Get IRS 8283 Form

When individuals or businesses decide to donate property valued at more than $500 to a charitable organization, navigating the tax implications becomes an essential part of the process. One key tool in this journey is the IRS 8283 form, a document specifically designed to report noncash charitable contributions. This form not only ensures compliance with IRS regulations but also enables donors to potentially benefit from tax deductions associated with their generosity. The form is divided into sections, each tailored to capture details about different types of donations, from simple apparel to more complex assets like stocks or real estate. Filling out the form accurately requires a diligent assessment of the donated property's value, a task that might also involve obtaining appraisals in the case of high-value donations. Furthermore, the form acts as a bridge between the charitable organization and the IRS, providing a transparent record of the donation. Understanding the nuances and mandates of the IRS 8283 form is therefore crucial for anyone looking to make a significant charitable contribution without encountering unnecessary hurdles in their tax journey.

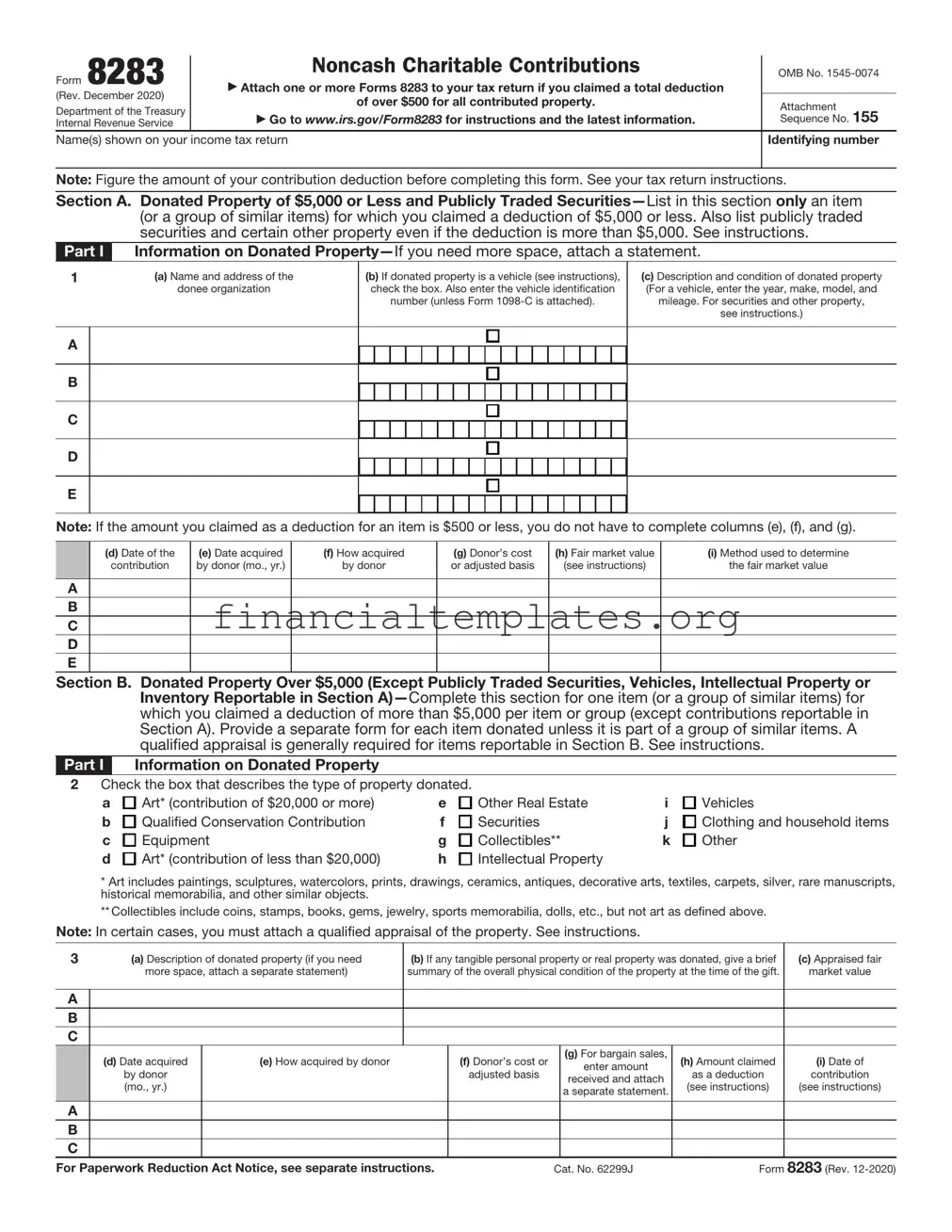

IRS 8283 Example

Form 8283 |

|

Noncash Charitable Contributions |

|

OMB No. |

|

|

|||

|

▶ Attach one or more Forms 8283 to your tax return if you claimed a total deduction |

