Get IRS 6781 Form

Navigating the complexities of investing in commodities and futures contracts presents a unique set of challenges, especially when it comes time to report gains and losses to the Internal Revenue Service (IRS). This is where the IRS 6781 form comes into play. A critical tool for investors, this form provides a way to separate gains and losses from section 1256 contracts, which includes futures contracts, foreign currency contracts, and others, from other types of investment income. It offers the option to mark-to-market these investments, which means investors can treat these contracts as if they were sold and repurchased at the year's end, allowing gains and losses to be treated as 60% long-term and 40% short-term, regardless of how long the contracts were actually held. This distinct tax treatment can potentially lead to advantageous tax situations for savvy investors. Understanding and properly utilizing the IRS 6781 form is essential for anyone involved in the complex world of commodities and futures investing to ensure they are maximizing their investment strategy while remaining compliant with IRS regulations.

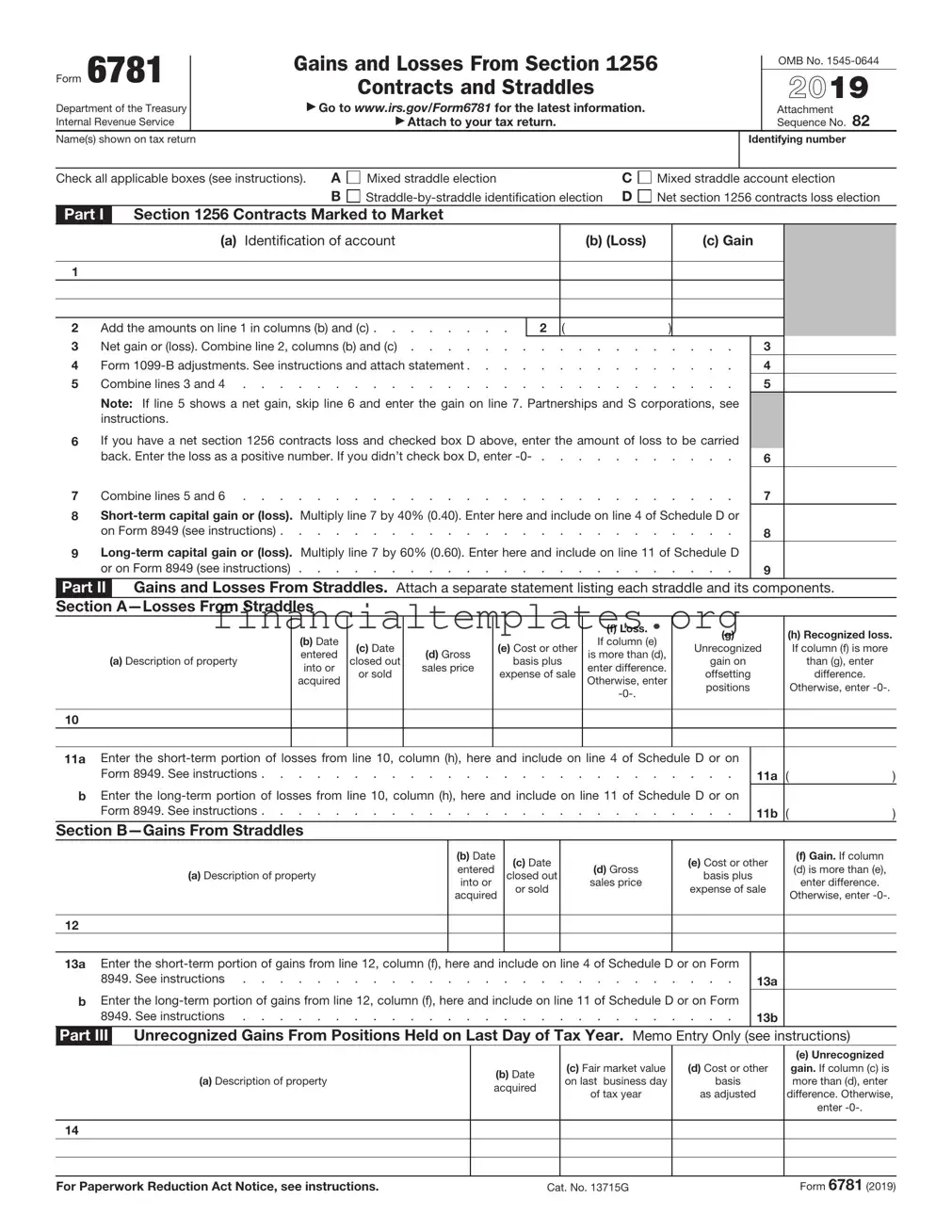

IRS 6781 Example

Form 6781 |

|

|

Gains and Losses From Section 1256 |

|

|

|

|

OMB No. |

||||||||

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

Contracts and Straddles |

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

2021 |

||||||||||

Department of the Treasury |

|

|

▶ Go to www.irs.gov/Form6781 for the latest information. |

|

|

|

|

|||||||||

Internal Revenue Service |

|

|

▶ Attach to your tax return. |

|

|

|

|

|

|

Attachment |

82 |

|||||

|

|

|

|

|

|

|

|

Sequence No. |

||||||||

Name(s) shown on tax return |

|

|

|

|

|

|

|

|

Identifying number |

|

||||||

|

|

|

|

|

|

|

|

|

|

|

||||||

Check all applicable boxes. |

A |

Mixed straddle election |

|

|

C Mixed straddle account election |

|

||||||||||

See instructions. |

B |

D Net section 1256 contracts loss election |

||||||||||||||

Part I |

Section 1256 Contracts Marked to Market |

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

(a) Identification of account |

|

|

(b) (Loss) |

|

|

(c) Gain |

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

2 |

Add the amounts on line 1 in columns (b) and (c) |

2 |

( |

) |

|

|

|

|

|

|

|

|

||||

3 |

Net gain or (loss). Combine line 2, columns (b) and (c) |

. . . . . |

. |

. . |

|

3 |

|

|

||||||||

4 |

Form |

. . . . . |

. |

. . |

|

4 |

|

|

||||||||

5 |

Combine lines 3 and 4 |

. . . . . |

. |

. . |

5 |

|

|

|||||||||

Note: If line 5 shows a net gain, skip line 6 and enter the gain on line 7. Partnerships and S corporations, see instructions.

6If you have a net section 1256 contracts loss and checked box D above, enter the amount of loss to

be carried back. Enter the loss as a positive number. If you didn’t check box D, enter |

6 |

7 Combine lines 5 and 6 |

7 |

8

Schedule D or on Form 8949. See instructions |

8 |

9

Schedule D or on Form 8949. See instructions |

9 |

Part II Gains and Losses From Straddles. Attach a separate statement listing each straddle and its components.

Section

(a) Description of property |

(b) Date |

(c) Date |

(d) Gross |

(e) Cost or |

(f) Loss. |

(g) |

(h) Recognized loss. |

||

If column (e) is |

|||||||||

|

entered into |

closed out |

sales price |

other basis |

Unrecognized |

