Get IRS 8453 Form

The process of filing taxes in the United States is well-known for its complexity and the need for meticulous attention to detail. Among the numerous forms and documents that taxpayers may encounter is the IRS 8453 form, an essential piece in the submission of electronic filings. This form serves as a U.S. Individual Income Tax Declaration for an IRS e-file Return, essentially acting as a cover document for the submission of certain paper documents that cannot be electronically filed. Taxpayers use it to transmit documentation and information necessary to the Internal Revenue Service (IRS) that cannot be sent digitally alongside the electronic portion of their tax return. The form plays a significant role in the auditing process, allowing the IRS to verify the accuracy and completeness of a taxpayer's electronically submitted return. Understanding the specific circumstances under which the IRS 8453 is required, along with a clear grasp of how to properly complete and submit this form, is crucial for anyone involved in the electronic filing process. The form’s role underscores the hybrid nature of tax filing systems, bridging the gap between digital submissions and the need for paper documentation in certain situations.

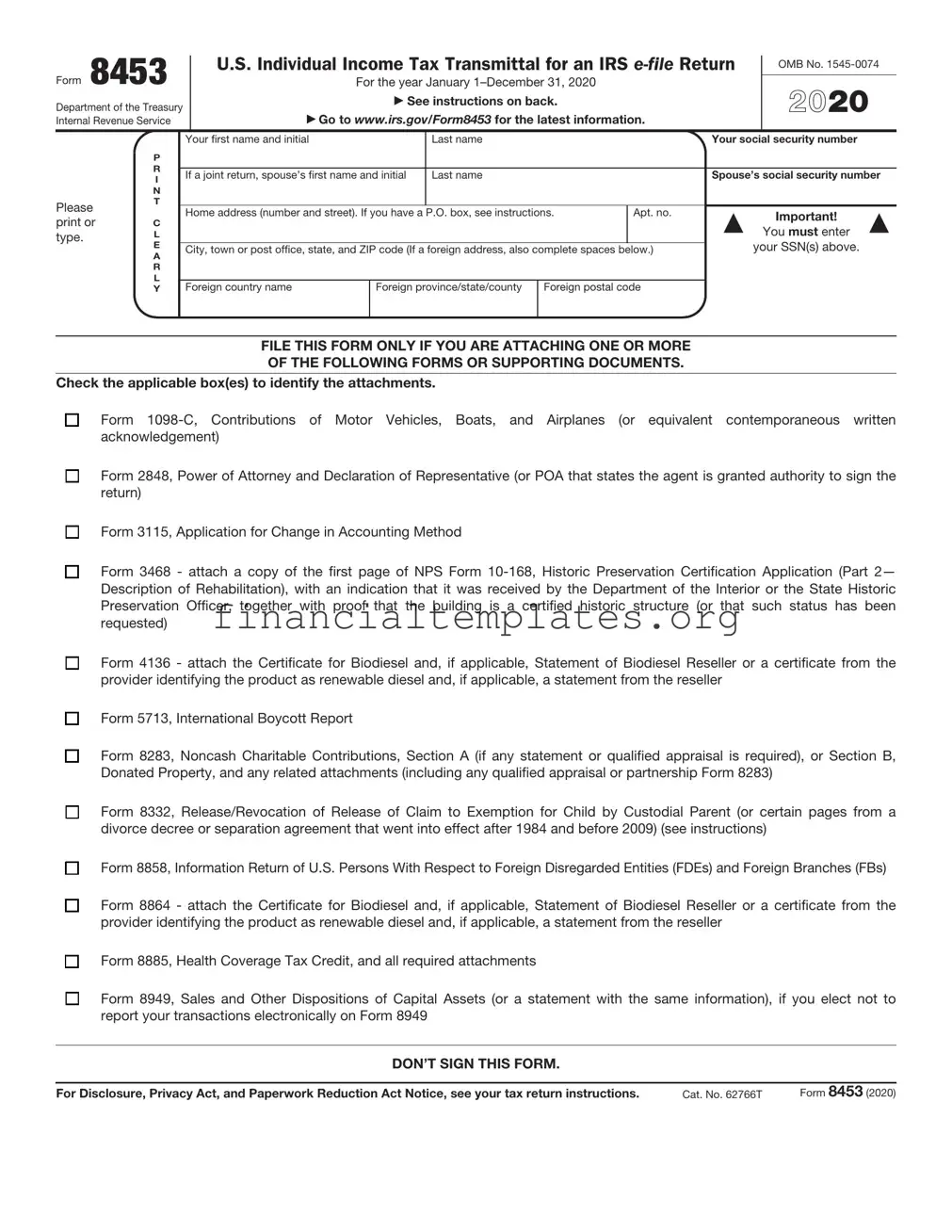

IRS 8453 Example

Form 8453

Department of the Treasury Internal Revenue Service

U.S. Individual Income Tax Transmittal for an IRS

For the year January

▶See instructions on back.

