Get IRS 8282 Form

The landscape of charitable contributions and their subsequent reporting to the Internal Revenue Service (IRS) is often navigated with meticulous attention to detail by both donors and donee organizations. Within this framework, the IRS 8282 form plays a pivotal role, especially when it comes to the disposition or sale of a donated property valued at more than $500. This form serves as a critical reporting tool that organizations must use within a specified timeframe after the sale or disposal of any non-cash charitable donation, ensuring a transparent record-keeping process. Its main purpose is to inform the IRS about any significant variance in the valuation of the donated property from the time of donation to its eventual sale or disposal, which might affect tax liabilities for the donor. By accurately completing and submitting this form, charities and similar entities uphold the integrity of the philanthropic sector, fostering trust and compliance with federal tax regulations. The importance of this form transcends its paperwork, embodying the accountability and ethical considerations vital to the relationship between donors, donee organizations, and the overseeing regulatory bodies that monitor these transactions for the public good.

IRS 8282 Example

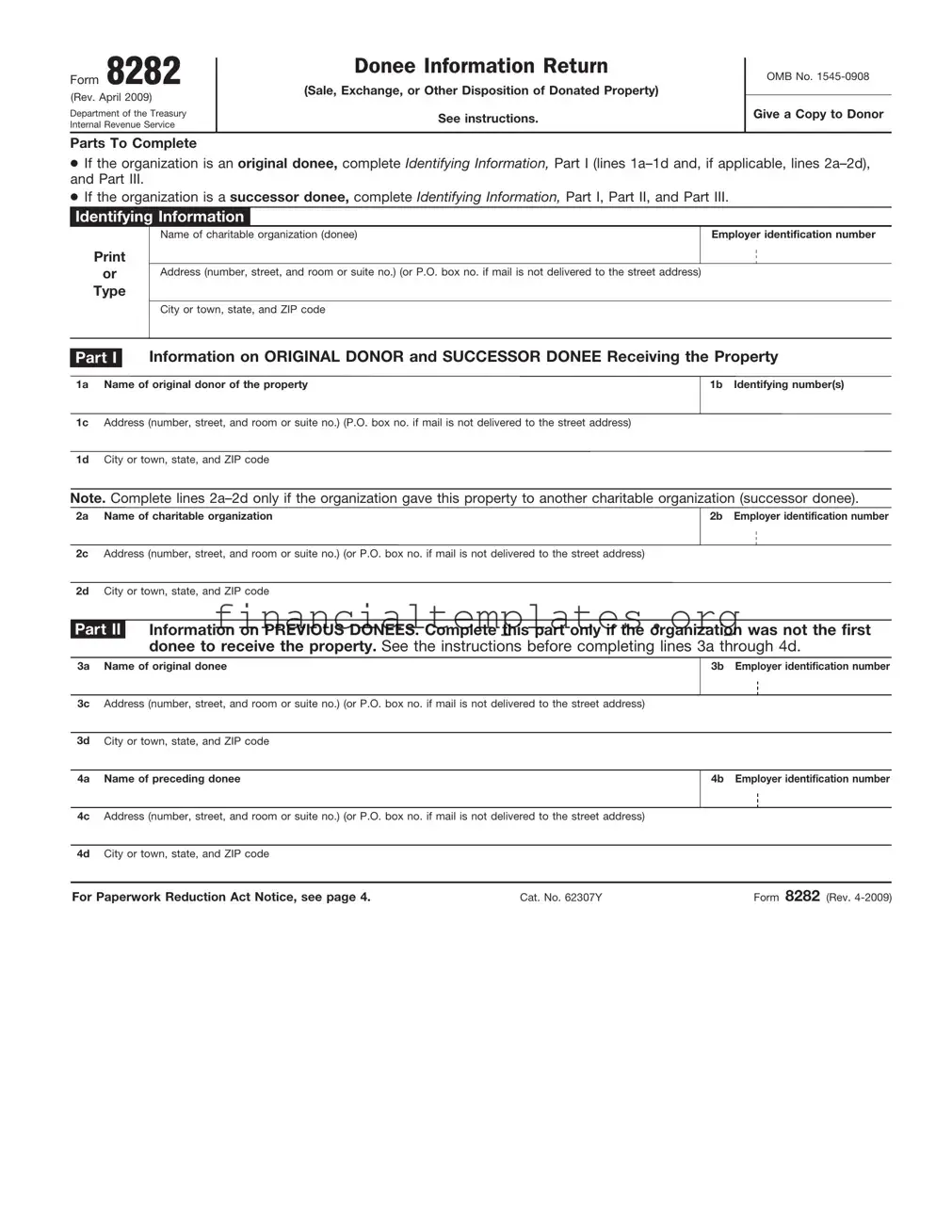

Form 8282

(Rev. October 2021)

Department of the Treasury

Internal Revenue Service

Donee Information Return

(Sale, Exchange, or Other Disposition of Donated Property)

▶Go to www.irs.gov/Form8282 for latest information.

