Get Irs 706 Na Form

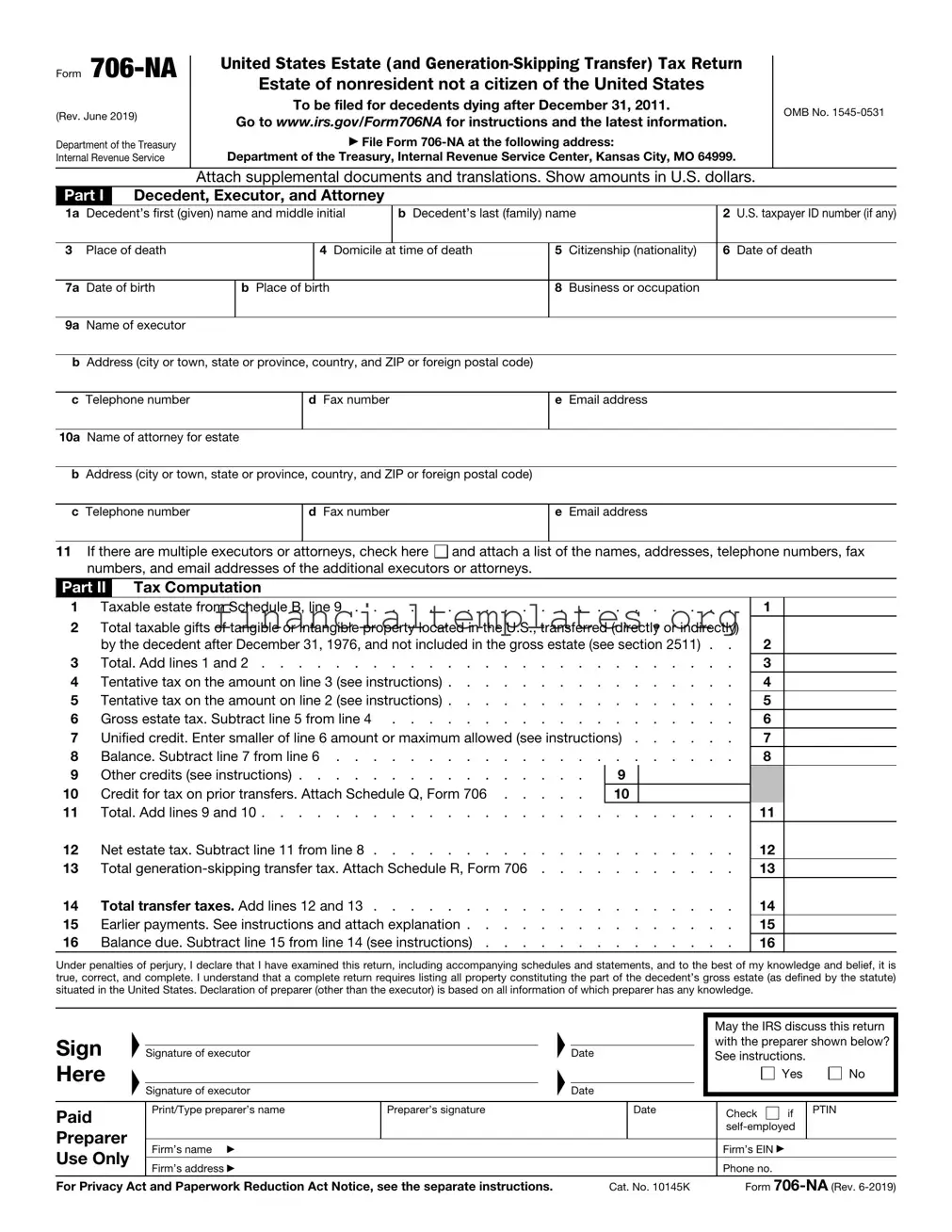

Grasping the complexity of international tax obligations involves navigating forms like the IRS 706-NA, pivotal for estates of non-residents not holding U.S. citizenship, especially pertinent for those passing after December 31, 2011. Designed for the United States Estate (and Generation-Skipping Transfer) Tax Return, this document requires meticulous adherence to detail, reporting assets within the U.S. and ensuring compliance with tax laws. It requires filing at the designated Internal Revenue Service Center in Kansas City, MO, and mandates the inclusion of supplementary documents and translations, highlighting the necessity for precision in both information and language. Notably, the form encapsulates various critical segments, from detailing the decedent's personal information, computing the taxable estate, to specifying deductions and credits accordingly. It underscores the importance of accurately documenting the estate's U.S. situs assets, calculating the estate and generation-skipping transfer taxes, and capturing any prepayments or credits towards the estate's tax obligation. By requiring the signatures of executors under oath, it emphasizes the legal accountability in the declaration's accuracy, encompassing a holistic approach to estate tax compliance for non-residents not citizens of the United States.

