Get IRS 8379 Form

The complexity of navigating financial responsibilities amidst the intricacies of federal taxation is a common challenge that many Americans face, particularly when these obligations intersect with personal circumstances such as marriage. One facet of this complexity arises in the instance of joint tax returns, where one spouse's past debts may unexpectedly impact the couple's overall tax refund. The IRS 8379 form, also known as the "Injured Spouse Allocation," serves as a crucial resource for mitigating such situations. It is designed to protect the portion of a joint refund rightfully belonging to a spouse who is not responsible for the other's debt. This form is applicable in scenarios involving federal debts like past-due federal taxes, state income taxes, child or spousal support payments, and certain federal non-tax debts, such as student loans. By completing and submitting Form 8379, the "injured" spouse may be able to recoup their share of the refund that might otherwise be used to offset the debts owed by their partner. The process of filing, along with understanding the eligibility requirements and navigating the expected timeline for processing, can be instrumental in ensuring that taxpayers do not unjustly forfeit their hard-earned money due to obligations solely attributable to their spouse.

IRS 8379 Example

Form 8379 |

Injured Spouse Allocation |

|

|

(Rev. November 2021) |

|

Department of the Treasury |

▶ Go to www.irs.gov/Form8379 for instructions and the latest information. |

Internal Revenue Service |

|

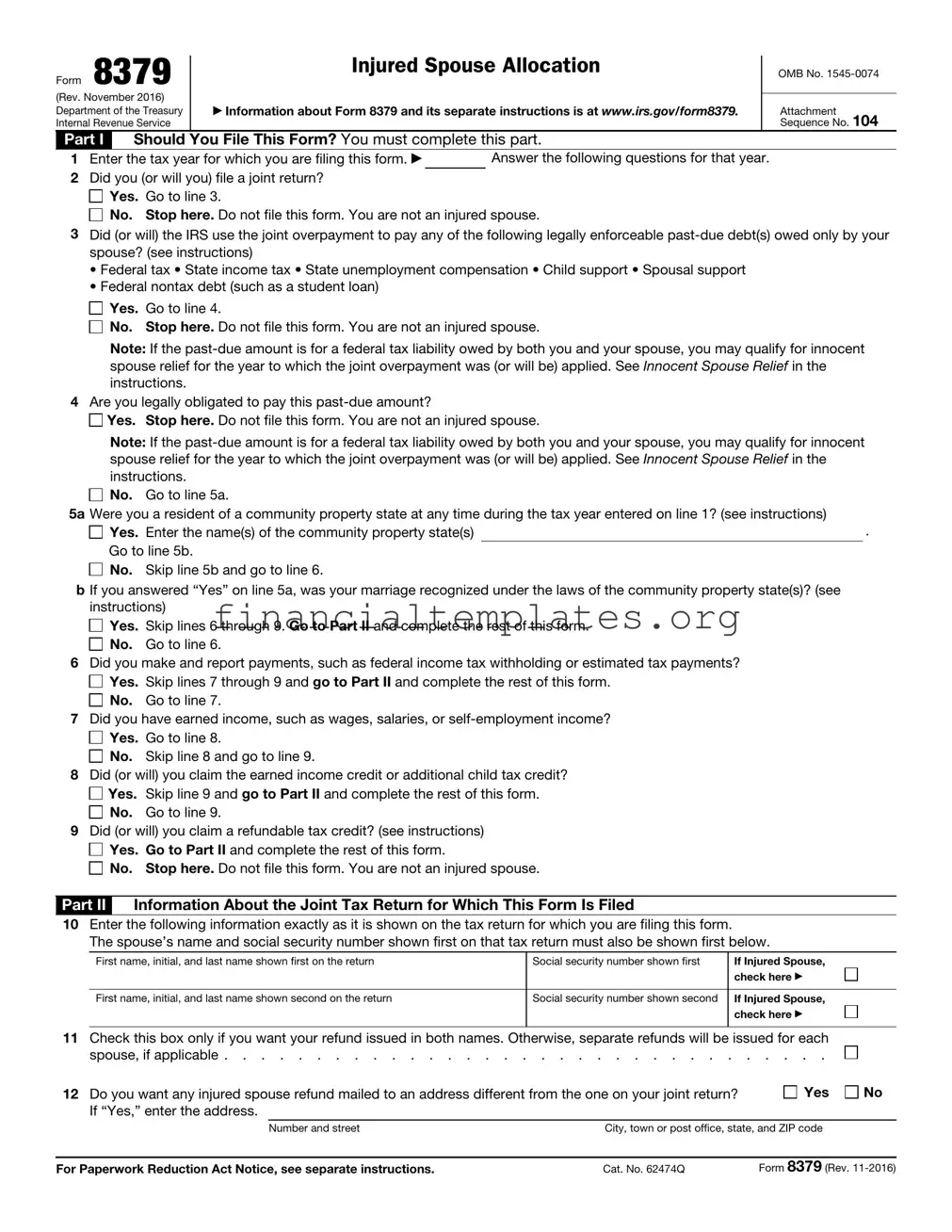

Part I Should You File This Form? You must complete this part.

OMB No.

Attachment Sequence No. 104

1 |

Enter the tax year for which you are filing this form ▶ |

|

. Answer the following questions for that year. |

2 |

Did you (or will you) file a joint return? |

|

|

Yes. Go to line 3.

No. Stop here. Do not file this form. You are not an injured spouse.

3Did (or will) the IRS use the joint overpayment to pay any of the following legally enforceable

spouse? See instructions.

• Federal tax • State income tax • State unemployment compensation • Child support

• Spousal support • Federal nontax debt (such as a student loan)

Yes. Go to line 4.

No. Stop here. Do not file this form. You are not an injured spouse.

Note: If the

4Are you legally obligated to pay this

Yes. Stop here. Do not file this form. You are not an injured spouse.

Yes. Stop here. Do not file this form. You are not an injured spouse.

Note: If the

No. Go to line 5a. |