If column (f) is |

|||

|

more than (d), |

||||||||

|

or acquired |

or sold |

|

plus expense |

gain on |

more than (g), |

|||

|

|

enter difference. |

|||||||

|

|

|

|

of sale |

offsetting |

enter difference. |

|||

|

|

|

|

Otherwise, |

|||||

|

|

|

|

|

positions |

Otherwise, enter |

|||

|

|

|

|

|

enter |

||||

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

10 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

11a Enter the |

|

|

|||||||

D or on Form 8949. See instructions |

. . . . . . . |

11a ( |

) |

||||||

bEnter the

D or on Form 8949. See instructions |

. |

. |

. . |

11b ( |

) |

|||

Section |

|

|

|

|

|

|

|

|

(a) Description of property |

(b) Date |

(c) Date |

(d) Gross |

|

|

(e) Cost or |

(f) Gain. |

|

|

|

If column (d) is |

||||||

|

entered into |

closed out |

sales price |

|

|

other basis |

||

|

|

|

more than (e), |

|||||

|

or acquired |

or sold |

|

|

plus expense |

|||

|

|

|

enter difference. |

|||||

|

|

|

|

|

|

of sale |

|

|

|

|

|

|

|

|

Otherwise, enter |

||

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

12 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

13a Enter the |

|

|

||||||

or on Form 8949. See instructions |

. |

. |

. . |

13a |

|

|||

bEnter the

D or on Form 8949. See instructions |

. . . 13b |

|

||||

Part III |

Unrecognized Gains From Positions Held on Last Day of Tax Year. Memo entry only (see instructions) |

|||||

|

(a) Description of property |

(b) Date |

(c) Fair market |

|

(d) Cost or |

(e) Unrecognized |

|

|

gain. If column (c) |

||||

|

|

acquired |

value on last |

|

other basis |

|

|

|

|

is more than (d), |

|||

|

|

|

business day |

|

as adjusted |

|

|

|

|

|

enter difference. |

||

|

|

|

of tax year |

|

|

|

|

|

|

|

|

Otherwise, enter |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

14 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For Paperwork Reduction Act Notice, see instructions. |

Cat. No. 13715G |

|

Form 6781 (2021) |

|||

Form 6781 (2021) |

Page 2 |

Section references are to the Internal Revenue Code unless otherwise noted.

What’s New

Qualified Opportunity Investment

If you held a qualified investment in a qualified opportunity fund (QOF) at any time during the year, you must file your return with Form 8997. See the Instructions for Form 8997.

Future Developments

For the latest information about developments related to Form 6781 and its instructions, such as legislation enacted after they were published, go to www.irs.gov/Form6781.

General Instructions

Purpose of Form

Use Form 6781 to report:

•Any capital gain or loss on section 1256 contracts under the

•Gains and losses under section 1092 from straddle positions.

For details on section 1256 contracts and straddles, see Pub. 550, Investment Income and Expenses.

Section 1256 Contract

A section 1256 contract is any:

•Regulated futures contract,

•Foreign currency contract,

•Nonequity option,

•Dealer equity option, or

•Dealer securities futures contract.

For definitions of these terms and more details, see section 1256(g) and Pub. 550.

A section 1256 contract doesn’t include any securities future contract, option on a securities future contract, interest rate swap, currency swap, basis swap, commodity swap, equity swap, equity index swap, credit default swap, interest rate cap, interest rate floor, or similar agreement.

