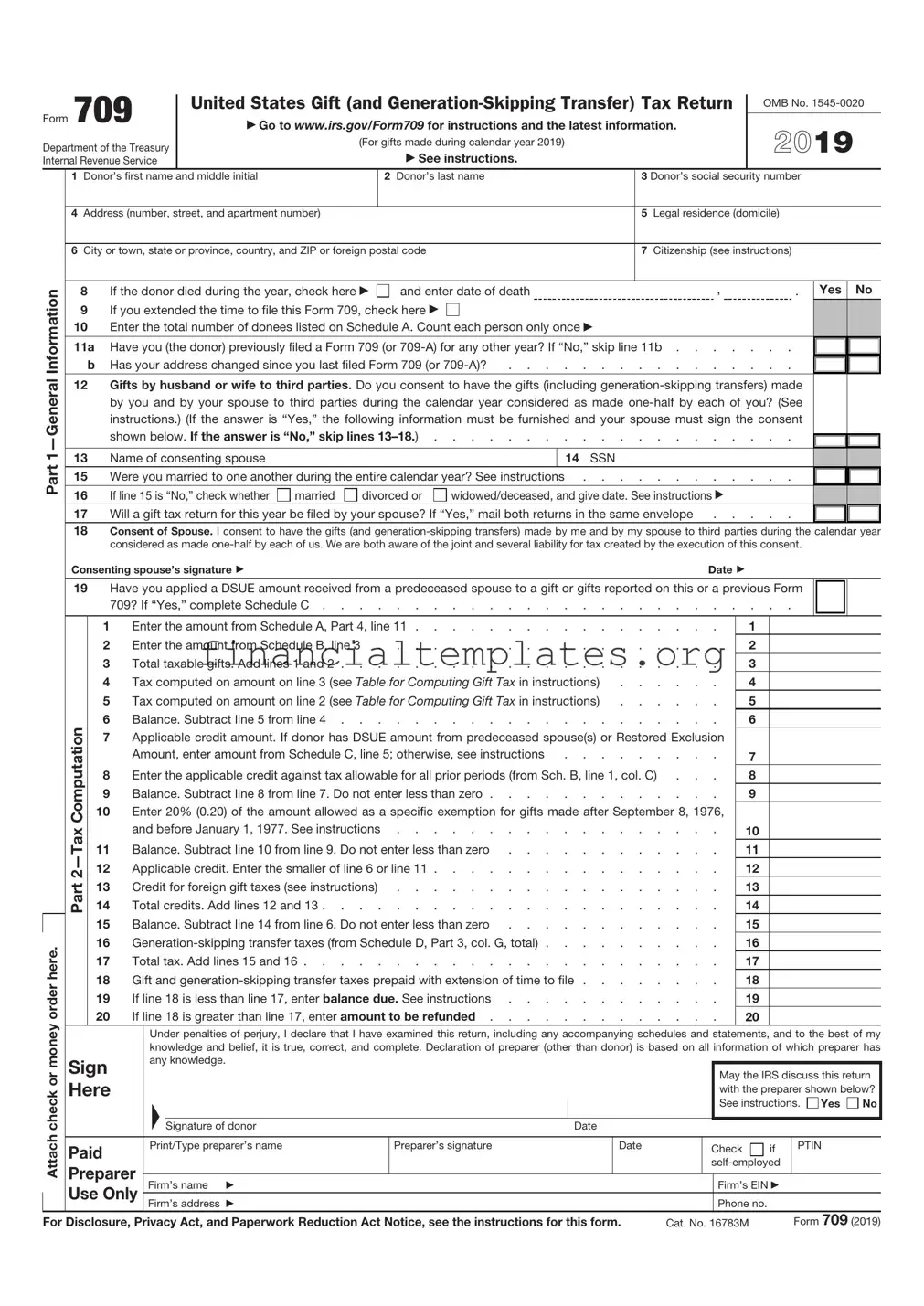

Get IRS 709 Form

Navigating the complexities of tax obligations can be a daunting task, and when it comes to gifting, the IRS 709 form plays a pivotal role. This form is crucial for anyone who gives gifts exceeding the annual exclusion limit, requiring detailed documentation to ensure compliance with tax laws. Interestingly, it's not just about reporting cash gifts; the form covers a wide array of transfers, including those of property and trusts, making it a versatile tool in the taxpayer's arsenal. The importance of accurately completing this form cannot be overstated, as it helps to determine whether a gift will deplete part of your lifetime estate and gift tax exemption. Beyond its immediate tax implications, the IRS 709 form fosters transparency in wealth transfer, providing a clear record of an individual's gifting history. With the potential implications for both the giver and the recipient, understanding and correctly filling out this form is a crucial step for anyone engaged in significant gifting activities.

