Get Irs 7575 Form

Navigating the landscape of IRS forms can often seem daunting, especially with forms like the IRS 7575, which plays a crucial role in the realm of state aid for local transportation. Issued in June 2007, this example IRS form is designed with specific users in mind, particularly emphasizing that it is for informational purposes and not for reproduction by individual taxpayers on personal computers. The distinct nature of the IRS 7575, a "machine readable" form, necessitates its printing on special paper using special inks, following precise specifications to ensure accuracy and compliance. This requirement underscores the unique handling and processing demands of some IRS documents, reflecting a broader effort to maintain integrity and efficiency in tax-related matters. Further guidance on the production of these specialized tax forms, including the IRS 7575, is thoroughly detailed in publications like Publication 1167, which covers Substitute Printed, Computer-Prepared, and Computer-Generated Tax Forms and Schedules, and Publication 1179, which outlines Specifications for Paper Document Reporting and Paper Substitutes across various form series. Access to these publications is facilitated through the IRS by calling 1-800-TAX-FORM, illustrating the agency's support in helping taxpayers and professionals navigate the complexities of tax documentation.

Irs 7575 Example

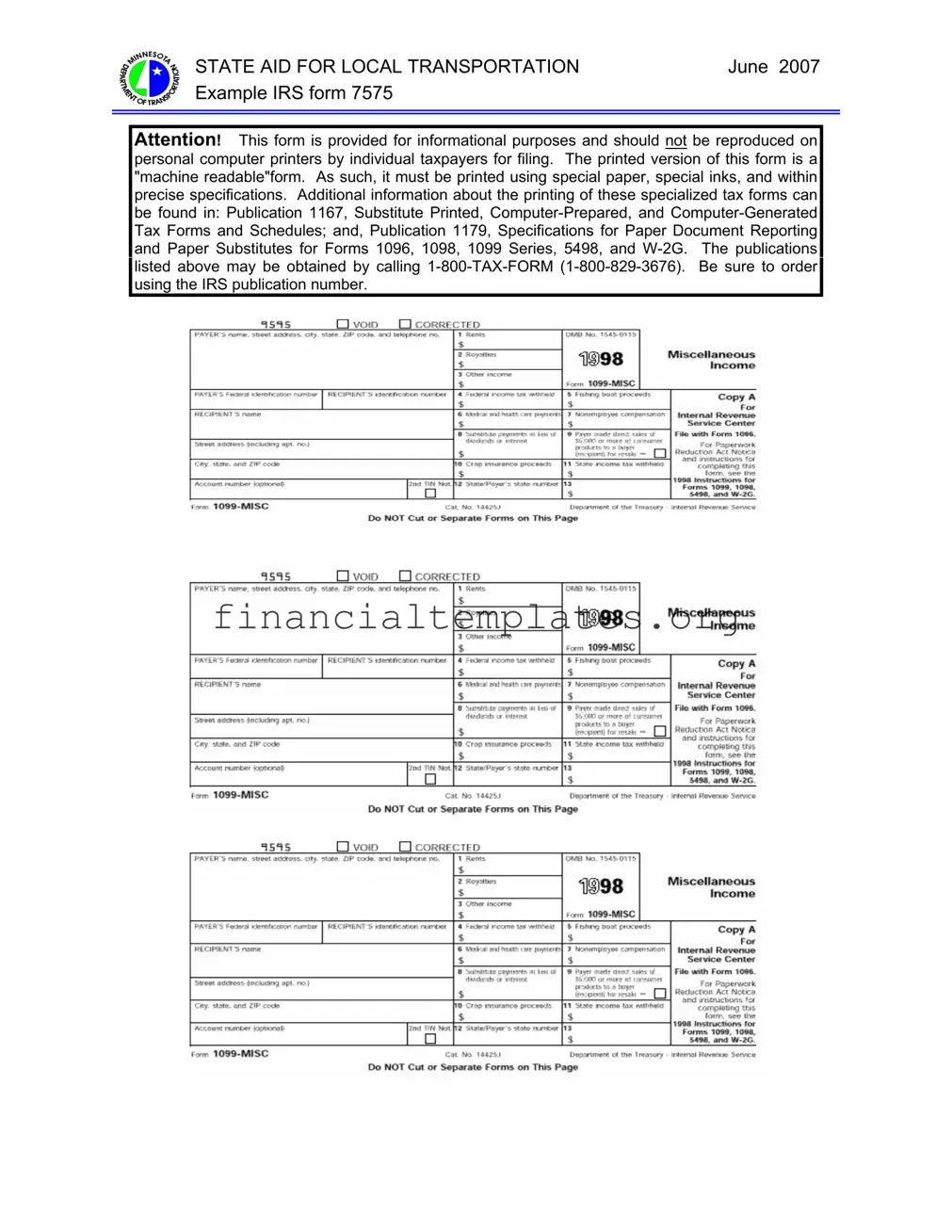

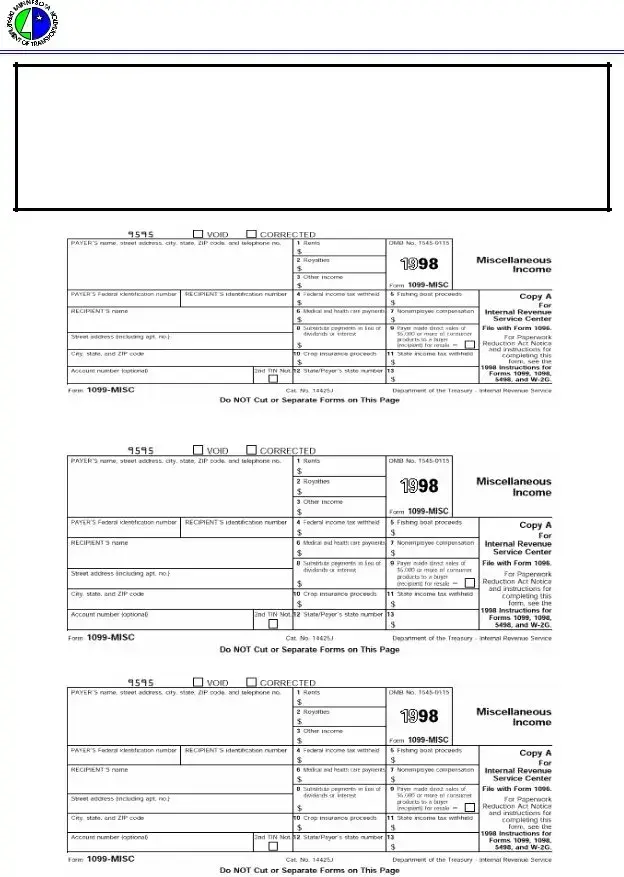

STATE AID FOR LOCAL TRANSPORTATION |

June 2007 |

Example IRS form 7575 |

|

ATTENTION! This form is provided for informational purposes and should not be reproduced on personal computer printers by individual taxpayers for filing. The printed version of this form is a "machine readable"form. As such, it must be printed using special paper, special inks, and within precise specifications. Additional information about the printing of these specialized tax forms can be found in: Publication 1167, Substitute Printed,

