Get Irs 851 Form

If companies were family members, the IRS Form 851 would be the genealogical chart tracing who belongs to whom. This form plays a crucial role for corporate groups that file a consolidated income tax return, essentially acting as a roster that lists the entire family tree of corporations under a common parent. It is a key document for tax years ending on or after the designated revision date, where the Department of the Treasury and the Internal Revenue Service get a clear picture of the affiliations between the parent corporation and its subsidiaries. The Form 851 covers various aspects: it tallies overpayment credits, estimated tax payments, and tax deposits for each corporation in the affiliated group. It also delves into the specifics like the principal business activities, changes in stock holdings over the tax year, and some intricate details about stock classifications and potential changes within the group’s composition. Form 851 isn't just a formality; it determines each subsidiary's eligibility to be considered part of the affiliated group, ensuring the consolidated tax return accurately reflects the group's financial situation. With its fingers in so many pies, understanding Form 851 is essential for corporations navigating the complexities of consolidated tax filing.

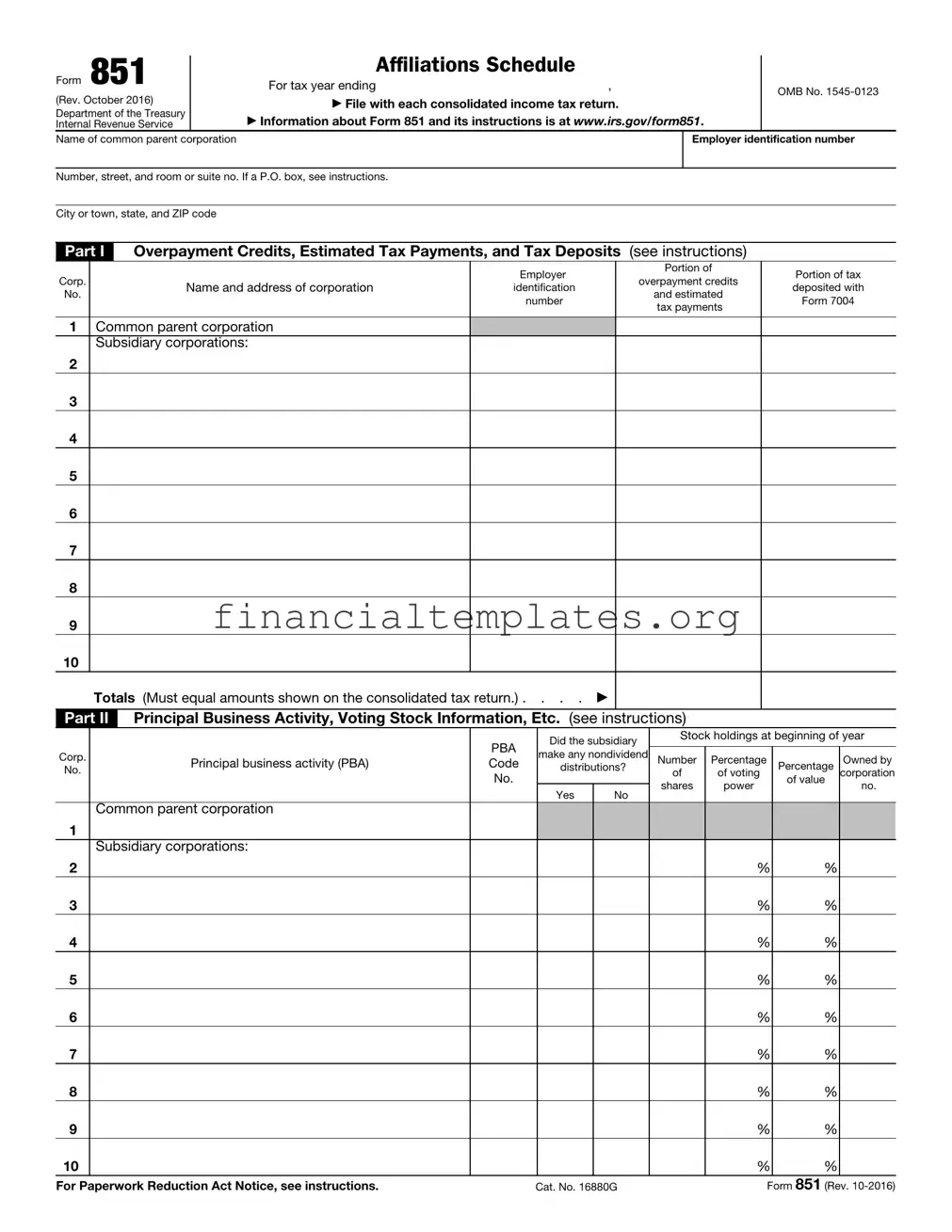

Irs 851 Example

Form 851 |

|

AFFILIATIONS |

SCHEDULE |

|

|

|

|

|

|

||

|

|

For tax year ending |

, |

|

OMB No. |

(Rev. October 2016) |

|

|

|

|

|

|

▶ File with each consolidated income tax return. |

|

|

||

Department of the Treasury |

|

|

|

||

|

▶ Information about Form 851 and its instructions is at www.irs.gov/form851. |

|

|||

Internal Revenue Service |

|

|

|||

Name of common parent corporation |

|

|

Employer identification number |

||

|

|

|

|

|

|

Number, street, and room or suite no. If a P.O. box, see instructions.

