Get IRS 8396 Form

When homeowners embark on the journey of purchasing a home with the assistance of a Mortgage Credit Certificate (MCC), navigating the tax implications becomes an essential part of financial management. Enter the IRS 8396 form, a crucial document for those looking to benefit from the Mortgage Interest Credit. Designed to offer relief and encourage homeownership, this form enables eligible taxpayers to claim a credit for a portion of the mortgage interest paid on their residence, transforming a routine financial obligation into a valuable tax advantage. By turning part of the interest into a direct credit against their tax liability, rather than a deduction that merely reduces taxable income, homeowners can significantly decrease the amount of tax they owe to the federal government. However, navigating the specifics of the IRS 8396 form—the qualifications, the limitations, and the process—requires a clear understanding so that taxpayers can maximize their benefits while ensuring compliance with tax laws. The form itself embodies a blend of opportunity and obligation, highlighting the importance of meticulous attention to detail in its completion and submission. As with many aspects of tax code, the potential benefits are balanced by the need for accuracy and adherence to guidelines, underscoring the value of fully grasping how the IRS 8396 form functions within the broader context of a taxpayer's financial landscape.

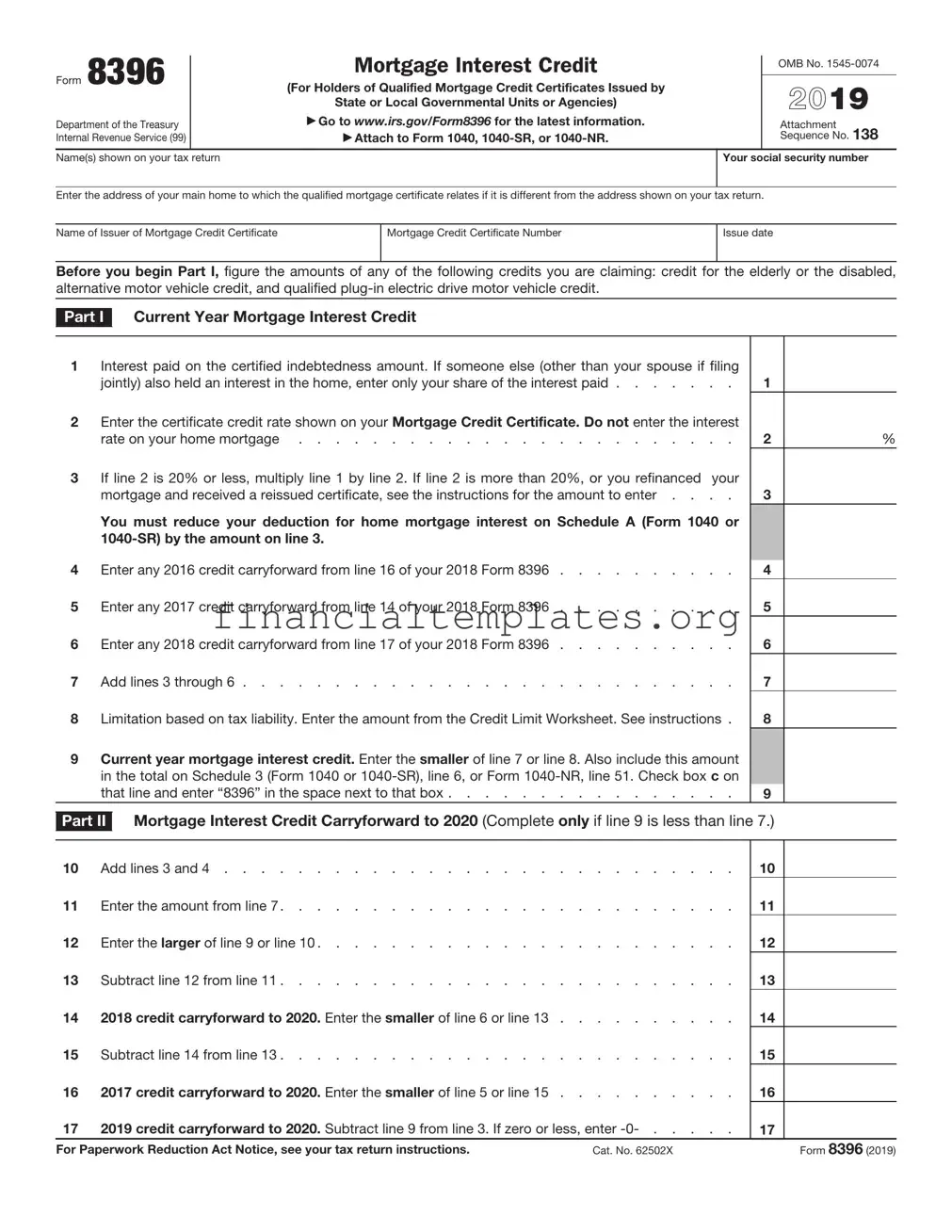

IRS 8396 Example

Mortgage Interest Credit |

OMB No. |

|

Form 8396 |

(For Holders of Qualified Mortgage Credit Certificates Issued by |

2021 |

|

||

|

State or Local Governmental Units or Agencies) |

|

Department of the Treasury |

▶ Go to www.irs.gov/Form8396 for the latest information. |

Attachment |

Internal Revenue Service (99) |

▶ Attach to Form 1040, |

Sequence No. 138 |

|

|

|

Name(s) shown on your tax return |

