Get Irs 8546 Form

Navigating the complexities of financial mishaps and misunderstandings with the Internal Revenue Service (IRS) can be stressful, especially when they result in unfair bank charges. But there's a remedy in place for such situations through the IRS Form 8546. This form is a tool for taxpayers to request reimbursement for bank charges incurred due to IRS errors, including erroneous levies, Direct Debit Installment Agreement (DDIA) processing errors, or mishandling of checks. The process necessitates a thorough documentation procedure, where claimants must provide their personal details, account information, and a clear description of the claim alongside essential proof like bank statements and specific documentation of the IRS mistake. Interestingly, the form also outlines the potential for electronic fund transfers (EFT) for reimbursement, aiming for a quicker, safer, and more convenient resolution. However, the IRS strictly warns against fraudulent claims, imposing severe penalties for any misrepresentation. The policy governing this form reflects the IRS's acknowledgment of its unique enforcement powers and the unintended financial burdens they can sometimes impose on taxpayers, providing a systematic path to rectification and financial fairness. Compliance with the Privacy Act of 1974 is assured, emphasizing the purpose and confidentiality of the information provided on the form. Properly navigating Form 8546 can thus offer taxpayers a valuable recourse, highlighting the IRS’s commitment to rectifying errors and ensuring justice in its financial interactions.

