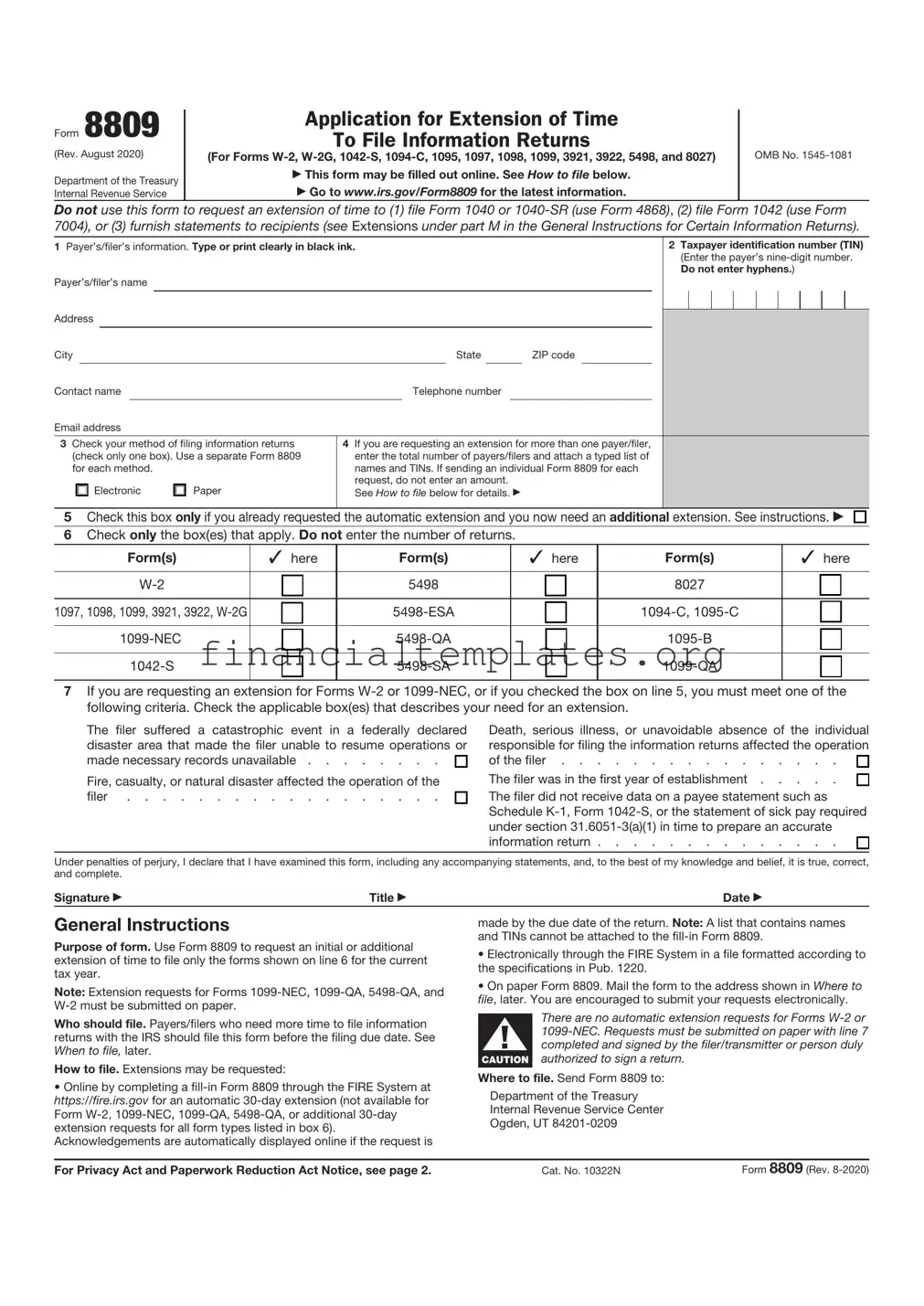

Get IRS 8809 Form

Navigating tax documentation requirements can often seem overwhelming, but understanding the purpose and process for specific forms helps streamline the experience. Among these, the IRS 8809 form plays a critical role for individuals and businesses alike. This form is essentially a request for an extension of time to file certain information returns. It is crucial for those who find themselves unable to meet original filing deadlines, providing a much-needed buffer to gather and report all necessary information accurately. The form covers a wide array of returns, making it applicable in numerous scenarios. Completing and submitting it correctly can save filers from penalties associated with late submissions, making an understanding of its use and nuances invaluable. It's pertinent that users pay attention to the specific returns the extension applies to, as well as the deadlines for filing the extension request, to ensure compliance with IRS guidelines.