OMB No.

Give a Copy to Donor

Parts To Complete

•If the organization is an original donee, complete Identifying Information, Part I (lines

•If the organization is a successor donee, complete Identifying Information, Part I, Part II, and Part III.

Identifying Information

or

Type

Name of charitable organization (donee) |

Employer identification number |

|

|

Address (number, street, and room or suite no.) (or P.O. box no. if mail is not delivered to the street address)

City or town, state, and ZIP code

Part I Information on ORIGINAL DONOR and SUCCESSOR DONEE Receiving the Property

1a Name of original donor of the property

1b Identifying number(s)

1c Address (number, street, and room or suite no.) (P.O. box no. if mail is not delivered to the street address)

1d City or town, state, and ZIP code

Note. Complete lines

2a Name of charitable organization

2b Employer identification number

2c Address (number, street, and room or suite no.) (or P.O. box no. if mail is not delivered to the street address)

2d City or town, state, and ZIP code

Part II Information on PREVIOUS DONEES. Complete this part only if the organization was not the first donee to receive the property. See the instructions before completing lines 3a through 4d.

3a Name of original donee

3b Employer identification number

3c Address (number, street, and room or suite no.) (or P.O. box no. if mail is not delivered to the street address)

3d City or town, state, and ZIP code

4a Name of preceding donee

4b Employer identification number

4c Address (number, street, and room or suite no.) (or P.O. box no. if mail is not delivered to the street address)

4d City or town, state, and ZIP code

For Paperwork Reduction Act Notice, see Instructions for Form 990. |

Cat. No. 62307Y |

Form 8282 (Rev. |

Form 8282 (Rev. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

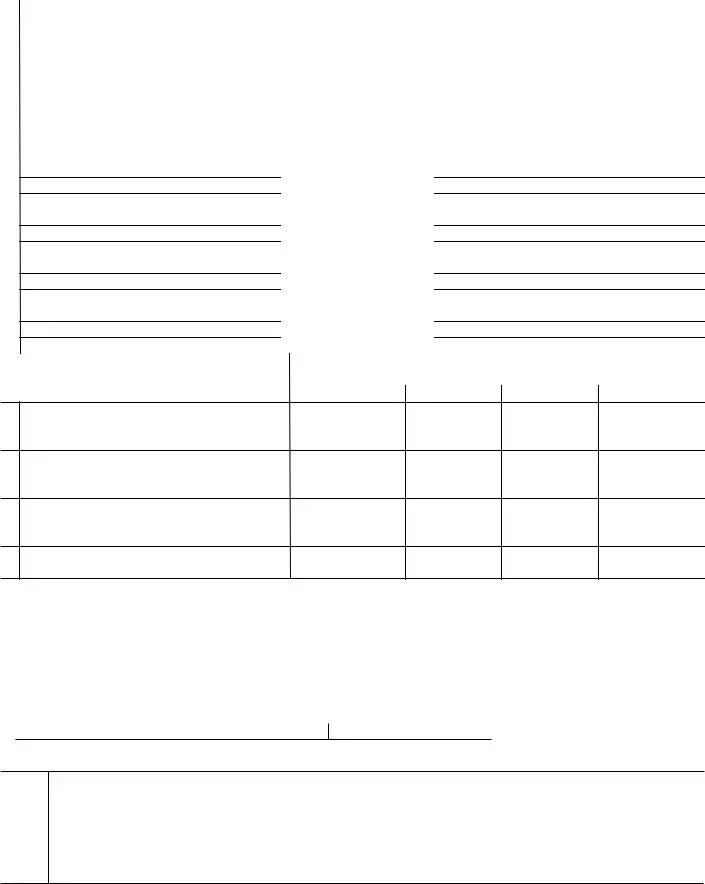

Page 2 |

||

Part III |

Information on DONATED PROPERTY |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

