Get IRS 7200 Form

For businesses navigating the complexities of tax credits and relief programs, understanding the intricacies of specific tax forms is crucial. Among these, the IRS 7200 form stands out as a pivotal document designed to facilitate the advance payment of employer credits due to COVID-19. This form allows employers to receive advances on certain tax credits that are not just beneficial but essential for maintaining financial stability during challenging times. As part of the relief efforts introduced by the government, the form plays a critical role in ensuring that businesses can leverage these credits promptly. It serves as a bridge, enabling employers to access funds more quickly than waiting for a tax return processing. By fully grasitating the purpose, eligibility criteria, and submission process of the IRS 7200 form, businesses can effectively manage their finances and navigate through the economic impacts of the pandemic with greater ease and confidence.

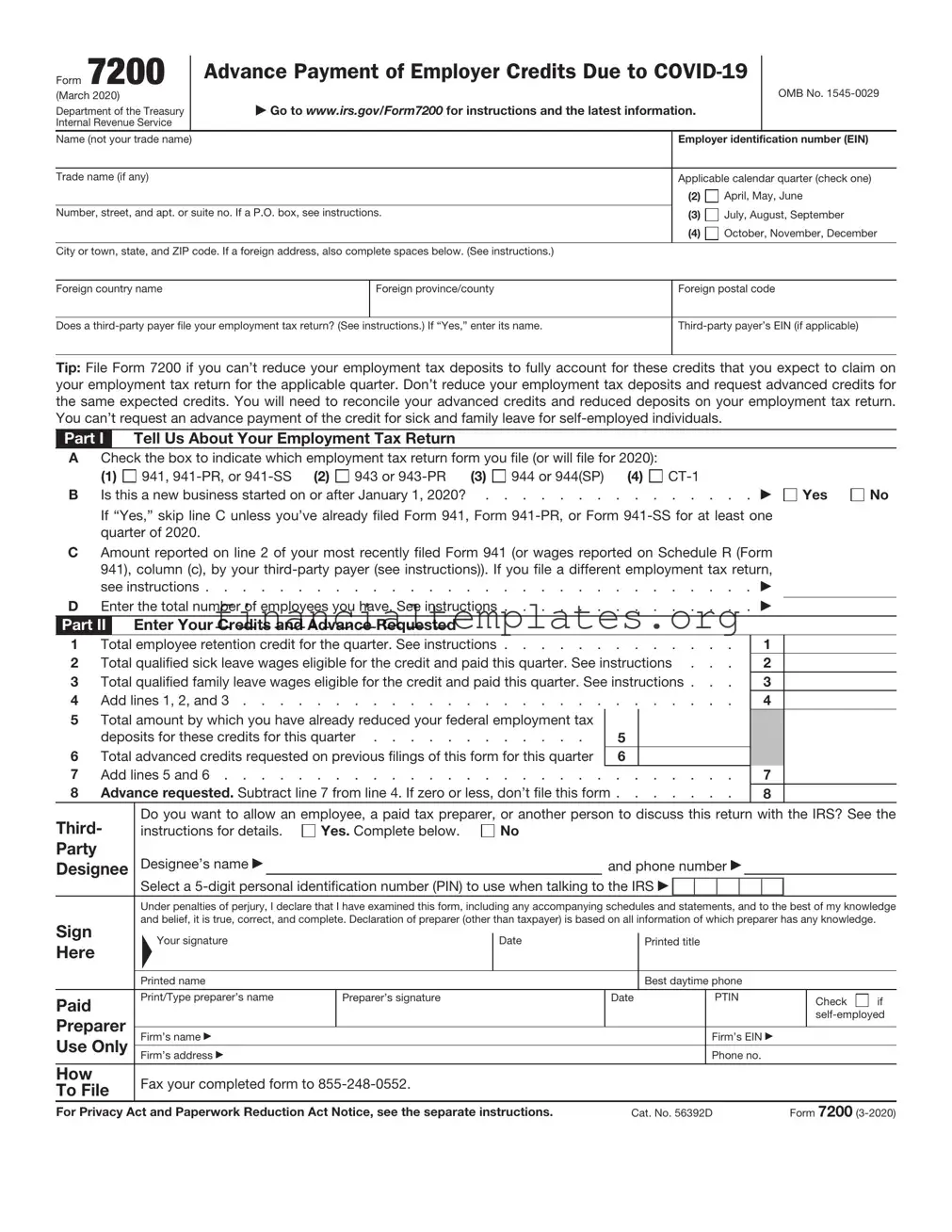

IRS 7200 Example

Form 7200

(Rev. April 2021)

Department of the Treasury

Internal Revenue Service

Advance Payment of Employer Credits Due to

▶Go to www.irs.gov/Form7200 for instructions and the latest information.