|

|

5a Were you a resident of a community property state at any time during the tax year entered on line 1? See instructions. |

|

|

Yes. Enter the name(s) of the community property state(s) |

|

. |

Go to line 5b. |

|

|

No. Skip line 5b and go to line 6. |

|

|

b If you answered “Yes” on line 5a, was your marriage recognized under the laws of the community property state(s)? See |

|

|

instructions. |

|

|

Yes. Skip lines 6 through 9. Go to Part II and complete the rest of this form. |

|

|

No. Go to line 6. |

|

|

6Did you make and report payments, such as federal income tax withholding or estimated tax payments?

Yes. Skip lines 7 through 9 and go to Part II and complete the rest of this form.

No. Go to line 7.

7Did you have earned income, such as wages, salaries, or

Yes. Go to line 8.

No. Skip line 8 and go to line 9.

8Did (or will) you claim the earned income credit or additional child tax credit?

Yes. Skip line 9 and go to Part II and complete the rest of this form.

No. Go to line 9.

9Did (or will) you claim a refundable tax credit? See instructions.

Yes. Go to Part II and complete the rest of this form.

No. Stop here. Do not file this form. You are not an injured spouse.

Part II |

Information About the Joint Return for Which This Form Is Filed |

|

|||

10 Enter the following information exactly as it is shown on the tax return for which you are filing this form. |

|

||||

|

The spouse’s name and social security number shown first on that tax return must also be shown first below. |

||||

|

|

|

|

|

|

|

First name, initial, and last name shown first on the return |

Social security number shown first |

|

If injured spouse, |

|

|

|

|

|

|

check here ▶ |

|

|

|

|

|

|

|

First name, initial, and last name shown second on the return |

Social security number shown second |

|

If injured spouse, |

|

|

|

|

|

|

check here ▶ |

|

|

|

|

|

|

11 |

Check this box only if you want your refund issued in both names. Otherwise, separate refunds will be issued for each |

|

|||

|

spouse, if applicable |

|

|||

12 |

Do you want any injured spouse refund mailed to an address different from the one on your joint return? |

Yes |

No |

||

|

If “Yes,” enter the address. If a foreign address, see instructions. |

|

|

|

|

|

|

|

|

|

|

|

Number and street |

City, town or post office, state, and ZIP code |

|

|

|

|

|

|

|||

For Paperwork Reduction Act Notice, see separate instructions. |

Cat. No. 62474Q |

Form 8379 (Rev. |

|||

Form 8379 (Rev.