2. Did the |

3. Was the |

|

4. Information on use of property. |

|

|

|||||||||

|

|

|

|

disposition |

use related |

|

• If you answered “Yes” to question 3 and the property was |

|||||||||||

|

|

|

|

involve the |

to the |

|

|

|||||||||||

|

|

|

|

|

|

tangible personal property, describe how the |

organization’s |

|||||||||||

|

|

|

|

organization’s |

organization’s |

|

||||||||||||

|

|

|

|

|

use of the property furthered its exempt |

purpose or function. |

||||||||||||

|

1. Description of the donated property sold, |

|

entire interest |

exempt |

|

|

||||||||||||

|

|

|

|

Also complete Part IV below. |

|

|

||||||||||||

|

|

in the |

|

purpose or |

|

|

|

|||||||||||

|

exchanged, or otherwise disposed of and how the |

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

property? |

function? |

|

• If you answered “No” to question 3 and the property was |

|||||||||||||

|

organization used the property. (If you need more |

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|||||||||

|

space, attach a separate statement.) |

|

|

|

|

|

|

|

|

|

tangible personal property, describe the |

organization’s |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

intended use (if any) at the time of the contribution. Also |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

complete Part IV below, if the intended use at the time of the |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

contribution was |

|

related to the organization’s exempt |

||||

|

|

|

|

|

|

|

|

|

|

|

|

purpose or function and it became impossible or infeasible |

||||||

|

|

|

|

Yes |

|

No |

Yes |

|

No |

|

to implement. |

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

A |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

B |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

C |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

D |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

Donated Property |

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

A |

|

|

|

|

B |

|

|

|

C |

|

|

D |

||

5 |

Date the organization received the |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

donated property (MM/DD/YY) |

/ |

|

/ |

|

|

|

/ |

|

/ |

|

/ |

/ |

|

/ |

/ |

||

6 |

Date the original donee received the |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

property (MM/DD/YY) |

/ |

|

/ |

|

|

|

/ |

|

/ |

|

/ |

/ |

|

/ |

/ |

||

7 |

Date the property was sold, exchanged, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

or |

otherwise disposed of (MM/DD/YY) |

/ |

|

/ |

|

|

|

/ |

|

/ |

|

/ |

/ |

|

/ |

/ |

|

8 |

Amount received upon disposition |

$ |

|

|

|

|

$ |

|

|

|

|

$ |

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Part IV |

Certification |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

You must sign the certification below if any property described in Part III above is tangible personal property and:

•You answered “Yes” to question 3 above, or

•You answered “No” to question 3 above and the intended use of the property became impossible or infeasible to implement.

Under penalties of perjury and the penalty under section 6720B, I certify that either: (1) the use of the property that meets the above requirements, and is described above in Part III, was substantial and related to the donee organization’s exempt purpose or function; or (2) the donee organization intended to use the property for its exempt purpose or function, but the intended use has become impossible or infeasible to implement.

▶Signature of officer

|

▶ |

|

Title |

Date |

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my knowledge and belief, it is true, correct, and complete.

Sign |

|

|

|

|

Here ▶ |

|

|

▶ |

|

Signature of officer |

Title |

Date |

||

|

|

|

|

|

|

Type or print name |

|

|

|

Form 8282 (Rev.

Form 8282 (Rev. |

Page 3 |

General Instructions

Section references are to the Internal Revenue Code.

Future developments. For the latest information about developments related to Form 8282 and its instructions, such as legislation enacted after they were published, go to www.irs.gov/Form8282.

Purpose of Form

Donee organizations use Form 8282 to report information to the IRS and donors about dispositions of certain charitable deduction property made within 3 years after the donor contributed the property.

Definitions

|

For Form 8282 and these |

▲ instructions, the term “donee” |

|

! |

includes all donees, unless |

CAUTION |

specific reference is made to |

“original” or “successor” donees.

Original donee. The first donee to or for which the donor gave the property. The original donee is required to sign Form 8283, Noncash Charitable Contributions, Section B. Donated Property Over $5,000 (Except Certain Publicly Traded Securities), presented by the donor for charitable deduction property.

Successor donee. Any donee of property other than the original donee.

Charitable deduction property. Any donated property (other than money and publicly traded securities) if the claimed value exceeds $5,000 per item or group of similar items donated by the donor to one or more donee organizations. This is the property listed in Section B on Form 8283.

Who Must File

Original and successor donee organizations must file Form 8282 if they sell, exchange, consume, or otherwise dispose of (with or without consideration) charitable deduction property (or any portion) within 3 years after the date the original donee received the property. See Charitable deduction property above.

If the organization sold, exchanged, or otherwise disposed of motor vehicles, airplanes, or boats, see Pub. 526, Charitable Contributions.

Exceptions. There are two situations where Form 8282 does not have to be filed.

1.Items valued at $500 or less. The organization does not have to file Form 8282 if, at the time the original donee signed Section B of Form 8283, the donor had signed a statement on Form 8283 that the appraised value of the specific item was not more than $500. If Form 8283 contains more than one item, this exception applies only to those items that are clearly identified as having a value of $500 or less. However, for purposes of the donor’s determination of whether the appraised value of the item exceeds $500, all shares of nonpublicly traded stock, or items that form a set, are considered one item. For example, a collection of books written by the same author, components of a stereo system, or six place settings of a pattern of silverware are considered one item.

