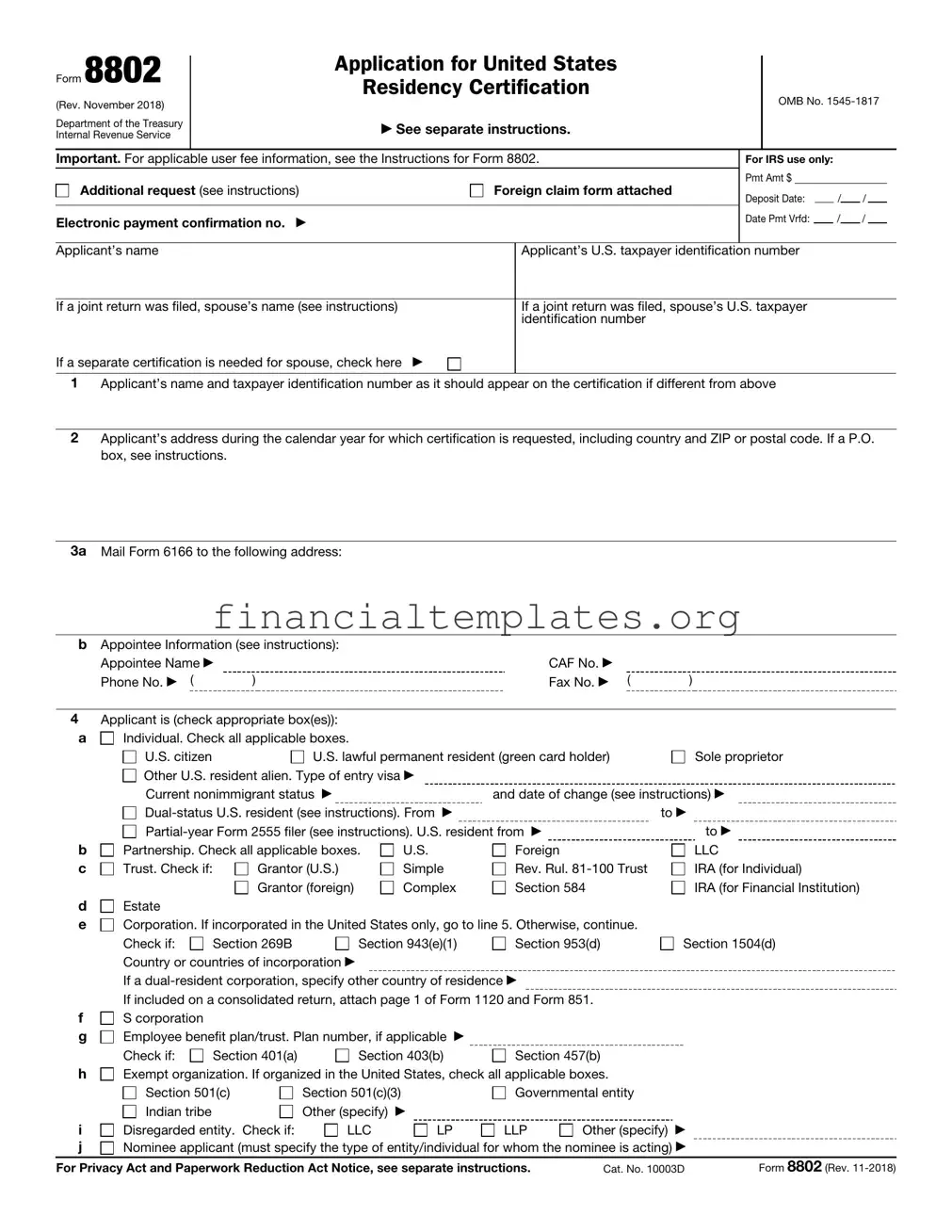

Get Irs 8802 Form

At the heart of international financial transactions and tax considerations for U.S. residents operating abroad is the IRS Form 8802, a crucial document that serves as an application for United States Residency Certification. Updated in November 2018 by the Department of the Treasury and the Internal Revenue Service, this form addresses the complexities of tax obligations and reductions for those engaging in cross-border businesses or having foreign income. Key elements include a required user fee, vivid instructions for additional requests, and specific guidelines for foreign claim forms and electronic payment confirmations. Designed to cater to a wide array of applicants, from individuals, corporations, partnerships, trusts to exempt organizations, the form delineates prerequisites for U.S. taxpayer identification numbers, appointee information, and detailed entity classifications. Additionally, the form meticulously outlines the procedures for requesting certification for different tax periods, including the current calendar year or years for which a tax return is not yet mandatory. Through this certification, applicants affirm their residency status to claim tax treaty benefits and avoid double taxation, embodying a vital step in international tax compliance and financial planning.

Irs 8802 Example

Form 8802

(Rev. November 2018)

Department of the Treasury Internal Revenue Service

Application for United States

Residency Certification

▶See separate instructions.

OMB No.

Important. For applicable user fee information, see the Instructions for Form 8802.

Additional request (see instructions) |

Foreign claim form attached |

Electronic payment confirmation no. ▶

For IRS use only:

Pmt Amt $

Deposit Date: |

|

/ |

|

/ |

Date Pmt Vrfd: |

|

/ |

|

/ |

Applicant’s name |

|

Applicant’s U.S. taxpayer identification number |

|

|

|

If a joint return was filed, spouse’s name (see instructions) |

|

If a joint return was filed, spouse’s U.S. taxpayer |

|

|

identification number |

If a separate certification is needed for spouse, check here |

▶ |

|

|

|

|

1Applicant’s name and taxpayer identification number as it should appear on the certification if different from above