Document Specifics

| Fact Name | Description |

|---|---|

| Form Title | IRS Form 7575 is titled "State Aid for Local Transportation". |

| Publication Date | The form's example is published in June 2007. |

| Intended Use | This form is intended for informational purposes and is not to be reproduced for filing by individual taxpayers. |

| Printing Requirements | IRS Form 7575 is a "machine readable" form, requiring special paper, inks, and precise specifications for printing. |

| Resources for Printing | Guidelines on printing this specialized tax form are available in Publication 1167 and Publication 1179. |

| Publication 1167 | Focuses on Substitute Printed, Computer-Prepared, and Computer-Generated Tax Forms and Schedules. |

| Publication 1179 | Provides Specifications for Paper Document Reporting and Paper Substitutes for various IRS forms including the 1099 Series and W-2G. |

| How to Obtain Publications | Publications can be obtained by calling 1-800-TAX-FORM (1-800-829-3676) and ordering using the IRS publication number. |

| Usage Warning | Taxpayers are cautioned against reproducing the form on personal computer printers for filing purposes. |

Guide to Writing Irs 7575

After deciding to apply for State Aid for Local Transportation, it is essential to correctly fill out the IRS 7575 form. This document is crucial for the application process but requires attention to detail to ensure accuracy. The distinctive nature of this form means it needs specific printing standards, including special paper and ink, as outlined by the IRS. Before beginning, it's advised to familiarize yourself with Publication 1167 and Publication 1179 for comprehensive guidelines on form printing.

