Get IRS 8332 Form

Filing taxes can often feel like navigating through a dense fog without a compass, especially when the situation involves shared parenting responsibilities after a separation or divorce. One beacon through this mist is the IRS 8332 form, a critical document for parents who are not filing their taxes jointly but need to address the issue of who gets to claim a child or children as dependents. The form is essentially an agreement that allows the custodial parent to release the right to claim a dependent to the non-custodial parent. This agreement not only impacts the tax refund or amount owed by each parent but also has implications for eligibility for certain tax credits, such as the Child Tax Credit and the Earned Income Tax Credit. Understanding when and how to properly use this form is vital for parents to ensure they're navigating their financial obligations in the most beneficial way post-divorce or separation.

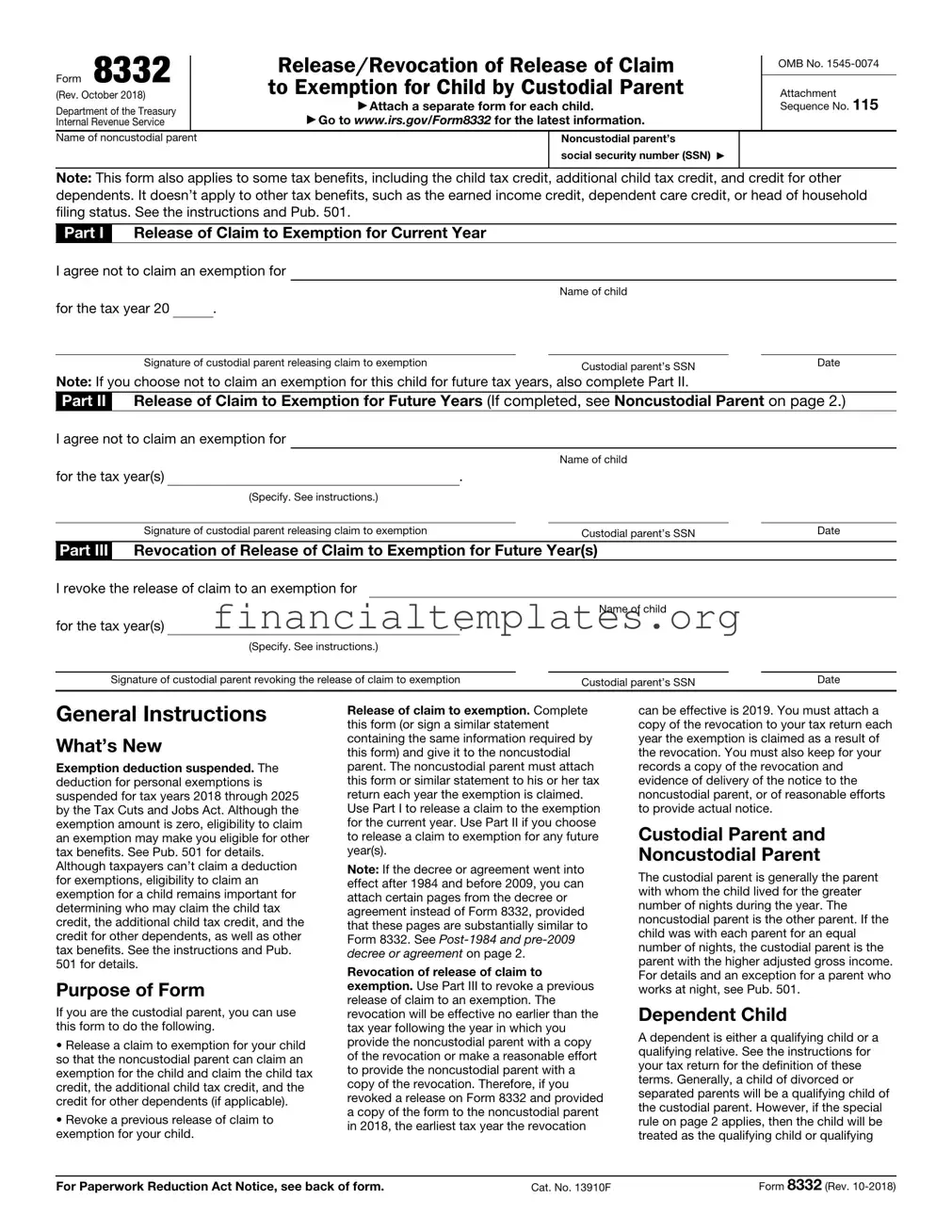

IRS 8332 Example

Form 8332 |

|

|

Release/Revocation of Release of Claim |

|

OMB No. |

|||

|

|

|||||||

|

|

|

|

|

|

|

||

|

|

|

to Exemption for Child by Custodial Parent |

|

|

|

||

(Rev. October 2018) |

|

|

|

Attachment |

115 |

|||

Department of the Treasury |

|

|

▶ Attach a separate form for each child. |

|

Sequence No. |

|||

|

|

▶ Go to www.irs.gov/Form8332 for the latest information. |

|

|

|

|||

Internal Revenue Service |

|

|

|

|

|

|||

Name of noncustodial parent |

|

|

|

Noncustodial parent’s |

|

|

|

|

|

|

|

|

social security number (SSN) ▶ |

|

|

|

|

|

|

|

|

|

|

|

|

|

Note: This form also applies to some tax benefits, including the child tax credit, additional child tax credit, and credit for other dependents. It doesn’t apply to other tax benefits, such as the earned income credit, dependent care credit, or head of household filing status. See the instructions and Pub. 501.

Part I Release of Claim to Exemption for Current Year

I agree not to claim an exemption for

Name of child

for the tax year 20 |

|

. |

Signature of custodial parent releasing claim to exemption |

|

Custodial parent’s SSN |

|

Date |

|

|

|

|

Note: If you choose not to claim an exemption for this child for future tax years, also complete Part II.