Irs 706 Na Example

Form

(Rev. June 2019)

Department of the Treasury Internal Revenue Service

United States Estate (and

Estate of nonresident not a citizen of the United States

To be filed for decedents dying after December 31, 2011.

Go to www.irs.gov/Form706NA for instructions and the latest information.

▶File Form

Department of the Treasury, Internal Revenue Service Center, Kansas City, MO 64999.

OMB No.

Attach supplemental documents and translations. Show amounts in U.S. dollars.

Part I |

Decedent, Executor, and Attorney |

|

|

|

|

|

|

|

|

|||||

1a Decedent’s first (given) name and middle initial |

b Decedent’s last (family) name |

|

|

2 U.S. taxpayer ID number (if any) |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||

3 |

Place of death |

|

|

4 Domicile at time of death |

5 Citizenship (nationality) |

6 Date of death |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||

7a Date of birth |

|

b Place of birth |

|

|

8 Business or occupation |

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||

9a Name of executor |

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|||||||

b Address (city or town, state or province, country, and ZIP or foreign postal code) |

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

||||

c Telephone number |

|

d Fax number |

|

|

e Email address |

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|||

10a Name of attorney for estate |

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

||||||||

b Address (city or town, state or province, country, and ZIP or foreign postal code) |

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

||||

c Telephone number |

|

d Fax number |

|

|

e Email address |

|

|

|

||||||

|

|

|

|

|

|

|

|

|

||||||

11 |

If there are multiple executors or attorneys, check here |

and attach a list of the names, addresses, telephone numbers, fax |

||||||||||||

|

numbers, and email addresses of the additional executors or attorneys. |

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|||||

Part II |

Tax Computation |

|

|

|

|

|

|

|

|

|||||

1 |

Taxable estate from Schedule B, line 9 |

. . . . . . . . . |

. |

1 |

|

|||||||||

2 |

Total taxable gifts of tangible or intangible property located in the U.S., transferred (directly or indirectly) |

|

|

|||||||||||

|

by the decedent after December 31, 1976, and not included in the gross estate (see section 2511) . |

. |

2 |

|

||||||||||

3 |

Total. Add lines 1 and 2 |

. . . . . . . . . |

. |

3 |

|

|||||||||

4 |

Tentative tax on the amount on line 3 (see instructions) |

. . . . . . . . . |

. |

4 |

|

|||||||||

5 |

Tentative tax on the amount on line 2 (see instructions) |

. . . . . . . . . |

. |

5 |

|

|||||||||

6 |

Gross estate tax. Subtract line 5 from line 4 |

. . . . . . . . . |

. |

6 |

|

|||||||||

7 |

Unified credit. Enter smaller of line 6 amount or maximum allowed (see instructions) |

. |

7 |

|

||||||||||

8 |

Balance. Subtract line 7 from line 6 |

. . . . . . . . . |

. |

8 |

|

|||||||||

9 |

Other credits (see instructions) |

. . |

9 |

|

|

|

|

|||||||

10 |

Credit for tax on prior transfers. Attach Schedule Q, Form 706 . . . |

. . |

10 |

|

|

|

|

|||||||

11 |

Total. Add lines 9 and 10 |

. . . . . . . . . |

. |

11 |

|

|||||||||

12 |

Net estate tax. Subtract line 11 from line 8 |

. . . . . . . . . |

. |

12 |

|

|||||||||

13 |

Total |

. . . . . . . . . |

. |

13 |

|

|||||||||

14 |

Total transfer taxes. Add lines 12 and 13 |

. . . . . . . . . |

. |

14 |

|

|||||||||

15 |

Earlier payments. See instructions and attach explanation |

. . . . . . . . . |

. |

15 |

|

|||||||||

16 |

Balance due. Subtract line 15 from line 14 (see instructions) . . . . |

. . . . . . . . . |

. |

16 |

|

|||||||||

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my knowledge and belief, it is true, correct, and complete. I understand that a complete return requires listing all property constituting the part of the decedent’s gross estate (as defined by the statute) situated in the United States. Declaration of preparer (other than the executor) is based on all information of which preparer has any knowledge.