|

|

|

(Rev. December 2021) |

|

of over $500 for all contributed property. |

|

Attachment |

Department of the Treasury |

|

|

||

|

|

|

||

|

▶ Go to www.irs.gov/Form8283 for instructions and the latest information. |

|

Sequence No. 155 |

|

Internal Revenue Service |

|

|

||

Name(s) shown on your income tax return |

|

Identifying number |

||

|

|

|

|

|

Note: Figure the amount of your contribution deduction before completing this form. See your tax return instructions.

Section A. Donated Property of $5,000 or Less and Publicly Traded

Part I |

Information on Donated |

|||||||||||||||||||

1 |

|

(a) Name and address of the |

(b) If donated property is a vehicle (see instructions), |

(c) Description and condition of donated property |

||||||||||||||||

|

|

donee organization |

check the box. Also enter the vehicle identification |

(For a vehicle, enter the year, make, model, and |

||||||||||||||||

|

|

|

|

|

number (unless Form |

mileage. For securities and other property, |

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

see instructions.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

A |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

B |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

C |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

D |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

E |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Note: If the amount you claimed as a deduction for an item is $500 or less, you do not have to complete columns (e), (f), and (g).

|

(d) Date of the |

(e) Date acquired |

(f) How acquired |

(g) Donor’s cost |

(h) Fair market value |

(i) Method used to determine |

|

contribution |

by donor (mo., yr.) |

by donor |

or adjusted basis |

(see instructions) |

the fair market value |

|

|

|

|

|

|

|

A |

|

|

|

|

|

|

B |

|

|

|

|

|

|

C |

|

|

|

|

|

|

D |

|

|

|

|

|

|

E |

|

|

|

|

|

|

Section B. Donated Property Over $5,000 (Except Publicly Traded Securities, Vehicles, Intellectual Property or Inventory Reportable in Section

Part I Information on Donated Property

2Check the box that describes the type of property donated.

a |

Art* (contribution of $20,000 or more) |

e |

Other Real Estate |

i |

Vehicles |

b |

Qualified Conservation Contribution |

f |

Securities |

j |

Clothing and household items |

c |

Equipment |

g |

Collectibles** |

k |

Other |

d |

Art* (contribution of less than $20,000) |

h |

Intellectual Property |

|

|

*Art includes paintings, sculptures, watercolors, prints, drawings, ceramics, antiques, decorative arts, textiles, carpets, silver, rare manuscripts, historical memorabilia, and other similar objects.

**Collectibles include coins, stamps, books, gems, jewelry, sports memorabilia, dolls, etc., but not art as defined above.

Note: In certain cases, you must attach a qualified appraisal of the property. See instructions.

3 |

(a) Description of donated property (if you need |

(b) If any tangible personal property or real property was donated, give a brief |

(c) Appraised fair |

|||||

|

more space, attach a separate statement) |

summary of the overall physical condition of the property at the time of the gift. |

