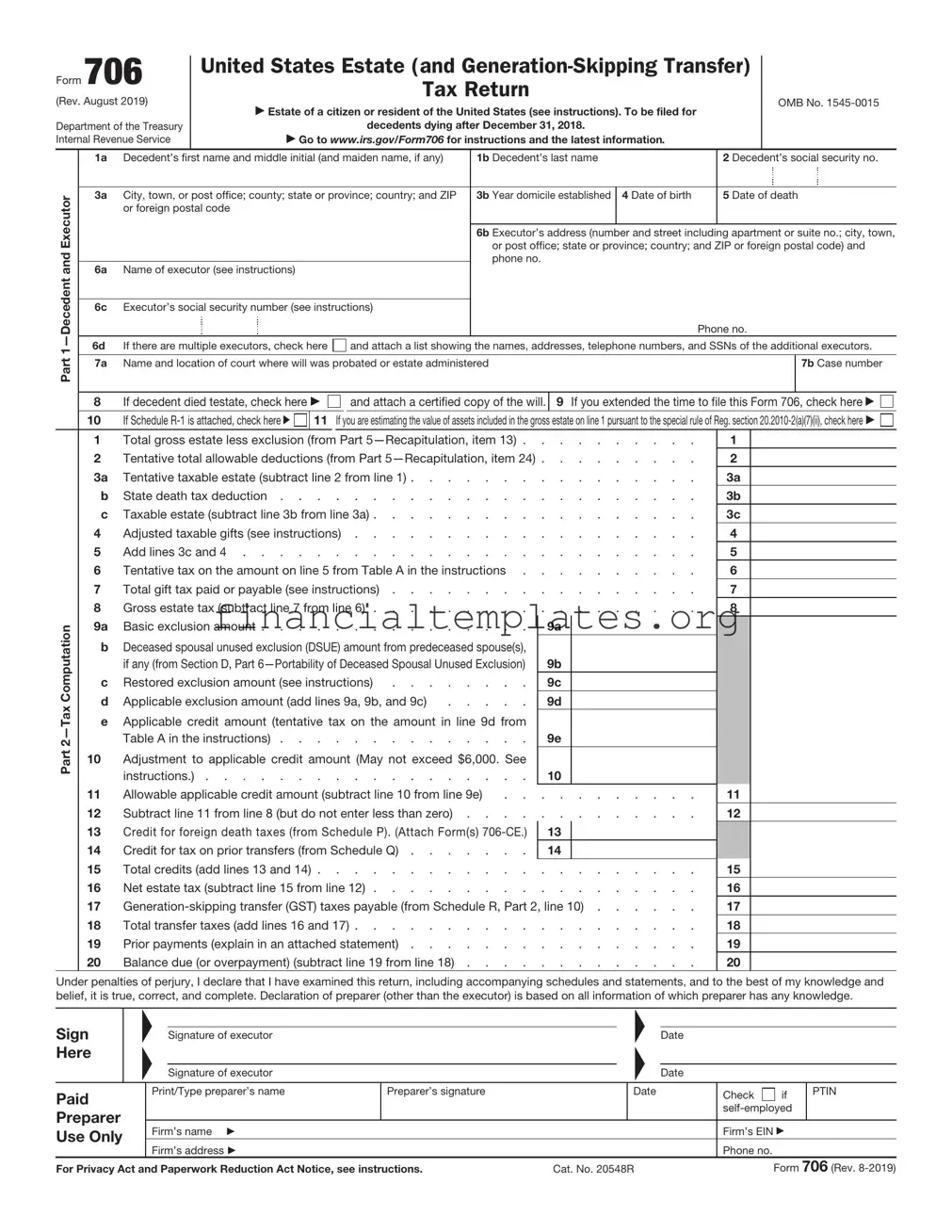

Get IRS 706 Form

When someone passes away, handling their estate becomes a priority for the survivors, which often includes dealing with taxes attributed to the deceased's assets. In the United States, the Internal Revenue Service (IRS) Form 706 plays a vital role in this process. Specifically designed for the estates of decedents, this form is used to report the value of an estate and determine if any taxes are due on the transfer of the assets. While the concept of estate tax can seem daunting at first glance, understanding the major aspects of IRS Form 706 can make the process more manageable. It addresses the need to evaluate the gross estate, applicable deductions, and the calculation of the net taxable estate, alongside determining tax liability, if any. Also significant is its role in capturing information about gifts made during the decedent's lifetime that may affect the overall tax calculation. Navigating through the complexities of this form, with its various schedules and requirements, is essential for executors or administrators tasked with the fiduciary duty of closing out an individual's estate in compliance with federal tax laws.

IRS 706 Example

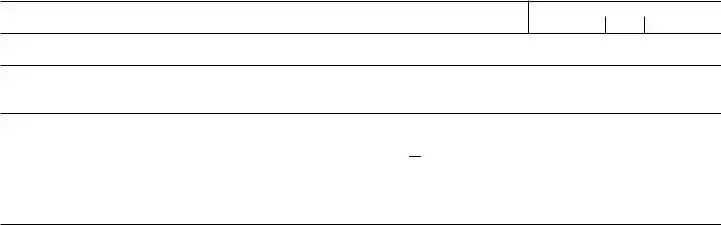

Form 706

(Rev. August 2019)

Department of the Treasury Internal Revenue Service

United States Estate (and

Tax Return

Estate of a citizen or resident of the United States (see instructions). To be filed for decedents dying after December 31, 2018.

Go to www.irs.gov/Form706 for instructions and the latest information.

OMB No.

Part

Part

1a |

Decedent’s first name and middle initial (and maiden name, if any) |

|

1b Decedent’s last name |

|

2 Decedent’s social security no. |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3a |

City, town, or post office; county; state or province; country; and ZIP |

|

3b Year domicile established |

4 Date of birth |

|

5 Date of death |

||||||||

|

or foreign postal code |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6b Executor’s address (number and street including apartment or suite no.; city, town, |

||||||

|

|

|

|

|

|

|

|

or post office; state or province; country; and ZIP or foreign postal code) and |

||||||

|

|

|

|

|

|

|

|

phone no. |

|

|

|

|

|

|

6a |

Name of executor (see instructions) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6c |

Executor’s social security number (see instructions) |

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

Phone no. |

|||

6d |

If there are multiple executors, check here |

|

|

and attach a list showing the names, addresses, telephone numbers, and SSNs of the additional executors. |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|||

7a |

Name and location of court where will was probated or estate administered |

|

|

|

|

7b Case number |

||||||||

|

|

|

|

|

|

|

|

|

|

|||||

8 |

If decedent died testate, check here |

|

|

|

|

and attach a certified copy of the will. |

9 If you extended the time to file this Form 706, check here |

|

||||||

10 |

If Schedule |

11 |

If you are estimating the value of assets included in the gross estate on line 1 pursuant to the special rule of Reg. section |