Sign |

▲ |

|

|

|

▲ |

Signature of executor |

|

|

|||

Here |

▲ |

|

|

|

▲ |

|

Signature of executor |

|

|

||

Paid |

|

Print/Type preparer’s name |

|

Preparer’s signature |

|

|

|

||||

|

|

|

|

|

|

Preparer |

|

Firm’s name ▶ |

|

|

|

|

|

|

|

||

Use Only |

|

|

|

|

|

|

Firm’s address ▶ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For Privacy Act and Paperwork Reduction Act Notice, see the separate instructions.

|

|

|

May the IRS discuss this return |

||||

|

|

|

with the preparer shown below? |

||||

Date |

|

See instructions. |

|

|

|||

|

|

|

|

|

Yes |

|

No |

Date |

|

|

|

|

|

|

|

|

Date |

|

|

Check |

if |

|

PTIN |

|

|

|

|

||||

|

|

|

|

|

|

||

|

|

|

|

|

|

||

|

|

|

|

Firm’s EIN ▶ |

|

|

|

|

|

|

|

|

|

||

|

|

|

|

Phone no. |

|

|

|

Cat. No. 10145K |

|

|

Form |

||||

Form |

Page 2 |

|

|

|

|

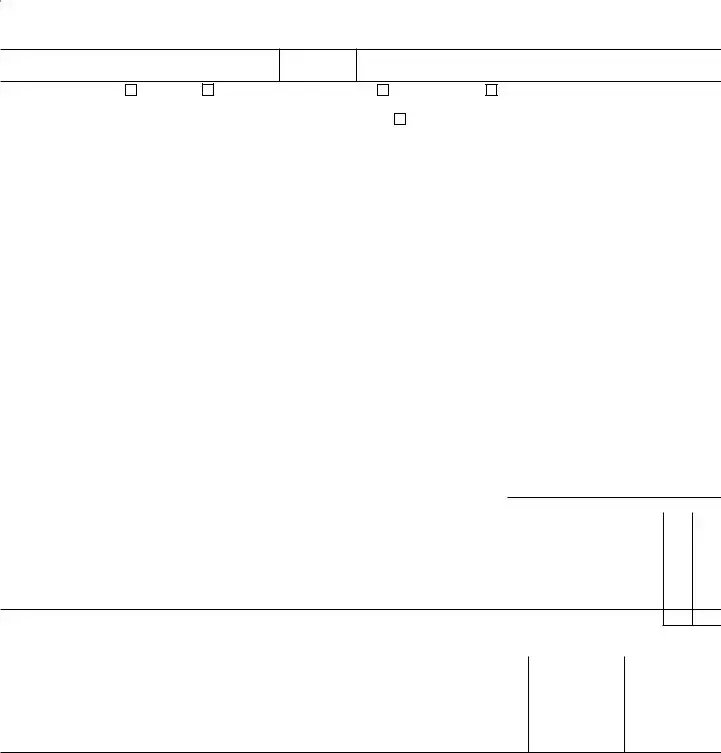

Part III |

General Information |

|

Authorization to receive confidential tax information under Regulations section 601.504(b)(2), to act as the estate’s representative before the IRS, and/or to make written or oral presentations on behalf of the estate:

Name of representative (print or type)

License state

Address (city or town, state or province, country, and ZIP or foreign postal code)

I declare that I am the |

attorney/ |

certified public accountant/ |

enrolled agent/ |

other representative (check the applicable |

box) for the executor. If licensed to practice in the United States, I am not under suspension or disbarment from practice before the Internal

