Get IRS 656-B Form

The path to resolving tax debt is not always straightforward, but with the right tools and information, it becomes much more manageable. For individuals and businesses facing the challenge of outstanding taxes, the IRS 656-B form represents a beacon of hope. This crucial document provides a structured way for taxpayers to propose a compromise to the IRS, allowing them to settle their debt for less than the full amount owed. The form is comprehensive, requiring detailed financial information to support the offer, but it opens the door to potentially significant relief for those burdened by tax liabilities. Understanding the nuances of the IRS 656-B form is the first step toward regaining financial stability and moving forward with a lighter load.

IRS 656-B Example

Form 656 Booklet |

|

Offer in |

|

Compromise |

|

CONTENTS |

|

■ What you need to know |

1 |

■ Paying for your offer |

3 |

■ How to apply |

4 |

■ Completing the application package |

5 |

■ Important information |

6 |

■Removable Forms - Form

Collection Information Statement for Businesses; Form 656, Offer in |

|

Compromise |

7 |

■ Application Checklist |

29 |

IRS contact information

If you want to see if you qualify for an offer in compromise before filling out the paperwork, you may use the Offer in Compromise

If you have questions regarding qualifications for an offer in compromise, please call our

Taxpayer resources

The Taxpayer Advocate Service (TAS) is an independent organization within the Internal Revenue Service that helps taxpayers and protects taxpayer rights. TAS helps taxpayers whose problems with the IRS are causing financial difficulties, who've tried but haven't been able to resolve their problems with the IRS or believe an IRS system or procedure isn't working as it should. The service is free. Your local advocate's number is in your local directory and at taxpayeradvocate.irs.gov. You can also call us at

WHAT YOU NEED TO KNOW

What is an Offer? |

An Offer in Compromise (offer) is an agreement between you (the taxpayer) and |

|

|

the IRS that settles a tax debt for less than the full amount owed. The offer |

|

|

program provides eligible taxpayers with a path toward paying off their tax debt. |

|

|

The ultimate goal is a compromise that suits the best interest of both the taxpayer |

|

|

and the IRS. Generally, you must |

make an appropriate offer based on what the |

|

IRS considers your true ability to |

pay. |

|

Submitting an application does not ensure that the IRS will accept your offer. |

|

|

It begins a process of evaluation and verification by the IRS, taking into |

|

|

consideration any special circumstances that may affect your ability to pay. |

|

|

This booklet will lead you through a series of steps to help you calculate an |

|

|

appropriate offer based on your assets, income, expenses, and future earning |

|

|

potential. The application requires you to describe your financial situation in detail, |

|

|

so before you begin, make sure you have the necessary information and |

|

|

documentation. |

|

Are You Eligible? |

Before your offer can be considered, you must (1) file all tax returns you are legally |

|

|

required to file, (2) have received a bill for at least one tax debt included on your |

|

|

offer, (3) make all required estimated tax payments for the current year, and (4) |

|

|

make all required federal tax deposits for the current quarter if you are a business |

|

|

owner with employees. The IRS will immediately return your offer without further |

|

|

consideration if you have not filed all legally required tax returns. |

|

|

Note: If it is determined you have not filed all tax returns you are legally |

|

|

required to file, the IRS will apply any initial payment you sent with your offer |

|

|

to your tax debt and return both your offer and application fee to you. You |

|

|

cannot appeal this decision. |

|

Bankruptcy, Open Audit or |

If you or your business is currently in an open bankruptcy proceeding, you are not |

|

Innocent Spouse Claim |

eligible to apply for an offer. Any resolution of your outstanding tax debts generally |

|

|

must take place within the context of your bankruptcy proceeding. |

|

|

If you are not sure of your bankruptcy status, contact the Centralized Insolvency |

|

|

Operation at |

|

|

and/or Taxpayer Identification Number. |

|

|

Resolve any open audit or outstanding innocent spouse claim issues before |

|

|

you submit an offer. |

|

Can You Pay in Full? |

Generally, the IRS will not accept an offer if you can pay your tax debt in full |

|

|

through an installment agreement or equity in assets. |

|

|

Note: Adjustments or exclusions, which may be considered during the offer |

|

|

investigation, such as allowance of $1,000 to a bank balance or $3,450 against the |

