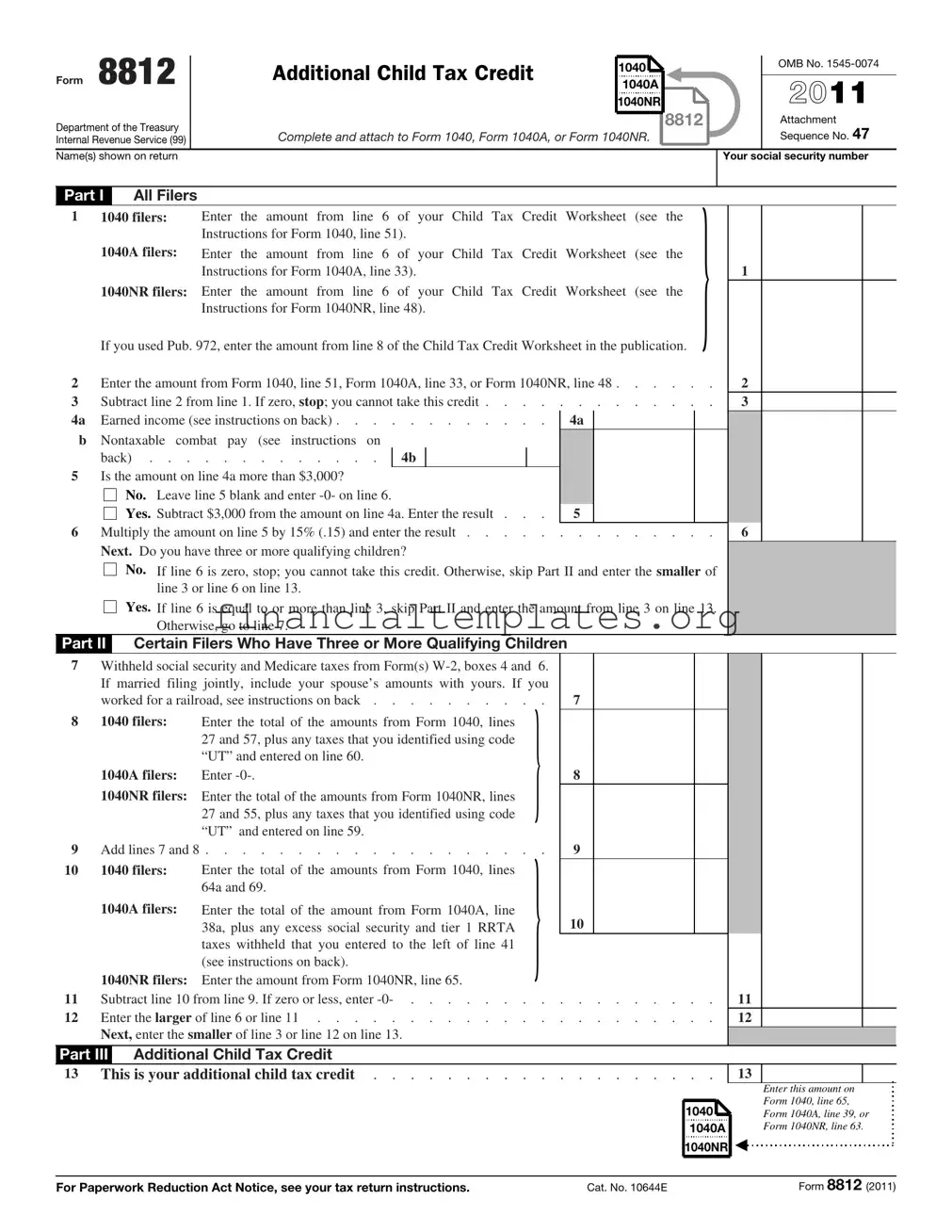

Get Irs 8812 Form

The Internal Revenue Service (IRS) Form 8812 is a crucial document for many taxpayers, playing a significant role in the financial adjustments during tax season. It serves as an attachment to the primary tax forms such as Form 1040, Form 1040A, or Form 1040NR, specifically designed for those who wish to claim the Additional Child Tax Credit. This tax credit is an essential benefit for families, potentially providing a refund even when no tax is owed. The form intricately calculates the allowable credit based on various factors, including earned income, the number of qualifying children, and the amount of Social Security and Medicare taxes paid, among others. Notably, the credit plays a part in not affecting eligibility for welfare benefits such as Temporary Assistance for Needy Families (TANF), Medicaid, Supplemental Nutrition Assistance Program (SNAP), and more, provided that the refund received is utilized within a certain period. For individuals with nontaxable combat pay, the form accommodates this by including it in the calculation, thereby ensuring that those serving in combat zones are not disadvantaged. Railroad employees also see their unique employment situation reflected in the form's instructions, addressing specific tax considerations pertinent to their sector. Moreover, the form guides filers through the process with detailed instructions for various scenarios such as self-employment and situations involving excess social security and tier 1 railroad retirement (RRTA) taxes withheld. With updates and information readily available on the IRS website, Form 8812 remains a dynamic tool for optimizing tax benefits associated with child care, underlining the IRS's commitment to supporting families through the tax code.

Irs 8812 Example

|

8812 |

|

ADDITIONAL CHILD TAX CREDIT |

|

1040 |

|

◀ |

|

|

|

|

|

OMB No. |

|

Form |

|

|

|

|

|

|

|

|

|

|||||

|

|

1040A |

|

|

|

|

|

2011 |

||||||

|

|

|

|

|

|

1040NR |

|

|

|

|

|

|

||

Department of the Treasury |

|

|

|

|

|

8812 |

|

|

|

Attachment |

||||

|

Complete and attach to Form 1040, Form 1040A, or Form 1040NR. |

|

|

|

|

|

|

Sequence No. 47 |

