Get IRS 8655 Form

For individuals and businesses seeking to navigate the complexities of tax-related matters, understanding the significance of IRS Form 8655 is paramount. This crucial document serves as a Reporting Agent Authorization, enabling designated agents to perform specific acts on behalf of taxpayers. These acts can range from filing returns to making payments, and even responding to IRS notices. Gaining clarity on the scope of authority granted via this form, the prerequisites for using it, and the specific procedures for its submission and implementation becomes indispensable. The role of authorized agents and the limitations of their powers are also critical aspects covered by Form 8655. By delving into these dimensions, the form emerges as a key tool in streamlining tax reporting and payment processes, ensuring that businesses and individuals comply effectively with tax obligations while leveraging the expertise of authorized representatives.

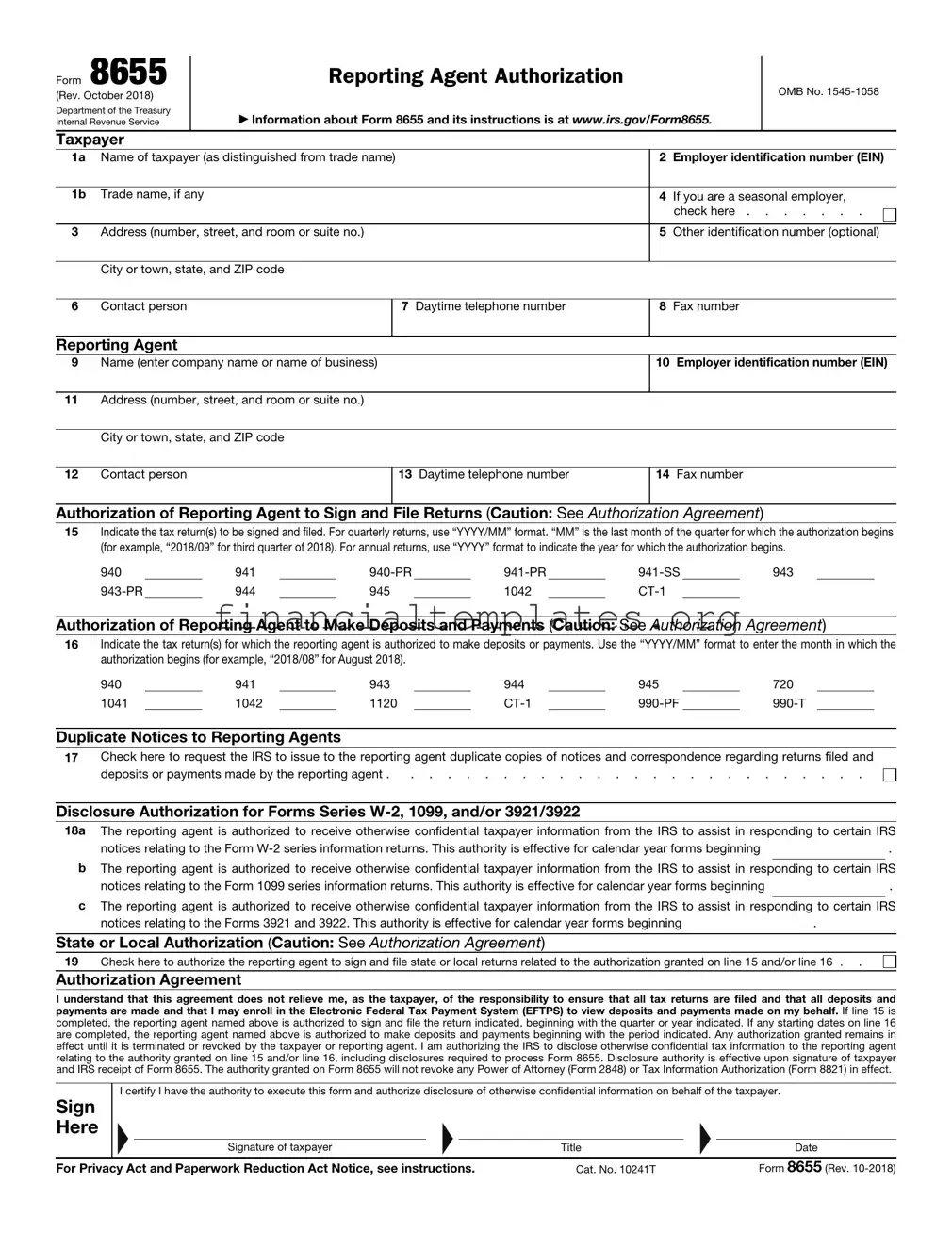

IRS 8655 Example

Form 8655 (Rev. October 2018)

Department of the Treasury Internal Revenue Service

Taxpayer

Reporting Agent Authorization

▶Information about Form 8655 and its instructions is at www.irs.gov/Form8655.

OMB No.

1a |

Name of taxpayer (as distinguished from trade name) |

2 |

Employer identification number (EIN) |

|

|

|

|

1b |

Trade name, if any |

4 |

If you are a seasonal employer, |

|

|

|

check here |

|

|

|

|

3 |

Address (number, street, and room or suite no.) |

5 |

Other identification number (optional) |

|

|

|

|

|

City or town, state, and ZIP code |

|

|

6Contact person

Reporting Agent

7Daytime telephone number

8Fax number

9 Name (enter company name or name of business) |

10 Employer identification number (EIN) |

11Address (number, street, and room or suite no.)

City or town, state, and ZIP code

12 |

Contact person |

13 Daytime telephone number |

14 Fax number |

Authorization of Reporting Agent to Sign and File Returns (Caution: See Authorization Agreement)