|

Your social security number |

|

|

|

Enter the address of your main home to which the qualified mortgage certificate relates if it is different from the address shown on your tax return.

Name of Issuer of Mortgage Credit Certificate

Mortgage Credit Certificate Number

Issue date

Before you begin Part I, figure the amounts of any of the following credits you are claiming: credit for the elderly or the disabled, alternative motor vehicle credit, and qualified

Part I Current Year Mortgage Interest Credit

1Interest paid on the certified indebtedness amount. If someone else (other than your spouse if filing

jointly) also held an interest in the home, enter only your share of the interest paid . . . . . . .

2Enter the certificate credit rate shown on your Mortgage Credit Certificate. Do not enter the interest

rate on your home mortgage . . . . . . . . . . . . . . . . . . . . . . . .

3If line 2 is 20% or less, multiply line 1 by line 2. If line 2 is more than 20%, or you refinanced your

mortgage and received a reissued certificate, see the instructions for the amount to enter . . . .

You must reduce your deduction for home mortgage interest on Schedule A (Form 1040) by the amount on line 3.

4 Enter any 2018 credit carryforward from line 16 of your 2020 Form 8396 . . . . . . . . . .

5 Enter any 2019 credit carryforward from line 14 of your 2020 Form 8396 . . . . . . . . . .

6 Enter any 2020 credit carryforward from line 17 of your 2020 Form 8396 . . . . . . . . . .

7 Add lines 3 through 6 . . . . . . . . . . . . . . . . . . . . . . . . . . .

8Limitation based on tax liability. Enter the amount from line 3 of the Credit Limit Worksheet in the

instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9Current year mortgage interest credit. Enter the smaller of line 7 or line 8. Also include this amount on Schedule 3 (Form 1040), line 6g . . . . . . . . . . . . . . . . . . . . . .

