Get IRS 8582 Form

Dealing with passive activity losses can be a complex process for taxpayers, making the Internal Revenue Service's (IRS) Form 8582 a critical document for many. This form is specifically designed to help taxpayers calculate and report passive activity losses and their allowable deduction amounts on their federal income tax returns. Primarily, it serves those involved in rental activities or businesses in which they do not materially participate. The nuances of Form 8582 are important to understand, as this document plays a key role in ensuring that losses are correctly reported and that taxpayers can make the most of potential tax benefits. Through this form, the IRS imposes limits on the amount of loss that can be deducted, reflecting the agency's aim to curtail the potential for tax sheltering. Accurately completing Form 8582 requires an understanding of passive activity rules, how losses are categorized, and the specific limitations imposed based on a taxpayer's income. The form's complexity underscores the importance of meticulous attention to detail and, often, the need for expert advice to navigate the intricacies of passive activity loss rules.

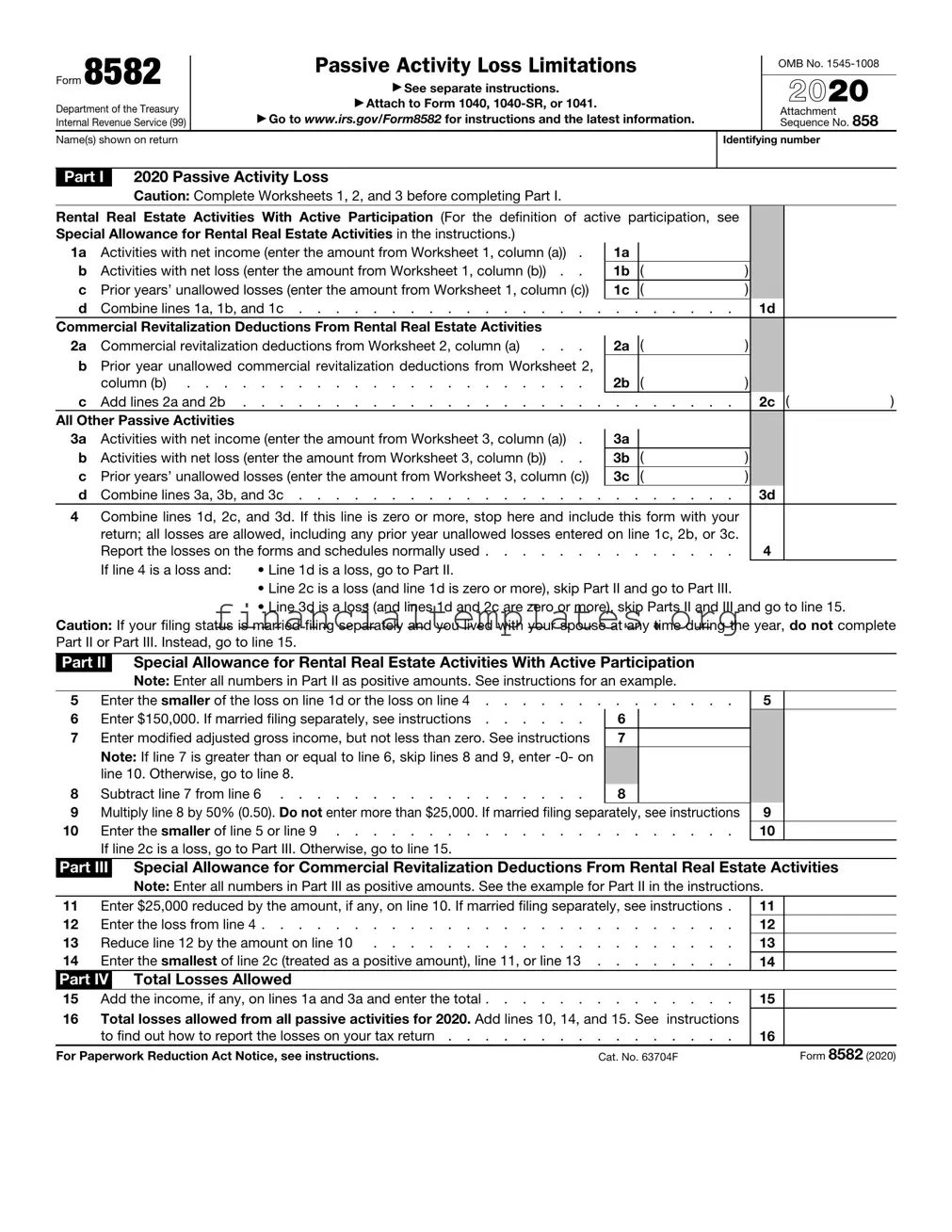

IRS 8582 Example

Form 8582 |

|

Passive Activity Loss Limitations |

|

OMB No. |

|

|

|||

|

|

|

||

|

|

|

|

|

|

▶ See separate instructions. |

|

2021 |

|

Department of the Treasury |

|

▶ Attach to Form 1040, |

|

|

|

|

▶ Go to www.irs.gov/Form8582 for instructions and the latest information. |

|

Attachment |

Internal Revenue Service (99) |

|

|

Sequence No. 858 |

|

Name(s) shown on return |

|

|

Identifying number |

|

Part I 2021 Passive Activity Loss

Caution: Complete Parts IV and V before completing Part I.

Rental Real Estate Activities With Active Participation (For the definition of active participation, see Special |

|

|

|

||||

Allowance for Rental Real Estate Activities in the instructions.) |

|

|

|

|

|

|

|

1a |

Activities with net income (enter the amount from Part IV, column (a)) . . . |

|

1a |

|

|

|

|

|

|

|

|

|

|||

b |

Activities with net loss (enter the amount from Part IV, column (b)) . . . . |

|

1b |

( |

) |