|

|

value of a car, are only applied if you are an individual and after it is determined |

|

|

that you cannot pay your tax debt in full. |

|

Your Future Tax Refunds |

The IRS will keep any refund, including interest, for tax periods extending through |

|

|

the calendar year that the IRS accepts the offer. For example, the IRS accepts |

|

|

your offer in 2020 and you file your 2020 Form 1040 on April 15, 2021 showing a |

|

|

refund; the IRS will apply your refund to your tax debt. The refund is not |

|

|

considered as a payment toward your offer. |

|

Doubt as to Liability |

If you have a legitimate doubt that you owe part or all of the tax debt, complete and |

|

|

submit a Form |

|

|

Form |

|

|

FORM |

|

Note: Do not submit both an offer under Doubt as to Liability and an offer under Doubt as to Collectibility or Effective Tax Administration at the same time. You must resolve any doubt you owe part or all of the tax debt before submitting an offer based on your ability to pay.

1

Notice of Federal Tax Lien |

A lien is a legal claim against all your current and future property. When you don’t |

|

pay your first bill for taxes due, a lien is created by law and attaches to your |

|

property. A Notice of Federal Tax Lien (NFTL) provides public notice to creditors. |

|

The IRS files the NFTL to establish priority of the IRS claim versus the claims of |

|

certain other creditors. The IRS may file a NFTL at any time. If the tax lien(s) has/ |

|

have not been released, the IRS may be entitled to any proceeds from the sale of |

|

property subject to the lien(s). You may be entitled to file an appeal under the |

|

Collection Appeals Program (CAP) before this occurs or request a Collection Due |

|

Process hearing after this occurs. |

|

Note: A Notice of Federal Tax Lien (NFTL) will not be filed on any individual shared |

|

responsibility payment under the Affordable Care Act. |

Trust Fund Taxes |

If your business owes liabilities that include trust fund taxes, the IRS may hold |

|

responsible individuals liable for the trust fund portion of the tax pursuant to |

|

applicable law. Trust fund taxes are the money withheld from an employee's |

|

wages, such as income tax, Social Security, and Medicare taxes. If the IRS enters |

|

into a compromise with an employer for a portion of the trust fund tax liability, the |

|

remainder of the trust fund taxes must be collected from the responsible parties. |

|

You are not eligible for consideration of an offer unless the trust fund portion of the |

|

tax is paid, or the IRS has made the Trust Fund Recovery Penalty determination(s) |

|

on all potentially responsible individual(s). However, if you are submitting the offer |

|

as a victim of payroll service provider fraud or failure, the trust fund recovery |

|

penalty assessment discussed above is not required prior to submitting the offer. |

Other Important Facts |

Each and every taxpayer has a set of fundamental rights they should be aware of |

|

when interacting with the IRS. Explore your rights and our obligations to protect |

|

them. For more information on your rights as a taxpayer, go to http://www.irs.gov/ |

|

|

|

Penalties and interest will continue to accrue. |

|

After you submit your offer, you must continue to timely file and pay all required tax |

|

returns, estimated tax payments, and federal tax payments for yourself and any |

|

business in which you have an interest. Failure to meet your filing and payment |

|

responsibilities during consideration of your offer will result in the IRS returning |

|

your offer. If the IRS accepts your offer, you must continue to stay current with all |

|

tax filing and payment obligations through the fifth year after your offer is accepted |

|

(including any extensions). |

|

Note: If you have filed your tax returns but you have not received a bill for at |

|

least one tax debt included on your offer, your offer and application fee may |

|

be returned and any initial payment sent with your offer will be applied to |

|

your tax debt. To prevent the return of your offer, include a complete copy of |

|

any tax return filed within 12 weeks of this offer submission. |

|

The IRS can't process your offer if the IRS referred your case, or cases, involving |

|

all of the liabilities identified in the offer to the Department of Justice. In addition, |

|

the IRS cannot compromise any tax liability arising from a restitution amount |

|

ordered by a court or a tax debt reduced to judgment. Furthermore, the IRS will not |

|

compromise any IRC § 965 tax liability for which an election was made under IRC |