To accurately complete the IRS 7575 form, follow these steps:

- Firstly, acquire the correct version of the IRS 7575 form. It's important this form is obtained through the IRS to meet the "machine readable" requirements. Avoid using personal computer printers for this task.

- Gather all necessary information related to the State Aid for Local Transportation you are applying for. This includes details on the project, funding required, and any supporting documentation that may be needed.

- Enter the official name of your local transportation authority or the entity applying for the aid in the designated area on the form.

- Provide a detailed description of the transportation project for which you seek aid. Include project goals, locations, and expected outcomes.

- Outline the financial details of the project, specifying the amount of state aid requested. Ensure these figures are accurate and supported by documentation, if available.

- Sign and date the form in the required section. Remember, the form must be printed and signed physically to comply with IRS standards. Electronic signatures may not be acceptable for this specific document.

- After completing the form, review all entered information for accuracy. Double-check the form against the guidelines provided in Publication 1167 and Publication 1179 to ensure it meets all necessary requirements.

- Finally, submit the form to the designated authority as directed. This might include mailing it to a specific IRS address or another governmental body overseeing the State Aid for Local Transportation.

Following these steps carefully will help ensure your application for State Aid for Local Transportation is submitted correctly. Remember, precision and adherence to IRS guidelines are crucial throughout this process. If you encounter any confusion or difficulty, referring to IRS Publications 1167 and 1179 or seeking professional advice may be beneficial. Keep copies of all submitted documents for your records.

Understanding Irs 7575

What is the purpose of IRS Form 7575?

Why can't IRS Form 7575 be printed on personal computer printers for filing?

Where can additional information about printing specialized tax forms, like IRS Form 7575, be found?

What are the consequences of improperly reproducing IRS Form 7575?

How can someone ensure they correctly fill out and submit IRS Form 7575?

IRS Form 7575, titled "State Aid for Local Transportation," is designed to facilitate the process of applying for and administering state aid allocated for local transportation projects. This form plays a critical role in ensuring that local transportation initiatives have the necessary funding and support from state resources. It is important to understand that this form is intended for informational purposes and serves as a guide for the proper application process.

IRS Form 7575 is a "machine readable" form, meaning it requires special paper, special inks, and must adhere to precise specifications to be processed correctly. The technology used by the IRS to read these forms is designed to work with specific materials and dimensions for accuracy and efficiency in processing. As such, reproducing this form on standard home or office printers could lead to errors in interpretation or rejection of the form.

For those seeking further details on the printing and handling of specialized tax forms like IRS Form 7575, the IRS provides two key publications: Publication 1167, "Substitute Printed, Computer-Prepared, and Computer-Generated Tax Forms and Schedules," and Publication 1179, "Specifications for Paper Document Reporting and Paper Substitutes for Forms 1096, 1098, 1099 Series, 5498, and W-2G." These documents offer guidance on how to correctly produce and manage such forms to ensure they meet IRS standards. Interested individuals can obtain these publications by calling 1-800-TAX-FORM (1-800-829-3676) and should request them by their publication number for ease of reference.

Improper reproduction of IRS Form 7575, including using incorrect paper or ink or failing to meet the specified dimensions, can lead to the form being unreadable by IRS processing machines. This, in turn, may result in the form being rejected or processed incorrectly, potentially delaying or jeopardizing the financial aid for local transportation projects. Therefore, it is of utmost importance to follow IRS guidelines meticulously to ensure successful submission and processing.

Ensuring the correct completion and submission of IRS Form 7575 involves a few critical steps. First, individuals should refer to the specified IRS publications for detailed instructions on form preparation and submission standards. Consulting with a tax professional or an IRS representative can also provide clarity and guidance. Additionally, requesting the printed version of IRS Form 7575 and related instructions directly from the IRS by calling 1-800-TAX-FORM ensures that individuals have access to the most current and accurate information. Attention to detail and adherence to IRS guidelines are crucial throughout this process.