|

|

c |

Prior years’ unallowed losses (enter the amount from Part IV, column (c)) . . |

|

1c |

( |

) |

|

|

d |

Combine lines 1a, 1b, and 1c |

. . . . . . . . |

|

1d |

|

||

All Other Passive Activities |

|

|

|

|

|

|

|

2a |

Activities with net income (enter the amount from Part V, column (a)) . . . |

|

2a |

|

|

|

|

|

|

|

|

|

|||

b |

Activities with net loss (enter the amount from Part V, column (b)) . . . . |

|

2b |

( |

) |

|

|

c |

Prior years’ unallowed losses (enter the amount from Part V, column (c)) . . |

|

2c |

( |

) |

|

|

d |

Combine lines 2a, 2b, and 2c |

. . . . . . . . |

|

2d |

|

||

3Combine lines 1d and 2d. If this line is zero or more, stop here and include this form with your return; all losses are allowed, including any prior year unallowed losses entered on line 1c or 2c. Report the

losses on the forms and schedules normally used |

3 |

If line 3 is a loss and: • Line 1d is a loss, go to Part II.

• Line 2d is a loss (and line 1d is zero or more), skip Part II and go to line 10.

Caution: If your filing status is married filing separately and you lived with your spouse at any time during the year, do not complete Part II. Instead, go to line 10.

Part II Special Allowance for Rental Real Estate Activities With Active Participation

Note: Enter all numbers in Part II as positive amounts. See instructions for an example.

4 |

Enter the smaller of the loss on line 1d or the loss on line 3 |

||

5 |

Enter $150,000. If married filing separately, see instructions |

5 |

|

6 |

Enter modified adjusted gross income, but not less than zero. See instructions |

6 |

|

|

Note: If line 6 is greater than or equal to line 5, skip lines 7 and 8 and enter |

|

|

|

on line 9. Otherwise, go to line 7. |

|

|

7 |

Subtract line 6 from line 5 |

7 |

|

8Multiply line 7 by 50% (0.50). Do not enter more than $25,000. If married filing separately, see instructions

9 |

Enter the smaller of line 4 or line 8 |

Part III Total Losses Allowed

4

8

9

10 |

Add the income, if any, on lines 1a and 2a and enter the total |

|

11 |

Total losses allowed from all passive activities for 2021. Add lines 9 and 10. See instructions to find |