Revenue Service and am qualified to practice in the state shown above. |

If not licensed to practice in the United States, check here. |

||||||||||

Signature |

|

CAF number |

|

Date |

|

Telephone number |

|

||||

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Yes |

No |

|

|

|

|

|

|

Yes |

No |

1a |

Did the decedent die testate? |

|

|

7 |

Did the decedent make any transfer (of |

|

|

||||

b Were letters testamentary or of administration |

|

|

|

property that was located in the United States |

|

|

|||||

|

|

|

at either the time of the transfer or the time of |

|

|

||||||

|

granted for the estate? |

|

|

|

|

|

|||||

|

|

|

|

death) described in section 2035, 2036, 2037, |

|

|

|||||

|

If granted to persons other than those filing the |

|

|

|

|

|

|||||

|

|

|

|

or 2038? See the instructions for Form 706, |

|

|

|||||

|

return, include names and addresses on page 1. |

|

|

|

Schedule G |

|

|

||||

2 |

Did the decedent, at the time of death, own any: |

|

|

|

If “Yes,” attach Schedule G, Form 706. |

|

|

||||

a |

Real property located in the United States? . |

|

|

8 |

At the date of death, were there any trusts in |

|

|

||||

b |

U.S. corporate stock? |

|

|

|

existence that were created by the decedent |

|

|

||||

c |

Debt obligations of (1) a U.S. person; or (2) the |

|

|

|

and that included property located in the |

|

|

||||

|

United States, a state or any political |

|

|

|

United States either when the trust was |

|

|

||||

|

subdivision, or the District of Columbia? . |

|

|

|

created or when the decedent died? . . . |

|

|

||||

d Other property located in the United States? . |

|

|

|

If “Yes,” attach Schedule G, Form 706. |

|

|

|||||

|

|

|

|

|

|||||||

3 |

Was the decedent engaged in business in the |

|

|

9 |

At the date of death, did the decedent: |

|

|

||||

|

United States at the date of death? . . . |

|

|

a |

Have a general power of appointment over |

|

|

||||

4 |

At the date of death, did the decedent have |

|

|

|

any property located in the United States? . |

|

|

||||

|

access, personally or through an agent, to a |

|

|

b |

Or, at any time, exercise or release the power? |

|

|

||||

|

safe deposit box located in the United States? |

|

|

|

If “Yes” to either a or b, attach Schedule H, |

|

|

||||

5 |

At the date of death, did the decedent own |

|

|

|

Form 706. |

|

|

|

|

|

|

|

any property located in the United States as a |

|

|

10a |

Have federal gift tax returns ever been filed? . |

|

|

||||

|

joint tenant with right of survivorship; as a |

|

|

|

|

||||||

|

|

|

b |

Periods covered ▶ |

|

|

|

|

|||

|

tenant by the entirety; or, with surviving |

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

spouse, as community property? . . . . |

|

|

c |

IRS offices where filed ▶ |

|

|

|

|

||

|

If “Yes,” attach Schedule E, Form 706. |

|

|

11 |

Does the gross estate in the United States |

|

|||||

6a |

Had the decedent ever been a citizen or resident |

|

|

|

|||||||

|

|

|

include any interests in property transferred to |

|

|||||||

|

of the United States? See instructions . . . |

|

|

|

a “skip person” as defined in the instructions |

|

|||||

b If “Yes,” did the decedent lose U.S. citizenship or |

|

|

|

for Schedule R of Form 706? |

|

|

|||||

|

residency within 10 years of death? See instructions |

|

|

|

If “Yes,” attach Schedules R and/or |

|

|

||||

Schedule A. Gross Estate in the United States (see instructions) |

|

|

|

|

|

Yes |

No |

||||

Do you elect to value the decedent’s gross estate at a date or dates after the decedent’s death (as authorized by section 2032)? ▶

To make the election, you must check this box ‘‘Yes.’’ If you check ‘‘Yes,’’ complete all columns. If you check ‘‘No,’’ complete columns (a), (b), and (e); you may leave columns (c) and (d) blank or you may use them to expand your column (b) description.

(a) |

(b) |

(c) |

(d) |

(e) |

Item |

Description of property and securities |

Alternate |

Alternate value in |

Value at date of |

no. |

For securities, give CUSIP number |

valuation date |

U.S. dollars |

death in U.S. dollars |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(If you need more space, attach additional sheets of same size.)

Total . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Schedule B. Taxable Estate (Caution: You must document lines 2 and 4 for the deduction on line 5 to be allowed.)

1 |

Gross estate in the United States (Schedule A total) |

1 |

|

2 |

Gross estate outside the United States (see instructions) |

2 |

|

3 |

Entire gross estate wherever located. Add amounts on lines 1 and 2 |

3 |

|

4 |

Amount of funeral expenses, administration expenses, decedent’s debts, mortgages and liens, and |

|

|

|

losses during administration. Attach itemized schedule (see instructions) |

4 |

|

5 |

Deduction for expenses, claims, etc. Divide line 1 by line 3 and multiply the result by line 4 . . . . |