Irs 8546 Example

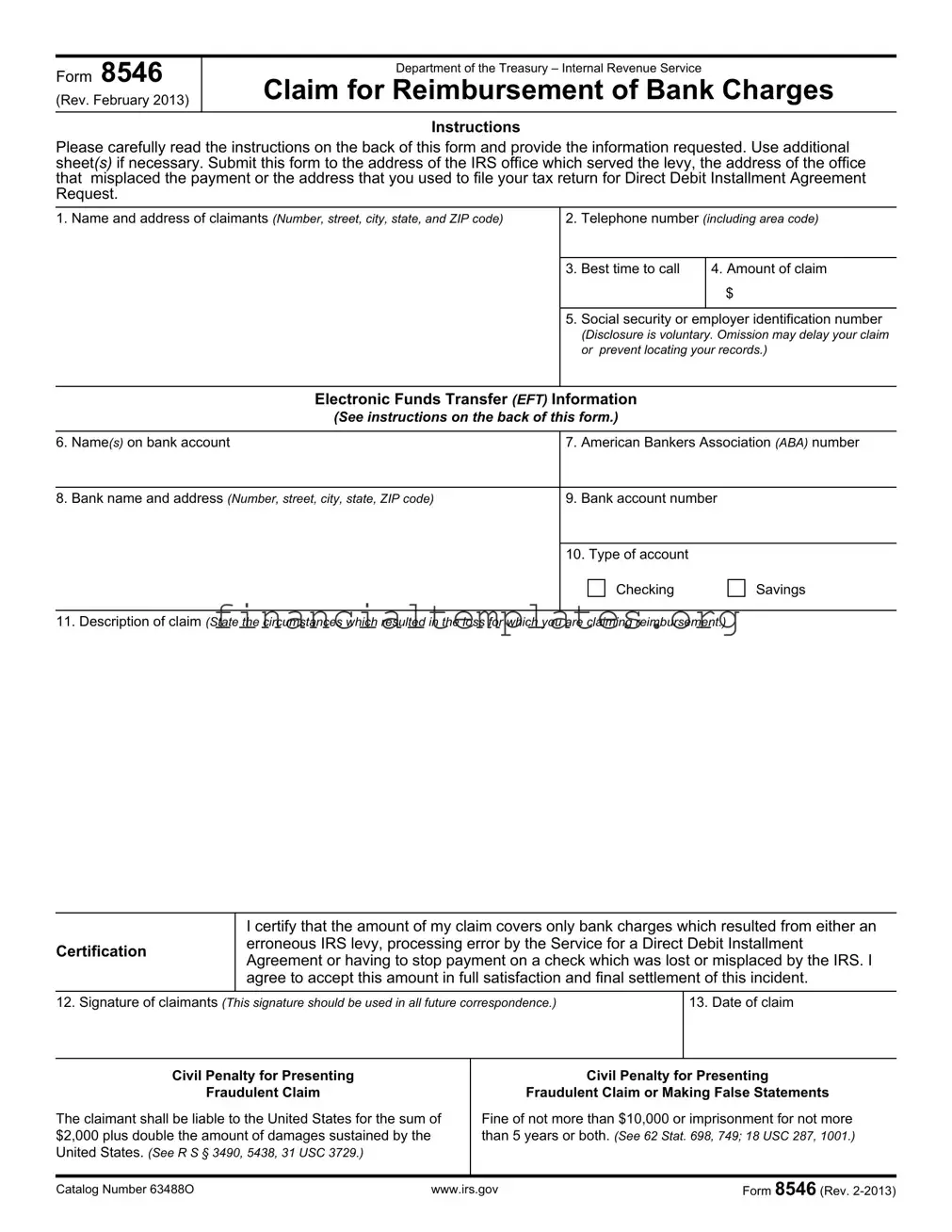

Form 8546 |

Department of the Treasury – Internal Revenue Service |

|

|

(Rev. February 2013) |

Claim for Reimbursement of Bank Charges |

|

|

Instructions

Please carefully read the instructions on the back of this form and provide the information requested. Use additional sheet(s) if necessary. Submit this form to the address of the IRS office which served the levy, the address of the office that misplaced the payment or the address that you used to file your tax return for Direct Debit Installment Agreement Request.

1.Name and address of claimants (Number, street, city, state, and ZIP code)

2.Telephone number (including area code)

3. Best time to call |

4. Amount of claim |

|

$ |

|

|

5.Social security or employer identification number

(Disclosure is voluntary. Omission may delay your claim or prevent locating your records.)

Electronic Funds Transfer (EFT) Information

(SEE INSTRUCTIONS ON THE BACK OF THIS FORM.)

6. |

Name(s) on bank account |

7. |

American Bankers Association (ABA) number |

|

|

|

|

|

|

8. |

Bank name and address (Number, street, city, state, ZIP code) |

9. |

Bank account number |

|

|

|

|

|

|

|

|

10. Type of account |

|

|

|

|

|

Checking |

Savings |

|

|

|

|

|

11.Description of claim (State the circumstances which resulted in the loss for which you are claiming reimbursement.)

Certification

I certify that the amount of my claim covers only bank charges which resulted from either an erroneous IRS levy, processing error by the Service for a Direct Debit Installment Agreement or having to stop payment on a check which was lost or misplaced by the IRS. I agree to accept this amount in full satisfaction and final settlement of this incident.

12.Signature of claimants (This signature should be used in all future correspondence.)

13. Date of claim

Civil Penalty for Presenting

Fraudulent Claim

The claimant shall be liable to the United States for the sum of $2,000 plus double the amount of damages sustained by the United States. (See R S § 3490, 5438, 31 USC 3729.)

Civil Penalty for Presenting

Fraudulent Claim or Making False Statements

Fine of not more than $10,000 or imprisonment for not more than 5 years or both. (See 62 Stat. 698, 749; 18 USC 287, 1001.)

Catalog Number 63488O |

www.irs.gov |

Form 8546 (Rev. |

Instructions

Please complete all blocks. Write "NONE" if the block does not apply.

Use this form only for reimbursement of bank charges for:

1.an erroneous levy, or

2.stopping payment on a check that the IRS lost or misplaced.

3.Direct Debit Installment Agreement (DDIA) processing error on the part of the Service.

The claimants must sign this form. If the bank account involved is a joint account, each owner on the account must sign the Form 8546 as a claimant for erroneous levy. DDIA processing error claims on joint returns also require signature of both spouses. However, an authorized agent or legal representative can file and sign the claim if the claimant can't because of disability, death, or other acceptable reason. Include proof of authorization if the claim is being filed on behalf of someone.

Claims must be made within one year of the date the claim accrues and are limited to $1,000. (See 31 USC 3723)

Please attach verification of the amount you are claiming. Include any documentation you may have explaining or acknowledging the IRS error. Also, include:

1.a copy of the levy (if the charges were caused by an erroneous levy),

2.records showing the bank charges caused by the erroneous levy, the request for replacement of a lost or misplaced check, or DDIA processing error on the part of the Service, and

3.records showing that the bank charges have been paid.

