, Schedule D helps taxpayers calculate capital gains or losses, which could affect the overall tax liability or refund of the family's income tax return. Both forms play a role in how investment income affects taxation.

The IRS Form 5329, Additional Taxes on Qualified Plans (Including IRAs) and Other Tax-Favored Accounts, also parallels Form 8814 in specific scenarios. Form 5329 is used to report additional taxes on IRA distributions and other tax-favored accounts not adequately addressed on the standard tax return forms. When parents use Form 8814 to report their child's income, they might also need Form 5329 if the child has early distributions from retirement accounts, showing how various streams of income and their associated penalties are recorded.

Form 2555, Foreign Earned Income, is another form that pairs with the concepts behind IRS Form 8814. While Form 8814 is for reporting a child's unearned income on a parent's tax return, Form 2555 is used by individuals to report income earned from foreign sources. Both forms highlight the diverse types of income that can impact an individual's tax return, addressing the global nature of income sources and the necessity to account for them properly in tax documentation.

The IRS Form 8863, Education Credits (American Opportunity and Lifetime Learning Credits), is yet another document echoing the familial and educational aspects of Form 8814. While Form 8814 addresses the income of children, Form 8863 is about claiming tax credits for education expenses paid for the taxpayer, the taxpayer's spouse, or dependents. Both forms illustrate the tax implications of family and education-related finances on an individual's tax situation.

Form W-2, Wage and Tax Statement, also shares a connection with IRS Form 8814, albeit indirectly. Form W-2 is issued by employers to report an employee's annual wages and the amount of taxes withheld from their paycheck. Parents might use information from a W-2 if their child had a job, in combination with Form 8814, to appropriately report their child's earnings along with any unearned income on their tax return. This linkage underlines the comprehensive view needed when reporting household income.

Similar in purpose to Form 8814, IRS Form 1041, U.S. Income Tax Return for Estates and Trusts, reports income, deductions, gains, losses, etc., for entities rather than individuals. This form emphasizes the various ways income can be earned and taxed in the United States, including through estates and trusts, just as Form 8814 addresses the unearned income of children. It showcases the breadth of tax responsibility across different sources of income.

The IRS Form 8606, Nondeductible IRAs, is akin to Form 8814 in that it deals with specific tax situations — in this case, contributions to traditional IRAs that are not tax-deductible and distributions from Roth IRAs. Similar to how Form 8814 requires careful consideration of a child's unearned income, Form 8606 necessitates detailed tracking of contributions and distributions to correctly handle tax obligations. Both forms require mindful record-keeping for accurate tax reporting.

IRS Form 709, United States Gift (and Generation-Skipping Transfer) Tax Return, relates to Form 8814 in the broader context of family financial planning. Form 709 is used to report gifts that exceed the annual exclusion limit, which can include transfers to children. While Form 8814 deals with a child's income, Form 709 addresses the transfer of wealth to children or others, underlining the intersection of income, gifts, and tax implications within a family unit.

Lastly, IRS Form 8889, Health Savings Accounts (HSAs), compliments the examination of family financial and tax matters similar to Form 8814. Form 8889 is for reporting contributions to and distributions from HSAs, which can affect a taxpayer's deductibles and overall tax situation. Like Form 8814 enabling parents to manage certain aspects of their child's financial matters, Form 8889 handles aspects of health-related savings and expenses, reflecting the nuanced facets of personal and family tax considerations.

Dos and Don'ts

Filling out the IRS 8814 form, which pertains to the taxation of a child's income, can be a nuanced process. It's pivotal to approach this task with detailed attention to ensure compliance and optimize tax benefits. Below are essential dos and don'ts to guide you through this process.

- Do thoroughly review your child's income details before starting the form to determine if using Form 8814 is advantageous for your situation. This form is primarily for parents opting to include their child’s income on their tax return.

- Do ensure you meet the eligibility criteria to use Form 8814. This includes verifying that the child's income only consists of investment income, such as dividends and interest, and does not exceed the set limit for the tax year.

- Do carefully calculate the child's tax according to the instructions provided in the form. This calculation can affect your tax bracket and overall tax liability.

- Do keep accurate records of all the child’s income documents, such as 1099 forms, as you will need these for accurate reporting and potential future audits.

- Do consult with a tax professional if you have any doubts or questions. The implications of incorrectly filling out the form can lead to penalties and interest.

- Don't attempt to use Form 8814 for a child's earned income from employment or self-employment. This form is exclusively for unearned income.

- Don't overlook the potential impact of including your child’s income on your tax return. It can sometimes lead to a higher overall tax due to how the added income shifts your tax bracket.

- Don't forget to consider the Kiddie Tax rules, which are designed to prevent parents from shifting large amounts of investment income to their children to be taxed at the child’s lower tax rate.

