Get IRS 843 Form

In navigating the intricacies of the Internal Revenue Service (IRS), taxpayers often encounter situations that necessitate adjustments to their taxes, penalties, or interest. Among the various forms provided by the IRS to facilitate these adjustments, the IRS 843 form stands out as a critical tool. This form allows individuals and entities alike to request refunds or abatements for specific types of taxes, charges, penalties, or interest. It serves as a bridge for taxpayers seeking redress from errors or excessive assessments and acts as a formal petition for consideration by the IRS. The importance of the IRS 843 form lies not only in its function but also in its ability to provide taxpayers with a means to rectify financial discrepancies, thus ensuring fairness and accuracy in tax administration. Through the proper completion and submission of this form, individuals can efficiently communicate their concerns to the IRS, making it an essential component of the tax resolution process.

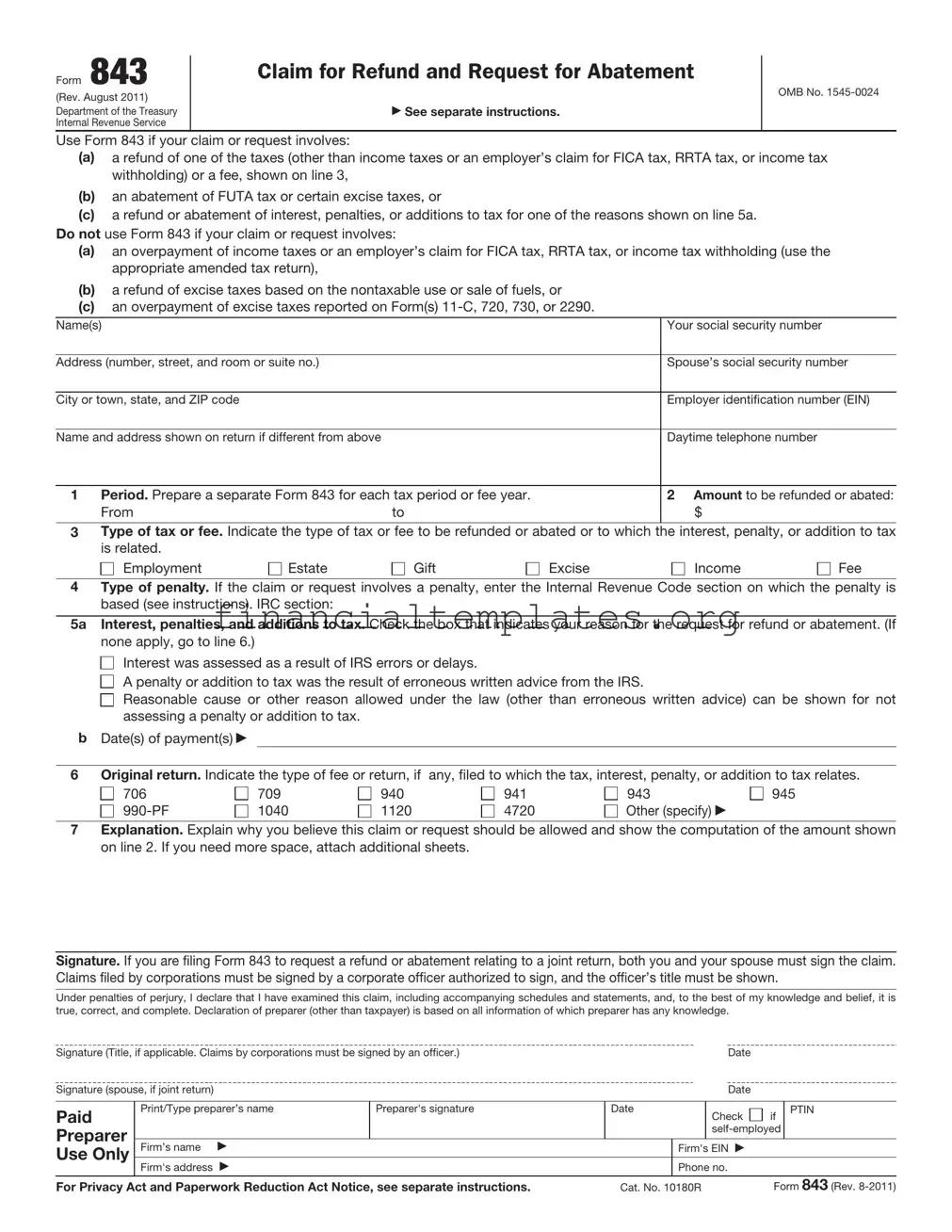

IRS 843 Example

Form 843

(Rev. August 2011)

Department of the Treasury

Internal Revenue Service

Claim for Refund and Request for Abatement

See separate instructions.

OMB No.

Use Form 843 if your claim or request involves:

(a)a refund of one of the taxes (other than income taxes or an employer’s claim for FICA tax, RRTA tax, or income tax withholding) or a fee, shown on line 3,

(b)an abatement of FUTA tax or certain excise taxes, or

(c)a refund or abatement of interest, penalties, or additions to tax for one of the reasons shown on line 5a.

Do not use Form 843 if your claim or request involves:

(a)an overpayment of income taxes or an employer’s claim for FICA tax, RRTA tax, or income tax withholding (use the appropriate amended tax return),

(b)a refund of excise taxes based on the nontaxable use or sale of fuels, or

(c)an overpayment of excise taxes reported on Form(s)

Name(s) |

Your social security number |

|

|

Address (number, street, and room or suite no.) |

Spouse’s social security number |