15Indicate the tax return(s) to be signed and filed. For quarterly returns, use “YYYY/MM” format. “MM” is the last month of the quarter for which the authorization begins (for example, “2018/09” for third quarter of 2018). For annual returns, use “YYYY” format to indicate the year for which the authorization begins.

940 |

|

941 |

|

|

|

|

943 |

|||

|

944 |

|

945 |

|

1042 |

|

|

|

Authorization of Reporting Agent to Make Deposits and Payments (Caution: See Authorization Agreement)

16Indicate the tax return(s) for which the reporting agent is authorized to make deposits or payments. Use the “YYYY/MM” format to enter the month in which the authorization begins (for example, “2018/08” for August 2018).

940 |

|

941 |

|

943 |

|

944 |

|

945 |

|

720 |

1041 |

|

1042 |

|

1120 |

|

|

|

Duplicate Notices to Reporting Agents

17Check here to request the IRS to issue to the reporting agent duplicate copies of notices and correspondence regarding returns filed and

deposits or payments made by the reporting agent . . . . . . . . . . . . . . . . . . . . . . . . . .

Disclosure Authorization for Forms Series

18a The reporting agent is authorized to receive otherwise confidential taxpayer information from the IRS to assist in responding to certain IRS

notices relating to the Form |

. |

bThe reporting agent is authorized to receive otherwise confidential taxpayer information from the IRS to assist in responding to certain IRS

notices relating to the Form 1099 series information returns. This authority is effective for calendar year forms beginning |

. |

cThe reporting agent is authorized to receive otherwise confidential taxpayer information from the IRS to assist in responding to certain IRS

notices relating to the Forms 3921 and 3922. This authority is effective for calendar year forms beginning |

. |

State or Local Authorization (Caution: See Authorization Agreement)

19 Check here to authorize the reporting agent to sign and file state or local returns related to the authorization granted on line 15 and/or line 16 . .

