Get IRS 6744 Form

Understanding tax forms is crucial for staying compliant with the Internal Revenue Service (IRS) guidelines. Among the various forms provided by the IRS, the 6744 form plays a fundamental role in preparing individuals who wish to offer volunteer tax preparation services. It is designed as a test booklet used in the Volunteer Income Tax Assistance (VITA) and the Tax Counseling for the Elderly (TCE) programs. The primary aim is to ensure volunteers are well-equipped with the knowledge and skills to provide accurate tax preparation services to those who need it. This form covers a wide range of topics, from filing basics to more complex tax scenarios, all intended to assess and enhance the volunteer's understanding of tax laws and filing procedures. By delving into the form's contents, volunteers can prepare themselves to assist others effectively, making it a crucial step in their training process. With tax laws frequently changing, the IRS 6744 form is updated annually, making it essential for volunteers to be familiar with the latest tax filing requirements and regulations.

IRS 6744 Example

6744

6744

VITA/TCE Volunteer Assistor’s Test/Retest 2021RETURNS

Volunteer Income Tax Assistance (VITA) / Tax Counseling for the Elderly (TCE)

Take your VITA/TCE training online at https://www.irs.gov (keyword: Link & Learn Taxes). Link to the Practice Lab to gain experience using tax software and take the certification test online, with immediate scoring and feedback.

Form 6744 (Rev.

How to Get Technical Updates?

Updates to the volunteer training materials will be contained in Publication

Volunteer Standards of Conduct

VITA/TCE Programs

The mission of the VITA/TCE return preparation programs is to assist eligible taxpayers in satisfying their tax responsibilities by providing free tax return preparation. To establish the greatest degree of public trust, volunteers are required to maintain the highest standards of ethical conduct and provide quality service.

Annually, all VITA/TCE volunteers (whether paid or unpaid) must pass the Volunteer Standards of Conduct (VSC) certification test and agree that they will adhere to the VSC by signing and dating Form 13615, Volunteer Standards of Conduct Agreement, prior to volunteering at a VITA/TCE site. In addition, return preparers, quality reviewers, coordinators, and tax law instructors must certify in Intake/Interview and Quality Review. Volunteers who answer tax law questions, instruct tax law classes, prepare or correct tax returns, or conduct quality reviews of completed returns must also certify in tax law prior to signing the form. Form 13615 is not valid until the sponsoring partner’s approving official (coordinator, instructor, administrator, etc.) or IRS contact confirms the volunteer’s identity with a

As a volunteer in the VITA/TCE Programs, you must adhere to the following Volunteer Standards of Conduct:

VSC #1 - Follow the Quality Site Requirements (QSR)

VSC #2 - Not accept payment, solicit donations, or accept refund payments for federal or state tax return preparation from customer

VSC #3 - Not solicit business from taxpayers you assist or use the information you gained about them for any direct or indirect personal benefit for you or any other specific individual.

VSC #4 - Not knowingly prepare false returns.

VSC #5 - Not engage in criminal, infamous, dishonest, notoriously disgraceful conduct, or any other conduct deemed to have a negative effect on the VITA/TCE Programs.

VSC #6 - Treat all taxpayers in a professional, courteous, and respectful manner.

Failure to comply with these standards could result in, but is not limited to, the following:

•Your removal from all VITA/TCE Programs;

•Inclusion in the IRS Volunteer Registry to bar future VITA/TCE activity indefinitely;

•Deactivation of your sponsoring partner’s site VITA/TCE EFIN (electronic filing ID number);

•Removal of all IRS products, supplies, loaned equipment, and taxpayer information from your site;

•Termination of your sponsoring organization’s partnership with the IRS;

•Termination of grant funds from the IRS to your sponsoring partner; and

•Referral of your conduct for potential TIGTA and criminal investigations.

TaxSlayer® is a copyrighted software program owned by Rhodes Computer Services. All screen shots that appear throughout the official Volunteer Income Tax Assistance (VITA) and Tax Counseling for the Elderly (TCE) training materials are used with the permission of Rhodes Computer Services.

Confidentiality Statement:

All tax information you receive from taxpayers in your volunteer capacity is strictly confidential and should not, under any circumstances, be disclosed to unauthorized individuals.