|

|

City or town, state, and ZIP code |

Employer identification number (EIN) |

|

|

Name and address shown on return if different from above |

Daytime telephone number |

1 Period. Prepare a separate Form 843 for each tax period or fee year. |

2 Amount to be refunded or abated: |

|

From |

to |

$ |

3Type of tax or fee. Indicate the type of tax or fee to be refunded or abated or to which the interest, penalty, or addition to tax

is related. Employment

Estate

Gift

Excise

Income

Fee

4Type of penalty. If the claim or request involves a penalty, enter the Internal Revenue Code section on which the penalty is based (see instructions). IRC section:

5a Interest, penalties, and additions to tax. Check the box that indicates your reason for the request for refund or abatement. (If none apply, go to line 6.)

Interest was assessed as a result of IRS errors or delays.

A penalty or addition to tax was the result of erroneous written advice from the IRS.

Reasonable cause or other reason allowed under the law (other than erroneous written advice) can be shown for not assessing a penalty or addition to tax.

bDate(s) of payment(s)

6 Original return. Indicate the type of fee or return, if |

any, filed to which the tax, interest, penalty, or addition to tax relates. |

||||

706 |

709 |

940 |

941 |

943 |

945 |

1040 |

1120 |

4720 |

Other (specify) |

|

|

7Explanation. Explain why you believe this claim or request should be allowed and show the computation of the amount shown on line 2. If you need more space, attach additional sheets.

Signature. If you are filing Form 843 to request a refund or abatement relating to a joint return, both you and your spouse must sign the claim. Claims filed by corporations must be signed by a corporate officer authorized to sign, and the officer’s title must be shown.

Under penalties of perjury, I declare that I have examined this claim, including accompanying schedules and statements, and, to the best of my knowledge and belief, it is true, correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