|

§ 965(i). You cannot appeal this decision. |

|

Note: Any offer containing a liability for which payment is being deferred under IRC |

|

§ 965(h)(1) can only be processed for investigation if an acceleration of payment |

|

under section 965(h)(3) and the regulations thereunder has occurred and no |

|

portion of the liability to be compromised resulted from entering into a transfer |

|

agreement under section 965(h)(3). |

|

The law requires the IRS to make certain information from accepted offers |

|

available for public inspection and review. Find instructions to request a public |

|

inspection file at www.IRS.gov keyword "OIC". |

2

|

The IRS may levy your assets up to the time the IRS official signs and |

|

acknowledges your offer as pending. In addition, the IRS may keep any proceeds |

|

received from the levy. If your assets are levied after your offer is submitted and |

|

pending evaluation, immediately contact the IRS employee whose name and |

|

phone number are listed on the levy. |

|

If you currently have an approved installment agreement, you will not be required |

|

to make your installment agreement payments while your offer is being |

|

considered. If your offer is not accepted and you have not incurred any additional |

|

tax debt, the IRS will reinstate your installment agreement. |

|

|

PAYING FOR YOUR OFFER |

|

Application Fee |

Offers require a $205 application fee. |

|

Exception: If you are an individual and meet the |

|

guidelines, there is no requirement to send any money with your offer. You |

|

are considered an individual if you are seeking compromise of a liability for which |

|

you are personally responsible, including any liability you incurred as a sole |

|

proprietor. |

Payment Options |

You must select a payment option and include the initial payment with your offer. |

|

The amount of the initial payment and subsequent payments will depend on the |

|

total amount of your offer and which of the following payment options you choose: |

|

Lump Sum Cash: This option requires 20% of the total offer amount to be paid |

|

with the offer and the remaining balance paid in 5 or fewer payments within 5 or |

|

fewer months of the date your offer is accepted. |

|

Periodic Payment: This option requires you to make the first payment with the |

|

offer and the remaining balance paid in monthly payments within 6 to 24 months, |

|

in accordance with your proposed offer terms. |

|

Note: Under the periodic payment option, you must continue to make |

|

monthly payments while the IRS is evaluating your offer. If you fail to make |

|

these payments at any time prior to receiving a final decision letter, the IRS will |

|

return your offer. You cannot appeal this decision. Total payments must equal the |

|

total offer amount. |

|

Reminder: The initial payment and monthly payments are not required if you meet |

|

the |

|

Generally, payments made on an offer will not be returned. You may make a |

|

deposit, as described in Form 656, Section 5, which may be returned if the offer is |

|

not accepted. If the IRS accepts your offer, your payments made during the offer |

|

process, including any money designated as a deposit, will be applied to your offer |

|

amount. |

|

If you do not have sufficient cash to pay for your offer, you may need to consider |

|

borrowing money from a bank, friends, and/or family. Other options may include |

|

borrowing against or selling other assets. |

|

If you are an individual, use the OIC |

|

at http://irs.treasury.gov/oic_pre_qualifier/ to assist in determining a starting |

|

point for your offer amount. |

|

Note: You may not pay your offer amount with an expected or current tax |

|

refund, money already paid, funds attached by any collection action, or |

|

anticipated benefits from a capital or net operating loss. If you are planning to |

|

use your retirement savings from an IRA or 401k plan, you may have future tax |

|

debt as a result. Contact the IRS or your tax advisor before taking this action. |

3

HOW TO APPLY

Application Process |

The application must include: |

|

• Form 656, Offer in Compromise |

|

• Completed and signed Form |

|

Wage Earners and |

|

• Completed and signed Form |

|

Businesses, if applicable |

|

• $205 application fee, unless you meet |

|

• Initial offer payment based on the payment option you choose, unless you |

|

meet |

|

Note: Your offer(s) cannot be considered without the completed and signed |

|

Form(s) 656, |

|

documentation. |

If You and Your Spouse Owe |

If you and your spouse have joint tax debt(s) and you or your spouse are also |

Joint and Separate Tax Debts |

responsible for separate tax debt(s) (including Trust Fund Recovery Penalty), you |

|

will each need to send in a separate Form 656. You will complete one Form 656 |

|

for yourself listing all your joint and any separate tax debts and your spouse will |

|

complete one Form 656 listing all his or her joint tax debt(s) plus any separate tax |

|

debt(s), for a total of two Forms 656. |

|

If you and your spouse or |

|

spouse does not want to be part of the offer, you may submit a Form 656 to |

|

compromise your responsibility for the joint tax debt. |

|

Each Form 656 will require the $205 application fee and initial payment |

|

unless you are an individual and meet the |

|

guidelines. |

If You Owe Individual and |

If you have individual and business tax debt that you wish to compromise, you will |