5 |

|

6 |

Charitable deduction (attach Schedule O, Form 706) and marital deduction (attach Schedule M, Form |

|

|

|

706, and computation) |

6 |

|

7 |

State death tax deduction (see instructions) |

7 |

|

8 |

Total deductions. Add lines 5, 6, and 7 |

8 |

|

9 |

Taxable estate. Subtract line 8 from line 1. Enter here and on line 1 of Part II |

9 |

|

Form

Document Specifics

| Fact Name | Description |

|---|---|

| Form Number and Revision Date | Form 706-NA, Revision for June 2019 |

| Purpose | United States Estate (and Generation-Skipping Transfer) Tax Return for estates of nonresidents not citizens of the United States |

| Filing Requirement | To be filed for decedents dying after December 31, 2011 |

| Filing Address | Department of the Treasury, Internal Revenue Service Center, Kansas City, MO 64999 |

| OMB Number | 1545-0531 |

| Documentation | Attach supplemental documents and translations; show amounts in U.S. dollars |

| Key Sections on the Form | Decedent, Executor, and Attorney information; Tax Computation; and General Information including authorization to receive confidential tax information |

Guide to Writing Irs 706 Na

Filling out the IRS Form 706-NA requires careful attention to detail and thoroughness to ensure compliance and correctness in filing the United States Estate (and Generation-Skipping Transfer) Tax Return for estates of nonresidents not citizens of the United States. This step-by-step guide is designed to simplify the process, making it more manageable.

Steps for Completing Form 706-NA:- Begin with Part I - Decedent, Executor, and Attorney. Fill in the decedent’s names, taxpayer ID (if applicable), place and date of death, domicile at time of death, citizenship, and birth information. Also, describe the decedent’s business or occupation.

- Provide the name and contact information of the executor and attorney for the estate. If there are multiple executors or attorneys, check the box in item 11 and attach a list with their information.

- Move on to Part II - Tax Computation. Calculate the taxable estate from Schedule B, line 9. Add total taxable gifts of U.S. situated property transferred by the decedent, and complete the tax computation section as instructed, showing amounts in U.S. dollars.

- In Part III - General Information, answer questions regarding the decedent's legal and tax situations, such as if the decedent died testate, owned any U.S. property, engaged in business in the U.S., or if there are any trusts or powers of appointment. Attach additional schedules if necessary.

- For Schedule A - Gross Estate in the United States, list all U.S. situated assets. If electing alternate valuation, check “Yes” and complete all columns; if not, only complete columns (a), (b), and (e).

- Complete Schedule B - Taxable Estate, by documenting the gross estate in both the U.S. and abroad, deducting expenses, claims, charitable and marital deductions, and state death taxes to arrive at the taxable estate.

- Review all parts and schedules for completeness and accuracy. Attach supplemental documents and translations as necessary.

- Sign and date the return. The executor and paid preparer must both sign the form. If there’s a preparer other than the executor, include their information as well.

- File Form 706-NA at the specified address: Department of the Treasury, Internal Revenue Service Center, Kansas City, MO 64999. Ensure all required attachments are included.

Completing Form 706-NA accurately is crucial to meet legal requirements and avoid potential penalties. This guide helps streamline the process, ensuring that all necessary information and documents are properly submitted. With careful attention to instructions and detailed information provision, this task can be effectively accomplished.

Understanding Irs 706 Na

-

What is Form 706-NA?

Form 706-NA is a tax form used by the Internal Revenue Service (IRS) for the estates of nonresident individuals not citizens of the United States, who have passed away after December 31, 2011. It's used to report United States Estate (and Generation-Skipping Transfer) Taxes.

-

Who needs to file Form 706-NA?

This form should be filed for a decedent who was not a U.S. resident or citizen at the time of death and owned assets in the United States. Executors or legal representatives of the estate are responsible for filing.

-

When is Form 706-NA due?

The form must be filed within nine months after the decedent's death. However, a six-month extension to file can be requested if more time is needed.

-

Where should Form 706-NA be filed?

Form 706-NA should be filed with the Department of the Treasury, Internal Revenue Service Center, Kansas City, MO 64999.

-

What information is required on Form 706-NA?

The form requires detailed information about the decedent, including name, date of death, citizenship, and an inventory of U.S. assets. Executors and attorneys involved with the estate must also be listed, with detailed tax computations provided in Part II of the form.

-

Are there any attachments required for Form 706-NA?

Yes, all supplemental documents and translations must be attached. This includes any schedules specified in the form's instructions, such as Schedules A (Gross Estate in the United States) and others relevant to deductions and credits claimed.