IRS 709 Example

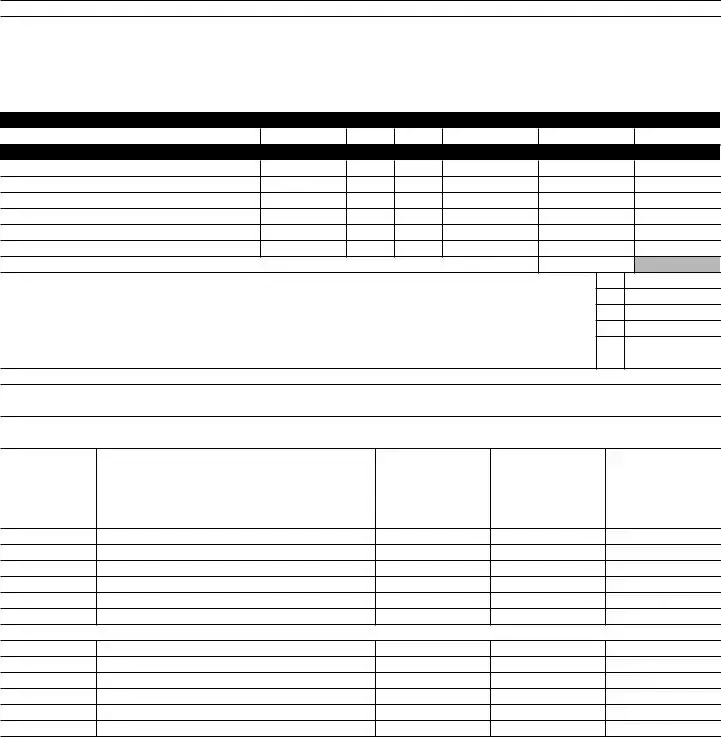

Form 709 |

|

United States Gift (and |

|

OMB No. |

||||||||||||

|

|

|||||||||||||||

|

▶ Go to www.irs.gov/Form709 for instructions and the latest information. |

|

2020 |

|||||||||||||

Department of the Treasury |

|

|

|

(For gifts made during calendar year 2020) |

|

|

|

|||||||||

|

|

|

|

▶ See instructions. |

|

|

|

|||||||||

Internal Revenue Service |

|

|

|

|

|

|

|

|||||||||

|

1 Donor’s first name |

|

and middle initial |

|

|

2 Donor’s last name |

|

|

|

3 Donor’s social security number |

||||||

|

|

|

|

|

|

|

|

|

|

|

||||||

|

4 Address (number, street, and apartment number) |

|

|

|

|

|

|

5 Legal residence (domicile) |

||||||||

|

|

|

|

|

|

|

|

|

||||||||

|

6 City or town, state or province, country, and ZIP or foreign postal code |

|

|

|

|

7 Citizenship (see instructions) |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

||||||

Information |

8 |

If the donor died during the year, check here ▶ |

and enter date of death |

, |

|

. |

Yes |

No |

||||||||

9 |

If you extended the time to file this Form 709, check here ▶ |

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|||||||

|

10 |

Enter the total number of donees listed on Schedule A. Count each person only once ▶ |

|

|

|

|

||||||||||

|

11a |

Have you (the donor) previously filed a Form 709 (or |

|

|

||||||||||||

|

b |

Has your address changed since you last filed Form 709 (or |

. . . . . . . . . . . . . . . . |

|

|

|||||||||||

12 |

Gifts by husband or wife to third parties. Do you consent to have the gifts (including |

|

|

|||||||||||||

|

|

|

||||||||||||||

|

|

by you and by your spouse to third parties during the calendar year considered as made |

|

|

||||||||||||

|

|

instructions.) (If the answer is “Yes,” the following information must be furnished and your spouse must sign the consent |

|

|

||||||||||||

|

|

shown below. If the answer is “No,” skip lines |

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Part |

13 |

Name of consenting spouse |

|

|

|

|

|

|

14 SSN |

|

|

|

|

|||

15 |

Were you married to one another during the entire calendar year? See instructions |

|

|

|||||||||||||

|

|

|

||||||||||||||

|

16 |

If line 15 is “No,” check whether |

married |

divorced or |

widowed/deceased, and give date. See instructions ▶ |

|

|

|

|

|||||||

|

17 |

Will a gift tax return for this year be filed by your spouse? If “Yes,” mail both returns in the same envelope |

|

|

||||||||||||

18Consent of Spouse. I consent to have the gifts (and

Consenting spouse’s signature ▶ |

Date ▶ |

19Have you applied a DSUE amount received from a predeceased spouse to a gift or gifts reported on this or a previous Form

709? If “Yes,” complete Schedule C . . . . . . . . . . . . . . . . . . . . . . . . . .

|

|

|

1 |

Enter the amount from Schedule A, Part 4, line 11 |

. . . |

|

1 |

|

|

|

|||||||

|

|

|

2 |

Enter the amount from Schedule B, line 3 |

. . . |

|

2 |

|

|

|

|||||||

|

|

|

3 |

Total taxable gifts. Add lines 1 and 2 |

. . . |

|

3 |

|

|

|

|||||||

|

|

|

4 |

Tax computed on amount on line 3 (see Table for Computing Gift Tax in instructions) . . . |

. . . |

|

4 |

|

|

|

|||||||

|

|

|

5 |

Tax computed on amount on line 2 (see Table for Computing Gift Tax in instructions) . . . |

. . . |

|

5 |

|

|

|

|||||||

|

|

Computation |

6 |

Balance. Subtract line 5 from line 4 |

. . . |

|

6 |

|

|

|

|||||||

|

|

7 |

Applicable credit amount. If donor has DSUE amount from predeceased spouse(s) or Restored Exclusion |

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

Amount, enter amount from Schedule C, line 5; otherwise, see instructions |

. . . |

|

7 |

|

|

|

|||||||

|

|

|

8 |

Enter the applicable credit against tax allowable for all prior periods (from Sch. B, line 1, col. C) |

. . . |

|

8 |

|

|

|

|||||||

|

|

|

9 |

Balance. Subtract line 8 from line 7. Do not enter less than zero |

. . . |

|

9 |

|

|

|

|||||||

|

|

|

10 |

Enter 20% (0.20) of the amount allowed as a specific exemption for gifts made after September 8, 1976, |

|

|

|

|

|

||||||||

|

|

|

and before January 1, 1977. See instructions |

. . . |

|

10 |

|

|

|

||||||||

|

|

11 |

Balance. Subtract line 10 from line 9. Do not enter less than zero |

. . . |

|

11 |

|

|

|

||||||||

|

|

|

|

|

|

|

|||||||||||

|

|

|

12 |

Applicable credit. Enter the smaller of line 6 or line 11 |

. . . |

|

12 |

|

|

|

|||||||

|

|

Part |

13 |

Credit for foreign gift taxes (see instructions) |

. . . |

|

13 |

|

|

|

|||||||

|

|

14 |

Total credits. Add lines 12 and 13 |

. . . |

|

14 |

|

|

|

||||||||

|

|

|

15 |

Balance. Subtract line 14 from line 6. Do not enter less than zero |

. . . |

|

15 |

|

|

|

|||||||

here. |

|

16 |

. . . |

|

16 |

|

|

|

|||||||||

|

17 |

Total tax. Add lines 15 and 16 |

. . . |

|

17 |

|

|

|

|||||||||

|

|

|

|

|

|

|

|||||||||||

order |

|

18 |

Gift and |

. . . |

|

18 |

|

|

|

||||||||

|

19 |

If line 18 is less than line 17, enter balance due. See instructions |

. . . |

|

19 |

|

|

|

|||||||||

|

|

|

|

|

|

|

|||||||||||

money |

|

|

20 |

If line 18 is greater than line 17, enter amount to be refunded |

. . . |

|

20 |

|

|

|

|||||||

|

|

|

|

Under penalties of perjury, I declare that I have examined this return, including any accompanying schedules and statements, and to the best of my |

