Get IRS 8801 Form

Filing taxes in the United States can often feel like navigating through a maze of documents and regulations. Among the myriad of forms the Internal Revenue Service (IRS) requires is the 8801 form, a crucial document for individuals who seek to understand and possibly apply the Minimum Tax Credit (MTC) to their tax returns. This form is particularly significant for those who have previously been subject to the Alternative Minimum Tax (AMT), a tax system designed to ensure that individuals who benefit from certain exclusions, deductions, or credits pay at least a minimum amount of tax. By correctly filling out form 8801, taxpayers can determine if they are eligible for a credit in future years, essentially allowing them to recover some of the taxes they paid under the AMT. This process involves a detailed calculation that considers various aspects of one’s income and taxes over the years. Understanding and utilizing form 8801 can provide a measure of relief and financial planning advantage to those who have navigated the complexities of the AMT, ensuring that they do not pay more than what is fair across different tax years.

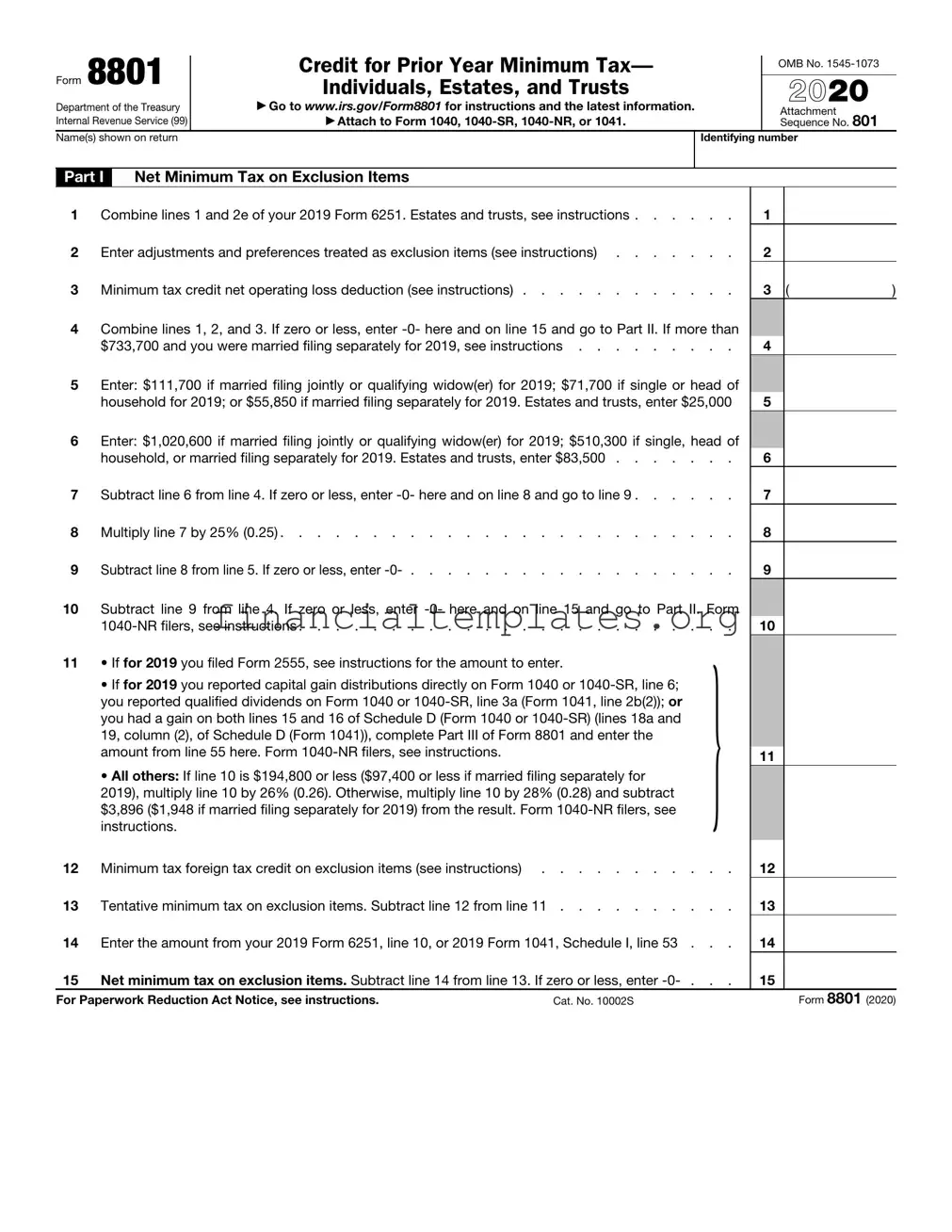

IRS 8801 Example

Form 8801 |

Credit for Prior Year Minimum Tax— |

|

|

|

OMB No. |

||||||

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|||

|

|

|

Individuals, Estates, and Trusts |

|

|

|

|

|

|

||

|

|

|

|

|

|

2021 |

|||||

Department of the Treasury |

▶ Go to www.irs.gov/Form8801 for instructions and the latest information. |

|

|

|

|||||||

Internal Revenue Service (99) |

▶ Attach to Form 1040, |

|

|

|

Attachment |

801 |

|||||

|

|

|

Sequence No. |

||||||||

Name(s) shown on return |

|

|

|

Identifying number |

|

||||||

|

|

|

|

|

|

|

|

|

|

||

Part I |

Net Minimum Tax on Exclusion Items |

|

|

|

|

|

|

|

|

||

1 |

Combine lines 1 and 2e of your 2020 Form 6251. Estates and trusts, see instructions . . . . |

. . |

1 |

|

|

|

|||||

2 |

Enter adjustments and preferences treated as exclusion items (see instructions) |

. . |

2 |

|

|

|

|||||

3 |

Minimum tax credit net operating loss deduction (see instructions) |

. . |

3 |

|

( |

) |

|||||

4 |

Combine lines 1, 2, and 3. If zero or less, enter |