Form 6744 – 2021 VITA/TCE Test |

|

Table of Contents |

|

Form 6744 – 2021 VITA/TCE Test |

3 |

Preface |

. . . 3 |

Test Instructions |

. 4 |

Test Answer Sheet |

. 8 |

Retest Answer Sheet |

. 11 |

Volunteer Standards of Conduct Test |

14 |

Test Questions |

. 14 |

Volunteer Standards of Conduct Retest Questions |

. 18 |

Intake / Interview and Quality Review Test Questions |

24 |

Intake / Interview and Quality Review Retest Questions |

. 26 |

Site Coordinator Test Questions |

28 |

Site Coordinator Course Retest Questions |

. 31 |

Basic Course Scenarios and Test Questions |

34 |

Basic Scenario 1: Joe Wilson |

. . 34 |

Basic Scenario 2: Chris and Marcie Davis |

. 35 |

Basic Scenario 3: Archie and Tina Reynolds |

. 36 |

Basic Scenario 4: Charles and Heather Brooks |

. . 37 |

Basic Scenario 5: Alan Carmichael |

. . 38 |

Basic Scenario 6: Bobbie Daniels |

. . 39 |

Basic Scenario 7: Fred and Wilma Jones |

. . 40 |

Basic Scenario 8: Sheila Parsons |

. . 50 |

Basic Scenario 9: Mary Rodgers |

. 56 |

Basic Course Retest Questions |

. 64 |

Advanced Course Scenarios and Test Questions |

74 |

Advanced Scenario 1: Karen White |

. 74 |

Advanced Scenario 2: Paul and Maggie Thomas |

. . 76 |

Advanced Scenario 3: Carol Wheeler |

. . 77 |

Advanced Scenario 4: Barbara Jacobs |

. 78 |

Advanced Scenario 5: Michael Block |

. . 79 |

Advanced Scenario 6: Sean Dennison |

. . 80 |

Advanced Scenario 7: Gilbert and Tara Washington |

. . 81 |

Advanced Scenario 8: Cynthia Simon |

. 91 |

Advanced Scenario 9: Richard Cook |

. 104 |

Advanced Course Retest Questions |

. 111 |

Introduction & Instructions |

1 |

Qualified Experienced Volunteer (QEV) Scenarios and Test Questions |

119 |

QEV Scenario 1: Donna and Becky Howard |

. 119 |

QEV Scenario 2: David Newberry and His Parents |

. 121 |

QEV Scenario 3: Sophia Woodruff |

. 124 |

QEV Scenario 4: Keisha and Jay Johnson |

. 127 |

QEV Scenario 5: Kenneth and Martha Kemper |

. 130 |

QEV Course Retest Questions |

. 139 |

Military Course Scenarios and Test Questions |

147 |

Military Scenario 1: Todd Long |

. 147 |

Military Scenario 2: Dave and Sandra Blackburn |

. 148 |

Military Scenario 3: Lisa Wagner |

. 150 |

Military Scenario 4: Robert and Shirley Myers |

. 151 |

Military Scenario 5: Daniel and Betty Simmons |

. 152 |

Military Course Retest Questions |

. 159 |

International Course Scenarios and Test Questions |

166 |

International Scenario 1: Andy and June Hillsdale |

. 166 |

International Scenario 2: Wilhelm and Mary Schmidt |

. 167 |

International Scenario 3: Justin Herzing |

. 169 |

International Course Retest Questions |

. 176 |

Federal Tax Law Update Test for Circular 230 Professionals |

181 |

Circular 230 Professionals Scenario 1: Herb and Alice Freeman |

. 181 |

Circular 230 Professionals Scenario 2: Chloe Carlow |

. 182 |

Circular 230 Professionals Scenario 3: Luther and Lexi Lincoln |

. 183 |

Circular 230 Professionals Scenario 4: Kendall and Siena King |

. 187 |

Federal Tax Law Update Retest for Circular 230 Professionals |

. 193 |

2021 VITA/TCE Foreign Student Test for Volunteers |

198 |

Residency Status, Form 8843, and Filing Status |

. 199 |

Scenario 1: Enrique Satō |

. 201 |

Taxability of Income, ITINs, and Credits |

. 205 |

Scenario 2: Kim Lee |

. 206 |

Scenario 3: Rudra Khatri |

. 215 |

Scenario 4: Gergana Alferov |

. 222 |

Refunds, Deductions, and the Best Form to Use |

. 229 |

2021 VITA/TCE Foreign Student Retest for Volunteers |

. 232 |

2 |

Introduction & Instructions |

Form 6744 – 2021 VITA/TCE Test

Preface

Quality Return Process

An accurate return is the most important aspect of providing quality service to the taxpayer.. It establishes credibility and integrity in the program.. Throughout the training material you were introduced to the major components of the VITA/TCE return prepara- tion process, including:

•Understanding and applying tax law

•Screening and interviewing taxpayers

•Using references, resources, and tools

•Conducting quality reviews

During training, you were given an opportunity to apply the tax law knowledge you gained.. You learned how to verify and use the information provided by the taxpayer on the intake and interview sheet in order to prepare a complete and correct tax return..

You also learned how to use your reference materials and conduct a quality review..

Now it is time to test the knowledge and skills you have acquired and apply them to specific scenarios. This is the final step to help you prepare accurate tax returns within your scope of training..

We welcome your comments for improving these materials and the VITA/TCE programs.. You may follow the evaluation procedures located on Link & Learn Taxes at https://www.irs.gov/ or

Thank you for being a part of this valuable public service for your neighbors and community..

Introduction & Instructions |

3 |

Test Instructions

Special Accommodations

If you require special accommodations to complete the test, please advise your instruc- tor, Site Coordinator, or other VITA/TCE volunteer contact immediately..

Reference Materials

This test is based on the tax law that was in effect when the publication was printed. Use tax year 2021 values for deductions, exemptions, tax, or credits for all answers on the test.. Remember to round to the nearest dollar.. Test answers have been rounded up or down as directed in the specific instructions on the form.

•This is an open book test.. You may use your course book and any other refer- ence material you will use as a volunteer.. A draft Form

Please complete this test on your own.. Taking the test in groups or with outside assis- tance is a disservice to the customers you volunteered to help..