1

2

3

4

5

6

7

8

9

%

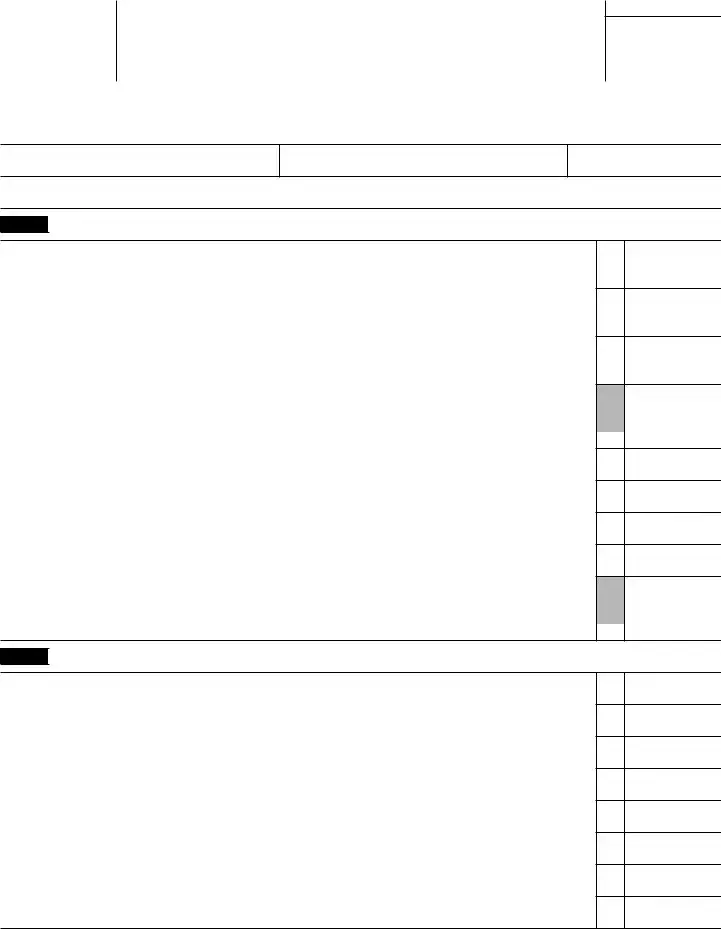

Part II Mortgage Interest Credit Carryforward to 2022 (Complete only if line 9 is less than line 7.)

10 |

Add lines 3 and 4 |

10 |

|

||

11 |

Enter the amount from line 7 |

11 |

|

||

12 |

Enter the larger of line 9 or line 10 |

12 |

|

||

13 |

Subtract line 12 from line 11 |

13 |

|

||

14 |

2020 credit carryforward to 2022. |

Enter the smaller of line 6 or line 13 |

14 |

|

|

15 |

Subtract line 14 from line 13 |

15 |

|

||

16 |

2019 credit carryforward to 2022. |

Enter the smaller of line 5 or line 15 |

16 |

|

|

17 |

2021 credit carryforward to 2022. |

Subtract line 9 from line 3. If zero or less, enter |

17 |

|

|

For Paperwork Reduction Act Notice, see your tax return instructions. |

Cat. No. 62502X |

|

Form 8396 (2021) |

||

Form 8396 (2021) |

Page 2 |

General Instructions

Future Developments

For the latest information about developments related to Form 8396 and its instructions, such as legislation enacted after they were published, go to www.irs.gov/Form8396.

Purpose of Form

Use Form 8396 to figure the mortgage interest credit for 2021 and any credit carryforward to 2022.

Who Can Claim the Credit

You can claim the credit only if you were issued a qualified Mortgage Credit Certificate (MCC) by a state or local governmental unit or agency under a qualified mortgage credit certificate program.

Homestead Staff Exemption Certificates, and certificates ▲! issued by the Federal Housing Administration,

Department of Veterans Affairs, and Farmers Home CAUTION Administration, do not qualify for the credit.

The home to which the certificate relates must be your main home and must also be located in the jurisdiction of the governmental unit that issued the certificate.

If the interest on the mortgage was paid to a related person, you cannot claim the credit.

Refinanced Mortgage

You can refinance your mortgage without losing this credit if your existing MCC is reissued and the reissued certificate meets all of the following conditions.

•It must be issued to the holder(s) of the existing certificate for the same property.

•It must entirely replace the existing certificate. The holder cannot retain any portion of the outstanding balance of the existing certificate.

•The certified indebtedness on the reissued certificate cannot exceed the outstanding balance shown on the existing certificate.

•The credit rate of the reissued certificate cannot exceed the credit rate of the existing certificate.

•The reissued certificate cannot result in a larger amount on line 3 than would otherwise have been allowable under the existing certificate for any tax year.

For each tax year, you must determine the amount of credit that you would have been allowed using your original MCC. To do this, multiply the interest that was scheduled to be paid on your original mortgage by the certificate rate on your original MCC. The result may limit your line 3 credit allowed when you have a reissued MCC, even if your new loan has a lower interest rate.