Common mistakes

Filling out the IRS 7575 form is a crucial process for obtaining state aid for local transportation projects. However, many individuals make errors during this process, potentially complicating their efforts. Here are seven common mistakes to avoid:

- Using a computer printer for reproduction: The form should not be reproduced on personal computer printers by individuals. It requires special paper, inks, and must adhere to precise specifications.

- Ignoring the instructions for machine-readable forms: The IRS 7575 is a machine-readable form, meaning it must be printed with specific materials to be processed correctly.

- Not consulting the necessary publications: Important additional information for correctly completing the form is found in Publication 1167 and Publication 1179. Failing to consult these can lead to errors.

- Lack of awareness about special printing requirements: Many are not aware that the IRS 7575 form must meet specific printing standards, which is vital for the form's acceptance.

- Delay in ordering required publications: Waiting too long to order the IRS publications necessary for completing the form can delay the entire process.

- Failing to use the IRS publication number when ordering: When obtaining the publications, it is crucial to order them using the IRS publication number to ensure receiving the correct documents.

- Assuming personal computer equipment is sufficient: Many individuals incorrectly believe their personal computer equipment is adequate for reproducing the form, which often leads to rejection.

Avoiding these mistakes is paramount in ensuring that the IRS 7575 form is filled out accurately and efficiently. Taking the time to understand and adhere to the IRS's specific requirements will streamline the process of obtaining state aid for local transportation initiatives.

Documents used along the form

When dealing with matters of state aid for local transportation, the IRS Form 7575 becomes crucial. However, this form often doesn't stand alone. Various other documents and forms are typically required to provide a comprehensive view of financial activities and to comply with regulations. Understanding these associated documents can streamline the process and ensure that all necessary information is adequately presented.

- Form 1040: Often individuals involved in local transportation projects must report personal income. Form 1040 is the U.S. individual income tax return form, crucial for declaring personal earnings, which may influence or be influenced by the allocations on the IRS Form 7575.

- Form 990: Non-profit organizations, which may receive state aid for local transportation, are required to file this form. It provides the IRS with information about the nonprofit's operations and financial status, ensuring they meet the standards for tax-exemption.

- Form 1099-MISC: This form is used to report payments made to independent contractors. For local transportation projects, payments to contractors for services like construction, consulting, or maintenance must be reported on Form 1099-MISC.

- W-2 Forms: Employees working directly on transportation projects will have their earnings reported by their employers on W-2 forms, data that might need to correlate with expenses claimed on the IRS Form 7575.

- Form 8821: Tax Information Authorization form allows designated parties to access tax information needed to support the documentation or claims made on Form 7575. It is often used by accountants or consultants working on behalf of the filer.

- Form 4506-T: Request for Transcript of Tax Return is used to request previous tax returns that can provide a historical financial perspective relevant to the current transportation project's funding and expenditures.

- Publication 15 (Circular E), Employer's Tax Guide: This document provides guidelines for employers on federal tax withholding for their employees, crucial for managing payroll in compliance with tax laws for those employed by state-aided local transportation projects.

- Schedule K-1 (Form 1065): Used by partnerships to report each partner's share of the partnership's earnings, losses, deductions, and credits. This form is relevant when a partnership structure is involved in managing or receiving state aid for local transportation.

Completing IRS Form 7575 is an intricate process that necessitates a keen eye on both details and the broader financial landscape. By ensuring that all related documents are accurately filled out and filed, individuals and organizations can better navigate the complexities of obtaining and reporting state aid for local transportation. This not only aids in maintaining compliance but also in fostering transparent and efficient funding utilization for vital community projects.

Similar forms

The IRS Form 1099 series can be seen as a cousin to the IRS 7575 form in their shared purpose of reporting specific financial information to the federal government. Just as the 7575 form aids in the administration of state aid for local transportation, the 1099 forms cover various types of income beyond wages, such as freelancing, dividends, and interest payments. Both sets of forms are integral to ensuring accurate tax reporting and compliance, though they cater to different sectors. Importantly, like the 7575, the 1099 forms must meet strict IRS standards for their physical format, as outlined in IRS Publication 1179, which discusses the specifications for paper document reporting.