▶Go to www.irs.gov/Form8453 for the latest information.

OMB No.

2021

Please print or type.

P R I N T

C

L E A R L Y

Your first name and initial |

|

Last name |

|

|

Your social security number |

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

||

If a joint return, spouse’s first name and initial |

Last name |

|

|

Spouse’s social security number |

|||

|

|

|

|

|

|

|

|

Home address (number and street). If you have a P.O. box, see instructions. |

Apt. no. |

▲ |

Important! |

▲ |

|||

|

|

|

|

|

|||

|

|

|

|

|

|

You must enter |

|

|

|

|

|

|

your SSN(s) above. |

|

|

City, town or post office, state, and ZIP code (If a foreign address, also complete spaces below.) |

|

|

|||||

|

|

|

|

|

|

||

Foreign country name |

Foreign province/state/county |

Foreign postal code |

|

|

|

||

|

|

|

|

|

|

|

|

FILE THIS FORM ONLY IF YOU ARE ATTACHING ONE OR MORE

OF THE FOLLOWING FORMS OR SUPPORTING DOCUMENTS.

Check the applicable box(es) to identify the attachments.

Form

Form 2848, Power of Attorney and Declaration of Representative (or POA that states the agent is granted authority to sign the return)

Form 3115, Application for Change in Accounting Method

Form 3468 - attach a copy of the first page of NPS Form

Form 4136 - attach the Certificate for Biodiesel and, if applicable, Statement of Biodiesel Reseller or a certificate from the provider identifying the product as renewable diesel and, if applicable, a statement from the reseller

Form 5713, International Boycott Report

Form 8283, Noncash Charitable Contributions, Section A (if any statement or qualified appraisal is required), or Section B, Donated Property, and any related attachments (including any qualified appraisal or partnership Form 8283)

Form 8332, Release/Revocation of Release of Claim to Exemption for Child by Custodial Parent (or certain pages from a divorce decree or separation agreement that went into effect after 1984 and before 2009) (see instructions)

Form 8858, Information Return of U.S. Persons With Respect to Foreign Disregarded Entities (FDEs) and Foreign Branches (FBs)

Form 8864 - attach the Certificate for Biodiesel and, if applicable, Statement of Biodiesel Reseller or a certificate from the provider identifying the product as renewable diesel and, if applicable, a statement from the reseller

Form 8885, Health Coverage Tax Credit, and all required attachments

Form 8949, Sales and Other Dispositions of Capital Assets (or a statement with the same information), if you elect not to report your transactions electronically on Form 8949

DON’T SIGN THIS FORM.

For Disclosure, Privacy Act, and Paperwork Reduction Act Notice, see your tax return instructions. |

Cat. No. 62766T |

Form 8453 (2021) |

Form 8453 (2021) |

Page 2 |

General Instructions

Future Developments

For the latest information about developments related to Form 8453 and its instructions, such as legislation enacted after they were published, go to www.irs.gov/Form8453.

Purpose of Form

Use Form 8453 to send any required paper forms or supporting documentation listed next to the checkboxes on Form 8453 (don’t send Form(s)

Don’t attach any form or document that isn’t ▲! shown on Form 8453 next to the checkboxes. If CAUTION you are required to mail in any documentation

not listed on Form 8453, you can’t file the tax return electronically.

Note: Don’t mail a copy of an electronically filed Form 1040,

When and Where To File

If you are an ERO, you must mail Form 8453 to the IRS within 3 business days after receiving acknowledgement that the IRS has accepted the electronically filed tax return.

If you are filing your tax return using an online provider, mail Form 8453 to the IRS within 3 business days after you have received acknowledgement from your intermediate service provider and/or transmitter that the IRS has accepted your electronically filed tax return. If you don’t receive an acknowledgement, you must contact your intermediate service provider and/or transmitter.