Business Tax Debt |

need to send in two Forms 656. Complete one Form 656 for your individual tax |

|

debts and one Form 656 for your business tax debts. Each Form 656 will require |

|

the $205 application fee and initial payment. |

|

Note: A business is defined as a corporation, partnership, or any business that is |

|

operated as other than a |

|

individual's share of a partnership debt. The partnership must submit its own offer |

|

based on the partnership's and partners' ability to pay. |

4

COMPLETING THE APPLICATION PACKAGE

Step 1 – Gather Your Information

Step 2 – Fill out Form

To calculate an offer amount, you will need to gather information about your financial situation, including cash, investments, available credit, assets, income, and debt.

You will also need to gather information about your household's gross monthly income and average expenses. The entire household includes all those in addition to yourself who contribute money to pay expenses relating to the household such as, rent, utilities, insurance, groceries, etc. This is necessary for the IRS to accurately evaluate your offer. The IRS may also use this to determine your share of the total household income and expenses.

In general, the IRS will not consider expenses for tuition for private schools, college expenses, charitable contributions, and other unsecured debt payments as part of the expense calculation.

Fill out Form

Step 3 – Fill out Form

Fill out Form

Step 4 – Attach Required |

You will need to attach supporting documentation with Form(s) |

Documentation |

|

|

copies of all required attachments. Do not send original documents. |

Step 5 – Fill out Form 656, Offer in Compromise

Step 6 – Include Initial Payment and $205 Application Fee

Step 7 – Mail the Application Package

Fill out Form 656. The Form 656 identifies the tax years and type of tax you would like to compromise. It also identifies your offer amount and the payment terms.

Include a personal check, cashier's check, or money order for your initial payment based on the payment option you selected (20% of the offer amount for a lump sum cash offer or the first month's payment for a periodic payment offer). Generally, initial payments will not be returned but will be applied to your tax debt if your offer is not accepted.

Include a separate personal check, cashier's check, or money order for the application fee. Make both payments (in U.S. dollars) payable to the “United States Treasury”.

You may choose to make your initial offer payment and application fee through the Electronic Federal Tax Payment System (EFTPS).

Reminder: If you meet the

Make a copy of your application package and keep it for your records.

Mail the completed application package to the appropriate IRS facility. See page 29, Application Checklist, for details.

Note: If you are working with an IRS employee, let him or her know you are sending or have sent an offer to compromise your tax debt(s).

5

IMPORTANT INFORMATION

After You Mail Your Application: We will contact you after we receive and review your offer application. Promptly reply to any requests for additional information within the time frame specified. Failure to reply timely will result in the return of your offer without appeal rights.

If the IRS accepts your offer, you must continue to timely file all required tax returns and timely pay all estimated tax payments and federal tax payments that become due in the future. If you fail to timely file and timely pay any tax obligations that become due within the five years after your offer acceptance (including any extensions) your offer may be defaulted. If the IRS defaults your offer, you will be liable for the original tax debt, less payments made, and all accrued interest and penalties. An offer does not stop the accrual of interest and penalties. Please note that if your final payment is more than the agreed amount, the IRS will not return the money but will apply it to your tax debt.

In addition, the IRS may default your offer if you fail to promptly pay any tax debts assessed after acceptance of your offer for any tax years prior to acceptance that were not included in your original offer.