2.Items consumed or distributed for charitable purpose. The organization does not have to file Form 8282 if an item is consumed or distributed, without consideration, in fulfilling your purpose or function as a

When To File

If the organization disposes of charitable deduction property within 3 years of the date the original donee received it and the organization does not meet exception 1 or 2 above, the organization must file Form 8282 within 125 days after the date of disposition.

Exception. If the organization did not file because it had no reason to believe the substantiation requirements applied to the donor, but the organization later becomes aware that the substantiation requirements did apply, the organization must file Form 8282 within 60 days after the date it becomes aware it was liable. For example, this exception would apply where Section B of Form 8283 is furnished to a successor donee after the date that donee disposes of the charitable deduction property.

Missing information. If Form 8282 is filed by the due date, enter the organization’s name, address, and employer identification number (EIN) and complete at least Part III, columns 1, 2, 3, and 4; and Part IV. The organization does not have to complete the remaining items if the information is not available. For example, the organization may not have the information necessary to complete all entries if the donor did not make Section B of Form 8283 available.

Where To File

Send Form 8282 to the Department of Treasury, Internal Revenue Service Center, Ogden, UT

Other Requirements

Information the organization must give a successor donee. If the property is transferred to another charitable organization within the

1.The name, address, and EIN of the organization.

2.A copy of Section B of Form 8283 that the organization received from the donor or a preceding donee. The preceding donee is the one who gave the organization the property.

3.A copy of this Form 8282, within 15 days after the organization files it.

The organization must furnish items 1 and 2 above within 15 days after the latest of the date:

•The organization transferred the property,

•The original donee signed Section B of Form 8283, or

•The organization received a copy of Section B of Form 8283 from the preceding donee if the organization is also a successor donee.

Information the successor donee must give the organization. The successor donee organization to whom the organization transferred this property is required to give the organization its name, address, and EIN within 15 days after the later of:

•The date the organization transferred the property, or

•The date the successor donee received a copy of Section B of Form 8283.

Form 8282 (Rev. |

Page 4 |

Information the organization must give the donor. The organization must give a copy of Form 8282 to the original donor of the property.

Recordkeeping. The organization must keep a copy of Section B of Form 8283 in its records.

Penalties

Failure to file penalty. The organization may be subject to a penalty if it fails to file this form by the due date, fails to include all of the information required to be shown on the filed form, or includes incorrect information on the filed form. The penalty is generally $50 per form. For more details, see sections 6721 and 6724.

Fraudulent identification of exempt use property. A $10,000 penalty may apply to any person who identifies in Part III tangible personal property the organization sold, exchanged, or otherwise disposed of, as having a use that is related to a purpose or function knowing that such property was not intended for such a use. For more details, see section 6720B.

Specific Instructions

Part I

Line 1a. Enter the name of the original donor.

Line 1b. The donor’s identifying number may be either an employer identification number or a social security number, and should be the same number provided on page 2 of Form 8283.

Line 1c and 1d. Enter the last known address of the original donor.

Lines

Part II

Complete Part II only if the organization is a successor donee. If the organization is the original donee, do not complete any lines in Part II; go directly to Part III.

If the organization is the second donee, complete lines 3a through 3d. If the organization is the third or later donee, complete lines 3a through 4d. On lines 4a through 4d, give information on the preceding donee.

Part III

Column 1. For charitable deduction property that the organization sold, exchanged, or otherwise disposed of within 3 years of the original contribution, describe each item in detail. For a motor vehicle, include the vehicle identification number. For a boat, include the hull identification number. For an airplane, include the aircraft identification number. Additionally, for the period of time the organization owned the property, explain how it was used. If additional space is needed, attach a statement.

Column 3. Check “Yes” if the organization’s use of the charitable deduction property was related to its exempt purpose or function. Check “No” if the organization sold, exchanged, or otherwise disposed of the property without using it.

Part IV

Certification. Sign and date the certification if any property described in Part III is tangible personal property and you answered “Yes” to Part III, question 3, or you answered “No” to Part III, question 3 and the intended use of the property became impossible or infeasible to implement.

Signature

Form 8282 is not valid unless it is signed by an officer of the organization. Be sure to include the title of the person signing the form and the date the form was signed.

How To Get Tax Help

Internet

You can access the IRS website 24 hours a day, 7 days a week, at www.IRS.gov to:

•Download forms and publications.

•Order IRS products online.

•Research your tax questions online.

•Search publications online by topic or keyword.

•Use the online Internal Revenue Code (IRC), Regulations, or other official guidance.