IRS 8809 Example

Form 8809

(Rev. August 2020)

Department of the Treasury Internal Revenue Service

Application for Extension of Time

To File Information Returns

(For Forms

Go to www.irs.gov/Form8809 for the latest information.

OMB No.

Do not use this form to request an extension of time to (1) file Form 1040 or

1 Payer’s/filer’s information. Type or print clearly in black ink. |

|

|

|

|

2 Taxpayer identification number (TIN) |

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Enter the payer’s |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Do not enter hyphens.) |

||||||||

Payer’s/filer’s name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

City |

|

|

|

|

State |

|

ZIP code |

|

|

|

||||||||||||

Contact name |

|

|

|

Telephone number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Email address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

3 Check your method of filing information returns |

4 If you are requesting an extension for more than one payer/filer, |

|

|

|

|

|

|

|

|

|

||||||||||||

(check only one box). Use a separate Form 8809 |

enter the total number of payers/filers and attach a typed list of |

|

||||||||||||||||||||

for each method. |

|

names and TINs. If sending an individual Form 8809 for each |

|

|||||||||||||||||||

|

Electronic |

Paper |

request, do not enter an amount. |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

See How to file below for details. |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5 Check this box only if you already requested the automatic extension and you now need an additional extension. See instructions.

6Check only the box(es) that apply. Do not enter the number of returns.

Form(s) |

here |

Form(s) |

here |

Form(s) |

here |

|

|

|

|

|

|

|

5498 |

|

8027 |

|

|

|

|

|

|

|

|

1097, 1098, 1099, 3921, 3922, |

|

|

|

||

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

7If you are requesting an extension for Forms

The filer suffered a catastrophic event in a federally declared disaster area that made the filer unable to resume operations or made necessary records unavailable . . . . . . . .

Fire, casualty, or natural disaster affected the operation of the filer . . . . . . . . . . . . . . . . . .

Death, serious illness, or unavoidable absence of the individual responsible for filing the information returns affected the operation of the filer . . . . . . . . . . . . . . . .

The filer was in the first year of establishment . . . . .

The filer did not receive data on a payee statement such as Schedule

Under penalties of perjury, I declare that I have examined this form, including any accompanying statements, and, to the best of my knowledge and belief, it is true, correct, and complete.

Signature |

Title |

|

|

Date |

|

General Instructions |

|

made by the due date of the return. Note: A list that contains names |

|||

Purpose of form. Use Form 8809 to request an initial or additional |

and TINs cannot be attached to the |

||||

• Electronically through the FIRE System in a file formatted according to |

|||||

extension of time to file only the forms shown on line 6 for the current |

|||||

the specifications in Pub. 1220. |

|

||||

tax year. |

|

|

|||

|

• On paper Form 8809. Mail the form to the address shown in Where to |

||||

Note: Extension requests for Forms |

|||||

file, later. You are encouraged to submit your requests electronically. |

|||||

|

|||||

|

|

There are no automatic extension requests for Forms |

|||

Who should file. Payers/filers who need more time to file information |

! |

||||

returns with the IRS should file this form before the filing due date. See |

|||||

completed and signed by the filer/transmitter or person duly |

|||||

When to file, later. |

|

||||

|

F |

authorized to sign a return. |

|

||

How to file. Extensions may be requested: |

|

CAUTION |

|

||

|

Where to file. Send Form 8809 to: |

|

|||

• Online by completing a |

|

||||

Department of the Treasury |

|

||||

https://fire.irs.gov for an automatic |

|

||||

Internal Revenue Service Center |

|

||||

Form |

|

||||

Ogden, UT |

|

||||

extension requests for all form types listed in box 6). |

|

|

|||

|

|

|

|

||

Acknowledgements are automatically displayed online if the request is |

|

|

|

||

|

|

|

|

||

For Privacy Act and Paperwork Reduction Act Notice, see page 2. |

|

Cat. No. 10322N |

Form 8809 (Rev. |

||

Form 8809 (Rev. |

Page 2 |

Need help? If you have questions about Form 8809, call the IRS toll free at

Also, see Pub. 1220 and Pub. 1187. For additional information, see Topic 803, Waivers and Extensions, at www.irs.gov/TaxTopics.