|||||||||||

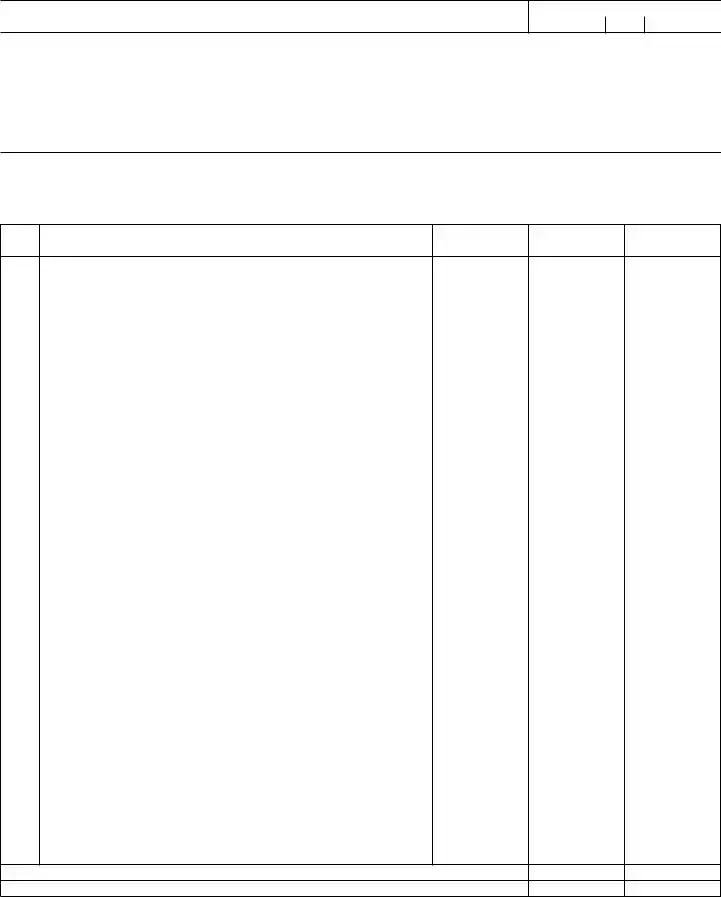

1 |

Total gross estate less exclusion (from Part |

|

1 |

|

|

|||||||||

2 |

Tentative total allowable deductions (from Part |

2 |

|

|

||||||||||

3a |

Tentative taxable estate (subtract line 2 from line 1) |

|

3a |

|||||||||||

b |

State death tax deduction |

|

3b |

|||||||||||

c |

Taxable estate (subtract line 3b from line 3a) |

|

3c |

|||||||||||

4 |

Adjusted taxable gifts (see instructions) |

|

4 |

|

|

|||||||||

5 |

Add lines 3c and 4 |

|

5 |

|

|

|||||||||

6 |

Tentative tax on the amount on line 5 from Table A in the instructions |

|

6 |

|

|

|||||||||

7 |

Total gift tax paid or payable (see instructions) |

|

7 |

|

|

|||||||||

8 |

Gross estate tax (subtract line 7 from line 6) |

8 |

|

|

||||||||||

9a |

Basic exclusion amount . . . . |

. . . . . . . |

. . . . |

9a |

|

|

|

|

||||||

bDeceased spousal unused exclusion (DSUE) amount from predeceased spouse(s),

|

if any (from Section D, Part |

9b |

|

c |

Restored exclusion amount (see instructions) |

9c |

|

d |

Applicable exclusion amount (add lines 9a, 9b, and 9c) |

. . . . . |

9d |

eApplicable credit amount (tentative tax on the amount in line 9d from

Table A in the instructions) |

9e |

10Adjustment to applicable credit amount (May not exceed $6,000. See

|

instructions.) |

10 |

|

|

|

|

11 |

Allowable applicable credit amount (subtract line 10 from line 9e) |

. . |

. . . . . . . . . |

11 |

|

|

12 |

Subtract line 11 from line 8 (but do not enter less than zero) . . . . |

. . . . . . . . . |

12 |

|

||

13 |

Credit for foreign death taxes (from Schedule P). (Attach Form(s) |

13 |

|

|

|

|

14 |

Credit for tax on prior transfers (from Schedule Q) |

14 |

|

|

|

|

15 |

Total credits (add lines 13 and 14) |

. . . . . . . . . |

15 |

|

||

16 |

Net estate tax (subtract line 15 from line 12) |

. . . . . . . . . |

16 |

|

||

17 |

17 |

|

||||

18 |

Total transfer taxes (add lines 16 and 17) |

. . . . . . . . . |

18 |

|

||

19 |

Prior payments (explain in an attached statement) |

. . . . . . . . . |

19 |

|

||

20 |

Balance due (or overpayment) (subtract line 19 from line 18) . . . . |

. . . . . . . . . |

20 |

|

||

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my knowledge and belief, it is true, correct, and complete. Declaration of preparer (other than the executor) is based on all information of which preparer has any knowledge.

Sign |

FF |

Signature of executor |

|

|

|

|

|

|

|

||

Here |

|

|

|

|

|

|

|

|

Signature of executor |

|

|

|

|

Print/Type preparer’s name |

|

Preparer’s signature |

|

Paid |

|

|

|||

|

|

|

|

|

|

Preparer |

|

Firm’s name |

|

|

|

|

|

|

|||

Use Only |

|

|

|

||

|

Firm’s address |

|

|

||

|

|

|

|

||

|

|

|

|

|

|

For Privacy Act and Paperwork Reduction Act Notice, see instructions.

FF

Date

Cat. No. 20548R

Date

Date

Check |

|

if |

PTIN |

|

|

||

|

|||

|

|

|

|

Firm’s EIN

Phone no.

Form 706 (Rev.

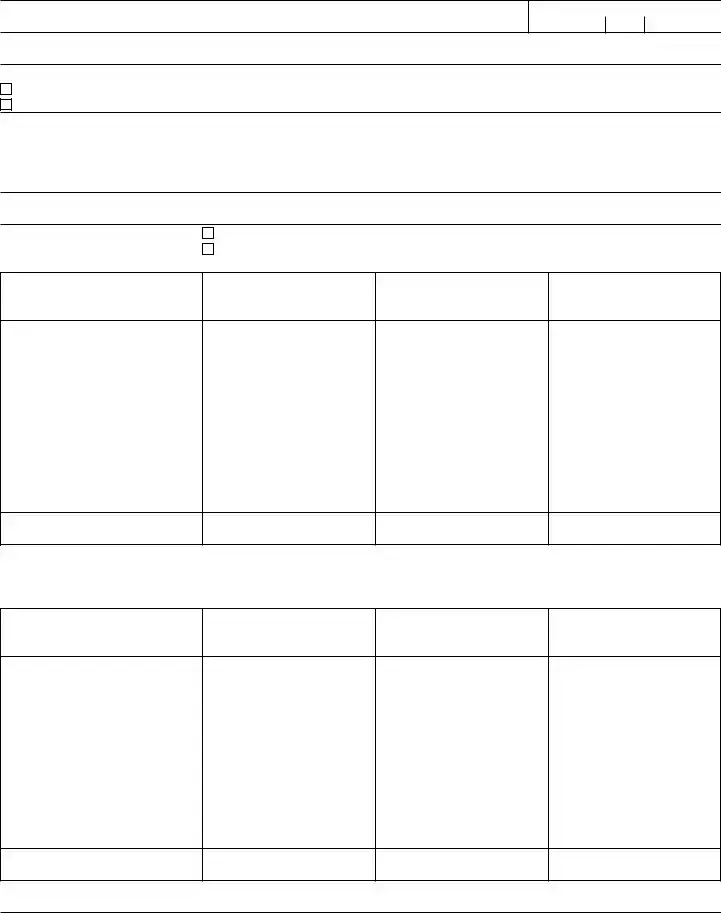

Form 706 (Rev.

Decedent’s social security number

Estate of:

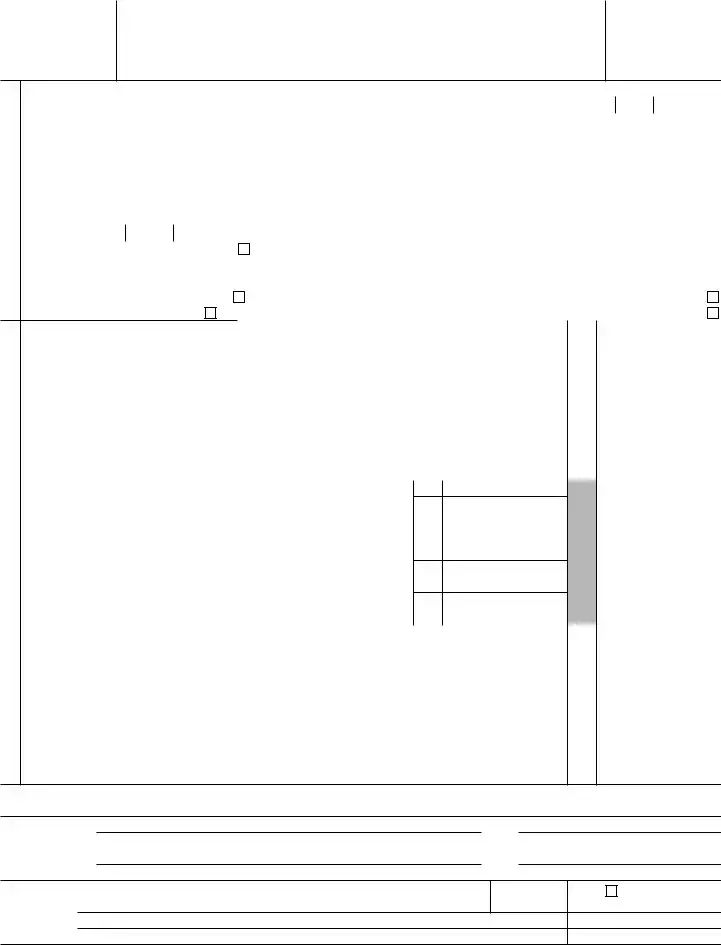

Part

Note: For information on electing portability of the decedent’s DSUE amount, including how to opt out of the election, see Part 6— |