|

|

out how to report the losses on your tax return |

|

|

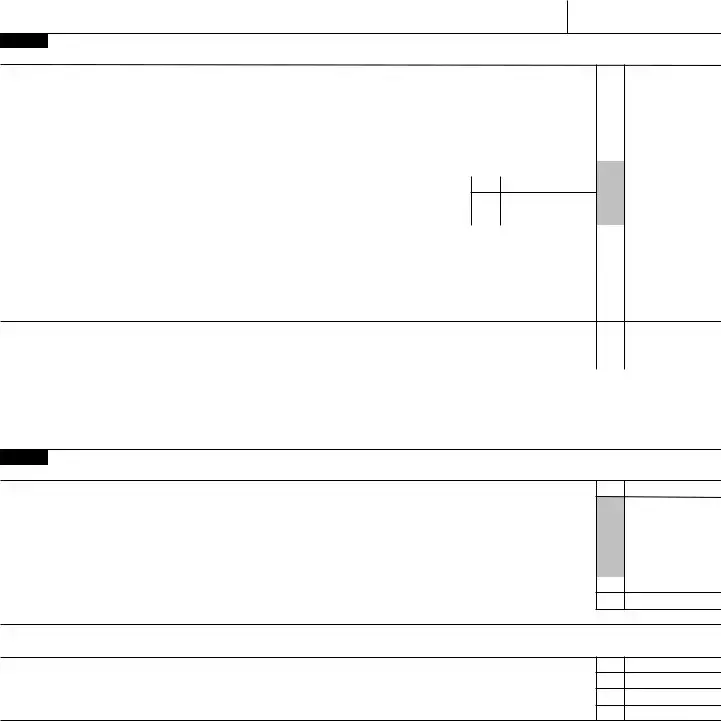

Complete This Part Before Part I, Lines 1a, 1b, and 1c. See instructions. |

|

Part IV |

||

10

11

Name of activity

Current year |

Prior years |

Overall gain or loss |

|||

|

|

|

|

|

|

(a) Net income |

(b) Net loss |

(c) Unallowed |

(d) Gain |

(e) Loss |

|

(line 1a) |

(line 1b) |

loss (line 1c) |

|||

|

|

||||

Total. Enter on Part I, lines 1a, 1b, and 1c ▶ |

|

|

For Paperwork Reduction Act Notice, see instructions. |

Cat. No. 63704F |

Form 8582 (2021) |

Form 8582 (2021) |

Page 2 |

Part V Complete This Part Before Part I, Lines 2a, 2b, and 2c. See instructions.

Name of activity

Current year |

Prior years |

Overall gain or loss |

|||

|

|

|

|

|

|

(a) Net income |

(b) Net loss |

(c) Unallowed |

(d) Gain |

(e) Loss |

|

(line 2a) |

(line 2b) |

loss (line 2c) |

|||

|

|

||||

Total. Enter on Part I, lines 2a, 2b, and 2c ▶

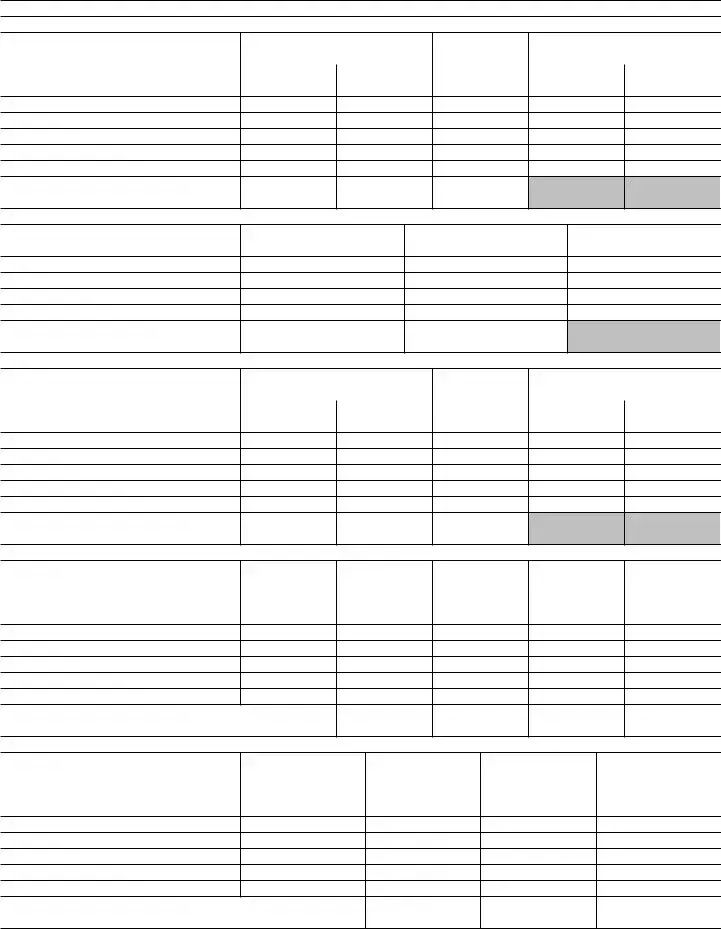

Part VI |

Use This Part if an Amount Is Shown on Part II, Line 9. See instructions. |

Name of activity

Form or schedule and line number to be reported on (see instructions)

(a)Loss

(b)Ratio

(c)Special allowance

(d)Subtract column (c) from

column (a).