Signature (Title, if applicable. Claims by corporations must be signed by an officer.) |

|

|

Date |

|

|

||

Signature (spouse, if joint return) |

|

|

|

Date |

|

|

|

|

|

|

|

|

|

|

|

Paid |

Print/Type preparer’s name |

Preparer's signature |

Date |

Check |

if |

PTIN |

|

|

|

|

|

|

|||

Preparer |

|

|

|

|

|

||

|

|

|

|

|

|

|

|

Use Only |

Firm’s name |

|

|

Firm's EIN |

|

|

|

Firm's address |

|

|

Phone no. |

|

|

||

|

|

|

|

|

|||

For Privacy Act and Paperwork Reduction Act Notice, see separate instructions. |

Cat. No. 10180R |

Form 843 (Rev. |

|||||

Document Specifics

| Fact Name | Description |

|---|---|

| Form Purpose | The IRS Form 843 is used to request a refund or ask for an abatement of certain taxes, interest, penalties, fees, and additions to tax. |

| Who Can File | Individuals, businesses, and entities that believe they have been overcharged or incorrectly assessed taxes, penalties, or interest can file Form 843. |

| Tax Types Covered | This form can be used for many types of taxes, including income, gift, and estate taxes, as well as certain excise taxes. |

| When to File | Form 843 must be filed within 3 years from the date the tax return was filed or 2 years from the date the tax was paid, whichever is later. |

| Documentation Needed | Filers must provide documentation supporting their reason for the request, such as proof of tax payment or documents showing why the tax, fee, penalty, or interest was incorrectly assessed. |

| Related Forms | Depending on the specific situation, other IRS forms such as Form 1040X (Amended U.S. Individual Income Tax Return) may also need to be filed. |

| Where to File | The filing address for Form 843 depends on the nature of the claim and the taxpayer’s location. The IRS provides separate addresses for different types of requests and regions. |

| Governing Law | Form 843 is governed by U.S. federal tax law, specifically the provisions related to the assessment and refund of taxes, penalties, fees, and additions to tax. |

| State-Specific Forms | Some states may have their own forms for similar purposes, and the laws governing those forms vary from state to state. |

Guide to Writing IRS 843

Filling out the IRS Form 843 requires attention to detail and an understanding of the specific case or situation being addressed. This form is used for claims relating to refunds or requests for abatement of certain taxes, penalties, fees, or interest. As you prepare to complete this form, gathering all pertinent information and supporting documentation will be crucial for a successful submission. Guides and instructions provided by the IRS can offer additional clarity, but the steps outlined below will give you a direct overview of the process involved.

- Start by downloading the latest version of IRS Form 843 from the Internal Revenue Service website to ensure you are using the most up-to-date form.

- Enter your complete name and current address in the designated fields. If you have a different address on file with the IRS that your refund or correspondence should go to, make sure to include that as well.

- Provide your Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN). If you are filing this form for a business, enter the Employer Identification Number (EIN).

- Specify the type of tax or fee, the tax form number related to your claim, and the tax period (year or quarter) that the claim relates to in the appropriate sections of the form.

- Clearly state the specific reason for your claim in the section provided. This description should include why you believe an abatement or refund is warranted under the law. Be concise yet thorough in your explanation.

- Enter the amount you are claiming for refund or abatement in the designated area. This amount should be calculated based on the instructions specific to the type of tax and reason for your claim.

- If applicable, check the appropriate box to indicate whether the claim pertains to a request for refund of a penalty due to reasonable cause and not willful neglect.

- Sign and date the form. If you are filing jointly or if the form pertains to an entity, the authorized individual must sign the form.

- Attach any required supporting documentation or schedules that substantiate your claim. This may include letters from the IRS, tax return excerpts, or other relevant material.

- Review the entire form and attached documents to ensure accuracy and completeness. Missing or incorrect information can lead to delays in processing.

- Mail the completed form and attachments to the IRS address specified for your type of claim and geographic location. This information can be found in the instructions for Form 843 or on the IRS website.

After you have submitted Form 843, the IRS will process your claim, which can take several weeks or months depending on the complexity of your case and the volume of claims being handled. You may receive correspondence from the IRS requesting additional information or clarifying details about your claim during this time. Responding promptly to any such requests can help expedite the processing of your claim. Keep copies of all documents you submit, as well as any correspondence you receive from the IRS, as part of your personal records.