City or town, state, and ZIP code

Part I |

Overpayment Credits, Estimated Tax Payments, and Tax Deposits (see instructions) |

|

|||

|

|

|

Employer |

Portion of |

Portion of tax |

Corp. |

|

|

overpayment credits |

||

|

Name and address of corporation |

identification |

deposited with |

||

No. |

|

and estimated |

|||

|

|

number |

Form 7004 |

||

|

|

|

tax payments |

||

|

|

|

|

|

|

|

|

|

|

|

|

1 |

Common parent corporation |

|

|

|

|

|

Subsidiary corporations: |

|

|

|

|

2 |

|

|

|

|

|

3 |

|

|

|

|

|

4 |

|

|

|

|

|

5 |

|

|

|

|

|

6 |

|

|

|

|

|

7 |

|

|

|

|

|

8 |

|

|

|

|

|

9 |

|

|

|

|

|

10 |

|

|

|

|

|

Totals (Must equal amounts shown on the consolidated tax return.) . . . . ▶

Part II |

Principal Business Activity, Voting Stock Information, Etc. (see instructions) |

|

|

|

||||||

|

|

|

Did the subsidiary |

|

Stock holdings at beginning of year |

|||||

|

|

PBA |

|

|

|

|

||||

Corp. |

|

make any nondividend |

Number |

Percentage |

|

Owned by |

||||

Principal business activity (PBA) |

Code |

|

||||||||

|

|

|

Percentage |

|||||||

|

distributions? |

|||||||||

No. |

of |

of voting |

corporation |

|||||||

|

|

|||||||||

|

No. |

|

|

|

of value |

|||||

|

|

|

|

|

||||||

|

|

|

|

|

shares |

power |

no. |

|||

|

|

|

Yes |

No |

|

|||||

|

|

|

|

|

|

|

||||

Common parent corporation |

|

|

|

|

|

|

|

|

||

1 |

|

|

|

|

|

|

|

|

|

|

Subsidiary corporations: |

|

|

|

|

|

|

|

|

||

2 |

|

|

|

|

|

|

% |

% |

|

|

3

%

%

4

%

%

5

%

%

6

%

%

7

%

%

8

%

%

9

%

%

10

%

%

For Paperwork Reduction Act Notice, see instructions. |

Cat. No. 16880G |

Form 851 (Rev. |

Form 851 (Rev. |

|

|

|

|

|

|

|

Page 2 |

||

|

|

|

|

|

|

|

|

|

|

|

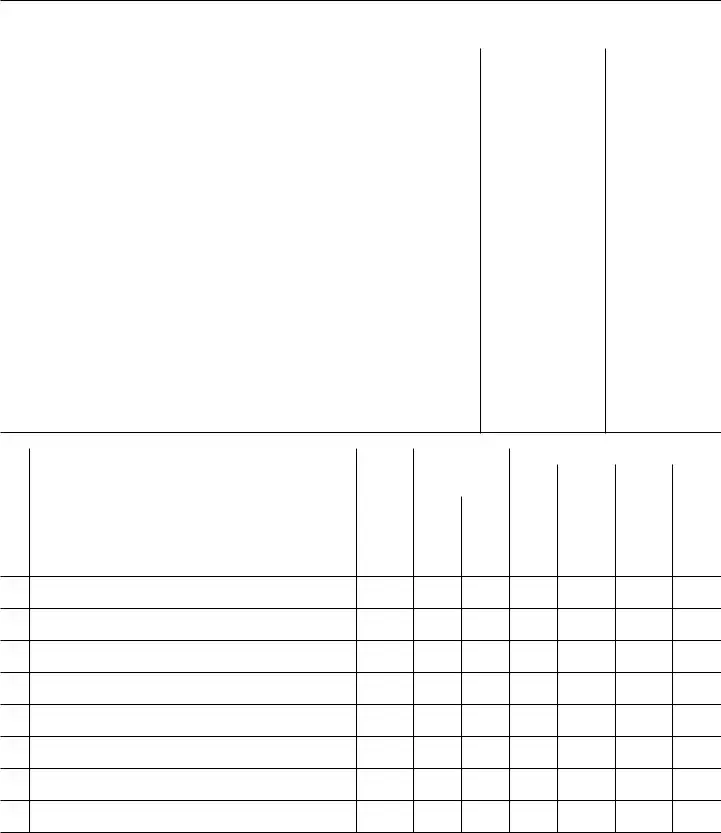

Part III |

Changes in Stock Holdings During the Tax Year |

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

(b) Shares held after |

|

|

|

|

|

Share- |

|

(a) |

Changes |

changes described in |

||

|

|

|

|

Date |

|

|

|

column (a) |

||

Corp. |

|

|

|

holder of |

|

|

|

|||

|

Name of corporation |

of |

|

|

|

|

|

|||

No. |

|

|

Corpora- |

transaction |

Number of |

|

Number of |

|

|

|

|

|

|

|

tion No. |

|

Percentage of |

Percentage of |

|||

|

|

|

|

|

shares |

|

shares |

|||

|

|

|

|

|

|

|

voting power |

value |

||

|

|

|

|

|

|

acquired |

|

disposed of |

||

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

% |

% |

|

|

|

|

|

|

|

|

|

% |

% |