Authorization Agreement

I understand that this agreement does not relieve me, as the taxpayer, of the responsibility to ensure that all tax returns are filed and that all deposits and payments are made and that I may enroll in the Electronic Federal Tax Payment System (EFTPS) to view deposits and payments made on my behalf. If line 15 is completed, the reporting agent named above is authorized to sign and file the return indicated, beginning with the quarter or year indicated. If any starting dates on line 16 are completed, the reporting agent named above is authorized to make deposits and payments beginning with the period indicated. Any authorization granted remains in effect until it is terminated or revoked by the taxpayer or reporting agent. I am authorizing the IRS to disclose otherwise confidential tax information to the reporting agent relating to the authority granted on line 15 and/or line 16, including disclosures required to process Form 8655. Disclosure authority is effective upon signature of taxpayer and IRS receipt of Form 8655. The authority granted on Form 8655 will not revoke any Power of Attorney (Form 2848) or Tax Information Authorization (Form 8821) in effect.

I certify I have the authority to execute this form and authorize disclosure of otherwise confidential information on behalf of the taxpayer.

Sign |

|

|

|

|

|

|

Here ▶ |

|

▶ |

|

|

▶ |

|

Signature of taxpayer |

|

Title |

Date |

|||

For Privacy Act and Paperwork Reduction Act Notice, see instructions. |

Cat. No. 10241T |

|

Form 8655 (Rev. |

|||

Form 8655 (Rev. |

Page 2 |

Instructions

What’s New

Fax number. The fax number for Form 8655 is changed to

Updated instructions for lines 15 and 16. The instructions for lines 15 and 16 have been clarified and now appear at the lines themselves. Please use the “YYYY/MM” format instead of the “MM/YYYY” format.

Former line 17a removed. The authorization agreement at the bottom of the form provides the disclosure authority previously covered by line 17a.

Increasing or decreasing authority. The instructions with regard to increasing or decreasing authority have been clarified. See Authority Granted.

Termination and Revocation. The instructions have been updated to distinguish between these terms and to explain the procedure for each. See Terminating or Revoking an Authorization.

Purpose of Form

Use Form 8655 to authorize a reporting agent to:

•Sign and file certain returns. Reporting agents must file returns electronically except as provided under Rev. Proc.

•Make deposits and payments for certain returns. Reporting agents must make deposits and payments electronically, generally through the Electronic Federal Tax Payment System (EFTPS.gov). See Pub. 4169, Tax Professional Guide to EFTPS, and Rev. Proc.

•Receive duplicate copies of tax information, notices, and other written and/ or electronic communication regarding any authority granted; and

•Provide IRS with information to aid in penalty relief determinations related to the authority granted on Form 8655.

Note. An authorization does not relieve the taxpayer of the responsibility (or from liability for failing) to ensure that all tax returns are filed timely and that all federal tax deposits (FTDs) and federal tax payments (FTPs) are made timely. A reporting agent must notify its client of that fact and must recommend that it enroll in the Electronic Federal Tax Payment System (EFTPS) to view EFTPS deposits and payments made on the client’s behalf. A reporting agent must provide this notification, in writing, upon entering into an agreement with the client and at least quarterly thereafter for as long as it provides services to that client. Sample language and other details may be found in Rev. Proc.

Authority Granted

Once Form 8655 is signed, any authority granted is effective beginning with the period indicated on lines 15, 16, 18a, 18b, and/or 18c and continues indefinitely unless terminated or revoked by the taxpayer or reporting agent. No authorization or authority is granted for periods prior to the period(s) indicated on Form 8655.

Where authority is granted for any form, it is also effective for related forms such as the corresponding

Disclosure authority is effective upon signature of taxpayer and IRS receipt of Form 8655. Any authority granted on Form 8655 does not revoke and has no effect on any authority granted on Forms 2848 or 8821, or any

To increase the authority granted to a reporting agent by a Form 8655 already in effect, submit another signed Form 8655, completing lines

Where To File

Send Form 8655 to:

Internal Revenue Service

Accounts Management Service Center MS 6748 RAF Team

1973 North Rulon White Blvd. Ogden, UT 84404

You can fax Form 8655 to the IRS. The number is

Additional Information

Additional information concerning reporting agent authorizations may be found in:

•Pub. 1474, Technical Specifications Guide for Reporting Agent Authorization and Federal Tax Depositors.