Understanding IRS 843

-

What is the IRS Form 843 used for?

IRS Form 843, "Claim for Refund and Request for Abatement," serves multiple purposes. Primarily, it's used by taxpayers to request a refund or abatement of certain taxes, interest, penalties, fees, and additions to tax. This form is versatile, catering to a range of situations. For example, it can be used to request the refund of penalties that were incorrectly applied due to reasonable cause or IRS errors. Besides, taxpayers might use it to adjust interest or fees that were improperly calculated. It's essential to note that this form cannot be used for all types of taxes and fees; thus, understanding its specific applicability is crucial.

-

How do you correctly fill out Form 843?

Completing Form 843 requires careful attention to detail. Initially, provide your name, address, and social security number (or employer identification number if applicable). On the form, you'll specify the type of tax or fee you're disputing, the tax period it relates to, and the exact amount you're claiming for refund or abatement. The critical section of Form 843 involves explaining the reasons for your claim. Here, clarity and conciseness in stating your case are key. Support your claim with a thorough explanation and, when possible, include relevant documentation or evidence to substantiate your position. Before submitting, ensure you've reviewed the instructions for where to send your completed form, as the address can vary based on the nature of your claim.

-

When should you file Form 843?

Timing for filing Form 843 hinges on the specific circumstances of your claim. Generally, you should file the form after you've been notified of a decision by the IRS that you disagree with, or after you've identified an error in the calculation of your taxes, penalties, or interest. It's crucial to abide by the IRS's deadlines to ensure your claim is considered. Typically, refund claims must be filed within three years from the time the original return was filed or two years from the date the tax was paid, whichever is later. For abatement requests related to penalties or interest, the timeline can vary, so reviewing the relevant IRS guidelines or consulting with a tax professional is recommended.

-

What are the common reasons for using Form 843?

Form 843 is employed for a diverse set of reasons, reflecting its broad applicability. Common uses include:

- Requesting a refund for specific penalties, such as failure-to-file or failure-to-pay, particularly when these penalties were assessed due to reasonable cause or an error by the IRS.

- Seeking abatement of interest charges that accrued because of IRS errors or unreasonable delays.

- Claiming refunds for certain fees or additions to tax that were improperly assessed.

- Adjusting specific tax assessments where the taxpayer has identified overpayments or errors in calculation.

Every case is unique, and the validity of a Form 843 claim will depend on the individual circumstances and the specific reasons presented.

-

What happens after you submit Form 843 to the IRS?

After submission, the IRS will review your Form 843 claim. This process can take varying amounts of time, often depending on the complexity of the claim and the IRS's current workload. If the IRS needs more information, they may contact you or request additional documentation to support your case. Once the review is complete, the IRS will make a decision and notify you of the outcome. If your claim is approved, the refund or abatement will be processed accordingly. However, if your claim is denied, the notice will outline the reasons for denial and provide information on how to appeal the decision if you disagree. Throughout this process, maintaining records of all communications and submissions to the IRS is advisable for reference and potential future use.

Common mistakes

Filling out IRS Form 843, which is used for claiming a refund or requesting an abatement of certain taxes, penalties, interest, or fees, can sometimes be confusing. People often make mistakes while completing this form, which can delay processing or impact the claim itself. Here are nine common mistakes to avoid:

Not specifying the type of tax or period it relates to. Each request must indicate clearly what tax year or period the claim is for.

Entering incorrect taxpayer identification numbers, such as a Social Security Number (SSN) or Employer Identification Number (EIN). This could lead to the IRS not being able to match the form to the correct taxpayer account.

Failing to state a specific reason for the claim. An explanation of why you believe the refund or abatement is warranted is required for processing.

Forgetting to sign the form. An unsigned form is invalid and will be returned or denied.

Inaccurately calculating the refund or abatement amount. This can lead to unnecessary delays or partial denials of the claim.

Not attaching necessary supporting documentation. Proofs such as amended tax returns, notices from the IRS, or other relevant documents must accompany the form.