|

|

|

|

|

|

|

|

|

% |

% |

|

|

|

|

|

|

|

|

|

% |

% |

|

|

|

|

|

|

|

|

|

% |

% |

|

|

|

|

|

|

|

|

|

% |

% |

|

|

|

|

|

|

|

|

|

% |

% |

|

|

|

|

|

|

|

|

|

% |

% |

(c)If any transaction listed above caused a transfer of a share of subsidiary stock (defined to include dispositions and deconsolidations), did the share's basis exceed its value at the time of the transfer? See

instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(d)Did any share of subsidiary stock become worthless within the meaning of section 165 (taking into account

the provisions of Regulations section

Yes

Yes

No

No

(e)If the equitable owners of any capital stock shown above were other than the holders of record, provide details of the changes.

(f)If additional stock was issued, or if any stock was retired during the year, list the dates and amounts of these transactions.

Form 851 (Rev.

Form 851 (Rev. |

Page 3 |

|

|

|

|

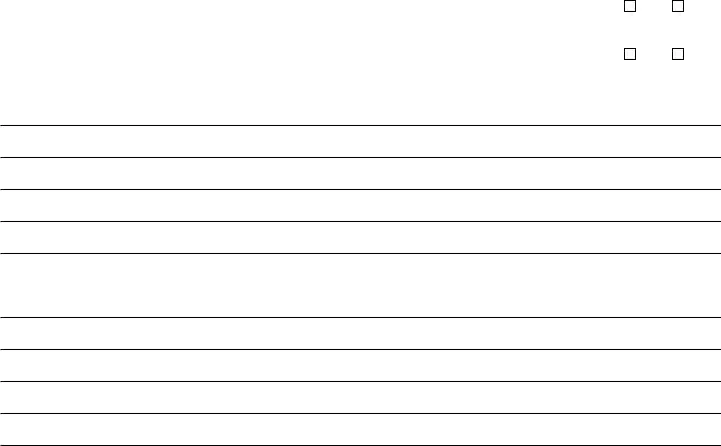

Part IV |

Additional Stock Information |

(see instructions) |

1 During the tax year, did the corporation have more than one class of stock outstanding? . . . . . .

If “Yes,” enter the name of the corporation and list and describe each class of stock.

Yes

No

Corp.

No.

Name of corporation

Class of stock

2During the tax year, was there any member of the consolidated group that reaffiliated within 60 months of disaffiliation? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

If “Yes,” enter the name of the corporation(s) and explain the circumstances.

Yes

No

Corp.

No.

Name of corporation

Explanation

3During the tax year, was there any arrangement in existence by which one or more persons that were not members of the affiliated group could acquire any stock, or acquire any voting power without acquiring

stock, in the corporation, other than a de minimis amount, from the corporation or another member of the affiliated group? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

If “Yes,” enter the name of the corporation and see the instructions for the percentages to enter in columns (a), (b), and (c).

Yes

No

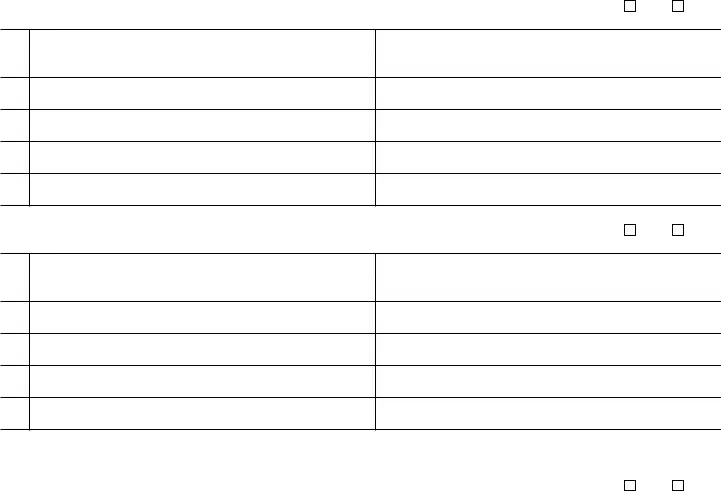

|

|

(a) |

(b) |

(c) |

|

Corp. |

Name of corporation |

Percentage of |

|||

Percentage of |

|||||

No. |

Percentage of value |

outstanding voting |

|||

|

voting power |

||||

|

|

|

stock |

||

|

|

|

|

||

|

|

% |

% |

% |

|

|

|

% |

% |

% |

|

|

|

% |

% |

% |

|

|

|

% |

% |

% |

|

Corp. |

(d) Provide a description of any arrangement. |

|

|

|

|

No. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Form 851 (Rev.