Total . |

. . . . . . . . . . . . . . . . ▶ |

|

Allocation of Unallowed Losses. See instructions. |

Part VII |

1.00

Name of activity

Form or schedule and line number to be reported on (see instructions)

(a)Loss

(b)Ratio

(c)Unallowed loss

Total . |

. . . . . . . . . . . . . . . . . . ▶ |

|

Allowed Losses. See instructions. |

Part VIII |

1.00

Name of activity

Form or schedule and line number to be reported on (see instructions)

(a)Loss

(b)Unallowed loss

(c)Allowed loss

Total . . . . . . . . . . . . . . . . . . . ▶

Form 8582 (2021)

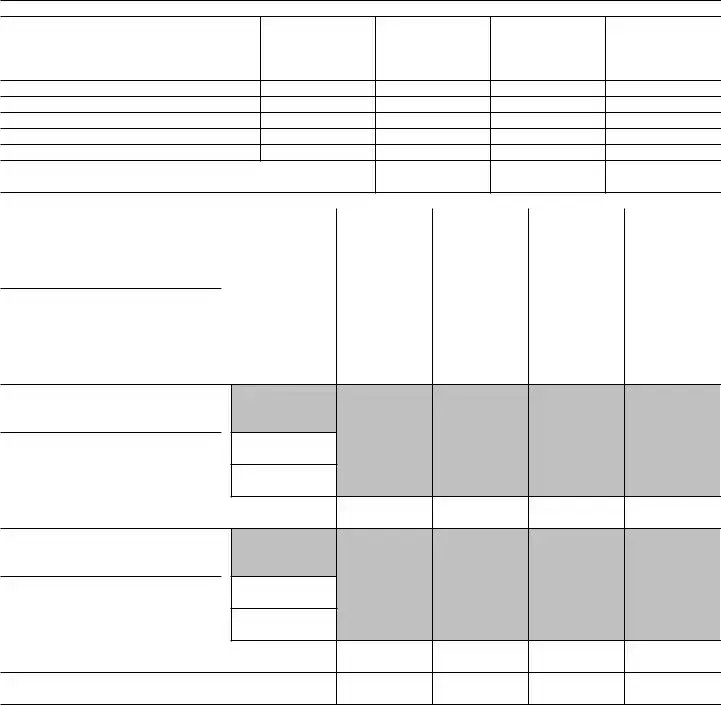

Form 8582 (2021) |

|

|

|

|

|

Page 3 |

|

Part IX |

|

Activities With Losses Reported on Two or More Forms or Schedules. See instructions. |

|

||||

Name of activity: |

(a) |

(b) |

(c) Ratio |

(d) Unallowed |

(e) Allowed |

||

|

|

|

loss |

loss |

|||

|

|

|

|

|

|

||

Form or schedule and line number to be reported on (see instructions):

1a Net loss plus prior year unallowed loss from form or schedule . . ▶

bNet income from form or schedule ▶

cSubtract line 1b from line 1a. If zero or less, enter

Form or schedule and line number to be reported on (see instructions):

1a Net loss plus prior year unallowed loss from form or schedule . . ▶

bNet income from form or schedule ▶

cSubtract line 1b from line 1a. If zero or less, enter

Form or schedule and line number to be reported on (see instructions):

1a Net loss plus prior year unallowed loss from form or schedule . . ▶

bNet income from form or schedule ▶

cSubtract line 1b from line 1a. If zero or less, enter

Total |

. . . . . . . . . . . . . . . . . ▶ |

1.00 |

Form 8582 (2021)

Document Specifics

| Fact Name | Description |

|---|---|

| Form Purpose | The IRS Form 8582 is used to report passive activity loss limitations. |

| User Group | This form is primarily used by individuals, estates, and trusts with interests in rental activities or other business activities considered passive. |

| Key Sections | Form 8582 includes sections for reporting unallowed losses from passive activities, calculating net income or loss from passive activities, and special rules and computations for certain situations. |

| Connection to Other Forms | Losses reported on Form 8582 may affect totals on the Form 1040 for individuals, particularly on Schedule E (Supplemental Income and Loss). |

| Filing Requirements | Not all taxpayers with passive activities need to file Form 8582; filing is required only when passive activity losses are disallowed under the IRS rules. |

| Governing Laws | The IRS regulations detailing passive activity loss limitations under the Tax Reform Act of 1986 govern the use of Form 8582. |