Note: Specifications for filing Forms

When to file. File Form 8809 as soon as you know an extension of time to file is necessary, but not before January 1 of the year in which the return is due. Form 8809 must be filed by the due date of the returns. See the chart below that shows the due dates for filing this form on paper or electronically. Payers/filers of Form

If you are requesting an extension of time to file several types of forms, you may use one Form 8809, but you must file Form 8809 by the earliest due date. For example, if you are requesting an extension of time to file both Forms 1098 and 5498, you must file Form 8809 by February 28 (March 31 if you file electronically). You may complete more than one Form 8809 to avoid this problem. An extension cannot be granted if a request is filed after the filing due date of the information returns.

The due dates for filing Form 8809 are shown below.

|

|

ELECTRONICALLY, |

|

ON PAPER, then the due |

then the due date |

IF you file Form(s) . . . |

date is . . . |

is . . . |

|

|

|

January 31 |

January 31 |

|

|

|

|

February 28 |

March 31 |

|

|

|

|

March 15 |

March 15 |

|

|

|

|

February 28 |

March 31 |

|

|

|

|

1095 |

February 28 |

March 31 |

|

|

|

1097, 1098, 1099 |

February 28 |

March 31 |

|

|

|

January 31 |

January 31 |

|

|

|

|

3921, 3922 |

February 28 |

March 31 |

|

|

|

5498 |

May 31 |

May 31 |

|

|

|

8027 |

Last day of February |

March 31 |

|

|

|

If any due date falls on a Saturday, Sunday, or legal holiday, file by the next business day.

Note: File your information returns as soon as they are ready and do not send a copy of Form 8809 or any letters with the returns you file (see Exception below).

Exception. When filing Form 8027 on paper only, attach a copy of your timely filed Form 8809.

Extension period. For all forms other than Forms

Note: Any approved extension of time to file will only extend the due date for filing the information returns with the IRS. It does not extend the due date for furnishing statements to recipients. If you need an extension for furnishing statements to recipients, see part M in the General Instructions for Certain Information Returns. Also, see the General Instructions for Forms W‐2 and W‐ 3, the Instructions for Form 1042‐S, the Instructions for Forms 1094‐B and 1095‐B, and the Instructions for Forms 1094‐C and 1095‐C.

Penalty. Payers/filers may be subject to a late filing penalty if they file a late return without receiving a valid extension. For more information on penalties, see part O in the General Instructions for Certain Information Returns, and Penalties in the Instructions for Form

Specific Instructions

Line 1. Enter the payer’s/filer’s name, in care of name, and complete mailing address, including room or suite number of the filer requesting the extension of time. Use the name and address where you want correspondence sent. For example, if you are a preparer and want to receive correspondence, enter your client’s complete name, care of (c/o) your firm, and your complete mailing address.

The legal name and TIN on your extension request must be F! exactly the same as the name you provided when you

applied for your EIN using Form

Enter the name of someone who is familiar with this request whom the IRS can contact if additional information is required. Please provide your telephone number and email address.

Line 2. Enter the payer’s

▲ Do not enter hyphens.

!

CAUTION

Line 5. Check this box only if you have already received the automatic

If you check this box, be sure to complete line 7.

Signature. No signature is required for the automatic

Privacy Act and Paperwork Reduction Act Notice. We ask for the information on this form to carry out the Internal Revenue laws of the United States. We use this information to determine if you qualify for an extension of time to file information returns. You are not required to request an extension of time to file; however, if you request an extension, sections 6081 and 6109 and their regulations require you to provide this information, including your identification number. Failure to provide this information may delay or prevent processing your request; providing false or fraudulent information may subject you to penalties. Routine uses of this information include giving it to the Department of Justice for civil and criminal litigation, and to cities, states, the District of Columbia, and U.S. commonwealths and possessions for use in administering their tax laws. We may also disclose this information to other countries under a tax treaty, to federal and state agencies to enforce federal nontax criminal laws, or to federal law enforcement and intelligence agencies to combat terrorism.