•Rev. Proc.

Substitute Form 8655

If you want to prepare and use a substitute Form 8655, see Pub. 1167, General Rules and Specifications for Substitute Forms and Schedules. If your substitute Form 8655 is approved, the form approval number must be printed in the lower left margin of each substitute Form 8655 you file with the IRS.

Terminating or Revoking an Authorization

If you have a valid Form 8655 on file with the IRS, the filing of a new Form 8655 indicating a new reporting agent terminates the authority of the prior reporting agent beginning with the period indicated on the new Form 8655. However, the prior reporting agent is still an authorized reporting agent and retains any previously granted disclosure authority for the periods prior to the beginning period of the new reporting agent’s authorization unless specifically revoked.

If the taxpayer wants to revoke an existing authorization, such that the reporting agent would no longer be authorized to act or receive information for previously authorized tax periods, send a copy of the previously executed Form 8655 to the IRS at the address under Where To File, above.

A reporting agent may terminate its authority by filing a statement with the IRS, either on paper or using a delete process. A reporting agent wanting to revoke its authority must submit the request in writing. The statement must be signed by the reporting agent (if filed on paper) and identify the name and address of the taxpayer and authorization(s) from which the reporting agent is withdrawing. For information on the delete process, see Pub. 1474.

Who Must Sign

Electronic signature. For guidance on optional electronic signature methods, including approved methods of authentication and signature and additional items that must appear on the Form 8655, see Pub. 1474, section 01.03.

Sole proprietorship. The individual owning the business.

Corporation (including a limited liability company (LLC) treated as a corporation). Generally, Form 8655 can be signed by: (a) an officer having legal authority to bind the corporation, (b) any person designated by the board of directors or other governing body, (c) any officer or employee on written request by any principal officer, and (d) any other person authorized to access information under section 6103(e).

Partnership (including an LLC treated as a partnership) or an unincorporated organization. Generally, Form 8655 can be signed by any person who was a member of the partnership during any part of the tax period covered by Form 8655.

Single member LLC treated as a disregarded entity. The owner of the LLC.

Trust or estate. The fiduciary.

Form 8655 (Rev. |

Page 3 |

Privacy Act and Paperwork Reduction Act Notice. We ask for the information on this form to carry out the Internal Revenue laws of the United States. Our authority to request this information is Internal Revenue Code sections 6011, 6061, 6109, and 6302 and the regulations thereunder. We use this information to identify you and record your reporting agent authorization. You are not required to authorize a reporting agent to act on your behalf. However, if you choose to authorize a reporting agent, you are required to provide the information requested, including your identification number. Failure to provide all the information requested may prevent or delay processing of your authorization; providing false or fraudulent information may subject you to penalties.

Routine uses of this information include giving it to the Department of Justice for civil and criminal litigation, and to cities, states, the District of Columbia, and U.S. commonwealths and possessions for use in administering their tax laws. We may also disclose this information to other countries under a tax treaty, to federal and state agencies to enforce federal nontax criminal laws, or to federal law enforcement agencies and intelligence agencies to combat terrorism.

You are not required to provide the information requested on a form that is subject to the Paperwork Reduction Act unless the form displays a valid OMB control number. Books or records relating to a form or instructions must be retained as long as their contents may become material in the administration of any Internal Revenue law.

The time needed to complete and file Form 8655 will vary depending on individual circumstances. The estimated average time is 1 hour, 7 minutes.