6

Form

(April 2021)

Department of the Treasury — Internal Revenue Service

Collection Information Statement for Wage Earners and

Use this form if you are

►An individual who owes income tax on a Form 1040, U.S. Individual Income Tax Return

►An individual with a personal liability for Excise Tax

►An individual responsible for a Trust Fund Recovery Penalty

►An individual who is

►An individual who is personally responsible for a partnership liability (only if the partnership is submitting an offer)

►An individual who is submitting an offer on behalf of the estate of a deceased person

Note: Include attachments if additional space is needed to respond completely to any question. This form should only be used with the Form 656, Offer in Compromise.

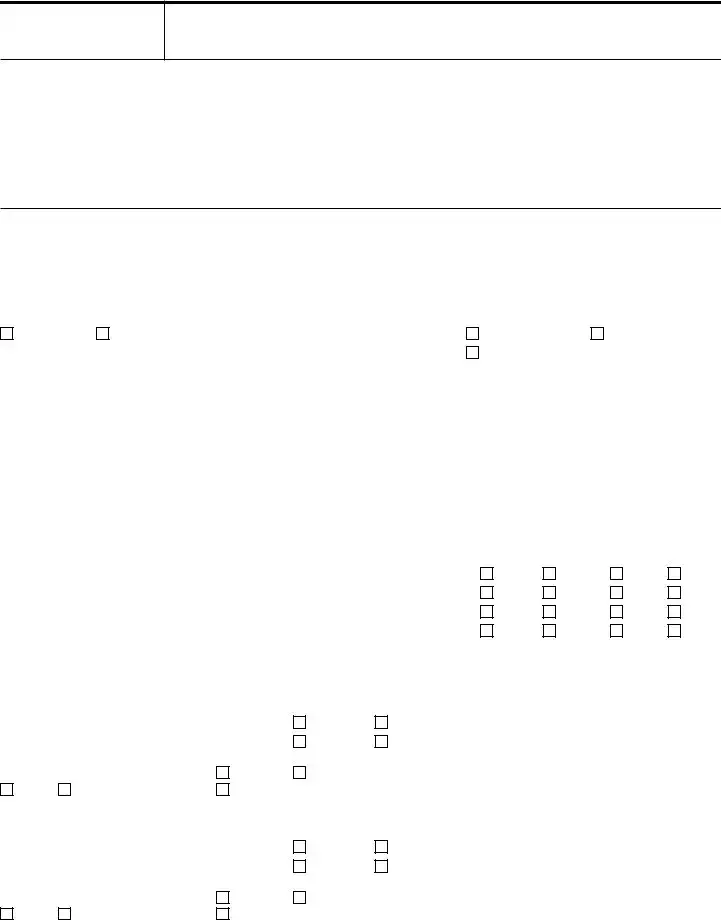

Section 1 |

|

|

|

|

Personal and Household Information |

|

|

|

|

|

||||||

Last name |

|

First name |

|

|

Date of birth (mm/dd/yyyy) |

|

|

Social Security Number |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- |

- |

Marital status |

|

Home physical address (street, city, state, ZIP code) |

Do you |

|

|

|

|

|

||||||||

|

Unmarried |

Married |

|

|

|

|

|

|

|

|

Own your home |

|

|

|

Rent |

|

If married, date of marriage (mm/dd/yyyy) |

|

|

|

|

|

|

|

|

Other (specify e.g., share rent, live with relative, etc.) |

|||||||

|

|

|

|

|

|

|

|

|

|

|||||||

County of residence |

|

Primary phone |

|

|

Home mailing address (if different from above or post office box number) |

|||||||||||

|

|

|

|

( |

) |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Secondary phone |

|

|

FAX number |

|

|

|

|

|

|

|

|

|

|

|||

( |

) |

- |

|

( |

) |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Provide information about your spouse. |

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Spouse's last name |

|

Spouse's first name |

|

Date of birth (mm/dd/yyyy) |

|

|

Social Security Number |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- |

- |

Provide information for all other persons in the household or claimed as a dependent. |

|

|

|

|

|

|

|

|||||||||

|

|

Name |

|

|

|

Age |

|

Relationship |

|

Claimed as a dependent |

Contributes to |

|||||

|

|

|

|

|

|

|

on your Form 1040 |

|

household income |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

Yes |

No |

|

Yes |

No |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Yes |

No |

|

Yes |

No |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Yes |

No |

|

Yes |

No |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Yes |

No |

|

Yes |

No |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Section 2 |

|

|

|

Employment Information for Wage Earners |

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Complete this section if you or your spouse are wage earners and receive a Form