2Applicant’s address during the calendar year for which certification is requested, including country and ZIP or postal code. If a P.O. box, see instructions.

3a Mail Form 6166 to the following address:

bAppointee Information (see instructions):

Appointee Name ▶ |

|

CAF No. ▶ |

|

Phone No. ▶ ( |

) |

Fax No. ▶ ( |

) |

4

a

b c

d e

f g

h

i j

Applicant is (check appropriate box(es)): |

|

|

|

|

||

Individual. Check all applicable boxes. |

|

|

|

|

||

U.S. citizen |

|

U.S. lawful permanent resident (green card holder) |

Sole proprietor |

|||

Other U.S. resident alien. Type of entry visa ▶ |

|

|

|

|||

Current nonimmigrant status ▶ |

|

and date of change (see instructions) ▶ |

||||

|

to ▶ |

|||||

▶ |

to ▶ |

|||||

Partnership. Check all applicable boxes. |

U.S. |

Foreign |

LLC |

|||

Trust. Check if: |

Grantor (U.S.) |

Simple |

Rev. Rul. |

IRA (for Individual) |

||

|

Grantor (foreign) |

Complex |

Section 584 |

IRA (for Financial Institution) |

||

Estate |

|

|

|

|

|

|

Corporation. If incorporated in the United States only, go to line 5. Otherwise, continue. |

|

|||||

Check if: |

Section 269B |

Section 943(e)(1) |

Section 953(d) |

Section 1504(d) |

||

Country or countries of incorporation ▶ |

|

|

|

|

||

If a |

|

|

||||

If included on a consolidated return, attach page 1 of Form 1120 and Form 851. |

|

|||||

S corporation |

|

|

|

|

|

|

Employee benefit plan/trust. Plan number, if applicable ▶ |

|

|

|

|||

Check if: |

Section 401(a) |

Section 403(b) |

Section 457(b) |

|

||

Exempt organization. If organized in the United States, check all applicable boxes. |

|

|||||

Section 501(c) |

Section 501(c)(3) |

Governmental entity |

|

|||

Indian tribe |

|

Other (specify) |

▶ |

|

|

|

Disregarded entity. Check if: |

LLC |

LP |

LLP |

Other (specify) |

▶ |

|

Nominee applicant (must specify the type of entity/individual for whom the nominee is acting) ▶

For Privacy Act and Paperwork Reduction Act Notice, see separate instructions. |

Cat. No. 10003D |

Form 8802 (Rev. |

Form 8802 (Rev. |

Page 2 |

|

|

Applicant name:

5Was the applicant required to file a U.S. tax form for the tax period(s) on which certification will be based?