If you have comments concerning the accuracy of this time estimate or suggestions for making Form 8655 simpler, we would be happy to hear from you. You can send us comments from www.irs.gov/formspubs. Click on More Information and then click on Give us feedback. Or you can send your comments to Internal Revenue Service, Tax Forms and Publications Division, 1111 Constitution Ave. NW,

Document Specifics

| Fact Number | Fact Detail |

|---|---|

| 1 | The IRS Form 8655, also known as the Reporting Agent Authorization, is used to authorize someone to act on a taxpayer's behalf for federal tax matters. |

| 2 | This form allows designated agents to receive tax information and make payments or file returns for the entities they represent. |

| 3 | It is commonly utilized by payroll service providers that manage payroll tax duties for other businesses. |

| 4 | The authorization given through Form 8655 includes various tax forms and schedules related to employment taxes, such as Forms 940, 941, and 944. |

| 5 | By signing the form, the taxpayer allows the IRS to directly communicate with the authorized agent regarding specific tax matters outlined in the document. |

| 6 | There is no expiration date for the authorization; it remains in effect until it is revoked by the taxpayer. |

| 7 | The form must be filed with the IRS but does not require a filing fee. |

| 8 | Agents authorized through Form 8655 are also permitted to sign checks on behalf of the taxpayer, provided this action is allowed under their agreement with the taxpayer. |

| 9 | The IRS maintains strict confidentiality and privacy laws, ensuring that taxpayer information is securely shared only with authorized individuals. |

| 10 | While the IRS Form 8655 is standardized for federal use, individual states may have their own forms and requirements for authorizing representatives for state-level tax matters. |

Guide to Writing IRS 8655

Completing the IRS 8655 form is a straightforward process designed to authorize an agent to communicate with the IRS on behalf of someone else. The form is essential for individuals or businesses who prefer to delegate tax reporting duties. Accuracy and attentiveness to detail will ensure the process is completed without delay. Here is how to fill out the form:

- Start by entering the name of the taxpayer. This should be the individual or entity that is authorizing the agent.

- Next, provide the taxpayer's identification number. For individuals, this is the Social Security Number (SSN). Businesses should use their Employer Identification Number (EIN).

- Fill in the taxpayer's address, including street, city, state, and zip code.

- Specify the plan number (if applicable) for taxpayers with multiple plans.

- Indicate the tax form number that the agent is authorized to access.

- In the "Tax Information Authorization" section, detail the specific years or periods the agent has permission to access.

- Name the appointee. This is the individual or entity being authorized as the agent.

- Provide the agent's address, including street, city, state, and zip code.

- Enter the agent's phone number and the best time for the IRS to contact them, if needed.

- The taxpayer must sign and date the form, officially granting authorization. If the taxpayer is a business, the signature of an officer or individual with the authority to bind the entity is required.

Once the IRS 8655 form is completed and signed, it should be submitted to the designated address provided by the IRS or the agent's instructions. Ensuring the form is filled out accurately is critical to authorize representation correctly and to avoid any delays in processing.

Understanding IRS 8655

What is the IRS 8655 form used for?

The IRS 8655 form, known as the Reporting Agent Authorization, allows taxpayers to authorize a reporting agent to file returns and make deposits or payments for specific federal taxes. This authorization covers various tax forms and is commonly used by businesses to permit third parties to handle their tax filings.

Who can be designated as a reporting agent?

A reporting agent can be an individual, a firm, or an organization that the taxpayer authorizes to act on their behalf. This agent must be an established business with the capability to process federal tax returns and payments. Typically, they are payroll service providers or professional accountants.

Does filing IRS 8655 allow the agent to receive tax refunds or transcripts?

Filing IRS 8655 does not permit the reporting agent to receive tax refunds. However, it does allow the agent to request and receive copies of tax transcripts relevant to the authorized tax forms, provided this is specified in the authorization agreement.

How do you file the IRS 8655 form?

The completed IRS 8655 form can be mailed or faxed to the IRS. There are no provisions for electronic submission directly to the IRS, but reporting agents may retain a copy of the form and submit it through their electronic filing system when requested. Always check the latest IRS instructions for the most current filing addresses or fax numbers.

Is there a filing deadline for the IRS 8655 form?

There is no strict filing deadline for the IRS 8655 form. However, it should be submitted well in advance of any tax filing or payment deadlines to ensure that the reporting agent is authorized to act by the required dates. It’s best practice to submit the form as soon as the reporting agent is chosen.

Can the authorization be revoked?