||||||

Internal Revenue Service (99) |

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name(s) shown on return |

|

|

|

|

|

|

|

|

Your social security number |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Part I |

All Filers |

|

|

|

|

|

|

|

|

|

|

|

||

1 |

1040 filers: |

Enter the amount from line 6 of your Child Tax Credit Worksheet (see the |

} |

|

|

|

||||||||

|

|

|

|

|

||||||||||

|

|

|

|

Instructions for Form 1040, line 51). |

|

|

|

|

|

|

|

|

|

|

|

1040A filers: |

Enter the amount from line 6 of your Child Tax Credit Worksheet (see the |

|

|

|

|

|

|||||||

|

|

|

|

Instructions for Form 1040A, line 33). |

|

|

|

|

|

|

|

1 |

|

|

|

1040NR filers: Enter the amount from line 6 of your Child Tax Credit |

Worksheet (see |

the |

|

|

|

|

|

||||||

|

|

|

|

Instructions for Form 1040NR, line 48). |

|

|

|

|

|

|

|

|

|

|

If you used Pub. 972, enter the amount from line 8 of the Child Tax Credit Worksheet in the publication.

2 |

Enter the amount from Form 1040, line 51, Form 1040A, line 33, or Form 1040NR, line 48 |

2 |

|

3 |

Subtract line 2 from line 1. If zero, stop; you cannot take this credit |

3 |

|

4a |

Earned income (see instructions on back) |

4a |

|

bNontaxable combat pay (see instructions on

|

back) |

4b |

|

|

|

|

|

|

5 |

Is the amount on line 4a more than $3,000? |

|

|

|

|

|

|

|

|

No. Leave line 5 blank and enter |

|

|

|

|

|

|

|

|

Yes. Subtract $3,000 from the amount on line 4a. Enter the result . . . |

5 |

|

|

||||

6 |

Multiply the amount on line 5 by 15% (.15) and enter the result |

. . . . . . . . . |

|

6 |

||||

|

Next. Do you have three or more qualifying children? |

|

|

|

|

|||

|

No. If line 6 is zero, stop; you cannot take this credit. Otherwise, skip Part II and enter the smaller of |

|

||||||

|

line 3 or line 6 on line 13. |

|

|

|

|

|

|

|

|

Yes. If line 6 is equal to or more than line 3, skip Part II and enter the amount from line 3 on line 13. |

|

||||||

|

Otherwise, go to line 7. |

|

|

|

|

|

|

|

Part II Certain Filers Who Have Three or More Qualifying Children

7Withheld social security and Medicare taxes from Form(s)