Special rules apply to certain foreign currency contracts. See section 988 and Regulations sections

Options and commodities dealers must take any gain or loss from the trading of section 1256 contracts into

account in figuring net earnings subject to

Under these rules, each section 1256 contract held at year end is treated as if it were sold at fair market value (FMV) on the last business day of the tax year. The wash sale rules don’t apply.

If your section 1256 contracts produce capital gain or loss, gains or losses on section 1256 contracts open at the end of the year, or terminated during the year, are treated as 60% long term and 40% short term, regardless of how long the contracts were held.

The

Straddle

A straddle means offsetting positions with respect to personal property of a type that is actively traded.

Offsetting Positions

If there is a substantial decrease in risk of loss to a taxpayer holding a position because that taxpayer or a related party also holds one or more other positions, then those positions are offsetting and may be part of a straddle. However, if an identified straddle is properly established, other positions held by the taxpayer won’t be treated as offsetting with respect to any position that is part of the identified straddle.

General Rule for Straddles

If you don’t make any of the elections described in box A, B, or C, and you have a loss on the section 1256 contract component, use Part II to reduce the loss by any unrecognized gain on the

Box A. Mixed Straddle Election

Under section 1256(d), you can elect to have the

Box B.

Make this election for mixed straddles according to Temporary Regulations section

(a)the close of the day the identified

mixed straddle is established, or (b) the time the position is disposed of. No

If you make this election, any positions you held on the day before the election are deemed sold for their FMV at the close of the last business day before the day of the election. For elections made on or before August 18, 2014, take this gain or loss into account when computing taxable income for the year in which the election was made. For elections made after August 18, 2014, take this gain or loss into account in the year you would have reported the gain or loss if the identified mixed straddle had not been established. In addition, when the gain or loss that accrued prior to the time the identified mixed straddle was established is taken into account, it will have the same character it would have had if the identified mixed straddle had not been established. See Regulations section

Each year you hold positions subject to this election, you must mark to market your section 1256 contracts and determine, in accordance with Regulations sections

Box C. Mixed Straddle Account Election

Make this election according to Temporary Regulations section

Form 6781 (2021) |

Page 3 |

Box D. Net Section 1256 Contracts Loss Election

If you have a net section 1256 contracts loss for 2021, you can elect to carry it back 3 years. Corporations, partnerships, estates, and trusts are not eligible to make this election. Your net section 1256 contracts loss is the smaller of:

•The excess of your losses from section 1256 contracts over the total of

(a) your gains from section 1256 contracts plus (b) $3,000 ($1,500 if married filing separately), or

•The total you would figure as your

The amount you can carry back to any prior year is limited to the smaller of:

•The gain, if any, that you would report on line 16 of Schedule D (Form 1040) for that carryback year if only gains and losses from section 1256 contracts were taken into account; or

•The gain, if any, reported on line 16 of Schedule D (Form 1040) for that carryback year.

The amounts just described are figured prior to any carryback from the loss year. Also, the carryback is allowed only to the extent it doesn’t increase or produce a net operating loss for the carryback year. The loss is carried to the earliest year first.

Make the election by checking box D and entering the amount to be carried back on line 6. To carry your loss back, file Form 1045, Application for Tentative Refund, or an amended return. Attach an amended Form 6781 and an amended Schedule D (Form 1040) for the applicable years.

On the amended Forms 6781 for the years to which the loss is carried back, report the carryback on line 1 of that year’s amended Form 6781. Enter “Net section 1256 contracts loss carried back from” and the tax year in column (a), and enter the amount of the loss carried back in column (b).

Specific Instructions

Part I

Line 1

Include on line 1 all capital gains and losses from section 1256 contracts open at the end of your tax year or closed out during the year. If you received a Form

broker’s name. List separately each transaction for which you didn’t receive a Form

If you are completing an amended 2021 Form 6781 to carry back a net section 1256 contracts loss from 2022 or a later year, report the carryback on line

1.Enter “Net section 1256 contracts loss carried back from” and the tax year in column (a), and enter the amount of the loss carried back to 2021 in column (b). See the instructions for box D for details.

Line 4

▲For information about how to ! elect to defer capital gain net income because you invested

CAUTION in a Qualified Opportunity Fund (QOF), see the Instructions for Form 8949. Don’t use line 4 to show the adjustment for a

If the Form

•The section 1256 contract part of a mixed straddle, if you made any of the mixed straddle elections.

•The amount of the loss, if you didn’t make any of the mixed straddle elections or the straddle wasn’t identified as a mixed straddle and you had a loss on the section 1256 contract part that was less than the unrecognized gain on the

•The section 1256 contract part of a hedging transaction. The gain or loss on a hedging transaction is treated as ordinary income or loss. See Pub. 550 for details.

Line 5

Partnerships enter the amount from line 5 on Form 1065, Schedule K, line 11. S corporations enter the amount from line 5 on Form

10.Lines 6 through 9 in Form 6781, Part I, don’t apply to partnerships or S corporations and are left blank.

Line 6

See the instructions for box D.

Line 8

If you are not deferring any of this

amount due to an investment in a QOF, include this amount on Schedule D (Form 1040), line 4; or on Schedule D (Form 1041), line 4. If you are deferring any of this amount due to an investment in a QOF, follow the instructions in the next paragraph.