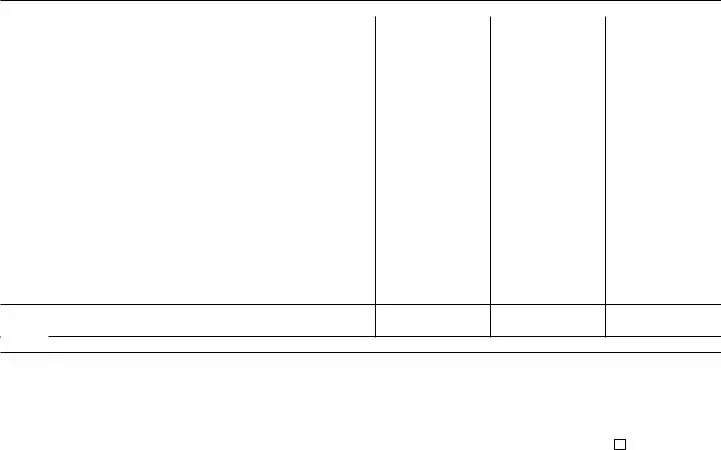

Part III Allocation Between Spouses of Items on the Joint Return. See the separate Form 8379 instructions for Part III.

|

|

Allocated Items |

(a) Amount shown |

(b) Allocated to |

(c) Allocated to |

|

(Column (a) must equal columns (b) + (c)) |

on joint return |

injured spouse |

other spouse |

|

|

|

|

|

|

|

13 |

Income: a. |

Income reported on Form(s) |

|

|

|

|

b. |

All other income |

|

|

|

14 |

Adjustments to income |

|

|

|

|

15 |

Standard deduction or itemized deductions |

|

|

|

|

16 |

Nonrefundable credits |

|

|

|

|

17 |

Refundable credits (do not include any earned income credit) |

|

|

|

|

18 |

Other taxes |

|

|

|

|

19 |

Federal income tax withheld |

|

|

|

|

20Payments

Part IV Signature. Complete this part only if you are filing Form 8379 by itself and not with your tax return.

Under penalties of perjury, I declare that I have examined this form and any accompanying schedules or statements, and to the best of my knowledge and belief, they are true, correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

Keep a copy of |

Injured spouse’s signature |

|

Date |

|

|

Phone number |

||

this form for |

|

|

|

|

|

|

|

|

your records |

|

|

|

|

|

|

|

|

Paid |

Print/Type preparer’s name |

Preparer’s signature |

Date |

|

Check |

if |

PTIN |

|

|

|

|

|

|

||||

Preparer |

|

|

|

|

|

|||

Firm’s name ▶ |

|

|

Firm’s EIN ▶ |

|

|

|||

Use Only |

|

|

|

|

||||

Firm’s address ▶ |

|

|

Phone no. |

|

|

|||

|

|

|

|

|

||||

|

|

|

|

|

|

Form 8379 (Rev. |

||

Document Specifics

| Fact Name | Description |

|---|---|

| Purpose of Form 8379 | The IRS Form 8379, Injured Spouse Allocation, is used by married taxpayers to get back their portion of a joint tax refund that was or will be applied to their spouse's past-due federal debts, state taxes, child or spousal support, or federal non-tax debt (like a student loan). |

| Who Should File | This form should be filed by the "injured spouse," a taxpayer who believes they should not be held responsible for their spouse's debt. It is especially relevant when one spouse has incurred debts or liabilities for which the other spouse believes they should not be liable. |

| Filing Options | Form 8379 can be filed with a joint tax return, amended joint tax return, or on its own after the joint return has been filed. Taxpayers can submit this form electronically or on paper by mailing it to the IRS. |

| Timeframe for Processing | The processing time for Form 8379 can vary based on whether it is filed with a tax return or separately. If filed with a tax return, it can take up to 14 weeks to process. If filed after the tax return has already been processed, it may take up to 8 weeks. |

Guide to Writing IRS 8379

Filing the IRS Form 8379 is a crucial step for individuals seeking to claim their share of a tax refund that was or is expected to be applied to their spouse's past-due obligations. It is essential for ensuring that an injured spouse's portion of a joint tax refund is appropriately allocated. This procedure demands attention to detail and an understanding of the specific information required to accurately complete the form. Below are the necessary steps to fill out Form 8379.

- Determine the correct tax year for the refund you are seeking. This information will be required in part I of the form.