OMB No.

Name (not your trade name) |

Employer identification number (EIN) |

|

|

|

|

Trade name (if any) |

Applicable calendar quarter in 2021 |

|

|

(check only one box) Caution: See |

|

|

instructions before completing to |

|

Number, street, and apt. or suite no. If a P.O. box, see instructions. |

||

determine if the credits and advance are |

||

|

||

|

available for the applicable quarter in 2021. |

City or town, state, and ZIP code. If a foreign address, also complete spaces below. (See instructions.)

|

|

(2) |

April, May, June |

|

|

|

|

|

|

Foreign country name |

Foreign province/county |

Foreign postal code (3) |

July, August, September |

|

|

|

(4) |

October, November, December |

|

|

|

|

|

|

Name on employment tax return

Part I Tell Us About Your Employment Tax Return

ACheck the box to indicate which employment tax return form you file (or will file for 2021). Check only one box.

(1) |

941, |

(2) |

943 or |

(3) |

944 |

(4) |

BEnter the total number of employees to whom you paid qualified wages eligible for the employee retention credit this quarter ▶

CAmount reported on line 2 of your most recently filed Form 941 (or wages reported on Schedule R (Form 941), column (d), by

your

DTax period of most recently filed Form 941 (for example, “Q4 2020”) or annual employment tax return (for example, “2020”) ▶

EIf you’re requesting an advance payment of the employee retention credit (Part II, line 1), enter the average number of

Aggregation rules apply. See instructions . . . . . . . . . . . . . . . . . . . . . . ▶

FIf you’re requesting an advance payment for qualified sick and/or family leave wages (Part II, lines 2 and/or 3), enter the number

of employees you had when qualified leave was taken during the quarter for the advance requested. See instructions . . ▶

GNumber of individuals provided COBRA premium assistance during the quarter for the advance requested . . ▶

HIf you’re eligible for the employee retention credit solely because your business is a recovery startup business,

|

check here |

. . . . . |

|

. . . |

▶ |

|

|||||||||||||||

Part II |

|

Enter Your Credits and Advance Requested |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

1 |

Total employee retention credit for the quarter. Don’t enter more than the amount eligible to be advanced |

|

|

|

|

|

|||||||||||||||

|

for the quarter. See instructions |

. . . . . |

|

. . |

|

|

1 |

|

|

|

|||||||||||

2 |

Total qualified sick leave wages eligible for the credit and paid this quarter. See instructions . . . |

. . |

|

|

2 |

|

|

|

|||||||||||||

3 |

Total qualified family leave wages eligible for the credit and paid this quarter. See instructions . . |

. . |

|

|

3 |

|

|

|

|||||||||||||

4 |

Total COBRA premium assistance provided this quarter. See instructions . . . . |

. . . . . |

|

. . |

|

|

4 |

|

|

|

|||||||||||

5 |

Add lines 1, 2, 3, and 4 |

. . . . . |

|

. . |

|

|

5 |

|

|

|

|||||||||||

6 |

Total amount by which you have already reduced your federal employment tax |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

deposits for these credits for this quarter. Enter as a positive number . . . . |

6 |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

7 |

Total advanced credits requested on previous filings of this form for this quarter . |

7 |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

8 |

Add lines 6 and 7 |

. . . . . |

|

. . |

|

|

8 |

|

|

|

|||||||||||

9 |

Advance requested. Subtract line 8 from line 5. If zero or less, don’t file this form . |