Yes, the taxpayer can revoke the authorization at any time. This is done by sending a written statement of revocation to the IRS, specifying the date of revocation and identifying the previously authorized reporting agent. The IRS also requires a copy of the revocation to be sent to the reporting agent.

What information do you need to complete the form?

To complete the IRS 8655 form, you'll need the taxpayer's identification number (EIN for businesses), the name and address of the taxpayer, and similar identifying information for the reporting agent. Additionally, you must specify which forms and tax periods the authorization covers.

Can the form be signed electronically?

Yes, the IRS accepts electronic signatures on the 8655 form. The taxpayer or authorized representative can sign the form electronically following the IRS's guidelines for valid electronic signatures, making the process more convenient and efficient.

How long does the authorization last?

The authorization remains in effect until it is revoked by the taxpayer. There is no set expiration date for the authorization, allowing the reporting agent to continue filing and paying taxes on behalf of the taxpayer until told otherwise.

Common mistakes

Filling out IRS forms accurately is crucial for compliance with tax laws and ensuring the smooth processing of requests. The IRS 8655 form, used for Reporting Agent Authorization, is no exception. Individuals and businesses commonly make mistakes when completing this form, which can lead to delays or errors in tax processing. Understanding these common pitfalls can help avoid unnecessary complications.

Incorrect Taxpayer Identification Numbers (TINs): One of the most common errors is entering an incorrect TIN, which includes both Social Security Numbers (SSNs) and Employer Identification Numbers (EINs). Ensuring accuracy in these numbers is critical for the IRS to correctly identify the taxpayer.

Failing to Sign and Date the Form: The IRS 8655 form must be signed and dated to be valid. An overlooked signature or date can result in the form being rejected, as it indicates the taxpayer's authorization and agreement with the information provided.

Not Specifying the Tax Form Numbers: The form requires taxpayers to identify the specific tax form numbers for which the reporting agent is authorized to report. Failure to list these form numbers can lead to misunderstandings and processing delays.

Omitting Contact Information: Accurate contact information for both the taxpayer and the reporting agent is essential. This information allows the IRS to communicate effectively with the involved parties if there are any questions or issues with the submitted forms or reported taxes.

Using Outdated Forms: The IRS updates its forms periodically to reflect current laws and requirements. Submission of an outdated version of IRS 8655 can lead to rejection or the need to resubmit using the correct, updated form.

Not Checking for Accuracy: Before submission, reviewing the form for accuracy and completeness is crucial. Mistakes, such as incorrect names, addresses, or tax years, can be easily overlooked but have significant ramifications on the processing of the form.

By avoiding these common mistakes, taxpayers and their representatives can ensure smoother interactions with the IRS, facilitating more efficient tax processing and reporting. Attention to detail and a thorough review process are key strategies to successfully completing and submitting the IRS 8655 form.

Documents used along the form

When handling tax-related matters, specifically involving the IRS 8655 form which is used to authorize a reporting agent to file returns and perform other tax functions on behalf of an entity, several other forms and documents often come into play. Understanding these additional documents can streamline the tax reporting and payment process, ensuring compliance and reducing the potential for errors. Here’s a look at some of these critical forms and documents often associated with the IRS 8655 form.

- Form 8821, Tax Information Authorization - This form allows individuals or entities to authorize any individual, corporation, firm, organization, or partnership to inspect and/or receive private tax information. Unlike the IRS 8655, Form 8821 does not allow the appointee to act on behalf of the taxpayer, only to access information.

- Form 2848, Power of Attorney and Declaration of Representative - Form 2848 grants an individual or entity the power to represent a taxpayer before the IRS, including but not limited to, discussing tax matters and signing agreements, waivers, or other documents. This form goes beyond information sharing to enable representation in disputes, agreements, and negotiations with the IRS.

- Form 941, Employer’s Quarterly Federal Tax Return - Often filed by agents authorized through IRS 8655, this form reports federal income tax withheld from employees' paychecks, and is used to pay the employer's portion of Social Security and Medicare tax. It is a critical document for businesses with employees.