If the certificate credit rates are different in the year you refinanced, attach a statement showing separate calculations for lines 1, 2, and 3 for the applicable parts of the year when the original MCC and the reissued MCC were in effect. Combine the amounts from both calculations for line 3. Enter that total on line 3 of the form and enter “see attached” on the dotted line next to line 2.

For more details, see Regulations section

Recapture of Credit

If you buy a home using an MCC and sell it within 9 years, you may have to recapture (repay) some of the credit. See Pub. 523, Selling Your Home; and Form 8828, Recapture of Federal Mortgage Subsidy.

Additional Information

See Pub. 530, Tax Information for Homeowners, for more details.

Specific Instructions

Part

Line 1

Enter the interest you paid during the year on the loan amount (certified indebtedness amount) shown on your MCC. In most cases, this will be the amount in box 1 on Form 1098, Mortgage Interest Statement, or on a similar statement you received from your mortgage holder. If the loan amount on your MCC is less than your total mortgage loan, you must allocate the interest to determine the part that relates to the loan covered by the MCC. See Pub. 530 for an example of how to allocate the interest.

Line 2

The certificate credit rate cannot be less than 10% or more than 50%.

Line 3

If you refinanced, see Refinanced Mortgage on this page.

If the certificate credit rate shown on line 2 is more than 20%, multiply line 1 by line 2, but do not enter more than $2,000 on line 3. If you and someone else (other than your spouse if filing jointly) held an interest in the home, the $2,000 limit must be allocated to each owner in proportion to the interest held. See Dividing the Credit in Pub. 530 for an example of how to make the allocation.

Reduction of home mortgage interest deduction on Schedule A (Form 1040). If you itemize your deductions on Schedule A, you must reduce the amount of home mortgage interest you would otherwise deduct on Schedule A by the amount on Form 8396, line 3, and report the reduced amount on Schedule A. You must do this even if part of the amount on line 3 is carried forward to 2022.

Line

Keep for Your Records

1.Enter the amount from Form 1040,

2.Form 1040 or Form

Form

3.Subtract line 2 from line 1. Enter this amount on Form 8396, line 8. If zero or less, enter

II of Form 8396 . . . . . . . . . . 3.

*If you are directed to complete Form 8396 by Credit Limit Worksheet B in the Instructions for Schedule 8812 (Form 1040), include the amount from line 14 of Credit Limit Worksheet B instead of the amount from Form 1040,

Part

If the amount on line 9 is less than the amount on line 7, you may have an unused credit to carry forward to the next 3 tax years or until used, whichever comes first. The current year credit is used first and then the prior year credits, beginning with the earliest prior year.

If you have any unused credit to carry forward to 2022, keep a copy of this form to figure your credit for 2022.

If you are subject to the $2,000 credit limit because your ▲! certificate credit rate is more than 20%, no amount over

the $2,000 limit (or your prorated share of the $2,000 if CAUTION you must allocate the credit) may be carried forward for

use in a later year.

Document Specifics

| Fact | Description |

|---|---|

| Title | IRS Form 8396: Mortgage Interest Credit |

| Purpose | To claim a tax credit for mortgage interest paid on a qualified home |

| Eligibility | Homeowners who have received a Mortgage Credit Certificate (MCC) from their state or local government |

| Benefit | Reduces the federal tax liability for qualified individuals based on mortgage interest paid |

| Limitations | The credit cannot exceed the total federal income tax liability after other credits and deductions |

| Documentation Needed | A valid Mortgage Credit Certificate (MCC) issued by a state or local governmental unit or agency |

| Impact on Other Taxes | The mortgage interest deduction may be reduced as a result of claiming the mortgage interest credit |

| Governing Law(s) | Primarily governed by federal tax law, but local and state laws also apply regarding eligibility and issuance of the Mortgage Credit Certificate |

Guide to Writing IRS 8396

After securing a mortgage that qualifies for a mortgage interest credit, individuals need to complete the IRS Form 8396. This procedure ensures that eligible taxpayers can claim their rightful mortgage interest credit during tax season. Doing so reduces one's federal income tax liability, providing significant savings. The process to correctly fill out Form 8396 is straightforward if one follows the necessary steps with attention to detail. Below is a guide meant to assist in completing this form accurately to ensure taxpayers receive the credit they are entitled to.

