Get Irs 8453 Eo Form

The process of electronically filing tax documents with the Internal Revenue Service (IRS) for exempt organizations or persons subject to tax includes a crucial step: the submission of Form 8453-EO, Exempt Organization Declaration and Signature for Electronic Filing. Specifically designed for use alongside Forms 990, 990-EZ, 990-PF, 990-T, 1120-POL, 4720, and 8868, this form plays a pivotal role in the tax filing procedure for the 2020 calendar year or fiscal year beginning in 2020. It serves multiple functions, including authenticating the electronic filing of returns, authorizing electronic funds withdrawals for tax payments, and allowing designated Electronic Return Originators (EROs) to transmit returns. Organizations or individuals using this form must accurately fill out details regarding their tax situation, ensuring that all declarations are complete and correct to the best of their knowledge under penalties of perjury. Moreover, Form 8453-EO facilitates the electronic filing process by enabling officers or persons subject to tax to consent to third-party transmissions and payments, thus streamlining the submission of their tax returns and associated payments to the IRS. For those seeking detailed guidance or the latest updates regarding Form 8453-EO, the IRS website serves as a valuable resource.

Irs 8453 Eo Example

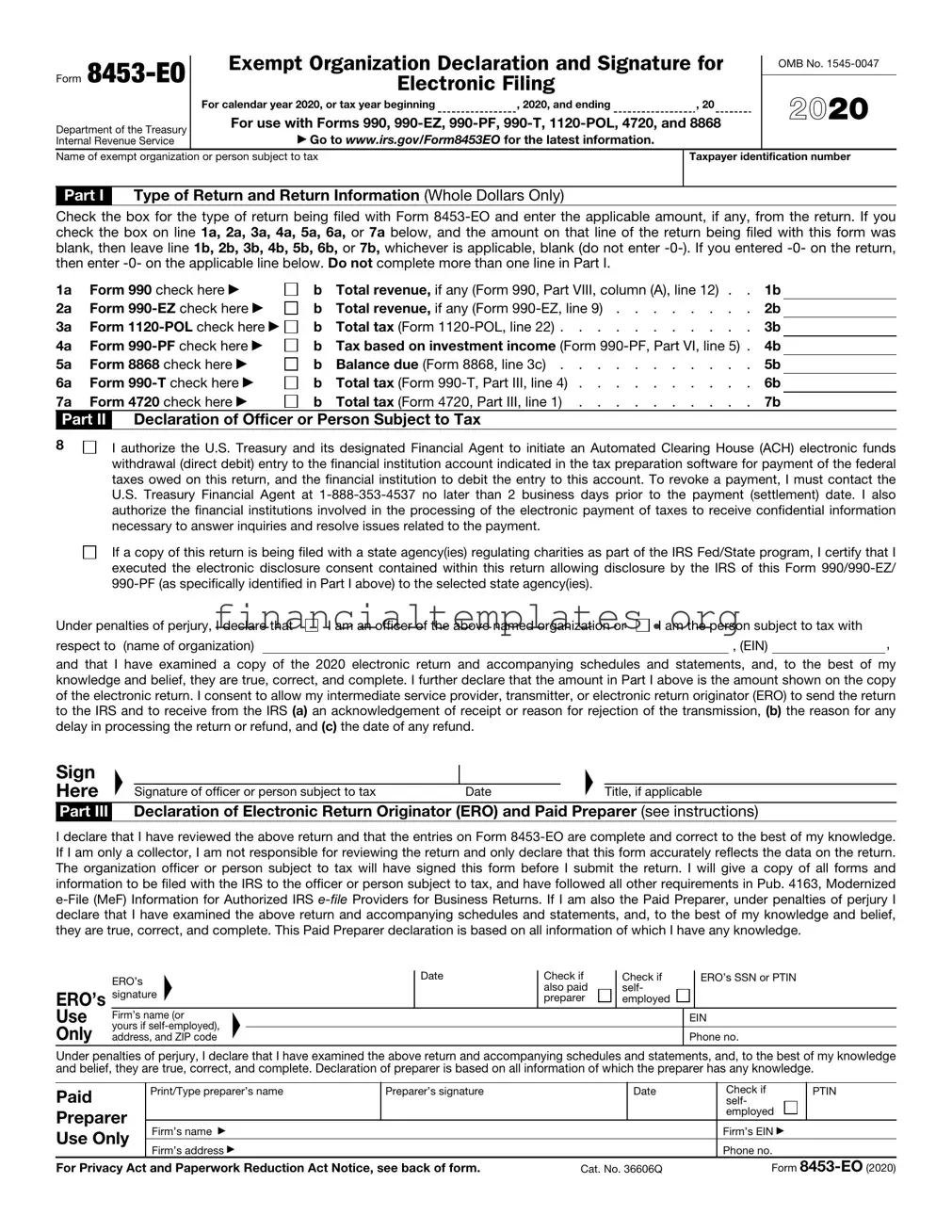

Form

Department of the Treasury Internal Revenue Service

Exempt Organization Declaration and Signature for

Electronic Filing

For calendar year 2020, or tax year beginning |

, 2020, and ending |

, 20 |

For use with Forms 990,

▶Go to WWW.IRS.GOV/FORM8453EO for the latest information.

OMB No.

2020

Name of exempt organization or person subject to tax

Taxpayer identification number

Part I Type of Return and Return Information (Whole Dollars Only)

Check the box for the type of return being filed with Form

1a Form 990 check here ▶

2a Form

3a Form

4a Form

5a Form 8868 check here ▶

6a Form

7a Form 4720 check here ▶

bTotal revenue, if any (Form 990, Part VIII, column (A), line 12) . . 1b

b |

Total revenue, if any (Form |

. . . |

. |

. . |

. |

2b |

b |

Total tax (Form |

. . . |

. |

. . |

. |

3b |

b Tax based on investment income (Form

b |

Balance due (Form 8868, line 3c) . . . . |

. |

. . |

. |

. |

. |

. |

5b |

b |

Total tax (Form |

. |

. . |

. |

. |

. |

. |

6b |

b |

Total tax (Form 4720, Part III, line 1) . . . |