Part II Release of Claim to Exemption for Future Years (If completed, see Noncustodial Parent on page 2.)

I agree not to claim an exemption for

|

|

|

|

|

Name of child |

|

|

for the tax year(s) |

. |

|

|

|

|

||

|

(Specify. See instructions.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Signature of custodial parent releasing claim to exemption |

|

|

|

Custodial parent’s SSN |

|

Date |

|

Part III Revocation of Release of Claim to Exemption for Future Year(s)

I revoke the release of claim to an exemption for

|

|

|

|

Name of child |

|

|

for the tax year(s) |

. |

|

|

|

|

|

|

(Specify. See instructions.) |

|

|

|

|

|

|

|

|

|

|

||

Signature of custodial parent revoking the release of claim to exemption |

|

Custodial parent’s SSN |

|

Date |

||

General Instructions

What’s New

Exemption deduction suspended. The deduction for personal exemptions is suspended for tax years 2018 through 2025 by the Tax Cuts and Jobs Act. Although the exemption amount is zero, eligibility to claim an exemption may make you eligible for other tax benefits. See Pub. 501 for details. Although taxpayers can’t claim a deduction for exemptions, eligibility to claim an exemption for a child remains important for determining who may claim the child tax credit, the additional child tax credit, and the credit for other dependents, as well as other tax benefits. See the instructions and Pub. 501 for details.

Purpose of Form

If you are the custodial parent, you can use this form to do the following.

•Release a claim to exemption for your child so that the noncustodial parent can claim an exemption for the child and claim the child tax credit, the additional child tax credit, and the credit for other dependents (if applicable).

•Revoke a previous release of claim to exemption for your child.

Release of claim to exemption. Complete this form (or sign a similar statement containing the same information required by this form) and give it to the noncustodial parent. The noncustodial parent must attach this form or similar statement to his or her tax return each year the exemption is claimed. Use Part I to release a claim to the exemption for the current year. Use Part II if you choose to release a claim to exemption for any future year(s).