Using Tax Preparation Software

The Practice Lab is a tax year 2021 tax preparation tool developed to help in the certifi- cation process for VITA/TCE volunteers.. Go to https://www.irs.gov/ and type “Link & Learn Taxes” in the keyword search field. Click on the link to open the website. The link to the Practice Lab is listed under “Additional Resources..” A universal password will be needed to access the Practice Lab.. Your instructor, Site Coordinator, or other VITA/TCE volunteer contact will be able to provide you with the universal password.. Once you access the Practice Lab, you will need to create an account if you do not already have one..

Using prior year software will not generate the correct answers for the 2021 test..

When entering Social Security numbers (SSNs) or Employer Identification Numbers (EINs), replace the Xs as directed, or with any four digits of your choice.. Use your city, state, and ZIP code when completing any of the forms, unless otherwise indicated.. Any question posed by the software not addressed in the interview notes can be answered as you choose..

All taxpayer names, SSNs, EINs, and account numbers provided in the scenarios are fictitious.

Taking the Test

When taking the tests, you may encounter both

tax return.. You can use the Practice Lab to prepare the sample returns.. Answer the questions following the scenario..

4 |

Introduction & Instructions |

You can complete the certification tests online using the Link & Learn Taxes website for immediate scoring.. Go to the Link & Learn Taxes

Test Answer Sheet

The test scenarios on Link & Learn Taxes are the same as in this booklet. Read each question carefully before entering your answers online.

Mark your answers in the test booklet.. Use the answer sheet if you are submitting the paper test to your instructor for grading.. In that case, make sure your name is at the top of the page and give your Test Answer Sheet and the completed Form 13615, Volunteer Standards of Conduct Agreement to your instructor, Site Coordinator, or other VITA/TCE volunteer contact as directed.. Do not submit your entire test booklet unless otherwise directed..

The retest questions are all based on the test scenarios.. There are

To answer the retest questions for return preparation scenarios, refer to the Interview Notes, Intake/Interview & Quality Review Sheet, and the tax return you prepared for the scenario..

Test Score

Once you submit your responses, Link & Learn Taxes will grade your test, provide you with an immediate score, and allow you to print or save your Form 13615, Volunteer Standards of Conduct Agreement.. The system will also provide feedback for any missed questions..

If you submit your paper test answer sheet to your instructor, he or she will advise you of your test results.. Your signed Volunteer Standards of Conduct Agreement will be maintained by your Site Coordinator or other VITA/TCE volunteer contact..

Certification

A score of 80% or higher is required for certification. If you do not achieve a score of at least 80%, you should review the subjects you missed or discuss it with your instructor, Site Coordinator, or other VITA/TCE volunteer contact.. For most tests, a retest is available.. Retest questions are included in this test booklet..

Introduction & Instructions |

5 |

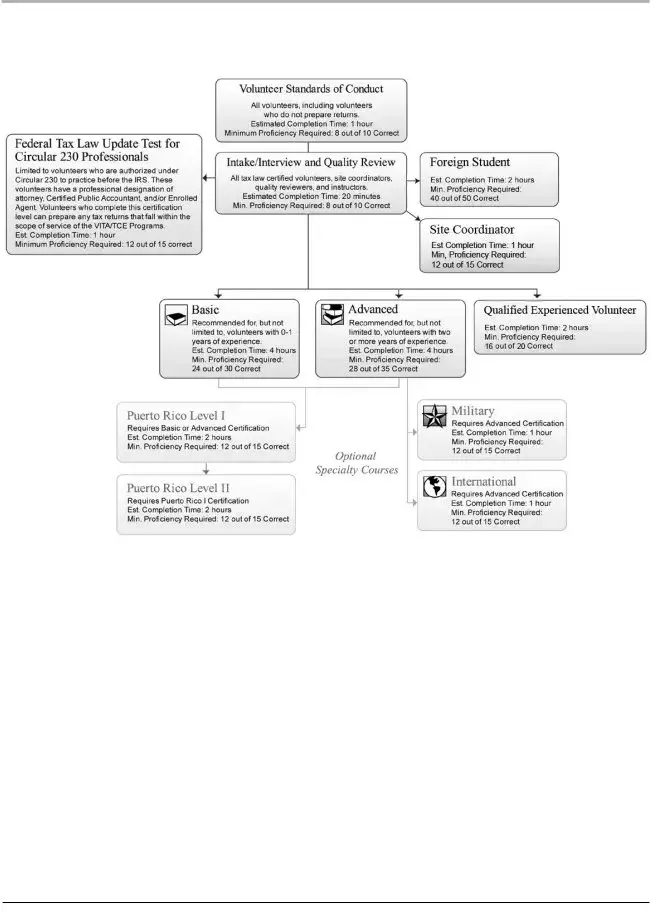

Certification Tests

Step 1: Volunteer Standards of Conduct.. This test is for all volunteers, including volunteers who do not prepare returns..

Estimated completion time: 1 hour. Minimum proficiency required: 8 out of 10 correct.

Step 2: Intake/Interview and Quality Review. This test is for all tax law certified volunteers, site coordinators, quality

reviewers, and instructors. Estimated completion time: 20 minutes. Minimum proficiency required: 8 out of 10 correct.

Step 3: Tax Law and Coordinator Certifications. Volunteers may take one or more of the following certifications:

•Federal Tax Law Update Test for Circular 230 Professionals. Limited to volunteers who are authorized under

Circular 230 to practice before the IRS. These volunteers have a professional designation of attorney, Certified Public Accountant, and/or Enrolled Agent. Volunteers who complete this certification level can prepare any tax returns that fall within the scope of service of the VITA/TCE programs. Estimated completion time: 1 hour. Minimum proficiency required: 12 out of 15 correct..