Yes. Check the appropriate box for the form filed and go to line 7.

990

1040

1040

1041

1041

1065

1065

1120

1120

1120S

1120S

5227

5500

No. |

Attach explanation (see instructions). Check applicable box and go to line 6. |

|||

|

Minor child |

QSub |

U.S. DRE |

Foreign DRE |

|

FASIT |

Foreign partnership |

Other ▶ |

|

Section 761(a) election

6Was the applicant’s parent, parent organization or owner required to file a U.S. tax form? (Complete this line only if you checked “No” on line 5.)

Yes. Check the appropriate box for the form filed by the parent.

990 |

1040 |

1041 |

1065 |

Other (specify) ▶

Parent’s/owner’s name and address ▶

1120

1120S

5500

and U.S. taxpayer identification number ▶ No. Attach explanation (see instructions).

7Calendar year(s) for which certification is requested.

Note. If certification is for the current calendar year or a year for which a tax return is not yet required to be filed, a penalties of perjury statement from Table 2 of the instructions must be entered on line 10 or attached to Form 8802 (see instructions).

8Tax period(s) on which certification will be based (see instructions).

9Purpose of certification. Must check applicable box (see instructions).

Income tax |

VAT (specify NAICS codes) ▶ |

Other (must specify) |

▶ |

10Enter penalties of perjury statements and any additional required information here (see instructions).

Sign here

Under penalties of perjury, I declare that I have examined this application and accompanying attachments, and to the best of my knowledge and belief, they are true, correct, and complete. If I have designated a third party to receive the residency certification(s), I declare that the certification(s) will be used only for obtaining information or assistance from that person relating to matters designated on line 9.

Applicant’s signature (or individual authorized to sign for the applicant) |

Applicant’s daytime phone no.: |

Keep a ▶ copy for

yourSignature records.

Name and title (print or type)

Spouse’s signature. If a joint application, both must sign.

Name (print or type)

MM/DD/YYYY

Date

Form 8802 (Rev.

Form 8802 (Rev. |

|

Worksheet for U.S. Residency Certification Application |

|

|

|

|

Page 3 |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Applicant Name |

|

|

|

|

|

|

|

Applicant TIN |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Appointee Name (If Applicable) |

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Calendar year(s) for which certification is requested (must be the same year(s) indicated on line 7) |

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||

11 Enter the number of certifications needed in the column to the right of each country for which certification is requested. |

|

|

|

|||||||||||

Note. If you are requesting certifications for more than one calendar year per country, enter the total number of certifications for all years for |