|||||||||||||

|

|

|

|

|

|||||||||||||

|

|

|

|

|

knowledge and belief, it is true, correct, and complete. Declaration of preparer (other than donor) is based on all information of which preparer has |

||||||||||||

|

|

Sign |

|

any knowledge. |

|

|

|

|

|

|

|

|

|

|

|

||

or |

|

|

|

|

|

|

|

|

May the IRS discuss this return |

||||||||

Here |

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

with the preparer shown below? |

|||||||||

check |

|

|

|

|

|

|

|

|

|||||||||

|

|

|

▲ |

|

|

|

|

|

|

See instructions. Yes |

No |

||||||

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

Signature of donor |

|

Date |

|

|

|

|

|

|

|

|

||||

Attach |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Paid |

|

Print/Type preparer’s name |

Preparer’s signature |

|

Date |

|

Check |

|

if |

PTIN |

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

Preparer |

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

Firm’s name ▶ |

|

|

|

|

|

Firm’s EIN ▶ |

|

|

|||||||

|

|

Use Only |

|

|

|

|

|

|

|

||||||||

|

|

Firm’s address ▶ |

|

|

|

|

|

Phone no. |

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

||||||

For Disclosure, Privacy Act, and Paperwork Reduction Act Notice, see the instructions for this form. |

Cat. No. 16783M |

Form 709 (2020) |

|||||||||||||||

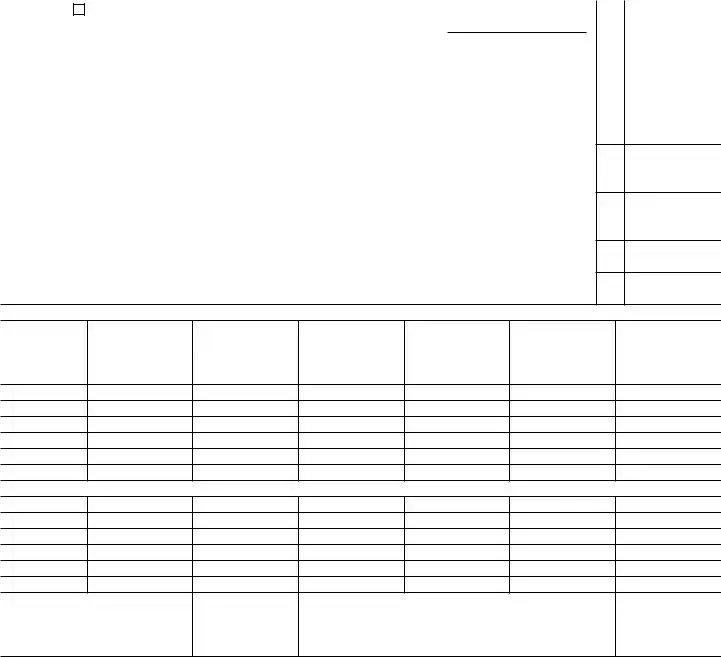

Form 709 (2020) |

Page 2 |

|

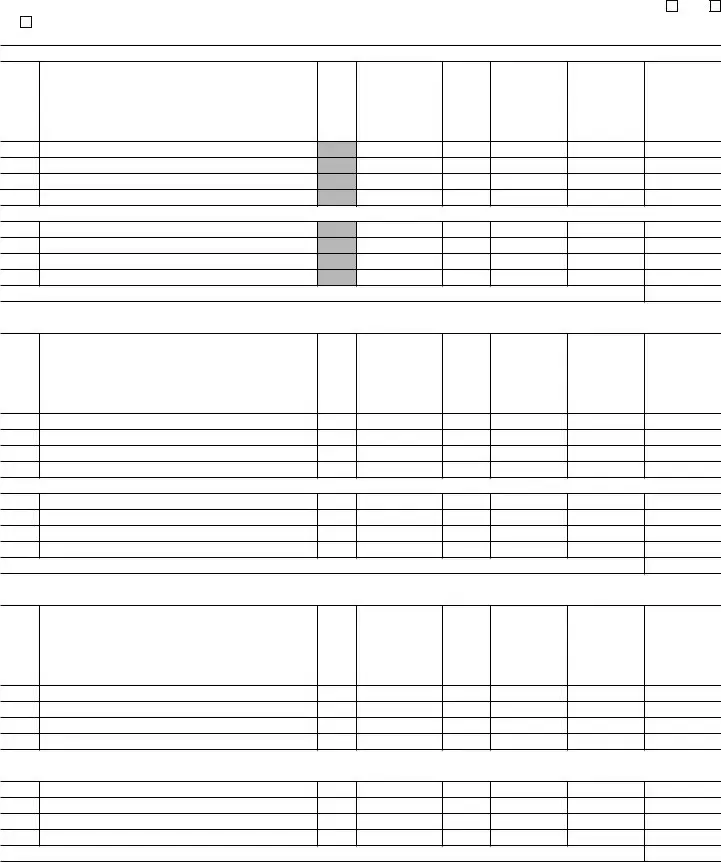

SCHEDULE A |

Computation of Taxable Gifts (Including transfers in trust) (see instructions) |

|

A Does the value of any item listed on Schedule A reflect any valuation discount? If “Yes,” attach explanation . . . . . . Yes |

No |

|

B

◀Check here if you elect under section 529(c)(2)(B) to treat any transfers made this year to a qualified tuition program as made ratably over a