Form 851 (Rev. |

Page 4 |

|

|

Instructions

Section references are to the Internal Revenue Code unless otherwise noted.

Future Developments

For the latest information about developments related to Form 851 and its instructions, such as legislation enacted after they were published, go to www.irs.gov/form851.

Purpose of Form

Use Form 851 to:

1.Identify the common parent corporation and each member of the affiliated group;

2.Report the amount of overpayment credits, estimated tax payments, and tax deposits attributable to each corporation; and

3.Determine that each subsidiary corporation qualifies as a member of the affiliated group.

Who Must File

The parent corporation must file Form 851 for itself and for corporations in the affiliated group. File Form 851 by attaching it to the consolidated tax return for the group.

Affiliated Group

An affiliated group is one or more chains of includible corporations connected through stock ownership with a common parent corporation. See sections 1504(a) and (b). The common parent must be an includible corporation and the following requirements must be met.

1.The common parent must own directly stock that represents at least 80% of the total voting power and at least 80% of the total value of the stock of at least one of the other includible corporations.

2.Stock that represents at least 80% of the total voting power, and at least 80% of the total value of the stock of each of the other corporations (except for the common parent) must be owned directly by one or more of the other includible corporations.

For this purpose, the term “stock” generally doesn't include any stock that:

1.Is nonvoting,

2.Is nonconvertible,

3.Is limited and preferred as to dividends and doesn't participate significantly in corporate growth, and

4.Has redemption and liquidation rights that don't exceed the issue price of the stock (except for a reasonable redemption or liquidation premium).

Address

Include the suite, room, or other unit number after the street address. If the post office does not deliver mail to the street address and the corporation has a P.O. box, show the box number instead.

Corporation Numbers

When listing information in Parts II, III, and IV, use the same number for the common parent corporation and for each subsidiary corporation as the number listed in Part I.

Part I

Portion of overpayment credits and estimated tax payments. Enter for the common parent corporation and for each subsidiary corporation the amount of:

•Overpayments of tax from the prior tax year that each corporation elected to credit to the current year's tax, and

•Estimated tax payments made by each corporation.

The total must be the same as the amounts entered on the lines for overpayments and estimated tax payments on the consolidated income tax return.

Tax deposited with Form 7004. Enter for the common parent the tax deposited with Form 7004, Application for Automatic Extension of Time To File Certain Business Income Tax, Information, and Other Returns, that is attributable to each corporation. The total must be the same as the amount entered on the “Tax deposited with Form 7004” line on the consolidated income tax return.

Part II

Principal business activity (PBA) and PBA Code No. Enter the PBA and the PBA code number for the common parent corporation and for each subsidiary corporation. Use the activity for the specific industry group from which the largest percentage of each corporation's total receipts is based.

A list of the PBAs and code numbers is located in the Instructions for Form 1120. Nondividend distributions. Nondividend distributions are any distributions (other than stock dividends and distributions in exchange for stock) made to shareholders during the tax year for which the consolidated tax return is filed that were in excess of the corporation's current and accumulated earnings and profits. See sections 301 and 316 and Form 5452, Corporate Report of Nondividend Distributions.

Part III

Question (c). For this purpose, the term “transfer” includes transactions in which (1) a

Item (e). The term “equitable owners” of stock means those that essentially have all the rights to enjoy the benefits of stock ownership without actually holding the stock, for example, beneficiaries of a trust.

Part IV

Question 1. For purposes of question 1 only, disregard certain preferred stock as described in section 1504(a)(4).

Question 3. The term “arrangement” includes, but is not limited to, phantom stock, stock appreciation rights, an option, warrant, conversion feature, or similar arrangements. Item 3a. Show the percentage of the value of the outstanding stock that the person(s) could acquire.

Item 3b. If the arrangement was associated with voting stock, show the percentage of outstanding voting stock that the person(s) could acquire.

Item 3c. If the arrangement was associated with the acquisition of voting power without the acquisition of the related stock, show the percentage of voting power that the person(s) could acquire.

Item 3d. Give a brief description of any arrangement (defined above) by which a person that is not a member of the affiliated group could acquire any stock, or acquire any voting power without acquiring stock, in the corporation.