For other returns, enter it in Part I of a Form 8949 with box B checked (if you received a Form

Line 9

If you are not deferring any of this amount due to an investment in a QOF, include this amount on Schedule D (Form 1040), line 11; or on Schedule D (Form 1041), line 11. If you are deferring any of this amount due to an investment in a QOF, follow the instructions in the next paragraph.

For other returns, enter it in Part II of a Form 8949 with box E checked (if you received a Form

▲ |

If you held a qualified |

|

! |

||

investment in a qualified |

||

opportunity fund (QOF) at any |

||

CAUTION |

time during the year, you must |

|

|

file your return with Form 8997. See the Instructions for Form 8997 for more information.

Part II

Use Section A for losses from positions that are part of a straddle. Generally, a loss is allowed to the extent it exceeds the unrecognized gain on offsetting positions. The part of the loss not allowed is treated as if incurred in the following year and is allowed to the same extent. However, a loss from a position established in an identified straddle after October 21, 2004, isn’t allowed. Instead, the basis of each offsetting position in the identified straddle that has unrecognized gain is increased by the amount of the unallowed loss multiplied by the following fraction:

The unrecognized gain (if any)

on the offsetting position

The total unrecognized gain on all positions that offset the loss position in the identified straddle

For more details, see Pub. 550, chapter 4.

Use Section B for gains from positions that are part of a straddle.

Form 6781 (2021) |

Page 4 |

Don’t include in Part II a disposition of any of the following.

•A position that is part of a hedging transaction.

•A loss position included in an identified straddle established before October 22, 2004, unless you disposed of all of the positions making up the straddle.

•A loss position included in an identified straddle established after October 21, 2004.

•A position that is part of a straddle if all of the positions of the straddle are section 1256 contracts.

Line 10, Column (a)

Enter the property and delivery date and indicate whether the property is a long or short position.

Line 10, Column (d)

For positions closed out or sold, enter the closing price or sales price.

Line 10, Column (e)

For positions closed out or sold, enter the cost or other basis plus commissions paid. Include nondeductible interest and carrying charges allocable to personal property that is part of a straddle. If any part of an unallowed loss from an offsetting position established in an identified straddle after October 21, 2004, increased your basis in the position, also include that amount. See Pub. 550 for details.

Line 10, Column (f)

Include in this column any loss not allowed in the prior year to the extent of the unrecognized gain.

Line 10, Column (g)

Enter the unrecognized gain on positions offsetting those in columns (a) through (f). Include unrecognized gain on any position you are treated as holding because it is held by a related party. Figure the amount to enter in this column by subtracting the cost or other basis of the offsetting position from the settlement price of that position as of the close of the last business day of your 2021 tax year.

Lines 11 and 13

Separate recognized gains and losses into short term and long term. Attach a separate statement for each. For information about holding periods for straddle positions, see Pub. 550 and Temporary Regulations section

Attach separate statements for (a) section 988 contracts that are part of a mixed straddle, and (b) any gain on the disposition or other termination of any position held as part of a conversion transaction (as defined in section 1258(c)). Identify the net gain or loss and report it on Form 4797, line 10.

Line 11a

Include this amount on Schedule D (Form 1040), line 4; or on Schedule D (Form 1041), line 4.

For other returns, enter it in Part I of a Form 8949 with box C checked. Enter “Form 6781, Part II” on line 1 in column

(a). Enter the (loss) as a negative number (in parentheses) in column (h). Leave all other columns blank.

Line 11b

Include this amount on Schedule D (Form 1040), line 11; or on Schedule D (Form 1041), line 11.

For other returns, enter it in Part II of a Form 8949 with box F checked. Enter “Form 6781, Part II” on line 1 in column

(a). Enter the (loss) as a negative number (in parentheses) in column (h). Leave all other columns blank.

Line 13a

If you are not deferring any of this amount due to an investment in a QOF, include this amount on Schedule D (Form 1040), line 4; or on Schedule D (Form 1041), line 4. If you are deferring any of this amount due to an investment in a QOF, follow the instructions in the next paragraph.

For other returns, enter it in Part I of a Form 8949 with box C checked. Enter “Form 6781, Part II” on line 1 in column

(a). Enter the gain in column (h). Leave all other columns blank.

Line 13b

If you are not deferring any of this amount due to an investment in a QOF, include this amount on Schedule D (Form 1040), line 11; or on Schedule D (Form 1041), line 11. If you are deferring any of this amount due to an investment in a QOF, follow the instructions in the next paragraph.

For other returns, enter it in Part II of a Form 8949 with box F checked. Enter “Form 6781, Part II” on line 1 in column

(a). Enter the gain in column (h). Leave all other columns blank.

Collectibles gain or (loss). A collectibles gain or (loss) is any

If any of the gain or loss you reported in Part II is a collectibles gain or (loss) and you are filing Form 1040,

Form 1040 or

Rate Gain Worksheet in the Instructions for Schedule D (Form 1040).

Form 1041. If you must complete the 28% Rate Gain Worksheet in the Instructions for Schedule D (Form 1041), include the collectibles gain or (loss) from Part II on line 3 of that worksheet.