Part

A |

B |

C |

D |

E |

F |

G |

H |

Item |

• Donee’s name and address |

|

Donor’s adjusted |

Date |

Value at |

For split gifts, |

Net transfer |

number |

• Relationship to donor (if any) |

|

basis of gift |

of gift |

date of gift |

enter 1/2 of |

(subtract col. G |

|

• Description of gift |

|

|

|

|

column F |

from col. F) |

|

• If the gift was of securities, give CUSIP no. |

|

|

|

|

|

|

|

• If closely held entity, give EIN |

|

|

|

|

|

|

1

Gifts made by

Total of Part 1. Add amounts from Part 1, column H . . . . . . . . . . . . . . . . . . . . . . ▶

Part

A |

B |

C |

D |

E |

F |

G |

H |

Item |

• Donee’s name and address |

2632(b) |

Donor’s adjusted |

Date |

Value at |

For split gifts, |

Net transfer |

number |

• Relationship to donor (if any) |

election |

basis of gift |

of gift |

date of gift |

enter 1/2 of |

(subtract col. G |

|

• Description of gift |

out |

|

|

|

column F |

from col. F) |

|

• If the gift was of securities, give CUSIP no. |

|

|

|

|

|

|

|

• If closely held entity, give EIN |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gifts made by |

|

|

|||||

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total of Part 2. Add amounts from Part 2, column H |

. . . ▶ |

|

|||||

Part

A |

B |

C |

D |

E |

F |

G |

H |

Item |

• Donee’s name and address |

2632(c) |

Donor’s adjusted |

Date |

Value at |

For split gifts, |

Net transfer |

number |

• Relationship to donor (if any) |

election |

basis of gift |

of gift |

date of gift |

enter 1/2 of |

(subtract col. G |

|

• Description of gift |

|

|

|

|

column F |

from col. F) |

|

• If the gift was of securities, give CUSIP no. |

|

|

|

|

|

|

|

• If closely held entity, give EIN |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1 |

|

|

|

|

|

|

|

Gifts made by

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total of Part 3. Add amounts from Part 3, column H |

▶ |

|

||||||

(If more space is needed, attach additional statements.) |

|

Form 709 (2020) |

||||||

Form 709 (2020) |

Page 3 |

|

Part |

|

|

1 |

Total value of gifts of donor. Add totals from column H of Parts 1, 2, and 3 |

1 |

2 |

Total annual exclusions for gifts listed on line 1 (see instructions) |

2 |

3 |

Total included amount of gifts. Subtract line 2 from line 1 |

3 |

Deductions (see instructions) |

|

|

4Gifts of interests to spouse for which a marital deduction will be claimed, based on item

|

numbers |

of Schedule A |

|

4 |

|

|

5 |

Exclusions attributable to gifts on line 4 . . |

. . . . . . . . . . . . |

|

5 |

|

|

6 |

Marital deduction. Subtract line 5 from line 4 . |

. . . . . . . . . . . . |

|

6 |

|

|

7 |

Charitable deduction, based on item numbers |

less exclusions |

|

7 |

|

|

8 |

Total deductions. Add lines 6 and 7 . . . |

. . . . . . . . . . . . |

. . . . . . . . |

|

8 |

|

9 |

Subtract line 8 from line 3 |

. . . . . . . . . . . . |

. . . . . . . . |

|

9 |

|

10 |

|

10 |

||||

11 |

Taxable gifts. Add lines 9 and 10. Enter here and on page 1, Part |

11 |

||||

Terminable Interest (QTIP) Marital Deduction. (See instructions for Schedule A, Part 4, line 4.)

If a trust (or other property) meets the requirements of qualified terminable interest property under section 2523(f), and: a. The trust (or other property) is listed on Schedule A; and

b. The value of the trust (or other property) is entered in whole or in part as a deduction on Schedule A, Part 4, line 4, then the donor shall be deemed to have made an election to have such trust (or other property) treated as qualified terminable interest property under section 2523(f).

If less than the entire value of the trust (or other property) that the donor has included in Parts 1 and 3 of Schedule A is entered as a deduction on line 4, the donor shall be considered to have made an election only as to a fraction of the trust (or other property). The numerator of this fraction is equal to the amount of the trust (or other property) deducted on Schedule A, Part 4, line 6. The denominator is equal to the total value of the trust (or other property) listed in Parts 1 and 3 of Schedule A.

If you make the QTIP election, the terminable interest property involved will be included in your spouse’s gross estate upon his or her death (section 2044). See instructions for line 4 of Schedule A. If your spouse disposes (by gift or otherwise) of all or part of the qualifying life income interest, he or she will be considered to have made a transfer of the entire property that is subject to the gift tax. See Transfer of Certain Life Estates Received From Spouse in the instructions.

12Election Out of QTIP Treatment of Annuities

◀ Check here if you elect under section 2523(f)(6) not to treat as qualified terminable interest property any joint and survivor annuities that are reported on Schedule A and would otherwise be treated as qualified terminable interest property under section 2523(f). See instructions. Enter the item numbers from Schedule A for the annuities for which you are making this election ▶

◀ Check here if you elect under section 2523(f)(6) not to treat as qualified terminable interest property any joint and survivor annuities that are reported on Schedule A and would otherwise be treated as qualified terminable interest property under section 2523(f). See instructions. Enter the item numbers from Schedule A for the annuities for which you are making this election ▶

SCHEDULE B Gifts From Prior Periods

If you answered “Yes” on line 11a of page 1, Part 1, see the instructions for completing Schedule B. If you answered “No,” skip to the Tax Computation on page 1 (or Schedule C or D, if applicable). Complete Schedule A before beginning Schedule B. See instructions for recalculation of the column C amounts. Attach calculations.

A

Calendar year or calendar quarter (see instructions)

B

Internal Revenue office

where prior return was filed

C |

D |

Amount of applicable |

Amount of specific |

credit (unified credit) |

exemption for prior |

against gift tax |

periods ending before |

for periods after |

January 1, 1977 |

December 31, 1976 |

|

E

Amount of

taxable gifts

1 |

Totals for prior periods |

1 |

|

|

2 |

Amount, if any, by which total specific exemption, line 1, column D, is more than $30,000 |

. . . . . . . |

2 |

|

3Total amount of taxable gifts for prior periods. Add amount on line 1, column E, and amount, if any, on line 2. Enter

here and on page 1, Part |

3 |

(If more space is needed, attach additional statements.) |

Form 709 (2020) |

Form 709 (2020) |

Page 4 |

SCHEDULE C Deceased Spousal Unused Exclusion (DSUE) Amount and Restored Exclusion

Provide the following information to determine the DSUE amount and applicable credit received from prior spouses. Complete Schedule A before beginning Schedule C.