•Foreign Student. Estimated completion time: 2 hours. Minimum proficiency required: 40 out of 50 correct.

•Site Coordinator. Estimated completion time: 1 hour. Minimum proficiency required: 12 out of 15 correct.

•Basic. Recommended for, but not limited to, volunteers with

•Advanced. Recommended for, but not limited to, volunteers with two or more years of experience.. Estimated comple- tion time: 4 hours. Minimum proficiency required: 28 out of 35 correct.

•Qualified Experienced Volunteer. Estimated completion time: 2 hours. Minimum proficiency required: 16 out of 20 correct..

Step 4: Optional Specialty Courses. Volunteers may take one or more of the following certifications:

•Puerto Rico Level I. Requires Basic or Advanced certification. Estimated completion time: 2 hours. Minimum profi- ciency required: 12 out of 15 correct..

•Puerto Rico Level II. Requires Puerto Rico Level I certification. Estimated completion time: 2 hours. Minimum profi- ciency required: 12 out of 15 correct..

•Military. Requires Advanced certification. Estimated completion time: 1 hour. Minimum proficiency required: 12 out of

15 correct..

•International. Requires Advanced certification. Estimated completion time: 1 hour. Minimum proficiency required: 12 out of 15 correct..

6 |

Introduction & Instructions |

Introduction & Instructions |

7 |

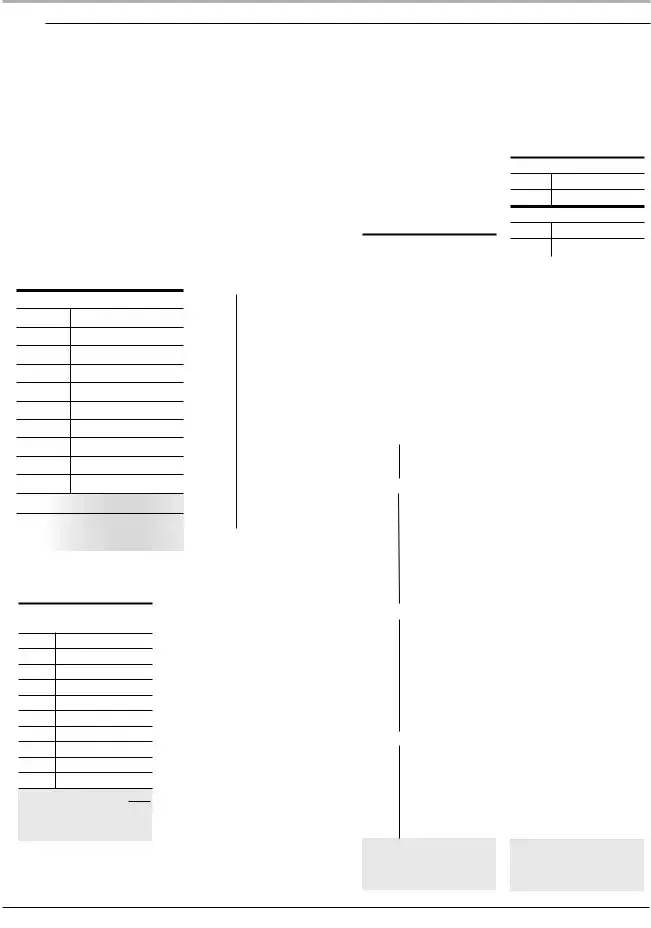

Test Answer Sheet

Name

If you are entering your test answers in Link & Learn Taxes, do not use this answer sheet..

Find the section heading that matches the test you are taking.. Record your answers in the spaces, next to the question number in the

Standards of Conduct

1..

2..

3..

4..

5..

6..

7..

8..

9..

10..

Total Answers Correct:__________

Total Questions: |

10 |

Passing Score: |

8 of 10 |

Intake/ Interview &

Quality Review Test

1..

2..

3..

4..

5..

6..

7..

8..

9..

10..