. . . . . |

|

. . |

|

|

9 |

|

|

|

|||||||||||

Third- |

Do you want to allow an employee, a paid tax preparer, or another person to discuss this return with the IRS? See the |

||||||||||||||||||||

instructions for details. |

Yes. Complete below. |

No |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

Party |

|

|

Designee’s name ▶ |

|

|

|

|

and phone number ▶ |

|

|

|

|

|

||||||||

Designee |

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

Select a |

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

Under penalties of perjury, I declare that I have examined this form, including any accompanying schedules and statements, and to the best of my knowledge |

||||||||||||||||||

Sign |

|

|

and belief, it is true, correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge. |

|

|||||||||||||||||

|

|

▲ |

|

|

Date |

|

Printed title |

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

Here |

|

|

Your signature |

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

Printed name |

|

|

|

|

|

Best daytime phone |

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Paid |

|

|

Print/Type preparer’s name |

|

Preparer’s signature |

|

|

Date |

PTIN |

|

|

|

Check |

if |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Preparer |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

Firm’s name ▶ |

|

|

|

|

|

|

|

|

Firm’s EIN ▶ |

|

|||||||||||

Use Only |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Firm’s address ▶ |

|

|

|

|

|

|

|

|

Phone no. |

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

How |

|

|

Fax your completed form to |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

To File |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

For Privacy Act and Paperwork Reduction Act Notice, see the separate instructions. |

Cat. No. 56392D |

|

|

|

|

|

Form 7200 (Rev. |

||||||||||||||

Document Specifics

| Fact Number | Fact Detail |

|---|---|

| 1 | The IRS Form 7200 is used for requesting an advance payment of employer credits due to COVID-19. |

| 2 | It was introduced as part of the Families First Coronavirus Response Act (FFCRA) and the Coronavirus Aid, Relief, and Economic Security (CARES) Act. |

| 3 | Employers, including tax-exempt organizations, can use this form to get an advance on paid leave and retained earnings credits. |

| 4 | The form can be filed before the end of the quarter and can be used multiple times during a calendar quarter. |

| 5 | Corrected forms or adjustments for previous errors are managed via IRS Form 941-X or other appropriate amended returns, not through Form 7200 after the quarter ends. |

| 6 | The IRS processes Form 7200 and issues advances based on the information provided, which means accurate record-keeping and thorough documentation are crucial. |

Guide to Writing IRS 7200

Completing the IRS 7200 form is a crucial step for eligible entities looking to advance claim employer credits. The process, while detailed, can be navigated successfully with careful attention to each section. The following steps are designed to guide you through the process, ensuring accuracy and compliance. Before starting, gather all necessary information including payroll records and any documentation related to eligible credits. This preparation will streamline the completion process.

- Begin by entering the Employer Identification Number (EIN) at the top of the form. This unique number is vital for identification and processing.

- Proceed to fill in the legal name of the entity as registered. If there's a name change since the last filing, document this appropriately.

- Fill in your trade name if it differs from the legal name. This helps in further identifying your entity.

- Enter the address of your business, ensuring accuracy with the street address, city, state, and zip code to avoid processing delays.

- Specify the quarter for which you are filing the form. This is crucial as it affects the calculation and processing of your claim.

- Indicate the type of employment taxes from which you are claiming an advance. This should align with your eligibility for the credit.

- Document the total amount of advance requested. This involves calculating the eligible credits in accordance with relevant guidelines.

- Ensure to sign and date the form. The signature attests to the accuracy of the information provided and compliance with applicable laws.

- Finally, review the form for accuracy and completeness. An oversight could lead to processing delays or a denial of the claim.

- Once completed, submit the form according to the instructions provided by the IRS. This could be via mail or electronically, depending on the requirements at the time of filing.

Upon submission, the IRS will process your form. Processing times can vary, so it's important to wait for official communication from the IRS regarding the status of your claim. This communication will typically outline the next steps or any additional information required to proceed. Accuracy and thoroughness in filling out the form can significantly impact the processing time and the outcome of your claim. Therefore, ensuring all information is correct and substantiated by your records is paramount.

Understanding IRS 7200

-

What is the purpose of the IRS Form 7200?

The IRS Form 7200 is used by employers to request an advance payment of employer credits due to COVID-19. These include the sick leave credit and the family leave credit under the Families First Coronavirus Response Act (FFCRA), as well as the Employee Retention Credit under the CARES Act. The form allows employers to receive the benefit of these credits in advance, helping to alleviate the financial burden while waiting for tax returns to be processed.

-

Who is eligible to file Form 7200?

Employers, including tax-exempt organizations, are eligible to file Form 7200 if they have paid qualified sick leave wages, qualified family leave wages, or qualified wages eligible for the Employee Retention Credit. This includes those who are self-employed but have similar qualifying wages.