Using out-of-date forms. Tax laws and forms change, and using an outdated version can result in processing errors.

Omitting contact information. Providing a current address and phone number ensures the IRS can reach you if further information is needed.

Incorrectly choosing the tax type or not marking the correct boxes for the type of request. This mistake could misdirect the form to the wrong department or delay its processing.

To ensure a smoother processing of your Form 843, it’s crucial to avoid these common errors. Double-check each section of the form before submission, and consider consulting a tax professional if you’re unsure about how to correctly complete any part of the form. Attention to detail can significantly impact the success of your claim or request.

Documents used along the form

When dealing with the IRS, specifically regarding claims for refunds or requests for abatements, Form 843 often comes into play. However, to effectively navigate the process, individuals usually need to prepare additional forms and documents to support their claim. These documents are vital for providing the necessary context and evidence to ensure the IRS thoroughly understands the nature of the request. Below is a list of common forms and documents frequently used in conjunction with Form 843.

- Form 8316: This form is crucial for individuals seeking a refund of Social Security and Medicare taxes that were incorrectly withheld. It's especially pertinent for nonresident aliens and student workers exempt from these taxes under a tax treaty or a section of the tax code.

- Form 2848, Power of Attorney and Declaration of Representative: This form allows taxpayers to authorize an individual, such as an attorney, certified public accountant, or enrolled agent, to represent them before the IRS. This representation is essential when the taxpayer cannot deal with the IRS directly.

- Copy of the original tax return: Including a copy of the original tax return associated with the claim helps the IRS to quickly identify and verify the specifics of the case. It provides a baseline for understanding the adjustments being requested.

- Cover letter: While not a formal IRS document, a cover letter can significantly enhance the clarity of a submission. It allows the taxpayer to outline the circumstances, explain the request in a narrative format, and itemize the enclosed documents. This personal touch can help direct the IRS's attention to the key aspects of the claim.

Collectively, these documents form a comprehensive package that supports the claim made on Form 843. It's important for individuals to ensure that all information is accurate and complete before submission. Proper documentation streamlines the review process, potentially leading to a faster resolution. Given the complexity of tax issues, consulting with a tax professional is highly recommended to ensure all forms and documents are correctly prepared and submitted.

Similar forms

The IRS 843 form, utilized for claiming a refund or requesting an abatement of certain taxes, interests, penalties, fees, and additions to tax, shares similarities with several key documents within the tax domain. One analogous document is the IRS Form 1040X, the Amended U.S. Individual Income Tax Return. Much like the 843 form, the 1040X allows taxpayers to correct previously filed tax returns, embracing a path to rectify financial discrepancies or claim overlooked deductions and credits. Both forms represent crucial tools in the taxpayer’s arsenal for ensuring their tax responsibilities are accurately met and adjusted.

Similar to the IRS 843 form is the Form 940, the Employer's Annual Federal Unemployment (FUTA) Tax Return. The Form 940 is employed by employers to report annual Federal Unemployment Tax Act (FUTA) tax. While its primary focus differs, it resembles the 843 in its capacity to adjust or amend previously reported information, thus affecting the calculation or recalculation of taxes due.

The IRS Form 941, Employer's Quarterly Federal Tax Return, also parallels the IRS 843 form in significant aspects. This form is used by employers to report income taxes, social security tax, or Medicare tax withheld from employees' paychecks, and to pay the employer's portion of social security or Medicare tax. The similarity lies in the potential for correction of errors, serving as a vehicle to amend previously submitted data, thus impacting future tax liabilities or fostering opportunities for reclaiming overpaid amounts.

Another document akin to the IRS 843 form is the Form 9465, Installment Agreement Request. This form allows taxpayers to make arrangements for paying off their tax debt over time. Though it primarily focuses on structuring payments, it shares the underlying principle of altering the approach or terms of tax liability resolution with the IRS 843 form, offering a structured method to manage financial obligations to the IRS.