Paperwork Reduction Act Notice

We ask for the information on this form to carry out the Internal Revenue laws of the United States. You are required to give us the information. We need it to ensure that you are complying with these laws and to allow us to figure and collect the right amount of tax.

You are not required to provide the information requested on a form that is subject to the Paperwork Reduction Act unless the form displays a valid OMB control number. Books or records relating to a form or its instructions must be retained as long as their contents may become material in the administration of any Internal Revenue law. Generally, tax returns and return information are confidential, as required by section 6103.

The time needed to complete and file this form will vary depending on individual circumstances. The estimated burden for business taxpayers filing this form is approved under OMB control number

If you have comments concerning the accuracy of these time estimates or suggestions for making this form simpler, we would be happy to hear from you. See the instructions for the tax return with which this form is filed.

Document Specifics

| Fact Name | Description |

|---|---|

| Form Purpose | Form 851 is used to identify the common parent corporation and each member of an affiliated group, report certain tax information, and confirm each subsidiary's qualification as a group member. |

| Filing Requirement | The form must be filed by the parent corporation for itself and all corporations in the affiliated group, attached to the consolidated tax return. |

| Affiliated Group Definition | An affiliated group consists of chains of corporations connected through stock ownership with a common parent, meeting specific ownership criteria. |

| Stock Ownership Requirement | The common parent must own at least 80% of the voting power and value of one other corporation, with similar ownership requirements throughout the group. |

| Address Information | The address provided must include any unit number, or a P.O. box if mail is not delivered to the street address. |

| Parts of the Form | The form is divided into sections detailing overpayment credits, estimated tax payments, tax deposits, business activities, stock information, and changes in stock holdings. |

| Stock Consideration | For stock ownership, certain types of stock are generally not considered, including nonvoting, nonconvertible, and limited dividend stocks. |

| Special Situations | Includes arrangements allowing non-group members to acquire stock, reaffiliations within 60 months of disaffiliation, and additional stock information. |

| Paperwork Reduction Act Notice | This notice explains the necessity of the form for compliance with U.S. tax laws, including confidentiality and estimated time to complete. |

Guide to Writing Irs 851

Filling out IRS Form 851 is a crucial step for corporations that are part of an affiliated group filing a consolidated income tax return. This form allows the common parent corporation to report the financial affiliations and transactions among the group members for the tax year, including overpayment credits, estimated tax payments, and stockholder information. To ensure accurate reporting and compliance with IRS requirements, follow these step-by-step instructions carefully.

- At the top of Form 851, fill in the tax year ending date.

- Enter the name of the common parent corporation along with its Employer Identification Number (EIN).

- Provide the complete address of the common parent corporation, including the number, street, room or suite no. If applicable, refer to the instructions for P.O. box usage.

- In Part I, for each corporation (starting with the common parent corporation), list the overpayment credits and estimated tax payments. Make sure to include any tax deposited with Form 7004. Ensure the totals match the consolidated tax return amounts.

- For Part II, indicate the principal business activity (PBA) and the corresponding PBA Code Number for the common parent and each subsidiary. Check “Yes” or “No” for each subsidiary to indicate if any nondividend distributions were made.

- In Part III, detail any changes in stock holdings during the tax year, including acquisitions, disposals, and any other relevant transactions affecting stock value or ownership percentages.

- Answer Questions (c) and (d) in Part III regarding the transfer of stock that caused a change in basis exceeding its value, and whether any share of subsidiary stock became worthless during the tax year.

- Include any necessary details regarding the equitable owners of capital stock or additional stock issued or retired during the year in the spaces provided.

- In Part IV, answer whether the corporation had more than one class of stock outstanding during the tax year. If "Yes", list and describe each class.

- If any member of the consolidated group re-affiliated within 60 months after disaffiliation, provide details including the name(s) of the corporation(s) and an explanation of the circumstances.

- Address any arrangements allowing persons not part of the affiliated group to acquire stock or voting power without acquiring stock. Provide percentages and a detailed description of any such arrangements.

After completing all relevant sections of IRS Form 851, double-check your entries for accuracy. This form should be attached to the consolidated tax return filed by the common parent corporation. Remember, meticulous attention to detail and accurate reporting are essential to comply with IRS regulations and to ensure the affiliated group's tax filings are complete and correct.

Understanding Irs 851

What is the purpose of IRS Form 851?

IRS Form 851, known as the Affiliations Schedule, serves a crucial role in the tax filing process for affiliated groups of corporations. It is primarily used to identify the common parent corporation and each member of the affiliated group. Additionally, the form details the allocation of overpayment credits, estimated tax payments, and tax deposits to each corporation within the group. Its structure ensures that every subsidiary corporation is recognized as a qualifying member of the affiliated group, thereby enabling the accurate consolidation of tax returns.

Who is required to file IRS Form 851?

The onus to file Form 851 falls on the common parent corporation, which bears the responsibility of filing for itself and on behalf of the corporations within the affiliated group. This form is attached to the consolidated tax return for the group, revealing the intricate connections and financial interactions among the entities, thus providing the IRS with a comprehensive view of their financial posture as a collective entity.