|

|

|

|

|

|||||

|

$745,200 and you were married filing separately for 2020, see instructions |

. . |

4 |

|

|

|

|||||

5 |

Enter: $113,400 if married filing jointly or qualifying widow(er) for 2020; $72,900 if single or head of |

|

|

|

|

|

|||||

|

household for 2020; or $56,700 if married filing separately for 2020. Estates and trusts, enter $25,400 |

5 |

|

|

|

||||||

6 |

Enter: $1,036,800 if married filing jointly or qualifying widow(er) for 2020; $518,400 if single, head of |

|

|

|

|

|

|||||

|

household, or married filing separately for 2020. Estates and trusts, enter $84,800 |

. . |

6 |

|

|

|

|||||

7 |

Subtract line 6 from line 4. If zero or less, enter |

. . |

7 |

|

|

|

|||||

8 |

Multiply line 7 by 25% (0.25) |

. . |

8 |

|

|

|

|||||

9 |

Subtract line 8 from line 5. If zero or less, enter |

. . |

9 |

|

|

|

|||||

10 |

Subtract line 9 from line 4. If zero or less, enter |

|

|

|

|

|

|||||

|

. . |

10 |

|

|

|

||||||

11 |

• If for 2020 you filed Form 2555, see instructions for the amount to enter. |

} |

|

|

|

|

|

||||

|

|

|

|

|

|||||||

|

• If for 2020 you reported capital gain distributions directly on Form 1040, |

|

|

|

|

|

|||||

|

|

|

|

|

|

||||||

|

3a (Form 1041, line 2b(2)); or you had a gain on both lines 15 and 16 of Schedule D (Form |

|

|

|

|

|

|||||

|

1040) (lines 18a and 19, column (2), of Schedule D (Form 1041)), complete Part III of Form |

11 |

|

|

|

||||||

|

8801 and enter the amount from line 55 here. |

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

||||

|

• All others: If line 10 is $197,900 or less ($98,950 or less if married filing separately for |

|

|

|

|

|

|||||

|

2020), multiply line 10 by 26% (0.26). Otherwise, multiply line 10 by 28% (0.28) and subtract |

|

|

|

|

|

|||||

|

$3,958 ($1,979 if married filing separately for 2020) from the result. |

|

|

|

|

|

|

|

|||

12 |

Minimum tax foreign tax credit on exclusion items (see instructions) |

. . |

12 |

|

|

|

|||||

13 |

Tentative minimum tax on exclusion items. Subtract line 12 from line 11 |

. . |

13 |

|

|

|

|||||

14 |

Enter the amount from your 2020 Form 6251, line 10, or 2020 Form 1041, Schedule I, line 53 . |