- Begin by accurately entering your name and Social Security Number (SSN) at the top of the form. These identifiers must match those on your tax return.

- On line 1, input the amount of interest received from the certified mortgage during the tax year. This information can be found on the mortgage interest statement provided by your lender.

- Proceed to line 2, where you should enter the Mortgage Credit Certificate (MCC) rate. Your state or local government, who issued the MCC, can supply this rate.

- Calculate the credit rate on line 3 by multiplying the figures on lines 1 and 2. The product is your initial mortgage interest credit. However, there are caps and limitations depending on your tax situation.

- If your home mortgage interest deduction, found on Schedule A, was reduced due to receiving this mortgage interest credit, you are to enter the amount of that reduction on line 4.

- Line 5 requires the addition of the amounts on lines 3 and 4, essentially giving you the total credit amount before any limits are applied.

- On line 6, you need to refer to the tax liability limit chart in the Form 8396 instructions to determine what your credit limit is based on your tax situation. Enter that limit on this line.

- Compare the figures entered on lines 5 and 6 to determine your allowable credit. The lower of these two numbers should be entered on line 7. This is the amount you can claim as your mortgage interest credit.

- Transfer the amount from line 7 to Schedule 3 (Form 1040), line 5 or the appropriate line as directed by the current year's IRS instructions to properly apply your credit toward your total tax liability.

Upon completing Form 8396 with the necessary diligence, taxpayers should attach it to their federal income tax return. It's essential to keep all related documents, such as the MCC and mortgage interest statements, for your records. These might be required for future reference or in the event of an IRS inquiry. Successfully applying this tax credit can significantly reduce your tax bill, underscoring the importance of correctly completing and submitting Form 8396 as part of your tax filing process.

Understanding IRS 8396

-

What is the IRS 8396 form used for?

The IRS 8396 form is designed for homeowners to claim a mortgage interest credit. This credit aims to assist individuals by allowing them to reduce their tax liability, provided they were issued a qualified Mortgage Credit Certificate (MCC) by a state or local governmental unit or agency under a qualified mortgage credit certificate program. Essentially, it helps make homeownership more affordable for first-time buyers and individuals with moderate incomes.

-

Who is eligible to file IRS Form 8396?

To be eligible to file Form 8396, individuals must have been issued a valid Mortgage Credit Certificate (MCC) by a state or local governmental entity. The form is aimed at taxpayers seeking to claim the mortgage interest credit for the current tax year. It's important for filers to verify that their MCC is still valid for the year they are claiming the credit and that the home associated with the MCC remains their primary residence.

-

How does filing the 8396 Form impact my tax return?

Filing Form 8396 can have a positive impact on your tax return by directly reducing your overall tax liability, dollar for dollar, not just lowering your taxable income. This means if you're eligible for a $1,000 mortgage interest credit, you reduce your tax liability by that same $1,000. However, it's important to note that there are limits and your ability to claim the full credit may be affected by the amount of your tax liability and other credits you are claiming.

-

What information do I need to complete Form 8396?

- Your Mortgage Credit Certificate (MCC)

- The amount of mortgage interest you paid during the tax year

- Any carryover of mortgage interest credit from previous years, if applicable

- Your tax liability before credits

This form requires precise information from your MCC, such as the certificate number and the issue date, and calculations based on the mortgage interest paid. It’s crucial to have this information readily available to ensure accurate filing.

-

Can I file Form 8396 electronically, or do I need to mail it in?

Yes, you can file Form 8396 electronically through IRS e-file as part of your standard tax return. This process is generally faster and more secure than mailing a physical copy. However, if you're already filing your tax return by mail or if you prefer to send in a paper copy, Form 8396 can also be included with your other tax documents and mailed to the IRS. It's important to verify the correct mailing address and adhere to any filing deadlines to avoid delays or penalties.