|

worked for a railroad, see instructions on back |

||

8 |

1040 filers: |

Enter the total of the amounts from Form 1040, lines |

} |

|

|

27 and 57, plus any taxes that you identified using code |

|

|

|

“UT” and entered on line 60. |

|

|

1040A filers: |

Enter |

|

|

1040NR filers: |

Enter the total of the amounts from Form 1040NR, lines |

|

|

|

27 and 55, plus any taxes that you identified using code |

|

|

|

“UT” and entered on line 59. |

|

9 |

Add lines 7 and 8 |

||

10 |

1040 filers: |

Enter the total of the amounts from Form 1040, lines |

} |

|

|

64a and 69. |

|

|

1040A filers: |

Enter the total of the amount from Form 1040A, line |

|

|

|

38a, plus any excess social security and tier 1 RRTA |

|

|

|

taxes withheld that you entered to the left of line 41 |

|

|

|

(see instructions on back). |

|

|

1040NR filers: |

Enter the amount from Form 1040NR, line 65. |

|

11 |

Subtract line 10 from line 9. If zero or less, enter |

||

12Enter the larger of line 6 or line 11 . . . . . . . . . . . . .

Next, enter the smaller of line 3 or line 12 on line 13.

7

8

9

10

. |

. |

. |

. |

. |

. |

. |

. |

. |

. |

. |

. |

. |

. |

. |

. |

. |

. |

11

12

Part III Additional Child Tax Credit

13 |

This is your additional child tax credit |

13

1040

1040A

1040NR ◀

Enter this amount on Form 1040, line 65, Form 1040A, line 39, or Form 1040NR, line 63.

For Paperwork Reduction Act Notice, see your tax return instructions. |

Cat. No. 10644E |

Form 8812 (2011) |

Form 8812 (2011) |

Page 2 |

|

|

Instructions

What's New

Future developments. The IRS has created a page on IRS.gov for information about Form 8812 and its instructions, at www.irs.gov/ form8812. Information about any future developments affecting Form 8812 (such as legislation enacted after we release it) will be posted on that page.

Purpose of Form

Use Form 8812 to figure your additional child tax credit. The additional child tax credit may give you a refund even if you do not owe any tax.

Who Should Use Form 8812

First, complete the Child Tax Credit Worksheet that applies to you. See the instructions for Form 1040, line 51, Form 1040A, line 33, or Form 1040NR, line 48. If you meet the condition given in the TIP at the end of your Child Tax Credit Worksheet, use Form 8812 to see if you can take the additional child tax credit.

Effect of Credit on Welfare Benefits

Any refund you receive as a result of taking the additional child tax credit will not be used to determine if you are eligible for the following programs, or how much you can receive from them. But if the refund you receive because of the additional child tax credit is not spent within a certain period of time, it may count as an asset (or resource) and affect your eligibility.

•Temporary Assistance for Needy Families (TANF).

•Medicaid and supplemental security income (SSI).

•Supplemental Nutrition Assistance Program (food stamps) and low- income housing.

•Any other benefits or assistance under any federal programs or under any state or local program financed in whole or in part with federal funds.

Nontaxable Combat Pay

Enter on line 4b the total amount of nontaxable combat pay that you, and your spouse if filing jointly, received in 2011. This amount should be shown in Form

Railroad Employees

If you worked for a railroad, include the following taxes in the total on Form 8812, line 7.

•Tier 1 tax withheld from your pay. This tax should be shown in box 14 of your Form(s)

•If you were an employee representative, 50% of the total tier 1 tax you paid for 2011.

1040A Filers

If you, or your spouse if filing jointly, had more than one employer for

2011 and total wages of over $106,800, figure any excess social security and tier 1 railroad retirement (RRTA) taxes withheld. See Pub. 505. Include any excess on Form 8812, line 10.