market value |

|||||

|

|

|

|

|

|

|

|

|

A |

|

|

|

|

|

|

|

|

B |

|

|

|

|

|

|

|

|

C |

|

|

|

|

|

|

|

|

|

(d) Date acquired |

(e) How acquired by donor |

|

(f) Donor’s cost or |

|

(g) For bargain sales, |

(h) Amount claimed |

(i) Date of |

|

by donor |

|

|

adjusted basis |

|

enter amount |

as a deduction |

contribution |

|

(mo., yr.) |

|

|

|

|

received |

(see instructions) |

(see instructions) |

|

|

|

|

|

|

|

|

|

A |

|

|

|

|

|

|

|

|

B |

|

|

|

|

|

|

|

|

C |

|

|

|

|

|

|

|

|

For Paperwork Reduction Act Notice, see separate instructions. |

Cat. No. 62299J |

Form |

8283 (Rev. |

|||||

Form 8283 (Rev. |

Page 2 |

Name(s) shown on your income tax return |

Identifying number |

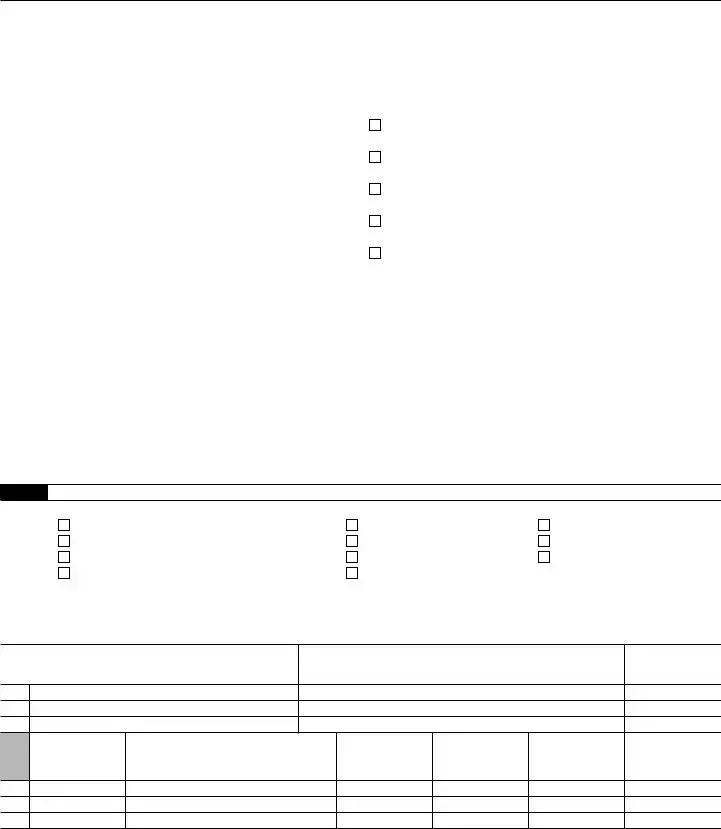

Part II Partial Interests and Restricted Use Property (Other Than Qualified Conservation Contributions)— Complete lines 4a through 4e if you gave less than an entire interest in a property listed in Section B, Part I. Complete lines 5a through 5c if conditions were placed on a contribution listed in Section B, Part I; also attach the required statement. See instructions.

4a Enter the letter from Section B, Part I that identifies the property for which you gave less than an entire interest ▶ If Section B, Part II applies to more than one property, attach a separate statement.

b Total amount claimed as a deduction for the property listed in Section B, Part I: (1) |

For this tax year . . ▶ |

(2) |

For any prior tax years ▶ |

cName and address of each organization to which any such contribution was made in a prior year (complete only if different from the donee organization in Section B, Part V, below):

Name of charitable organization (donee)

Address (number, street, and room or suite no.) |

City or town, state, and ZIP code |

|

|

dFor tangible property, enter the place where the property is located or kept ▶

eName of any person, other than the donee organization, having actual possession of the property ▶

Yes No

5a Is there a restriction, either temporary or permanent, on the donee’s right to use or dispose of the donated property?

bDid you give to anyone (other than the donee organization or another organization participating with the donee

organization in cooperative fundraising) the right to the income from the donated property or to the possession of the property, including the right to vote donated securities, to acquire the property by purchase or otherwise, or to designate the person having such income, possession, or right to acquire? . . . . . . . . . . . . .

cIs there a restriction limiting the donated property for a particular use? . . . . . . . . . . . . . .

Part III Taxpayer (Donor)

I declare that the following item(s) included in Section B, Part I above has to the best of my knowledge and belief an appraised value of not more than $500 (per item). Enter identifying letter from Section B, Part I and describe the specific item. See instructions.