Common mistakes

Filing tax forms can be a daunting task, especially when it comes to specific forms like the IRS Form 8396, which is used to claim the Mortgage Interest Credit. This credit is designed for certain homeowners, allowing them to reduce their tax liability by a portion of the mortgage interest they've paid on a qualified home. However, mistakes can happen, and they often do. Here are nine common errors to avoid when completing this form:

Not checking the eligibility criteria thoroughly. Many filers fail to verify if they truly qualify for the credit, which can lead to complications.

Forgetting to include the name and Social Security number on the form. This basic information is crucial for the IRS to process any tax document.

Incorrectly reporting the amount of interest paid. It's essential to only include the interest eligible for the credit, not the total mortgage interest paid.

Missing out on attaching the Mortgage Credit Certificate (MCC). The MCC is a key document that must be submitted with the form for the credit to be processed.

Calculation errors are common, especially when determining the credit rate or the total credit amount. Double-check these calculations to avoid discrepancies.

Filing the form for the wrong tax year. Ensure the form corresponds to the tax year for which you're claiming the credit.

Ignoring the carryforward rules. If the credit cannot be fully utilized in one year, it may be carried forward. However, this aspect is often overlooked.

Omitting necessary personal information or providing incomplete details about the property can lead to unnecessary delays or rejections.

Not seeking professional advice when needed. The complexity of tax laws means sometimes it's best to consult with a tax professional or an expert.

While the process of filling out any tax form, including the IRS Form 8396, can seem intricate, paying close attention to these details can help you avoid basic mistakes. This not only smoothens the process but also ensures you make the most of the potential benefits.

Documents used along the form

When dealing with the IRS Form 8396, which is used for claiming the Mortgage Interest Credit, it's essential to get acquainted with other forms and documents that often accompany it. This credit is specifically designed to help homeowners with low incomes afford the interest on their mortgages. However, navigating through all the necessary paperwork can be somewhat overwhelming. Below is a concise list of documents and forms that you may need to gather alongside Form 8396 to ensure a smooth and efficient process.

- Form 1040: The U.S. Individual Income Tax Return is a fundamental document where you report your annual income, claim tax credits like the Mortgage Interest Credit, and calculate your tax refund or amount owed to the IRS. It acts as the main form for personal federal income tax returns.

- Form 6251: Alternative Minimum Tax—Individuals. Some taxpayers who claim specific types of deductions, including the Mortgage Interest Credit, may need to fill out this form. It ensures that those who benefit from certain tax advantages pay at least a minimum amount of tax.

- Schedule A (Form 1040): Itemized Deductions. If you're not taking the standard deduction and instead itemize your deductions, this schedule is necessary. It's where you'll list allowable deductions, including mortgage interest (separate from the Mortgage Interest Credit), real estate taxes, and charitable contributions.

- Form 1098: Mortgage Interest Statement. This document is typically sent by your mortgage lender and reports the amount of interest and related expenses you paid on your mortgage during the tax year. It's essential for accurately completing both Form 8396 and Schedule A.

- Form 8828: Recapture of Federal Mortgage Subsidy. If you sell or otherwise dispose of your home within nine years of purchasing it through a federally subsidized program, you might need to fill out this form. It calculates whether you owe any recaptured amount for the federal mortgage subsidy you received.

Understanding each of these forms and how they interlink can significantly ease the tax filing process. The Mortgage Interest Credit, while beneficial, brings with it a responsibility to accurately report and document. By familiarizing yourself with these forms, you're better prepared to navigate your tax obligations and potentially maximize your returns. Remember, when in doubt, seeking guidance from a tax professional can provide clarity and ensure you're following all necessary protocols.

Similar forms

The IRS Form 8396, used for claiming the mortgage interest credit, shares similarities with several other tax documents, particularly those related to homeownership and tax credits. One such document is IRS Form 1098, the Mortgage Interest Statement. This form is issued by lenders to borrowers outlining the amount of interest and related expenses paid on a mortgage during the tax year. Both forms are integral in capturing the financial aspects of owning a home, with Form 1098 often providing the necessary information to complete Form 8396 and maximize homeowner tax benefits.