- Provide personal information for both you and your spouse, including your names, Social Security numbers, and your home address. This ensures that the IRS can accurately associate the form with the correct tax return and individuals.

- Indicate whether you are filing Form 8379 with your joint return, with an amended return, or after the original return was filed. Place a check in the appropriate box in Part I.

- Detail the amount of the refund from your joint tax return and the portion that you believe should be allocated to you. This involves understanding how much of the refund is attributable to each spouse's income, deductions, and credits.

- In Part II, specify all types of income, adjustments, tax credits, federal income tax withheld, and estimates or other payments. You must clearly identify which spouse each item belongs to by marking the appropriate column. This step is crucial for the IRS to determine the injured spouse's share of the joint refund.

- If you live in a community property state, review the instructions for Part III carefully. You may need to allocate income and deductions differently, according to state laws. This could affect the computation of the injured spouse's relief.

- Review your form for accuracy and completeness. Ensure that all the required sections are filled out correctly to avoid any delays in the processing of your form.

- Sign and date the form. Your signature is crucial as it validates the form. If filing jointly, both spouses must sign.

- Attach Form 8379 to the front of your joint return, amended return, or mail it by itself after you have filed your return. The correct mailing address depends on whether you are filing Form 8379 by itself or with your tax return, so refer to the IRS instructions for the appropriate address.

Once completed and sent, the IRS will process Form 8379. The proceedings involve a careful review of the provided information, after which the IRS determines the injured spouse's portion of the joint refund. The intended outcome is to ensure that each spouse receives their fair share of the refund, undiminished by the other's debts. The process requires patience, as it may take up to 14 weeks to complete, especially if the form is filed during the tax filing season.

Understanding IRS 8379

-

What is the purpose of the IRS Form 8379?

IRS Form 8379, known as the Injured Spouse Allocation form, is designed for taxpayers who want to prevent their share of a joint tax refund from being applied to their spouse's past due debts. These debts can include federal tax, state income tax, child or spousal support, or a federal non-tax debt, such as a student loan.

-

How do I know if I qualify to file Form 8379?

To qualify for injured spouse relief, you must meet specific requirements: you must have filed a joint tax return, not be legally obligated to pay the past-due amount your spouse owes, and have reported income (such as wages, taxable non-wage income, or made payments) and applicable withholdings on the joint return.

-

Can I file Form 8379 electronically?

Yes, Form 8379 can be filed electronically with your tax return. If you're filing it by itself after the original return has been processed, you may also submit it through electronic filing systems. However, processing times may vary depending on the method chosen.

-

How do I attach Form 8379 to my tax return?

If you're filing Form 8379 with your joint tax return, simply include it with your tax documents. For electronic filings, follow the software’s instructions to attach the form. If you're filing Form 8379 by itself after your return has been processed, make sure to send it to the IRS service center where you filed your original return.

-

What information do I need to complete Form 8379?

To complete Form 8379, both spouses must provide their Social Security numbers, names, and the amount of the refund, among other details. The injured spouse must also document their share of the tax return's income, deductions, and credits. Precise instructions are provided with the form to guide you through the allocation process.

-

How long does it take for the IRS to process Form 8379?

The processing time for Form 8379 can vary. If filed with a joint return or by itself electronically, it can take up to 14 weeks. However, if filed by mail after the joint return has been processed, expect the processing to take up to 8 weeks.

-

What should I do if my refund was already seized?

If your refund was already seized, you can still file Form 8379. This form can be submitted up to three years from the due date of the original return (including extensions) or two years from the date the tax was paid, whichever is later. If accepted, the IRS will issue the injured spouse's portion of the refund.

-

Can Form 8379 be used to allocate a refund for state taxes?

Form 8379 is used exclusively for federal tax returns and cannot be used for state tax issues. If your state has similar provisions for injured spouses, you'll need to contact your state's tax agency for the appropriate form and filing procedure.

-

Where can I get help with completing Form 8379?

If you're unsure about how to complete Form 8379 or whether you qualify, consider consulting a tax professional. Additionally, the IRS provides resources and assistance for those who need help with the form. Information and instructions are available on the IRS website, or you can call the IRS helpline for guidance.