. |

. . |

. |

. |

. |

. |

7b |

Part II Declaration of Officer or Person Subject to Tax

8

I authorize the U.S. Treasury and its designated Financial Agent to initiate an Automated Clearing House (ACH) electronic funds withdrawal (direct debit) entry to the financial institution account indicated in the tax preparation software for payment of the federal taxes owed on this return, and the financial institution to debit the entry to this account. To revoke a payment, I must contact the U.S. Treasury Financial Agent at

If a copy of this return is being filed with a state agency(ies) regulating charities as part of the IRS Fed/State program, I certify that I executed the electronic disclosure consent contained within this return allowing disclosure by the IRS of this Form

Under penalties of perjury, I declare that

respect to (name of organization)

I am an officer of the above named organization or

I am the person subject to tax with

, (EIN),

and that I have examined a copy of the 2020 electronic return and accompanying schedules and statements, and, to the best of my knowledge and belief, they are true, correct, and complete. I further declare that the amount in Part I above is the amount shown on the copy of the electronic return. I consent to allow my intermediate service provider, transmitter, or electronic return originator (ERO) to send the return to the IRS and to receive from the IRS (a) an acknowledgement of receipt or reason for rejection of the transmission, (b) the reason for any delay in processing the return or refund, and (c) the date of any refund.

Sign Here

Part III

▲

|

|

▲ |

|

Signature of officer or person subject to tax |

Date |

Title, if applicable |

Declaration of Electronic Return Originator (ERO) and Paid Preparer (see instructions)

I declare that I have reviewed the above return and that the entries on Form

ERO’s

Use

Only

ERO’s |

▲ |

signature |

|

Firm’s name (or

yours if

▲

Date |

Check if |

Check if |

|

ERO’s SSN or PTIN |

|

also paid |

self- |

|

|

|

preparer |

employed |

|

|

|

|

|

|

|

|

|

|

EIN |

|

|

|

|

|

|

|

|

|

Phone no. |

|

|

|

|

|

|

Under penalties of perjury, I declare that I have examined the above return and accompanying schedules and statements, and, to the best of my knowledge and belief, they are true, correct, and complete. Declaration of preparer is based on all information of which the preparer has any knowledge.