|

|

|

|

|

Portability of Deceased Spousal Unused Exclusion. |

|

|

|

Note: Some of the following elections may require the posting of bonds or liens. |

|

Yes |

No |

|

Please check “Yes” or “No” for each question. See instructions. |

|

|

|

|

1 |

Do you elect alternate valuation? |

1 |

|

|

2 |

Do you elect |

2 |

|

|

3 |

Do you elect to pay the taxes in installments as described in section 6166? |

|

|

|

|

If “Yes,” you must attach the additional information described in the instructions. |

|

|

|

|

Note: By electing section 6166 installment payments, you may be required to provide security for estate tax deferred |

|

|

|

|

under section 6166 and interest in the form of a surety bond or a section 6324A lien. |

3 |

|

|

4 |

Do you elect to postpone the part of the taxes due to a reversionary or remainder interest as described in section 6163? . |

4 |

|

|

Part

Note: Please attach the necessary supplemental documents. You must attach the death certificate. See instructions.

Authorization to receive confidential tax information under Reg. section 601.504(b)(2)(i); to act as the estate’s representative before the IRS; and to make written or oral presentations on behalf of the estate:

Name of representative (print or type)

State

Address (number, street, and room or suite no., city, state, and ZIP code)

I declare that I am the |

attorney/ |

certified public accountant/ |

enrolled agent (check the applicable box) for the executor. I am not under |

suspension or disbarment from practice before the Internal Revenue Service and am qualified to practice in the state shown above.

Signature

CAF number

Date

Telephone number

1Death certificate number and issuing authority (attach a copy of the death certificate to this return).

2 |

Decedent’s business or occupation. If retired, check here |

and state decedent’s former business or occupation. |

|

|

|

3a |

Marital status of the decedent at time of death: |

|

Married

Widow/widower

Single

Legally separated

Divorced

3b For all prior marriages, list the name and SSN of the former spouse, the date the marriage ended, and whether the marriage ended by annulment, divorce, or death. Attach additional statements of the same size if necessary.

4a Surviving spouse’s name

4b Social security number

4c Amount received (see instructions)

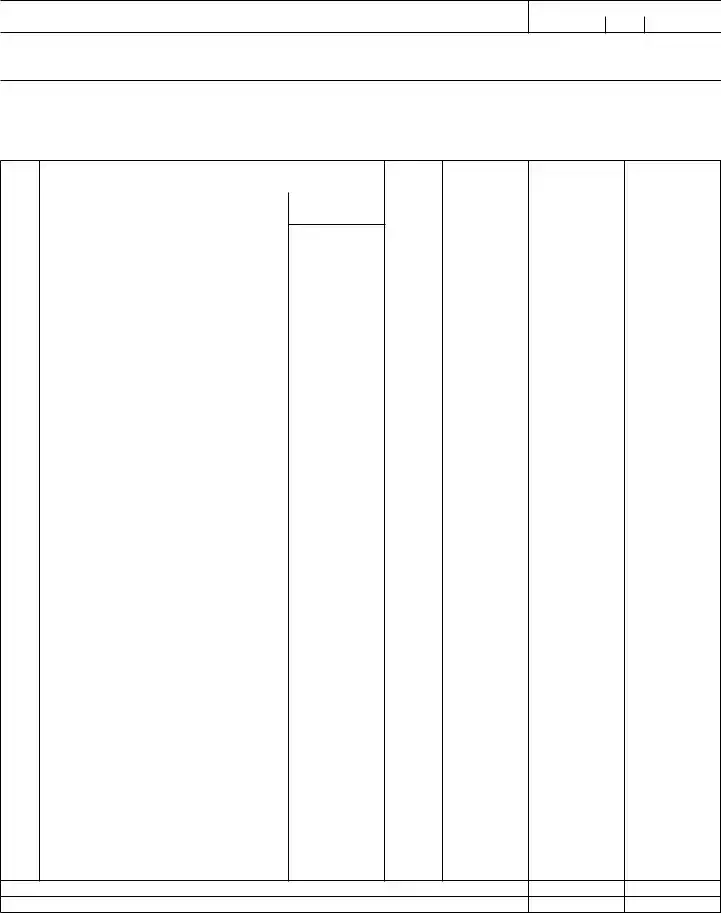

5Individuals (other than the surviving spouse), trusts, or other estates who receive benefits from the estate (do not include charitable beneficiaries shown in Schedule O) (see instructions).

Name of individual, trust, or estate receiving $5,000 or more |

Identifying number |

Relationship to decedent |

Amount (see instructions) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

All unascertainable beneficiaries and those who receive less than $5,000 . . . . . . . . . . . . . . .

Total . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

If you answer “Yes” to any of the following questions, you must attach additional information as described. |

Yes |

No |

||

6 |

Is the estate filing a protective claim for refund? |

|

|

|

|

If “Yes,” complete and attach two copies of Schedule PC for each claim. |

|

|

|

7 |

Does the gross estate contain any section 2044 property (qualified terminable interest property (QTIP) from a prior gift or estate)? |

|

|

|

|

See instructions |

|

|

|

8a |

Have federal gift tax returns ever been filed? |

|

|

|

|

If “Yes,” attach copies of the returns, if available, and furnish the following information. |

|

|

|

b |

Period(s) covered |

c Internal Revenue office(s) where filed |

|

|

|

|

|

|

|

9a |

Was there any insurance on the decedent’s life that is not included on the return as part of the gross estate? |

|

|

|

b |

Did the decedent own any insurance on the life of another that is not included in the gross estate? |

|

|

|

Page 2

Form 706 (Rev.

Decedent’s social security number

Estate of:

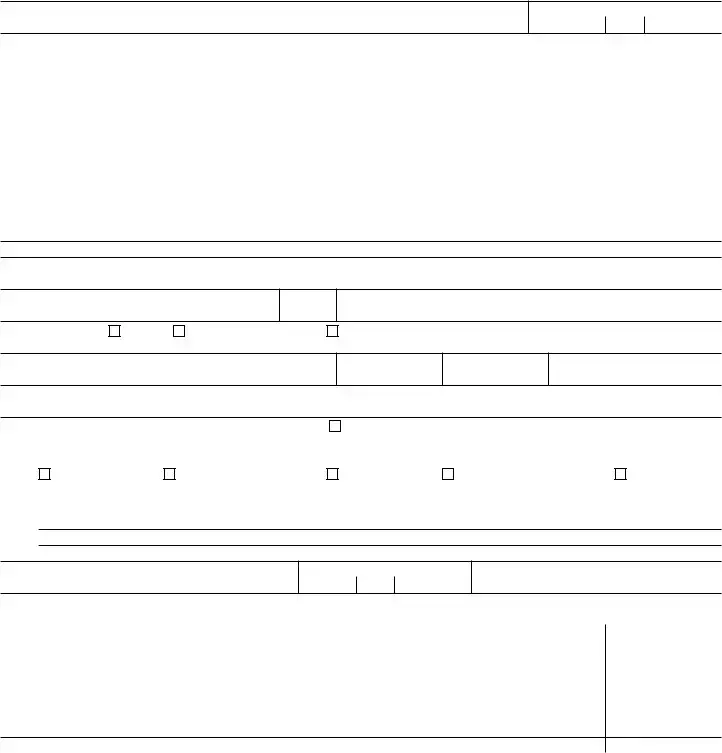

Part

If you answer “Yes” to any of the following questions, you must attach additional information as described. |

Yes No |

10Did the decedent at the time of death own any property as a joint tenant with right of survivorship in which (a) one or more of the other joint tenants was someone other than the decedent’s spouse, and (b) less than the full value of the property is included on

the return as part of the gross estate? If “Yes,” you must complete and attach Schedule E . . . . . . . . . . .