Guide to Writing IRS 8582

Filing taxes can often seem daunting, with various forms and instructions to navigate. The IRS Form 8582 is particularly crucial for those who need to report passive activity losses. This form helps manage how these losses are deducted, directly influencing an individual's taxable income. While the form itself may appear complex, breaking down the steps to fill it out can simplify the process. It's essential to approach this task methodically, ensuring accuracy to prevent any potential issues with the IRS.

- Gather all necessary documentation including records of income and losses from passive activities. These might be from rental properties or businesses in which you don't actively participate.

- Review the instructions for Form 8582 provided by the IRS to familiarize yourself with the form's requirements.

- Enter your name and Social Security Number (SSN) at the top of the form, ensuring that they match the information on your tax return.

- Under Part I, identify all passive activities that have a current year loss. List these activities and the amount of loss from each.

- In Part II, follow the instructions to calculate adjustments to the losses reported in Part I, if applicable. This section is often used if you have any income from passive activities.

- Part III is where you summarize the total losses allowed from all passive activities. This involves following specific calculations outlined in the form's instructions to arrive at the amount of loss that can be deducted this tax year.

- If required, complete Part IV to report any passive activity loss limitations from prior years that are allowed in the current year. This section applies if you have unused passive activity losses from previous years that are being carried forward.

- Carefully review all the information entered on the form to ensure its accuracy. Errors can result in processing delays or unwanted attention from the IRS.

- Attach Form 8582 to your tax return before submission. Ensure you're also attaching any other required forms or schedules that support the information reported on Form 8582.

- Keep a copy of the completed Form 8582 for your records. It’s important to have documentation of your filings, especially pertaining to passive activities and losses.

Once Form 8582 is correctly filled out and submitted with your tax return, the next steps largely depend on the IRS's processing of your documents. It's crucial to monitor any correspondence from the IRS following the submission of your tax return and to respond promptly to any requests for additional information. By accurately completing Form 8582 and adhering to the submission guidelines, you're effectively managing your passive activity losses and ensuring compliance with tax regulations. The importance of the accuracy and timeliness of this process cannot be understated.

Understanding IRS 8582

What is the purpose of the IRS Form 8582?

IRS Form 8582 is designed to help individuals calculate and report the correct amount of passive activity loss (PAL) limitations. This form is used in conjunction with your tax return to determine how much of the loss from passive activities can be deducted in the current year.

Who needs to file Form 8582?

Form 8582 should be filed by individuals, estates, and trusts that have income or losses from passive activities. Passive activities are business activities in which the taxpayer does not materially participate, or rental activities regardless of participation. It’s not required if your total losses from passive activities are fully deductible.

What information do I need to fill out Form 8582?

To complete Form 8582, you need detailed information about your income and losses from all passive activities. This includes but is not limited to: rental real estate income, loss from limited partnerships, and other passive activity income or losses documented in your tax items.

How does Form 8582 affect the deductibility of passive activity losses?

The form limits the amount of passive activity losses you can deduct in a given tax year. Losses that are not deductible because they exceed income can be carried forward to the next tax year. The specifics of how much loss can be deducted depend on the amount of your passive income and the particulars of your passive activities.

Can losses from passive activities be carried forward, and if so, how?

Yes, losses from passive activities that are not deductible in the current year because they exceed your passive income can be carried forward to future years. The IRS Form 8582 calculates the non-deductible amount, which then becomes part of the carryforward loss to be applied against future passive income.

Are there any exceptions to the rules for passive activity loss limitations?

There are certain exceptions to the passive activity loss limitations. For example, real estate professionals who materially participate in their rental activities may be able to deduct losses beyond the passive activity loss limits. Additionally, there are special rules for certain kinds of passive activities, like rental real estate activities with active participation by the taxpayer.

What happens if I do not file Form 8582 but have passive activities?

If you don’t file Form 8582 and you have losses from passive activities, you may underreport your taxable income by improperly deducting losses. This can lead to an audit or penalties from the IRS for not accurately reporting your tax obligations.

Where can I find Form 8582 and its instructions?

Form 8582 and its detailed instructions can be found on the IRS website. The IRS typically updates forms annually, so make sure you are using the most current version for the tax year you are filing.