Paid |

Print/Type preparer’s name |

Preparer’s signature |

|

Date |

Check if |

PTIN |

|

|

|

|

self- |

|

|

Preparer |

|

|

|

|

employed |

|

|

|

|

|

|

|

|

Firm’s name ▶ |

|

|

|

Firm’s EIN ▶ |

|

|

Use Only |

|

|

|

|

||

Firm’s address ▶ |

|

|

|

Phone no. |

|

|

|

|

|

|

|

||

For Privacy Act and Paperwork Reduction Act Notice, see back of form. |

Cat. No. 36606Q |

Form |

||||

Form |

Page 2 |

|

|

Instead of filing Form

TIP electronic return originator (ERO) can sign the return using a personal identification number (PIN). For details, see Form

Future Developments

For the latest information about developments related to Form

Purpose of Form

Use Form

•Authenticate the electronic Form 990, Return of Organization Exempt From Income Tax; Form

•Authorize the ERO, if any, to transmit via a

•Authorize the intermediate service provider (ISP) to transmit via a third- party transmitter if you’re filing online (not using an ERO); and

•Authorize an electronic funds withdrawal for payment of federal taxes owed (Form

Who Must File

If you’re filing a 2020 Form 990, Form

When To File

Form 990, Form

Form

Form 4720. Generally, file Form 4720 by the due date of the organization’s Form 990,

15th day of the 5th month after the end of the tax year. The Form

Form 8868. Generally, file Form 8868 by the due date of the return for which you’re requesting an extension. The Form

How To File

File Form

Part II. Declaration of Officer or Person Subject to Tax

If a Form

If the officer or person subject to tax checks the box when filing Form

•Routing number,

•Account number,

•Type of account (checking or savings),

•Debit amount, and

•Debit date (date the organization or person subject to tax wants the debit to occur).

In the third paragraph, check the appropriate box to declare whether you are an officer or person subject to tax (and enter the name of the organization and employer identification number (EIN)).

An electronically transmitted return will not be considered complete (and therefore not considered filed) unless either:

•Form

•The return is filed through an ERO and Form

The signature of the officer or person subject to tax allows the IRS to disclose to the ISP, ERO, and/or transmitter:

•An acknowledgment that the IRS has accepted the electronically filed return, and

•The reason(s) for a delay in processing the return or refund.

The declaration of officer or person subject to tax must be signed and dated by:

•The president, vice president, treasurer, assistant treasurer, chief accounting officer; or

•Any other officer or person subject to tax authorized to sign the return.

If this return contains instructions to the IRS to provide a copy(ies) of the return to a state agency(ies) regulating charities as part of the IRS Fed/State program, the checkbox in Part II must be checked.

Part III. Declaration of Electronic Return Originator (ERO) and Paid Preparer

Note: If the return is filed online through an ISP and/or transmitter (not using an ERO), don’t complete the ERO’s Use Only section in Part III.

If the return is filed through an ERO, the IRS requires the ERO’s signature. A paid preparer, if any, must sign Form

An ERO may sign the Form

Use of PTIN

Paid preparers. Anyone who is paid to prepare the organization’s return must enter their PTIN in Part III. The PTIN entered must have been issued after September 27, 2010. For information on applying for and receiving a PTIN, see Form

EROs who aren’t paid preparers. Only EROs who aren’t also the paid preparer of the return have the option to enter their PTIN or their social security number in the ERO’s Use Only section of Part III. If the PTIN is entered, it must have been issued after September 27, 2010. For information on applying for and receiving a PTIN, see Form

Privacy Act and Paperwork Reduction Act Notice. We ask for the information on this form to carry out the Internal Revenue laws of the United States. You’re required to give us the information. We need it to ensure that you’re complying with these laws and to allow us to figure and collect the right amount of tax.

You’re not required to provide the information requested on a form that is subject to the Paperwork Reduction Act unless the form displays a valid OMB control number. Books or records relating to a form or its instructions must be retained as long as their contents may become material in the administration of any Internal Revenue law. Generally, tax returns and return information are confidential, as required by Internal Revenue Code section 6103. However, certain returns and return information of tax exempt organizations and trusts are subject to public disclosure and inspection, as provided by section 6104.