11a Did the decedent, at the time of death, own any interest in a partnership (for example, a family limited partnership), an unincorporated business, or a limited liability company; or own any stock in an inactive or closely held corporation? . . . .

bIf “Yes,” was the value of any interest owned (from above) discounted on this estate tax return? If “Yes,” see the instructions on

reporting the total accumulated or effective discounts taken on Schedule F or G . . . . . . . . . . . . . .

12Did the decedent make any transfer described in sections 2035, 2036, 2037, or 2038? See instructions. If “Yes,” you must

complete and attach Schedule G . . . . . . . . . . . . . . . . . . . . . . . . . . . .

13a Were there in existence at the time of the decedent’s death any trusts created by the decedent during his or her lifetime? . .

bWere there in existence at the time of the decedent’s death any trusts not created by the decedent under which the decedent

possessed any power, beneficial interest, or trusteeship? . . . . . . . . . . . . . . . . . . . . .

c Was the decedent receiving income from a trust created after October 22, 1986, by a parent or grandparent? . . . . . .

If “Yes,” was there a GST taxable termination (under section 2612) on the death of the decedent? . . . . . . . . .

dIf there was a GST taxable termination (under section 2612), attach a statement to explain. Provide a copy of the trust or will creating the trust, and give the name, address, and phone number of the current trustee(s).

eDid the decedent at any time during his or her lifetime transfer or sell an interest in a partnership, limited liability company, or

closely held corporation to a trust described in line 13a or 13b? . . . . . . . . . . . . . . . . . . .

If “Yes,” provide the EIN for this transferred/sold item.

14Did the decedent ever possess, exercise, or release any general power of appointment? If “Yes,” you must complete and attach Schedule H

15Did the decedent have an interest in or a signature or other authority over a financial account in a foreign country, such as a bank

account, securities account, or other financial account? . . . . . . . . . . . . . . . . . . . . .

16Was the decedent, immediately before death, receiving an annuity described in the “General” paragraph of the instructions for

Schedule I or a private annuity? If “Yes,” you must complete and attach Schedule I . . . . . . . . . . . . .

17Was the decedent ever the beneficiary of a trust for which a deduction was claimed by the estate of a predeceased spouse

under section 2056(b)(7) and which is not reported on this return? If “Yes,” attach an explanation . . . . . . . . .

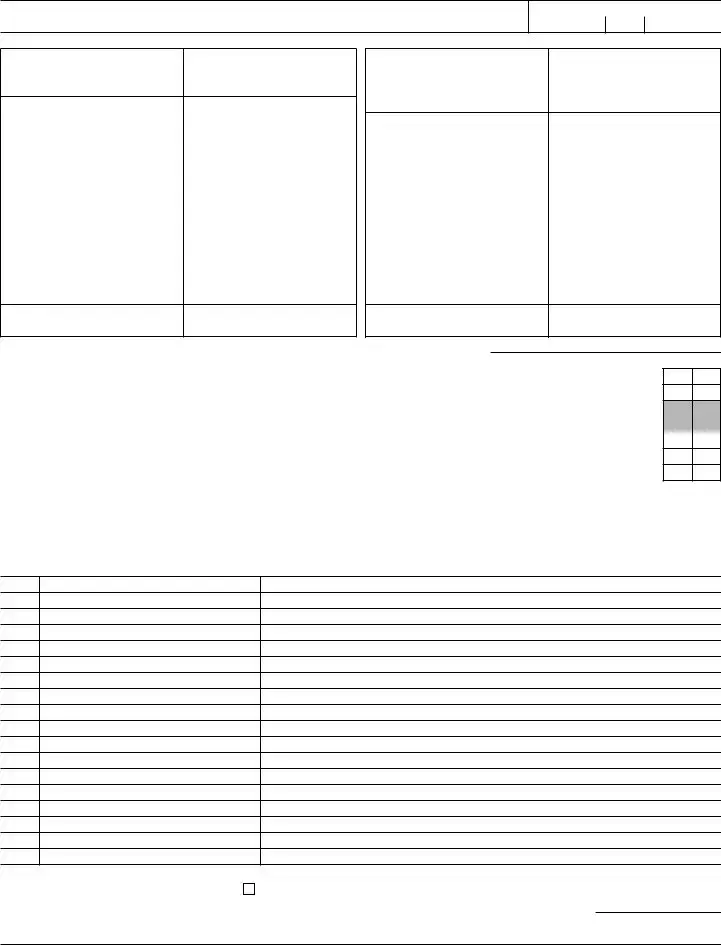

Part

Item no. |

Gross estate |

|

|

Alternate value |

|

Value at date of death |

|

|

|

|

|

|

|

||

1 |

Schedule |

1 |

|

|

|

||

2 |

Schedule |

2 |

|

|

|

||

3 |

Schedule |

3 |

|

|

|

||

4 |

Schedule |

4 |

|

|

|

||

5 |

Schedule |

5 |

|

|

|

||

6 |

Schedule |

6 |

|

|

|

||

7 |

Schedule |

7 |

|

|

|

||

8 |

Schedule |

. . . . . . . . . . . . |

8 |

|

|

|

|

9 |

Schedule |

9 |

|

|

|

||

10 |

Estimated value of assets subject to the special rule of Reg. section |

10 |

|

|

|

||

11 |

Total gross estate (add items 1 through 10) |

11 |

|

|

|

||

12 |

Schedule |

. . . . . . |

12 |

|

|

|

|

13 |

Total gross estate less exclusion (subtract item 12 from item 11). Enter here and |

|

|

|

|

||

|

on line 1 of Part |

13 |

|

|

|

||

|

|

|

|

|

|

|

|

Item no. |

|

Deductions |

|

|

|

|

Amount |

|

|

|

|

||||

14 |

Schedule |

14 |

|

||||

15 |

Schedule |

. . . . . . . |

15 |

|

|||

16 |

Schedule |

. . . . . . . |

16 |

|

|||

17 |

Total of items 14 through 16 |

. . . . . . . |

17 |

|

|||

18 |

Allowable amount of deductions from item 17 (see the instructions for item 18 of the Recapitulation) . . |

18 |

|

||||

19 |

Schedule |

. . . . . . . |

19 |

|

|||

20 |

Schedule |

. . . . . . . |

20 |

|

|||

21 |

Schedule |

. . . . . . . |

21 |

|

|||

22 |

Schedule |

. . . . . . . |

22 |

|

|||

23 |

Estimated value of deductible assets subject to the special rule of Reg. section |

23 |

|

||||

24 |

Tentative total allowable deductions (add items 18 through 23). Enter here and on line 2 of the Tax Computation |

24 |

|

||||

Page 3

Form 706 (Rev.