. . |

14 |

|

|

|

|||||

15 |

Net minimum tax on exclusion items. Subtract line 14 from line 13. If zero or less, enter |

. . |

15 |

|

|

|

|||||

For Paperwork Reduction Act Notice, see instructions. |

Cat. No. 10002S |

|

|

|

|

Form 8801 (2021) |

|||||

Form 8801 (2021) |

Page 2 |

||

Part II |

Minimum Tax Credit and Carryforward to 2022 |

|

|

16 |

Enter the amount from your 2020 Form 6251, line 11, or 2020 Form 1041, Schedule I, line 54 . . . |

16 |

|

17 |

Enter the amount from line 15 |

17 |

|

18 |

Subtract line 17 from line 16. If less than zero, enter as a negative amount |

18 |

|

19 |

2020 credit carryforward. Enter the amount from your 2020 Form 8801, line 26 |

19 |

|

20 |

Enter your 2020 unallowed qualified electric vehicle credit (see instructions) |

20 |

|

21 |

Combine lines 18 through 20. If zero or less, stop here and see the instructions |

21 |

|

22 |

Enter your 2021 regular income tax liability minus allowable credits (see instructions) |

22 |

|

23 |

Enter the amount from your 2021 Form 6251, line 9, or 2021 Form 1041, Schedule I, line 52 . . . . |

23 |

|

24 |

Subtract line 23 from line 22. If zero or less, enter |

24 |

|

25Minimum tax credit. Enter the smaller of line 21 or line 24. Also enter this amount on your 2021

Schedule 3 (Form 1040), line 6b; or Form 1041, Schedule G, line 2c |

25 |

26Credit carryforward to 2022. Subtract line 25 from line 21. Keep a record of this amount because

you may use it in future years |

26 |

Form 8801 (2021)

Form 8801 (2021) |

Page 3 |

Part III Tax Computation Using Maximum Capital Gains Rates

Complete Part III only if you are required to do so by line 11 or by the Foreign Earned Income Tax Worksheet in the instructions.

Caution: If you didn’t complete the 2020 Qualified Dividends and Capital Gain Tax Worksheet, the 2020 Schedule D Tax Worksheet, or Part V of the 2020 Schedule D (Form 1041), see the instructions before completing this part.*

27Enter the amount from Form 8801, line 10. If you filed Form 2555 for 2020, enter the amount from line

3 of the Foreign Earned Income Tax Worksheet in the instructions . . . . . . . . . . . .

Caution: If for 2020 you filed Form 1041 or 2555, see the instructions before completing lines 28, 29, and 30.

28Enter the amount from line 4 of your 2020 Qualified Dividends and Capital Gain Tax Worksheet, the amount from line 13 of your 2020 Schedule D Tax Worksheet, or the amount from line 26 of the 2020

Schedule D (Form 1041), whichever applies (as refigured for the AMT, if necessary)* . . . . . .

If you figured your 2020 tax using the 2020 Qualified Dividends and Capital Gain Tax Worksheet, skip line 29 and enter the amount from line 28 on line 30. Otherwise, go to line 29.

29Enter the amount from line 19 of your 2020 Schedule D (Form 1040), or line 18b, column (2), of the

2020 Schedule D (Form 1041) . . . . . . . . . . . . . . . . . . . . . . . .

30Add lines 28 and 29, and enter the smaller of that result or the amount from line 10 of your 2020

Schedule D Tax Worksheet . . . . . . . . . . . . . . . . . . . . . . . . .

31 |

Enter the smaller of line 27 or line 30 |

32 |

Subtract line 31 from line 27 |

33If line 32 is $197,900 or less ($98,950 or less if married filing separately for 2020), multiply line 32 by 26% (0.26). Otherwise, multiply line 32 by 28% (0.28) and subtract $3,958 ($1,979 if married filing

|

separately for 2020) from the result |

. . . . . . . . ▶ |

|

34 |

Enter: |

} |

|

|

• $80,000 if married filing jointly or qualifying widow(er) for 2020, |

. . . . . . . |

|

|

• $40,000 if single or married filing separately for 2020, |

||

|

• $53,600 if head of household for 2020, or |

|

|

• $2,650 for an estate or trust.