Part III

Complete Part III by listing each position (whether or not part of a straddle) that you held at the end of the tax year (including any position you are treated as holding because it is held by a related party) if the FMV of the position at such time exceeds your cost or other basis as adjusted.

Don’t include positions that are part of an identified straddle or hedging transaction, property that is stock in trade or inventory, or property subject to depreciation used in a trade or business.

Don’t complete Part III if you don’t

have a recognized loss on any position (including section 1256 contracts).

Paperwork Reduction Act Notice. We ask for the information on this form to carry out the Internal Revenue laws of the United States. You are required to give us the information. We need it to ensure that you are complying with these laws and to allow us to figure and collect the right amount of tax.

You are not required to provide the information requested on a form that is subject to the Paperwork Reduction Act unless the form displays a valid OMB control number. Books or records relating to a form or its instructions must be retained as long as their contents may become material in the administration of any Internal Revenue law. Generally, tax returns and return information are confidential, as required by section 6103.

The time needed to complete and file this form will vary depending on individual circumstances. The estimated burden for individual taxpayers filing this form is approved under OMB control number

Recordkeeping . . . |

. |

8 hr., 36 min. |

Learning about the |

|

|

law or the form . . . |

. |

1 hr., 57 min. |

Preparing the form . |

. |

3 hr., 7 min. |

Copying, assembling, |

|

|

and sending the form |

|

|

to the IRS |

. |

. . 16 min. |

If you have comments concerning the accuracy of these time estimates or suggestions for making this form simpler, we would be happy to hear from you. See the instructions for the tax return with which this form is filed.

Document Specifics

| Fact Number | Fact Detail |

|---|---|

| 1 | The IRS Form 6781 is titled "Gains and Losses From Section 1256 Contracts and Straddles". |

| 2 | It is used primarily for taxpayers who have engaged in trading Section 1256 contracts. |

| 3 | Section 1256 contracts include regulated futures contracts, foreign currency contracts, non-equity options, dealer equity options, and dealer securities futures contracts. |

| 4 | One of the key benefits of Form 6781 is the 60/40 tax treatment. This means 60% of gains or losses are considered long-term, regardless of how long the contract was held. |

| 5 | The remaining 40% of gains or losses are treated as short-term, irrespective of the holding period. |

| 6 | Losses reported on Form 6781 can be carried back up to three years to offset gains in those years, providing a tax refund opportunity. |

| 7 | Form 6781 also asks taxpayers to segregate trades into various categories, such as those that are part of a mixed straddle, identified straddles, and straddle-by-straddle identifications. |

| 8 | This form must be filed with the taxpayer’s annual tax return. |

| 9 | While federal in nature, the outcomes of Form 6781 can affect state tax filings, depending on the state’s tax code relating to capital gains and losses. |

Guide to Writing IRS 6781

Once you've decided to dive into the finer points of financial strategies such as commodities and futures contracts, navigating the IRS Form 6781 becomes a crucial step. This form helps taxpayers report gains and losses from such contracts, ensuring proper tax treatment and compliance. While the form might seem daunting at first, breaking it down step by step can simplify the process.

To correctly file IRS Form 6781, follow these steps:

- Start by gathering all necessary documents related to your commodities and futures contracts. This includes broker statements and any other records of transactions.

- On the form, begin by entering your name and social security number (SSN) or taxpayer identification number (TIN) at the top.

- Proceed to Part I of the form, which is dedicated to Section 1256 Contracts. Here, you will list all gains and losses from these contracts over the tax year.

- In Part I, Line 1, enter the aggregate profit or loss from all Section 1256 contracts closed during the year. This information typically comes from your broker statements.

- If applicable, fill out Line 2 for any net gain or loss carryover from the previous year. This would only apply if you had reported Section 1256 contracts in a prior tax year.

- Next, move to Part II of the form if you have elected Section 988 transactions that need to be treated under Section 1256 contracts. This section requires a more detailed breakdown of your transactions.

- For each transaction, detail the name of the commodity or financial instrument, the date of the transaction, and the gain or loss realized.

- After listing all transactions, summarize the total net gain or loss on Line 10 of Part II.

- Finally, take the net figures from Sections I and II, and follow the instructions for incorporating these into your overall tax return. This might involve transferring totals to other forms or schedules, depending on your specific tax situation.

Remember, accuracy is key when filling out IRS Form 6781. Double-check all numbers and consider consulting with a tax professional if you encounter complexities or have specific questions related to your financial activities. Taking these steps can help ensure that your tax reporting is thorough and compliant.

Understanding IRS 6781

-

What is the IRS Form 6781?

IRS Form 6781, also known as "Gains and Losses From Section 1256 Contracts and Straddles", is used by traders and investors to report gains and losses from section 1256 contracts and straddle positions. Section 1256 contracts include regulated futures contracts, foreign currency contracts, nonequity options, dealer equity options, and dealer securities futures contracts. This form is essential for taxpayers to calculate the correct tax treatment of their trading activities, including the special 60/40 rule, where 60% of gains or losses are considered long-term, irrespective of the holding period, and the remaining 40% are treated as short-term.

-

Who needs to file the IRS Form 6781?