Total Answers Correct:__________

Site Coordinator Test |

|

Basic Course Test |

|||

1.. |

|

|

|

Basic Scenario 1 |

|

2.. |

|

|

|

1.. |

|

3.. |

|

|

|

2.. |

|

4.. |

|

|

|

Basic Scenario 2 |

|

5.. |

|

|

|

3.. |

|

6.. |

|

|

|

4.. |

|

7.. |

|

|

|

Basic Scenario 3 |

|

8.. |

|

|

|

5.. |

|

9.. |

|

|

|

6.. |

|

10.. |

|

|

|

Basic Scenario 4 |

|

11.. |

|

|

|

7.. |

|

12.. |

|

|

|

8.. |

|

13.. |

|

|

|

Basic Scenario 5 |

|

14.. |

|

|

|

9.. |

|

15.. |

|

|

|

10.. |

|

Total Answers Correct:________ |

Basic Scenario 6 |

||||

|

|

|

|

|

|

Total Questions: |

15 |

|

11.. |

|

|

Passing Score: |

12 of 15 |

12.. |

|

||

|

|

|

|

13.. |

|

|

|

|

|

|

|

|

|

|

|

Basic Scenario 7 |

|

|

|

|

|

|

|

|

|

|

|

14.. |

|

|

|

|

|

|

|

|

|

|

|

15.. |

|

|

|

|

|

|

|

|

|

|

|

16.. |

|

|

|

|

|

|

|

|

|

|

|

17.. |

|

|

|

|

|

|

|

|

|

|

|

18.. |

|

|

|

|

|

|

|

|

|

|

|

19.. |

|

|

|

|

|

|

|

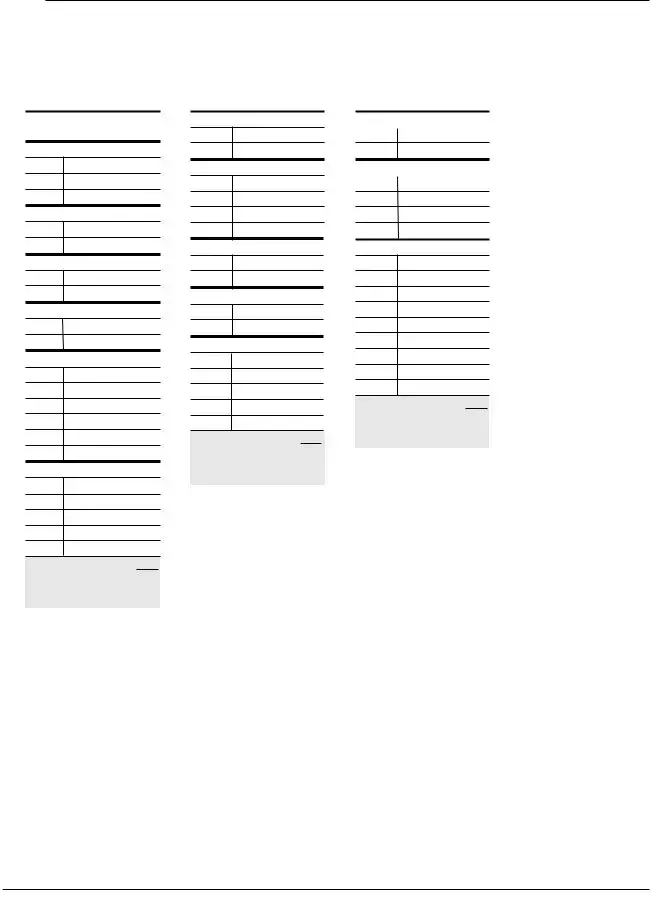

Basic Course Test

Basic Scenario 8

20..

21..

22..

23..

24..

Basic Scenario 9

25..

26..

27..

28..

29..

30..

Total Answers Correct:______

Total Questions: |

30 |

Passing Score: |

24 of 30 |

Advanced Course Test

Advanced Scenario 1

1..

2..

3..

Advanced Scenario 2

4..

5..

Advanced Scenario 3

6..

7..

8..

Advanced Scenario 4

9..

10..

Advanced Scenario 5

11..

12..

Advanced Scenario 6

13..

14..

Advanced Course Test

Advanced Scenario 7

15..

16..

17..

18..

19..

20..

21..

22..

Advanced Scenario 8

23..

24..

25..

26..

27..

28..

29..

Advanced Scenario 9

30..

31..

32..

33..

34..

35..

Total Answers Correct:________

Total Questions: |

35 |

Passing Score: |

28 of 35 |

Total Questions: |

10 |

Passing Score: |

8 of 10 |

Privacy Act Notice

The Privacy Act of 1974 requires that when we ask for information we tell you our legal right to ask for the information, why we are asking for it, and how it will be used.. We must also tell you what could happen if we do not receive it, and whether your response is voluntary, required to obtain a benefit, or mandatory. Our legal right to ask for information is 5 U.S.C. 301.

We are asking for this information to assist us in contacting you relative to your interest and/or participation in the IRS volunteer income tax preparation and outreach programs.. The information you provide may be furnished to others who coordinate activities and staffing at volunteer return preparation sites or outreach activities. The information may also be used to establish effective controls, send correspondence and recognize volunteers.

Your response is voluntary.. However, if you do not provide the requested information, the IRS may not be able to use your assistance in these programs..

8Introduction & Instructions

Document Specifics

| Fact Name | Description |

|---|---|

| 1. Purpose | The IRS 6744 form is used for Volunteer Income Tax Assistance (VITA) and Tax Counseling for the Elderly (TCE) programs as a test and training aid. |

| 2. Content | It contains scenarios, problems, and solutions for training volunteers to prepare taxes accurately. |

| 3. Audience | Designed primarily for volunteers who will assist in preparing taxes for low-to-moderate income families, the elderly, and individuals with disabilities. |

| 4. Accessibility | Available publicly on the IRS website, allowing potential volunteers to access and study it in preparation for certification. |

| 5. Annual Update | The IRS updates the form annually to reflect tax law changes and to introduce new training scenarios. |

| 6. Testing Requirement | Volunteers must pass the test covered by this form to become IRS-certified to provide tax preparation assistance. |

| 7. Certification Levels | The form includes tests for different certification levels, from basic to advanced, including specific certifications for military and international tax situations. |

| 8. Format Options | It is available in various formats, including PDF, to accommodate different learning styles and needs. |

| 9. State-Specific Versions | While the IRS 6744 form is a federal document, volunteers may also need to be aware of state-specific tax laws and may require additional state-specific training. |

Guide to Writing IRS 6744

After completing the IRS 6744 form, individuals are better prepared to understand the complexities of tax preparation and assistance. This step is crucial for volunteers in tax assistance programs to ensure they are well-equipped to provide accurate and helpful service. Filling out the form accurately is paramount, as it covers essential areas of tax knowledge and procedures. The process is straightforward but requires attention to detail to ensure all information is correctly supplied and comprehensively completed. Following the steps below will aid in this task.