-

Can Form 7200 be filed for any tax period?

Form 7200 can only be filed for wages paid during specific periods that are clearly defined by the relevant COVID-19 relief acts. Employers should consult the IRS guidelines or a tax professional to determine the specific timeframes during which they can file the form based on the credits they are claiming.

-

How can an employer file IRS Form 7200?

To file IRS Form 7200, employers must complete the form and fax it to the number provided by the IRS. Currently, electronic filing is not an option. Employers must ensure that all required information is provided and that they've calculated their credit amounts correctly to avoid processing delays.

-

What happens after Form 7200 is filed?

After Form 7200 is filed, the IRS will process the request. If the advance payment is approved, the IRS will issue the payment to the employer. It’s important for employers to note that the processing time can vary. Employers should also keep a copy of the form and any corresponding documentation for their records.

-

Is it necessary to report the credits claimed on Form 7200 on other tax forms?

Yes, employers must report the credits claimed on Form 7200 on their federal employment tax returns, such as Form 941, Employer's Quarterly Federal Tax Return. The amount of any advance payment received will reduce the credits that can be claimed on these returns. Accurate record-keeping is essential to ensure proper reporting.

-

Can an employer file more than one Form 7200?

Employers may file Form 7200 multiple times during a tax year to request additional advance payments of credits. However, it is crucial to not exceed the allowable amount of credits. Miscalculations can lead to discrepancies that might result in future liabilities with the IRS.

-

What are the common mistakes to avoid when filing Form 7200?

Common mistakes include miscalculating the credit amount, not providing all necessary identification numbers, and filing the form for credits not eligible for advance payment. Ensuring accuracy and completeness when filling out Form 7200 can help avoid these errors.

-

Where can employers get assistance with Form 7200?

Employers can get assistance with Form 7200 by consulting the IRS website for detailed instructions and FAQs. Additionally, contacting a tax professional or advisor who is familiar with the specific COVID-19 relief measures can provide valuable guidance and ensure compliance with filing requirements.

Common mistakes

Filling out the IRS 7200 form can be a daunting task, and it's easy to make mistakes that can delay the processing of this important document. To help you avoid common errors, here are five mistakes people often make:

Incorrect Employer Identification Number (EIN): Many people mistakenly enter an incorrect EIN, which is a critical error since it's the primary way the IRS identifies your business.

Incomplete employee details: Failing to provide complete information for each employee, such as their Social Security Number (SSN) or wages, can result in processing delays.

Overlooking eligible credits: Often, businesses miss out on claiming all the credits they're entitled to, simply because they're not aware of them or misunderstand the eligibility requirements.

Miscalculating amounts: It's common to see miscalculations of credit amounts which can either lead to delayed processing or an undesired audit.

Incorrect tax period: Entering the wrong tax period can cause significant confusion and delay the application process, as it won't match the IRS records.

Here are some additional tips to ensure you fill out the form correctly:

Double-check all identification numbers, especially your EIN, to ensure accuracy.

Make sure you have up-to-date information on all credits you're claiming.

Consult the instructions for the form carefully to avoid simple errors in calculation or data entry.

By being diligent and attentive to detail, you can avoid these common mistakes and ensure a smoother process for your IRS 7200 form submission.

Documents used along the form

Filing taxes and understanding which forms to use can be daunting. The IRS 7200 form, for instance, is used by employers to request an advance payment of employer credits due to COVID-19. This form is often just one piece of the puzzle during tax preparation. To help navigate this complexity, it's beneficial to be familiar with other forms and documents that are typically used alongside the IRS 7200 form. Below is a list of these documents, each briefly described to provide clarity and aid in your tax preparation journey.

- Form 941: Employers use this form to report income taxes, Social Security tax, or Medicare tax withheld from employee's paychecks. Additionally, it reports the employer's portion of Social Security or Medicare tax.

- Form 944: This form is designed for smaller employers to file their annual federal tax return. It's an alternative to filing Form 941 quarterly and is used to report withheld income tax and both the employer and employee portions of Social Security and Medicare taxes.

- Form 943: Specifically for agricultural employers, this form is used to report federal income tax withheld from employees and both the employer and employee portions of Social Security and Medicare taxes on farmworkers.