Records to support your claim must include bank statements and correspondence.

If you have any questions about this claim, please contact the IRS office that issued the levy or requested replacement of your check. The address is on your copy of the levy or the request for a new check. If your questions relate to a Direct Debit Installment Agreement, please contact the IRS at

If IRS approves your claim, the money can be sent to your bank by electronic funds transfer (EFT), or we can send you a check. Payment by EFT will be faster, safer, and more convenient for you. If you want us to pay your claim by EFT, we need the bank information in items 6 through 10. The American Bankers Association (ABA) number (item 7) is the first nine digits in the number at the bottom of your checks. If you have no checking account, ask your bank what its ABA number is. If you do not complete items 6 through 10, a check will be sent to you.

Internal Revenue Policy

Reimbursement of Bank Charges Due to Erroneous Levy and Service Loss or Misplacement of Taxpayer

Checks, or Direct Debit Installment Agreement Processing Errors.

The Service recognizes that there are circumstances when an erroneous use of its unique enforcement powers may cause tax- payers to incur certain bank charges. Taxpayers who incur bank charges due to an erroneous levy or a Direct Debit Installment Agreement (DDIA) processing error on the part of the Service may file a claim for reimbursement of those expenses. Bank charges include a financial institution's customary charge for complying with the levy instructions as well as charges for overdrafts that are a direct consequence of an erroneous levy or DDIA processing error on the part of the Service. In addition, there are times when a taxpayer's check may be lost or misplaced in processing. When the Service asks for a replacement check, the taxpayer maybe reimbursed for bank charges incurred in stopping payment on the original check. The charges must have been paid by the taxpayer and must not have been waived or reimbursed by the financial institution. Claims must be filed with the District Director or Service Center Director within one year after accrual of the expense.

The following criteria must be present in all erroneous levy cases:

(1)The Service acknowledges the levy was erroneous;

(2)The taxpayers must not have contributed to the continuation or compounding of the error; and

(3)Prior to the levy, the taxpayer did not refuse (either orally or in writing) to timely respond to Service inquiries or provide infor- mation relevant to the liability for which the levy was made.

The following criteria must be present in all lost check cases:

(1)The Service acknowledges it lost or misplaced the check during processing;

(2)the Service asks the taxpayer for a replacement of the pay- ment; and

(3)the Service is satisfied that the replacement payment has been received.

The following criteria must be present in all DDIA processing error cases.

(1)The Service failed to act timely, took an incorrect or improper action, or a systemic failure caused the bank fees;

(2)The taxpayer must not have contributed to the continuation or compounding of the error that caused the bank fees; and

(3)Prior to the processing error, the taxpayer did not refuse (either orally or in writing) to timely respond to the Service’s inquiries or provide sufficient information for the DDIA processing change to be made.

In compliance with the Privacy Act of 1974, the following is provided.

Solicitation of the information is authorized by Title 31 USC 3723; 31 CFR 3.20 et seq. Disclosure of the information is voluntary.

The principal purpose of this information will be for our internal use in processing your claim under 31 USC 3723, or for any court proceedings which may ensue from the filing of this claim.

We may disclose the information on this form relevant to the processing of your claim or to any court proceedings resulting from your claim. We may give the information to the Department of Justice for the purpose of seeking legal advice or recommend- ing prosecutions for fraudulent claims or the making of false statements.

Catalog Number 63488O |

www.irs.gov |

Form 8546 (Rev. |

Document Specifics

| Fact | Detail |

|---|---|

| Purpose of the Form | For the reimbursement of bank charges due to an erroneous IRS levy, a Direct Debit Installment Agreement (DDIA) processing error by the IRS, or for stopping payment on a check lost or misplaced by the IRS. |

| Documentation Required | Claimants must provide a copy of the levy, if applicable, records showing the bank charges, and proof that the charges were paid. |

| Claim Limitations | Claims are limited to $1,000 and must be filed within one year of the date the claim accrues. |

| Form Submission | Submit to the IRS office that issued the levy, requested replacement of the lost check, or to the address used for a Direct Debit Installment Agreement Request. |

| Required Signatures | If it is a joint account, or for DDIA on joint returns, signatures from all account owners or both spouses are required. Agents or legal representatives may sign if authorized. |