Another document closely aligned with IRS Form 8396 is Form 5405, First-Time Homebuyer Credit and Repayment of the Credit. This form was designed for first-time homebuyers to claim a tax credit for the purchase of a home, a policy aimed at incentivizing homeownership. Like Form 8396, it addresses the fiscal advantages of buying a home, albeit focusing on a different segment of the homeowner population. The connection lies in their shared goal: to provide financial relief to homeowners through the tax code.

IRS Form 8829, Expenses for Business Use of Your Home, also bears a resemblance to Form 8396. Form 8829 is used to calculate the deductible expenses of operating a business from one's home, which can include a portion of mortgage interest among other home-related expenses. While Form 8396 directly credits mortgage interest against income taxes owed, both documents reflect the tax implications of using home-related expenses to lower one's taxable income, highlighting the interplay between personal residence costs and tax deductions or credits.

Last but not least, IRS Form 2441, Child and Dependent Care Expenses, shares a conceptual similarity with Form 8396. Form 2441 allows taxpayers to claim a credit for the cost of childcare or dependent care, facilitating the taxpayer's ability to work or look for work. Although it pertains to a different aspect of tax relief, it's similar to Form 8396 in that it provides a tax credit. Both forms thus serve to lessen the tax burden on individuals by offering credits for specific expenses, benefiting diverse groups of taxpayers by acknowledging and supporting their financial expenditures in distinct areas of life.

Dos and Don'ts

When filing IRS Form 8396, used for claiming the Mortgage Interest Credit, carefully following instructions ensures the process goes smoothly. Below are lists of things you should and shouldn’t do when completing this form:

Do:

- Read the instructions provided by the IRS for Form 8396 thoroughly before starting. This ensures you understand the requirements and eligibility criteria.

- Double-check your Mortgage Credit Certificate (MCC) because the details on this document are critical for filling out Form 8396 correctly.

- Ensure your Social Security Number (SSN) and other personal information are accurately entered. This basic information is crucial for identity verification.

- Calculate your mortgage interest credit accurately. Use the correct percentage rate given on your MCC to calculate your credit.

- Include the form when filing your annual income tax return. Form 8396 should be attached to your Form 1040 or 1040-SR.

- Keep a copy of your completed Form 8396 and all relevant documents for your records. This is important in case of audits or questions from the IRS.

- Check for the updated version of Form 8396. The IRS occasionally updates its forms, so make sure you're using the most current version.

- Consider consulting a tax professional if you have questions or uncertainties. Tax laws and forms can be complex, and professional advice can help avoid mistakes.

- Report all necessary financial information. Transparency with the IRS is crucial to avoid future complications.

- File your form before the deadline. Late submissions can lead to delays or penalties.

Don't:

- Leave any sections blank. If a section does not apply to you, enter "N/A" or "0," as required.

- Rush through filling out the form without checking your MCC and other documents for the correct information.

- Forget to sign your tax return. An unsigned tax return can delay processing.

- Overlook errors in calculation. Double-check your math to ensure accuracy.

- Miss out on attaching other required forms or schedules as indicated in the instructions for your tax situation.

- Ignore IRS notices regarding your Form 8396. If the IRS contacts you for more information or to correct information, respond promptly.

- Guess on figures or estimates. Always use exact numbers from your MCC and mortgage documents.

- Assume Form 8396 only impacts your federal taxes. This credit might affect your state tax situation as well.

- Submit outdated forms. Using an old version of Form 8396 can lead to processing errors.

- Attempt to claim the credit without a valid MCC. The MCC is essential for claiming the Mortgage Interest Credit.

Misconceptions

Many people find tax forms confusing, and the IRS Form 8396, used for claiming the Mortgage Interest Credit, is no exception. Here's a list of common misconceptions about this form that we hope will clarify important points:

It's only for first-time homebuyers: This is not true. Although the Mortgage Interest Credit is often associated with first-time homebuyers, it's actually designed for those who received a mortgage credit certificate (MCC) from their state or local government. The MCC program isn't limited to first-time buyers, though specific qualifications may vary by issuing agency.