35Enter the amount from line 5 of your 2020 Qualified Dividends and Capital Gain Tax Worksheet, the

|

amount from line 14 of your 2020 Schedule D Tax Worksheet, or the amount from line 27 of the 2020 |

||

|

Schedule D (Form 1041), whichever applies. If you didn’t complete either worksheet or Part V of the 2020 |

||

|

Schedule D (Form 1041), enter the amount from your 2020 Form 1040, |

||

|

2020 Form 1041, line 23, whichever applies; if zero or less, enter |

||

36 |

Subtract line 35 from line 34. If zero or less, enter |

||

37 |

Enter the smaller of line 27 or line 28 |

||

38 |

Enter the smaller of line 36 or line 37 |

||

39 |

Subtract line 38 from line 37 |

||

40 |

Enter: |

} |

|

|

• $441,450 if single for 2020, |

|

|

|

• $248,300 if married filing separately for 2020, |

|

|

|

• $496,600 if married filing jointly or qualifying widow(er) for 2020, |

. . . . . . . |

|

|

• $469,050 if head of household for 2020, or |

|

|

41 |

• $13,150 for an estate or trust. |

|

|

Enter the amount from line 36 |

|||

42Form 1040,

Schedule D (Form 1041), enter the amount from your 2020 Form 1041, line 23; if zero or less, enter

. |

. |

. |

. |

. |

. |

. |

. |

. |

. |

. |

. |

. |

. |

. |

. |

. |

. |

. |

. |

. |

. |

. |

. |

. |

. |

. |

. |

. |

. |

. |

. |

27

28

29

30

31

32

33

34

35

36

37

38

39

40

41

42

*The 2020 Qualified Dividends and Capital Gain Tax Worksheet is in the 2020 Instructions for Forms 1040 and

Form 8801 (2021)

Form 8801 (2021) |

|

|

|

|

|

Page 4 |

|||

Part III |

|

Tax Computation Using Maximum Capital Gains Rates (continued) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

43 |

Add lines 41 and 42 |

|

43 |

|

|||||

44 |

Subtract line 43 from line 40. If zero or less, enter |

|

44 |

|

|||||

45 |

Enter the smaller of line 39 or line 44 |

|

45 |

|

|||||

46 |

Multiply line 45 by 15% (0.15) |

. |

. |

. ▶ |

|

46 |

|

||

47 |

Add lines 38 and 45 |

|

47 |

|

|||||

|

If lines 47 and 27 are the same, skip lines 48 through 52 and go to line 53. Otherwise, go to line |

|

|

||||||

|

48. |

|

|

|

|

|

|

|

|

48 |

Subtract line 47 from line 37 |

48 |

|

||||||

49 |

Multiply line 48 by 20% (0.20) |

. |

. |

. ▶ |

|

49 |

|

||

|

If line 29 is zero or blank, skip lines 50 through 52 and go to line 53. Otherwise, go to line 50. |

|

|

||||||

50 |

Add lines 32, 47, and 48 |

|

50 |

|

|||||

51 |

Subtract line 50 from line 27 |

51 |

|

||||||

52 |

Multiply line 51 by 25% (0.25) |

. |

. |

. ▶ |

|

52 |

|

||

53 |

Add lines 33, 46, 49, and 52 |

53 |

|

||||||

54If line 27 is $197,900 or less ($98,950 or less if married filing separately for 2020), multiply line 27 by 26% (0.26). Otherwise, multiply line 27 by 28% (0.28) and subtract $3,958 ($1,979 if married filing

separately for 2020) from the result |

54 |

55Enter the smaller of line 53 or line 54 here and on line 11. If you filed Form 2555 for 2020, don’t enter this amount on line 11. Instead, enter it on line 4 of the Foreign Earned Income Tax Worksheet in the

instructions for line 11 |

. . . . . . . . . . . . . . . . . . . . . . . . . . |

55 |

Form 8801 (2021)

Document Specifics

| Fact | Description |

|---|---|

| Name of Form | IRS Form 8801 |

| Purpose | Used to calculate the minimum tax for individuals, estates, and trusts from prior years and potential credit for the current year. |

| Who Needs to File | Individuals, estates, and trusts who have to calculate their alternative minimum tax (AMT) credit from a prior year. |

| When to File | Filed with the taxpayer's annual income tax return. |

| Related Forms | Often associated with Form 6251 (Alternative Minimum Tax). |

| Availability | Available for download from the official IRS website or through tax preparation software. |

| Significance of Filing | Filing this form helps taxpayers to possibly reduce their future taxes through the AMT credit. |

| State-Specific Versions | Several states may require a different or additional form to be filed. Governed by state-specific tax law. |

Guide to Writing IRS 8801

After completing your annual tax return, you might find yourself in a situation where you need to adjust your credit for the minimum tax for prior years. This is where Form 8801 comes into play. Used correctly, it can provide significant tax benefits for those who have previously paid the Alternative Minimum Tax (AMT) or who have carryforward credits. The process of filling out Form 8801 can be intricate, requiring close attention to your previous year's tax details and calculations for the current year. Here are the steps to guide you through the process efficiently.