A |

B |

|

C |

D |

E |

F |

|

Name of deceased spouse |

Date of death |

Portability election |

If “Yes,” DSUE |

DSUE amount applied |

Date of gift(s) |

||

(dates of death after December 31, 2010, only) |

|

|

made? |

amount received |

by donor to lifetime |

(enter as mm/dd/yy |

|

|

|

|

|

|

from spouse |

gifts (list current |

for Part 1 and as |

|

|

Yes |

|

No |

|

and prior gifts) |

yyyy for Part 2) |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

Part |

|

|

|

|

|

||

Part

TOTAL (for all DSUE amounts applied from column E for Part 1 and Part 2) . . . . . . . . . ▶

1 |

Donor’s basic exclusion amount (see instructions) |

2 |

Total from column E, Parts 1 and 2 |

3 |

Restored Exclusion Amount (see instructions) |

4 |

Add lines 1, 2, and 3 |

5Applicable credit on amount in line 4 (see Table for Computing Gift Tax in the instructions). Enter here and on line 7,

Part

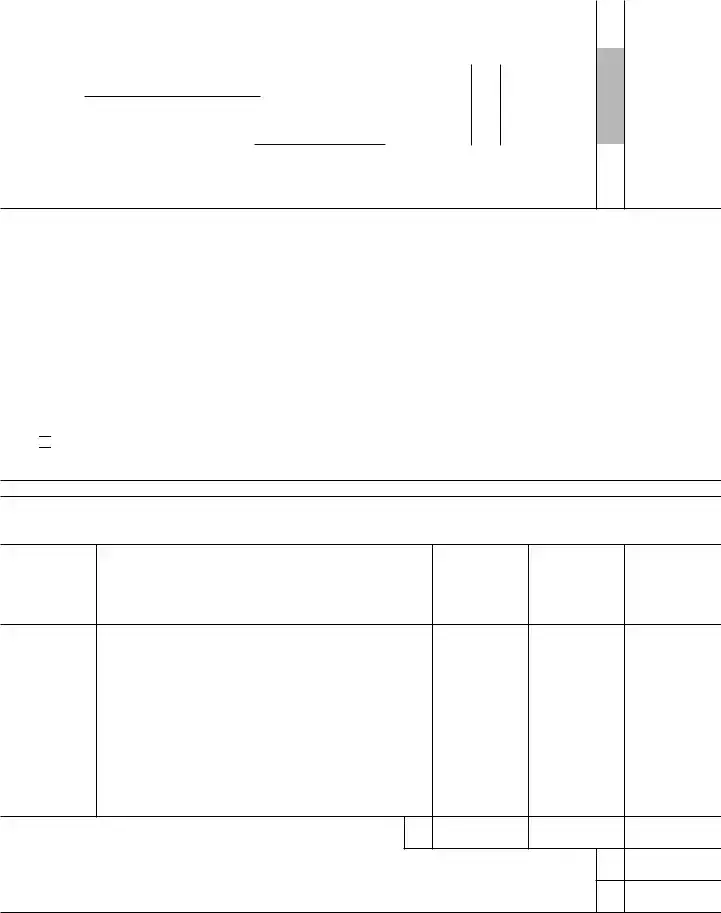

SCHEDULE D Computation of

1

2

3

4

5

Note: Inter vivos direct skips that are completely excluded by the GST exemption must still be fully reported (including value and exemptions claimed) on Schedule D.

Part

A |

B |

C |

D |

E |

Item number |

Description |

Value |

Nontaxable |

Net transfer |

(from Schedule A, |

(only for ETIP transfers) |

(from Schedule A, |

portion of transfer |

(subtract col. D |

Part 2, col. A, then |

|

Part 2, col. H, |

|

from col. C) |

ETIP transfers, |

|

or close of ETIP |

|

|

if any) |

|

described in col. B) |

|

|

1

Gifts made by spouse (for gift splitting only)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(If more space is needed, attach additional statements.) |

|

|

Form 709 (2020) |

|

Form 709 (2020) |

|

|

Page 5 |

|

Part |

|

|||

Check here ▶ |

if you are making a section 2652(a)(3) (special QTIP) election. See instructions. |

|

||

Enter the item numbers from Schedule A of the gifts for which you are making this election ▶ |

|

|||

1 |

Maximum allowable exemption (see instructions) |

. . . . . . . . . . . . . . . . . . . |

1 |

|

2 |

Total exemption used for periods before filing this return |

2 |

||

3 |

Exemption available for this return. Subtract line 2 from line 1 |

3 |

||

4 |

Exemption claimed on this return from Part 3, column C, total below |

4 |

||

5Automatic allocation of exemption to transfers reported on Schedule A, Part 3. To opt out of the automatic

allocation rules, you must attach an “Election Out” statement. See instructions |

5 |

6Exemption allocated to transfers not shown on line 4 or line 5 above. You must attach a “Notice of Allocation.”