▶

Signature of |

|

|

|

taxpayer (donor) ▶ |

Date ▶ |

||

Part IV |

|

Declaration of Appraiser |

|

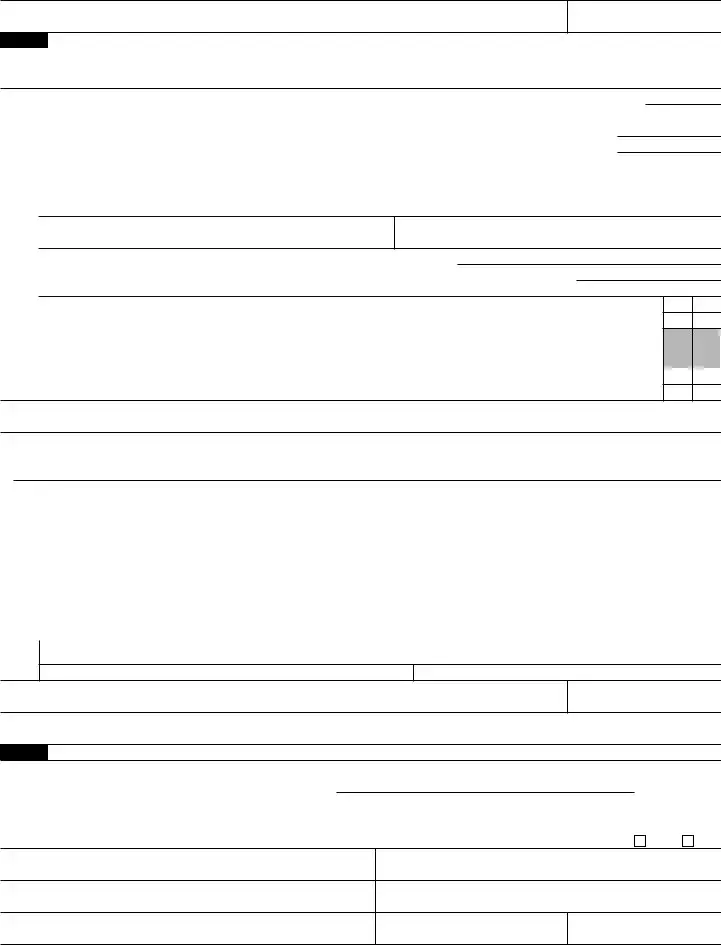

I declare that I am not the donor, the donee, a party to the transaction in which the donor acquired the property, employed by, or related to any of the foregoing persons, or married to any person who is related to any of the foregoing persons. And, if regularly used by the donor, donee, or party to the transaction, I performed the majority of my appraisals during my tax year for other persons.

Also, I declare that I perform appraisals on a regular basis; and that because of my qualifications as described in the appraisal, I am qualified to make appraisals of the type of property being valued. I certify that the appraisal fees were not based on a percentage of the appraised property value. Furthermore, I understand that a false or fraudulent overstatement of the property value as described in the qualified appraisal or this Form 8283 may subject me to the penalty under section 6701(a) (aiding and abetting the understatement of tax liability). I understand that my appraisal will be used in connection with a return or claim for refund. I also understand that, if there is a substantial or gross valuation misstatement of the value of the property claimed on the return or claim for refund that is based on my appraisal, I may be subject to a penalty under section 6695A of the Internal Revenue Code, as well as other applicable penalties. I affirm that I have not been at any time in the

Sign |

Appraiser signature ▶ |

|

Date ▶ |

Here |

|

||

Appraiser name ▶ |

Title ▶ |

||

Business address (including room or suite no.) |

|

Identifying number |

|

|

|

|

|

City or town, state, and ZIP code

Part V Donee Acknowledgment

This charitable organization acknowledges that it is a qualified organization under section 170(c) and that it received the donated property as described in Section B, Part I, above on the following date ▶

Furthermore, this organization affirms that in the event it sells, exchanges, or otherwise disposes of the property described in Section B, Part I (or any portion thereof) within 3 years after the date of receipt, it will file Form 8282, Donee Information Return, with the IRS and give the donor a copy of that form. This acknowledgment does not represent agreement with the claimed fair market value.

Does the organization intend to use the property for an unrelated use? |

. . . . . . . . . . . |

. . . ▶ |

Yes |

No |

Name of charitable organization (donee) |

Employer identification number |

|

|

|

|

|

|

|

|

Address (number, street, and room or suite no.) |

City or town, state, and ZIP code |

|

|

|

|

|

|

|

|

Authorized signature |

Title |

Date |

|

|

Form 8283 (Rev.