Mail Form 8453 to:

Internal Revenue Service

Attn: Shipping and Receiving, 0254 Receipt and Control Branch Austin, TX

Specific Instructions

Name and address. Print or type the information in the spaces provided. If using a foreign address, don’t abbreviate the country name.

P.O. box. Enter the box number only if the post office doesn’t deliver mail to the home address.

Note: The address must match the address shown on the electronically filed tax return.

Social security number (SSN). Be sure to enter the taxpayer’s SSN in the space provided on Form 8453. If a joint tax return, list the SSNs in the same order as the first names.

Payments

Don’t attach a payment to Form 8453. Instead, mail it by April 18, 2022 (April 19, 2022, if you live in Maine or Massachusetts), with Form

To pay your taxes online or for more information, go to www.irs.gov/Payments.

Form 2848. An electronically transmitted return signed by an agent must have a power of attorney attached to Form 8453 that specifically authorizes the agent to sign the return.

Divorce decree or separation agreement. If the divorce decree or separation agreement went into effect after 1984 and before 2009, the noncustodial parent can attach certain pages from the decree or agreement instead of Form 8332. To be able to do this, the decree or agreement must state all three of the following.

1.The noncustodial parent can claim the child as a dependent without regard to any condition (such as payment of support).

2.The other parent won’t claim the child as a dependent.

3.The years for which the claim is released.

The noncustodial parent must attach all of the following pages from the decree or agreement.

•Cover page (include the other parent’s SSN on that page).

•The pages that include all of the information identified in

(1) through (3) above.

•Signature page with the other parent’s signature and date of agreement.

Note: The noncustodial parent must attach the required information even if it was filed with a return in an earlier year.

Document Specifics

| Fact Name | Description |

|---|---|

| Form Purpose | The IRS 8453 form is an official document used to transmit paper documents to the IRS that cannot be filed electronically alongside an e-filed tax return. |

| Who Must File | Any taxpayer filing an electronic tax return that requires additional documentation to be submitted to the IRS needs to file Form 8453. |

| Types of Documents Sent with Form 8453 | Documents often include W-2s, Form 2848 (Power of Attorney), and other tax forms or schedules that support the e-filed return. |

| Governing Law(s) for State-Specific Forms | For taxpayers required to file state-specific versions of Form 8453, governing laws vary by state and are often aligned with federal guidelines while accommodating state-specific tax filing requirements. |

Guide to Writing IRS 8453

Understanding the importance of accurately completing IRS forms is paramount when filing taxes electronically. One of these key documents is the IRS 8453 form. This form plays a crucial role in the electronic filing process, serving as an official declaration that the information submitted electronically is true and correct. To make sure your tax filing process is seamless, it's critical to follow the step-by-step guide to fill out the IRS 8453 form correctly.

- Start by gathering all required information and documents. This includes your tax return, any schedules or forms referenced in your e-file, and your W-2 forms or any 1099 forms if applicable.

- Enter your name(s) as shown on your tax return. If you're filing jointly, include both names in the order they appear on the return.

- Input your Social Security Number (SSN). If filing jointly, include the SSN for both filers.

- For each document listed on the form that you're submitting with the 8453, such as W-2s or 1099s, check the corresponding box to indicate what is being attached.

- Ensure that all information within the form matches exactly what is on your e-filed tax return. This includes checking that all numbers, names, and social security numbers are accurate and correctly placed.

- If a tax professional prepared your return, they should include their Preparer Tax Identification Number (PTIN) in the designated area.

- Review the declaration statement on the form, confirming that by signing, you declare that all information is accurate to the best of your knowledge.

- Sign and date the form. If filing jointly, both parties must sign.

- If applicable, have your tax preparer sign and date the form as well. They should also include their firm's name and EIN (Employer Identification Number) if they're using one.

- Last but not least, follow the IRS instructions for mailing your form and any accompanying documents. Typically, these will be sent to the IRS service center designated for your area.

Accurately completing and submitting the IRS 8453 form is a straightforward but essential step in the electronic filing process. By meticulously following these steps, taxpayers can ensure their tax submissions are properly processed, paving the way for a smooth tax returning experience.

Understanding IRS 8453

-

What is an IRS 8453 form?

The IRS 8453 form is a United States tax form used for the electronic filing of tax returns. It serves as a transmittal document for certain paper documents that cannot be electronically filed. Taxpayers use it to submit original or corrected tax documents that are necessary for processing but are not eligible for electronic filing.