Note: If the decree or agreement went into effect after 1984 and before 2009, you can attach certain pages from the decree or agreement instead of Form 8332, provided that these pages are substantially similar to Form 8332. See

Revocation of release of claim to exemption. Use Part III to revoke a previous release of claim to an exemption. The revocation will be effective no earlier than the tax year following the year in which you provide the noncustodial parent with a copy of the revocation or make a reasonable effort to provide the noncustodial parent with a copy of the revocation. Therefore, if you revoked a release on Form 8332 and provided a copy of the form to the noncustodial parent in 2018, the earliest tax year the revocation

can be effective is 2019. You must attach a copy of the revocation to your tax return each year the exemption is claimed as a result of the revocation. You must also keep for your records a copy of the revocation and evidence of delivery of the notice to the noncustodial parent, or of reasonable efforts to provide actual notice.

Custodial Parent and

Noncustodial Parent

The custodial parent is generally the parent with whom the child lived for the greater number of nights during the year. The noncustodial parent is the other parent. If the child was with each parent for an equal number of nights, the custodial parent is the parent with the higher adjusted gross income. For details and an exception for a parent who works at night, see Pub. 501.

Dependent Child

A dependent is either a qualifying child or a qualifying relative. See the instructions for your tax return for the definition of these terms. Generally, a child of divorced or separated parents will be a qualifying child of the custodial parent. However, if the special rule on page 2 applies, then the child will be treated as the qualifying child or qualifying

For Paperwork Reduction Act Notice, see back of form. |

Cat. No. 13910F |

Form 8332 (Rev. |

Form 8332 (Rev. |

Page 2 |

relative of the noncustodial parent for purposes of the dependency exemption, the child tax credit, the additional child tax credit, and the credit for other dependents.

Special Rule for Children of Divorced or Separated Parents

A child is treated as a qualifying child or a qualifying relative of the noncustodial parent if all of the following apply.

1.The child received over half of his or her support for the year from one or both of the parents (see the Exception below). If you received payments under the Temporary Assistance for Needy Families (TANF) program or other public assistance program and you used the money to support the child, see Pub. 501.

2.The child was in the custody of one or both of the parents for more than half of the year.

3.Either of the following applies.

a. The custodial parent agrees not to claim an exemption for the child by signing this form or a similar statement. If the decree or agreement went into effect after 1984 and before 2009, see

b. A

For this rule to apply, the parents must be one of the following.

•Divorced or legally separated under a decree of divorce or separate maintenance.

•Separated under a written separation agreement.

•Living apart at all times during the last 6 months of the year.

If this rule applies, and the other dependency tests in the instructions for your tax return are also met, the noncustodial parent can claim an exemption for the child.

Exception. If the support of the child is determined under a multiple support agreement, this special rule does not apply, and this form should not be used.

instead of Form 8332, provided that these pages are substantially similar to Form 8332. To be able to do this, the decree or agreement must state all three of the following.

1.The noncustodial parent can claim the child as a dependent without regard to any condition (such as payment of support).

2.The other parent will not claim the child as a dependent.

3.The years for which the claim is released.

The noncustodial parent must attach all of the following pages from the decree or agreement.

•Cover page (include the other parent’s SSN on that page).

•The pages that include all of the information identified in (1) through (3) above.

•Signature page with the other parent’s signature and date of agreement.

The noncustodial parent must ▲! attach the required information

even if it was filed with a return in CAUTION an earlier year.

Specific Instructions

Custodial Parent

Part I. Complete Part I to release a claim to exemption for your child for the current tax year.

Part II. Complete Part II to release a claim to exemption for your child for one or more future years. Write the specific future year(s) or “all future years” in the space provided in Part II.

To help ensure future support, you TIP may not want to release your

claim to the exemption for the child for future years.

Part III. Complete Part III if you are revoking a previous release of claim to exemption for your child. Write the specific future year(s) or “all future years” in the space provided in Part III.