||||||||||||||

each country (see instructions). |

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Column A |

|

Column B |

|

Column C |

|

Column D |

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Country |

CC |

|

# |

Country |

CC |

# |

Country |

CC |

# |

Country |

CC |

|

# |

|

Armenia |

AM |

|

|

Finland |

FI |

|

Latvia |

LG |

|

South Africa |

SF |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Australia |

AS |

|

|

France |

FR |

|

Lithuania |

LH |

|

Spain |

SP |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Austria |

AU |

|

|

Georgia |

GG |

|

Luxembourg |

LU |

|

Sri Lanka |

CE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Azerbaijan |

AJ |

|

|

Germany |

GM |

|

Mexico |

MX |

|

Sweden |

SW |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Bangladesh |

BG |

|

|

Greece |

GR |

|

Moldova |

MD |

|

Switzerland |

SZ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Barbados |

BB |

|

|

Hungary |

HU |

|

Morocco |

MO |

|

Tajikistan |

TI |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Belarus |

BO |

|

|

Iceland |

IC |

|

Netherlands |

NL |

|

Thailand |

TH |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Belgium |

BE |

|

|

India |

IN |

|

New Zealand |

NZ |

|

Trinidad and Tobago |

TD |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Bermuda |

BD |

|

|

Indonesia |

ID |

|

Norway |

NO |

|

Tunisia |

TS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Bulgaria |

BU |

|

|

Ireland |

EI |

|

Pakistan |

PK |

|

Turkey |

TU |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Canada |

CA |

|

|

Israel |

IS |

|

Philippines |

RP |

|

Turkmenistan |

TX |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

China |

CH |

|

|

Italy |

IT |

|

Poland |

PL |

|

Ukraine |

UP |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cyprus |

CY |

|

|

Jamaica |

JM |

|

Portugal |

PO |

|

United Kingdom |

UK |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Czech Republic |

EZ |

|

|

Japan |

JA |

|

Romania |

RO |

|

Uzbekistan |

UZ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Denmark |

DA |

|

|

Kazakhstan |

KZ |

|

Russia |

RS |

|

Venezuela |

VE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Egypt |

EG |

|

|

Korea, South |

KS |

|

Slovak Republic |

LO |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Estonia |

EN |

|

|

Kyrgyzstan |

KG |

|

Slovenia |

SI |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

0 |

|

|

0 |

|

|

|

0 |

|

|

|

0 |

Column A - Total |

|

|

Column B - Total |

|

Column C - Total |

|

Column D - Total |

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

0 |

12 Enter the total number of certifications requested (add columns A, B, C, and D of line 11) . . |

. . . . . . . |

. |

▶ |

|

||||||||||

Form 8802 (Rev.

Document Specifics

| Fact | Description |

|---|---|

| Form Title | Application for United States Residency Certification |

| Revision Date | November 2018 |

| Department | Department of the Treasury Internal Revenue Service |

| OMB Number | 1545-1817 |

| User Fee Information | Important information on applicable user fees is contained in the instructions for Form 8802. |

| Additional Request and Payment Confirmation | Options for additional request and electronic payment confirmation number are provided. |

| Applicant Information | Sections to fill out applicant's name, TIN, spouse's information, and address during the certification year. |

| Type of Applicant | Applicants can specify their status such as individual, corporation, partnership, exempt organization, etc. |

| Privacy Act and Paperwork Reduction Act Notice | References to the Privacy Act and Paperwork Reduction Act Notice are included in the form. |

Guide to Writing Irs 8802

Filling out the IRS Form 8802 is a crucial step for individuals, trusts, estates, or entities requiring United States residency certification. This document plays a significant role in the taxing rights between the U.S. and other countries, helping to prevent double taxation or enabling reduced withholding tax rates under treaty benefits. The process involves providing detailed information about your residency status, along with supporting documentation and applicable user fees. Following a systematic approach will simplify the process and ensure the application is complete.

- Review the form: Before starting, read through the entire form to familiarize yourself with the required information.

- Gather necessary information: Collect all relevant documents, including your U.S. taxpayer identification number, applicable foreign claim forms, and information about the tax periods for which certification is requested.

- Fill in basic applicant information: Enter the applicant’s name and U.S. taxpayer identification number. If a joint return was filed, include the spouse’s name and their U.S. taxpayer identification number. Mark the checkbox if a separate certification for the spouse is needed.

- Address and appointee details: Provide the applicant’s address during the calendar year for which certification is requested. If appointing someone else like a tax adviser, fill in the appointee’s information including name, CAF No., and contact details.

- Indicate applicant type: Check the box that best describes the applicant’s status, such as individual, partnership, corporation, etc., and provide any additional details required in this section.

- U.S. tax form filing information: State whether the applicant filed a U.S. tax form for the tax periods certification is based on. If yes, check the appropriate box for the form filed. If no, provide an explanation.

- Specify the calendar year(s) for which certification is requested: Clearly indicate the year or years for which you're requesting certification.