The time needed to complete and file this form will vary depending on individual circumstances. The estimated burden for tax exempt organizations filing this form is approved under OMB control number

Document Specifics

| Fact | Detail |

|---|---|

| Form Name and Purpose | Form 8453-EO is used by exempt organizations to authenticate the electronic filing of various forms, authorize an ERO to transmit, and authorize electronic funds withdrawal. |

| Applicable Forms | Used with Forms 990, 990-EZ, 990-PF, 990-T, 1120-POL, 4720, and 8868. |

| Filing Requirement | Must be filed by organizations using electronic filing methods without an ERO, or by an ERO on behalf of the organization. |

| Submission Method | Form 8453-EO should be scanned into a PDF and transmitted with the electronically filed return. |

| Signatory Requirements | Must be signed by an officer of the organization or a person subject to tax, and if applicable, by the ERO and/or paid preparer. |

Guide to Writing Irs 8453 Eo

After preparing an exempt organization's electronic tax return, the next step involves authenticating the submission through Form 8453-EO. This document plays a crucial role in the electronic filing process, serving as a declaration and signature form for the exempt organization or person subject to tax. Filling it out accurately is essential for ensuring the electronic filing is processed correctly by the IRS. Below is a detailed guide to assist with each part of Form 8453-EO for a smooth filing experience.

- First, enter the Name of exempt organization or the person subject to the tax at the top of the form, followed by the Taxpayer identification number.

- Under Part I Type of Return and Return Information, check the box next to the type of return you are filing (e.g., Form 990, 990-EZ, etc.). In the corresponding ‘b’ section, input the applicable amount from your return if any.

- In Part II Declaration of Officer or Person Subject to Tax, if opting to pay any owed federal taxes via electronic funds withdrawal, check the appropriate box. If not, leave this section blank.

- Still in Part II, check the relevant box to indicate whether you are an officer of the named organization or a person subject to tax. Fill in the name of the organization and its EIN as requested in the paragraph.

- Sign and date the form in the designated area at the bottom of Part II. A title is optional but recommended if applicable.

- For return submissions through an ERO, proceed to Part III Declaration of Electronic Return Originator (ERO) and Paid Preparer. If an ERO is not used and you're filing online through an ISP and/or transmitter, this section can be skipped.

- If applicable, have the ERO sign the form, filling in their information in the ‘ERO’s Use Only’ section. Paid preparers must sign in the 'Paid Preparer Use Only' space, unless they are also serving as the ERO, in which case they should check the box labeled Check if also paid preparer.

- Finally, ensure any paid preparer who assisted with the form inputs their PTIN in the specified area. EROs who are not paid preparers have the option to enter either their PTIN or SSN.

Upon completing these steps, scan the signed Form 8453-EO into a PDF file as part of your submitting documentation through your tax software. This ensures that your electronic filing is authenticated and can be processed by the IRS. Following these instructions carefully will help in avoiding common mistakes and delays in the filing process.

Understanding Irs 8453 Eo

What is IRS Form 8453-EO used for?

Form 8453-EO is utilized by exempt organizations to authenticate the electronic filing of various forms, such as Form 990, 990-EZ, 990-PF, 990-T, 1120-POL, 4720, and 8868. It allows an organization to authorize an electronic return originator (ERO), if being used, to transmit their return via a third-party transmitter. Additionally, it authorizes electronic funds withdrawal for the payment of federal taxes and consents to electronic disclosure to state agencies if part of the IRS Fed/State program.

Who needs to file Form 8453-EO?

This form must be filed by any exempt organization that is electronically filing Form 990, 990-EZ, 990-PF, 990-T, Form 1120-POL, Form 4720, or Form 8868 with payment through an internet service provider and/or transmitter and not using an ERO. An ERO has the option to use either Form 8453-EO or Form 8879-EO to obtain authorization to file one of the specified forms.

When should Form 8453-EO be filed?

The filing deadline varies by form type. For Forms 990, 990-EZ, 990-PF, or 990-T, it should be filed by the 15th day of the 5th month following the organization's accounting period end. Form 1120-POL must be filed by the 15th day of the 4th month after the organization’s accounting period ends. Generally, Form 4720 follows the due date of the organization’s other applicable forms, and Form 8868 is due by the due date of the return for which an extension is being requested. If the regular due dates fall on a weekend or legal holiday, the next business day is the deadline. Form 8453-EO is to be transmitted with the electronically filed return.