-

How is the estate tax determined for a nonresident not a citizen of the U.S.?

The estate tax is computed based on the fair market value of the decedent's U.S. assets at the time of death. Deductions may be available, and applicable credits, such as the unified credit, are considered to determine the net estate tax due.

-

Is it necessary to show amounts in U.S. dollars?

Yes, all amounts must be reported in U.S. dollars, with any foreign currency converted at the exchange rate in effect on the date of the decedent's death.

-

What happens if you are late filing Form 706-NA?

Late filing may result in penalties and interest on any unpaid taxes due. It's important to file on time or request an extension if more time is needed to gather the necessary information.

-

Can the IRS discuss the return with the preparer?

Yes, but only if the "Yes" box in the authorization section at the bottom of the form is checked, allowing the IRS to discuss this return with the preparer indicated.

Common mistakes

Not attaching necessary supplemental documents and translations. The requirement to include supportive documents, such as appraisals and translations for non-English paperwork, is often overlooked. These are crucial for verifying the information provided on the return.

Omitting to show amounts in U.S. dollars. Values must be converted to U.S. dollars, using the appropriate exchange rate, for every item listed on the form, including the valuation of assets and deductions.

Failing to correctly list all U.S. situated assets. It's essential to comprehensively identify and list all assets located in the United States, as any omission can lead to underreporting and possible penalties.

Incorrect calculations in the Tax Computation section. The tax computation is complex, requiring careful attention to detail. Mistakes here can significantly affect the tax liability or refund.

Overlooking the unified credit. The form allows for a unified credit, but filers sometimes miss claiming this benefit, potentially resulting in overpayment of taxes.

Missing out on other credits and deductions. Similar to the unified credit, other credits and deductions are often overlooked, such as state death tax deductions, which can reduce the overall tax burden.

Not listing the correct executor or attorney details. It's critical to provide accurate and complete contact information for the executor(s) and attorney, including additional executors or attorneys if applicable.

Miscalculating the taxable estate. This involves properly understanding the deductions for expenses, debts, losses, and the applicable marital or charitable deductions, which reduce the gross estate to the taxable estate.

Forgetting to sign and date the form. An unsigned or undated form is considered incomplete by the IRS and will not be processed, potentially leading to delays and penalties.

It's worth noting that navigating the intricacies of the IRS Form 706-NA can be challenging. Avoiding these common pitfalls not only ensures compliance but can also help in minimizing the tax liability of the estate.

Documents used along the form

When dealing with the intricacies of estate planning and tax filing for estates of nonresident aliens not citizens of the United States, Form 706-NA often requires supplementary documentation to provide a complete picture of the decedent's estate and fulfill legal obligations. These forms and documents play critical roles in the calculation of the estate and generation-skipping transfer taxes, ensuring that all relevant information is accurately communicated to the Internal Revenue Service (IRS).

- Form 1040-NR: U.S. Nonresident Alien Income Tax Return. This document is used to report income earned in the U.S. by nonresident aliens, potentially relevant to the estate's income tax obligations.

- Form 709: United States Gift (and Generation-Skipping Transfer) Tax Return. This form is necessary for reporting gifts or generation-skipping transfers which might affect the taxable estate.

- Form 8832: Entity Classification Election. For estates that involve entities, this form is key in determining how the entity is classified for federal tax purposes, affecting the estate's tax calculations.

- Schedule Q, Form 706: Credit for Tax on Prior Transfers. This schedule is attached to Form 706-NA when applicable, to claim a credit for taxes on transfers made by the decedent prior to their death.

- Schedule R, Form 706: Generation-Skipping Transfer Tax. For estates subject to the generation-skipping transfer tax, this schedule details the calculations of such taxes owed.

- Schedule O, Form 706: Charitable, Public, and Similar Gifts and Bequests. This schedule itemizes deductions claimed for charitable donations made by the estate.

- Schedule M, Form 706: Marital Deduction. Used to report any transfers to the surviving spouse, which are eligible for the marital deduction, affecting the estate's taxable total.

- Death Certificate: While not an IRS form, the death certificate is a fundamental document typically required to accompany Form 706-NA, providing proof of the decedent's death and details necessary for accurately processing the estate.

Together, these forms create a comprehensive framework that addresses the varied aspects of estate and transfer taxes for nonresident aliens not citizens of the United States. Through diligent preparation and submission of these documents, executors can ensure compliance with U.S. tax laws, properly honor the decedent's legacy, and safeguard the interests of beneficiaries.