What constitutes an affiliated group according to IRS Form 851?

An affiliated group, in the context of IRS Form 851, encompasses one or more chains of includible corporations connected through stock ownership with a common parent corporation. Two pivotal criteria underscore this definition: the common parent must own at least 80% of the total voting power and value of the stock of at least one other includible corporation, and, conversely, each of the other corporations must have at least 80% of their stock owned directly by one or more of the other includible corporations. This definition shapes the infrastructure of corporate tax filings by fostering unity and coherence in fiscal matters.

Can you explain the segments within IRS Form 851?

IRS Form 851 is meticulously divided into several segments, each crafted to capture specific details:

- Part I: Delineates overpayment credits, estimated tax payments, and tax deposits, attributing them to the common parent and subsidiary corporations. This part reconciles the collective tax responsibilities and entitlements.

- Part II: Undertakes the task of detailing the Principal Business Activity (PBA) and stock information, ensuring clarity in corporate identities and their operational scopes within the group.

- Part III: Focuses on any shifts in stock holdings throughout the tax year, capturing the dynamic nature of corporate structures and their impact on tax obligations.

- Part IV: Sheds light on additional stock information which may include various classes of stock and reconstructions in the group's makeup, further refining the fiscal portrait of the affiliated group.

What are the implications of failing to properly file IRS Form 851?

Failure to accurately file IRS Form 851 can lead to several repercussions for an affiliated group. Essential for consolidating tax returns, any inaccuracies, omissions, or lateness in filing this form can disrupt the accurate assessment of taxes due, potentially leading to penalties, interests, or audits. Correct and timely filing of Form 851 is imperative to ensure that the affiliated group's tax obligations are met appropriately, maintaining compliance with IRS regulations and avoiding unnecessary fiscal scrutiny.

Common mistakes

Filling out IRS Form 851 is a crucial step for corporations filing a consolidated income tax return. However, several common mistakes can be made during this process:

- Inaccurate Employer Identification Number (EIN): Not using the correct EIN for the common parent corporation can result in processing delays.

- Incorrect Address Information: Entering an incomplete or incorrect address for the common parent corporation, such as forgetting the suite or room number, can lead to misdirected correspondence.

- Miscalculating Overpayment Credits and Estimated Tax Payments: Failure to accurately report the overpayment credits and estimated tax payments for each corporation may affect the credit available for the current year's tax.

- Tax Deposited with Form 7004 Errors: Incorrectly attributing the tax deposited with Form 7004 to the wrong corporation within the group could lead to an inaccurate calculation of taxes due.

- Principal Business Activity (PBA) Code Misclassification: Misidentifying the PBA code for any corporation in the group can lead to incorrect tax treatment.

- Overlooking Nondividend Distributions: Failing to report nondividend distributions can result in inaccuracies in the consolidated tax return.

- Changes in Stock Holdings: Not properly reporting acquisitions, dispositions, or changes in stock holdings during the tax year can affect the eligibility of subsidiaries as members of the affiliated group.

- Ignoring Changes in Stock Classes: If there were changes in the classes of stock during the tax year and this is not reported, it could impact the tax filing.

- Failure to Report Arrangements: Not disclosing any arrangements by which non-group members could acquire stock or voting power can lead to incomplete compliance.

Avoiding these mistakes is essential for ensuring that the Form 851 accurately reflects the taxation situation of the affiliated group. Double-checking all information, understanding the requirements, and consulting the instructions for Form 851 can help in avoiding these common errors.

Documents used along the form

When filing Form 851, the Affiliations Schedule with the IRS, it's not uncommon for businesses to also need other forms and documents to provide a complete picture of their tax situation. Understanding these additional forms can help ensure that you're fully prepared when consolidating your tax returns.

- Form 1120: U.S. Corporation Income Tax Return. This form is the primary form used by corporations to report their income, gains, losses, deductions, credits and to figure out their federal income tax liability.

- Form 7004: Application for Automatic Extension of Time to File Certain Business Income Tax, Information, and Other Returns. This form allows businesses to request an extension of time to file their tax returns, including Form 1120.

- Form 5452: Corporate Report of Nondividend Distributions. Companies use this form to report nondividend distributions, which are payments to shareholders that are not made from earnings and profits.

- Form 1139: Corporation Application for Tentative Refund. This document is used by corporations to apply for a quick refund of taxes from carryback of a net operating loss, unused general business credits, overpayment of tax due to a claim of right adjustment under section 1341(b)(1), or overpayment of tax due to a loss or unused credit carryback.

- Form 8822-B: Change of Address or Responsible Party — Business. If a corporation changes its address or its responsible party, this form communicates the update to the IRS.

- Form 5471: Information Return of U.S. Persons With Respect to Certain Foreign Corporations. Companies with ownership interests in foreign corporations may need to file this form to satisfy reporting requirements.