- Don't submit the form without double-checking all the information for accuracy. Mistakes can lead to processing delays and possible interactions with the IRS.

By adhering to these guidelines, you can more effectively manage your child's investment income and ensure compliance with tax laws, minimizing potential issues with the IRS. Remember, when in doubt, seeking advice from a tax professional is always a prudent strategy.

Misconceptions

Filing taxes can often feel overwhelming due to the complex rules and forms involved. One such form is the IRS Form 8814, which revolves around the taxation of a child's income. Misunderstandings about this form can lead to mistakes in tax returns. Let's address some common misconceptions.

- Only for large amounts of income: Some believe that Form 8814 is only used when a child has a significant amount of income. In reality, it's applicable for smaller amounts too, specifically over $1,100 and up to a certain limit.

- Any type of income qualifies: A common mistake is assuming that all types of income can be reported on Form 8814. Actually, it's meant for certain unearned income, like interest and dividends, not wages or business earnings from a job or self-employment.

- It eliminates the need to file a return for the child: While using Form 8814 can avoid the necessity of filing a separate tax return for the child, this isn't always the case. Depending on the child's income amount and type, filing a separate return might still be required.

- Parents must always use Form 8814: Not all parents are required to use this form. It's an option provided by the IRS to simplify the tax filing process, but assessing whether it's beneficial or not is key. Factors like the child's total income and potential deductions should be considered.

- Form 8814 leads to lower taxes: Many assume that including a child's income on their return will always lead to lower taxes. Depending on the parents' tax bracket, however, this method might actually increase the overall tax owed.

- There are no age restrictions: Contrary to what some think, there are age limits. The child's unearned income can be reported on the parents' return if the child is under age 19 at the end of the year, or under 24 if a full-time student.

- It's a complicated form: While tax forms can be daunting, Form 8814 is designed to be straightforward. It guides parents through reporting their child's income in a few steps, simplifying what could be a more complicated filing process.

- Use of the form can trigger an audit: There's a misconception that using Form 8814 increases the likelihood of an IRS audit. The reality is, audits are based on inconsistencies or errors in a tax return, not the use of specific forms.

- Any parent can use Form 8814 for any child: This form is only an option for parents reporting their biological or adopted child's income. Parents cannot use it for other relatives' children, such as nieces or nephews, unless they are legal guardians.

- It offers no privacy: Some parents worry that using Form 8814 means they have to give detailed accounts of their child's income sources on their own tax return. In fact, the form only requires total amounts of each type of income, not detailed descriptions.

Clearing up these misconceptions can help taxpayers make informed decisions when handling their child's unearned income and filing their taxes. It's always good practice to review the latest IRS guidelines or consult a tax professional if unsure.

Key takeaways

Dealing with taxes can seem overwhelming, especially when it involves managing your child's income as well. The IRS 8814 form is designed to simplify this process for parents. Here are some key points to keep in mind when you're filling out and using the IRS 8814 form:

- Eligibility: This form is for parents who wish to include their child’s income on their tax return. It’s aimed mainly at children under 19 years of age, or under 24 if they’re full-time students.

- Type of Income: IRS 8814 form is specifically used for a child's unearned income, which typically includes interest, dividends, and capital gains. Make sure the income qualifies before using this form.

- Income Limits: There are income limitations to consider. If your child's unearned income exceeds a certain threshold, using this form may not be an option. This threshold can change, so always check the current year’s tax guidelines.

- Benefits: Including your child’s income on your tax return could potentially lower the overall tax responsibility since the child’s tax rate might be lower.

- Filing Requirements: Even if using the 8814 form, you still need to ensure that all other tax filing requirements are met both for yourself and your child. This can include filing separate returns for other types of income your child may have.

- Impact on Credits and Deductions: Be aware that including your child's income on your return may affect your eligibility for certain tax deductions and credits. Always calculate both scenarios to determine which option is more financially beneficial.

- State Taxes: While the IRS 8814 form pertains to federal taxes, don't forget about state taxes. Some states have different rules for children’s income, so check your state's guidelines to ensure compliance.

- Documentation: Keep detailed records of all the income sources and documentation when using the 8814 form. This is crucial in case the IRS has any questions or requires verification of the information provided on your tax return.

Remember, the goal is to make sure you're compliant with tax laws while potentially minimizing your family's overall tax burden. If you're unsure about how to proceed, consider seeking advice from a tax professional. They can provide guidance tailored to your specific situation, helping you navigate through the process more smoothly.

Popular PDF Documents

Budget Loan - Guidance on the types of expenses eligible for budgeting loans aims to streamline the application process for potential applicants.

Affidavit of Heirship for a House - The document must be signed in the presence of a notary public, who verifies the identity of the affiant and their understanding and agreement to the affidavit's terms.