Decedent’s social security number

Estate of:

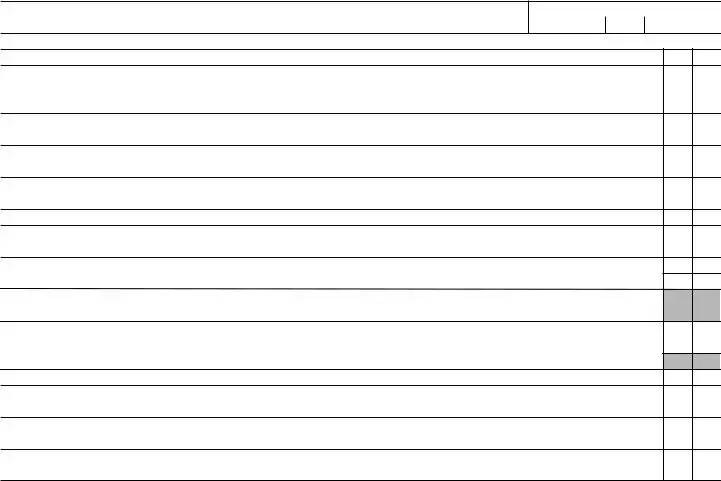

Part

Portability Election

A decedent with a surviving spouse elects portability of the DSUE amount, if any, by completing and timely filing this return. No further action is required to elect portability of the DSUE amount to allow the surviving spouse to use the decedent’s DSUE amount.

Section A. Opting Out of Portability

The estate of a decedent with a surviving spouse may opt out of electing portability of the DSUE amount. Check here and do not complete Sections B and C of Part 6 only if the estate opts NOT to elect portability of the DSUE amount.

Section B. Qualified Domestic Trust (QDOT) |

Yes |

No |

Are any assets of the estate being transferred to a QDOT? |

|

|

If “Yes,” the DSUE amount portable to a surviving spouse (calculated in Section C, below) is preliminary and shall be redetermined at the time of the final distribution or other taxable event imposing estate tax under section 2056A. See instructions for more details.

Section C. DSUE Amount Portable to the Surviving Spouse (To be completed by the estate of a decedent making a portability election.) Complete the following calculation to determine the DSUE amount that can be transferred to the surviving spouse.

1 |

Enter the amount from line 9d, Part |

1 |

|

2 |

Reserved |

2 |

|

3 |

Enter the value of the cumulative lifetime gifts on which tax was paid or payable. See instructions . . . |

3 |

|

4 |

Add lines 1 and 3 |

4 |

|

5 |

Enter amount from line 10, Part |

5 |

|

6 |

Divide amount on line 5 by 40% (0.40) (do not enter less than zero) |

6 |

|

7 |

Subtract line 6 from line 4 |

7 |

|

8 |

Enter the amount from line 5, Part |

8 |

|

9 |

Subtract line 8 from line 7 (do not enter less than zero) |

9 |

|

10 |

DSUE amount portable to surviving spouse (Enter lesser of line 9 or line 9a, Part |

10 |

|

Section D. DSUE Amount Received From Predeceased Spouse(s) (To be completed by the estate of a deceased surviving spouse with DSUE amount from predeceased spouse(s))

Provide the following information to determine the DSUE amount received from deceased spouses.

A |

B |

C |

D |

E |

F |

G |

|

Name of Deceased Spouse |

Date of Death |

Portability |

If “Yes,” DSUE |

DSUE Amount |

Year of Form 709 |

Remaining DSUE |

|

(dates of death after |

(enter as mm/dd/yy) |

Election |

Amount Received |

Applied by |

Reporting Use of DSUE |

Amount, if any |

|

December 31, 2010, only) |

|

Made? |

From Spouse |

Decedent to |

Amount Listed in col. E |

(subtract col. E |

|

|

|

|

|

|

Lifetime Gifts |

|

from col. D) |

|

|

|

|

|

|

|

|

|

|

Yes |

No |

|

|

|

|

|

|

|

|

|

|

|

|

Part 1 — DSUE RECEIVED FROM LAST DECEASED SPOUSE |

|

|

|

||||

|

|

|

|

|

|

|

|

Part 2 — DSUE RECEIVED FROM OTHER PREDECEASED SPOUSE(S) AND USED BY DECEDENT |

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total (for all DSUE amounts from predeceased spouse(s) applied) . . |

|

|

|

||||

Add the amount from Part 1, column D, and the total from Part 2, column E. Enter the result on line 9b, Part |

|

||||||

Computation |

|

||||||

Page 4

Form 706 (Rev.

Estate of:

Decedent’s social security number

SCHEDULE

•For jointly owned property that must be disclosed on Schedule E, see instructions.

•Real estate that is part of a sole proprietorship should be shown on Schedule F.

•Real estate that is included in the gross estate under sections 2035, 2036, 2037, or 2038 should be shown on Schedule G.

•Real estate that is included in the gross estate under section 2041 should be shown on Schedule H.

•If you elect section 2032A valuation, you must complete Schedule A and Schedule

Note: If the value of the gross estate, together with the amount of adjusted taxable gifts, is less than the basic exclusion amount and Form 706 is being filed solely to elect portability of the DSUE amount, consideration should be given as to whether you are required to report the value of assets eligible for the marital or charitable deduction on this schedule. See the instructions for more information. If you are not required to report the value of an asset, identify the property but make no entries in the last three columns.

Item

number

1

Description

Alternate

valuation date

Alternate value

Value at date of death

Total from continuation schedules or additional statements attached to this schedule .

TOTAL (Also enter on Part

(If more space is needed, attach the continuation schedule from the end of this package or additional statements of the same size.)

Schedule

Form 706 (Rev.

Estate of:

Decedent’s social security number

SCHEDULE

Part 1. Type of Election (Before making an election, see the checklist in the instructions):

Protective election (Reg. section

Regular election. Complete all of Part 2 (including line 11, if applicable) and Part 3. See instructions.

Before completing Schedule

The election is not valid unless the agreement (that is, Part 3. Agreement to Special Valuation Under Section 2032A):

•Is signed by each qualified heir with an interest in the specially valued property, and

•Is attached to this return when it is filed.

Part 2. Notice of Election (Reg. section

Note: All real property entered on lines 2 and 3 must also be entered on Schedules A, E, F, G, or H, as applicable.

1 Qualified |

Farm used for farming, or |

|

Trade or business other than farming |

2Real property used in a qualified use, passing to qualified heirs, and to be specially valued on this Form 706.

A

Schedule and item number

from Form 706

B

Full value

(without section 2032A(b)(3)(B)

adjustment)

C

Adjusted value

(with section 2032A(b)(3)(B)

adjustment)

D

Value based on qualified use (without section 2032A(b)(3)(B) adjustment)

Totals . . . . . . . . . .

Attach a legal description of all property listed on line 2.

Attach copies of appraisals showing the column B values for all property listed on line 2.

3Real property used in a qualified use, passing to qualified heirs, but not specially valued on this Form 706.

A |

B |

C |

D |

Schedule and item number |

Full value |

Adjusted value |

Value based on qualified use |

from Form 706 |

(without section 2032A(b)(3)(B) |

(with section 2032A(b)(3)(B) |

(without section 2032A(b)(3)(B) |

|

adjustment) |

adjustment) |

adjustment) |

Totals . . . . . . . . . .

If you checked “Regular election,” you must attach copies of appraisals showing the column B values for all property listed on line 3.

(continued on next page)

Schedule

Form 706 (Rev.

Estate of:

Decedent’s social security number

4Personal property used in a qualified use and passing to qualified heirs.

A

Schedule and item

number from Form 706

B

Adjusted value (with section 2032A(b)(3)(B) adjustment)

A (continued) |

B (continued) |

Schedule and item |

Adjusted value (with section |

number from Form 706 |

2032A(b)(3)(B) adjustment) |

|

|

“Subtotal” from col. B, below left |

|

Subtotal . . . . . . .

Total adjusted value . . .

5Enter the value of the total gross estate as adjusted under section 2032A(b)(3)(A).

6Attach a description of the method used to determine the special value based on qualified use.

7 Did the decedent and/or a member of his or her family own all property listed on line 2 for at least 5 of the 8 years Yes No immediately preceding the date of the decedent’s death? . . . . . . . . . . . . . . . . . . .