Common mistakes

Filling out the IRS 8379 form, which is designed for injured spouse allocation, requires close attention to detail. People often overlook critical parts of the process, leading to common mistakes. Understanding these mistakes can help in preparing the form accurately and efficiently.

-

Not Checking Eligibility

Many individuals fail to confirm their eligibility before submitting the form. The IRS has specific criteria to determine who qualifies as an injured spouse, including not being responsible for the past-due amount that the IRS is using to offset the refund. Assuming eligibility without verifying can result in the rejection of the application.

-

Incorrectly Allocating Income and Deductions

Allocation of income, deductions, and credits between spouses can be complex. Errors in this area could significantly impact the outcome. It's crucial to carefully determine which portions of these financial elements belong to the injured spouse and ensure they are clearly and correctly reported on the form.

-

Not Including Required Documentation

Another common mistake is the omission of necessary documents. The form requires the attachment of specific documents, such as a copy of the joint tax return if not already filed or additional state forms if applicable. Failing to attach these documents can delay processing or result in a denial.

-

Using the Wrong Year’s Form

Tax forms are updated yearly to reflect changes in tax law and policy. Using the form for the wrong tax year can lead to an immediate rejection. It's essential to ensure that the version of Form 8379 being used corresponds to the correct tax year for the return in question.

-

Misunderstanding the Form’s Purpose

A misunderstanding of what the form is for leads to its misuse. Form 8379 is specifically for the allocation of a joint refund among spouses when one spouse’s past debts result in a tax refund offset. It is not a form for disputing the tax debt itself or for separating tax liabilities. Understanding its purpose ensures it is used correctly and for the right reasons.

By avoiding these mistakes, individuals can improve their chances of successfully navigating the complexities of Form 8379. Attention to detail, along with a careful review of the IRS guidelines, can significantly aid in this process.

Documents used along the form

When dealing with tax issues, especially those related to injured spouse relief, the IRS Form 8379 is often not the only document required. To navigate through the process smoothly, certain forms and documents might be necessary either to support the claim, provide additional details, or comply with IRS requirements. The following list encompasses several forms and documents that are commonly associated with or required alongside Form 8379.

- Form 1040: The U.S. Individual Income Tax Return is a crucial document that provides the IRS with a snapshot of the filer's income, tax liabilities, and credits for the year. It sets the stage for where the Injured Spouse Allocation (Form 8379) comes into play.

- Form 1040-X: This is an Amended U.S. Individual Income Tax Return. It's necessary if there are changes to be made to a previously filed Form 1040, which can affect the outcome of the Injured Spouse Allocation.

- W-2 Forms: These forms are issued by employers and outline the amount of money earned and taxes withheld for an employee. They're required to substantiate earnings and tax withholdings cited in the injured spouse claim.

- Form 8857: Request for Innocent Spouse Relief. This form is used if one is seeking relief from joint tax liabilities due to actions taken by their spouse or former spouse. It's distinct from Form 8379 but related in the sense of seeking tax relief due to circumstances involving a spouse.

- State Tax Return: In some cases, especially in community property states, a copy of the state tax return is necessary. It provides additional context and information that may affect the federal tax situation.

- Direct Deposit Forms: If one is entitled to a refund, setting up direct deposit through the appropriate form or account information sheet ensures that the refund is received as quickly and securely as possible.

- Identity Verification Documents: The IRS may require proof of identity, such as a driver’s license, state ID, or social security card, especially in cases where identity theft or fraud is suspected.

- Proof of Payment: If disputing a claim that one spouse is solely responsible for a debt, receipts or bank statements proving payment can be critical. This documentation can help in reallocating tax burdens or refunds more accurately.

Understanding each of these documents and how they relate to one's tax situation is imperative. These forms serve to either substantiate the claims made, correct previous submissions, or provide further detail to the IRS regarding one's financial situation and liabilities. They are integral in ensuring that the process of seeking injured spouse relief goes as smoothly as possible.

Similar forms

The IRS Form 8379, Injured Spouse Allocation, resembles the IRS Form 8857, Request for Innocent Spouse Relief, in several ways. Both forms are designed for spouses seeking relief from joint tax liabilities. While the Form 8379 is for those wanting to prevent their portion of a refund from being applied to their spouse's debts, Form 8857 is used when seeking relief from tax owed due to incorrect items reported by a spouse or ex-spouse. Each form addresses the issue of fairness for individuals who believe they should not be held responsible for their partner's debt.