You are not required to provide the information requested on a form that is subject to the Paperwork Reduction Act unless the form displays a valid OMB control number. Books or records relating to a form or its instructions must be retained as long as their contents may become material in the administration of any Internal Revenue law. Generally, tax returns and return information are confidential, as required by Code section 6103.

The time needed to complete and file this form will vary depending on individual circumstances. The estimated average time is:

Recordkeeping |

|

4 hr., 4 min. |

|

Learning about the law or the form |

. |

. |

18 min. |

Preparing and sending |

|

|

|

the form to the IRS |

. |

. |

22 min. |

If you have comments concerning the accuracy of these time estimates or suggestions for making this form simpler, we would be happy to hear from you. You can send us comments from www.irs.gov/FormComments. Or you can send your comments to the Internal Revenue Service, Tax Forms and Publications Division, 1111 Constitution Ave. NW,

Document Specifics

| Fact | Detail |

|---|---|

| Form Name | IRS Form 8809 |

| Purpose | Used to request an extension of time to file certain information returns. |

| Who Files It? | Businesses, government entities, or any filers of information returns who need additional time. |

| Extension Length | Generally, a single 30-day extension is granted. |

| Filing Method | Can be filed electronically through the IRS FIRE system or mailed directly to the IRS. |

| Deadline | The request must be filed by the due date of the returns for which the extension is being requested. |

Guide to Writing IRS 8809

After deciding to request an extension for filing certain tax-related forms, the IRS Form 8809 is the next necessary step. This form is straightforward in its approach, guiding users through the process to ensure deadlines are met with ease. Following a specific set of steps to complete this form accurately is key to avoiding any delays in processing the request for an extension. Ensuring all details are filled in correctly helps in preventing possible setbacks or the need for resubmission.

- Start by entering the filer's name in the designated area. This should be the name of the individual or entity requesting the extension.

- Next, fill in the filer's address, including the street address, city, state, and ZIP code, in the corresponding fields.

- For identification, provide the filer's Employer Identification Number (EIN) or Social Security Number (SSN), depending on the filer's status.

- Specify the kind of form you're requesting an extension for by checking the appropriate box. If the form you need is not listed, check the box for 'Other' and clearly indicate the form number in the space provided.

- If applicable, check the box to indicate whether the request is for a foreign entity that does not have an office or place of business in the United States.

- In the part of the form that asks for the specific tax period end date, enter the month, day, and year. This specifies for which tax period the extension is being requested.

- If you are requesting an automatic 30-day extension, check the corresponding box. Remember, some forms are eligible for an automatic extension without the need to file Form 8809.

- Sign and date the form at the bottom. The signature confirms that all the information provided is accurate to the best of your knowledge.

- After completing the form, review all the information to ensure accuracy and completeness. Missing or incorrect information can lead to processing delays.

- Finally, send the form to the IRS. The mailing address or fax number to use depends on your location and can be found in the instructions for Form 8809.

Once the IRS receives the completed Form 8809, they will process the extension request. It's important to monitor the status and be aware that even with an extension, any tax owed to the Internal Revenue Service should be paid by the original due date to avoid potential penalties and interest. Proper completion and timely submission of Form 8809 can help ensure that taxpayers have the additional time they need without adding stress to the process.

Understanding IRS 8809

-

What is the IRS Form 8809?

IRS Form 8809 is an application used by businesses to request an extension of time to file certain information returns. This includes, but is not limited to, forms in the 1099 series, W-2 forms, and various other tax documents. The form is designed to give filers additional time to ensure completeness and accuracy of their submissions to the Internal Revenue Service (IRS).

-

When should you file Form 8809?

You should file Form 8809 by the due date of the returns for which you are requesting an extension. It's important to note that the extension period granted is automatic, meaning you do not need to wait for approval from the IRS. However, filing the form as early as possible is recommended to avoid any potential issues or delays with your extension request.

-

How do you file Form 8809?