Document Specifics

| Fact Name | Description |

|---|---|

| Purpose of Form 8283 | This form is utilized by individuals, partnerships, and corporations to report information about noncash charitable contributions. It serves as a way to inform the IRS of donations that exceed $500 in a given tax year. |

| Sections on Form 8283 | Form 8283 is divided into two sections. Section A is for items valued at $5,000 or less, and Section B is for items valued more than $5,000, requiring a qualified appraisal for each item. |

| Appraisal Requirements | For contributions reported in Section B, a qualified appraisal must be obtained for items with a claimed value of more than $5,000. This appraisal must be performed by a qualified appraiser no earlier than 60 days before the item was donated. |

| Governing Laws | The instructions and regulations surrounding Form 8283 are governed primarily by federal tax law, specifically the Internal Revenue Code (IRC). There are no state-specific laws for Form 8283 as it is a federal form filed with the IRS. |

Guide to Writing IRS 8283

Filling out the IRS 8283 form is a necessary step for anyone who has made a non-cash donation valued at more than $500 within the tax year. It's one of the ways to report the value of donated property. The process might seem a bit complicated at first, but with clear instructions, it can be completed accurately. After this form is submitted, the Internal Revenue Service (IRS) will use the provided information to understand the nature and value of the donations made. The next steps often involve further review or documentation requests, but the primary goal is to ensure all is in order for tax-related purposes.

To correctly fill out the IRS 8283 form, follow these steps:

- Gather all necessary documentation related to the non-cash donations. This could include receipts, appraisals, and other relevant information that will help to accurately fill out the form.

- Download the latest version of IRS Form 8283 from the IRS website to ensure that all the information reflects current laws and requirements.

- Begin with Section A if your donated property’s value does not exceed $5,000. Complete all required fields which will ask for detailed information about the donated items, including a description, the condition of the items, and how you acquired them.

- If the value of any single item or group of similar items exceeds $5,000, you will need to also complete Section B. This section requires a qualified appraisal for the donated property and may involve more detailed information about the item(s), including the appraiser’s details.

- Input your personal information as requested on the form. This will include your name, identification number (Social Security Number or Employer Identification Number), and a detailed list of the donated items.

- Review all the information provided for accuracy. Ensure that the dates, values, and descriptions match your documentation.

- Sign and date the form in the designated area. If you completed Section B, make sure the appraiser also signs and dates the form.

- Attach Form 8283 to your tax return. Remember, this form must be filed with your annual tax return for the year in which the donation was made.

After submitting Form 8283 with your tax return, it's crucial to keep copies of all documentation and the form itself for your records. The IRS may request additional information or documentation, so having everything organized and accessible will make responding to such inquiries much simpler. Accurate completion and submission of this form are key elements in reporting non-cash donations and ensuring compliance with tax regulations.

Understanding IRS 8283

What is the IRS Form 8283?

The IRS Form 8283 is a document that taxpayers must fill out to report non-cash charitable contributions. This form is necessary when the value of the donation exceeds $500. It helps the IRS track the amount of non-cash donations made by individuals and ensures that taxpayers receive the proper deduction for their charitable contributions.

Who needs to file the IRS Form 8283?

Any taxpayer who makes a non-cash contribution over $500 to a charitable organization during the tax year needs to file IRS Form 8283. It’s required regardless of whether you're an individual, a partnership, or a corporation.

What information is required on Form 8283?

Form 8283 requires detailed information about the donated items, including a description of the items or group of similar items, the condition of the items, how you acquired them (purchase, gift, inheritance, etc.), the date you acquired the items, the date you donated the items, the fair market value of the items, and how the value was determined. If the donation is above $5,000, a qualified appraisal must accompany the form.

What is the fair market value and how do I determine it?

Fair market value (FMV) is the price that the item would sell for on the open market between a willing buyer and willing seller, both having reasonable knowledge of all the relevant facts. To determine FMV, you might compare the sale prices of similar items in similar conditions, or you can obtain a professional appraisal. For items over $5,000, a qualified appraisal is required.

Do I need an appraisal for my donation?

If the value of any single item or group of similar items you donate is more than $5,000, you are required to obtain a qualified appraisal. The appraisal must be made no more than 60 days before the donation and must be received before the due date (including extensions) of the tax return on which you are first reporting the contribution.

What if I made multiple donations throughout the year?

If you make multiple non-cash charitable contributions throughout the year that exceed $500 each, you need to file a separate Form 8283 for each donation. However, if the donations are to the same organization, you can list them together as long as their total value exceeds $500.

How does filing Form 8283 affect my taxes?