Any individual, partnership, corporation, trust, or estate that participates in transactions involving section 1256 contracts must file IRS Form 6781. This requirement applies regardless of whether these transactions result in gains or losses during the tax year. It's important for taxpayers involved in these types of transactions to track their activity closely throughout the year to accurately complete Form 6781.

-

How do I complete the IRS Form 6781?

To complete the IRS Form 6781, you'll need to report the total gain or loss from all section 1256 contracts for the tax year. The form is divided into parts:

- Part I: Where you list all aggregate gains and losses from section 1256 contracts.

- Part II: Where you provide details on gains and losses from straddles, if applicable.

It’s important to accurately report each transaction, as this will determine your tax liability. You may need to refer to brokerage statements or other records to compile the necessary information.

-

When is IRS Form 6781 due?

IRS Form 6781 is due when you file your annual income tax return. The deadline is typically April 15th for individuals and March 15th for corporations, unless you file for an extension. If you receive an extension to file your income tax return, the same extension applies to Form 6781.

-

What are the tax implications of filing Form 6781?

Filing Form 6781 can affect your taxes in several ways. Most notably, it allows for the special 60/40 tax rule, wherein 60% of gains or losses are taxed at the long-term capital gains rate, which is generally lower than the short-term capital gains rate applied to the remaining 40%. This can potentially reduce the amount of taxes owed. However, misreporting or failing to report transactions on Form 6781 can lead to audits, penalties, and interest.

-

Can I file IRS Form 6781 electronically?

Yes, you can file IRS Form 6781 electronically as part of your overall tax return through IRS-approved e-filing services. E-filing is the preferred method as it's faster and typically more secure than paper filing. However, ensure that your chosen tax software supports Form 6781 as part of its e-filing service.

-

Where can I find more information or assistance with IRS Form 6781?

For more information or assistance with IRS Form 6781, you can visit the official IRS website, which provides detailed instructions and resources for completing the form. Additionally, tax professionals, such as CPAs and enrolled agents, can provide guidance and help ensure that you are accurately reporting your transactions according to current tax laws.

Common mistakes

Filling out IRS Form 6781, which deals with gains and losses from Section 1256 Contracts and Straddles, can sometimes feel like navigating through a maze without a map. This form is crucial for traders and investors who need to report their financial maneuvers accurately on their tax returns. However, common mistakes are often made during this process, some of which could potentially lead to headaches with the Internal Revenue Service. Let's walk through five missteps to avoid:

-

Not properly separating types of contracts. Section 1256 contracts have a distinct tax treatment, including a blend of long-term and short-term capital gains or losses. A common misstep is mixing these with other types of financial contracts on Form 6781. This mistake can create confusion and potentially result in inaccurate tax calculations.

-

Incorrect calculation of gains or losses. Calculating gains or losses requires precision. This includes understanding how to mark these contracts to market at the year's end and making the appropriate adjustments. Errors in these calculations can significantly impact the amount of tax owed or the size of a refund.

-

Failing to claim a loss carryback. Section 1256 of the Internal Revenue Code offers taxpayers the unique opportunity to carry back net losses for up to three years. However, this beneficial provision is often overlooked or misunderstood, leading individuals to miss out on potential tax refunds from prior years.

-

Overlooking mixed straddle account adjustments. Those who elect to use a mixed straddle account must make certain adjustments to their filings. It's common to either neglect these adjustments or not fully understand how to apply them, which can result in an incomplete or incorrect tax return.

-

Forgetting to attach Form 6781 to the tax return. It might seem straightforward, but it's surprisingly common to fill out Form 6781 correctly and then forget to attach it to the main tax return. This oversight can delay processing and might trigger inquiries from the IRS.

Avoiding these pitfalls can make a big difference in easing the tax return process and ensuring compliance with the IRS. Remember, when it comes to taxes, attention to detail can save a lot of time and trouble down the road.

Documents used along the form

Completing IRS Form 6781, concerning gains and losses from Section 1256 Contracts and Straddles, is an important step for taxpayers involved in commodity futures, foreign currency contracts, non-equity options, and other similar financial instruments. However, to accurately report gains and losses and comply with the taxation requirements, several other forms and documents are often used alongside Form 6781. Understanding these documents can help taxpayers ensure they're fulfilling their obligations and potentially optimizing their tax situations.

- Form 1040 (U.S. Individual Income Tax Return): This is the primary form used by individual taxpayers to file their annual income tax returns. Information from Form 6781 is used to complete specific sections of Form 1040, relating to capital gains or losses.

- Form 8949 (Sales and Other Dispositions of Capital Assets): Before completing the Schedule D of Form 1040, taxpayers use Form 8949 to report the sale or exchange of capital assets. This form helps in detailing individual transactions that are summarized on Schedule D.

- Schedule D (Capital Gains and Losses): Part of Form 1040, Schedule D is specifically used to summarize capital gains and losses from transactions reported on Form 8949, as well as certain transactions that are reported directly on Schedule D.

- Form 1099-B (Proceeds From Broker and Barter Exchange Transactions): This form is typically issued by brokers or barter exchanges to report proceeds from the sale or exchange of securities, commodities, and barter exchange transactions. It provides necessary details for completing Forms 8949 and 6781.