|

See instructions |

6 |

|

7 |

Add lines 4, 5, and 6 |

7 |

|

8 |

Exemption available for future transfers. Subtract line 7 from line 3 |

8 |

|

Part

A |

B |

C |

D |

E |

F |

G |

Item number |

Net transfer |

GST exemption |

Divide col. C |

Inclusion ratio |

Applicable rate |

|

(from Schedule D, |

(from Schedule D, |

allocated |

by col. B |

(Subtract col. D |

(multiply col. E |

transfer tax |

Part 1) |

Part 1, col. E) |

|

|

from 1.000) |

by 40% (0.40)) |

(multiply col. B |

|

|

|

|

|

|

by col. F) |

1

Gifts made by spouse (for gift splitting only)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total exemption claimed. Enter here |

|

Total |

|

|||

and on Part 2, line 4, above. May not |

|

3, Schedule A, Part 4, line 10; and on page 1, Part |

|

|||

exceed Part 2, line 3, above . . . |

|

Computation, line 16 |

|

|||

|

|

|

|

|

|

|

(If more space is needed, attach additional statements.) |

|

|

|

Form 709 (2020) |

||

Document Specifics

| Fact Name | Description |

|---|---|

| Purpose of Form 709 | The IRS Form 709 is used to report gifts that exceed the annual exclusion amount, ensuring that any gift tax owed is properly accounted for. |

| Annual Exclusion | For 2023, the annual exclusion amount is $16,000 per recipient. This means that gifts up to this amount can be given without needing to file Form 709. |

| Lifetime Exemption | Form 709 also applies to the Unified Credit against Estate Tax, offering a lifetime exemption amount. This exemption allows individuals to give gifts up to a certain total over their lifetime before owing taxes. |

| Spouses and Gifting | Spouses can combine their annual exclusions to double the amount they can give tax-free to a single recipient. This is known as gift splitting and requires consent by both spouses on a filed Form 709. |

| Governing Laws | Form 709 is governed by federal law, specifically the IRS tax code. There are no state-specific versions of Form 709, as gift and estate taxes are federally regulated. |

Guide to Writing IRS 709

Filling out the IRS Form 709 might seem daunting at first, but it's a straightforward process once you understand the steps involved. This form is essential for reporting gifts that exceed the annual exclusion limit, ensuring that everyone pays their fair share. By carefully following the instructions step by step, you can complete the form accurately and avoid potential issues down the road. Remember, the goal is to provide clear, truthful information about any significant gifts, helping to maintain the integrity of the tax system.

- Start by gathering all necessary information related to the gifts you have made during the year. This includes the dates of the gifts, the values of each gift at the time they were given, and the recipients' details.

- Download the most current version of IRS Form 709 from the Internal Revenue Service website to ensure you are using the correct form for the tax year you are reporting.

- Enter your personal information at the top of the form, including your name, address, and Social Security Number (SSN). If you are married and choose to split gifts with your spouse, you'll need their information as well.

- Determine which gifts exceed the annual exclusion limit. For the year you're reporting, find out what the annual exclusion amount is, as it can change from year to year.

- For each gift that exceeds the exclusion limit, list the recipient's name, the date the gift was made, and the gift's value in the sections provided on the form. Make sure to list each gift separately and accurately.

- Calculate the total value of the gifts that exceeded the annual exclusion limit and enter this total in the designated area on the form.

- If applicable, complete the schedule for taxable gifts using the information from prior years' Form 709s. This is necessary to accurately calculate your lifetime gift and estate tax exclusion.

- Complete any applicable sections regarding the GST (Generation-Skipping Transfer) tax if you made gifts to someone two or more generations below you, such as a grandchild.

- Sign and date the form. If you're filing jointly with your spouse, make sure they sign and date the form as well.

- Review the form to ensure that all information is accurate and complete. Missing or incorrect information can lead to delays or potential penalties.

- Mail the completed form to the IRS at the address provided in the form's instructions. Make sure to keep a copy of the form for your records.

Once you've mailed in your Form 709, you've completed your responsibility for reporting high-value gifts for that tax year. The IRS may contact you if they need more information or to clarify any details. Remember, it's better to accurately report gifts using Form 709 than to face penalties later for not reporting. Staying organized and keeping detailed records can make this process smoother for future tax years.

Understanding IRS 709

-

What is the IRS 709 form used for?

The IRS Form 709 is used to report gifts that exceed the annual exclusion limit and is required for an individual to report transfers of property or money. It plays a crucial role in the United States tax system, as it allows the Internal Revenue Service (IRS) to keep track of a person's lifetime exemption from the federal gift and estate tax. Gifts that require reporting include monetary gifts, the sale of property below its market value, or an interest-free or reduced-interest loan.

-

Who needs to file IRS Form 709?

IRS Form 709 must be filed by any individual who gives a gift to another person that exceeds the annual exclusion limit for that year. As of the last update, the annual exclusion limit is $15,000 per recipient. This means if you give more than this amount to any one person in a given year, you are required to file Form 709. Additionally, if you split gifts with your spouse, you both may be required to file this form, even if the individual gifts did not exceed the limit when split.

-

When is IRS Form 709 due?

The due date for filing IRS Form 709 is April 15th of the year following the year in which the gifts were made. If this date falls on a weekend or a legal holiday, the deadline is extended to the next business day. It's important to note that an extension of time to file your income tax return does not extend the time to file your gift tax return. However, you can request a six-month extension for the gift tax return by using Form 8892.

-

Does filing IRS Form 709 mean I will have to pay taxes?

Filing IRS Form 709 does not necessarily mean that you will owe gift taxes. The form is used to track amounts against your lifetime exemption from the federal estate and gift tax. For most people, the gifts they give during their lifetime will not exceed the lifetime exemption amount, which is significantly higher than the annual exclusion limit. Taxes are typically only owed if your cumulative gifts exceed the lifetime exemption. Even if you must file Form 709, you might not necessarily owe any taxes due to these exemptions.

Common mistakes

Filing IRS Form 709, the United States Gift (and Generation-Skipping Transfer) Tax Return, can be a perplexing task fraught with potential for error. This form is instrumental in reporting gifts that exceed the annual exclusion limit, thereby ensuring compliance with tax regulations. Recognizing and avoiding common mistakes can streamline the filing process, ensuring accuracy and preventing unnecessary scrutiny. Below are seven frequent errors individuals make when completing this form.

Not understanding the need to file Form 709 for gifts above the annual exclusion amount. Many individuals are unaware that any gift given to a single recipient, exceeding the annual exclusion limit (which is adjusted periodically for inflation), necessitates the filing of Form 709. This misunderstanding often results in failure to file.

Failing to aggregate gifts to the same person that cumulatively exceed the exclusion amount. Gifts to a single person, when added together within the calendar year, may surpass the threshold for required reporting, a detail often overlooked.