- Gather your necessary documents, including your tax return from the previous year, specifically looking for any AMT paid or credit carryforwards to this year.

- Begin with Part I of the form to calculate your current year's minimum tax credit and any carryforward to next year. This part requires information about your AMT from previous years, if applicable.

- Move to Part II, which is where you calculate the AMT for the current year. This section relies heavily on adjustments and preferences from your current year's tax situation.

- In Part III, if applicable, calculate the refundable portion of the prior year minimum tax credit. Not everyone will need to complete this part, as it depends on specific eligibility criteria such as income level.

- Part IV is for the actual calculation of the credit that you carry forward to the next year. This step involves subtracting the credit used this year from the total credit available.

- After filling out the necessary parts, review the form carefully. Mistakes in calculation or overlooked carryforwards can significantly impact the accuracy of your tax obligations.

- Attach Form 8801 to your current year's tax return if you’ve calculated a credit that affects this year's tax. Even if it doesn't affect this year's taxes, keep a completed copy for your records, as it may impact future tax returns.

Completing the IRS Form 8801 requires careful attention to detail and a good understanding of your tax history, particularly regarding the Alternative Minimum Tax. Given the potential complexity, some might find it helpful to seek advice from a tax professional to ensure accuracy and maximize potential credits. Nonetheless, by meticulously following these steps, individuals can navigate through the process, ensuring they claim any credits they're entitled to and setting themselves up for potential tax benefits in future years.

Understanding IRS 8801

-

What is the IRS 8801 Form?

The IRS 8801 Form, also known as the Credit for Prior Year Minimum Tax - Individuals, Estates, and Trusts, is designed for taxpayers to calculate and claim a credit. This credit is for certain taxes paid in prior years and is applicable to both individuals and entities like estates and trusts.

-

Who needs to file Form 8801?

Form 8801 should be filed by taxpayers who have a minimum tax credit carryforward from the previous year. This includes individuals, estates, and trusts that were subject to the alternative minimum tax (AMT) or had certain allowable credits reduced because of the AMT in prior years.

-

When is Form 8801 due?

The due date for Form 8801 coincides with your tax return filing deadline. For individuals, this is usually April 15 of the year following the tax year. If you file an extension for your tax return, the due date for filing Form 8801 extends accordingly.

-

How do I calculate the credit on Form 8801?

The calculation process involves determining the minimum tax credit available from the previous year and applying it against your current year tax liability. This involves a detailed calculation that considers the alternative minimum tax paid in prior years and any credits that were limited due to the AMT.

It is advisable to use IRS instructions or consult with a tax professional to accurately complete this form.

-

Can Form 8801 be filed electronically?

Yes, Form 8801 can be filed electronically. Most modern tax software supports the e-filing of this form, alongside your standard tax return. Electronic filing is encouraged for faster processing and more secure submission.

-

What documents do I need to file Form 8801?

To file Form 8801, you will need your tax return from the previous year, particularly if you paid alternative minimum tax or had certain credits reduced by the AMT. You may also need information on any income adjustments or tax preferences from that year.

-

Can I carry forward the credit from Form 8801 to future years?

Yes, if the credit calculated on Form 8801 is not fully utilized in the current tax year, the unused portion can be carried forward to future years. There is no expiration on the credit carryforward.

-

What happens if I make a mistake on Form 8801?

If you discover an error on a filed Form 8801, you should file an amended return as soon as possible. Use Form 1040-X for individuals or the appropriate amended return form for estates and trusts, attaching a corrected Form 8801. This will help you avoid potential penalties and ensure you receive the correct credit amount.

-

Where can I get help with filing Form 8801?