Earned Income

IF you... |

AND you... |

THEN enter on line 4a... |

|

|

|

|

||

|

|

|

|

|

|

|

||

have net earnings |

use either optional method to figure |

the amount figured using Pub. 972. |

|

|

|

|

||

from self- |

those net earnings |

|

|

|

|

|

|

|

employment |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

completed Worksheet B of the EIC |

your earned income from Worksheet B, line 4b, plus all of your nontaxable combat pay if you did not elect to include it in |

||||||

are taking the EIC |

instructions in your Form 1040 |

earned income for the EIC. If you were a member of the clergy, subtract (a) the rental value of a home or the nontaxable |

||||||

instructions |

portion of an allowance for a home furnished to you (including payments for utilities), and (b) the value of meals and |

|||||||

on Form 1040, line |

||||||||

|

lodging provided to you, your spouse, and your dependents for your employer’s convenience. |

|

|

|

||||

64a, or Form |

|

|

|

|

||||

|

|

|

|

|

|

|

||

1040A, line 38a |

did not complete Worksheet B or |

your earned income from Step 5 of the EIC instructions in your tax return instructions, plus all of your nontaxable combat |

||||||

|

filed Form 1040A |

pay if you did not elect to include it in earned income for the EIC. |

|

|

|

|

||

|

|

|

|

|

|

|

||

|

were |

the amount figured using Pub. 972. |

|

|

|

|

||

|

Schedule SE because you were a |

|

|

|

|

|

|

|

|

member of the clergy or you had |

|

|

|

|

|

|

|

|

church employee income, or you are |

|

|

|

|

|

|

|

|

filing Schedule C or |

|

|

|

|

|

|

|

|

statutory employee |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

are not |

your earned income figured as follows: |

|

|

|

|

||

|

Schedule SE, C, or |

Line 7 of Form 1040 or Form 1040A, or line 8 of Form 1040NR |

|

|

|

|

||

|

above reasons |

|

|

|

|

|||

|

Subtract, if included on line 7 (line 8 for Form 1040NR), any: |

|

|

|

|

|||

|

|

|

|

|

|

|||

are not taking the |

|

• |

Taxable scholarship or fellowship grant not reported on a Form |

} |

|

|

|

|

EIC |

|

• |

Amount received for work performed while an inmate in a penal institution (put |

|

|

|

||

|

|

|

|

|

||||

|

|

|

“PRI” and the amount subtracted in the space next to line 7 of Form 1040 or |

|

|

|

||

|

|

|

1040A (line 8 for Form 1040NR)). |

|

|

|

||

|

|

• |

Amount received as a pension or annuity from a nonqualified deferred |

|

|

|

||

|

|

|

compensation plan or a nongovernmental section 457 plan (put “DFC” and the |

– |

||||

|

|

|

amount subtracted in the space next to line 7 of Form 1040 or Form 1040A (line 8 |

|||||

|

|

|

for Form 1040NR)). This amount may be shown in box 11 of your Form |

|

|

|

||

|

|

|

you received such an amount but box 11 is blank, contact your employer for the |

|

|

|

||

|

|

|

amount received as a pension or annuity. |

|

|

|

||

|

|

• Amount from Form 2555, line 43, or Form |

|

|

|

|

||

|

|

Add all your nontaxable combat pay from Form(s) |

|

+ |

|

|

||

Earned income =

Document Specifics

| # | Fact | Description |

|---|---|---|

| 1 | Form Number | IRS Form 8812 |

| 2 | Title | Additional Child Tax Credit |

| 3 | Applicable Forms | Attach to Form 1040, Form 1040A, or Form 1040NR |

| 4 | Purpose | To figure your additional child tax credit |

| 5 | Eligibility | Used after completing the Child Tax Credit Worksheet |

| 6 | Effect on Welfare | Refund from this credit does not impact most welfare benefits |

| 7 | Nontaxable Combat Pay | Enter combat pay received in 2011 on line 4b |

| 8 | Railroad Employees | Include certain railroad taxes on line 7 |

| 9 | Earned Income | Line 4a requires calculation based on various sources of income |

| 10 | OMB Number | 1545-0074 |

Guide to Writing Irs 8812

Filling out IRS Form 8812 is required for those who wish to claim the Additional Child Tax Credit, which may provide a refund to taxpayers who owe no tax. This document supplements your main tax return form by calculating the credit that might be owed to you, based on certain conditions regarding your income and child tax credits already calculated. After completing the required Child Tax Credit Worksheet, referenced in your main tax form's instructions, Form 8812 helps in determining the additional credit amount.