8Were there any periods during the

a |

Did not own the property listed on line 2? |

b |

Did not use the property listed on line 2 in a qualified use? |

cDid not materially participate in the operation of the farm or other business within the meaning of section 2032A(e)(6)? If you answered “Yes” to any of the above, attach a statement listing the periods. If applicable, describe whether

the exceptions of sections 2032A(b)(4) or (5) are met.

9Attach affidavits describing the activities constituting material participation and the identity and relationship to the

decedent of the material participants.

10Persons holding interests. Enter the requested information for each party who received any interest in the specially valued property. (Each of the qualified heirs receiving an interest in the property must sign the agreement, to be found on Part 3 of this Schedule

A

B

C

D

E

F

G

H

A

B

C

D

E

F

G

H

Name |

Address |

Identifying number |

Relationship to decedent |

Fair market value |

|

|

|

|

|

You must attach a computation of the GST tax savings attributable to direct skips for each person listed above who is a skip person. See instructions.

11 Woodlands election. Check here |

if you wish to make a Woodlands election as described in section 2032A(e)(13). Enter |

the schedule and item numbers from Form 706 of the property for which you are making this election

Attach a statement explaining why you are entitled to make this election. The IRS may issue regulations that require more information to substantiate this election. You will be notified by the IRS if you must supply further information.

Schedule

Form 706 (Rev.

Decedent’s social security number

Estate of:

Part 3. Agreement to Special Valuation Under Section 2032A

There cannot be a valid election unless:

• The agreement is executed by each one of the qualified heirs, and

• The agreement is included with the estate tax return when the estate tax return is filed. We (list all qualified heirs)

|

|

|

, |

being all the qualified heirs and (list all other persons having an interest in the property required to sign this agreement) |

|

||

|

|

|

|

|

|

|

, |

being all other parties having interests in the property, which is qualified real property and which is valued under section 2032A, do |

|

||

hereby approve of the election made by |

|

, |

|

Executor/Administrator of the estate of |

|

, |

|

pursuant to section 2032A to value said property on the basis of the qualified use to which the property is devoted and do hereby |

|

||

enter into this agreement pursuant to section 2032A(d). |

|

||

The undersigned agree and consent to the application of subsection (c) of section 2032A with respect to all the property described on Form 706, Schedule

The undersigned interested parties who are not qualified heirs consent to the collection of any additional estate and GST taxes imposed under section 2032A(c) from the specially valued property.

If there is a disposition of any interest which passes, or has passed to him or her, or if there is a cessation of the qualified use of any specially valued property which passes or passed to him or her, each of the undersigned heirs agrees to file a Form

It is understood by all interested parties that this agreement is a condition precedent to the election of

Each of the undersigned understands that by making this election, a lien will be created and recorded pursuant to section 6324B on the property referred to in this agreement for the adjusted tax differences with respect to the estate as defined in section 2032A(c)(2)

(C).

As the interested parties, the undersigned designate the following individual as their agent for all dealings with the Internal Revenue Service concerning the continued qualification of the specially valued property under section 2032A and on all issues regarding the special lien under section 6324B. The agent is authorized to act for the parties with respect to all dealings with the Internal Revenue Service on matters affecting the qualified real property described earlier. This includes the authorization:

•To receive confidential information on all matters relating to continued qualification under section 2032A of the specially valued real property and on all matters relating to the special lien arising under section 6324B;

•To furnish the Internal Revenue Service with any requested information concerning the property;

•To notify the Internal Revenue Service of any disposition or cessation of qualified use of any part of the property;

•To receive, but not to endorse and collect, checks in payment of any refund of Internal Revenue taxes, penalties, or interest;

•To execute waivers (including offers of waivers) of restrictions on assessment or collection of deficiencies in tax and waivers of notice of disallowance of a claim for credit or refund; and

•To execute closing agreements under section 7121.

(continued on next page)

Schedule

Form 706 (Rev.

Estate of:

Decedent’s social security number

Part 3. Agreement to Special Valuation Under Section 2032A (continued)

• Other acts (specify)

By signing this agreement, the agent agrees to provide the Internal Revenue Service with any requested information concerning this property and to notify the Internal Revenue Service of any disposition or cessation of the qualified use of any part of this property.

Name of Agent |

Signature |

Address |

The property to which this agreement relates is listed in Form 706, United States Estate (and

IN WITNESS WHEREOF, the undersigned have hereunto set their hands at |

, |

|||||||

this |

|

day of |

|

. |

|

|

|

|

SIGNATURES OF EACH OF THE QUALIFIED HEIRS: |

|

|||||||

|

|

|

|

|

|

|

|

|

Signature of qualified heir |

|

|

|

Signature of qualified heir |

|

|||

|

|

|

|

|

|

|

|

|

Signature of qualified heir |

|

|

|

Signature of qualified heir |

|

|||

|

|

|

|

|

|

|

|

|

Signature of qualified heir |

|

|

|

Signature of qualified heir |

|

|||

|

|

|

|

|

|

|

|

|

Signature of qualified heir |

|

|

|

Signature of qualified heir |

|

|||

|

|

|

|

|

|

|

|

|

Signature of qualified heir |

|

|

|

Signature of qualified heir |

|

|||

|

|

|

|

|

|

|

|

|

Signature of qualified heir |

|

|

|

Signature of qualified heir |

|

|||

Signatures of other interested parties

Signatures of other interested parties

Schedule

Form 706 (Rev.

Estate of:

Decedent’s social security number

SCHEDULE

(For jointly owned property that must be disclosed on Schedule E, see instructions.)

Note: If the value of the gross estate, together with the amount of adjusted taxable gifts, is less than the basic exclusion amount and Form 706 is being filed solely to elect portability of the DSUE amount, consideration should be given as to whether you are required to report the value of assets eligible for the marital or charitable deduction on this schedule. See the instructions for more information. If you are not required to report the value of an asset, identify the property but make no entries in the last four columns.

Item |

Description, including face amount of bonds or number of shares |

Unit value |

Alternate |

Alternate value |

Value at |

|

and par value for identification. Give CUSIP number. |

||||||

number |

valuation date |

date of death |

||||

If trust, partnership, or closely held entity, give EIN. |

|

|

||||

|

|

|

|

|

||

|

CUSIP number or EIN, |

|

|

|

|

|

|

where applicable |

|

|

|

|

1

Total from continuation schedules (or additional statements) attached to this schedule .

TOTAL (Also enter on Part

(If more space is needed, attach the continuation schedule from the end of this package or additional statements of the same size.)

Schedule

Document Specifics

| Fact Name | Description |

|---|---|

| Purpose of IRS 706 | This form is primarily used to calculate the estate tax due to the Federal government, as well as to report the distribution of the estate's assets. |

| Who Must File | IRS 706 must be filed by the executor of an estate whose gross value exceeds the exemption threshold established for the year of the decedent's death. |

| Filing Deadline | The form is generally required to be filed within nine months of the decedent's death, although an extension of six months is available if requested prior to the expiration of the original deadline. |

| Applicable Laws for State-Specific Forms | While IRS 706 pertains to federal estate taxes, many states have their own estate or inheritance tax forms, governed by the individual state's tax laws. |

| Deductions and Credits | Deductions for funeral expenses, debts, losses, and charitable contributions, among others, can be claimed on this form, potentially reducing the estate's tax liability. |

| Portability Election | IRS 706 allows a surviving spouse to inherit any unused estate tax exemption from their deceased spouse, thereby increasing their own exemption amount through a portability election. |

Guide to Writing IRS 706

Filing the IRS Form 706 may appear daunting at first glance, but understanding the process and preparing in advance can significantly simplify the task. This form is essential for reporting an individual's estate and determining if any taxes are due. It is an important step in settling a deceased individual's affairs, ensuring that all financial responsibilities are met in accordance with the law. By following a step-by-step approach, you can fill out this form accurately and efficiently, avoiding common pitfalls and ensuring compliance with IRS requirements.

- Collect all necessary documentation, including the deceased's death certificate, will, trust documents, and an inventory of the estate's assets and liabilities.

- Identify the estate's executor or administrator, as this individual will be responsible for filing Form 706.