Omitting information about previous gifts. The form requires a history of past gifts as they affect the lifetime exemption amount. Leaving this information out can misrepresent one's tax liability.

Incorrectly splitting gifts between spouses. Couples can combine their exclusions to effectively double the amount they can gift tax-free. However, this requires both spouses to consent by filing Form 709, an action sometimes forgotten or executed improperly.

Miscalculating deductions for gifts that qualify for educational or medical exclusions. Payments made directly to an educational institution for someone else's tuition or to a healthcare provider for someone else's medical expenses do not count against the annual exclusion limit but need to be documented correctly.

Missing the deadline for filing, which is April 15 following the year in which the gift was made. An extension for filing can be requested, but many fail to realize this option or remember the deadline.

Attempting to navigate complex scenarios without professional advice. People often underestimate the complexity of their gifting strategy, particularly when dealing with gifts to trusts or minors. Missteps in such situations can lead to erroneous filings or unintended tax consequences.

Understanding these pitfalls and proceeding with caution or seeking guidance can make the process of filing Form 709 less daunting and help ensure compliance with federal gift tax regulations.

Documents used along the form

The IRS Form 709 is crucial in the landscape of gift and generation-skipping transfer (GST) taxes, serving as the United States Gift (and Generation-Skipping Transfer) Tax Return. It is a vehicle through which individuals report gifts that exceed the annual exclusion amount, ensuring compliance with federal tax obligations. However, navigating the complexities of gift and estate planning often requires more than this single form. Several additional documents and forms may be utilized to provide a comprehensive view of an individual's financial and estate planning situation, ensuring adherence to all applicable laws and maximizing tax benefits. Below is a list of other forms and documents frequently used alongside IRS Form 709.

- IRS Form 1040: The U.S. Individual Income Tax Return is often necessary alongside Form 709 to report any income that might affect the taxpayer's overall financial situation, including any gifts that produce income.

- IRS Form 706: This is the United States Estate (and Generation-Skipping Transfer) Tax Return, required for estates that exceed the federal estate tax exemption amount. It is often prepared in conjunction with Form 709 when coordinating estate and gift tax strategies.

- IRS Form 1041: The U.S. Income Tax Return for Estates and Trusts is needed for any estate or trust generating income. It complements Form 709 when trusts or estates are part of the gifting strategy.

- IRS Form 8839: Qualified Adoption Expenses form is crucial for individuals who have adopted a child and wish to document any related expenses, which may include gifts to agencies or caretakers.

- Schedule A: Itemized Deductions are often considered in conjunction with Form 709, especially if the taxpayer is making charitable gifts that might impact their taxable estate.

- IRS Form 2848: Power of Attorney and Declaration of Representative allows individuals to authorize someone else, often a tax professional, to handle their tax matters, including filing Form 709.

- IRS Form 4506: Request for Copy of Tax Return may be necessary if the taxpayer needs to reference past tax returns while preparing their current Form 709.

- IRS Form 8821: Tax Information Authorization permits someone other than the taxpayer to request and inspect confidential tax information, useful when coordinating with financial or estate planners on gifting strategies.

In essence, while the IRS Form 709 is a key element in reporting significant gifts and transfers for tax purposes, it often does not stand alone. A thorough approach to estate and gift planning may require the support of additional forms and documents to ensure compliance and optimize tax strategies. Taxpayers should consider their entire financial picture, including income, potential estate taxes, and any special circumstances such as adoption, when planning gifts and transfers. Consulting with a tax professional can provide guidance tailored to an individual’s unique situation.

Similar forms

The IRS 709 form, a crucial document for those involved in the gifting of assets or transferring wealth, shares similarities with several other key documents within the tax and estate planning landscape. One notable document with which Form 709 shares attributes is the IRS Form 1040, the standard tax return for individuals. Both forms are integral to personal financial reporting and tax computation. Whereas Form 709 is used to report gifts that exceed the annual exclusion limit, thereby affecting one's lifetime estate and gift tax exemption, Form 1040 encompasses the broader spectrum of personal income taxation. Each form, in its respective capacity, requires detailed financial information that contributes to the calculation of taxes owed or the acknowledgment of gifts given.

Another document akin to IRS Form 709 is the IRS Form 706, which is used for reporting the estate of a deceased person. While Form 709 is concerned with gifts given during one's lifetime, Form 706 deals with the transfer of the deceased's estate above certain thresholds. Both of these forms are instrumental in the administration of federal transfer taxes and serve as key components in estate planning and the intergenerational transfer of wealth. They require the declarer to provide comprehensive details about the value of the transferred assets to ensure compliance with tax obligations.

The IRS Form 3520, Annual Return To Report Transactions With Foreign Trusts and Receipt of Certain Foreign Gifts, also shares commonalities with Form 709. This form is utilized for reporting significant transactions with foreign trusts and the receipt of large gifts from non-resident aliens or foreign estates. Similar to Form 709, Form 3520 ensures compliance with U.S. tax laws regarding the international transfer of wealth. Both documents play a critical role in the global movement of assets, demanding meticulous record-keeping and reporting to the IRS to prevent tax evasion and to maintain transparent financial transactions.

Lastly, IRS Form 4506, Request for Copy of Tax Return, while serving a different primary function, relates to Form 709 in terms of the broader tax documentation and compliance framework. Form 4506 is used to request a copy of a previously filed tax return, which can include a range of forms such as Form 709, 1040, or 706. Individuals might need to access these documents for a variety of reasons, including legal proceedings, financial planning, or further compliance checks. The relationship between these forms highlights the interconnectedness of various tax documents and the importance of maintaining detailed financial records for both current and future needs.

Dos and Don'ts

When it comes to filling out the IRS Form 709, United States Gift (and Generation-Skipping Transfer) Tax Return, there are several do's and don'ts to keep in mind. This form is used to report gifts that exceed the annual exclusion limit and is a critical element of your tax documentation. Here’s a helpful list to guide you through the process:

Do's:

- Always check the IRS website for the most current version of Form 709. Tax laws and forms can change, and using the latest version ensures compliance.