How is Form 8453-EO filed?

To file Form 8453-EO, prepare and complete the form, then scan it to create a PDF file. The tax preparation software you are using should allow for the transmission of this PDF file along with your electronically filed return. If electronic funds withdrawal is selected for tax payment, the necessary financial institution account information must be included in the tax preparation software for processing.

What are the responsibilities of the Electronic Return Originator (ERO) and Paid Preparers in relation to Form 8453-EO?

An ERO is required to review, sign, and transmit Form 8453-EO when filing electronically on behalf of an exempt organization. The ERO can sign the form using a rubber stamp, mechanical device, or computer software program that includes a facsimile of the ERO's signature or printed name. Paid preparers must sign the form in the designated section if they have been compensated for preparing the return. If the paid preparer is also the ERO, this section does not need to be completed, but the box indicating "Check if also paid preparer" should be checked. All paid preparers must enter their PTIN.

Common mistakes

Filling out IRS Form 8453-EO, the Exempt Organization Declaration and Signature for Electronic Filing, requires careful attention to detail. Organizations often make mistakes on this form, which can delay processing. Here are ten common errors:

Not checking the appropriate box for the type of return being filed in Part I, leading to confusion about which form the 8453-EO is accompanying.

Entering incorrect amounts on lines 1b through 7b. It should match the figures on the corresponding electronic return exactly, without rounding off to the nearest dollar.

Overlooking the need to leave certain lines blank if the related line on the electronic return is blank, as stated in the form's instructions, which can lead to discrepancies.

Failing to authorize electronic funds withdrawal correctly in Part II by not checking the box, leading to payment issues.

Incorrect or incomplete information about the financial institution account, including routing and account numbers, can prevent or delay the electronic funds withdrawal.

Not providing complete declaration information in the third paragraph of Part II, specifically around the authority and identity of the officer or person subject to tax.

Missing the signature and date in Part II, which is crucial as it is under penalties of perjury and confirms the truthfulness and completeness of the attached electronic return.

Incomplete or improperly completed Part III, particularly the area designated for the Electronic Return Originator (ERO) and paid preparer, which can invalidate the form.

Forgetting to check the box in Part III if the paid preparer is also the ERO, causing confusion regarding the roles of the individuals involved in filing.

Entering inaccurate or outdated Preparer Tax Identification Numbers (PTIN) or failing to use them at all. This oversight can result in processing delays.

In conclusion, careful review and accurate completion of IRS Form 8453-EO are essential for exempt organizations. Avoiding these common mistakes helps ensure a smoother electronic filing process.

Documents used along the form

When preparing and filing tax-related documents for an organization, especially when doing so electronically, it's essential to know which additional forms and documents might be needed alongside the primary one. In the case of the IRS Form 8453-EO, which is an Exempt Organization Declaration and Signature for Electronic Filing, there are several other forms that are commonly used in conjunction with it. Understanding these forms helps ensure all necessary information and declarations are accurately submitted to the IRS.

- Form 990 - This form is known as the "Return of Organization Exempt from Income Tax." It's used by tax-exempt organizations to provide the IRS with annual financial information.

- Form 990-EZ - A shorter version of Form 990, it's designed for eligible organizations to report their financial information more succinctly.

- Form 1120-POL - Used by political organizations, this form reports income taxes specifically for groups involved in political activities.

- Form 990-PF - A form used by private foundations in the U.S., including insightful details about grants and financial activities throughout the year.

- Form 8868 - Organizations needing more time to file their return can use this form to apply for an Automatic Extension of Time To File an Exempt Organization Return.

- Form 4720 - Individuals, estates, trusts, and certain exempt organizations file this form to report certain excise taxes under chapters 41 and 42 of the Internal Revenue Code.

- Form 8879-EO - IRS e-file Signature Authorization for an Exempt Organization. This form is used for an officer of the organization to authorize an electronic return originator (ERO) to e-file a return.

- Form 990-T - Exempt Organization Business Income Tax Return, used by tax-exempt organizations to report and pay income tax on unrelated business income.