The IRS Form 656, Offer in Compromise, bears resemblance to the 843 form as well. The Form 656 allows taxpayers to negotiate with the IRS to settle their tax debts for less than the full amount owed. Both forms provide a means to address and potentially modify one's tax obligations, either by correcting errors with Form 843 or by proposing a compromise with Form 656, ultimately seeking a more favorable outcome for the taxpayer.

Similarly, the Form 2555, Foreign Earned Income, which is used by individuals to report foreign earned income and exclude it from taxable income in the U.S., shares a conceptual link with the IRS 843 form. Both documents permit taxpayers to adjust their tax responsibilities based on specific circumstances—foreign income in the case of Form 2555 and errors or excessive payments for Form 843—thus optimizing their tax positions.

Form 8822, Change of Address, while administratively focused, parallels the IRS 843 form in its function of updating vital information with the IRS to ensure accurate and timely communications. The correction or updating of address details through Form 8822 can be crucial for receiving notices about refunds or abatements requested via the IRS 843 form, highlighting an operational similarity in maintaining current and correct taxpayer information.

Lastly, Form 1120, the U.S. Corporation Income Tax Return, reveals a resemblance to the IRS 843 form by catering to the tax reporting needs of corporations. Though primarily designed for reporting income, gains, losses, deductions, credits, and to calculate the income tax liability of corporations, it allows for amendments and corrections, akin to the personal adjustments facilitated by the IRS 843 form for individual taxpayers. Both forms play pivotal roles in ensuring tax compliance and rectifying previously submitted tax data.

Dos and Don'ts

Filling out the IRS 843 form, used for claiming a refund or requesting an abatement of certain taxes, penalties, fees, or interest, requires attention to detail and an understanding of your tax situation. Ensuring accuracy and completeness in your application can significantly affect its processing and the outcome. Below are key dos and don'ts to guide you through this process:

Do:Read the instructions for Form 843 carefully to understand which taxes or fees are eligible for claim or abatement. This form is not universally applicable for all tax situations.

Gather all necessary documents and information before starting to fill out the form. This includes previous tax returns, notices from the IRS, and documentation supporting your claim.

Clearly explain the reasons for your claim in the designated area on the form. Providing a detailed, written statement can help the IRS understand your situation and process your request more efficiently.

Review the form for accuracy and completeness once filled out. Errors or missing information can delay processing or lead to denial of your claim.

Use the correct address for mailing your form, which can vary depending on the nature of your claim and your geographic location.

Keep copies of the completed Form 843 and all supporting documentation for your records. Having this information on hand is crucial if the IRS has questions or there are further issues with your claim.

Don’t use Form 843 for situations that have specific forms or processes. For example, do not use it to amend an income tax return—Form 1040X serves that purpose.

Don’t forget to sign and date the form. An unsigned form can lead to automatic rejection.

Don’t include sensitive personal information, such as your full Social Security Number, in any written explanation without ensuring the security of your submission.

Don’t make vague or unspecific claims. The IRS needs clear, concise reasons to understand why you believe a refund or abatement is warranted.

Don’t ignore IRS notices regarding your Form 843. If the IRS requires additional information or documentation, prompt response is crucial.

Don’t hesitate to seek professional advice if unsure about any part of the process. Tax professionals can provide valuable guidance and ensure your claim is properly prepared.

Misconceptions

Many people have misconceptions about the IRS Form 843, which is used for claiming refunds or requesting abatements of certain taxes, interest, penalties, fees, and additions to tax. Understanding what this form is and isn't designed for can help in making informed decisions about when and how to use it effectively.

-

It's only for individual income tax issues. A common misconception is that Form 843 is exclusively for individual taxpayers dealing with income tax problems. However, this form is versatile and can also be used by estates, trusts, and businesses to request abatements or refunds related to payroll taxes, penalty charges, and specific other taxes.