Filing Form 8283 allows you to claim deductions for your non-cash charitable contributions on your tax return. The deductions can lower your taxable income, potentially reducing the amount of tax you owe. It's important to accurately report the value of donated items to avoid any discrepancies that could lead to an audit.

What happens if I don't file Form 8283 for my donations?

If you fail to file Form 8283 for non-cash contributions over $500, you may lose the opportunity to claim them as deductions on your tax return. This oversight can result in a higher tax bill. Additionally, if the omission is deemed negligent or fraudulent, there could be penalties.

Where can I find IRS Form 8283 and how do I submit it?

You can find IRS Form 8283 on the official IRS website. It can be downloaded and printed for completion. Once filled out, attach it to your federal income tax return and submit both documents to the IRS. Ensure you keep a copy for your records, along with any appraisals and donation acknowledgments from charitable organizations.

Common mistakes

The IRS 8283 form is used to report information about noncash charitable contributions. Properly completing this form is essential for individuals seeking to claim a deduction for their donated property. Common mistakes can lead to issues with the Internal Revenue Service (IRS), including audits, delays, and denials of deductions. Here are nine mistakes often made when filling out the form:

Failing to fill out the form for contributions over $500: Any noncash donation valued over $500 requires individuals to complete Form 8283. Neglecting to fill out and attach this form to their tax return is a common oversight.

Incorrect valuation of the donated property: It is crucial to accurately assess the fair market value of the donated item. Overestimating or underestimating this value can raise red flags with the IRS.

Not obtaining a qualified appraisal when necessary: For items valued over $5,000, a qualified appraisal must be obtained and attached to the form (excluding publicly traded securities). Many fail to comply with this requirement.

Omitting required details about the donated property: A comprehensive description of the donated item is crucial. This should include the condition of the item, as this significantly impacts its value.

Incomplete or incorrect donor information: Individuals often make errors in reporting their own details, such as name, address, or taxpayer identification number, leading to processing delays.

Not detailing the charitable organization correctly: It is necessary to provide accurate information about the recipient organization, including its name, address, and tax-exempt status.

Forgetting to sign and date the form: An unsigned form is considered incomplete by the IRS, which can invalidate the attempt to claim a deduction.

Misunderstanding the different sections of the form: The form has sections for different types of contributions and specific instructions on how to complete each. Misinterpretation of these sections can lead to incorrect filing.

Failing to attach the form to the tax return: Once completed, Form 8283 must be attached to the individual's tax return. Overlooking this step can result in the IRS not considering the donations for deduction.

By avoiding these mistakes, individuals can ensure that their charitable contributions are appropriately documented and accepted by the IRS, thereby maximizing their potential tax benefits while complying with federal tax laws.

Documents used along the form

When filing the IRS Form 8283 for noncash charitable contributions, individuals may need to supplement this form with additional documents to provide a full picture of the donation for tax deduction purposes. These documents support the information entered on the form, verify the value of the donated property, and ensure compliance with IRS regulations.

- Appraisal Summary: This summary is part of the Form 8283 for donations valued over $5,000 and is not publicly traded securities. It requires details about the appraiser and a summary of the appraised property, ensuring the donation's value is accurately reflected and substantiated.

- Acknowledgment Letter from the Charity: This letter is a receipt provided by the charity, acknowledging receipt of the donation. It confirms the date the donation was made and states if the donor received any goods or services in return, which is crucial for tax deduction eligibility.

- IRS Form 1098-C: This form is specific to donations of motor vehicles, boats, and airplanes valued over $500. The charity issues this form, detailing the donation and its use, sale, or intended improvements, which directly affects the deduction amount.

- Photographic Records: For tangible donations, photographs offer a visual record that supports the condition and quality of the donated item, complementing the appraiser’s written report.

- Donor's Record of Donation: This personal record kept by the donor details the item or property donated, its condition, and how the value was determined—a handy reference that supports the figures reported to the IRS.

- Bill of Sale: When a donated item had been purchased by the donor before being donated, this document proves the item's original purchase price, which can be useful for establishing a basis for valuation.

Collecting and preparing these documents alongside the IRS Form 8283 requires attention to detail but is necessary for accurately reporting noncash contributions. Each document serves to substantiate the donation's value, ensuring donors can rightfully claim their tax deductions and comply with IRS requirements. It is advisable to consult with a tax professional when dealing with complex donations or when in doubt about the required documentation.