The revocation will be effective no earlier than the tax year following the year you provide the noncustodial parent with a copy of the revocation or make a reasonable effort to provide the noncustodial parent with a copy of the revocation. Also, you must attach a copy of the revocation to your tax return for each year you are claiming the exemption as a result of the revocation. You must also keep for your records a copy of the revocation and evidence of delivery of the notice to the noncustodial parent, or of reasonable efforts to provide actual notice.

Example. In 2015, you released a claim to exemption for your child on Form 8332 for the years 2016 through 2020. In 2018, you decided to revoke the previous release of exemption. If you completed Part III of Form 8332 and provided a copy of the form to the noncustodial parent in 2018, the revocation will be effective for 2019 and 2020. You must attach a copy of the revocation to your 2019 and 2020 tax returns and keep certain records as stated earlier.

Noncustodial Parent

Attach this form or similar statement to your tax return for each year you claim the exemption for your child. You can claim the exemption only if the other dependency tests in the instructions for your tax return are met.

If the custodial parent released his TIP or her claim to the exemption for

the child for any future year, you must attach a copy of this form or similar statement to your tax return

for each future year that you claim the exemption. Keep a copy for your records.

Note: If you are filing your return electronically, you must file Form 8332 with Form 8453, U.S. Individual Income Tax Transmittal for an IRS

Paperwork Reduction Act Notice. We ask for the information on this form to carry out the Internal Revenue laws of the United States. You are required to give us the information. We need it to ensure that you are complying with these laws and to allow us to figure and collect the right amount of tax.

You aren’t required to provide the information requested on a form that is subject to the Paperwork Reduction Act unless the form displays a valid OMB control number. Books or records relating to a form or its instructions must be retained as long as their contents may become material in the administration of any Internal Revenue law. Generally, tax returns and return information are confidential, as required by Internal Revenue Code section 6103.

The average time and expenses required to complete and file this form will vary depending on individual circumstances. For the estimated averages, see the instructions for your income tax return.

If you have suggestions for making this form simpler, we would be happy to hear from you. See the instructions for your income tax return.

Document Specifics

| Fact | Description |

|---|---|

| Purpose of Form 8332 | This form is used by custodial parents to release their claim to a child's exemption for tax purposes to the non-custodial parent. |

| Yearly Requirement | The custodial parent must file Form 8332 for each tax year they wish to release their exemption claim. |

| Revocation Process | Custodial parents can revoke a previously granted exemption by providing written notice to the non-custodial parent and filing the revocation with their tax return. |

| IRS Acceptance | The IRS requires the non-custodial parent to attach Form 8332 or a similar statement to their return to claim the child's exemption based on the release. |

| Governing Law | Federal tax law governs Form 8332 and its requirements; there are no state-specific variations. |

Guide to Writing IRS 8332

Filling out IRS Form 8332 can seem daunting at first, but it's a straightforward process once you understand the steps involved. This form is crucial for divorced or separated parents who are making decisions about who will claim a child as a dependent for tax purposes. By completing this form, one parent can transfer the tax dependency of a child to the other parent, allowing them the eligibility to claim certain tax benefits. Here's how to fill out the form without feeling overwhelmed.

- Start by downloading the latest version of IRS Form 8332 from the official IRS website to ensure you have the most up-to-date form.

- Read the instructions carefully before you begin filling out the form. These instructions are often updated, and understanding them fully will help you avoid common mistakes.

- In Part I of the form, enter the name of the child or children for whom you're releasing the claim. Make sure to spell their names correctly as they appear on social security cards.

- Fill in your full name and social security number in the spaces provided. This identifies you as the custodial parent releasing the claim.

- In the “Year or years for which you're revoking the release of claim” section, specify the tax year(s) for which this form will apply. If you're making this decision for a single year, list that year. If you’re making an indefinite agreement, specify the range of years.

- If applicable, complete Part II to revoke a previous release of claim. You must have already filed a Form 8332, or a similar statement, to use this section. Provide the year or years the revocation applies to.

- Sign and date the form to validate it. The form will not be considered valid without your signature and the date. This also applies to Part II if you're revoking a previous agreement.