Common mistakes

The IRS Form 8582 is crucial for individuals who need to report passive activity loss limitations. It's a complex form that requires careful attention, as mistakes can lead to audits, penalties, or missed opportunities to optimize one's tax situation. When navigating this document, there are several common errors individuals should be aware of:

-

Not fully understanding passive activity losses: It's imperative for taxpayers to comprehend the distinction between passive and non-passive income. Passive activities are generally ones in which the taxpayer does not materially participate. Misclassification can lead to incorrect filing.

-

Ignoring state-specific rules: While Form 8582 is a federal form, different states may have their own regulations concerning passive activity losses. Failing to consider these variances can complicate state income tax filings.

-

Miscalculating adjusted gross income: The form uses adjusted gross income (AGI) to determine how much of the passive activity loss can be deducted. Errors in calculating AGI can therefore directly affect the loss deduction.

-

Omitting relevant information: Taxpayers sometimes forget to include all necessary documents and information related to their passive activities. Every piece of information helps in accurately determining the extent of passive activity loss limitations.

-

Misuse of real estate professional status: There are specific criteria that qualify someone as a real estate professional, which affects how losses can be reported. Incorrectly claiming this status can lead to significant discrepancies in reported passive activity losses.

-

Overlooking carryover losses: Passive activity losses that are not deductible in the current year can often be carried over to the next tax year. Failing to properly track and include these carryovers can result in the loss of valuable deductions.

-

Failing to report all income from passive activities: All income from passive activities must be reported to accurately calculate the loss limitations. Overlooking some income sources can lead to an underestimation of allowable losses.

-

Not seeking professional advice: Given the complexity of passive activity loss rules and the potential for significant tax implications, consulting with a tax professional is advisable. DIY approaches without a solid understanding may lead to costly errors.

In summary, when preparing IRS Form 8582, individuals should exercise diligence, ensure they fully understand the distinctions between passive and non-passive activities, and consider professional advice. Accurate completion of this form can significantly impact one's financial and tax situation.

Documents used along the form

When embarking on the task of filing taxes, especially for those with real estate investments or passive activity losses, encountering IRS Form 8582 is quite common. This form, crucial for reporting passive activity loss limitations, is just one piece of the puzzle. To ensure a comprehensive and compliant tax return, several other forms and documents might also play a vital role. Understanding each document's purpose can illuminate the broader tax filing process, ensuring individuals are well-prepared to meet their obligations.

- Form 1040: The backbone of individual tax filing, this form gathers information about your income, deductions, and credits to determine your tax liability or refund.

- Schedule E (Form 1040): Specifically relevant for those with rental property income, royalties, partnerships, S corporations, estates, trusts, and residual interests in REMICs, this form details supplemental income or loss.

- Form 4562: Used to report depreciation and amortization, essential for those who need to calculate deductions for the depreciation of property and amortization of costs.

- Form 4797: Necessary for reporting the sale of business property, this form helps differentiate between ordinary gains and losses and those that are capital in nature.

- Form 6251: This form is used to determine if an individual owes alternative minimum tax (AMT), a tax system parallel to the standard income tax.

- Schedule K-1: Received from entities such as trusts, S corporations, and partnerships, it reports a shareholder's, partner's, or beneficiary's share of income, deductions, credits, etc.

- Form 8824: Involving like-kind exchanges, useful for those who have exchanged real estate or business assets without recognizing a taxable gain or loss.

- Form 4684: Critical for reporting casualties and thefts of personal use and income-producing property, it helps to determine allowable losses for such unfortunate events.

With a solid grasp of these forms and documents, taxpayers can approach their filing responsibilities with confidence, knowing they have the tools to navigate the complexities of tax law. While Form 8582 might be the starting point for those with passive activities, the journey through tax preparation is a comprehensive process that benefits from understanding and properly utilizing a variety of IRS forms.

Similar forms

The IRS 8582 form, utilized for reporting passive activity loss limitations, bears similarity to the IRS Schedule E (Form 1040). Schedule E is employed by taxpayers to report income and losses from rental property, royalties, partnerships, S corporations, estates, and trusts. Both forms deal with income from passive activities, yet while IRS 8582 specifically focuses on the losses and their limitations, Schedule E provides a broader overview of income and losses from real estate and other passive activities.