| Payment Options | Reimbursement can be made by Electronic Funds Transfer (EFT) if bank information is provided, or by check if not. |

| Penalties for Fraudulent Claims | Claimants face a $2,000 fine plus double the amount of damages to the United States for fraudulent claims. Additional penalties include a fine of up to $10,000 or imprisonment for up to 5 years or both for making false statements. |

| Bank Information Needed for EFT | Name on bank account, American Bankers Association (ABA) number, bank name and address, bank account number, and the type of account (checking or savings). |

| Governing Laws | Relevant laws include 31 USC 3723 for claims and penalties for fraudulent claims are outlined in 18 USC 287 and 1001. |

Guide to Writing Irs 8546

The IRS Form 8546 allows individuals to claim reimbursement for bank charges incurred due to specific IRS actions like erroneous levies, processing errors for Direct Debit Installment Agreements (DDIA), or mistakes involving checks. Understanding the proper way to complete this form is crucial for ensuring a smooth submission process. Following these detailed steps will guide you through the form completion.

- Read the instructions on the back of Form 8546 carefully to understand the eligibility criteria and the types of charges that may be reimbursed.

- Provide the name and address of the claimant in the designated area, ensuring accuracy in spelling and format to avoid any processing delays.

- Enter the claimant's telephone number, including the area code, to facilitate easy communication, and specify the best time to call to reduce the chances of missed calls from the IRS.

- Detail the amount of the claim in dollars and cents, representing the total of the bank charges you are seeking reimbursement for.

- Include your Social Security or Employer Identification Number as applicable. This information is crucial for identification and verification purposes.

- For those opting for reimbursement via Electronic Funds Transfer (EFT), provide the account holder's name(s), the American Bankers Association (ABA) number, the bank name and address, the bank account number, and indicate the type of account (checking or savings).

- In the Description of Claim section, explain the circumstances leading to the incurred bank charges for which reimbursement is being sought. Be concise but include enough detail to explain the situation clearly.

- Sign the form in the space provided under the "Certification" section to affirm the accuracy and truthfulness of your claim. Remember, if the bank account is a joint account, both owners must sign the form.

- Date the claim next to the signature(s) to indicate when the form was completed.

- Attach any required documentation, such as a copy of the levy, bank statements showing the charges, and any correspondence or acknowledgments from the IRS related to the error.

- Submit the completed form and attachments to the appropriate IRS office as indicated in the initial instructions, depending on the reason for the claim (e.g., the IRS office that issued the levy, the office that requested the replacement of the lost or misplaced check, or the office related to your Direct Debit Installment Agreement).

- After submission, retain a copy of the completed form and all attachments for your records.

After completing these steps and submitting your Form 8546, the review process begins. If the IRS approves your claim, reimbursement can be issued either through an Electronic Funds Transfer (EFT) to the bank account you specified or by mailing a check to the address provided. The IRS strives to process these claims efficiently, but it's important to ensure all submitted information is accurate and complete to avoid unnecessary delays.

Understanding Irs 8546

What is the purpose of IRS Form 8546?

IRS Form 8546 is designed for taxpayers to claim reimbursement for bank charges incurred due to an erroneous IRS levy, processing errors by the Service related to a Direct Debit Installment Agreement, or the necessity to stop payment on a check lost or misplaced by the IRS. These circumstances recognize the financial inconveniences caused to taxpayers due to errors or mishandling by the IRS.

Who needs to sign the Form 8546?

For an erroneous levy related to a joint bank account, each owner must sign the form. Similarly, for claims on joint returns due to Direct Debit Installment Agreement processing errors, both spouses must sign. If a claimant is unable to sign because of disability, death, or another valid reason, an authorized agent or legal representative may sign on their behalf, provided that proof of authorization is included.

What documentation is required to support a claim?

To support a claim, taxpayers must attach verification of the claimed amount, including any IRS communication acknowledging the error. Essential documents are a copy of the levy leading to erroneous charges, records showing the bank charges, and evidence that these have been paid. Bank statements and correspondence serve as critical supporting documentation.

How can I contact the IRS for questions about my claim?