Similar forms

Form 706, the United States Estate (and Generation-Skipping Transfer) Tax Return, is akin to Form 706-NA but caters to the estates of U.S. citizens or residents, as opposed to nonresident aliens. Both forms tackle the same broad objective: calculating estate tax liability. However, Form 706 demands a comprehensive account of the decedent’s global assets, contrasted with Form 706-NA’s focus on U.S.-situated assets for those outside the U.S. citizenship or residency umbrella.

IRS Form 709, United States Gift (and Generation-Skipping Transfer) Tax Return, parallels Form 706-NA in its treatment of generation-skipping transfer taxes but is specifically dedicated to gifts and generation-skipping transfers made during an individual’s lifetime, rather than at death. Both forms include schedules for calculating the respective taxes and credits, reflecting their roles in managing transfers that might bypass direct inheritance.

Form 1040, U.S. Individual Income Tax Return, while primarily for annual income taxes, intersects with Form 706-NA through the concept of global income reporting for citizens and resident aliens, emphasizing the taxpayer’s global obligation. Conversely, Form 706-NA underscores a nonresident alien's estate obligations specifically related to U.S. assets, underscoring the variance in scope founded on the taxpayer’s residency status.

The FinCEN Form 114, Report of Foreign Bank and Financial Accounts (FBAR), is tangentially related to Form 706-NA, given that both demand the disclosure of foreign assets. Whereas FinCEN Form 114 focuses on Americans’ foreign bank and financial accounts exceeding certain thresholds, Form 706-NA involves a nonresident’s U.S.-situated assets at death, illustrating the flip side of asset declaration requirements based on residency status.

Form 8832, Entity Classification Election, while distinct in its primary function—allowing entities to choose their tax classification—shares a conceptual link with Form 706-NA through the lens of how entity choices impact estate planning and subsequent taxation. Entities owned by nonresidents that hold U.S. assets could affect the estate's taxation, showcasing the interconnectedness of entity classification and estate tax implications.

Form 3520, Annual Return To Report Transactions With Foreign Trusts and Receipt of Certain Foreign Gifts, connects with Form 706-NA via the international aspect of estate planning. This form is used to report transactions between U.S. persons and foreign trusts, as well as large gifts from non-U.S. persons, highlighting the scrutiny on cross-border transactions and transfers, akin to how 706-NA scrutinizes U.S. assets of nonresidents.

Lastly, Schedule K-1 (Form 1041), Beneficiary's Share of Income, Deductions, Credits, etc., although a component of a trust or estate’s income tax filing, shares the thematic relevance of tax obligations following a person’s death with Form 706-NA. It deals with the income distributed to beneficiaries from the estate or trust, reflecting the continuation of tax obligations beyond an individual’s lifetime, complementary to how Form 706-NA accounts for the immediate tax implications of a nonresident's death on their U.S. assets.

Dos and Don'ts

Filling out IRS Form 706-NA, which pertains to the United States Estate (and Generation-Skipping Transfer) Tax Return for nonresident non-citizens, requires careful attention to detail. To ensure accuracy and compliance with IRS requirements, here are seven dos and don'ts to consider.

Do:

- Review the latest form instructions on the IRS website. This will provide the most current filing requirements and address updates.

- Check the form for any updates or changes. Tax laws and form requirements can change, and using the latest version is crucial.

- Convert all amounts to U.S. dollars, using the exchange rate applicable at the date of the decedent's death for any foreign currency amounts.

- Attach all required supplemental documents and translations for non-English documents. These supports are essential for the IRS to verify the information provided.

- Complete every applicable section thoroughly. Skipping parts of the form can result in processing delays or reviews.

- Sign and date the form. An unsigned form is considered incomplete and will not be processed.

- File the form at the correct address listed for Form 706-NA filings to avoid processing delays. As specified, this is typically at the Department of the Treasury, Internal Revenue Service Center, Kansas City, MO 64999.

Do Not:

- Estimate values of assets. Obtain accurate appraisals or valuations where necessary, especially for property and investments situated in the United States.

- Ignore the filing deadline. Late filings can result in penalties and interest on any taxes due.

- Omit information about previous filings or tax IDs. Lack of transparency can cause unnecessary queries or audits.

- Forget to check the box if electing alternate valuation dates, as this decision will impact the estate's tax liability.