- Determine the basis for certification: Indicate the tax period(s) on which the certification will be based and specify the purpose of the certification.

- Penalties of perjury statement: Enter the required statement from Table 2 of the instructions or attach it to Form 8802, confirming the accuracy of the application under penalties of perjury.

- Signature: The form must be signed by the applicant or an individual authorized to sign on behalf of the applicant, indicating their name and title. Include the daytime phone number. If it’s a joint application, both spouses must sign.

- Worksheet for U.S. Residency Certification Application: Complete the supplementary worksheet if additional space is needed or specific instructions direct you to it. This includes detailing the countries for which certification is requested and the number of certifications needed.

- Review and submit: Double-check the completed form for any errors or missing information. Attach any required supporting documents and the applicable fee before mailing it to the IRS.

After submitting the form, it’s important to stay organized. Keep a copy of the completed Form 8802, the payment confirmation (if paid electronically), and all correspondence with the IRS. The processing time can vary; however, you can track the status of your application by contacting the IRS directly. Patience is key during this process, and you should allow sufficient time for the IRS to review and process your Form 8802 application.

Understanding Irs 8802

What is Form 8802?

Form 8802 is a request made to the Internal Revenue Service (IRS) for a United States Residency Certification. This certification is essential for individuals or entities seeking to claim tax benefits under international treaties or agreements, helping to avoid double taxation. The form provides official proof of residency in the U.S. for tax purposes.

Who needs to file Form 8802?

The form should be filed by any U.S. taxpayer (individuals, estates, trusts, or entities) that requires proof of U.S. residency for the purposes of claiming income tax treaty benefits with a foreign country. This includes U.S. citizens, lawful permanent residents, and those with a significant presence in the U.S.

What is the submission process for Form 8802?

To submit Form 8802, complete the form according to the instructions provided by the IRS. It includes providing detailed taxpayer information, the tax period for which certification is requested, and the purpose of the certification. Applicants must pay a user fee, which varies based on the request. The form can be mailed to the IRS, with the address provided in the instructions.

Is there a fee to file Form 8802?

Yes, there is an applicable user fee for filing Form 8802. The amount of the fee is detailed in the instructions for Form 8802 and depends on the specific requirements of the application. The fee supports the processing of the request for U.S. residency certification.

What information is needed to complete Form 8802?

Filling out Form 8802 requires the applicant’s name, U.S. taxpayer identification number, specifics about the type of applicant (individual, corporation, estate, etc.), and the tax period for which residency certification is required. If applicable, information about the spouse, appointee, and type of tax form filed by the applicant or their parent organization must be provided.

How long does it take to receive a U.S. Residency Certification after submitting Form 8802?

The processing time for Form 8802 can vary depending on the IRS's workload and the completeness of the application. Generally, applicants might wait several weeks to a few months to receive their U.S. Residency Certification. It’s advisable to apply well in advance of when the certification is needed.

Can Form 8802 be filed electronically?

As of the latest guidance, Form 8802 requires a physical submission via mail to the IRS. Electronic filing is not mentioned as an option. Always check the current IRS guidelines or consult a tax professional to see if electronic filing has been made available.

What happens if I make a mistake on Form 8802?

If you realize a mistake on your Form 8802 after submission, it is important to correct it promptly. Contact the IRS directly for guidance on how to amend your application. This may involve submitting additional information or a corrected form, depending on the nature of the error.

Do I need to file Form 8802 every year?

Yes, if you require U.S. Residency Certification annually for tax treaty benefits or other international tax obligations, you need to file Form 8802 for each tax year for which certification is needed. Each application will cover certification for specific years requested.

Common mistakes

Not accurately providing the applicant's name and taxpayer identification number as they should appear on the certification. This includes discrepancies with records or failing to update information if it's changed.

Omitting or incorrectly filling out the applicant’s address for the calendar year for which certification is requested. Using a P.O. Box without checking the corresponding instructions could lead to processing delays or rejections.