- Determine the applicable filing deadline. Generally, Form 706 must be filed within 9 months of the deceased's death, although an extension may be requested.

- Download the most current version of IRS Form 706 from the IRS website.

- Complete the "Decedent and Executor Information" section, providing the necessary personal information about the deceased and the estate's executor.

- Calculate the gross estate value by listing all assets and their fair market values at the time of death, following the instructions provided in the form.

- Subtract any allowable deductions, such as funeral expenses, debts of the estate, and any qualified charitable contributions.

- Compute the taxable estate value by subtracting the allowable deductions from the gross estate value.

- Calculate any estate tax owed by applying the appropriate tax rates, as detailed in the form's instructions.

- Sign and date the form. Ensure that the estate's executor or administrator provides their signature.

- Attach any required documentation, which may include a copy of the death certificate, documentation of appraised values, and records of any estimated tax payments.

- Mail the completed form and any attachments to the appropriate IRS address, as specified in the form's instructions.

After the form is filed, the next steps will involve the IRS reviewing the submitted information. If everything is in order, they will process the estate's tax return. The executor may receive a notice of acceptance, or the IRS might request additional information or clarification regarding the submitted form. In some cases, an audit may be conducted to verify the information on the form. Throughout this process, it's important to respond promptly to any IRS inquiries and provide any requested documentation to ensure a smooth resolution. Familiarizing oneself with the instructions and seeking professional advice if needed can greatly assist in navigating these steps confidently and ensuring the estate is properly settled.

Understanding IRS 706

-

What is the IRS Form 706 and who needs to file it?

The IRS Form 706, officially known as the United States Estate (and Generation-Skipping Transfer) Tax Return, is a form used by the executors of estates to report the estate's value for federal estate tax purposes. If the gross estate, combined with prior taxable gifts, exceeds the federally exempt amount in the year of the decedent's death, filing this form is required. The federal exemption amount changes periodically, so it's important to check the current threshold to determine if you need to file.

-

What is the deadline for filing IRS Form 706?

The IRS requires Form 706 to be filed within 9 months after the decedent’s date of death. However, there is an option to request a 6-month extension if more time is needed to gather the necessary information and valuations. To request an extension, Form 4768 must be filed before the original due date of Form 706. It's crucial to adhere to this timeline to avoid potential penalties.

-

What information do you need to complete Form 706?

Completing Form 706 requires detailed information about the decedent and their estate. This includes but is not limited to: the decedent's legal name, social security number, and date of death; a comprehensive inventory of the estate's assets and their values at the date of death; information on any deductions, such as debts and administrative expenses; and details of any lifetime gifts that count against the lifetime exemption amount. It’s important to collect all relevant documents and accurately report values to ensure proper compliance.

-

Are there any deductions allowed on IRS Form 706?

Yes, the IRS allows several deductions on Form 706 which can significantly reduce the taxable estate. These deductions include debts owed by the decedent at the time of death, funeral expenses, administrative expenses related to the estate, loss during the administration of the estate, and bequests to qualifying charities. Additionally, bequests to a surviving spouse are generally deductible in full under the unlimited marital deduction provision, potentially lowering the estate's tax liability.

-

How can I obtain IRS Form 706 and its instructions?

IRS Form 706 and its accompanying instructions can be obtained directly from the Internal Revenue Service. The most straightforward way to get these documents is by downloading them from the IRS website. This ensures you have the most current version of the form and instructions, which is critical as tax laws and exemptions may change. Alternatively, you can also request these documents by phone or visit a local IRS office, if available in your area.

Common mistakes

-

Not thoroughly reading the instructions provided by the IRS for Form 706 can lead to errors. The form is complex, and each section requires careful attention to detail.

-

Missing the filing deadline is a common mistake. For Form 706, the deadline is typically nine months after the decedent's date of death, with a six-month extension available if requested.

-

Failing to report all of the decedent’s assets on the form is a significant oversight. This includes everything from bank accounts to real estate, and even small or overlooked assets.

-

Omitting previously gifted amounts can result in inaccuracies. Any gifts made by the decedent before their death that exceed annual exclusions must be reported.

-

Incorrectly valuing assets, either by overvaluation or undervaluation, can lead to complications. Assets should be valued at their fair market value at the time of the decedent’s death.

-

Not claiming available deductions is a missed opportunity. Deductions for funeral expenses, debts, and other eligible reductions can significantly lower the estate’s tax liability.

-

Miscalculating the taxable estate by not properly applying adjustments and exclusions leads to an incorrect tax base, which can impact the amount of tax due.

-

Forgetting to sign and date the form renders it incomplete. An unsigned Form 706 will not be processed by the IRS, potentially causing delays.

-

Failing to attach necessary documentation, such as death certificates or appraisals for high-value assets, can hold up the processing of the form.

-

Submitting the form to the wrong address, which can vary depending on the decedent’s place of residence or the executor’s location, may result in processing delays.

In addition to these common mistakes, it’s important to remain vigilant for potential issues that can arise during the filing process. Here are a few more general tips to consider:

Always check the IRS website for the most current version of Form 706 and its instructions.

Consider consulting with a tax professional or estate planning expert who can provide guidance tailored to your specific situation.

Keep copies of everything you submit to the IRS for your records.

Be meticulous in documenting and valuing estate assets to ensure accuracy.

Double-check calculations and the completeness of all requirements before submission to minimize errors.

Documents used along the form

When handling the estate of a deceased individual, the IRS Form 706, United States Estate (and Generation-Skipping Transfer) Tax Return, is a critical document. This form is used to report the estate's value and assess any taxes owed. However, preparing and filing a Form 706 often involves submitting additional forms and documents to provide a comprehensive account of the deceased's estate. These additional forms play a pivotal role in ensuring accurate reporting and compliance with tax laws.

- Form 1041, U.S. Income Tax Return for Estates and Trusts: This form is used by the estate's executor or fiduciary to report any income the estate generates. The requirement to file Form 1041 exists when the estate earns income of $600 or more during the tax year or has a beneficiary who is a nonresident alien.

- Form 709, United States Gift (and Generation-Skipping Transfer) Tax Return: In cases where the deceased made significant gifts above annual exclusion amounts, Form 709 is required. It reports gifts that may affect the estate's tax liability, providing a detailed account of any lifetime gifts that could impact the overall estate value.

- Schedule H (Form 706), Generation-Skipping Transfer Tax: For estates subject to generation-skipping transfer taxes, Schedule H must be completed. This schedule is integral to calculating any taxes due on transfers to beneficiaries who are two or more generations below the decedent.

- Letters of Administration or Letters Testamentary: These legal documents, issued by a probate court, authorize an individual to act as the executor or personal representative of the deceased's estate. They are necessary for individuals filing Form 706 to prove their legal authority to manage the estate's affairs.

Each of these documents serves its unique purpose in the estate settlement process, complementing the IRS Form 706 to ensure thorough and accurate tax compliance. Navigating through these requirements can be a complex task, emphasizing the importance of careful attention to detail and compliance with all applicable laws and regulations. By understanding the role of each form and document, executors and administrators can better navigate the complexities of estate management and tax reporting.

Similar forms

The IRS 706 form, while unique in its purpose, shares similarities with a range of other tax and legal documents. For example, the IRS 1041 form, which is used for estates and trusts to report income, bears a resemblance in its function to distribute the tax obligations tied to an entity's earnings after someone's death. Just like the IRS 706 form helps determine the estate tax liabilities based on the valuation of the deceased's estate, the 1041 form navigates the income taxation for the assets that are still generating income beyond the death of the estate's owner.

Similarly, the IRS 709 form, used for reporting gifts that exceed the annual exclusion amount, overlaps with the 706 in its concern with transfers of wealth. Both forms are integral in understanding the movement of assets that might not be part of regular income but are significant for tax purposes. The IRS 706 deals with the transfer of assets after death, while the 709 captures the flow of wealth during one's lifetime, both being critical in ensuring the accurate calculation of taxes owed to the government.