Similar to IRS Form 8379, Form 1040X, Amended U.S. Individual Income Tax Return, also involves modifying previously filed tax information. Taxpayers use Form 1040X to correct errors or make changes to an original tax return. Although the purposes differ—Form 8379 is for claiming a share of a refund, while Form 1040X is for correcting errors—both forms allow taxpayers to adjust financial representations made to the IRS.

The IRS Form 433-A, Collection Information Statement for Wage Earners and Self-Employed Individuals, shares similarities with Form 8379 in its personal financial disclosure requirements. Form 433-A is used to gather financial information from individuals to establish payment plans or settlements for outstanding taxes. Like Form 8379, it requires detailed personal financial information to assess the filer's economic situation, albeit for different ends: resolution of debt versus allocation of a refund.

IRS Form 656, Offer in Compromise, and Form 8379 are alike in that they both provide means to mitigate financial burdens associated with taxes. Form 656 allows taxpayers to settle their tax liabilities for less than the full amount owed, appealing to those unable to pay their tax debt in full. In contrast, Form 8379 helps ensure that one spouse's portion of a joint refund is not used to cover the other spouse's debts, yet both forms aim to alleviate financial stress related to taxes.

Form 9465, Installment Agreement Request, parallels Form 8379 in its approach to resolving tax-related financial issues. Taxpayers file Form 9465 to request a payment plan for taxes they cannot pay in full by the due date. Although serving different functions—Form 9465 for managing payment of existing tax liabilities, and Form 8379 for protecting a spouse's share of a refund—they both facilitate taxpayers' financial management within the framework of tax obligations.

The resemblance between IRS Form 8379 and the Change of Address Form 8822 lies in their potential to affect the processing of tax documents and disbursements. Form 8822 is used to notify the IRS of a change in address, ensuring that taxpayers receive all correspondence and refunds. Like Form 8379, which seeks to allocate a refund correctly between spouses, ensuring the right party receives the intended funds relies on current personal information being accurately recorded with the IRS.

IRS Form 2848, Power of Attorney and Declaration of Representative, although used for different purposes, shares a procedural similarity with Form 8379. Form 2848 allows taxpayers to authorize an individual to represent them before the IRS, handling tax matters on their behalf. This delegation can include dealing with refunds and debts, areas where Form 8379 may also come into play. Both forms involve authorizing actions related to an individual’s tax responsibilities.

Lastly, IRS Form W-7, Application for IRS Individual Taxpayer Identification Number (ITIN), aligns with Form 8379 in the aspect of taxpayer identification. Form W-7 is utilized by individuals requiring an ITIN to comply with U.S. tax laws. Though its primary purpose is to assign identification numbers, and Form 8379's is to distribute refund portions, both are integral in ensuring accurate processing and allocation of tax responsibilities. Each form, in its way, supports the proper administration of tax laws to benefit the individual taxpayer.

Dos and Don'ts

Filling out the IRS 8379 form, also known as the Injured Spouse Allocation form, is crucial for those who believe their portion of a joint tax refund was unfairly applied to their spouse's past due obligations. Care and precision are necessary to ensure your rights are protected. Below are some essential dos and don'ts during this process:

- Do gather all necessary documentation, including your tax return and any notices from the IRS, before starting the form. This preparation ensures accuracy and completeness.

- Do complete every section of the form that applies to your situation. Skipping sections can lead to processing delays or even a denial of your request.

- Do use the correct tax year for which you are requesting relief. Failing to do so can result in confusion and incorrect processing of your form.

- Do consider getting professional help if you find the form confusing. A tax professional can provide guidance and ensure your form is correctly completed.

- Don't wait to file Form 8379. Submit it as soon as you are aware that your portion of the refund has been, or could be, applied to your spouse's debt. Timeliness is essential.

- Don't forget to sign and date the form. An unsigned form is invalid and will not be processed.

- Don't send the form to the wrong IRS office. Double-check the IRS instructions for the correct mailing address or consider filing electronically for added security and speed.

- Don't overlook the need to file an amended tax return, if necessary. In certain situations, you may need to correct your original tax return before the IRS can process Form 8379.

Handling the IRS 8379 form with care not only helps protect your financial interest but also ensures that the process is as swift and smooth as possible. Attention to detail and adherence to these guidelines greatly increase the probability of a favorable outcome.