-

Who needs to file an IRS 8453 form?

This form is primarily for taxpayers who are filing their tax returns electronically but must also submit paper documents to verify certain information. These might include taxpayers with stock transactions, donations of property, certain credits, or who are attaching a statement to their return notifying the IRS of a special situation.

-

What documents are typically submitted with the IRS 8453?

- Documents detailing the sale of stocks, bonds, or other investment property.

- Documentation for charitable contributions of property over a certain value.

- Statements supporting credits or deductions taken on the tax return.

- Any other necessary documents specifically requested by the form's instructions or by the IRS.

-

How do you file an IRS 8453 form?

First, complete your electronic tax return and identify any documents that must be sent by mail. Then, fill out the IRS 8453 form according to the instructions, including your name, Social Security Number, and the tax year. Attach the specified documents to the 8453 form and mail it to the IRS at the address provided in the instructions for the form.

-

Can the IRS 8453 form be filed electronically?

The IRS 8453 form itself is a part of the electronic filing process but cannot be filed entirely electronically since its primary purpose is to accompany certain paper documents that need to be mailed to the IRS. However, the rest of the tax return associated with it is submitted electronically.

-

Is there a deadline for filing the IRS 8453 form?

The IRS 8453 form, along with any accompanying documents, should be submitted after the electronic filing of your tax return and by the tax return due date, typically April 15th. If you have received an extension for filing your return, ensure the form and documents are sent by the extended due date.

-

What happens if you don't file the IRS 8453 form?

Failing to file the IRS 8453 form and/or the accompanying documents might result in delays in processing your tax return, or the IRS may disallow the credits or deductions you claim. This can lead to an underpayment of taxes and possibly penalties and interest on any amount owed.

-

How do you know if the IRS has received your 8453 form?

Since the IRS 8453 form is mailed, using a delivery method that includes tracking or confirmation is recommended. This way, you can verify when the form has been delivered to the IRS. The IRS does not send a confirmation upon receipt, so it's crucial to keep your tracking information as proof of delivery.

Common mistakes

When individuals embark on filling out the IRS 8453 form, a document essential for the electronic filing of tax returns, several common mistakes are often made. These errors can delay processing, lead to incorrect tax calculations, or even trigger audits from the IRS. It's crucial to approach this task with attention to detail to ensure that all information is accurate and complete.

Not double-checking the Social Security number (SSN) or Employer Identification Number (EIN). This critical piece of information must be accurate. If it's incorrect, it can lead to the form being rejected or, worse, the return being associated with the wrong taxpayer or entity. Always verify these numbers against official documents.

Overlooking the necessity to attach the correct supporting documents. The IRS 8453 form serves as a transmittal for certain tax documents that cannot be electronically filed. Failing to attach the required documents, such as W-2s or schedules supporting claims, can halt the processing of your return.

Entering incorrect tax year. It's a simple oversight but placing the wrong tax year on the form can cause significant confusion and delay. Ensure that you're working on the form designated for the correct tax year.

Omitting a signature. An unsigned IRS 8453 form is like a ship without a sail; it goes nowhere. Both taxpayers and their authorized e-file provider must sign the form. Forgetting to sign or only having one party sign can invalidate the entire submission.

Misunderstanding the form’s purpose. Some taxpayers mistakenly use the IRS 8453 as a replacement for the full tax return or as a stand-alone document. It's essential to understand that this form accompanies e-filed returns and supports specific documentation needs. It does not substitute for the tax return form itself.

Addressing these mistakes before submission can streamline your filing process and avoid unnecessary delays or questions from the IRS. Taking extra time to review your form and ensure all information is correct and complete is well worth the effort.

Documents used along the form

When filing taxes in the United States, the IRS Form 8453 serves as the U.S. Individual Income Tax Transmittal for an IRS e-file Return. This form is typically used to submit certain documents that cannot be filed electronically alongside an electronic submission of a taxpayer's return. However, the IRS 8453 is just one piece of the puzzle when completing one's tax obligations. Other key forms and documents often accompany it, each serving a specific purpose in the tax filing process.

- Form 8949: This form is used to report sales and other dispositions of capital assets. Taxpayers who must report capital gains or losses from the sale of investments or property use Form 8949 to detail each transaction and compute the taxable gain or loss to be transferred to Schedule D.