Assistance with filing Form 8801 can be obtained from a tax professional, the IRS's official website, or tax preparation software. A tax advisor or preparer can provide personalized guidance based on your specific tax situation.

Common mistakes

Filling out the IRS 8801 form, which pertains to the credit for prior year minimum tax—individuals, estates, and trusts, can be daunting. Common mistakes often occur, which could potentially lead to delays or errors in processing. Awareness and avoidance of these mistakes can significantly streamline the process. Here are five typical errors:

Not Checking Eligibility: Many filers skip the crucial step of verifying whether they are eligible for the credit. This form is specific to those who have had to pay alternative minimum tax (AMT) in prior years and might have a credit to claim against their regular tax this year. Overlooking eligibility can lead to unnecessary complications.

Incorrect Carryforward Information: A common mistake is incorrectly reporting the credit carryforward from a previous year. This figure is essential, as it impacts the amount available for the current year's credit. Ensuring accuracy in these numbers can prevent discrepancies that might trigger reviews or audits.

Failing to Attach Required Forms: The IRS often requires additional forms or documents to process the 8801 form properly. Forgetting to attach necessary documentation, such as a copy of your AMT calculation from the prior year, can result in processing delays or denials of the claimed credit.

Miscalculating the Credit: The calculation of the AMT credit can be complex, involving various inputs and considerations from previous tax years. Errors in this computation are common and can lead to underclaiming or overclaiming the credit, potentially leading to issues with the IRS.

Omitting Required Personal Information: Even with all calculations correctly done, simply forgetting to include necessary personal information, such as Social Security Number or address, can stall the process. The IRS requires complete and accurate information to process any form, and any omissions can lead to significant delays.

Avoiding these mistakes requires careful review and adherence to the IRS instructions for the 8801 form. In many cases, consulting with a tax professional can help ensure accuracy and compliance, reducing the likelihood of errors and the potential for processing delays.

Documents used along the form

When individuals embark on filing their taxes, especially those navigating the complexities of tax credits and minimum tax considerations, the IRS 8801 form becomes a focal point. This form, Credit for Prior Year Minimum Tax—Individuals, Estates, and Trusts, is instrumental for those aiming to carry forward unused minimum tax credits from previous years. However, completing it requires several other forms and documents for accurate computation and proper filing. Below is a compilation of essential forms and documents that are often used in conjunction with the IRS 8801 form to ensure a comprehensive and compliant tax filing process.

- Form 1040: The U.S. Individual Income Tax Return is the starting point for most taxpayers. It provides the essential information about an individual's income, tax deductions, and credits, which are necessary to calculate the current year's tax liability and potential carryforward credits.

- Form 6251: Alternative Minimum Tax—Individuals. This form is critical for determining the amount of alternative minimum tax (AMT) an individual may owe. The results from Form 6251 directly impact the calculations on Form 8801.

- Form 1041: U.S. Income Tax Return for Estates and Trusts. For estates and trusts required to file Form 8801, Form 1041 provides the necessary income and tax information relevant to these entities.

- Form 1099: This is a series of documents that report various types of income from non-employment related sources, such as dividends, interest, and freelance income. These forms help in determining the total income that could be subject to AMT and affect calculations on Form 8801.

- Schedule D: Capital Gains and Losses. This schedule is used to report the sale or exchange of capital assets. Since capital gains may impact AMT calculations, this information is vital for accurate Form 8801 submissions.

- Schedule A: Itemized Deductions. For individuals who itemize deductions instead of taking the standard deduction, Schedule A details allowable deductions that can affect AMT calculations and the potential for carryforward credits.

- Schedule J: Form 1041 — Accumulation Distribution for Certain Complex Trusts. For trusts filing Form 8801, Schedule J can provide necessary information related to distributions, which may influence the trust's tax calculations.

- Schedule K-1: The document reports a beneficiary's share of an estate's or trust's income, deductions, credits, etc. For individuals reporting income from estates or trusts, this form affects taxable income and potentially the calculations for AMT and the credit carried forward on Form 8801.

Accurately leveraging these forms and documents in tandem with Form 8801 requires attention to detail and a thorough understanding of tax laws and guidelines. Each document plays a crucial role in informing the taxpayer’s current liabilities, possible deductions, and the amount of credit that can be carried over to subsequent years. Together, they form an intricate tapestry that captures the entirety of an individual’s, estate's, or trust's fiscal situation, ensuring compliance and maximizing the benefits of tax credits and deductions. Navigating this process effectively helps in optimizing one’s tax responsibilities and planning strategically for future tax periods.