•View Internal Revenue Bulletins (IRBs) published in the last few years.

•Sign up to receive local and national tax news by email. To subscribe, visit www.irs.gov/Charities.

Ordering Forms and Publications

Visit www.irs.gov/Formspubs to download forms and publications. Otherwise, you can go to www.irs.gov/ OrderForms to order current and prior- year forms and instructions. Your order should arrive within 10 business days.

Phone Help

If you have questions and/or need help completing this form, please call

Document Specifics

| Fact Name | Description |

|---|---|

| Form Purpose | The IRS Form 8282 is used by organizations to report information to the IRS when they sell, exchange, or otherwise dispose of charitable deduction property or vehicles within three years after the date they originally received the property. |

| Required Filers | Organizations that have received tax-deductible property valued over $500 and have disposed of it within three years must file Form 8282. |

| Filing Deadline | The form must be filed within 125 days after the disposition of the property. |

| Donee Information | Form 8282 requires details about the organization that received the donation, including the name, address, and tax identification number. |

| Donor Information | The form requires details about the donor of the property, such as their name and social security number or tax identification number. |

| Property Description | Organizations need to accurately describe the donated property, as well as the date they originally received it and its value at the time of receipt. |

| Disposition Details | Details about the sale, exchange, or other disposition of the property, including the date of disposition and the amount the property was sold for, are required. |

| Penalties for Noncompliance | Failing to file Form 8282 or providing inaccurate information can result in penalties and fines from the IRS. |

| Governing Law | The requirement to file Form 8282 is governed by federal tax law, specifically under the Internal Revenue Code. |

Guide to Writing IRS 8282

After donating property valued over $5,000 to a charitable organization, if that organization then disposes of the property within three years, a specific procedure must be followed to keep the Internal Revenue Service (IRS) informed. This involves completing IRS Form 8282, Donee Information Return. This form plays a critical role in maintaining transparency about the disposition of donated property and ensures that all parties adhere to the regulations governing charitable donations. It is a straightforward process but requires attention to detail to ensure accuracy and compliance. Below are step-by-step instructions designed to assist in completing Form 8282 promptly and correctly.

- Start by downloading the latest version of IRS Form 8282 from the official IRS website. Ensure you have the current form, as using an outdated version could result in processing delays.

- In Part I, enter the name, address, and taxpayer identification number (TIN) of the organization that received the donated property. This identifies the charitable organization to the IRS.

- Place the name, address, and social security number or TIN of the donor in the designated area. This confirms who made the initial donation.

- Detail the information regarding the donated property in Part II. This includes a description of the donated item(s), date of the original donation, and the date of the disposition. Be as specific as possible to ensure clarity.

- Indicate the amount received, if any, from the disposition of the property. This amount is crucial for the IRS to determine if there are any tax implications stemming from the sale or disposal.

- If applicable, explain the reason for the disposition of the donated property in the space provided. This provides context to the IRS regarding why the item was sold or otherwise disposed of within the three-year period.

- Sign and date the form in Part III, attesting that all the information provided is accurate to the best of your knowledge. This section also requests the title of the individual completing the form, ensuring accountability.

- Review the entire form for accuracy and completeness. Errors or omissions can lead to processing delays or requests for additional information, which can be time-consuming.

- Finally, submit the form to the IRS at the address provided in the instructions for Form 8282. Keep a copy of the completed form for your records.

Completing and submitting IRS Form 8282 is a critical step in ensuring compliance with federal tax laws regarding charitable donations. By following these steps, organizations can swiftly navigate the process, keeping both themselves and their donors in good standing with the IRS.

Understanding IRS 8282

-

What is the IRS 8282 form?

The IRS 8282 form, also known as the "Donee Information Return," is used by organizations to report information to the Internal Revenue Service (IRS) when they sell, exchange, consume, or otherwise dispose of charitable donation property within three years after receiving it. This form helps the IRS ensure that the property’s value, as claimed by the donor for tax deduction purposes, aligns with the amount the donee organization ultimately receives from its sale or disposal.

-

Who needs to file the IRS 8282 form?

Any donee organization, typically a charitable institution, that sells, exchanges, or otherwise disposes of donated property exceeding a certain value within three years of receiving it must file an IRS 8282 form. This requirement applies regardless of whether the organization is tax-exempt or not. It's important for organizations to understand their responsibility in reporting these transactions to avoid penalties.

-

When should the IRS 8282 form be filed?

The IRS 8282 form must be filed within 125 days after the date of the sale or disposal of the donated property. Timely submission is crucial to remain compliant with IRS regulations. If an organization fails to file on time, it may face penalties, including fines.

-

What information is required on the IRS 8282 form?