- Form W-2, Wage and Tax Statement - Prepared by employers, this form reports an employee's annual wages and the amount of taxes withheld from their paycheck. Reporting agents authorized by the IRS 8655 form might assist in preparing and submitting these forms for a business.

Together with the IRS 8655, these forms embody the core documents fundamental in navigating the tax responsibilities of a business or individual. Proper completion and timely submission of these forms are crucial for tax compliance, effective representation before the IRS, and the accurate reporting of wages and taxes. By familiarizing oneself with these documents, individuals and businesses can better manage their tax-related obligations and ensure smoother interactions with tax authorities.

Similar forms

The IRS Form 8655, Reporting Agent Authorization, shares similarities with several other tax-related documents in terms of function and purpose. One such document is Form 2848, Power of Attorney and Declaration of Representative. Similar to Form 8655, Form 2848 allows taxpayers to authorize an individual, such as an accountant or attorney, to represent them before the IRS. The key difference lies in the scope of authority granted; Form 2848 provides a broader range of representations including audits, appeals, and collection issues, while Form 8655 specifically authorizes reporting agents to perform acts like signing and filing certain returns.

Another related document is Form 8821, Tax Information Authorization. Like Form 8655, it permits the delegation of tasks to a third party. However, Form 8821 is used to authorize an individual or organization to inspect and/or receive confidential tax information for a specified period. It does not grant authority to act on behalf of the taxpayer, which is a fundamental function of Form 8655 where agents are authorized to act in filing and payment matters for employment taxes.

Form SS-4, Application for Employer Identification Number (EIN), also shares characteristics with Form 8655. Both forms are integral to business operations, especially concerning tax reporting and employment taxes. While Form 8655 authorizes agents to handle tax reporting duties, Form SS-4 is used by entities to apply for an EIN, which is necessary for tax filing and reporting purposes. The connection between them is the need for businesses to manage tax-related responsibilities efficiently.

Form 940, Employer’s Annual Federal Unemployment (FUTA) Tax Return, is another document related to Form 8655. Reporting agents authorized through Form 8655 often handle the preparation and filing of Form 940 on behalf of their clients. This delegation streamlines the tax filing process, allowing businesses to comply with federal unemployment tax obligations without managing the filings directly. The similarity lies in the operational aspect, where Form 8655 facilitates the agent's ability to manage employment tax requirements, including unemployment taxes.

Lastly, Form 941, Employer's Quarterly Federal Tax Return, is closely associated with Form 8655. Authorized reporting agents use Form 8655 to file Form 941 on behalf of the businesses they represent. This form is critical for reporting wages paid, tips earned by employees, and taxes withheld from their paychecks. The relationship between these documents underscores the role of authorized agents in ensuring compliance with federal tax withholdings and reporting as mandated by the IRS.

Dos and Don'ts

The IRS 8655 form, also known as the Reporting Agent Authorization, allows taxpayers to appoint an agent to act on their behalf for federal tax filing purposes. Filling out this form accurately is crucial to ensure smooth processing and avoid potential issues. Here are 10 dos and don'ts to keep in mind when completing this form:

Do:- Read the instructions carefully before you start filling out the form to understand all requirements.

- Double-check the taxpayer identification numbers (TINs), including Social Security Numbers (SSNs) or Employer Identification Numbers (EINs), to ensure they are correct.

- Ensure that the name of the taxpayer matches the name associated with the TIN provided.

- Clearly indicate the tax forms and periods for which the agent is authorized to act on your behalf.

- Sign and date the form; an electronic signature is acceptable if it meets IRS standards.

- Leave any required fields blank. Incomplete forms may lead to processing delays or rejections.

- Authorize an agent who does not meet the IRS requirements for representing taxpayers.

- Use outdated forms. Always download the latest version from the IRS website to ensure compliance with current regulations.

- Forget to notify the IRS if you wish to revoke the authorization by writing to the specific IRS address provided in the form's instructions.