- Form W-2: This wage and tax statement is issued by employers to report an employee's annual wages and the amount of taxes withheld from their paycheck. It is essential for employees when they prepare their personal tax returns.

- Form W-3: Accompanying Form W-2, this transmittal form is used by employers to send copies of all W-2s to the Social Security Administration. It summarizes the total earnings, Social Security wages, Medicare wages, and withholding for all employees for the previous year.

- Form 1095-C: Employers with 50 or more full-time employees use this form to report information about health insurance coverage offered or not offered to their employees. It is crucial for employers to demonstrate compliance with the Affordable Care Act's employer mandate.

While this list is not exhaustive, it covers the primary forms and documents commonly associated with the IRS 7200 form. Each serves its unique purpose in the wider context of employment taxation and benefits reporting. By understanding these forms, employers can better navigate the complexities of tax season, ensuring compliance and leveraging potential benefits. Remember, it's always wise to consult with a tax professional or legal advisor to ensure accuracy and compliance with the latest tax laws and regulations.

Similar forms

The IRS Form 941, Employer's Quarterly Federal Tax Return, shares similarities with the IRS 7200 form in its purpose of reporting employer tax obligations. Both forms are integral to the process of managing employment taxes, yet they serve different reporting time frames. Form 941 is submitted quarterly, documenting wages paid, tips employees received, federal income tax withheld, and both employer's and employees' share of social security and Medicare taxes. Conversely, Form 7200 allows for the advance payment of employer credits due to the pandemic exigencies.

IRS Form 944, Employer's Annual Federal Tax Return, is designed for smaller employers to report their tax obligations annually rather than quarterly, which parallels the IRS 7200 in its focus on employer tax responsibilities. While Form 7200 facilitates the advanced receipt of credits for sick and family leave and employee retention in a crisis context, Form 944 aggregates a year’s worth of employment tax liability, such as Social Security, Medicare, and withheld federal income tax, offering a simpler annual filing option for those eligible.

The IRS Form W-2, Wage and Tax Statement, similar to the IRS 7200 form, deals with employment taxes. Form W-2 is issued by employers to report employees' annual wages and the amount of taxes withheld from their paychecks. Its connection to Form 7200 lies in the fundamental requirement of accurate employment tax reporting. Both forms ensure that credits, such as those for sick and family leave, are correctly administered based on the wages reported, albeit serving different stages in the tax reporting and reimbursement process.

IRS Form W-4, Employee's Withholding Certificate, indirectly correlates with the IRS 7200 form by addressing the initial stage of employment tax handling. Employees use Form W-4 to determine the amount of federal income tax to withhold from their pay. In essence, the correct completion of Form W-4 impacts the accuracy of calculations for credits on Form 7200, especially since these credits are based on taxes owed and paid on employee wages. Thus, accurate tax withholding directly influences the reconciliation processes involved with the IRS 7200.

IRS Form 1099-NEC, Nonemployee Compensation, relates to IRS 7200 in the broader context of tax reporting for payments made to non-employees. While the 7200 form addresses advance payments of employment tax credits to employers, Form 1099-NEC is used to report payments to independent contractors. This relationship highlights the diverse mechanisms through which work compensation and associated taxes are reported, emphasizing the comprehensive nature of employment and contractor tax reporting and its implications for credit calculations and advances.

Lastly, IRS Form 8850, Pre-Screening Notice and Certification Request for the Work Opportunity Credit, bears resemblance to IRS 7200 due to its role in facilitating tax credits for employers. Form 8850 is used by employers to pre-screen and certify that an employee is a member of a targeted group to qualify for the work opportunity tax credit. Like Form 7200, this form is part of the process for employers to claim certain tax relief benefits, illustrating the varied channels through which businesses can manage their tax liabilities in response to employment practices.

Dos and Don'ts

Filing IRS Form 7200, Advance Payment of Employer Credits Due to COVID-19, requires attention to detail and an understanding of the guidelines. Failure to accurately complete the form can delay the processing of your request or result in a denial of the advance payments. Consider these do's and don'ts to navigate the form successfully.

- Do ensure that your business is eligible for the credits claimed on Form 7200. Understanding the eligibility criteria is crucial before you apply for advance payment.

- Do gather all necessary information prior to filling out the form. This includes payroll records and any other documentation that supports the credits you are claiming.

- Do double-check your calculations. Accuracy is key to avoiding processing delays or errors in the advance payment amount.