Similar forms

The IRS 1040 form, commonly known as the U.S. Individual Income Tax Return, shares similarities with the IRS 8801 form in terms of its function in tax reporting. Both forms are pivotal for taxpayers in calculating their income tax, but while the 1040 form is used to report income and calculate taxes owed, the 8801 form focuses on calculating the minimum tax for individuals who have to consider alternative minimum tax (AMT) from prior years.

Form 6251, the Alternative Minimum Tax—Individuals, is closely related to the 8801 form as it helps determine the amount of AMT a taxpayer owes. The connection lies in the AMT calculations, where the 6251 form calculates the current year's AMT, and the 8801 form is utilized for carrying forward AMT credits not utilized in the current year to future tax years.

The IRS Schedule D (Form 1040) is a document used for reporting capital gains and losses from investments, which can impact the calculations on Form 8801. Capital gains and losses can significantly affect a taxpayer's regular and alternative minimum tax calculations, making the interplay between Schedule D and Form 8801 crucial for accurate tax calculation and reporting.

Form 1116, Foreign Tax Credit, shares a connection with Form 8801 as it involves the application of tax credits. While Form 1116 is used by taxpayers to claim a credit for foreign taxes paid, Form 8801 allows for the carryforward of unused minimum tax credits. Both forms work within the tax credit framework, enabling taxpayers to reduce their tax liability through credits.

Form 8863, Education Credits (American Opportunity and Lifetime Learning Credits), is similar to IRS 8801 in its provision for tax credits. Form 8863 allows taxpayers to claim education-related credits, potentially impacting a taxpayer's overall tax situation and interacting with the AMT considerations in Form 8801.

The IRS 8582 form, which focuses on Passive Activity Loss Limitations, has relevance to the 8801 form through its impact on a taxpayer’s adjusted gross income. Adjustments to income through passive activity loss limitations can influence AMT calculations and, consequently, the determination of unused minimum tax credits on Form 8801.

Form 5329, Additional Taxes on Qualified Plans (Including IRAs) and Other Tax-Favored Accounts, is connected to Form 8801 through its impact on a taxpayer’s tax liability. The additional taxes calculated on Form 5329 can affect a taxpayer's overall tax burden, potentially interacting with the AMT and the credit carryforward calculations on Form 8801.

IRS Form 5695, Residential Energy Credits, offers taxpayers the chance to claim credits for specific energy-efficient home improvements, similarly to how Form 8801 deals with tax credits. The completion of Form 5695 can directly influence the taxpayer’s liability and the calculation of potential AMT credits on Form 8801, particularly as these energy credits can reduce the total tax owed.

Form 4562, Depreciation and Amortization, plays a part in determining the taxable income, much like Form 8801 does in the context of AMT credit calculations. The depreciation and amortization figures filled out on Form 4562 can affect a taxpayer’s income and, subsequently, their AMT calculations and credit eligibility on Form 8801.

Lastly, Form 1041, U.S. Income Tax Return for Estates and Trusts, although primarily used by entities rather than individuals, intersects with Form 8801 through its contribution to determining eligible AMT credits. Beneficiaries of estates and trusts who receive income that has been subject to the alternative minimum tax may find relevance in Form 8801 for carrying forward any unused AMT credits.

Dos and Don'ts

Filing IRS Form 8801, which relates to the Credit for Prior Year Minimum Tax for individuals, estates, and trusts, can be a complex process. To ensure accuracy and compliance with the Internal Revenue Service (IRS) regulations, here are some recommended dos and don'ts:

Do:

- Review your prior year tax return. Confirm if you were subject to the Alternative Minimum Tax (AMT) in the previous year. This will help determine your eligibility for the credit.

- Keep accurate records. Documentation of your income, deductions, and credits is crucial, especially if you need to refer back to these details for completing Form 8801 accurately.

- Understand carryforward rules. If your credit amount exceeds your tax liability, know how you can carry forward the unused portion to future years.

- Seek professional advice when needed. Given the complexity of tax laws, consulting with a tax professional can provide clarity and ensure that your form is completed correctly.

Don't:

- Ignore instructions. The IRS provides detailed instructions for Form 8801. Failing to follow these can result in errors that may lead to delays or an audit.