IRS Form W-2G shares a connection with Form 7575 through its role in reporting specific types of income - in this case, gambling winnings. Both forms are designed to inform the IRS about transactions that may affect an individual's or entity's tax obligations. They are part of the broader ecosystem of tax reporting that enables the accurate collection of taxes. Compliance with precise printing and submission specifications is required for both, ensuring that the IRS can efficiently process and analyze the reported data. This similarity underscores the diverse types of financial activities that must be reported to maintain financial transparency and compliance.

Form 5498, which is used for reporting contributions to individual retirement arrangements (IRAs), also shares characteristics with the IRS 7575 form. Though they serve vastly different purposes, both are crucial for accurate tax reporting and compliance. Form 5498 provides the IRS with information about retirement savings, which can affect taxpayers' deductions and tax responsibilities. Like the 7575 form, Form 5498 also has specific printing and submission requirements to ensure compatibility with IRS processing systems, as emphasized in IRS publications that guide the creation of substitute tax forms.

Publication 1167 is intrinsically linked to the IRS 7575 form, not through content, but by its focus on the production of substitute tax forms. This publication outlines the guidelines for reproducing IRS forms with computer-generated methods, ensuring they meet the strict standards necessary for machine readability. Both the 7575 form and the guidelines in Publication 1167 highlight the importance of adhering to specific technical specifications when producing tax forms to avoid processing errors and potential penalties for inaccuracies or non-compliance.

Similar to the IRS 7575 form, Publication 1179 offers detailed instructions on the specifications for paper documents and substitute forms including the 1099 series, 5498, and W-2G, among others. This publication is crucial for entities that need to create their own versions of these forms, ensuring that they are correctly formatted and can be accurately read by IRS processing equipment. Both the publication and the form emphasize the necessity of compliance with specific technical requirements to facilitate efficient tax processing and reporting.

The IRS form 1096, which serves as a summary or transmittal form for the 1099 series, 5498, and others, shares a procedural connection with the IRS 7575 form. Though the 1096 form collates information from multiple forms for submission, it complements the 7575 form's role in tax reporting by ensuring that all necessary documentation is organized and processed correctly. Together, they exemplify the varied types of documentation the IRS requires for thorough and accurate tax administration, each subject to strict guidelines for their format and submission.

Each of these forms and publications plays a unique role in the tapestry of tax administration and compliance, yet they share commonalities with the IRS 7575 form in terms of purpose, requirements, and the emphasis on precise specifications for physical documents. Understanding these connections sheds light on the broader context of tax reporting and the meticulous standards set forth by the IRS to ensure fairness, accuracy, and efficiency in tax collection and governance.

Dos and Don'ts

When dealing with IRS Form 7575, State Aid for Local Transportation, it's crucial to navigate the intricacies with precision to ensure compliance and accuracy in your submission. Here are essential do's and don'ts to consider:

Do's:- Use the Correct Form: Ensure you're using the official IRS Form 7575. It's specially designed to be machine readable, requiring specific printing techniques.

- Follow IRS Printing Instructions: Refer to IRS Publication 1167 and Publication 1179 for detailed guidance on the correct printing methods, including the use of special paper and inks.

- Order Publications: If you're unsure about the printing requirements, don't hesitate to order the necessary publications from the IRS by calling 1-800-TAX-FORM (1-800-829-3676) and requesting by their number.

- Verify Your Information: Double-check all the data you input to ensure it's accurate and matches the records you have. Mistakes could lead to processing delays or issues with your state aid.

- Consult with a Professional: If you're uncertain about any part of the form or its requirements, it's wise to seek advice from a tax professional. They can provide valuable guidance and ensure you comply with IRS standards.

- Keep Records: After you've submitted the form, make sure to keep a copy of the filled-out form and any correspondence from the IRS regarding your submission. This will be useful for your records and any future reference.

- Alter the Form's Layout: Do not attempt to reproduce or alter the layout of Form 7575 on personal computers for filing. The form must be used as is, due to its machine-readable nature.

- Ignore Printing Specifications: Disregarding the specific printing requirements can lead to your form being rejected or incorrectly processed.

- Use Generic Paper or Inks: Standard office paper and inks are not suitable for this form. Adhere strictly to the IRS’s specifications.

- Guess on Information: If you're unsure about any information requested on the form, don't make assumptions. Incorrect data can result in unwanted complications.

- Forget to Sign and Date: An oversight in signing or dating the form can invalidate your submission. Always check that these are completed before submitting.