In the section where the applicant must indicate their status (individual, corporation, partnership, etc.), a common mistake is not checking all applicable boxes or providing incomplete information regarding their tax status.

Forgetting to attach required additional forms or explanations when the applicant indicates they didn't have to file a U.S. tax form for the tax period(s) on which the certification will be based. This oversight can invalidate the application.

Requesting certification for a calendar year or a year for which a tax return is not yet required to be filed without including the penalties of perjury statement from Table 2 of the instructions.

Failing to check the appropriate box under the purpose of certification section or not specifying other purposes when necessary. This can lead to the IRS not understanding the intention behind the certification request, delaying the process.

Incorrectly entering the total number of certifications requested on the worksheet for U.S. Residency Certification Application. This detail is crucial for processing and inaccuracies can lead to receiving an incorrect number of certifications.

When filling out the IRS 8802 form, individuals often make mistakes that can delay the process or result in rejection. Being thorough and reviewing the form multiple times for accuracy can help avoid these common errors.

Documents used along the form

When navigating the intricacies of international taxation and residency certification, understanding the landscape of necessary forms and documents is crucial. The IRS 8802 form, which applies for U.S. residency certification, often represents just one piece of the puzzle. Engaging with this process typically requires additional documentation to accurately portray an applicant's tax situation to both the U.S. Internal Revenue Service (IRS) and foreign tax authorities. The comprehensive preparation of these forms and their supplements ensures a smoother process in obtaining certifications and fulfilling international tax obligations.

- Form 1040: U.S. Individual Income Tax Return. This form is the standard federal income tax form used to report an individual’s gross income. It is pivotal for establishing the income-based residency status of an individual.

- Form 1065: U.S. Return of Partnership Income. For entities treated as partnerships for tax purposes, this form provides crucial information on the income, deductions, and gains of the partnership, relevant for residency certification.

- Form 1120: U.S. Corporation Income Tax Return. Corporations must file this form annually to report their income, gains, losses, deductions, and credits to the IRS.

- Form 1120S: U.S. Income Tax Return for an S Corporation. This form is used by S corporations for reporting their annual income, deductions, losses, gains, etc. It is essential when such entities apply for residency certifications.

- Form 2555: Foreign Earned Income. For individuals claiming foreign earned income exclusion, this form is necessary to establish the tax home in a foreign country and qualify for U.S. residency certification.<

- Form 8833: Treaty-Based Return Position Disclosure Under Section 6114 or 7701(b). Used by taxpayers to disclose treaty-based tax positions, this form often accompanies Form 8802 when treaties affect the applicant's U.S. residency status.

- Form W-9: Request for Taxpayer Identification Number and Certification. This form is critical for verifying a taxpayer’s identification number, mandatory for processing Form 8802.

- Form 5472: Information Return of a 25% Foreign-Owned U.S. Corporation or a Foreign Corporation Engaged in a U.S. Trade or Business. Relevant for foreign corporations needing U.S. residency certification, it supplies necessary ownership and financial information.

- Form 3520: Annual Return To Report Transactions With Foreign Trusts and Receipt of Certain Foreign Gifts. This form may be relevant for individuals or entities engaging in transactions with foreign trusts, affecting their residency status.

- Form SS-4: Application for Employer Identification Number (EIN). While not directly related to the residency certification, entities often need an EIN before they can apply for Form 8802, making SS-4 a prerequisite document in many cases.

Each document serves a unique purpose in the elaboration of an individual's or entity's fiscal narrative, emphasizing the importance of thorough preparation and detailed understanding. Persons or entities considering applying for U.S. residency certification via Form 8802 should review their tax affairs comprehensively, ensuring all relevant documentation is accurate and up to date. This approach not only facilitates compliance with international tax laws but also strengthens the reliability of their residency claims, aiding in smooth and favorable dealings with tax authorities.