Similar forms

The IRS 8283 form is a document used for reporting non-cash charitable contributions. A similar document in essence would be the IRS 1040 Schedule A form, which is used for itemizing deductions on a personal income tax return. Both forms serve the purpose of reducing taxable income through deductions; however, the 1040 Schedule A encompasses a broader range of deductions, including medical expenses, taxes paid, and interest deductions, in addition to charitable contributions, whereas the 8283 form is specifically focused on non-cash donations to charities.

Equally, the IRS 8282 form bears resemblance to the 8283, as it is used to report information when a charitable organization disposes of a charitable deduction property within three years after the donor contributed the property. The 8282 form completes the reporting circle by ensuring the IRS tracks the lifecycle of non-cash charitable contributions, providing accountability and preventing abuse of the tax benefit system. This form is the counterpoint to the 8283, focusing on the charity's responsibility after receiving donations.

The Form 1098-C is another document closely related to Form 8283 but from a different angle. This form is specifically used for documenting charitable contributions of motor vehicles, boats, and airplanes. The detailed information provided on a Form 1098-C, including the value of the donation and how the charity used the vehicle, is essential for donors to complete Form 8283 accurately when donating these specific types of property. Thus, while 1098-C focuses on a subset of non-cash donations, its use complements the 8283 by providing necessary details for tax deduction purposes.

Form 4562, Depreciation and Amortization, shares a connection with Form 8283 through the concept of asset valuation over time. While Form 8283 requires an appraisal for non-cash donations valued over a certain amount, Form 4562 deals with the depreciation or amortization of the donor's property over its useful life for business or income-producing purposes. Both forms address the value of property but from different perspectives: one from a charitable contribution standpoint and the other from an income-producing asset standpoint.

Lastly, the IRS W-9 form, Request for Taxpayer Identification Number and Certification, is indirectly related to the processing of Form 8283. Charitable organizations may require a donor to complete a W-9 to accurately report the charitable contribution on their own tax filings, particularly if they provide the donor with goods or services in exchange for the donation. Although the W-9's principal use is for verifying an individual's taxpayer identification number for various purposes, its role in facilitating accurate reporting for charitable contributions connects it to the overall process involving Form 8283.

Dos and Don'ts

When filling out the IRS 8283 form, there are several key actions you should take and avoid to ensure the process is completed correctly. Adhering to these guidelines can help prevent common mistakes and ensure your charitable contributions are properly documented for tax purposes.

Do:

- Review the instructions for Form 8283 provided by the IRS. This ensures you understand the form's requirements.

- Gather documentation for all non-cash contributions over $500 you plan to report. This includes receipts, appraisals, and other relevant records.

- Complete Section A for items valued at $500 to $5,000 or Section B for items valued more than $5,000, based on the value of your donation.

- For donations requiring appraisal (generally those over $5,000), ensure the appraiser has properly signed and completed the relevant section of the form.

- Attach any additional documents required, such as the appraisal report for high-value items.

- Keep a copy of the completed Form 8283 and all supporting documentation for your records.

Don't:

- Don't underestimate the value of your donated items without consulting an appraisal, especially for items over $5,000.

- Don't forget to have the recipient organization sign the form if a signature is required for donations valued over $500.

- Don't leave any fields blank. If a section does not apply, enter "N/A" (not applicable).

- Don't file Form 8283 separately from your tax return. It should be included with your Form 1040.

- Don't neglect to consult a tax professional if you are unsure about how to value your contributions or how to fill out the form correctly.

- Don't ignore IRS deadlines for filing, as this could result in penalties or the disallowance of your charitable deduction.

Misconceptions

The IRS 8283 form is often surrounded by misconceptions that can confuse taxpayers. Understanding what it is, when it's needed, and how to accurately complete it, is crucial for anyone making non-cash charitable contributions. Here are 10 common misconceptions about the IRS 8283 form and the truths behind them.

- Misconception 1: You need to file Form 8283 for any donation, no matter how small.

In truth, Form 8283 is only required for donations of non-cash property valued over $500. For donations below this threshold, keeping a record of the donation for your files is sufficient.

- Misconception 2: Only physical goods donations require Form 8283.

While it's commonly used for physical goods, Form 8283 is also required for other types of non-cash donations, such as stocks or vehicles, provided the value exceeds the $500 mark.