The form requires detailed information about the donated property, including a description of the item, the date it was originally donated, the donor’s details, and the amount the organization received from its sale or disposal. Also, the organization must provide its own identification details, such as its name, address, and taxpayer identification number.

-

How is the IRS 8282 form filed?

The IRS 8282 form can be filed either electronically through the IRS e-file system or mailed directly to the IRS in paper form. Organizations are encouraged to check with the IRS or a tax professional to ensure they are using the most current form and filing method.

-

Are there penalties for not filing the IRS 8282 form?

Yes, failing to file the IRS 8282 form can lead to penalties. The IRS may impose fines on organizations that do not comply with the reporting requirements. These penalties can vary depending on the duration of the delay and the circumstances surrounding the non-compliance. It's advisable for organizations to file the form on time to avoid these penalties.

-

Can the IRS 8282 form be corrected after it has been filed?

If an organization discovers an error on a filed IRS 8282 form, it can file an amended return. The process involves submitting a new form with the corrected information and noting that it is an amended return. This step ensures that the IRS has the most accurate information regarding the disposition of donated property.

-

Where can one find the IRS 8282 form?

The IRS 8282 form is available on the IRS website. Organizations can download the form for free. Additionally, instructions for completing and filing the form can also be found on the website, providing valuable guidance to ensure the form is filled out correctly.

-

What should organizations do if they have questions about the IRS 8282 form?

If organizations have questions or need assistance with the IRS 8282 form, they should consult a tax professional or contact the IRS directly. Tax professionals can provide tailored advice based on the specific circumstances of the organization, while the IRS can offer general guidance on how to comply with the filing requirements.

Common mistakes

Filing the IRS Form 8282, which is required when an organization sells, exchanges, or disposes of charitable deduction property or vehicles valued at more than $500 within three years of receipt, can sometimes be complex. Mistakes in completing this form can lead to delays or penalties. Here are nine common errors people often make:

Not filing on time - Organizations must file Form 8282 within 125 days after the disposition of the property. Delaying beyond this timeframe can result in penalties.

Incorrect or missing Taxpayer Identification Numbers (TINs) - Providing accurate TINs for both the donor and the donee organizations is crucial. Mistakes or omissions can lead to processing delays.

Failing to describe the donated property accurately - A thorough and precise description of the donated property is essential. This includes its condition at the time of donation, as this can affect valuation.

Overlooking the donor’s acknowledgment section - The donee organization must attach a copy of the Section B of Form 8283 previously given to them by the donor, if applicable. This oversight can lead to questions about the property's original valuation and donor details.

Incorrectly reporting the sale price - When the property is sold, the actual sale price must be reported accurately. Misreporting can result in discrepancies and potential audits.

Omitting the date of disposition - The date when the property was sold, exchanged, or otherwise disposed of is critical for the IRS’s timeline. Failure to include this date can cause unnecessary complications.

Misunderstanding the use of the property - If the charitable organization used the property for a mission-related purpose before disposition, its reporting might differ. Misrepresenting how the property was used before disposition can lead to issues with the IRS.

Not providing details of any improvements - If the property was improved before its sale by the charitable organization, this needs to be reported. Not accounting for these improvements can affect the reported value of the property.

Forgetting to sign and date the form - An unsigned or undated form is considered incomplete by the IRS. This simple oversight can lead to the rejection of the form, necessitating refiling.

In dealing with IRS paperwork, attention to detail and adherence to guidelines are critical. Ensuring that Form 8282 is completed accurately and submitted on time helps charitable organizations avoid potential fines and ensures compliance with federal regulations.

Documents used along the form

When dealing with donations to non-profit organizations, especially those involving non-cash items worth more than $500, the IRS Form 8282 becomes relevant. This form, titled "Donee Information Return," is used by organizations to report information about the sale, exchange, or other disposition of charitable deduction property. However, in the process of filing this form, various other documents and forms are often utilized to ensure compliance with IRS regulations and to support the information reported. Here is a list of seven such documents and forms.

- IRS Form 8283: This form is used by donors to report information on non-cash charitable contributions. It must be filed in the year the donation is made and is often required in conjunction with Form 8282, providing a detailed description of the donated property.

- IRS Form 1040: The individual income tax return form where taxpayers can claim charitable contributions as deductions. Donations reported on Form 8283 are typically reflected on Schedule A of Form 1040.

- IRS Form 990: This form is the Return of Organization Exempt From Income Tax. It's used by non-profit organizations to provide the IRS with annual financial information, including details of significant donations received and any disposition of donated assets.

- Acknowledgement Letter from Donee: This document is a written acknowledgment provided by the donee organization to the donor. It confirms the receipt of the donation and provides details needed by the donor for tax purposes, potentially including a description of the donated property.