- Begin by providing your personal information, including your name, address, and contact details, in the designated section at the top of the form.

- Read through the instructions carefully to understand what the form is asking and how to properly fill it out. This form requires thorough reading to ensure all details are accurately captured.

- Answer all the questions in the form pertaining to tax laws and regulations. These questions are designed to assess your knowledge of tax preparation, so it’s important to answer them to the best of your ability.

- Make use of the reference materials provided by the IRS if you encounter questions where you are unsure of the answer. This form acts as both an assessment and a learning tool, so referring to IRS publications for answers is encouraged.

- Check your answers carefully once you have completed the form. It’s essential to double-check your responses for any errors or omissions that could impact the accuracy of your assessment.

- Sign and date the bottom of the form after completing all sections. Your signature confirms that you have provided true and accurate information to the best of your knowledge.

- Follow the instructions on the form for submitting it to the appropriate department or individual overseeing the tax assistance program you are involved with. Submission procedures may vary, so it’s important to comply with the specified guidelines.

After submission, your form will be reviewed to assess your understanding and readiness to assist in tax preparation tasks. Based on this review, you may receive additional training or resources to further your knowledge and skills before actively participating in any tax preparation services. This ensures the highest standards of assistance are met, benefiting both volunteers and those they help during the tax season.

Understanding IRS 6744

-

What is the purpose of the IRS 6744 form?

The IRS 6744 form is designed to serve as a Volunteer Assistor's Test/Retest for individuals who wish to participate in volunteer programs such as the Volunteer Income Tax Assistance (VITA) and the Tax Counseling for the Elderly (TCE) programs. These programs offer free tax help to those who qualify for assistance. The form assesses the knowledge of volunteers to ensure they are well-equipped to provide accurate tax preparation services.

-

Who needs to complete the IRS 6744 form?

Individuals seeking to volunteer with the VITA or TCE programs are required to complete the IRS 6744 form. This includes new volunteers who are aiming to participate for the first time and returning volunteers who must certify their knowledge annually to remain active in the program.

-

What sections are included in the IRS 6744 form?

The IRS 6744 form contains multiple sections, each focusing on different aspects of tax laws and filing procedures relevant to the volunteer work. Sections include basic, advanced, military, international, and other specialized tax scenarios, designed to cover a wide range of situations volunteers might encounter. Volunteers are required to complete specific sections based on the roles they wish to perform within the VITA/TCE programs.

-

How can one access the IRS 6744 form?

The IRS 6744 form can be accessed and downloaded from the official website of the Internal Revenue Service (IRS). It is available in PDF format, allowing individuals to print it for manual completion or fill it out electronically, depending on their preference.

-

Is there a deadline for submitting the IRS 6744 form?

Yes, there is a deadline for submitting the IRS 6744 form, which typically aligns with the training schedule of the VITA/TCE programs. The exact deadline can vary annually and by location, so it is crucial for volunteers to check with their local program coordinators or the IRS website for specific dates to ensure their certification is completed on time.

-

What happens after submitting the IRS 6744 form?

After submission, the IRS 6744 forms are reviewed to validate the volunteer's competency in tax preparation. Successful volunteers are then certified to participate in the VITA/TCE programs for the tax season. They will be notified of their certification status and provided with additional information on their roles and responsibilities, training opportunities, and how to access tax preparation resources and support.

Common mistakes

Filling out forms for the IRS is never an enjoyable task, but it's crucial for ensuring compliance with tax laws and regulations. One such form, the IRS 6744, is commonly mishandled in several ways. Let's explore six common mistakes that individuals often make when completing this form. Understanding these errors can help avoid unnecessary delays or complications with tax processing.

-

Not Checking the Tax Year: Many individuals forget to verify the tax year for which they are filing. The IRS frequently updates its forms, including the 6744, to reflect the current tax laws and regulations. Using the wrong version can lead to the rejection of the form.

-

Skipping Sections: It's not uncommon for people to skip entire sections that they believe do not apply to them. However, every section of the 6744 form serves a purpose, and omitting information can result in incomplete filing, necessitating further clarification from the IRS.

-

Incorrect Information: Entering incorrect information, whether it be a Social Security number, income amounts, or deductions, can significantly delay the processing of the form. Accuracy is paramount when filling out IRS forms.

-

Failure to Sign and Date: Surprisingly, one of the most common mistakes is the failure to sign and date the form. An unsigned form is considered incomplete and will not be processed until this oversight is corrected.

-

Omitting Supporting Documentation: Various sections of the 6744 form require supporting documentation for verification purposes. Neglecting to include this documentation can halt the progress of your filing until the missing documents are submitted.

-

Incorrect Use of Attachments: When additional information is necessary, attachments can be used. However, failing to clearly reference these attachments in the form or attaching unrelated documents can confuse the reviewing agents and slow down the process.