Each form serves a unique purpose, contributing specific details required for comprehensive tax reporting and compliance. By ensuring these forms are correctly and fully completed, organizations can maintain their tax-exempt status and adhere to federal regulations. Keeping organized records and understanding the specific requirements for each form is crucial for a smooth filing process.

Similar forms

The Form 8453-EO, used by exempt organizations for electronic filing declarations, shares similarities with Form 8879-EO, IRS e-file Signature Authorization for an Exempt Organization. Both forms serve as electronic signatures for exempt organizations, authorizing the submission of their respective returns via electronic means. The key difference lies in their usage; while Form 8453-EO is utilized alongside electronic filings of various exempt organization returns such as Forms 990, 990-EZ, and others, Form 8879-EO specifically facilitates the use of a personal identification number (PIN) as a signature for electronic filings, providing an alternate method of authorization.

Similarly, Form 8879, IRS e-file Signature Authorization, operates in the same realm but caters to individual taxpayers instead of organizations. It functions as the electronic signature for individuals, joint filers, or estate and trust returns, paralleling the Form 8453-EO’s role for organizations. The purpose of Form 8879 is to validate the electronic submission of Form 1040, 1040-SR, or other individual income tax returns, allowing taxpayers to authorize electronic return originators (EROs) to file on their behalf, thus mirroring the authorization process of Form 8453-EO for exempt organizations.

Form 8453, U.S. Individual Income Tax Transmittal for an IRS e-file Return, is similar to the 8453-EO in that it is a transmittal form used for electronic filing. However, Form 8453 is designed for individual filers to submit specific documents by mail that cannot be electronically filed, such as W-2s or supporting documentation for a tax credit claim. Like the 8453-EO, it ensures that critical paper documents are correctly matched with their electronic submissions, though it caters to individual taxpayers rather than exempt organizations.

Another related document is Form 7004, Application for Automatic Extension of Time To File Certain Business Income Tax, Information, and Other Returns. This form enables businesses, including certain exempt organizations, to request extensions for filing their returns, similar to how Form 8868, which can be filed electronically using Form 8453-EO, allows exempt organizations to apply for an extension. Both extension forms underscore the IRS's flexibility in accommodating various entities' filing needs, highlighting mechanisms to ensure timely compliance without completing the final return submission.

Last, Form 990 itself, while not a form for electronic signatures or authorizations, is inherently connected to the Form 8453-EO as one of the primary forms that an exempt organization might file electronically. Form 990, Return of Organization Exempt From Income Tax, requires detailed financial and operational information. When filed electronically, the authorization through Form 8453-EO confirms the integrity and consent of the submitting organization, binding the electronic submission to the entity's officer or authorized individual.

Dos and Don'ts

When it comes to completing the IRS Form 8453-EO, certain practices can make the process smoother and help avoid common pitfalls. This form is crucial for exempt organizations, as it declares and authenticates electronic filings of returns such as Forms 990, 990-EZ, and others. Here are some dos and don'ts to consider:

- Do double-check the type of return you're filing and ensure you're selecting the correct box in Part I to match your submission.

- Do accurately report total revenue, taxes, and any amounts due in Part I, exactly as stated in your return forms, to ensure consistency between documents.

- Do make sure that the officer or tax-responsible person properly authorizes the electronic funds withdrawal if opting to make a tax payment directly from a bank account.

- Do ensure all information related to the financial institution account is correctly entered if you opt for direct debit payment, including routing and account numbers.

- Do verify that the form is signed by an authorized officer of the organization, with their title clearly indicated, to authenticate the filing.

- Do retain a copy of the completed Form 8453-EO for your records, as well as any acknowledgment received from the IRS concerning the electronic filing.

- Do use the form to authorize an Electronic Return Originator (ERO), if employed, to transmit the return, ensuring you complete the declaration in Part III if applicable.

- Don't leave any applicable lines in Part I blank if your return includes values for total revenue, total tax, or balance due—enter these amounts carefully.

- Don't opt for an electronic funds withdrawal without double-checking bank details and payment amount for accuracy to prevent transaction issues.

- Don't sign the form without thoroughly reviewing all parts of your electronic return, along with schedules and statements, for correctness and completeness.

- Don't forget to include the date and title of the officer or person subject to tax alongside their signature in Part II.