- Provide the noncustodial parent with a copy of the completed form. They will need to attach it to their tax return to benefit from the exemption for the specified tax year(s).

- Keep a copy of the form for your records. It's always a good idea to have your own copy for reference in case any disputes or questions arise in the future.

By following these steps, you can successfully complete IRS Form 8332, ensuring that both parents are clear about who will claim the tax benefits related to their child or children. This clarity can help avoid confusion when it's time to file taxes, making the process smoother for everyone involved.

Understanding IRS 8332

-

What is the IRS Form 8332 and when should it be used?

IRS Form 8332, titled "Release/Revocation of Release of Claim to Exemption for Child by Custodial Parent", is a document specifically designed for divorced or separated parents. It should be used when the custodial parent is granting the non-custodial parent the right to claim the child as a dependent for tax purposes. This form is necessary because, according to the IRS rules, only the custodial parent would typically be eligible to claim the child. However, if the custodial parent agrees, they can release this claim, allowing the non-custodial parent to claim the exemption instead.

-

How does one fill out Form 8332?

Form 8332 is straightforward to fill out. It requires the name of the custodial parent, the name(s) of the child or children for whom the exemptions are being released, and the tax year(s) for which the release is applicable. If the release is for more than one year, specifying the years is necessary. Additionally, the form must be signed and dated by the custodial parent. There's also a section for revoking a previous release, which must state the years for which the revocation applies, and similarly, it must be signed and dated.

-

Can Form 8332 be used retroactively?

Form 8332 can be used retroactively under certain conditions. If it is filled out and filed with a tax return in a subsequent year, the non-custodial parent may amend past returns to claim the dependent exemption if they meet all other IRS requirements. However, this action is subject to statutes of limitations for tax refunds, generally within three years from the date the original return was filed or two years from the date the tax was paid, whichever is later.

-

Is it possible to revoke the release of claim to exemption once it's been given?

Yes, the custodial parent has the right to revoke the release of claim. This revocation must be done on Form 8332 or a similar statement. The revocation will be effective starting the next tax year after the year in which the custodial parent provides or makes reasonable efforts to provide the non-custodial parent with the written revocation. Just like the original release, the revocation must be attached to the tax return for each year the exemption is claimed or revoked by the non-custodial parent.

-

What happens if both parents accidentally claim the child in the same tax year?

If both parents claim the same child as a dependent for the same tax year, the IRS will apply tie-breaker rules to determine who gets the exemption. Typically, the child is treated as the qualifying child of the custodial parent unless Form 8332 releases the exemption to the non-custodial parent. If there's a dispute, the IRS may require additional documentation to determine the child's proper exemption.

-

How should the non-custodial parent submit Form 8332 to the IRS?

The non-custodial parent does not directly submit Form 8332 to the IRS initially. Instead, they should attach it to their tax return when they file it. This serves as proof that they have permission from the custodial parent to claim the child as a dependent. Keeping a copy of Form 8332 for their records is also advisable in case the IRS requests it in the future.

-

Are there any special considerations for electronically filed tax returns?

For electronically filed tax returns, the non-custodial parent cannot physically attach Form 8332. Instead, they should retain a copy of the form and be prepared to provide it if the IRS requests it for verification purposes. Make sure to follow all electronic filing guidelines and have all necessary documentation, including Form 8332, on hand to ensure compliance with IRS requirements.

Common mistakes

Filling out IRS Form 8332, which involves the release or revocation of the claim to a child's exemption by the custodial parent, is an important process for many families. However, mistakes can occur which may lead to delays or complications. Here are several common mistakes people make:

Not providing complete information on all required lines. Each section should be carefully reviewed to ensure no fields are left blank unless indicated.

Using the wrong tax year. It's crucial to indicate the correct tax year(s) for which the claim is being released or revoked. Confusion often arises when the form is filled out close to the new year.

Failure to sign and date the form. An unsigned form is invalid and will not be accepted by the IRS, delaying the process.

Not understanding the difference between revoking and releasing a claim. These actions have distinct tax implications, and misunderstanding could lead to unintended financial consequences.