- At the top of Form 8812, enter your name(s) as shown on your return and your social security number.

- In Part I, for line 1, enter the amount from your Child Tax Credit Worksheet:

- For 1040 filers, see the Instructions for Form 1040, line 51.

- For 1040A filers, refer to the Instructions for Form 1040A, line 33.

- For 1040NR filers, look at the Instructions for Form 1040NR, line 48. If you used Pub. 972, input the amount from line 8 of that worksheet.

- For line 2, input the amount from Form 1040, line 51; Form 1040A, line 33; or Form 1040NR, line 48.

- Subtract line 2 from line 1 and enter this on line 3. If the result is zero, you're not eligible for the credit; do not proceed with this form.

- Enter your earned income on line 4a and nontaxable combat pay on line 4b, if applicable.

- If the amount on line 4a is more than $3,000, subtract $3,000 from it and enter this result on line 5. Otherwise, enter -0- on line 6.

- Multiply the amount on line 5 by 15% and enter this calculation on line 6.

- In Part II, if you have three or more qualifying children, complete lines 7 through 12 as directed. This includes entering withheld social security and Medicare taxes, calculating other taxes and withholdings, and determining the larger of line 6 or line 11 to compare with line 3 for your credit amount.

- For those not proceeding to Part II, or after completing it, fill in Part III with your calculated additional child tax credit on line 13. This is the amount you will enter on your Form 1040, Form 1040A, or Form 1040NR, as specified at the bottom of the form.

Always review your calculations and information entered for accuracy. The correct figures and adherence to the instructions ensure your eligibility and the accurate amount of credit. When completed, attach Form 8812 to your tax return before submission. This auxiliary form supports your claim for the additional child tax credit and plays a vital role in securing potential refunds.

Understanding Irs 8812

What is Form 8812?

Form 8812 is used to calculate the Additional Child Tax Credit (ACTC), which may provide a refund even to those who owe no tax. It is an attachment to Form 1040, 1040A, or 1040NR.

Who needs to fill out Form 8812?

If, after completing the Child Tax Credit Worksheet that accompanies your tax return, you find you're entitled to a credit larger than the taxes you owe, you should use Form 8812 to determine if you can get the additional child tax credit.

How does the Additional Child Tax Credit work?

The ACTC is a refundable credit. It means if the credit amount is more than the taxes you owe, you can get the difference as a refund.

Is there an income limit to qualify for the ACTC?

Yes, you need to have earned income of more than $3,000 to qualify. Earned income includes wages, salaries, tips, and self-employment income.

How does nontaxable combat pay affect the ACTC?

Nontaxable combat pay can be included as earned income when calculating the ACTC. This can increase the credit amount for eligible military families.

What should railroad employees know about Form 8812?

Railroad employees should include their tier 1 tax withheld and, for employee representatives, 50% of the total tier 1 tax paid when filling out line 7 of Form 8812.

What if I have more than one employer?

If you or your spouse worked for more than one employer and total wages were over $106,800 in 2011, you need to calculate any excess social security and tier 1 RRTA taxes withheld. This amount is included on Form 8812, line 10.

How does the Additional Child Tax Credit affect welfare benefits?

The ACTC refund will not be considered when determining eligibility for welfare benefits. However, if not spent within a certain period, it could count as an asset and potentially affect eligibility.

How do I know if I should include my nontaxable combat pay as earned income?

You have the option to include your nontaxable combat pay in your earned income when calculating the ACTC. This decision can potentially increase your credit amount, especially if other earned income is low.

Common mistakes

Filling out the IRS Form 8812 for the Additional Child Tax Credit can be complex, and errors can cost taxpayers refunds they are rightfully owed or lead to IRS audits. Here are five common mistakes to avoid:

- Miscalculating Earned Income: One of the first steps in Form 8812 involves determining earned income, which is crucial for calculating the credit. Taxpayers often mistakenly include non-earned income or fail to properly account for nontaxable combat pay, leading to an inaccurate credit calculation.