Similar forms

The IRS Form W-9, officially titled "Request for Taxpayer Identification Number and Certification," shares similarities with IRS Form 8802, as both forms involve the provision of taxpayer identification numbers and certain tax-related certifications. While Form 8802 is focused on obtaining a United States residency certification for international tax purposes, Form W-9 is commonly used domestically to confirm a person's taxpayer identification number (TIN) for reporting purposes. Each document plays a crucial role in ensuring compliance with tax laws and facilitating accurate reporting.

Form W-8BEN, titled "Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding," is another document related to Form 8802 in that it involves international taxation matters. Form W-8BEN is used by foreign individuals to certify their non-U.S. residency status to avoid or reduce withholding on income connected to U.S. sources, aligning with the objective of Form 8802 to certify U.S. residency for avoiding dual taxation. Both forms address cross-border tax issues but from opposite perspectives.

Form 1040, the U.S. Individual Income Tax Return, correlates with Form 8802 since individuals applying for U.S. residency certification might have their tax obligations assessed based on income reported on Form 1040. The linkage between these documents arises because the tax status, residency, and income information declared on Form 1040 can be a basis for the residency certification provided by Form 8802.

Form 1120, "U.S. Corporation Income Tax Return," is pertinent for corporations seeking U.S. residency certification through Form 8802, especially for those involved in international business activities. Just as individuals use Form 1040, corporations use Form 1120 to report their income, gains, losses, deductions, and credits to the IRS. The connection lies in proving a corporation's tax residency and compliance with U.S. tax obligations to support applications on Form 8802.

Form 5472, "Information Return of a 25% Foreign-Owned U.S. Corporation or a Foreign Corporation Engaged in a U.S. Trade or Business," is intricately linked with Form 8802 in terms of addressing international taxation aspects. Both forms are pivotal for foreign entities operating within the U.S., with Form 5472 focusing on the disclosure of transactions between U.S. corporations and their foreign shareholders, and Form 8802 serving to establish U.S. tax residency for purposes of treaty benefits.

Form 1065, "U.S. Return of Partnership Income," akin to Form 8802, is essential for partnerships that need to prove their U.S. residency status or compliance with U.S. tax laws, particularly when engaging in international transactions. Partnerships use Form 1065 to report their financial status and operations to the IRS, which can be requisite information when applying for U.S. residency certification through Form 8802.

Form 2555, "Foreign Earned Income," is relevant for U.S. citizens or resident aliens reporting income earned abroad, which can directly impact the application process of Form 8802. The purpose of Form 2555 is to claim the foreign earned income exclusion, and its use indicates the taxpayer's international financial engagements, a context within which Form 8802's certification might be sought to clarify the individual's U.S. tax residency status.

Form 8832, "Entity Classification Election," while primarily serving for entities to elect their classification for U.S. tax purposes, intersects with the purpose behind Form 8802 in that both forms involve decisions impacting an entity's taxation in an international context. Entities may file Form 8832 to be treated differently under U.S. tax law, affecting how they might approach or benefit from the residency certification provided by Form 8802.

Dos and Don'ts

When filing IRS Form 8802, it's important to proceed with care, paying attention to accuracy and completeness to avoid common pitfalls. Here's a concise list of do's and don'ts to guide you through the process:

- Do ensure all information provided matches official documents. Discrepancies in names, addresses, and identification numbers can result in processing delays or denials.

- Do specify the calendar year for which certification is requested accurately in section 7. Mistakes here can lead to incorrect residency certification.

- Do check the correct boxes that apply to the applicant's status in section 4. Selecting incorrect classifications may lead to the wrong type of certification.

- Do include all necessary attachments and supporting documentation, such as tax forms or explanations for not filing, if applicable.

- Do sign and date the form where required. An unsigned form is considered incomplete and will not be processed.

- Don't overlook the instructions for filling out Form 8802. They contain crucial information on the documentation and steps required for a successful application.

- Don't leave mandatory fields blank. If a section does not apply, ensure to mark it as N/A (not applicable) rather than omitting it entirely.

- Don't forget to include the appropriate user fee. The application will not be processed without the correct payment.