- Misreport the decedent's domicile, citizenship, or the executor’s information. Accurate details are crucial for the IRS's assessment.

- Submit the form without reviewing it for mistakes. Errors can lead to processing delays or incorrect tax calculations.

- Assume you don't need professional advice. Considering the complexities of estate tax laws, consulting with a tax professional or attorney specializing in estate planning can be invaluable.

Misconceptions

Many people have misconceptions about the IRS Form 706-NA, which is critical for handling the estate of a nonresident who is not a citizen of the United States. Understanding these misconceptions can help in accurately completing and filing the form, ensuring compliance with U.S. tax law.

Misconception #1: The Form 706-NA only needs to be filed for large estates. In reality, the requirement to file Form 706-NA is not solely based on the size of the estate. Instead, it hinges on the U.S.-situated assets. Any estate of a nonresident, non-citizen with U.S.-situated assets might need to file this form, depending on specific criteria detailed in the instructions for the form.

Misconception #2: All assets owned by the decedent need to be reported on Form 706-NA. This is incorrect. Only those assets that are situated in the United States at the time of the decedent's death should be reported on Form 706-NA. Assets located outside the U.S. are not relevant to this form, though they may be subject to reporting requirements in the decedent's country of residence or citizenship.

Misconception #3: Filing Form 706-NA is the sole responsibility of the executor. While it is true that the executor or administrator of the estate is primarily responsible for filing Form 706-NA, in some cases, other individuals or entities may need to take action. For example, if no executor or administrator is appointed, a person in actual or constructive possession of any U.S. property of the decedent may need to file the form.

Misconception #4: The form is only for estates involving significant U.S. estate tax liability. Although the form is instrumental in calculating the U.S. estate tax liability, it serves other purposes. For example, it provides the IRS with a complete picture of the decedent’s U.S.-situated assets, which could affect tax calculations, credits, and deductions.

Misconception #5: Translations of foreign documents are not needed when filing Form 706-NA. If any supplemental documents are in a language other than English, translations must be attached. This ensures that the IRS can accurately review and understand all provided information, which is crucial for the proper assessment of the estate.

Misconception #6: The Unified Credit is available to any estate filed under Form 706-NA. The Unified Credit, which offsets a portion of the estate tax, is generally much smaller for nonresident, non-citizen decedents' estates than it is for U.S. citizens and residents. The applicable credit amount and eligibility are strictly defined in the instructions for the form, highlighting the unique treatment of nonresident, non-citizen estates under U.S. tax law.

Clearing up these misconceptions is vital for appropriately handling the estate of a nonresident not a citizen of the United States and ensuring compliance with U.S. tax obligations.

Key takeaways

- If you are handling an estate for a decedent who was not a U.S. citizen and did not reside in the United States, use Form 706-NA for reporting estate and generation-skipping transfer taxes.

- This form is required for estates of individuals who passed away after December 31, 2011. Always check the latest version for updates.

- File Form 706-NA with the Internal Revenue Service Center in Kansas City, MO. This ensures it gets to the right office for processing.

- Remember to attach all supplemental documents and translations that are necessary for understanding the estate. This can include death certificates, wills, and property appraisals, all translated into English.

- Make sure to report values in U.S. dollars. If the estate includes assets located abroad or transactions in foreign currencies, convert these values to U.S. dollars using the appropriate exchange rate.

- Details of the decedent, such as full name, citizenship, domicile at time of death, and date of death, must be accurately filled out in Part I of the form.

- If there are multiple executors or attorneys, you must check the box in item 11 and attach a list with the full contact details of each individual.

- Any taxable gifts of tangible or intangible property located in the U.S. transferred by the decedent must be reported. This includes assets gifted after December 31, 1976, that were not included in the gross estate.

- The tax computation section (Part II) requires careful attention. It includes totaling up taxable estate and gifts, calculating tentative tax, and determining credits and previous payments.

- Authorization to receive confidential tax information and act as the estate's representative before the IRS is designated in Part III. Proper documentation of this authorization is crucial.

- It's important to determine if the estate includes property that triggers specific schedules like Schedules G, H, E, and others for special types of transfers and property interests.

Popular PDF Documents

What Is a 1099r - It enables tax filers to report payments received from a retirement plan due to permanent and total disability, impacting their tax calculations.

Irs Tax Lien - By completing Form 12277, taxpayers can argue that a lien was incorrectly filed or has since been resolved, asking for formal removal.