- Don't overlook the instructions for each line of the form. These instructions are designed to guide you through the process and ensure the information is entered correctly.

- Don't leave any required fields blank. Incomplete forms may not be processed, leading to potential delays in receiving your advance payment.

- Don't forget to sign and date the form. An unsigned Form 7200 is considered incomplete and will result in processing delays.

By adhering to these guidelines, you can simplify the filing process and expedite your advance payment from the IRS. Remember, accuracy, completeness, and attention to detail are your best tools when completing IRS Form 7200.

Misconceptions

The IRS 7200 form often generates a lot of confusion and misunderstanding amongst taxpayers and businesses alike. Here, we aim to clear up some common misconceptions and ensure that the facts are known, allowing for a smoother and more accurate handling of this important form.

Misconception 1: The IRS 7200 form can be filed at any time.

In fact, this form has specific deadlines that must be adhered to. It's crucial to know these deadlines to avoid penalties.Misconception 2: Only large businesses need to file IRS Form 7200.

Small businesses are also eligible and may need to file Form 7200, especially if they are claiming advance payment of employer credits due to paid leave and other tax creditable expenditures.Misconception 3: The form can be filed electronically.

As of the last update, the IRS requires IRS Form 7200 to be faxed for processing, not electronically submitted through email or an online portal.Misconception 4: The IRS Form 7200 process is long and complicated.

While it may seem daunting, with the right documentation and understanding, submitting Form 7200 can be straightforward. Preparation is key.Misconception 5: You can use Form 7200 to correct errors on your quarterly employment tax returns.

Form 7200 is used for advance payment requests, not corrections. Corrections to previously filed employment tax returns should be made on the appropriate amended return form.Misconception 6: There’s no penalty for inaccurately completing Form 7200.

Incorrect or fraudulent information can lead to penalties or audits, making it critical to carefully prepare and review your form before submission.Misconception 7: Once filed, the IRS Form 7200 cannot be amended.

If you realize there was an error in your request, the process to address it isn't by amending the form but rather reconciling it on your employment tax return.Misconception 8: Form 7200 refunds are processed immediately.

While the IRS aims to process these requests promptly, processing times can vary. Expect several weeks before seeing a refund.Misconception 9: Every business qualifies for credits claimed on Form 7200.

Eligibility for the credits applies to specific situations dictated by current tax laws and credits available. Businesses should verify they meet these requirements before filing.Misconception 10: Form 7200 details don’t need to be included in your annual tax return.

You must reconcile any advance received through Form 7200 on your annual or quarterly tax filings to ensure your accounts are accurate and up to date.

Key takeaways

The IRS Form 7200, Advance Payment of Employer Credits Due to COVID-19, serves a crucial role for businesses navigating through the economic impacts of the pandemic. Here are key takeaways related to filling out and using this form:

- Eligibility should be carefully determined: Before using IRS Form 7200, employers should ensure they qualify for the advance payment of employer credits. These credits are generally available to businesses affected by COVID-19, but specific eligibility criteria must be met.

- Accuracy is critical: When filling out Form 7200, it's essential to provide accurate information. Errors can delay processing and affect the amount of the advance payment. Employers should double-check their calculations and the information provided to avoid mistakes.

- Keep track of deadlines: The IRS sets specific deadlines for submitting Form 7200 to claim advance payments. These deadlines are linked to payroll tax filing dates. Missing a deadline can result in delayed or missed advance payments, impacting an employer's cash flow.

- Documentation is key: Employers should maintain thorough records of their eligibility for credits claimed and advance payments received. This documentation will be necessary for reconciling advance payments with actual credits claimed on employment tax returns.

- Understand the reconciliation process: Eventually, employers will need to reconcile advance payments received with credits claimed on their employment tax returns. Understanding this process is crucial to ensure compliance and avoid potential discrepancies with the IRS.

Employers can find detailed instructions and additional resources for Form 7200 on the IRS website. Seeking advice from tax professionals can also be beneficial in navigating the complexities related to these credits and ensuring compliance.

Popular PDF Documents

Tax Form 4506-t - Through the 4506-T form, taxpayers can acquire specific return information, crucial for resolving disputes or clarifying tax obligations.

Application for Car Loan - Designed to facilitate a clear understanding of loan terms, including interest rates and repayment schedules, for informed financial decisions.