Having these forms at hand can streamline the process of filing your consolidated tax return and ensure compliance with IRS rules and regulations. It's important to review each form's instructions carefully to determine how they fit into your overall tax filing strategy. Always consult with a professional if you're unsure about how to properly complete and file these documents.

Similar forms

The IRS Form 1040, U.S. Individual Income Tax Return, shares similarities with Form 851 in that it is a fundamental document required for filing annual income tax returns, albeit for individuals rather than corporations. Both forms serve as the primary documents for their respective filers, consolidating financial information to comply with U.S. tax laws. While Form 851 consolidates information for an affiliated group of corporations, Form 1040 consolidates an individual's income sources, deductions, and credits to calculate their tax liability.

Form 1120, U.S. Corporation Income Tax Return, is akin to Form 851 because it is used by corporations to report their annual income, gains, losses, deductions, and credits. Both forms are integral in the corporate tax filing process, with Form 851 being specifically for affiliated groups filing consolidated returns. Form 1120 is used by individual corporations to file their standalone tax returns before they are combined into a consolidated return with Form 851.

The Schedule K-1 (Form 1065), Partner's Share of Income, Deductions, Credits, etc., is used to report a partner's share of a partnership's income, deductions, and credits. It is similar to Form 851, as both documents deal with allocating income and financial information among multiple parties. However, while Form 851 deals with the allocation within an affiliated group of corporations, Schedule K-1 focuses on the distribution among partners in a partnership.

The Form 1065, U.S. Return of Partnership Income, relates to Form 851 by serving as the primary document for reporting a partnership's financial information, including income, losses, deductions, and credits. Both forms are used to report collective financial details of a group - Form 851 for an affiliated group of corporations and Form 1065 for partnerships. They are essential for the IRS to assess the proper tax liability based on the combined financial activities of their respective entities.

Similar to Form 851, Form 5471, Information Return of U.S. Persons With Respect to Certain Foreign Corporations, requires detailed financial information disclosure from filers. While Form 851 is concerned with domestic affiliated groups' financial information and stock ownership, Form 5471 captures a U.S. person's ownership in foreign corporations, showcasing the global nature of tax reporting. Both forms ensure compliance and transparency in the financial activities of business entities.

Form 1120-S, U.S. Income Tax Return for an S Corporation, parallels Form 851 as it's used by S corporations to report their annual tax return information. While Form 1120-S serves S corporations specifically, providing details on income, losses, deductions, credits, and tax liability, Form 851 serves to compile similar information for an affiliated group of corporations filing consolidated returns. Both are critical in their respective spheres for the accurate reporting of business income to the IRS.

Form 8865, Return of U.S. Persons With Respect to Certain Foreign Partnerships, has similarities with Form 851 regarding the reporting structure and requirement for disclosing transactions and financial standings. Form 851 focuses on domestic affiliated corporate groups, while Form 8865 is intended for reporting interests in foreign partnerships, yet both exist to ensure transparency and compliance in international and domestic financial dealings.

Form 8832, Entity Classification Election, resembles Form 851 in that it involves choices about the tax treatment of entities. While Form 8832 allows an entity to choose how it will be classified for federal tax purposes (such as an S corporation, C corporation, partnership, or disregarded entity), Form 851 is utilized by corporations choosing to file consolidated tax returns as an affiliated group. Both forms reflect the IRS's requirement for clarity on the tax status and reporting methods of business entities.

Finally, Form 7004, Application for Automatic Extension of Time To File Certain Business Income Tax, Information, and Other Returns, while not a tax return form itself, is related to Form 851 in its role in the tax filing process. Form 7004 is used to request extensions for filing tax returns, including those of corporations that might later file Form 851 as part of their consolidated tax returns. This link underscores the integrated nature of tax administration and compliance, providing flexibility in the corporate tax filing calendar.

Dos and Don'ts

When working with IRS Form 851, Affiliations Schedule, attention to detail is key. This document plays a critical role in filing a consolidated income tax return for affiliated groups. Here is a list of do's and don'ts to ensure accuracy and compliance:

- Do ensure that the common parent corporation's name and all subsidiary information are accurately listed, as Form 851 requires detailing each member of the affiliated group.

- Do verify the Employer Identification Number (EIN) for the common parent corporation is current and correctly entered, as it is essential for identification purposes.

- Do include the correct year-end date for the tax year being reported to match the period of the consolidated income tax return.

- Do review the instructions for Part I regarding overpayment credits, estimated tax payments, and tax deposits to allocate these correctly among the group members.

- Do accurately report the principal business activity (PBA) and PBA code for both the common parent and each subsidiary, reflecting the main revenue-generating activity.

- Don't overlook the need to report changes in stock holdings during the tax year in Part III, including shares acquired or disposed of, as these impact the affiliated group's structure.