To ensure a smoother process with the IRS, individuals should approach the 6744 form with diligence, carefully review all instructions provided, and consider seeking assistance when unsure. This proactive approach can help mitigate errors and expedite the handling of one’s tax matters.

Documents used along the form

When dealing with the intricate details of tax preparation and filing, it's important to know that the IRS 6744 form is often just the beginning. This form, vital for VITA/TCE volunteers, prepares them for the tax season. However, there are several other critical forms and documents that individuals and professionals frequently use alongside the IRS 6744 form to ensure accuracy and compliance with tax laws. These additional documents help navigate the complexities of tax filing, ensuring that every detail is correctly reported and processed.

- Form W-2, Wage and Tax Statement: This document is issued by employers to report an employee’s annual wages and the amount of taxes withheld from their paycheck. It’s essential for correctly filing taxes.

- Form 1040, U.S. Individual Income Tax Return: The primary form used by individuals to file their annual income tax returns. It covers income, deductions, and credits to calculate the amount of tax owed or refund due.

- Schedule C (Form 1040), Profit or Loss from Business: Utilized by sole proprietors to report profits or losses from their business. This form helps detail the income and expenses pertaining to the business activities.

- Form 8863, Education Credits: For those claiming education credits, this form calculates the amount of credit that can be claimed for qualified education expenses, aiding in reducing the tax owed.

- Form 1099-MISC, Miscellaneous Income: Reports income from sources other than a traditional employer, such as freelance income, rent, or awards. This form is crucial for accurately reporting various types of income.

- Form 9465, Installment Agreement Request: Used to request a monthly installment plan if individuals cannot pay the full amount of taxes they owe. It’s an essential form for those looking to make arrangements for tax payments.

- Form 8962, Premium Tax Credit: This document is used to calculate the amount of premium tax credit individuals are eligible for, based on their income and household information, and to reconcile it with any advanced payments.

- Form 1095-A, Health Insurance Marketplace Statement: Essential for individuals who have purchased health insurance through the Marketplace. This form provides information needed to complete Form 8962.

The IRS 6744 form along with these documents, help to ensure that taxpayers can navigate the complexities of tax preparation and reporting. From accurately reporting income and taxes paid to calculating deductions and credits, these forms collectively ensure individuals and businesses comply with tax laws while seeking to maximize their eligible benefits. Understanding and utilizing these documents correctly can lead to a more straightforward and less stressful tax filing experience.

Similar forms

The IRS 6744 form is intimately connected to a variety of other documents due to its role in testing volunteers for the IRS Volunteer Income Tax Assistance and Tax Counseling for the Elderly programs. One such document is the Form 1040, the U.S. individual income tax return. Both forms are integral to understanding and processing individual tax filings, though the IRS 6744 serves the specific purpose of preparing volunteers, ensuring they're familiar with the kind of information and scenarios they'll encounter on the Form 1040.

Similarly, the Publication 4012, also known as the Volunteer Resource Guide, shares a close relationship with the IRS 6744 form. This guide provides volunteers with detailed assistance and reference materials, complementing the IRS 6744's purpose by offering comprehensive examples, scenarios, and guidelines that volunteers might need during tax preparation.

The Form 13614-C, the Intake/Interview & Quality Review Sheet, is another document closely related to the IRS 6744. This form is used during the volunteer tax preparation process to ensure that the volunteer collects all necessary information from the taxpayer accurately. It works hand in hand with the IRS 6744 by ensuring that volunteers are well-prepared and knowledgeable about the kinds of questions and information they need to gather.

The IRS Training Guide, though not a single form, is a collection of materials specifically designed to educate volunteers on tax laws and filing procedures. It complements the IRS 6744 form by providing in-depth explanations and additional learning resources, facilitating a deeper understanding of the tax preparation process that volunteers need to master.

The Publication 17, Your Federal Income Tax (For Individuals), though primarily targeted at taxpayers, shares similarities with the IRS 6744 form. It explains the rules of filing individual tax returns in great detail, something volunteers need to know. The knowledge contained within Publication 17 underpins the scenarios found in the IRS 6744 form, making it an essential reference.

The Form 8879, IRS e-file Signature Authorization, is related indirectly. It authorizes an ERO (Electronic Return Originator) to input an electronic signature on e-filed documents, a process that volunteers need to understand. Although primarily for professional use, familiarity with the Form 8879 and its purpose reinforces the IRS 6744 form's objective of comprehensive volunteer training.

Form 8863, Education Credits (American Opportunity and Lifetime Learning Credits), represents a specific tax benefit that volunteers may encounter when assisting taxpayers. Understanding the eligibility and documentation requirements for these credits, as taught in the IRS 6744 form, is crucial for volunteers who aim to provide accurate and helpful tax preparation services.

The Schedule C (Form 1040), Profit or Loss from Business, is essential for volunteers working with taxpayers who own businesses. The IRS 6744 includes scenarios involving self-employment and small business income, preparing volunteers to handle such situations confidently and competently. This similarity underscores the comprehensive nature of the IRS 6744's training.

Finally, the Form 8822, Change of Address, while administrative, is similar in that it emphasizes accuracy and attention to detail. Volunteers learn the importance of updating addresses to ensure taxpayers receive timely and accurate correspondence from the IRS. This mirrors the IRS 6744's goal of meticulousness and reliability in tax preparation.