- Appraisal Summary: For donations of property valued over a certain amount, an appraisal summary must be attached to Form 8283. This document validates the claimed value of the donated property and must meet specific IRS requirements.

- IRS Form 1098-C: This form is specifically used for reporting a donation of a motor vehicle, boat, or airplane. If such an item is donated and then sold by the organization, the Form 1098-C serves as a detailed record of the transaction.

- Sales Records: When a donated item is sold by the donee organization, maintaining detailed sales records is crucial. These documents support the information reported on Form 8282 and may include sales receipts, auction records, or other transaction documents.

This array of forms and documents ensures that both donors and donee organizations meet their reporting obligations and can substantiate their tax deductions and income. Each document plays a vital role in the seamless tracking and reporting of non-cash donations, making the process transparent and efficient for all parties involved.

Similar forms

The IRS 8282 form, often used when a donated property is sold within three years of donation, shares similarities with several other documents in various contexts. A close counterpart is the IRS 8283 form, which is required for noncash charitable contributions. These two forms work in tandem; the donor uses Form 8283 to report the initial donation, and the recipient organization may need to file Form 8282 if the donated item is sold within a specific timeframe. Essentially, both forms ensure transparency and compliance in charitable donations, tracking the journey of a donated item from gift to sale.

Another similar document is the Schedule A (Form 1040), which beneficiaries use to itemize deductions on their tax returns, including charitable donations. Like the IRS 8282 form, Schedule A requires detailed information about donations, but from the viewpoint of the donor, to determine the allowable deduction amount. Both documents are integral to the tax deduction process for charitable contributions, ensuring accurate reporting to the Internal Revenue Service (IRS).

The IRS Form 1098-C, Contributions of Motor Vehicles, Boats, and Airplanes, also shares similarities with the IRS 8282 form. Form 1098-C is necessary when donating vehicles, and it includes information such as the vehicle's identification number and the sale price, if sold by the charity. Both forms are designed to track the disposition of donated property, safeguarding against fraudulent or inflated donation claims and keeping the donation process transparent.

The IRS Form 990, Return of Organization Exempt from Income Tax, is similar to the IRS 8282 form but on a broader scale. While Form 8282 focuses on the sale of specific donated items, Form 990 provides a comprehensive overview of a nonprofit organization's financial activities, including any income from the sale of donated items. This ensures that non-profit organizations operate within their tax-exempt guidelines, including how donations are managed and utilized.

Form W-2, Wage and Tax Statement, though primarily for employment income, shares a fundamental purpose with the IRS 8282 form: reporting to the IRS for tax compliance. Just as Form W-2 reports on the income an individual receives from an employer, Form 8282 reports on the sale of donated property by nonprofit organizations, both serving as checks to ensure accurate tax reporting and compliance.

Similarly, Form 1099-MISC, used to report miscellaneous income, parallels the IRS 8282 form in its role in reporting unusual or specific types of income. Where 1099-MISC covers a broad range of non-employee compensation, Form 8282 focuses on income from the sale of donated goods, highlighting the IRS's interest in capturing all forms of income for taxation and monitoring purposes.

The IRS Form 8949, Sales and Other Dispositions of Capital Assets, is related to Form 8282 through its focus on reporting sales transactions. Form 8949 is used by individuals to report the sale and exchange of capital assets, paralleling the reporting obligation organizations face when they sell donated property as highlighted in Form 8282. Both forms play critical roles in ensuring gains from sales are correctly reported to the IRS.

Form 4562, Depreciation and Amortization, has an indirect connection to Form 8282, as it deals with the depreciation of property—a concept that might affect the valuation of donated property before its sale. While Form 4562 is for taxpayers to claim depreciation on property used in business or income-producing activities, the sale price reported on Form 8282 could be influenced by the depreciated value of donated items, affecting the tax implications for the involved nonprofit organization.

The Charitable Contribution Deduction under the United States Tax Code harks back to the purpose behind the IRS 8282 form but from the donor's perspective. It outlines the rules and limits for tax deductions for donated property, reflecting the intertwined nature of various IRS forms that collectively aim to record, regulate, and encourage charitable contributions while maintaining tax compliance.

Last but not least, the IRS Form 1023, Application for Recognition of Exemption Under Section 501(c)(3) of the Internal Revenue Code, while not directly related to transactions, establishes the foundation for which organizations would later use Form 8282. Form 1023 is filled out by organizations seeking tax-exempt status, which is a prerequisite for being required to report the sale of donated goods under Form 8282. This foundational document underscores the legal and operational framework that enables charitable organizations to accept, report, and operate within the purview of tax-exempt status.