- Don't forget to disclose nondividend distributions in Part II, as this information is crucial for determining the distribution of earnings and profits within the group.

- Don't ignore questions regarding stock decorations in Part IV, including if there is more than one class of stock outstanding or if any arrangements exist that could change stock ownership or voting power outside the group.

- Don't file Form 851 without attaching it to the consolidated tax return. It is a supplement to the main filing and is not meant to be filed independently.

- Don't rush through filling out the form without double-checking all entered information for accuracy and completeness, as errors can lead to processing delays or audits.

Following these recommendations will help ensure the correct filing of Form 851 and contribute to the smooth processing of the affiliated group's consolidated tax return.

Misconceptions

There are several common misconceptions about the IRS Form 851, which is crucial for accurately filing consolidated income tax returns. Understanding these misconceptions is important for taxpayers to ensure compliance and optimize their tax situations.

- Misconception 1: Form 851 is only for large corporations.

Contrary to what some may believe, Form 851 is not exclusively for large corporations. It's mandatory for any common parent corporation filing a consolidated tax return on behalf of itself and other affiliated corporations meeting the ownership requirements. This includes small and medium-sized entities that are part of a controlled group of corporations.

- Misconception 2: All subsidiaries must be listed on Form 851 regardless of ownership stake.

Another misunderstanding is that all subsidiaries or related entities must be detailed on Form 851. The truth is, only those subsidiaries in which the common parent corporation owns at least 80% of the total voting power and total value of their stock are required to be listed. This ownership threshold ensures the group qualifies as an affiliated group for filing a consolidated return.

- Misconception 3: Estimated tax payments and overpayment credits are reported in the aggregate for the group.

While consolidated returns are filed as a single document, Form 851 requires the disaggregation of estimated tax payments and overpayment credits by delineating how much is attributable to each corporation within the affiliated group. This misconception may lead to the incorrect reporting of payments and credits, impacting the overall tax liability of the consolidated group.

- Misconception 4: Changes in stock ownership within the tax year do not need to be specifically reported on Form 851.

Any changes in stock ownership among the affiliated corporations during the tax year must be closely detailed in Parts III and IV of Form 851. This includes acquisitions, dispositions, and alterations in stock classes. The detailed reporting of stock ownership changes is crucial for maintaining compliance and accurately reflecting the tax implications of these changes.

Dispelling these misconceptions is essential for taxpayers involved in filing consolidated tax returns. An accurate understanding of the requirements for Form 851 ensures proper compliance with IRS regulations and enables corporations to manage their consolidated tax liabilities effectively.

Key takeaways

Form 851, known as the Affiliations Schedule, plays a crucial role in the filing of consolidated income tax returns by affiliated groups of corporations. Here are key takeaways regarding the completion and use of this form:

- Primary Purpose: Form 851 is designed to identify the common parent corporation and each member of an affiliated group, report specific tax credits and payments for each corporation, and confirm that each subsidiary qualifies as a member of the affiliated group.

- Filing Requirement: The common parent corporation is responsible for filing Form 851 on behalf of itself and all corporations in the affiliated group as part of the consolidated tax return.

- Definition of an Affiliated Group: An affiliated group consists of chains of corporations connected through stock ownership with a common parent corporation. The common parent must own significant portions of the voting power and value in at least one other corporation.

- Ownership Requirements: To meet the definition of an affiliated group, the common parent must directly own stock representing at least 80% of the total voting power and total value of the stock of one or more includible corporations.

- Address and Corporation Numbers: It's essential to include the correct address for the common parent corporation and consistently use designated corporation numbers throughout Form 851.

- Overpayment Credits and Estimated Tax Payments: Part I of Form 851 requires detailed reporting of overpayment credits and estimated tax payments by the common parent and each subsidiary corporation.

- Principal Business Activity: Corporations must list their principal business activities and associated codes in Part II, which helps clarify the primary economic activities within the affiliated group.

- Stock Information: The form requires detailed information about any changes in stock holdings, including issues, retirements, and changes in voting power, throughout the tax year.

- Special Situations: Form 851 encompasses items for disclosing arrangements that allow individuals outside the affiliated group to acquire stock or voting power, highlighting the need for transparency in corporate structures.

The completion of Form 851 requires careful attention to the specific holdings and transactions of the affiliated group, ensuring accurate representation of affiliations and financial movements within the group for tax purposes. Compliance with these requirements ensures that the Internal Revenue Service accurately assesses taxes and acknowledges the consolidated entity's operations and contributions.

Popular PDF Documents

What Is Amt Depreciation - It serves as a checkpoint for taxpayers to validate their tax obligations beyond the standard IRS forms.

IRS 8962 - Form 8962 helps translate your health insurance premiums into potential tax savings or obligations.

Uncollected Social Security and Medicare Tax on Wages - This form can also lead to a review of a worker's employment situation by the IRS, potentially leading to broader corrections in classification practices.