- Incorrectly Reporting the Number of Qualifying Children: The amount of credit increases with the number of qualifying children. However, not all children qualify due to age, relationship, and residency requirements. Ensuring that only eligible children are claimed is essential to avoid misrepresenting your eligibility for the credit.

- Overlooking the Social Security and Medicare Taxes for Certain Filers: For filers with three or more qualifying children, overlooking or incorrectly calculating the amount of Social Security and Medicare taxes from Form W-2, boxes 4 and 6, can result in a lower credit than one might be eligible for.

- Failure to Include Excess Social Security and Tier 1 RRTA Taxes Withheld: Taxpayers who, along with their spouses if filing jointly, had more than one employer and total wages over the Social Security wage base may fail to include excess Social Security and Tier 1 RRTA taxes withheld. This oversight can lead to a reduced credit amount.

- Incorrectly Applying the Child Tax Credit Worksheet Results: The results from the Child Tax Credit Worksheet are essential for filling out Form 8812. Mistakes in transferring these amounts or misunderstanding the instructions can cause taxpayers to claim the wrong credit amount.

It's vital for taxpayers to review their Form 8812 submissions carefully, given these common pitfalls. Ensuring accuracy not only secures the tax benefits to which they're entitled but also prevents issues with the IRS. For complicated tax situations, consulting with a professional may be beneficial to navigating these challenges effectively.

Documents used along the form

When preparing your taxes and utilizing the IRS Form 8812 for Additional Child Tax Credit, it's essential to have the right documents at hand. This form is typically accompanied by other forms and documents, each serving a specific purpose in the tax filing process. Understanding these forms can simplify the process and ensure accuracy in filing.

- Form 1040 or 1040-SR: This is the U.S. Individual Income Tax Return form. It is the standard federal income tax form used to report an individual's gross income.

- Form 1040A or 1040EZ: These forms were simpler versions of the Form 1040 for individuals with straightforward tax situations. They are no longer in use since the 2018 tax year, replaced by a redesigned Form 1040.

- Form 1040NR: This form is for nonresident aliens to file their tax return. Similar to Form 1040 but tailored for nonresident filers.

- Form W-2: This is the Wage and Tax Statement provided by employers. It reports an employee’s annual wages and taxes withheld from their paycheck.

- Schedule 8812: This schedule accompanies Form 8812. It is used for taxpayers with three or more qualifying children to calculate the refundable part of the child tax credit.

- Publication 972: The Child Tax Credit publication provides detailed information to help filers understand and calculate their eligible tax credits for their children.

- Schedule EIC: This is the Earned Income Credit form, used to document a taxpayer's eligibility for the EIC if they have qualifying children.

- Form 2555 or Form 2555-EZ: These forms are used for taxpayers who earn income from foreign sources. They are essential for those claiming the Foreign Earned Income Exclusion or ajusting their income to exclude foreign earnings.

- Form W-2, box 12, with code Q: This pertains to the section of Form W-2 that reports nontaxable combat pay. This amount is crucial for individuals looking to calculate the Additional Child Tax Credit accurately.

By understanding each of these documents and their purpose in the tax filing process, individuals can ensure they correctly file their taxes and claim any credits or deductions for which they're eligible. It's always recommended to consult with a tax professional or the IRS directly for guidance tailored to individual circumstances.

Similar forms

The IRS Form 1040 is a foundational document for personal tax filing in the United States, similar in many ways to the IRS Form 8812. The Form 1040 serves as a taxpayer's main vehicle for annual income reporting, tax calculation, and determination of taxes owed or refund due. Similar to how the Form 8812 allows taxpayers to calculate and claim the Additional Child Tax Credit, the Form 1040 includes various sections for reporting income, tax deductions, and credits, directly impacting the taxpayer's financial obligations to the government.

Form W-2, the Wage and Tax Statement, parallels the IRS Form 8812 in its role of facilitating tax credit calculations. Specifically, information from the Form W-2, such as wages earned and federal income tax withheld, is crucial for accurately completing Form 8812, especially when calculating the Earned Income on Part I or adjusting income levels to qualify for the Additional Child Tax Credit. The interdependence of these forms highlights the cohesive nature of tax documentation, ensuring individuals claim all applicable benefits.