Incorrectly identifying the custodial parent. The custodial parent is the one with whom the child spent the most nights during the year, a detail that's crucial for this form.

Not updating the form when circumstances change. If custody arrangements or decisions regarding claims to exemptions change, a new form needs to be submitted to reflect these changes.

Sending the form to the IRS instead of attaching it to the tax return or providing it to the non-custodial parent. The form should be used as part of the tax filing process or exchanged between parents, as appropriate.

Avoiding these mistakes will assist in ensuring the process is completed smoothly and correctly. It is always recommended to seek guidance if there are any uncertainties when filling out this form.

Documents used along the form

When dealing with the intricacies of taxes, especially concerning family situations like custody agreements, the IRS Form 8332 becomes a crucial document. This form is specifically used by custodial parents to release their claim to a child's exemption, allowing the non-custodial parent to claim the child as a dependent for tax purposes. However, completing your tax responsibilities doesn't stop with the submission of Form 8332. There are several other forms and documents often used alongside it to ensure compliance and maximize benefits under the tax code. Let's explore some of these essential documents.

- Form 1040 - The U.S. Individual Income Tax Return is perhaps the most well-known tax form. It's the starting point for most taxpayers, serving as the primary form used to file personal income taxes, onto which the information from Form 8332 will feed.

- Form 1040-SR - A version of Form 1040 designed for seniors, offering a more readable font size and a chart to help calculate the standard deduction for taxpayers who are 65 years old or older.

- Schedule EIC (Form 1040) - If the non-custodial parent can claim the child as a dependent, they might also qualify for the Earned Income Credit (EIC). Schedule EIC is necessary to calculate and claim this credit.

- Schedule 8812 (Form 1040) - This form is crucial for those looking to claim the Child Tax Credit in addition to the dependent exemption facilitated by Form 8332. It helps determine the credit amount you're eligible for.

- W-2 Forms - Wages and tax statement forms from employers are essential for accurately reporting income on Form 1040. They're fundamental to the tax filing process and necessary for both custodial and non-custodial parents.

- Form 1098-T - If claiming an education credit for a dependent, this form, provided by educational institutions, summarizes received tuition payments and scholarships, essential for Form 8863.

- Form 8863 - Education Credits (American Opportunity and Lifetime Learning Credits) form is required when claiming education credits for qualifying expenses paid for a dependent student.

- Child Custody Agreement - While not a tax form, the child custody agreement document is critical. It outlines the details of custody arrangements and can serve as supporting documentation for the IRS in situations involving dependents.

- Form 2120 - For cases where multiple support agreements are in place, this form allows several persons to provide over half of a person's support collectively, detailing the declaration of support.

- State Tax Forms - Each state may have its own tax forms that need to be completed in addition to federal forms. These forms can vary widely depending on the state and may also be affected by custody and dependency exemptions.

Each of these documents plays a specific role in the broader context of tax preparation, especially for those navigating the implications of custody and child dependency. Understanding how they interact with Form 8332 and with each other is key to navigating the tax season successfully and ensuring that all tax advantages and obligations are duly met. As always, consulting with a tax professional can provide tailored advice to individual circumstances, ensuring compliance and optimization of tax benefits.

Similar forms

The IRS 8332 form, which is used by custodial parents to release their claim to a child's exemption for tax purposes, shares similarities with the W-4 form. The W-4 form allows employees to indicate their tax situations to their employers, such as how many dependents they have, which directly affects the amount of tax withheld from their paychecks. Both forms directly impact the tax obligations of individuals by allowing them to declare dependents or exemptions, thus influencing their take-home pay or tax liability.

Another document resembling the IRS 8332 form is the 1040EZ form, which was a simplified version of the IRS 1040 form used for filing individual income tax returns. Like the 8332, the 1040EZ included considerations for dependents and tax credits, playing a crucial role in determining an individual's tax refund or amount owed. Although the 1040EZ has been phased out and replaced by a redesigned 1040 form, both it and the 8332 form cater to taxpayers looking to accurately report their dependency status for tax purposes.