- Miss Deadlines: Submitting your form late can impact the timeliness of your aid or lead to penalties. Keep track of all relevant deadlines to ensure timely submission.

Misconceptions

When it comes to IRS Form 7575, titled "STATE AID FOR LOCAL TRANSPORTATION", there are several misconceptions that need to be cleared up to ensure that taxpayers understand it correctly. The aim here is to address these misconceptions directly and provide correct information in a straightforward manner.

It's just another IRS form. While IRS Form 7575 relates to taxes, its specific focus is on state aid for local transportation, distinguishing it from other forms that deal with income, deductions, or credits.

Anyone can file it. This form is not for individual taxpayer use. Instead, it's intended for specific use cases related to state aid and local transportation funding.

You can fill it out and print it on any printer. This form must be printed using special paper and inks to be machine-readable. It cannot be accurately printed using standard home or office printers.

Electronic filing is available for this form. Given the need for the form to be machine-readable and printed with specific materials, electronic filing is not an option for Form 7575. Specialized printing is required.

The form is widely available. While one might think that all IRS forms are readily accessible, IRS Form 7575 comes with specific printing requirements. These are outlined in Publication 1167 and 1179, which are essential for proper submission.

Any mistakes can be easily corrected by reprinting at home. Because of the special printing requirements, any corrections would likely involve more than simply reprinting the form at home. The correct materials and specifications must be used again.

There's no need for special software or equipment to print Form 7575. On the contrary, printing this form accurately requires access to specialized equipment capable of meeting the IRS's strict printing standards.

Publication numbers for further information are difficult to find. When in need of more information about printing and submitting Form 7575, the specific publication numbers are readily available. You can call 1-800-TAX-FORM and request Publication 1167 and 1179 using their publication numbers for guidance.

This form is filed annually by all taxpayers. Form 7575 is not a standard annual requirement for all taxpayers. It serves a specific purpose related to state aid for local transportation and is not part of the regular filing process for individuals.

Understanding the specific nature and requirements of IRS Form 7575 is crucial for those involved in state and local transportation financing. It's important to adhere to the unique specifications for preparing and submitting this form to ensure successful processing by the IRS.

Key takeaways

Understanding the IRS 7575 form is crucial for local transportation authorities seeking state aid. This form, while being a critical piece of documentation, requires careful attention to detail to ensure it is filled out and submitted correctly. Here are key takeaways to guide you through the process:

- The IRS 7575 form is specifically designed for state aid applications related to local transportation. This highlights its importance for entities looking to receive financial assistance for transportation projects.

- It is paramount to use the form only for informational purposes unless it is officially distributed. Reproducing the form on personal computers for filing is not permitted, emphasizing the need for obtaining the official document for submission.

- The form needs to be machine-readable. This requirement underlines the necessity for special paper, special inks, and precise printing specifications. Such specifications ensure the form is processed accurately and efficiently by the IRS systems.

- Guidance on printing and preparing the form can be found in Publication 1167 and Publication 1179. These publications provide detailed instructions, ensuring compliance with IRS standards.

- For those in need of these publications, they are available for order by calling 1-800-TAX-FORM (1-800-829-3676). This service facilitates easy access to essential resources for correctly handling the form.

- When calling to request publications, it’s important to use the IRS publication number for reference. This ensures you receive the correct materials needed for your documentation process.

- The IRS emphasizes caution against reproduction of the form using standard office equipment. This cautionary advice is meant to prevent errors and ensure the integrity of the submission process.

- Filling out the IRS 7575 form correctly is crucial for securing state aid for local transportation initiatives. The strict guidelines around its preparation and submission underscore the importance of diligence and accuracy in handling tax forms.

In summary, while navigating the complexities of the IRS 7575 form may seem daunting, understanding these key points ensures a smooth process in applying for state aid. Careful adherence to the IRS guidelines and utilizing the available resources will guide you through successful form preparation and submission.

Popular PDF Documents

Taxpayer Protection Program Phone Number - For those who have experienced identity theft, timely submission of Form 14039 is crucial in minimizing potential damage and safeguarding your tax account.

What Is 990 Tax Form - A critical component for nonprofits seeking to reassure stakeholders of their dedication to transparency and public accountability.