-

It guarantees a refund. Filing Form 843 does not guarantee that a refund or request will be approved. The outcome depends on the IRS's review of the case, the evidence provided, and whether the request meets the criteria for relief.

-

Form 843 can be used for any tax year or period. While Form 843 can be used for many taxes and fees, there are limits on how far back you can go to request a refund or abatement. Typically, claims must be filed within three years from the date the original tax return was filed or two years from the date the tax was paid, whichever is later.

-

It's complicated and requires a tax professional. While seeking assistance from a tax professional can be beneficial, especially in complex cases, many taxpayers can complete Form 843 themselves, particularly if their case is straightforward. The instructions provided by the IRS guide you through the completion of the form.

-

Form 843 covers interest and penalties on all taxes. This is not entirely true. While Form 843 can be used to request abatement or refund of interest and penalties for many kinds of taxes, there are specific situations and types of taxes for which it cannot be used. For example, interest related to certain underpayments cannot be abated using this form.

-

You don't need to provide documentation. When you submit Form 843, supporting documentation must often be provided to substantiate your claim. This can include proof of tax payments, previous IRS correspondence, and any relevant tax documents that support your request for a refund or abatement.

-

It's for disputing the amount of tax you owe. A significant misunderstanding is that Form 843 is a way to contest the amount of tax the IRS claims you owe. In reality, this form is for seeking a refund or abatement of interest, penalties, or fees—not for challenging the underlying tax liability itself. For disputing tax liabilities, other forms and procedures are in place, such as filing an amended return or other forms specific to disputing IRS decisions.

Key takeaways

The Internal Revenue Service (IRS) Form 843 is used for specific purposes, including claiming a refund or requesting an abatement of certain taxes, interest, penalties, fees, and additions to tax. When taxpayers find themselves in situations that warrant adjustments to their tax records, understanding how to properly fill out and use IRS Form 843 is crucial. Here are four key takeaways to consider:

- Correct Identification of the Issue: It's imperative to correctly identify the reason for filling out Form 843. Whether it’s for a tax refund, an abatement of interest or penalties, or other tax-related issues, clarity on the form's purpose helps in the accurate and efficient processing of the request. The IRS scrutinizes these forms closely, and a clear, well-documented reason helps avoid unnecessary delays or denials.

- Accurate Information: Filling out Form 843 requires precise information. This includes personal identification details, tax periods involved, and the specific amounts being claimed or disputed. Accurate calculations and the provision of supporting documentation are essential. Any errors or omissions can result in the rejection of the form or a longer processing time. Detailed records and careful review are your best allies in this process.

- Supporting Documentation: Always attach relevant supporting documents when submitting Form 843. This might include letters from the IRS, tax calculation sheets, or any other evidence that supports your claim. Providing a well-organized package of information substantiates your request and aids in the swift resolution of your case. Lack of sufficient supporting materials can lead to a request being overlooked or dismissed.

- Understanding the Timelines: Be aware of the IRS timelines for processing Form 843 claims. Generally, taxpayers should prepare for a waiting period, as the review and decision-making processes take time. Additionally, there are deadlines for submitting this form related to the tax issue in question. Understanding these timelines is crucial to ensure that your claim is considered and to set realistic expectations for resolution.

By keeping these key points in mind, taxpayers can navigate the complexities of Form 843 with greater ease and confidence. While the process may seem daunting, proper preparation and attention to detail will significantly enhance the likelihood of a favorable outcome. Above all, when in doubt, seeking the advice of a tax professional can provide invaluable guidance and peace of mind.

Popular PDF Documents

Sss Form Loan - Highlighting the importance of truthful information, the application emphasizes adherence to honesty for a successful loan process.

Mortgage Credit Certificate Program - Form 8396 is a key document for eligible MCC holders, directly affecting the tax advantages associated with homeownership.

Estimate Taxes Due - Utilize Form 2210 to determine if you're subject to penalties for not making sufficient tax payments.