Form 8809 can be filed electronically through the IRS FIRE system (Filing Information Returns Electronically) or by paper mail. Electronic filing is preferred by the IRS for its efficiency and speed. To file electronically, you must have an account set up with the FIRE system. If you choose to file by mail, ensure to send the completed form to the appropriate address listed in the form's instructions.

-

Can you file Form 8809 for multiple forms or payers?

Yes, you can use a single Form 8809 to request an extension for multiple forms of the same type. However, if you need extensions for different types of forms, you must file separate Form 8809s for each form type. Similarly, if you are filing on behalf of multiple payers, each payer must submit their own Form 8809 to request extensions for their returns.

-

What is the length of the extension granted by Form 8809?

Typically, the IRS grants a 30-day extension upon submission of Form 8809. This extension is from the original due date of the returns. In some cases, for specific forms, such as the W-2 form, a longer extension period may be available. It's crucial to check the specific instructions for the forms you are filing to understand the extension period you are eligible for.

-

Are there any penalties for filing Form 8809 late?

Filing Form 8809 late does not in itself incur penalties, as the form is an application for an extension of time to file information returns. However, failing to file the required information returns by the extended due date can result in penalties. These penalties can vary based on how late the returns are filed and the size of the business, among other factors. It is, therefore, essential to ensure that all necessary returns are filed by the new deadline provided by the extension.

Common mistakes

Filling out the IRS Form 8809, which is the Application for Extension of Time to File Information Returns, may seem straightforward, but errors can occur. These mistakes can lead to delays or issues with your application. Being aware of common errors can help ensure the process goes smoothly.

-

Not Checking the Box for the Specific Information Return: One common mistake is failing to check the box for the specific information return you're seeking an extension for. The IRS needs to know exactly which documents you're requesting extra time to file. This oversight can lead to unnecessary back-and-forth communication with the IRS, delaying the approval of your extension.

-

Incorrect Taxpayer Identification Numbers (TINs): Providing incorrect TINs, such as Employer Identification Numbers (EINs) or Social Security Numbers (SSNs), is a frequent error. This mistake can lead to the rejection of your application since the IRS uses these numbers to identify your account. Always double-check the TINs you enter against official documents.

-

Omitting the Contact Person Information: It's essential to fill in the contact person's information section. This person is the IRS's point of contact if there are questions or issues with your application. Leaving this part blank can cause delays in the processing of your form, as the IRS would have no direct way to request additional information or clarify discrepancies.

-

Forgetting to Sign and Date the Form: Perhaps one of the simplest but most vital steps is signing and dating the form. This mistake can render your application incomplete in the eyes of the IRS. A signature verifies the accuracy and truthfulness of the application, and without it, the form cannot be processed.

By avoiding these common pitfalls, you can streamline your application process for an extension of time to file your information returns. Always remember to review your form thoroughly before submission to ensure all information is correct and complete.

Documents used along the form

When dealing with tax-related documentation, especially in the case of requesting an extension for filing information returns by using the IRS Form 8809, it is common practice to encounter or require additional forms to complete the process efficiently and comprehensively. These documents might vary based on specific needs, such as the type of taxpayer or the information being reported. Here is a brief overview of four forms that are frequently used in conjunction with Form 8809 to ensure a thorough and accurate submission.

- Form W-9: This request for Taxpayer Identification Number (TIN) and Certification is often necessary when initiating relationships with new employees or independent contractors. It's crucial for verifying the correct TIN of the payee for reporting purposes.

- Form 1096: Serving as an Annual Summary and Transmittal of U.S. Information Returns, this document is essential for summarizing the information of all 1099 forms sent to the IRS if paper filing is the method chosen. It plays a pivotal role in consolidating the data for transmission.

- Form 1099: This series of documents is critical for reporting various types of income outside of wages, salaries, and tips. Depending on the specific situation—such as freelance work (1099-NEC), interest income (1099-INT), or dividend payments (1099-DIV)—the appropriate version of Form 1099 must be filed.

- Form 4868: While not directly related to informational returns, Form 4868, Application for Automatic Extension of Time To File U.S. Individual Income Tax Return, is frequently used by individuals seeking an extension on their personal taxes, which may coincide with the need to file Form 8809 for business-related extensions.