- Form 6251 (Alternative Minimum Tax—Individuals): Taxpayers may need to complete Form 6251 to determine if they owe alternative minimum tax (AMT), which can be affected by certain adjustments and preferences related to transactions reported on Form 6781.

- Form 4868 (Application for Automatic Extension of Time To File U.S. Individual Income Tax Return): If a taxpayer needs more time to gather information required for Form 6781 and related forms, they can file Form 4868 to request a six-month extension to file their tax return.

- Form 8824 (Like-Kind Exchanges): While not commonly associated with Form 6781, Form 8824 is used when a taxpayer has engaged in a like-kind exchange that may involve contracts or other instruments reported on Form 6781. It helps report deferral of capital gains or losses.

- Records and Statements: Keeping detailed records and statements of all transactions is essential. These documents provide the crucial details needed to accurately complete Form 6781 and other related tax documents.

Having a comprehensive understanding and the correct completion of these forms and documents can significantly impact a taxpayer’s obligations and benefits under the tax code. Taxpayers dealing with complex financial products, such as those reported on Form 6781, should consider consulting with a tax professional to ensure all the necessary paperwork is in order and accurately reflects their financial activities throughout the year.

Similar forms

The IRS 6781 form, designated for gains and losses from Section 1256 Contracts and Straddles, shares similarities with the Schedule D (Form 1040), which is used for reporting capital gains and losses from the sale or exchange of capital assets. Both forms are integral in the process of calculating tax obligations related to investment activities. While the IRS 6781 form specifically deals with gains and losses from certain types of contracts, Schedule D encompasses a broader range of capital assets, including stocks, real estate, and other investments. The connection lies in their mutual goal of determining the investment income or loss that contributes to the taxpayer's overall tax liability.

Form 8949, Sales and Other Dispositions of Capital Assets, operates in conjunction with Schedule D and similarly to the IRS 6781 form. It requires detailed reporting of each capital asset transaction, such as sales, exchanges, and dispositions, before the summary of these transactions is reported on Schedule D. The IRS 6781 form's requirement for detailed listing and calculation of gains and losses from Section 1256 transactions mirrors this necessity for detailed record-keeping, albeit focused on a specific type of investment activity. Both forms serve the purpose of ensuring transparency and accuracy in reporting taxable events.

Form 1040, U.S. Individual Income Tax Return, is the primary tax form for individuals and serves as the umbrella under which forms like IRS 6781 and Schedule D fall. It summarizes an individual's income, including income or losses reported on the IRS 6781 form and Schedule D, calculating the total tax liability or refund due to or from the taxpayer. While Form 1040 addresses a wide array of income sources, from wages to dividends, it directly links with the IRS 6781 form through the inclusion of investment income or loss, illustrating the interconnectivity of various forms in comprehensively reporting an individual's tax situation.

Form 4797, Sales of Business Property, is another form that shares similarities with the IRS 6781 form. It is used to report the sale, exchange, or involuntary conversion of property used in a trade or business. Both forms are concerned with the realization and reporting of gains and losses, but they cater to different types of assets and transactions. The IRS 6781 form focuses on financial contracts and straddles, while Form 4797 is concerned with tangible business property. Nonetheless, both contribute to the overall depiction of an individual's or entity's financial changes within a fiscal period.

Form 6251, Alternative Minimum Tax—Individuals, is related to the IRS 6781 form in its potential tax implications for taxpayers with certain types of investments. The calculation of alternative minimum tax (AMT) may be necessary for individuals who engage in transactions covered by IRS 6781, as gains and losses from Section 1256 contracts can affect AMT liability. While Form 6251 encompasses a broader range of tax preference items and adjustments, its connection with the IRS 6781 form exemplifies the need for a harmonized approach in evaluating tax obligations beyond standard income tax calculations.

The IRS Form 8621, Information Return by a Shareholder of a Passive Foreign Investment Company or Qualified Electing Fund, parallels the IRS 6781 form in its specificity to a certain niche of tax reporting, focusing on the impact of foreign investments. Similar to how the IRS 6781 form captures the nuances of Section 1256 contracts, Form 8621 addresses the complexities associated with investments in passive foreign investment companies (PFICs). Both forms cater to specialized investment scenarios, requiring detailed reporting to accurately assess the tax consequences and integrate these into the taxpayer's overall tax profile.

Dos and Don'ts

When filling out the IRS 6781 form, which is related to gains and losses from certain contract and straddle transactions, it's important to approach the task with care. Here are some do's and don'ts to keep in mind:

Do's:

Review the instructions carefully. The IRS provides detailed instructions for Form 6781, which help to clarify what information is needed and how to accurately complete the form.

Record all relevant transactions. It's crucial to report all gains and losses from section 1256 contracts and straddles. Ensure you have a comprehensive record of the year's transactions to provide accurate information.

Use accurate figures. Double-check your math and ensure the numbers you input reflect your actual gains and losses. Accuracy is key to avoiding issues with the IRS.

Seek professional advice if needed. If you're unsure about any part of the form, consider consulting with a tax professional. They can provide guidance and help you to avoid mistakes.

Don'ts:

Rush through the process. Taking your time to fill out Form 6781 correctly can prevent errors and save you from potential penalties or audits down the line.