The FAFSA (Free Application for Federal Student Aid) application is another document bearing resemblance to the IRS 8332 in terms of its relevance to dependency status. The FAFSA requires students to report whether they are dependents of their parents, which can affect their eligibility for certain types of financial aid. This parallels the 8332 form's role in establishing the child's dependency for tax benefits, demonstrating how both documents influence financial support allocation based on dependency status.

The Child Support Order closely aligns with the IRS 8332 form as well. This legal document outlines a non-custodial parent's obligation to provide financial support for their child or children. Similar to how the 8332 form can shape the tax benefits related to dependency exemptions, the Child Support Order determines financial responsibilities based on the child's living arrangements and the parents' custody agreement. Both documents are pivotal in defining financial responsibilities towards children post-divorce or separation.

Finally, the Medical Consent Form for minors shares functionalities with the IRS 8332, albeit in a non-financial realm. This form allows a parent or guardian to authorize another adult to consent to medical treatment for a minor, essentially transferring certain rights regarding the child's care. Similar to the IRS 8332, which transfers the tax exemption right from one parent to another, the Medical Consent Form involves a legal transfer of rights for the well-being of a child, emphasizing the importance of documentation in managing and safeguarding children's rights and benefits.

Dos and Don'ts

The IRS Form 8332 is crucial for noncustodial parents who wish to claim a dependent for tax purposes, as it allows the custodial parent to release the claim to the exemption. Mistakes on this form can lead to disputes or audits. Below are guidelines to follow when completing this form:

Do:Read the instructions provided by the IRS for Form 8332 carefully to ensure you understand the criteria and process.

Ensure that the custodial parent signs the form. Without their signature, the IRS will not honor the form.

Fill out the form accurately, providing all necessary details such as the name and Social Security Number (SSN) of the child for whom you're claiming the exemption.

Attach Form 8332 to your tax return if you are the noncustodial parent claiming the child. This step is vital for the IRS to process your claim correctly.

Keep a copy of the completed and signed Form 8332 for your records. It's essential to have proof of the custodial parent's consent in case of any disputes or audits.

Verify that the form covers the correct tax year(s). The IRS will not apply the exemption to the years not specified on the form.

Do not leave any fields blank. Incomplete forms may be rejected or cause delays in processing your tax return.

Avoid guessing or estimating information. Make sure all data, especially the SSN and the year for which you're claiming the exemption, are accurate.

Do not use Form 8332 for years not intended by the custodial parent. This can lead to legal complications and potential penalties.

Do not assume verbal agreements are sufficient. The IRS requires the signed form to change the custodial exemption.

Do not forget to update Form 8332 if there are changes to custody agreements that affect tax years beyond the original agreement. Always file a new form to reflect these changes.

Never forge signatures or alter the form in any fraudulent way. Doing so can result in severe legal consequences, including fines and imprisonment.

Misconceptions

The IRS 8332 form, commonly associated with the handling of tax benefits related to children in cases of divorce or separation, is often misunderstood. Here, we aim to clarify some of these misconceptions to provide a clearer picture of its role and how it affects tax filing.

Only the custodial parent can claim a child as a dependent: One of the most common misconceptions is that the IRS 8332 form exclusively benefits the custodial parent. In reality, this form allows the custodial parent to release the right to claim a child as a dependent to the non-custodial parent. This enables the non-custodial parent to claim the child for tax purposes, given that certain conditions are met and the form is properly filed.

Form 8332 is needed for every tax year: Many believe that you need to file a new Form 8332 for every tax year in which the non-custodial parent wishes to claim the dependency exemption. However, the truth is that the form can be filed for a single year or for multiple years, depending on the agreement between the parents. A single submission can cover future tax years until the conditions change or the agreement ends.

The form grants full custody rights: A significant misunderstanding is the belief that by signing Form 8332, the custodial parent is surrendering custody of the child. This form solely relates to tax exemptions and does not affect the custody arrangement established by a court order.