Misconceptions

The IRS Form 8379, or the Injured Spouse Allocation, is often misunderstood due to its complexity and specific use case. The misconceptions surrounding this form can lead to confusion and misfiling. Here are six common misunderstandings about Form 8379 clarified:

- Only spouses with joint debts need to file it. This is not true. Form 8379 is designed for use by married couples who file a joint tax return when one spouse has past due debts (like child support, federal debts, or state taxes) that the other is not responsible for. It allows the “injured” spouse to get back their share of the joint refund, not just those with joint debts.

- Form 8379 is automatically applied when you file jointly. Actually, if you believe you're entitled to part of the refund that might otherwise be used to offset your spouse's debts, you must actively file Form 8379. It is not automatically applied with your joint tax return.

- It’s only for those who owe child support. While back child support is a common debt offset with joint tax refunds, Form 8379 can also be used for other types of debts, such as federal student loans, spouse’s individual state tax obligations, or federal tax debts.

- Filing Form 8379 will delay your return for months. It’s true that filing Form 8379 can lead to delays in processing your tax return, but it typically takes about 8-14 weeks to process, not months as some believe. The exact time can vary depending on whether you file it with your tax return or after the fact.

- Anyone can file Form 8379 for any reason. This form is specifically for injured spouses — those who are not legally obligated to pay the past-due amounts of their spouses. Not everyone qualifies to file this form. Couples have to meet certain IRS requirements to use it effectively.

- You need a lawyer to file Form 8379. While legal advice can be beneficial, especially in complicated tax situations, individuals can fill out and submit Form 8379 without a lawyer's help. The IRS provides instructions for filling out the form, and there are many resources available to help taxpayers understand these guidelines.

Key takeaways

The IRS Form 8379, also known as the Injured Spouse Allocation form, plays a pivotal role for married couples who file joint tax returns but don't want their portion of a refund to be applied towards their spouse's past due debts. Understanding the nuances of this form can help ensure that you navigate through your financial responsibilities effectively while safeguarding your share of any tax refunds. Here are five key takeaways to consider when you're filling out and using the IRS Form 8379.

- Eligibility Criteria: Before using Form 8379, it's important to verify your eligibility. You qualify as an injured spouse if you're not legally obligated to pay your spouse's past due debts and you reported income (such as wages, taxable interest, etc.) on the joint tax return. Additionally, if you've made payments such as federal income tax withheld from wages or estimated tax payments, and if the overpayment (refund) would have been applied to your spouse's past debts, you should consider this form.

- Filing Options: Form 8379 can be filed with your joint tax return, with an amended return, or on its own after you've already submitted your joint tax return. This flexibility allows you to assert your injured spouse claim at the most convenient time for your circumstances.

- Required Information: When completing Form 8379, you must provide specific details about both spouses. This includes not only personal identifying information but also an allocation of income, adjustments, and credits. This detail is crucial for the IRS to determine the portion of the refund that is attributable to the injured spouse.

- Processing Time: Patience is key, as processing the Form 8379 can take longer than a standard tax return—up to 14 weeks if filed with a joint return or amended return, and up to 8 weeks if filed after the joint return has been processed. Planning ahead can help manage expectations and reduce stress.

- State Debts May Not Qualify: It’s imperative to understand that the injured spouse relief provided by Form 8379 applies primarily to federal debts, such as federal tax arrears, child support, student loans, and certain state taxes. Debts to state agencies might not qualify, so it’s worthwhile to check if your specific circumstances would benefit from filing this form.

Properly utilizing Form 8379 can protect your portion of a tax refund from being used to cover your spouse's separate legal financial obligations. Always ensure that you're eligible and provide complete and accurate information to the IRS to facilitate a smooth process. If in doubt, seeking guidance from a tax professional can provide clarity and confidence as you navigate this aspect of your tax responsibilities.

Popular PDF Documents

IRS W-3 - Employers must authenticate the accuracy of the information on the W-3 before submission to avoid discrepancies.

Irs 10k Lutzdecrypt - Form 8300 is not just for traditional businesses; it extends to non-profits, individuals, and other entities engaged in qualifying transactions.

IRS 8814 - Parents considering this option should evaluate how it affects their tax liability and potential benefits.