Form 4562, Depreciation and Amortization, also shares commonalities with IRS 8582. Form 4562 is used by taxpayers to claim depreciation on property or amortization on assets, which can affect passive activity income or losses. Both forms are integral to calculating the taxable income from business or rental properties, especially when assets are involved that depreciate over time.

The IRS Form 4797, Sales of Business Property, has parallels with the IRS 8582. This form is relevant for taxpayers who sell or exchange business property and need to report gains or losses. Similar to the 8582, it has implications on the income reported from passive activities, especially when the sale of an asset involved in a passive activity leads to a loss or gain that affects the taxpayer's overall income scenario.

IRS Form 8586, Low-Income Housing Credit, is somewhat synonymous with IRS 8582 in its niche focus. While Form 8582 deals with the limitations on passive activity losses, Form 8586 is for claiming the low-income housing credit, which can influence the income from rental properties, a common type of passive activity. Both forms play a role in the tax treatment of income derived from real estate.

Form 6251, Alternative Minimum Tax—Individuals, is interrelated with the IRS 8582 form. Taxpayers use Form 6251 to calculate and report alternative minimum tax (AMT), which might be required if deductions and credits lower their tax bill substantially. Since passive activity losses reported on IRS 8582 can be a significant deduction for some taxpayers, it may influence their AMT calculations, making these forms connected in the tax preparation process.

IRS Form 8863, Education Credits (American Opportunity and Lifetime Learning Credits), although focusing on deductions for education, indirectly connects with IRS 8582. The rationale is that passive activity losses may adjust adjusted gross income (AGI), which in turn, can affect eligibility for education credits. Taxpayers must be mindful of how losses reported on Form 8582 impact their overall income, potentially influencing their qualification for educational tax benefits.

Form 5329, Additional Taxes on Qualified Plans (Including IRAs) and Other Tax-Favored Accounts, shares an indirect relationship with IRS 8582. This form is used to report additional taxes on IRAs or other tax-favored accounts but is influenced by the taxpayer's AGI, affected by passive activity loss limitations. Therefore, the amount of loss reported on IRS 8582 can impact the calculations on Form 5329, connecting these seemingly disparate forms.

IRS Form 1040, U.S. Individual Income Tax Return, is directly correlated with IRS 8582. Essentially, all forms related to income, deductions, and credits funnel into the Form 1040, the main tax return form for individuals. Passive activity loss limitations reported on Form 8582 adjust the AGI on Form 1040, illustrating a direct link in how passive activities affect the overall tax liability.

Form 2441, Child and Dependent Care Expenses, also ties back to IRS 8582, albeit more loosely. The form allows taxpayers to claim credit for child and dependent care expenses, which is calculated based on AGI. Since passive activity losses can alter AGI, there's a consequential effect on the eligibility and amount of credit one can claim on Form 2441, showing the interconnectedness of these tax documents.

IRS Form 8962, Premium Tax Credit, rounds out the list. This form is for claiming the premium tax credit, a refundable credit that helps eligible individuals and families cover the premiums for their health insurance purchased through the Health Insurance Marketplace. Similar to some other credits and deductions, the premium tax credit calculation is influenced by the taxpayer's AGI, which can be affected by the reporting of passive activity losses on IRS 8582. This demonstrates how various aspects of an individual's tax situation are intertwined, with passive activity losses playing a pivotal role.

Dos and Don'ts

Filling out IRS Form 8582, which deals with Passive Activity Loss Limitations, can be a complex process. Approaching it with care is essential to ensure accuracy and compliance. Below is a list of dos and don'ts that can help guide you through the process smoothly and effectively.

- Do review the instructions provided by the IRS for Form 8582 carefully. Understanding the guidelines can prevent mistakes and ensure the form is completed correctly.

- Do gather all necessary documents related to your passive activities, including income and expenses, before starting the form. Having all the relevant information on hand can simplify the process.

- Do use software or a tax professional if you're unsure about how to proceed. Form 8582 can be tricky, and there's no shame in seeking assistance to get it right.

- Do double-check your math and the information entered on the form. Even small errors can lead to delays or audits.

- Do keep a copy of the completed form and all supporting documents for your records. This can be invaluable if questions arise later on.

- Don't overlook passive activity income or losses from previous years. Form 8582 requires a cumulative approach, so past years' activities could still be relevant.

- Don't rush through filling out the form. Taking your time to understand each section can prevent costly mistakes.

- Don't forget to sign and date the form. An unsigned form is considered incomplete and will not be processed.