Dos and Don'ts

When handling the IRS 8282 form, it's crucial to pay attention to detail. Here's a simple guide to help you navigate the process smoothly:

Do's:

- Ensure all information provided is accurate and up to date, especially your contact details and the specifics of the donated property.

- Keep a copy of the filled-out form for your records. This can be helpful in case of any discrepancies or audits in the future.

- If the form seems confusing, seek advice from a professional. This can prevent mistakes that might cause delays or issues with the IRS.

- Submit the form within the stipulated timeframe after the sale or disposal of the donated property, typically within 125 days.

Don'ts:

- Don't guess on details. If unsure about any information, such as the exact value of the property when it was donated, look it up or consult with someone who knows.

- Avoid leaving sections incomplete. If a section doesn't apply, it's better to fill it with 'N/A' than to leave it blank.

- Resist the urge to submit the form without double-checking. A quick review can catch errors that might otherwise lead to unnecessary complications.

- Don't ignore IRS inquiries. If the IRS contacts you for more information or clarification after you've submitted the form, respond promptly to avoid penalties.

Misconceptions

When it comes to the IRS 8282 form, several misconceptions swirl around, adding a layer of confusion to what is already a complex topic. Understanding these misconceptions is vital for anyone diving into the details of tax-deductible donations, especially those related to non-cash charitable contributions. Let's clear up some of the common misunderstandings.

- Only large charities need to worry about it: One common misconception is that the IRS 8282 form is only a concern for large organizations. In reality, any organization that receives a non-cash contribution valued over $5,000, and then disposes of it within three years, must file this form. It applies to all sizes of charities, ensuring transparency and proper recording of non-cash contributions.

- It’s the donor's responsibility to file it: Another misunderstanding is that it's up to the donor to file IRS Form 8282. However, the responsibility actually falls on the donee organization that sells, exchanges, or otherwise disposes of the donated property. This form serves as a follow-up to the initial IRS Form 8283, which the donor files with their tax return when claiming a deduction for the contribution.

- You only need to report very high-value items: While it's true the form is for items valued over $5,000, this doesn't mean only items of extraordinarily high value need to be reported. Any non-cash item over this threshold, regardless of its nature, requires reporting if disposed of within three years of donation.

- It must be filed for every donated item that’s sold: This statement isn’t entirely accurate. The filing requirement kicks in when the disposed item’s contribution was previously reported on Form 8283 for a deduction over $5,000. If the property falls under this value or wasn’t claimed as a deduction, then there's no need for Form 8282.

- Filing the form is complicated: While dealing with IRS forms can often seem daunting, filing Form 8282 is relatively straightforward. The form requires basic information about the disposed property, the organization, and the original donor. Proper record-keeping and an understanding of the form’s instructions can simplify the process significantly.

Cutting through these misconceptions helps both donors and charitable organizations navigate the intricacies of non-cash contributions more effectively. With correct information, complying with IRS regulations can be a hassle-free process, ensuring the focus remains on the charitable cause rather than on tax reporting complexities.

Key takeaways

The IRS Form 8282, otherwise known as the "Donee Information Return," plays a crucial role in documenting the disposition of charitable donations of property valued over $500. When a charity decides to sell, exchange, or otherwise dispose of donated items within three years, filling out this form becomes a requirement. Here are four key takeaways to consider when dealing with Form 8282:

- Timely Submission is Crucial: The form must be filed within 125 days following the disposition of the donated property. Both the IRS and the original donor should receive a copy of the form. This timeframe ensures transparency and compliance with IRS regulations, helping donors avoid potential penalties.

- Accuracy is Key: Ensuring that all information on the form is accurate and complete is paramount. This includes details about the donated property, the sale price, and the date of the donation. Incorrect information can lead to misunderstandings and issues with the IRS.

- Understand When to File: Not every donation requires the filing of Form 8282. It's specifically for items or batches of similar items valued over $500 that were disposed of within three years from the date of donation. Understanding the criteria can save organizations time and resources.

- Seek Professional Help if Needed: Given the complexities surrounding tax laws and IRS forms, consulting with a tax professional or legal advisor can be prudent. They can provide guidance tailored to your specific situation, making the process smoother and helping ensure compliance.

Filling out and submitting IRS Form 8282 correctly plays a critical role in charitable giving and tax compliance. By keeping these takeaways in mind, both donors and charitable organizations can navigate these obligations more effectively, ensuring that the spirit of giving continues without unintended complications.

Popular PDF Documents

Cdp Hearing - Facilitates a dialogue between the IRS and taxpayers over disputed collection actions.

Berks County Tax Claim Bureau - Key for employers to understand their tax liabilities and reconcile any differences.