It replaces the mortgage interest deduction: This is another misconception. The Mortgage Interest Credit (Form 8396) and the mortgage interest deduction are two separate tax benefits. You can claim both in the same year, but you must reduce your deduction by the amount of the credit claimed.

The form is complicated to fill out: While tax forms can be intimidating, Form 8396 is relatively straightforward, especially if you already have your MCC and know your mortgage interest amount. It consists of just a few lines requiring basic information about your mortgage and the credit rate provided by your MCC.

You can claim the credit for any home loan interest: In fact, you can only claim the Mortgage Interest Credit for the interest paid on the loan that was covered by your MCC. Other home loan interest may qualify for the mortgage interest deduction, but not for this credit.

The credit is refundable: Unfortunately, this is not the case. If the credit you calculate on Form 8396 is more than your total tax liability, you cannot get the difference back as a refund. However, a portion of the unused credit may be carried forward to future tax years, depending on your situation.

Everyone who qualifies for the MCC will benefit from the credit: While the MCC can lead to significant tax savings, its actual benefit can vary widely. Factors such as your tax bracket, the amount of mortgage interest you pay, and the specific conditions of your MCC can all affect how beneficial the credit will be for you.

The form needs to be filed every year: This is true but sometimes misunderstood as an inconvenience. In reality, if you're eligible for the Mortgage Interest Credit, filing Form 8396 each year can provide you with an annual tax benefit, reflecting the ongoing support for homeownership that the program is designed to offer.

Understanding the specifics of IRS Form 8396 can unlock valuable tax savings for those who qualify. Like with all tax matters, consider seeking advice from a tax professional if you're unsure about your eligibility or how to claim the credit.

Key takeaways

The IRS Form 8396, titled Mortgage Interest Credit, serves as a key document for homeowners who aim to claim a mortgage interest credit on their federal tax return. This credit can significantly reduce the total amount of federal income tax one owes. To ensure proper use and filing of this form, consider the following key takeaways:

- Eligibility: To use Form 8396, you must hold a Mortgage Credit Certificate (MCC) issued by a state or local governmental unit or agency under a qualified MCC program. This certificate essentially allows you to claim a portion of the mortgage interest paid as a tax credit.

- Form Purpose: This form calculates the mortgage interest credit that can be claimed and determines any carryforward to future years. This credit serves to directly reduce your tax liability, not just decrease your taxable income.

- Required Information: When completing Form 8396, you will need specific details, including the amount of mortgage interest paid, the certificate credit rate specified in your MCC, and the home's acquisition date.

- Filing Status: If you're married and planning to file separately, consider that the mortgage interest credit must be split according to the interest paid by each spouse. This splitting is mandated even if only one spouse is listed on the MCC.

- Limitations: The credit cannot exceed the total of your tax liability after certain credits, such as the foreign tax credit, education credits, and general business credit, have been applied. This limitation ensures that the mortgage interest credit is used effectively within your overall tax situation.

- Carryover Provision: If your mortgage interest credit exceeds your tax liability, you're allowed to carry over the unused portion to the following years, subject to certain limitations and until the credit is used up or the certificate expires.

- Documentation: It's imperative to keep meticulous records, including the MCC and any documents related to your mortgage interest payments. These records should be retained to support your claim if ever questioned by the IRS.

- Filing Deadline: Like your tax return, Form 8396 must be filed by the tax filing deadline, typically April 15. For those requesting an extension, the form should be submitted by the extended due date to avoid penalties.

- Professional Advice: The rules surrounding the mortgage interest credit can be complex. Seeking guidance from a tax professional is advisable to ensure that all requirements are met, and the maximum benefit is received. A professional can help navigate the intricacies of Form 8396 and its implications for your tax situation.

By understanding these key aspects of IRS Form 8396, homeowners can better navigate the process of claiming their rightful mortgage interest credit, potentially enabling significant savings on their federal tax obligations.

Popular PDF Documents

Do You Have to File a 1095-c - It represents a significant shift towards utilizing tax information for health benefit eligibility, embracing modern data verification methods.

Addendum Meaning in Real Estate - The addendum is a binding agreement once signed, making the conditions regarding personal property legally enforceable.