It's irreversible: Some people think once Form 8332 is filed, it cannot be undone. In reality, the custodial parent can revoke the agreement for any tax year not yet filed, by providing written notice to the non-custodial parent. This revocation must also be submitted to the IRS for the affected tax years.

Submission guarantees the non-custodial parent will get the exemption: Filing Form 8332 does not automatically ensure that the non-custodial parent will benefit from the exemption. The non-custodial parent must still meet all other IRS requirements to claim the child as a dependent.

It allows the non-custodial parent to claim all tax benefits: Another misconception is that by obtaining the signed Form 8332, the non-custodial parent can claim all child-related tax benefits. In fact, certain benefits, such as the Earned Income Tax Credit (EITC) and Head of Household filing status, still may not be available to the non-custodial parent even if they obtain the right to claim the exemption for the child.

The form can be submitted electronically: As of the last update, the IRS requires Form 8332 to be attached to the non-custodial parent's tax return if filed by mail. If e-filing, the non-custodial parent must keep the form for their records and be prepared to provide it if requested by the IRS. Thus, the form itself is not submitted electronically alongside the tax return.

Child support payments are a precondition: Some people mistakenly believe that the non-custodial parent must be up-to-date on child support payments to file Form 8332. Although maintaining child support obligations is crucial, the IRS does not use Form 8332 to enforce child support payment compliance or to condition the claiming of the dependency exemption on such payments.

Understanding the accurate information regarding Form 8332 can aid parents in making informed decisions about their tax filings and the implications of involving the IRS in their custody arrangements. Always consult a tax professional or the IRS for the most current guidance and how it applies to your situation.

Key takeaways

The Internal Revenue Service (IRS) Form 8332 is crucial for divorced or separated parents dealing with the tax implications of claiming a child as a dependent. It serves as a declaration by the custodial parent to release the child tax credit and exemption for the dependent child to the non-custodial parent. To ensure clarity and compliance with tax laws, here are key takeaways about filling out and utilizing Form 8332 effectively.

- Required for Release: The custodial parent must complete Form 8332 to release the claim to the child's exemption. Without it, the non-custodial parent cannot claim the child tax credit on their tax return, even if stipulated in a divorce decree or separation agreement.

- Validity: Once signed, Form 8332 is valid for the tax year specified on the form. It can include future years if indicated, but clarity in designation is necessary to avoid disputes or misunderstandings with the IRS.

- Revocation: Revocation of the release of claim is possible by the custodial parent. It must be done for a specific tax year and cannot take effect for any year the non-custodial parent has already claimed the dependent. Proper procedure involves notifying the non-custodial parent of the revocation.

- Attach to Tax Return: The non-custodial parent must attach the completed and signed Form 8332 to their tax return to claim the child as a dependent.

- Electronic Filing Awareness: When filing electronically, one cannot attach the form directly to the tax return. The non-custodial parent should keep a completed copy available if requested by the IRS.

- No Temporary Releases: Form 8332 cannot be used for temporary releases of claim. It is designed for annual or specified multi-year claims.

- Impact on State Taxes: While Form 8332 is for federal tax purposes, it's important to consider how releasing or claiming a dependent affects state taxes, as regulations can vary.

- Limited to Child Tax Credit: The use of Form 8332 is specific to the child tax credit and does not include other tax benefits such as earned income tax credit, child and dependent care expenses, or head of household filing status, which may be available to the custodial parent.

Understanding and properly utilizing Form 8332 ensures that both parents navigate post-separation or divorce scenarios with minimal tax complications. Whether you are the custodial or non-custodial parent, it is advisable to consult with a tax professional to leverage tax benefits appropriately and comply with IRS rules and regulations.

Popular PDF Documents

IRS W-3 - The W-3 form is key to maintaining compliance with federal tax laws, safeguarding businesses against potential payroll reporting issues.

New Idr Plan - Borrowers must choose a different repayment plan for loans ineligible for income-based plans, guaranteeing they stay on track with repayments.