Another document, the IRS W-9 form, is commonly used to provide taxpayer identification number and certification. Like the IRS 706, it's about providing essential information to manage fiscal responsibilities accurately. While the W-9 is often more relevant for employment or freelance work, ensuring that the correct tax information is on file for payers, its purpose of assuring the right amount of tax liability is reported echoes the objective of the 706 form in estate settlements.

The Form SS-4, necessary for applying for an Employer Identification Number (EIN), showcases another procedural parallel to the IRS 706. This document, crucial for identifying a business entity just like an EIN helps identify an estate or a trust on form 706, laying the groundwork for tax filing requirements. Both forms serve as an introduction to the IRS, setting the stage for further financial disclosure and tax responsibilities.

State inheritance tax waivers also share a concept with the IRS 706 form. Though not a federal document, these waivers are critical in states that impose their own taxes on inheritance. Like the 706, which deals with federal estate taxes, state waivers determine the tax implications of transferring assets within specific jurisdictions, emphasizing the complexity of managing an estate's tax obligations beyond federal requirements.

Last but not least, the IRS 8822 form, which is used to inform of a change in address, while simplistic in nature compared to the 706, illustrates how maintaining accurate records is crucial for proper tax management. This parallels the need for accuracy in the 706 form's detailed account of an estate's valuation for tax purposes. Both documents highlight the importance of providing the IRS with up-to-date information to ensure tax responsibilities are met accurately and promptly.

Each of these documents, though varied in their specific applications, converges on the overarching theme of tax liability and reporting. The IRS 706 form, in concert with these other forms, creates a comprehensive picture of an individual's or entity's fiscal responsibilities at different stages of life and business operations, ensuring a thorough and accurate accounting of taxable activities and assets.

Dos and Don'ts

The IRS Form 706, the United States Estate (and Generation-Skipping Transfer) Tax Return, is a form filed by the executor of a decedent's estate to calculate the estate tax owed under Chapter 11 of the Internal Revenue Code. The form is used to report the estate's value and calculate the appropriate taxes based on the current laws. Proper completion of this form is crucial, as errors can result in penalties or delays. Here are nine do's and don'ts to keep in mind when preparing IRS Form 706.

- Do gather all necessary documentation before beginning. This includes the will, death certificate, appraisals, account statements, and property deeds. Accurate documentation ensures the correct valuation of the estate.

- Do double-check the filing threshold. Not every estate is required to file Form 706. Make sure the estate meets the current filing requirement, which is subject to change from year to year.

- Do take advantage of deductions. Understand what deductions are allowable, such as funeral expenses, debts of the estate, and property passed to surviving spouses, to reduce the taxable estate value.

- Do consider valuation dates carefully. The executor has the option to value the estate assets on the date of death or six months later, choosing the alternate valuation date which can lower the estate's tax liability.

- Do seek professional advice. Given the complexity of estate tax laws, consulting with a tax professional or attorney specializing in estate planning can prevent costly mistakes.

- Don't underestimate the importance of timely filing. The form is generally due nine months after the date of death, with a six-month extension available if requested before the due date.

- Don't overlook state requirements. Some states have their own estate or inheritance tax forms. Be aware of and comply with any state-specific filing requirements.

- Don't guess on valuations. Estate assets need to be accurately valued, which might require professional appraisals. This is especially true for unique or valuable items like art, jewelry, or real estate.

- Don't ignore IRS updates. Tax laws and filing requirements can change. Regularly check for updates to ensure compliance with the latest rules and regulations.

Misconceptions

The IRS Form 706, often shrouded in mystery and misconceptions, serves as the United States Estate (and Generation-Skipping Transfer) Tax Return, playing a pivotal role in the administration of estates. Given its complexity and the daunting nature of tax matters, it's no surprise a few myths have taken root, sometimes leading to costly misunderstandings. Here, we will explore and demystify five common misconceptions surrounding this significant form.

- Only Wealthy Estates Need to File: A prevalent misconception is that IRS Form 706 is reserved solely for the ultra-wealthy. While it's true that the form is required for estates that exceed the federal exemption amount ($12.06 million for individuals dying in 2022), smaller estates may also need to file under certain circumstances, such as when a surviving spouse wishes to preserve any unused exemption amount for their own future estate tax purposes.

- Form 706 is Only a Federal Requirement: Another misunderstanding is viewing Form 706 strictly as a federal obligation, neglecting the fact that some states require a version of this form for their own estate or inheritance taxes. This means executors may have additional filing requirements beyond the federal mandate, depending on the decedent's state of residence and any real estate owned in other states.

- Filing Deadline Can Be Easily Extended: While the IRS does grant extensions for filing Form 706, securing an extension is not as straightforward as it may appear. The executor needs to proactively request an extension by filing Form 4768 before the original deadline (nine months after the decedent's date of death). Furthermore, an extension to file does not equate to an extension to pay any owed taxes, which can lead to penalties if not properly managed.

- Form 706 Covers All Types of Transfers: Individuals often believe that Form 706 encompasses all transfer types, including those made during the decedent's lifetime. However, it primarily concerns transfers made as a result of death. Gifts made during the individual's life are reported separately, via Form 709, United States Gift (and Generation-Skipping Transfer) Tax Return.

- Once Filed, the Estate’s Tax Responsibilities Are Complete: The final filing of Form 706 does not necessarily close the chapter on an estate’s tax obligations. The IRS may audit the return, leading to additional requests for information and, potentially, adjustments to the tax owed. Moreover, the executor should be aware of other potential tax filings, including the final personal income tax return for the decedent and possibly an income tax return for the estate itself (Form 1041).

Dispelling these myths is crucial for executors and beneficiaries to navigate the complexities of estate administration effectively. An informed approach ensures compliance with tax laws, minimizes potential penalties, and safeguards the financial interests of the estate and its heirs.

Key takeaways

The IRS 706 form is an essential document for individuals dealing with the estate of someone who has passed away. This form, officially called the United States Estate (and Generation-Skipping Transfer) Tax Return, plays a crucial role in the administration of an estate's financial obligations to the federal government. Here are six key takeaways to understand when dealing with the IRS 706 form.

- Threshold Requirement: Not every estate must file a Form 706. As of the latest tax year, only estates with a gross value exceeding the federal estate tax exemption limit—a figure set and occasionally adjusted by the IRS—are required to file. This threshold often changes, so it's crucial to check the current limits.

- Filing Deadline: The IRS 706 form must be filed within nine months following the decedent's date of death, although an automatic six-month extension is available if requested before the deadline passes. This strict timeline helps to avoid penalties and interest.

- State Estate Tax Consideration: Several states impose their own estate taxes, separate from federal obligations. While Form 706 is a federal form, understanding your state's estate tax laws is vital, as there may be additional filing requirements at the state level.

- Valuing Estate Assets: One of the most significant aspects of completing Form 706 is accurately valuing the estate's assets as of the date of death. This can be complex and may require professional appraisals to determine the fair market value of real estate, stocks, and other property.

- Marital Deduction: The IRS allows a marital deduction that can significantly reduce the taxable estate if assets are transferred to the surviving spouse. This is an important consideration for reducing or eliminating estate tax and requires careful planning and documentation on Form 706.

- Generation-Skipping Transfer Tax: For individuals leaving assets to grandchildren or other "skip" persons, the IRS imposes a generation-skipping transfer (GST) tax. Part of the Form 706 filing includes calculating any potential GST tax to ensure compliance with this complex area of estate tax law.

Filing an IRS 706 form can be challenging, given the nuances of estate value, deductions, and taxes. It often involves detailed record-keeping, professional appraisals, and a deep understanding of the tax code. For those unaccustomed to such tasks, consulting a tax professional or estate lawyer is highly recommended to navigate the requirements and avoid any pitfalls.

Popular PDF Documents

Deferred Loan Payment - An emphasis on the legal implications of providing false information underscores the form's importance and federal oversight.

Housing Payment - Locate your nearest authorized rent payment center from PAYOMATIC branches to community credit unions, effective starting April 4, 2014.