- Misconception 3: The value you assign to your donation on Form 8283 is final and not subject to review.

The IRS can review and challenge the value you claim for your donated property. It's important to ensure the value you declare is supported with a qualified appraisal if required, or based on fair market value for items not needing an appraisal.

- Misconception 4: Completing Form 8283 is complicated and requires professional help.

While having a professional can make the process smoother, many taxpayers can competently fill out Form 8283 by carefully following the instructions provided by the IRS, especially for less complex donations.

- Misconception 5: You must attach detailed information about the donated items.

Form 8283 requires a description of the donated item, but the level of detail needed varies. Generally, you do not need to attach a lengthy description or proof of the item's condition unless the IRS specifically requests it.

- Misconception 6: Only individuals can use Form 8283 for tax deductions.

Corporations, partnerships, and other entities making eligible non-cash contributions can also file Form 8283 as part of their tax returns to claim deductions.

- Misconception 7: You must know the exact purchase price of donated items.

While helpful, knowing the purchase price is not always necessary or required. What's important is the item's current fair market value, which may be different from its purchase price due to depreciation or appreciation.

- Misconception 8: All donations over $500 require a qualified appraisal attached to Form 8283.

A qualified appraisal is only necessary for donations valued over $5,000, except for publicly traded securities. Donations between $500 and $5,000 require Form 8283 but not necessarily an appraisal.

- Misconception 9: If you're audited, only the Form 8283 will be scrutinized.

In the event of an audit, the IRS may review all documentation related to your non-cash contributions, including but not limited to Form 8283. This can include receipts from the charity, photographs of the items, and appraisals.

- Misconception 10: Filing Form 8283 significantly increases your chance of an IRS audit.

While there's a widespread belief that claiming deductions increases audit risk, there's no specific evidence that filing Form 8283 alone significantly raises your audit chances. The key is to ensure all claimed deductions, including those requiring Form 8283, are well-documented and legitimate.

Understanding these misconceptions and the truths behind the IRS 8283 form can make the process of claiming non-cash charitable contributions easier and more straightforward. Always ensure you're following the latest IRS guidelines and consult with a tax professional if you have complex donations or unique situations.

Key takeaways

Filing the IRS Form 8283 is essential when you have made a non-cash donation valued over $500 to a qualified organization during the tax year. Understand that properly completing this form is crucial for accurately reporting such donations on your tax returns. Here are key points to keep in mind:

- Eligibility: You need to fill out Form 8283 if the total of your non-cash contributions over the year exceeds $500. This form is not for cash donations, regardless of the amount.

- Form Sections: Form 8283 is divided into two sections. Section A is for items valued at $5,000 or less, and Section B is for items valued over $5,000 or more. The type of information required varies between these two sections.

- Qualified Appraisal: For donations valued over $5,000 (except publicly traded securities), a qualified appraisal is necessary. You must also complete Section B of the form for these items.

- Information Required: You will need to describe each item or group of similar items donated, the condition of the items, how you obtained the items (purchase, gift, inheritance), the original cost, date of contribution, and method used to determine the fair market value.

- Signatures: For items or groups of items valued over $5,000, you need the signature of the qualified appraiser on the form. If you donate artwork valued at $20,000 or more, you must also include a photograph of the artwork.

- Keeping Copies: It’s important to keep a completed copy of Form 8283 for your records. Additionally, maintain any appraisals and photographs related to your donation, as the IRS may request these in an audit.

- Filing Deadline: Form 8283 should be filed with your yearly tax return. Make sure that it is filed by the tax filing deadline for the year in which the donation was made.

- Risks of Overvaluation: Be cautious not to overestimate the value of your donations. Deliberate overvaluation of donated items can result in penalties and audits. Always ensure the valuation is backed by a qualified appraisal when required.

Accurately completing and filing Form 8283 is integral to substantiating non-cash charitable contributions. It not only supports the claims made on your tax returns but also helps in keeping the taxation process transparent and fair. Always consult with a tax professional or an advisor if you find any part of the process confusing or if you have items of significant value to donate.

Popular PDF Documents

Mortgage Modification Agreement - Demystifies the steps non-borrowers need to take to have their income counted towards a home loan modification.

IRS 1040 - The form’s design considers various income levels and situations, making it applicable across a wide demographic range.