IRS Form 1040A, also known as the "Short Form," shares similarities with Form 8812, as it was a simplified version of the more comprehensive Form 1040. Before its retirement in 2018, Form 1040A facilitated a quicker filing process for those with straightforward tax situations, offering specific credits including adjustments for child tax credit, akin to what Form 8812 provides through its detailed computation for the Additional Child Tax Credit. Both forms streamlined the tax filing process by catering to common taxpayer needs, simplifying the way individuals account for dependents and family-related tax relief.

Form 1040NR, designed for nonresident aliens to file U.S. taxes, aligns with Form 8812 in its specialized approach to tax compliance. Form 1040NR participants, like those using Form 8812, navigate specific instructions tailored to their unique filing status and eligibility criteria, particularly in how nonresident aliens address U.S.-sourced income and claim benefits like the Additional Child Tax Credit if applicable. Both forms exemplify the IRS’s commitment to accommodating the diverse fiscal profiles within the U.S. taxpaying population.

Form 8863, Education Credits (American Opportunity and Lifetime Learning Credits), mirrors the purpose of Form 8812 in providing taxpayers with avenues to reduce their tax liabilities through specific credits. Where Form 8812 focuses on providing relief to those with qualifying children, Form 8863 aims at taxpayers looking to offset education expenses. Both documents enhance the accessibility of tax benefits tailored to personal or family investment in future growth, be it through nurturing a child or pursuing higher education.

The Schedule EIC, Earned Income Credit, is closely related to IRS Form 8812 in its focus on supporting low-to-moderate-income working families. Just as Form 8812 facilitates claiming the Additional Child Tax Credit, Schedule EIC is utilized to calculate and claim the Earned Income Credit. These forms are pivotal for households aiming to maximize their tax refunds and effectively reduce their overall tax burden, showcasing the tax code's accommodation for various taxpayer needs.

Form 2441, Child and Dependent Care Expenses, is another document that shares a functional resemblance to Form 8812. It targets taxpayers who incur expenses for child or dependent care, allowing them to claim a credit that reduces their tax liability, much like the Additional Child Tax Credit. The coordination between these forms underscores a multi-faceted approach to supporting American families through tax incentives for essential care services.

IRS Publication 972, Child Tax Credit, serves as a comprehensive guide similar to Form 8812, offering detailed information for taxpayers on qualifying and claiming the Child Tax Credit. While Form 8812 is a tool for actual calculation and filing, Publication 972 provides the essential knowledge foundation that informs the use of Form 8812, ensuring taxpayers are well-equipped to secure all credits for which they are eligible.

Lastly, Form W-4, Employee's Withholding Certificate, indirectly connects with Form 8812 through the payroll withholding process. Taxpayers can adjust their withholding rates based on anticipated tax credits, including the Additional Child Tax Credit calculated on Form 8812. This proactive strategy allows individuals to manage their take-home pay and potential tax refunds more effectively, illustrating the interconnected nature of tax forms and personal financial planning.

Dos and Don'ts

When it comes to filling out IRS Form 8812 for the Additional Child Tax Credit, it is important to adhere to specific guidelines to ensure the process is smooth and error-free. Below are four essential dos and don’ts to consider:

- Do carefully verify the amounts entered from other forms, such as Form 1040 and W-2, to ensure the calculations are based on accurate information.

- Do include your nontaxable combat pay if it applies to you, as it may increase the credit amount you're eligible for.

- Do calculate your earned income accurately, especially if you have received earnings from self-employment, as this affects the credit amount.

- Do check the IRS website or the latest publications for any updates regarding the form or additional guidance on how to fill it out, as tax laws can change.

- Don’t overlook the section that applies to filers with three or more qualifying children, as this can significantly impact the credit amount.

- Don’t inaccurately report your income or child tax credit amounts, as this could lead to processing delays or an audit.

- Don’t forget to attach Form 8812 to your Form 1040, 1040A, or 1040NR, since failing to do so could delay the processing of your tax return.

- Don’t ignore instructions regarding how the Additional Child Tax Credit affects welfare benefits, as you must consider the impact of the credit on these benefits.