- Estimate amounts. Guessing or estimating figures can lead to inaccuracies on your form. Always use exact amounts based on your financial records.

- Overlook carryback benefits. In some instances, the AMT credit can be carried back to previous tax years, not just carried forward. This opportunity should not be ignored without proper consideration.

- Submit without reviewing. Always double-check your calculations and the information you provide on the form to ensure everything is accurate and complete. Mistakes can cause unnecessary delays in processing.

Misconceptions

When it comes to understanding IRS forms, it's easy to get overwhelmed or misinformed. The IRS 8801 form, which relates to the calculation of the credit for prior year minimum tax for individuals, estates, and trusts, is no exception. Here are some misconceptions about it:

- Only for High-Income Earners: Many believe the IRS 8801 is solely for individuals with high incomes. However, it applies to any taxpayer who has paid alternative minimum tax (AMT) in a prior year and may be eligible for a credit in the current year.

- It's a One-Time Form: Some think you only need to file form 8801 once. The truth is, you should file it any year you want to claim the credit for prior year minimum tax, as long as it's applicable.

- Too Complicated to File Without a Professional: While the form can be complex, individuals with a good understanding of their financial situation and tax software can successfully complete it without professional help.

- No Impact on Returns: Another misconception is that the form doesn't affect tax returns significantly. For those eligible, it can lower the overall tax liability, making a substantial difference.

- Only Applies to Individuals: Although targeted primarily at individuals, the form also pertains to estates and trusts, expanding its applicability.

- Electronic Filing Isn't an Option: Many are under the impression that IRS 8801 must be filed on paper. However, it can be filed electronically, which is convenient and faster.

- Only Affects Current Year Taxes: The credit can actually be carried forward to future years if not fully utilized in the current year, contrasting the belief that it only impacts taxes for the filing year.

- Separate Filing for Each Year’s AMT Credit: This is partially true. You need to calculate the credit each year, but the form itself encompasses the calculation to carry over unused credits, not just for one year.

- It's Identical to Form 6251: Some confuse it with Form 6251, which is used to calculate AMT for the current year. Form 8801, on the other hand, is used to calculate the credit for prior year minimum tax.

Understanding these misconceptions about IRS Form 8801 can help taxpayers effectively claim eligible credits, potentially saving money and avoiding unnecessary filing mistakes.

Key takeaways

The IRS Form 8801, Credit for Prior Year Minimum Tax - Individuals, Estates, and Trusts, plays a crucial role in the tax filing process for those who seek to claim a credit for alternative minimum tax (AMT) paid in the previous years. Understanding the key aspects of this form can significantly impact your ability to utilize it effectively. Here are seven key takeaways to remember when dealing with Form 8801:

- Objective of Form 8801: It allows individuals, estates, and trusts to compute a credit for certain taxes paid in prior years. This credit can then be applied against your current year's income tax liability.

- Eligibility Criteria: To use Form 8801, you must have paid AMT in a prior year or have a carryforward of a minimum tax credit. Remember, not everyone who paid AMT qualifies to use this form.

- Calculation of Credit: The form assesses how much of the AMT paid in previous years can be credited against your current tax liabilities. This requires understanding how prior year's AMT calculations impact present financial obligations.

- Documentation: Keep detailed records. Proper documentation is imperative to justify the AMT payments that qualify for credit, including the original tax returns and calculations from those years.

- Timing Issues: Consider the timing of your credit claim. While the form can help recoup prior year's AMT, it's essential to apply it correctly within the allowed timeframe to optimize tax benefits.

- Impact on Tax Returns: Filing Form 8801 can potentially reduce your current year's tax liability, possibly leading to lower taxes owed or increased refunds.

- Professional Guidance Recommended: Given its complexity, seeking assistance from a tax professional who understands the nuances of AMT and Form 8801 is advisable. They can help navigate the specifics, ensuring accuracy and optimizing potential credits.

Navigating Form 8801 demands attention to detail and an understanding of how AMT payments from previous years affect your current and future tax situation. With these takeaways in mind, you can better manage this aspect of your tax planning strategy, ensuring you claim the maximum credit available to you.

Popular PDF Documents

Sample T4 - It details contributions to the Canada Pension Plan (CPP) or Quebec Pension Plan (QPP).

House Tax Form - Understand how to report personal property you own but is used in your business, including fully depreciated items.