Dos and Don'ts

Filling out the IRS 6744 form requires attentiveness and care to ensure the accuracy and completeness of your submission. Here are essential dos and don'ts to consider during the process:

Do:

- Read through the entire form before starting to fill it out to ensure a clear understanding of what is required.

- Use black ink or type your responses if the form allows it, to make sure that all information is legible.

- Double-check your calculations and the information provided for accuracy to avoid any unnecessary delays in processing.

- Include your contact information where requested, so the IRS can reach you if there are any questions or further information is needed.

- Sign and date the form if required, as an unsigned form may not be processed.

Don't:

- Don't skip sections or leave fields blank unless the form specifically instructs you to do so.

- Don't guess on figures or information. If unsure, seek clarification or assistance before submitting the form.

- Don't use pencil or any ink color other than black, as this may lead to issues in scanning or reading your document.

- Don't ignore the instructions for submitting attachments or additional documentation that may be required.

- Don't forget to keep a copy of the completed form and any attachments for your records.

Misconceptions

The Internal Revenue Service (IRS) Form 6744, often involved in tax preparation training and testing, is subject to numerous misconceptions. It's essential to clear up these misunderstandings to ensure accurate and efficient tax preparation. Below are nine common misconceptions about the IRS 6744 form.

-

IRS Form 6744 is for tax filing: This is not correct. The primary purpose of Form 6744 is to offer a comprehensive test for volunteers in the Volunteer Income Tax Assistance (VITA) and Tax Counseling for the Elderly (TCE) programs. It is not used for filing taxes.

-

Everyone can use IRS Form 6744: In reality, this form is intended specifically for volunteers who are training to assist in the VITA and TCE programs. It's not meant for the general public or professional tax preparers outside these programs.

-

The form changes significantly every year: While updates are made to Form 6744 annually to reflect new tax laws and provisions, these changes are often incremental. The core structure of the form stays relatively consistent to maintain a standard for volunteer training.

-

Form 6744 is only useful during tax season: Although its usage peaks during tax season, Form 6744 can be a valuable resource for ongoing education and training throughout the year for VITA and TCE volunteers.

-

There's a fee associated with IRS Form 6744: This form is freely provided by the IRS. There are no fees associated with its use, fitting with the volunteer-driven nature of the programs it supports.

-

The form is available exclusively in paper format: The IRS makes Form 6744 available in both print and digital formats. This accessibility ensures that volunteers can easily access the resources they need to complete their training.

-

Filling out IRS Form 6744 grants certification for tax preparation: Completing the form is just a part of the training process for VITA/TCE volunteers. Certification is granted after passing the associated tests, not solely based on completing the form.

-

Only IRS employees can assist with questions about Form 6744: While IRS employees can offer guidance, trained coordinators and experienced volunteers within the VITA/TCE programs can also provide assistance and answer questions related to Form 6744.

-

Form 6744 details are irrelevant for people who don't volunteer: Understanding the contents of Form 6744 can give insight into the types of questions and scenarios volunteers are trained to handle. This knowledge can be valuable for anyone interested in the tax preparation process or considering volunteer work in the future.

Key takeaways

The IRS 6744 form is essential for individuals who are volunteering to assist in tax preparation through the IRS Volunteer Income Tax Assistance (VITA) and Tax Counseling for the Elderly (TCE) programs. Ensuring accurate and efficient use of this form is crucial for volunteers to offer the best assistance possible. Here are key takeaways about filling out and using the IRS 6744 form:

- Before filling out the form, it's important to undergo the appropriate training provided by the IRS. This training equips volunteers with the necessary knowledge and skills to effectively use the form.

- The form tests the knowledge of volunteers on federal income tax laws, focusing on those laws pertinent to the tax returns they will be assisting with. Therefore, thoroughly understanding these laws is crucial before attempting to complete the form.

- Completion of the IRS 6744 form is mandatory for all volunteers in the VITA/TCE programs. It serves as a certification of their competence in preparing taxes.

- The form is updated annually to reflect the latest tax law changes. Volunteers must use the most current version of the IRS 6744 form to ensure compliance with the latest tax laws.

- Sections of the IRS 6744 form are designed to cater to different levels of volunteer expertise, ranging from basic to advanced tax law concepts. Volunteers should complete the sections relevant to their training level.

- Answers to the test questions contained in the form can be found in the IRS publications and the training materials provided to volunteers. Utilizing these resources can significantly increase the chances of successfully completing the form.

- After filling out the form, it must be reviewed by the program coordinator or an assigned instructor. This step ensures that volunteers have accurately completed the form and are ready to provide tax preparation services.

- Successful completion of the IRS 6744 form is followed by receiving a certification. This certification is necessary for volunteers to actively participate in the VITA/TCE programs and provide tax preparation services.

By keeping these key takeaways in mind, volunteers can effectively navigate through the IRS 6744 form, ensuring that they are well-prepared to assist taxpayers under the VITA/TCE programs. It is not just about filling out a form but about ensuring competent and compliant tax preparation assistance to those in need.

Popular PDF Documents

Beethoven Lives Upstairs Answer Key - The worksheet subtly addresses Beethoven's isolation due to his partial deafness, making his achievements all the more remarkable.

Irs Form 851 - Instructions included with Form 851 guide corporations on how to detail the equitable owners of subsidiary stocks.

W-8ben Sample - Advisors recommend the W-8BEN form to non-U.S. residents as a key step in managing their U.S.-source income and taxes.