Attentiveness to these guidelines not only helps in submitting a correctly completed Form 8812, but it also minimizes the chances of errors that could delay processing your tax refund. Accurate and thorough completion of this form is crucial for taking full advantage of the available tax credits for which you're eligible.

Misconceptions

Many people have misconceptions about the IRS Form 8812, which is used to calculate the Additional Child Tax Credit. Below are seven common misconceptions explained:

Only for Families with a High Income: Some believe that Form 8812 is only for families with a high income. However, the form is actually beneficial for lower to moderate income taxpayers who may not owe a lot of tax and can receive a refundable credit.

Complicated to File: Another misconception is that Form 8812 is too complicated to file. While it does require additional information, following the instructions step by step can make the process manageable for taxpayers.

Only for Biological Children: People often think the credit only applies to biological children. In fact, the credit can be claimed for adopted children and stepchildren, as long as they meet the age, relationship, and residency tests.

Nontaxable Combat Pay Must Be Excluded: Some taxpayers mistakenly believe they must exclude their nontaxable combat pay. However, taxpayers have the option to include this pay to potentially increase their Additional Child Tax Credit.

Does Not Affect Other Government Benefits: There's a false notion that getting the Additional Child Tax Credit will reduce other government benefits. The refund received from this credit will not be counted as income for programs like Medicaid and SNAP when initially received.

Can File Form 8812 Anytime: A common misconception is that Form 8812 can be filed separately from your tax return at any time. This form must be filed along with your tax return.

Earned Income Threshold Is High: Some taxpayers are under the misconception that they need a high amount of earned income to qualify. In reality, you only need more than $3,000 of earned income to begin qualifying for the credit.

Understanding the facts about the Additional Child Tax Credit and IRS Form 8812 can significantly benefit taxpayers, especially those with lower to moderate incomes.

Key takeaways

Understanding the IRS Form 8812, which is utilized for calculating the Additional Child Tax Credit, is essential for taxpayers who wish to ensure they receive all the credits to which they are entitled. Here are four key takeaways to guide you through filling out and using Form 8812 effectively:

- Eligibility is the First Step: Before considering the use of Form 8812, taxpayers must complete the Child Tax Credit Worksheet associated with their tax return form (Form 1040, Form 1040A, or Form 1040NR). This worksheet determines initial eligibility for the Child Tax Credit. If instructions from the worksheet prompt the use of Form 8812, it suggests potential eligibility for the Additional Child Tax Credit, which could offer a refund even when no tax is owed.

- Understanding Earned Income Requirements: On Form 8812, the calculation for the Additional Child Tax Credit partially hinges on earned income. Taxpayers must have over $3,000 in earned income to qualify for the credit. This threshold underscores the importance of accurately reporting all eligible earned income, including special considerations such as nontaxable combat pay for military service members, which is entered on line 4b of Form 8812.

- Special Considerations for Different Filers: Form 8812 accounts for various taxpayer circumstances, including those with three or more qualifying children and individuals with nontaxable combat pay. Moreover, there are specific instructions for individuals who worked for a railroad and for families where one or both spouses have excess social security and tier 1 railroad retirement (RRTA) taxes withheld because they had multiple employers throughout the year.

- Impact on Welfare Benefits: Any refund received as a result of claiming the Additional Child Tax Credit on Form 8812 will not affect the taxpayer's eligibility for federal welfare benefits, including Temporary Assistance for Needy Families (TANF), Medicaid, and the Supplemental Nutrition Assistance Program (SNAP). However, if the refund from the Additional Child Tax Credit is not spent within a specific time frame, it could be considered an asset and potentially influence eligibility for these programs.

By carefully following these guidelines and accurately completing Form 8812, taxpayers can navigate the complexities of the tax code to ensure they receive every available benefit for their family. It's a powerful tool in making sure hard-earned money stays in the pockets of those who need it most.

Popular PDF Documents

8832 Election - Form 8832 offers a legal pathway for eligible entities to assert their preferred tax status, enhancing their ability to plan and execute financial strategies.

Texas Resale Certificate Online - The form requires details of the seller from whom the tax-exempt purchase is made.