- Schedule D (Form 1040): Schedule D is the primary tax form used to report overall capital gains and losses from transactions reported on Form 8949, and certain other transactions that do not need to be reported on Form 8949.

- Form 1099-R: When taxpayers receive distributions from pensions, annuities, retirement plans, or IRAs, the payer reports this information on Form 1099-R. Taxpayers use this form to report such distributions on their tax returns.

- Form 4868: This form serves as the Application for Automatic Extension of Time To File U.S. Individual Income Tax Return. It is used when taxpayers need additional time to file their tax return beyond the April deadline.

- Form 8888: Taxpayers use this form to allocate their refund among up to three accounts. It allows for direct deposit of the refund into checking, savings, or other accounts, including purchasing up to $5,000 in U.S. Series I Savings Bonds.

- Form W-2: Issued by employers, this form reports an employee's annual wages and the amount of taxes withheld from their paycheck. It is a critical document for accurately reporting income and tax withholdings to the IRS.

While the IRS 8453 form is vital for electronically filing tax returns that require paper documentation for certain attachments, these additional forms and documents play crucial roles in the broader tax filing process. They ensure the accurate reporting of income, expenses, and other financial activities to comply with U.S. tax laws, ultimately aiding individuals in fulfilling their tax responsibilities accurately and on time.

Similar forms

The IRS 8453 form, often used for electronic filing of tax returns, shares similarities with a range of other documents primarily due to their role in validating, authorizing, or providing supplemental information to a primary process. One such document is the IRS Form 8879, known as the e-file Signature Authorization. Like the 8453, Form 8879 is used when filing taxes electronically, serving as a way to authenticate the taxpayer's identity and allowing tax preparers to file on behalf of the taxpayer. This form acts as a digital handshake between the taxpayer and the IRS, ensuring that the information submitted electronically is accurate and authorized by the taxpayer.

Another document akin to the IRS 8453 is Form W-2, the Wage and Tax Statement. Although serving a fundamentally different primary purpose — reporting an employee's annual wages and the amount of taxes withheld from their paycheck — it shares the element of being an essential document required for accurately filing an individual's tax return. The W-2 provides vital information needed for taxpayers to fill out their returns and, like the 8453, is integral to the tax submission process.

The 1099-MISC form, used to report various types of income other than wages, salaries, and tips, also parallels the IRS 8453 in function. It's necessary for freelancers, independent contractors, and other non-employees to report earnings from services provided. This document is crucial for individuals to report accurate income information to the IRS, much like the 8453 form enables authorization and submission of electronic filing details.

Form 4868, the Application for Automatic Extension of Time to File U.S. Individual Income Tax Return, although different in its use — requesting additional time to file an income tax return — shares the similarity of being a form filed with the IRS to alter the status of a taxpayer's filing obligations. Like the 8453, it interacts directly with taxpayer information and modifies the process by which a taxpayer engages with the IRS, in this case, by providing more time to file.

The Schedule C form, used by sole proprietors to report profits and losses of their business, aligns with the IRS 8453 in its role in the tax filing process. It contributes detailed information about a taxpayer's business earnings and expenses, which is crucial for accurate tax returns. Though its content differs, its necessity for providing specific, detailed information to the IRS mirrors the 8453’s role in facilitating accurate and authorized electronic filing.

Lastly, the Direct Deposit Authorization form, widely used across various sectors to allow the electronic transfer of funds into bank accounts, shares a common goal with the IRS 8453: ensuring accurate and authorized information transfer. In the context of tax returns, direct deposit forms authorize the IRS to deposit refunds directly into a taxpayer’s account, similar to how the 8453 form permits the electronic submission of the taxpayer's return, emphasizing security, accuracy, and efficiency.

Dos and Don'ts

When you're filling out the IRS 8453 form, following certain guidelines can help ensure the process is completed successfully and accurately. This form, used for submitting documents electronically to the IRS, plays a crucial role in the tax filing process. Here are four dos and don'ts to keep in mind:

Do:- Double-check your Taxpayer Identification Number (TIN) and Social Security Number (SSN) to ensure they're correct. Mistakes here can lead to processing delays or even rejections.

- Review all the information on your form before you submit it. Accuracy is key to a smooth processing experience.

- Keep a copy of the form and all documents you're submitting for your records. Having these on hand can be crucial if any questions arise later on.

- Use the IRS e-file system to submit your Form 8453. This method is not only faster but also more secure compared to paper filings.