- Don't submit without double-checking the form for errors and omissions. Accuracy is essential for a smooth processing experience.

Adhering to these guidelines can significantly enhance the effectiveness of your Form 8802 application, minimizing the risk of delays and ensuring that all necessary compliance requirements are met efficiently.

Misconceptions

Many people have misunderstandings about IRS Form 8802, which is used to apply for U.S. residency certification. Addressing these misconceptions is key to ensuring that individuals and entities accurately complete their applications and meet their needs effectively. Here are five common misconceptions explained:

- Only individuals need to file Form 8802: This is not true. While individuals can file Form 8802, it is also designed for various types of entities, including corporations, partnerships, trusts, estates, and exempt organizations. The form is versatile and caters to a broad spectrum of applicants seeking U.S. residency certification for tax purposes.

- Form 8802 is only for citizens and green card holders: Another common misconception is that the form is exclusive to U.S. citizens or lawful permanent residents. The truth is, Form 8802 is also applicable to U.S. resident aliens, including those with dual-status or nonimmigrant statuses, provided they meet certain criteria for a given tax year. The purpose of the form extends beyond the citizenship or immigration status of the applicant.

- Applicants must always attach their tax return: While the form requires information on whether the applicant filed a U.S. tax form for the periods certification is requested, it doesn't mean a tax return must always be attached. Instead, applicants should check the appropriate box indicating the form filed and include other specified information. In cases where no U.S. tax form was filed for the requested year, applicants must attach an explanation rather than a tax return.

- Electronic payment confirmation is always required: The section for electronic payment confirmation number is there to provide proof of payment for the application fee when applicable. However, this doesn't mean that every submission of Form 8802 requires an electronic payment or its confirmation number. The necessity for this information depends on how the applicant chooses to pay the applicable fee and if it's required for the type of request being made.

- The form is solely for income tax purposes: While obtaining U.S. residency certification is often associated with income tax benefits, such as avoiding double taxation, Form 8802 serves a broader purpose. Applicants can request certification for income tax, VAT (Value Added Tax), or other specified reasons. The form is designed to assist with a variety of international tax matters beyond just income tax issues.

Understanding these aspects of Form 8802 can significantly impact how individuals and entities navigate their international tax obligations and prevent common mistakes during the application process.

Key takeaways

Understanding the IRS Form 8802 is crucial for those who need United States residency certification, especially when dealing with international taxation. Here are five key takeaways to ensure accuracy and compliance:

- Form 8802 is specifically designed for applicants requesting a certification of U.S. residency for purposes of tax treaties and foreign tax credits. This certification, once granted, serves to assert the taxpayer's residency in the U.S. for the purpose of international taxation.

- To complete Form 8802 correctly, the applicant must provide detailed information, including their name, U.S. taxpayer identification number, and detailed information regarding their status as a U.S. resident, including citizenship status, visa types, and dates of residency. This comprehensive data collection ensures that the IRS can accurately assess and confirm the applicant's U.S. residency status.

- A key component of the form is the requirement to list the calendar year or years for which residency certification is requested. It's important to note that if the certification is for the current calendar year or a future year in which the tax return has not yet been filed, a signed penalties of perjury statement is required.

- Form 8802 includes a section for the applicant to specify the purpose of the residency certification. This could range from income tax purposes, VAT, or other specific needs. Clearly indicating the reason for certification helps streamline the application process and ensures the provided certification meets the applicant's needs.

- Applicants must sign the form under penalties of perjury, declaring that all information and accompanying documents are true, correct, and complete to the best of their knowledge. This legal declaration underscores the seriousness of the application process and the importance of providing accurate information.

By carefully preparing and submitting Form 8802, applicants can effectively obtain U.S. residency certification, a pivotal step in managing international tax obligations and benefits.

Popular PDF Documents

Do I Need a Business License Report - Pinpoint the procedure for indicating your acceptance of Tempe's tax conditions on the special event license application.

House Tax Form - Navigate the process of reporting assets physically removed during the last year to maintain accurate tax records.