- Misplace your copy of the filled-out form. Keep it in your records for at least four years after the due date of the last tax return covered by the authorization.

Misconceptions

The Internal Revenue Service (IRS) Form 8655 has its share of misconceptions that lead to confusion among taxpayers and businesses. Understanding the true purpose and use of this form is crucial for compliance with tax regulations.

It's the same as giving power of attorney. Many believe Form 8655 grants a power of attorney to the reporting agent. However, this form actually authorizes an agent to sign and file certain tax returns and make deposits or payments for these returns on behalf of the taxpayer.

It allows agents to represent the taxpayer in audits. Unlike a power of attorney, Form 8655 does not authorize agents to represent taxpayers in tax audits or hearings before the IRS.

The form is required for all businesses. This is a common misconception. Only businesses wanting to designate a reporting agent to handle their specific tax affairs need to complete this form.

It needs to be filed annually. Once filed, Form 8655 remains in effect until it is revoked. There is no need to submit a new form each year unless there is a change in the reporting agent or the information previously provided has changed.

Completing the form grants access to all tax information. The authority granted by Form 8655 is limited to the filing of specified tax forms and actions related to those filings, such as making payments. It does not provide a blanket access to all of the taxpayer's IRS information.

Any party can be designated as a reporting agent. To be designated as a reporting agent, a party must meet specific IRS requirements. Not just anyone can fulfill this role.

The form must be completed before a professional can advise on tax matters. Advisory services regarding taxes do not require the completion of Form 8655. This form solely pertains to the authority to file and pay for certain tax returns.

Electronic signatures are not accepted. Contrary to this belief, the IRS does allow electronic signatures on Form 8655, meeting specific criteria and guidelines established by the IRS.

There’s no way to revoke the authorization. If a taxpayer wishes to change reporting agents or revoke the authorization altogether, they can do so by notifying the IRS in writing. This flexibility ensures taxpayers can control who has the authority to act on their behalf.

Understanding these misconceptions about IRS Form 8655 helps taxpayers and businesses navigate their tax obligations more effectively, ensuring compliance with IRS regulations while retaining control over their financial information.

Key takeaways

The IRS 8655 form, known as the Reporting Agent Authorization, plays a crucial role for businesses that opt to have a third party manage their federal tax filings and payments. Understanding how to accurately complete and utilize this form is essential for ensuring compliance with IRS requirements. Below are four key takeaways for individuals and businesses considering the use of a reporting agent.

- Authorized Agents: The form allows businesses to authorize third parties to perform specific acts on their behalf. These acts can include signing and filing federal tax returns, making federal tax payments, and receiving copies of tax-related notices or correspondence from the IRS. Selecting a trustworthy and competent agent is critical, as they will have access to sensitive tax information.

- Filing Requirements: Accuracy is paramount when completing the IRS 8655 form. The form requires detailed information about the taxpayer and the reporting agent, including Identification numbers and contact information. All sections must be completed to ensure the IRS can process the form without delay. Incomplete forms may lead to processing delays or refusal of the authorization.

- Updating Information: It might be necessary to update or revoke the authorization given on the IRS 8655 form due to changes in the relationship with the reporting agent or business details. The IRS should be notified promptly of any changes to maintain accurate records and ensure that only authorized individuals have access to your tax information.

- Retention of Documents: After the IRS 8655 form is submitted, both the taxpayer and the reporting agent should retain copies of the form and any related correspondence from the IRS. This documentation will be critical if there are any questions or issues regarding the authorization in the future. Keeping records organized and accessible can facilitate smooth interactions with the IRS.

Popular PDF Documents

1099b What Is It - Lastly, the 1099-B includes any federally reportable transactions within the tax year, ensuring all income is accounted for.

What Is Form 8453 Used for - This form ensures that the electronic filing system works seamlessly alongside traditional paper-based documentation requirements.

Charging Sales Tax - The certification part of AU-11 ensures that the applicant acknowledges their responsibility for the accuracy of the information provided.