- Forget to attach any required documents. The IRS 8453 form serves as a coversheet for specific documents that need to be mailed after e-filing; not attaching these can result in an incomplete submission.

- Sign the form digitally or with an electronic signature. The IRS requires a handwritten signature on the form for it to be processed.

- Ignore the filing deadlines. Submitting the form after the deadline can lead to penalties or delays in processing your return.

- Send in incomplete or inaccurate forms. Filling out the form with missing or incorrect information can cause significant delays in the processing of your documents.

Misconceptions

The Internal Revenue Service (IRS) Form 8453, or the U.S. Individual Income Tax Transmittal for an IRS e-file Return, often comes surrounded by confusion and misconceptions. Understanding the form’s true purpose and requirements can demystify the e-filing process and ensure tax compliance. Below are six common misconceptions about IRS Form 8453 that need to be cleared up.

- Form 8453 is only for individuals. While it's commonly associated with individual tax filings, Form 8453 serves broader purposes. It’s used in various contexts, including but not limited to individual income tax returns. For instance, it can be required in the submission of documents or supporting material that cannot be electronically filed with certain types of returns or transactions.

- It’s unnecessary if you e-file. One might think that e-filing eliminates the need for any paper documents, but this is a misconception. In fact, Form 8453 is specifically designed for certain e-filed returns. It functions as a cover sheet to transmit documentation that the IRS requires in paper form. This ensures that the digital and physical components of your tax filing are properly linked.

- Form 8453 must be mailed immediately after e-filing. Timing matters, but the urgency is often overstated. Taxpayers usually have a specific timeframe after e-filing—generally, until October 15—to mail Form 8453 and any accompanying documents to the IRS. This gives filers ample time to organize and send required paperwork.

- The form is complex and difficult to fill out. Despite the intimidating aura of IRS forms, Form 8453 is relatively straightforward. It requires basic taxpayer information, along with details of the accompanying documents. Like any tax form, reading the instructions carefully can demystify the process and ease completion.

- Electronic payment negates the need for Form 8453. The method of payment for any tax due has no bearing on whether Form 8453 is required. Even if you’ve paid electronically, if the IRS mandates that certain support documents be submitted in paper form, you’ll still need to use Form 8453 as a transmittal.

- Once submitted, there is no further action needed with the IRS. Mailing Form 8453 and related documents does not always mark the end of your obligations. The IRS may request additional information or clarifications. Therefore, it’s important to stay attentive to any correspondence from the IRS following the submission.

Dispelling these misconceptions helps taxpayers navigate their responsibilities more effectively and avoid potential pitfalls. Always refer to the latest IRS guidance or consult with a tax professional to ensure compliance and accuracy in your tax filings.

Key takeaways

The IRS 8453 form is an essential document for taxpayers who opt to file their tax returns electronically. Specific understandings and actions are crucial when dealing with this form to ensure compliance and accuracy in your tax submission process. Here are five key takeaways about filling out and using the IRS 8453 form.

- Understand its purpose: The IRS 8453 form serves as an official declaration to the IRS, authenticating the electronic filing of your tax return. Its primary role is to cover certain documents or information that can't be transmitted electronically with your tax return.

- Know which documents to attach: If you're required to submit additional documents after electronic filing, like W-2 forms or certain schedules, they must be sent along with the IRS 8453 form. Be clear on what needs to be attached to avoid processing delays.

- Double-check your information: Before submitting, ensure that all the information on your 8453 form matches the information on your electronically filed tax return. Discrepancies can lead to processing errors or unwanted scrutiny from the IRS.

- Timely submission is key: After e-filing your tax return, the IRS 8453 form, with any necessary attachments, must be mailed to the IRS within 3 days. Delaying this step can result in late penalties or issues with your tax return’s acceptance.

- Keep a copy: Always keep a copy of the completed IRS 8453 form and any documents you attach for your records. This documentation can be invaluable if there are questions or audits in the future.

Adhering to these guidelines will assist in the smooth processing of your tax return and help you maintain compliance with IRS regulations.

Popular PDF Documents

Irs 1040A - It includes options for standard deductions and tax credits, making it easier for eligible filers.

Pa Filing Requirements - Use tax obligations address purchases from out-of-state vendors, ensuring fairness in tax obligations.

San Jose Business License Search - Built to capture essential information such as business location, contact details, and activity description for tax purposes.