If your claim relates to an erroneous levy or a request for a replacement check, contact the IRS office that issued the levy or the request. Their address should be on your copy of the relevant document. For inquiries related to Direct Debit Installment Agreements, the IRS can be reached at 1-800-829-1040, or you can mail questions to the address where you filed your tax return.

How are approved claims paid?

Approved claims can be paid either by electronic funds transfer (EFT) to the taxpayer's bank account or by check. Opting for EFT can be faster, safer, and more convenient. Taxpayers wishing for EFT payment must provide their bank information (items 6 through 10 on Form 8546).

How much time do I have to file a claim?

Claims must be made within one year of the date when the claim accrues. This period is meant to ensure timely processing and reimbursement of valid claims related to bank charges incurred because of IRS errors.

What are the consequences of filing a fraudulent claim?

Presenting a fraudulent claim or making false statements in connection with such a claim is subject to strict penalties, including a fine of up to $10,000 or imprisonment for not more than 5 years, or both. This underlines the importance of honesty and accuracy in filing a claim.

What are the limitations on the claim amount?

Claims are limited to $1,000, focusing on covering the direct bank charges incurred by the taxpayer due to errors by the IRS. This limit underscores the form's purpose of addressing financial inconveniences rather than compensating for broader financial damages.

Common mistakes

Filling out IRS Form 8546 involves several steps where individuals can easily make errors. Recognizing and avoiding these common mistakes can smoothen the process:

- Not reading the instructions carefully: Before starting to fill out the form, it is crucial to read all instructions thoroughly. Skipping this step can lead to misunderstandings about what information is required and where it should be entered.

- Leaving sections blank: Every section of the form should be completed. If a particular section does not apply to an individual's situation, filling it with 'NONE' is preferable over leaving it blank. This indicates that the question was not overlooked.

- Incorrectly entering the bank account or ABA number: Providing precise bank information is critical, especially for receiving reimbursements via Electronic Funds Transfer (EFT). Entering incorrect banking details can delay or misdirect payments.

- Neglecting to include necessary documentation: The form requires specific documents to support the claim, such as bank statements and correspondence acknowledging the IRS error. Failure to attach these can result in the rejection of the claim.

- Forgetting to sign the form: An unsigned form is incomplete. If the bank account is jointly owned or if the form pertains to joint returns, both parties must sign. For situations where the claim is filed on behalf of someone else, proof of authorization must also be attached.

- Exceeding the claim submission deadline: Claims must be submitted within one year from when the claim accrues. Missing this deadline can forfeit the right to reimbursement.

Being meticulous in following each step, double-checking entered information, and ensuring all required documents are attached can significantly improve the chances of a successful claim on Form 8546.

Documents used along the form

When dealing with the Internal Revenue Service (IRS), particularly concerning reimbursement of bank charges as detailed in Form 8546, individuals and businesses often find themselves navigating through a maze of related documents and forms. These documents serve to supplement the information provided on Form 8546, ensuring a comprehensive presentation of one’s financial claim to the IRS. Understanding the function and requirement of each document can significantly streamline the claim process.

- Form 4868 - Application for Automatic Extension of Time To File U.S. Individual Income Tax Return. This form is used when an individual needs more time to file their taxes, which may coincide with issues necessitating Form 8546.

- Form 8821 - Tax Information Authorization. It authorizes the IRS to share tax information with third parties, useful for resolving bank charge issues.

- Form 2848 - Power of Attorney and Declaration of Representative. This form allows individuals to authorize someone else to represent them before the IRS, potentially to handle matters related to Form 8546.

- Form 1040 - U.S. Individual Income Tax Return. The primary form used by individuals to file their federal income taxes. Discrepancies leading to Form 8546 claims may originate from transactions reported on Form 1040.

- Form 941 - Employer's Quarterly Federal Tax Return. Businesses may find discrepancies related to their employee tax withholdings that relate to Form 8546 claims.

- Form 1099-MISC - Miscellaneous Income. Incorrect reporting on this form may lead to banking errors affecting taxpayers, necessitating the use of Form 8546.

- Form 4506-T - Request for Transcript of Tax Return. This form is used to request previous tax returns, which can serve as evidence or documentation in support of a Form 8546 claim.

- Bank Statements and Correspondence - These documents are critical for substantiating the claim made on Form 8546. They provide proof of the bank charges incurred due to IRS actions.