In navigating the complexities of tax filing and information reporting, understanding the role and requisite of each of these documents in relation to Form 8809 becomes invaluable. By familiarizing oneself with these forms, individuals and businesses can ensure compliance with IRS requirements, thereby avoiding potential penalties and facilitating a smoother tax reporting process.

Similar forms

The IRS 8809 form, used for requesting an extension of time to file information returns, shares similarities with several other documents used in tax and employment administration. Notably, it aligns with the W-9 form, which individuals and entities use to provide their taxpayer identification number to entities that will pay them income. Both forms are integral to the proper reporting and documentation of financial information to the IRS, ensuring compliance with federal tax laws and regulations.

Equally, the IRS 4868 form, which taxpayers use to request an extension of time to file their individual tax returns, bears resemblance to the 8809 form. While the 4868 pertains to individual income tax returns and the 8809 addresses information returns, both serve the crucial function of granting additional time to fulfill tax filing obligations, thereby preventing penalties for late submissions.

Another document, the Form 7004, is used by businesses, trusts, and estates to request an extension for filing their tax returns. Similar to the 8809 form, the 7004 is pivotal for entities that need more time to compile their financial information accurately. Both forms help in avoiding the repercussions of late filings by officially extending submission deadlines.

The W-2 form, although primarily a wage and tax statement provided by employers to their employees, correlates with the 8809 form in its role in annual tax documentation. Employers who find themselves unable to furnish W-2 forms to their employees by the deadline may use Form 8809 to seek an extension, highlighting the interconnectedness of these documents in managing tax reporting responsibilities.

Similarly, the 1099 series, which encompasses various forms reporting non-employee compensation, dividends, and other income payments, aligns with the 8809 form. Entities required to issue 1099 forms can file Form 8809 when they need more time to ensure accurate and thorough reporting, mirroring the extension request process for information returns.

The IRS Form 945, used to report withheld federal income tax from nonpayroll items, shares a functional similarity with the 8809 in that timely and accurate reporting is crucial. When entities require more time to report amounts withheld, submitting form 8809 can extend their filing deadline, emphasizing the importance of precision in tax documentation across different contexts.

The Form 940, which employers use to report annual Federal Unemployment Tax Act (FUTA) tax, also ties into the necessity for extensions that the 8809 form facilitates. Businesses that are not ready to file Form 940 by the deadline can request an extension through Form 8809, ensuring they remain compliant while compiling their FUTA tax information.

Form 941, required for reporting quarterly payroll taxes, can present challenges in meeting filing deadlines, similar to the circumstances surrounding the 8809 form. Employers who are unable to prepare their 941 submissions in time have the option to file Form 8809 to gain additional time, underlining the form’s essential role in maintaining tax filing compliance.

The Schedule K-1 (Form 1065), which partners in partnerships use to report their share of the partnership's income, deductions, and credits, interacts with the 8809 form in the context of deadlines. Partnerships that require more time to distribute Schedule K-1s accurately to all partners can leverage Form 8809 to extend their filing period, ensuring fair and precise allocation of tax responsibilities among partners.

Last but not least, the Affordable Care Act (ACA) reporting forms (1094 and 1095 series), which detail health insurance coverage offered and provided by employers, match the 8809 form in utility. Employers needing additional time to gather and report this information accurately can file Form 8809, underscoring the document’s significance in facilitating comprehensive healthcare reporting to meet federal requirements.

Dos and Don'ts

When it comes to filling out the IRS Form 8809, it's essential to approach it with care and attention. This form is used to request an extension of time to file certain information returns. To ensure the process is smooth and error-free, here are some key dos and don'ts:

- Do verify your eligibility for an extension before you begin. Not all forms or situations qualify.

- Do gather all necessary information, including payer name, Taxpayer Identification Number (TIN), and address before starting the form.

- Do ensure that the form is filled out completely. Missing information can lead to delays or denials of your request.

- Do sign and date the form, as an unsigned form is considered invalid and will not be processed.

- Don't wait until the last minute to request an extension. Processing times can vary, and late submissions might not be granted the extension.

- Don't assume an extension to file also extends the time to pay any taxes due. This form is for reporting extensions, not payment extensions.

- Don't forget to check the specific IRS guidelines for the forms you're requesting an extension for. Different rules may apply to different forms.

- Don't submit incomplete forms. Double-check that all required sections are filled out correctly to avoid unnecessary complications.