- Read the instructions carefully before you start to fill out the form. Understanding the instructions can help prevent errors and save time.

- Include all necessary documentation, such as appraisals for gifts of property, to support the values you report on the form.

- Use black ink and clear handwriting if you are filling out the form by hand. This makes your submission easier to read and process.

- Double-check your math and the information provided to ensure accuracy. Mistakes can lead to delays or audits.

- Consider seeking assistance from a tax professional if you are unsure about how to report certain gifts or calculate the tax. Professional guidance can help avoid mistakes.

- Make a copy of the completed form and all supporting documents for your records before submitting everything to the IRS.

Don'ts:

- Don't wait until the last minute to start preparing your Form 709. Adequate preparation time reduces the risk of errors.

- Don't overlook the annual exclusion. Gifts below a certain threshold may not need to be reported, so familiarize yourself with the current limits.

- Don't forget to sign and date the form. An unsigned form is considered incomplete and will not be processed.

- Don't ignore IRS notices regarding your Form 709. If the IRS contacts you with questions or requests for additional information, respond promptly.

- Don't underestimate the value of gifts of property. It's important to provide an accurate valuation to ensure correct tax reporting.

- Don't attempt to hide or underreport gifts. The penalties for doing so can be severe.

- Don't use pencil or non-permanent ink if filling out the form by hand. The IRS requires submissions to be completed in a permanent medium to prevent alterations.

Misconceptions

Understanding the IRS Form 709, also known as the United States Gift (and Generation-Skipping Transfer) Tax Return, is crucial for effectively navigating gift taxes in the U.S. Unfortunately, there are several misconceptions about this form that can lead to confusion. Here are eight of those misconceptions explained:

Only cash gifts require reporting. This is not true. All gifts of value, including property or stocks, need to be reported if they exceed the annual exclusion limit.

Gifts to family members do not count. Regardless of who receives the gift, if its value exceeds the annual exclusion amount, it must be reported. Family relationships do not exempt one from this requirement.

Filing Form 709 means you'll always pay taxes. Filing Form 709 does not necessarily result in a tax bill. It's primarily for reporting purposes. Taxes are only due if your lifetime gift and estate tax exemption amount is exceeded.

You must file Form 709 every year you give a gift. You're only required to file Form 709 in years when you give gifts that exceed the annual exclusion limit.

Each couple can double the gift exclusion limit. While true that a married couple can effectively double the exclusion limit through gift-splitting, it requires both spouses to consent to split the gift on Form 709, making both parties responsible for the gift for tax purposes.

Gifts to spouses are always exempt. While most gifts to your spouse are exempt from the gift tax, there are exceptions, especially if your spouse is not a U.S. citizen. In such cases, a higher annual exclusion limit applies, but it's not unlimited.

The annual gift tax exclusion applies per gift. The annual exclusion limit actually applies per recipient, not per gift. This means you can give multiple gifts to the same person up to the exclusion limit without having to file Form 709.

If you don't owe tax, you don't need to keep records. Keeping thorough records of all gifts made above or below the exclusion limit is crucial. Should the IRS question your past gifts or your filed Form 709, having detailed records can be invaluable.

It’s essential to dispel these misconceptions to ensure you're complying with the tax laws and making the most of the gift and estate tax provisions available to you. When in doubt, consulting with a tax professional can provide clarity and help avoid any costly mistakes.

Key takeaways

The IRS 709 form, officially known as the United States Gift (and Generation-Skipping Transfer) Tax Return, plays a crucial role in the context of gift taxation in the United States. When individuals give gifts that exceed the annual exemption limit, they may need to file this form. Here are key takeaways to ensure accurate completion and use of the IRS 709 form:

- Determine the Need to File: Not everyone needs to file Form 709. You are required to file if you give gifts to one person that exceed the annual exclusion limit ($15,000 for 2022, subject to indexing for inflation) within a single year.

- Understand What Counts as a Gift: A gift can be any transfer of property or assets where you receive nothing or less than the full value in return. This includes cash, stocks, real estate, and even interest-free or below-market-interest-rate loans.

- Annual Exclusion: The IRS allows each individual to give a certain amount to as many people as they like without needing to file Form 709. This amount is subject to change, so always check the current year's exclusion limit. However, gifts to your spouse or to a political organization for its use, and tuition or medical expenses you pay for someone else do not count against the annual limit.

- Lifetime Exemption: In addition to the annual exclusion, there's also a lifetime exemption that applies to the aggregate of all gifts exceeding the annual exclusion limits and the estate value upon death. The amount of the lifetime exemption also changes periodically.

- Gift Splitting: Married couples have the option to split gifts. This strategy allows a couple to double the annual exclusion amount to any one recipient. However, both spouses must agree to gift split and must file a Form 709, even if only one spouse made the actual gift.

- Fill Out the Form Accurately: The IRS 709 form requires detailed information about each gift given over the annual exclusion, including the recipient's name, the gift's value, and the date of the gift. Any documentation that can support the value of the gift should be kept in case of an audit.

- Pay Attention to Deadlines: The Form 709 is generally due on April 15 of the year following the year in which the taxable gifts were made. If you file for an extension on your income tax returns, the deadline for your Form 709 is also extended.

- Consider Professional Advice: The rules surrounding gift taxes can be complex, especially when dealing with large sums or special circumstances (such as gifts to trusts). Consulting with a tax professional can help avoid mistakes and ensure that you are taking advantage of all available exclusions and exemptions.

Filling out and using the IRS 709 form correctly is essential for complying with tax laws while taking full advantage of gift tax exclusions and exemptions. Whether you are gifting large sums of money, valuable assets, or planning for the future, understanding how to properly document these transactions will serve you well.

Popular PDF Documents

IRS 8880 - Filing form 8880 can potentially lower the amount of tax owed to the IRS by the filer.

Philhealth Online Payment Gcash - PhilHealth's decision to make the PPPS freely downloadable showcases a commitment to transparency and ease of use in healthcare financial dealings.

Can You Change Your Business Address - Ensure your business complies with local tax laws by updating your location details when needed.