- IRS Levy Notice - A copy of any levy notices received from the IRS which led to the bank charges that one is seeking reimbursement for.

- Form 843 - Claim for Refund and Request for Abatement. While not directly related to bank charges, this form is used to request a refund or abatement of certain fees, penalties, or interest, which may be pertinent in cases where these costs are part of the financial burden placed on the taxpayer due to IRS errors.

Each of these documents plays a crucial role in the narrative and justification of a reimbursement claim filed with the IRS, particularly through Form 8546. The clear documentation and appropriate completion of these forms can be instrumental in achieving a favorable resolution. Dealing with financial discrepancies and seeking reimbursement from the IRS can be a daunting task. However, with the proper preparation and understanding of the necessary documents, taxpayers can approach their claims with confidence and clarity.

Similar forms

The IRS Form 4506, "Request for Copy of Tax Return," is similar to Form 8546 because both forms are used by taxpayers to request action from the IRS due to specific circumstances affecting their financial or tax records. While Form 8546 is specifically for claiming reimbursement of bank charges due to IRS errors, Form 4506 allows taxpayers to request copies of previously filed tax returns, which could be necessary after recognizing discrepancies or when preparing to file a claim similar to that detailed in Form 8546. Both forms necessitate the taxpayer to provide personal information and specific details about the request, ensuring the IRS can accurately process the claim or request.

Form 2848, "Power of Attorney and Declaration of Representative," shares a procedural similarity with IRS Form 8546 in that it involves authorizing another individual to take specific actions on behalf of the taxpayer. In situations where taxpayers are unable to file Form 8546 due to disability, death, or other acceptable reasons, Form 2848 could be used to grant a legal representative the authority to act on the taxpayer's behalf, including filing a claim for reimbursement. Both forms are integral in situations where direct taxpayer action is not feasible, and representation or claims are necessary for resolving issues with the IRS.

IRS Form 9465, "Installment Agreement Request," is akin to Form 8546 as both pertain to managing financial obligations with the IRS under special circumstances. While Form 8546 is used to claim reimbursement for bank charges incurred due to specific IRS errors, Form 9465 helps taxpayers unable to pay their full tax debt upfront by requesting a payment plan. Direct Debit Installment Agreement (DDIA) errors, mentioned in Form 8546, could directly lead taxpayers to use Form 9465 to arrange or adjust their payment agreements with the IRS, highlighting a financial management link between the two forms.

The Form 843, "Claim for Refund and Request for Abatement," bears resemblance to the Form 8546 in its fundamental purpose of requesting remuneration from the IRS. Where Form 8546 focuses on reimbursement for bank charges resulting from IRS errors concerning levies or payment processing, Form 843 encompasses a broader scope, allowing taxpayers to claim refunds or request abatements for charges like penalties, fees, and interest. Both forms require detailed explanations of the circumstances leading to the financial loss, thereby providing a structured pathway for taxpayers to mitigate errors or oversights affecting their financial interactions with the IRS.

Dos and Don'ts

When dealing with the IRS Form 8546, aiming for a smooth claim process is crucial. Here are some important dos and don'ts to keep in mind:

- Do carefully read the instructions on the back of the form before you start filling it out. This ensures you understand what information is needed.

- Do provide all the information requested in the form. If a section does not apply to you, write "NONE" to show that you didn’t overlook it.

- Do use additional sheet(s) if necessary to provide complete information about your claim.

- Do attach verification of the bank charges you are claiming. This includes bank statements, a copy of the levy if applicable, and any correspondence acknowledging the IRS error.

- Do make sure to include your best contact information, including a telephone number and the best time to call, to avoid delays in communication.

- Don’t forget to sign the Form 8546. If the bank account is a joint account or the claim involves a joint return, make sure both parties sign the form.

- Don’t ignore the timeline for filing a claim. Claims must be made within one year of the date the claim accrues.

- Don’t leave out the Electronic Funds Transfer (EFT) information if you prefer to receive your reimbursement directly to your bank account. This is faster and more secure than receiving a check.

- Don’t hesitate to contact the IRS if you have questions. Use the contact information provided on your copy of the levy or the request for a new check, or the IRS number provided for issues related to Direct Debit Installment Agreements.