Misconceptions

The IRS 8809 form, officially known as the Application for Extension of Time to File Information Returns, is surrounded by a number of misconceptions. Here, we aim to clarify some of these misunderstandings, helping taxpayers accurately navigate their filing obligations.

It grants an automatic extension for all tax returns. The 8809 form only applies to information returns, not to all tax filings. For example, it does not extend the deadline for your personal or business income tax returns.

It provides an unlimited extension period. Filing Form 8809 typically grants a single 30-day extension for the deadline to file information returns. It doesn't offer an indefinite extension, and specific deadlines depend on the type of information return.

You can file for multiple extensions. A common misconception is that organizations or individuals can file multiple 8809 forms to keep extending their deadline. However, in most cases, you're only permitted a one-time extension for each applicable information return series.

The 8809 form is difficult to file. Contrary to what some may believe, filing Form 8809 can be straightforward, especially with electronic filing options available through the IRS Fire System. You can typically complete and submit your extension request quickly.

Approval is not guaranteed. The extension granted by filing Form 8809 is automatic upon submission for most information returns, which means you do not need to wait for explicit approval from the IRS before the extension is applied.

An extension to file means an extension to pay. It's crucial to understand that an extension to file does not equate to an extension to pay any taxes due. The 8809 form specifically relates to information returns, which generally do not involve direct tax payments.

Every entity must file Form 8809 for extensions. Not every taxpayer needs to file this form to get an extension. Depending on the specific situation, some information returns may have automatic extensions or different procedures not involving Form 8809.

The same deadlines apply regardless of filing method. Deadlines for filing information returns can differ depending on whether you are filing electronically or on paper. Electronic submissions typically have a later due date, so filing Form 8809 might not always be necessary when filing electronically.

Penalties for late filing can always be avoided by submitting Form 8809. While filing for an extension can help prevent penalties related to late submissions of information returns, it's important to file the extension request on time. Late submission of Form 8809 itself can lead to penalties, and an extension does not waive any penalties already incurred for past due periods.

Clearing up these misconceptions is vital for anyone responsible for managing tax-related obligations. By understanding these aspects of the IRS 8809 form, taxpayers can better navigate their filing requirements and avoid common pitfalls. Always consult with a tax professional or attorney for guidance specific to your situation.

Key takeaways

Filling out and using the IRS 8809 form is a task that many individuals and businesses may need to complete to request an extension of time to file certain information returns. While the process might seem daunting at first, understanding the key aspects can greatly simplify the task. Here are some crucial takeaways:

- Identify the Need for an Extension: The first step is recognizing whether there is a genuine need for an extension to file the required information returns. Common reasons include incomplete records or unexpected delays.

- Understand Which Returns Are Eligible: Not every information return is eligible for an extension using Form 8809. It’s primarily used for forms in the 1099 series, W-2 series, and other specified forms. Confirming eligibility is a crucial initial step.

- Automatic Extension: For certain forms, the IRS grants an automatic 30-day extension when Form 8809 is filed timely. Knowing which forms qualify for this automatic extension can alleviate last-minute filing stress.

- Manual versus Electronic Filing: The IRS allows Form 8809 to be filed either manually or electronically. Electronic filing is quicker and provides immediate confirmation of receipt, which can be particularly useful as the deadline approaches.

- One Form Per Return Type: When filing an extension for multiple return types, a separate Form 8809 must be completed for each type. This requirement ensures clarity and prevents processing errors on the part of the IRS.

- Non-extendable Deadline: While an extension to file can be granted, it's essential to remember there is no extension for payment obligations. If payment is due with a return, it must be made by the original deadline to avoid penalties and interest.

By keeping these key points in mind, individuals and businesses can navigate the process of requesting an extension with the IRS more effectively, ensuring compliance and avoiding unnecessary stress. It's always wise to seek advice or assistance if any uncertainties arise during the process to ensure all IRS requirements are met accurately and timely.

Popular PDF Documents

IRS Schedule K-1 1065 - Proper reporting via the Schedule K-1 1065 supports the financial integrity of the partnership and trust among partners.

Maryland Boat Bill of Sale - Specially designed to ensure compliance with Maryland’s regulations on the private sale of boats and vessels.