Guess on amounts or dates. Estimations can lead to inaccuracies in your tax filings. Use exact numbers and dates for all reported transactions to ensure compliance.

Ignore IRS rules on straddles and contracts. The IRS has specific rules about how to report gains and losses from these transactions. Ignoring these rules can result in incorrect filings.

Forget to sign and date the form. An unsigned form is considered incomplete by the IRS and can lead to delays in processing your taxes.

Misconceptions

Filing taxes can often be confusing, especially when dealing with specific forms like the IRS 6781. There are several misconceptions about this form that can lead to confusion. Let's clarify some of these misunderstandings:

It's only for professional traders: Many believe that Form 6781 is exclusively for professional traders. However, it is also applicable to individuals who engage in commodity futures, index futures, and foreign currency contracts as part of their investment strategy.

You must report every transaction in detail: While it's crucial to keep detailed records, Form 6781 requires aggregate reporting. This means you report the total gains or losses for each category, rather than listing each transaction individually.

Losses aren't allowed: This is not true. Form 6781 allows individuals to report both gains and losses from section 1256 contracts. In fact, recognizing losses can be an important part of tax planning.

Only futures contracts are covered: Form 6781 covers more than just futures contracts. It also applies to foreign currency contracts and nonequity options, among other section 1256 contracts.

Filing is mandatory for all investors: Only those who have transactions that fall under section 1256 contracts need to file Form 6781. If you do not engage in these types of transactions, you do not need to file this form.

There's no benefit in filing: Filing Form 6781 can be beneficial, particularly because it allows for a 60/40 split on gains and losses. This means 60% of the gain or loss is treated as long-term, regardless of the holding period, potentially leading to lower tax rates.

Any accountant can help with the form: Although many tax professionals are familiar with Form 6781, it's best to seek out someone with experience in futures and commodities trading. They can provide more specialized advice and ensure the form is filled out correctly.

It must be filed separately: Some believe Form 6781 must be filed independently of the tax return. In reality, it should be filed as part of your tax return, and its totals feed into your overall taxable income calculation.

Filing this form invites audits: There's no evidence to support the idea that filing Form 6781 increases your chances of an audit. Like any part of the tax return, as long as your information is accurate and complete, you should not have any increased risk of audit.

Understanding these misconceptions about IRS Form 6781 can help taxpayers accurately report their investments and potentially take advantage of tax benefits. Always ensure to seek guidance from a knowledgeable tax professional to navigate these complexities effectively.

Key takeaways

The IRS 6781 form, known as the "Gains and Losses From Section 1256 Contracts and Straddles," serves a vital purpose for taxpayers engaged in certain types of investment transactions. Understanding the proper completion and use of this form is essential for accurately reporting and potentially mitigating tax liabilities associated with these investments. Below are key takeaways to guide individuals in handling Form 6781 effectively.

- Identify Section 1256 Contracts: It is crucial to determine whether your transactions involve Section 1256 contracts, as these typically include regulated futures contracts, foreign currency contracts, nonequity options, and more. These contracts must be marked to market at the year's end to report gains and losses.

- Understand Straddles: A straddle involves holding offsetting positions on personal property, usually stocks. Understanding the rules for straddles is important for accurate reporting, as the tax treatment can vary based on the specific transaction involved.

- Mark-to-Market Accounting: Taxpayers with Section 1256 contracts are required to treat these as sold at fair market value on the last business day of the year, with resulting gains or losses included on Form 6781. This approach is known as mark-to-market accounting.

- 60/40 Rule: A significant aspect of Form 6781 is the 60/40 rule, which allows for 60% of net gains from Section 1256 contracts to be taxed as long-term capital gains, regardless of how long the contracts were held. This can offer a tax advantage due to the lower rate applied to long-term gains.

- Loss Carryback Option: Form 6781 permits the carryback of net Section 1256 contract losses for up to three tax years, but only against net Section 1256 gains. This option, subject to certain conditions, can provide taxpayers with a means to recoup taxes paid in earlier years.

- Accurate Record-Keeping: Maintaining detailed records of transactions is vital for completing Form 6781 accurately. This includes dates of transactions, the type of contract, entry and exit points, and the calculation of gains or losses.

- Elective Provisions: Certain elections, like the opt-out of the mark-to-market rules for straddle positions, have specific requirements and deadlines for notification to the IRS. It’s important to be aware of these to avoid unintended tax consequences.

- Filing Requirement: Completing Form 6781 is not only a requirement for taxpayers with Section 1256 contracts and straddles but also serves as a tool for potentially reducing tax liabilities through strategic use of allowed tax treatment for these transactions.

Overall, the proper completion and strategic use of Form 6781 can offer significant benefits to taxpayers engaged in complex investment strategies. By familiarizing themselves with the key aspects of this form, taxpayers can navigate the intricacies of tax reporting for these unique transactions with confidence.

Popular PDF Documents

Tax POA Form 21-002-13 - Authorizes an agent to receive tax notices, respond to inquiries, and conduct transactions with tax officials.

IRS 8868 - Fulfilling the requirements of form 8868 helps maintain an organization's good standing with the IRS.

1098 E Form - The IRS 1098 form is designed for reporting mortgage interest of $600 or more, paid by an individual or sole proprietor to the lender in the course of the tax year.