Approaching the Form 8546 with these guidelines in mind will help streamline the process of claiming reimbursement for bank charges and minimize potential delays or issues. Remember, accuracy and completeness are your best allies in ensuring your claim is processed efficiently.

Misconceptions

Only individuals can file Form 8546: This is not accurate. Both individuals and businesses, through their employer identification number (EIN), can file for reimbursement of bank charges by using Form 8546. The form allows for the social security number or employer identification number for this purpose.

Form 8546 is for any bank fee reimbursement: Incorrect. Form 8546 is specifically for claiming reimbursement of bank charges due to an erroneous IRS levy, a Direct Debit Installment Agreement processing error by the Service, or the need to stop payment on a check that was lost or misplaced by the IRS.

There's no deadline for filing a claim: This statement is false. Claims must be submitted within one year from the date the claim accrues. Failing to submit within this period may result in the claim being denied.

Any bank charges can be claimed: Not true. Only specific bank charges that directly result from the IRS's erroneous actions (like erroneous levies or processing errors) are reimbursable. These include the financial institution’s customary charges for complying with the levy instructions and charges for overdrafts directly related to the IRS's error.

Submission of supporting documents is optional: Actually, providing supporting documentation is mandatory. The claimant should attach verification of the amount being claimed, including any documentation acknowledging the IRS error, bank statements, and correspondence related to the bank charges.

You can only receive reimbursement by check: This is incorrect. While you can receive reimbursement by check, the IRS also offers the option for the funds to be sent through an Electronic Funds Transfer (EFT) to your bank account, making the process faster and more convenient.

All bank charges due to IRS actions are reimbursable: Misleading. Bank charges are only reimbursable if they are not waived or reimbursed by the financial institution, and they result specifically from an erroneous levy, a Direct Debit Installment Agreement processing error by the IRS, or payment stoppage on a lost or misplaced check.

Filing Form 8546 guarantees reimbursement: Inaccurate. Filing this form does not automatically ensure reimbursement. The IRS must first acknowledge that the levy was erroneous or that a processing error occurred. Additionally, claimants must meet specific criteria, including not having contributed to the error themselves.

Key takeaways

When dealing with financial discrepancies related to the Internal Revenue Service (IRS), understanding how to properly use Form 8546 can provide significant relief. Here are key takeaways to guide you through the process:

- Form 8546 is designed for taxpayers seeking reimbursement for bank charges incurred due to IRS errors. These errors include erroneous levies, direct debit installment agreement processing errors, or issues related to misplaced checks by the IRS.

- It's essential to complete the form accurately, including all necessary details such as your name, address, social security or employer identification number, and detailed electronic funds transfer information, if you prefer reimbursement through this method.

- Documentation is key to substantiate your claim. Attach all relevant documentation, including copies of the erroneous levy if applicable, bank records showing the charges you incurred, and proof that these charges have been paid.

- Both joint account holders and spouses on joint returns must sign Form 8546, ensuring that all parties affected by the IRS's mistake are acknowledged in the claim process.

- Timing matters. Claims need to be submitted within one year from when the error occurred or when the bank charge was imposed. This helps ensure timely reimbursement and compliance with legal statutes.

- If the form is being submitted on behalf of someone else due to reasons such as disability or death, proof of authorization must be included to authenticate the representation.

- Choosing electronic funds transfer (EFT) for reimbursement can expedite the process. Ensure that your bank's American Bankers Association (ABA) number, along with your account details, are correctly filled out to facilitate this mode of payment.

- Understanding the consequences of submitting fraudulent claims is crucial. The IRS imposes strict penalties, including fines or imprisonment, for such actions. Hence, honesty and accuracy in the filing process are paramount.

Successfully navigating Form 8546 can alleviate unnecessary financial burdens caused by IRS errors, ensuring that taxpayers are duly reimbursed for bank charges they should not have borne. Remember, ensuring accuracy, providing thorough documentation, and adhering to deadlines are your best strategies for a successful claim.

Popular PDF Documents

How to File Power of Attorney in California - The Tax POA 3520-PIT form is a document that allows an individual to grant another person the authority to handle their tax matters with the tax authorities.

Arizona Tpt - Designed to aid residential rental businesses in navigating their tax responsibilities with specific guidelines.