- Don't neglect the declaration of the ERO and Paid Preparer in Part III, if this applies to your filing situation.

- Don't use the form without checking the most current instructions and guidelines available on the IRS website, considering legislative changes or updates may affect filing requirements.

- Don't disregard the necessity of obtaining a Preparer Tax Identification Number (PTIN) for paid preparers, ensuring it's correctly reported on the form if needed.

Adhering to these guidelines can contribute to a successful and compliant submission of Form 8453-EO, aiding organizations in effectively managing their electronic tax filings.

Misconceptions

There are several misconceptions about the IRS Form 8453-EO that can confuse both seasoned professionals and those new to handling tax documents for exempt organizations. Addressing these can help ensure accurate and efficient filing.

- All exempt organizations must file Form 8453-EO: In reality, only those exempt organizations that are submitting their returns electronically are required to file Form 8453-EO. This form acts as a declaration and signature document for electronic filing, rather than a universal requirement for all tax-exempt entities.

- Form 8453-EO serves as the tax return: This is a misunderstanding. Form 8453-EO is not the tax return itself but is a supporting document for electronic submissions. The actual tax return consists of forms like 990, 990-EZ, 990-PF, among others, depending on the organization’s activities and financial situation.

- Form 8453-EO can authorize an extension: While Form 8453-EO is used alongside various tax forms, including Form 8868 (used for requesting extensions), it does not in itself grant an extension. The authorization it provides is specifically for electronic filing and payment (if applicable).

- Electronic funds withdrawal authorization is always required: This form part is optional and is only relevant if the organization chooses to pay any owed taxes via direct debit. If the organization does not owe taxes or chooses another payment method, this section does not apply.

- Any organization member can sign the Form 8453-EO: The signing of Form 8453-EO is limited to officers or individuals authorized to act on behalf of the organization. Typically, this includes roles such as the president, vice president, treasurer, or another officer with significant responsibility.

- The paid preparer must always sign Form 8453-EO: A paid preparer's signature is only necessary if they prepared the form. If an electronic return originator (ERO) is also the paid preparer, then checking the appropriate box suffices, and only one signature is needed. This clarification helps maintain the form’s integrity while simplifying the process.

Understanding these clarifications helps in navigating the complexities of tax filing for exempt organizations, ensuring compliance while minimizing errors.

Key takeaways

Filing the IRS Form 8453-EO is an important step for exempt organizations and others subject to tax when submitting certain tax forms electronically. Understanding the key takeaways from this form can help ensure accurate and compliant submission. Here are six essential points to remember:

- The IRS Form 8453-EO serves multiple purposes, including authenticating the electronic filing of various forms such as Form 990, Form 990-EZ, Form 990-PF, Form 990-T, and others. It also authorizes an electronic funds withdrawal for payment of federal taxes owed.

- Organizations or individuals filing electronically through an Intermediate Service Provider (ISP) and/or transmitter, without the use of an Electronic Return Originator (ERO), are required to accompany their filing with Form 8453-EO.

- For those opting to pay owed taxes via electronic funds withdrawal, checking the corresponding box in Part II of the form is necessary. This action authorizes the U.S. Treasury to debit the indicated financial account for tax payments.

- The declaration section of the form, found in Part II, must be signed and dated by an officer of the organization or the individual subject to tax. This signature certifies that the information provided on the form and the accompanying electronic submission is accurate.

- If the return is filed through an ERO, the Declaration of Electronic Return Originator (ERO) and Paid Preparer section in Part III must be completed, including a signature from the ERO. Paid preparers need to provide their Preparer Tax Identification Number (PTIN) but have the option to omit their section if they are also serving as the ERO.

- Failure to correctly complete and include Form 8453-EO with an electronic filing can result in the return not being considered filed. This underscores the importance of ensuring that all sections applicable to the filer's specific circumstances are accurately completed and that the form accompanies the electronic submission.

Adhering to these guidelines when completing the IRS Form 8453-EO helps exempt organizations and others meet their tax filing requirements efficiently and accurately.

Popular PDF Documents

Hawaii Department of Taxation - Requires taxpayer identification and business details for accurate processing.

Irs Form 14242 - Take action against tax scams by reporting them with IRS Form 14242.