- Don't hesitate to amend a previously filed Form 8582 if you discover errors. Correcting mistakes promptly can help avoid penalties.

By following these guidelines, you can navigate the complexities of IRS Form 8582 with confidence. Remember, when in doubt, consult a tax professional to ensure compliance and maximize your tax benefits.

Misconceptions

The IRS Form 8582 is often misunderstood in several key aspects. It's critical to discern between the myths and facts to ensure accurate tax reporting and avoid potential pitfalls. Here, we delve into six common misconceptions about the IRS Form 8582.

It's only for real estate professionals: A widespread misconception is that IRS Form 8582 is exclusively for individuals engaged in the real estate profession. In reality, this form is used by all taxpayers who have passive activity losses, including those from rental properties or businesses in which they do not materially participate.

Passive losses can't be used to offset other income: Many believe that losses reported on Form 8582 cannot be used to offset any other types of income, such as wages or dividends. However, certain exceptions allow passive losses to be offset against nonpassive income, notably for real estate professionals who meet specific criteria, allowing their losses to be deducted against other sources of income.

Form 8582 is straightforward to fill out: While the IRS strives to make its forms as user-friendly as possible, Form 8582 can be complex, requiring detailed information about all passive activities and the calculation of allowed losses. Proper completion often necessitates a thorough understanding of passive activity loss rules.

All rental losses are treated the same: Another common misconception is the uniform treatment of rental losses. The truth is, the IRS makes distinctions based on the active participation of the taxpayer and whether they qualify as a real estate professional. These distinctions can affect how losses are reported and the amount that may be deductible.

You must use Form 8582 every year: Taxpayers often believe that once they file Form 8582, they must continue to do so in subsequent years. However, the need to file this form varies from year to year based on current income, losses, and participation in passive activities. If there are no passive activities or losses in a given year, filing Form 8582 may not be necessary.

Filing Form 8582 means you'll be audited: There's a misconception that filing Form 8582 increases the risk of an IRS audit. While it's true that the IRS scrutinizes deductions and losses, the mere act of filing Form 8582 is not a red flag in itself. Compliance with IRS rules and accurate reporting are key factors that influence audit risk.

Understanding these misconceptions about IRS Form 8582 can lead to more accurate tax filing and potentially minimize errors that could result in penalties or missed opportunities for tax savings. Taxpayers should consult with a tax professional to navigate the complexities of passive activity losses and ensure compliance with IRS regulations.

Key takeaways

The IRS Form 8582 is crucial for taxpayers with passive activity losses. Understanding its purpose and proper way to fill it out ensures compliance with tax laws and could potentially optimize a taxpayer's financial situation. Here are four key takeaways about the IRS Form 8582:

- Determining Eligibility: It's essential for taxpayers to first determine if they are required to use Form 8582. This form is specifically designed for individuals, estates, and trusts that have income or losses from passive activities. Passive activities are usually business activities in which the taxpayer does not materially participate or rental activities, regardless of participation level. Understanding whether your income or losses are considered passive is the first step in determining eligibility.

- Navigating Passive Activity Loss (PAL) Rules: The IRS limits the amount of loss a taxpayer can claim from passive activities. Essentially, the loss from passive activities can only be used to offset income generated from other passive activities. Unused losses can be carried forward to future tax years. Form 8582 is used to calculate the allowable passive activity loss that can be claimed in the current tax year.

- Accurate Record Keeping: For accurate completion of Form 8582, meticulous record keeping is essential. Taxpayers should keep detailed records of income, losses, and expenses for all passive activities. This includes keeping track of any carryover losses from previous years, as this information is critical for accurately completing the form.

- Professional Assistance: Given the complexity of tax laws surrounding passive activities and losses, seeking professional tax advice is often beneficial. Tax professionals can provide guidance on whether Form 8582 is necessary, how to accurately complete it, and strategies for optimizing passive activity income and losses for tax purposes.

By thoroughly understanding and accurately completing IRS Form 8582, taxpayers can ensure they are in compliance with passive activity loss rules and potentially minimize their tax liabilities.

Popular PDF Documents

Alabama Tax Forms - Filers using the 40A form must sign and date it, certifying their submitted information's accuracy under penalty of perjury.

Form 5020 - A valuable document in the process of securing workers' compensation for job-related injuries within Virginia.

IRS Schedule D 1040 or 1040-SR - Completing Schedule D accurately requires keeping good records of the original purchase prices and sale prices of assets.