Your employer’s name |

Pay period |

Weekly |

Employer’s address (street, city, state, ZIP code) |

||||

|

|

|

Monthly |

Other |

|

|

|

|

|

|

|

|

|||

Do you have an ownership interest in this |

If yes, check the business interest that applies |

|

|

||||

business |

|

Partner |

Sole proprietor |

|

|

||

Yes |

No |

Officer (complete Form |

|

|

|||

|

|

|

|

|

|

||

Your occupation |

How long with this employer |

|

|

|

|

||

|

|

|

(years) |

(months) |

|

|

|

|

|

|

|

|

|

||

Spouse’s employer's name |

Pay period |

Weekly |

Employer’s address (street, city, state, ZIP code) |

||||

|

|

|

Monthly |

Other |

|

|

|

|

|

|

|

||||

Does your spouse have an ownership |

If yes, check the business interest that applies |

|

|

||||

interest in this business |

Partner |

Sole proprietor |

|

|

|||

Yes |

No |

Officer (complete Form |

|

|

|||

|

|

|

|

|

|

||

Spouse's occupation |

How long with this employer |

|

|

|

|

||

|

|

|

(years) |

(months) |

|

|

|

|

|

|

|

|

|

||

Catalog Number 55896Q |

|

www.irs.gov |

|

|

Form |

|

|

Page 2

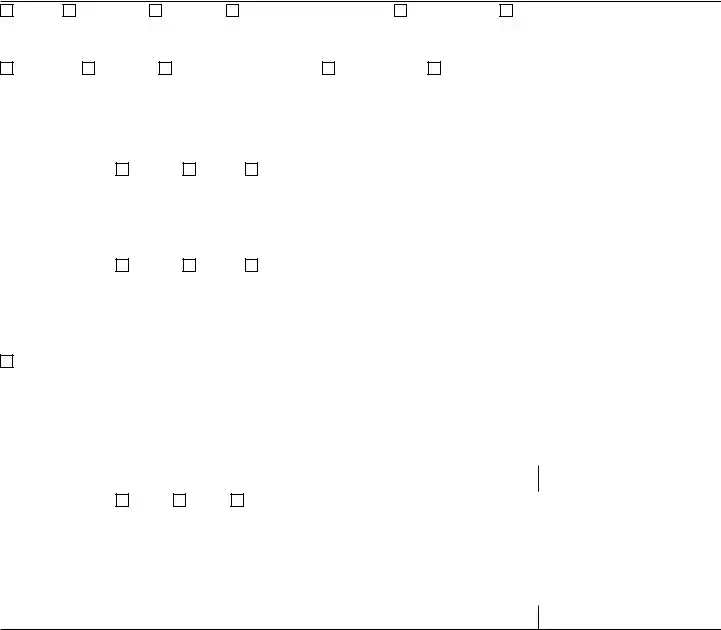

Section 3 |

Personal Asset Information |

|

|

Use the most current statement for each type of account, such as checking, savings, money market and online accounts, stored value cards (such as a payroll card from an employer), investment, retirement accounts (IRAs, Keogh, 401(k) plans, stocks, bonds, mutual funds, certificates of deposit) and virtual currency (such as Bitcoin, Ripple, Ethereum, etc.), life insurance policies that have a cash value, and safe deposit boxes. Asset value is subject to adjustment by IRS based on individual circumstances. Enter the total amount available for each of the following (if additional space is needed include attachments).

Round to the nearest dollar. Do not enter a negative number. If any line item is a negative number, enter "0".

Cash and Investments (domestic and foreign)

|

Cash |

Checking |

Savings |

Money Market Account/CD |

Online Account |

Stored Value Card |

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Bank name |

|

|

|

|

|

|

|

|

|

|

|

Account number |

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1a) |

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

Checking |

|

Savings |

Money Market Account/CD |

Online Account |

Stored Value Card |

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Bank name |

|

|

|

|

|

|

|

|

|

|

|

Account number |

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1b) |

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total of bank accounts from attachment |

(1c) |

$ |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

Add lines (1a) through (1c) minus ($1,000) = |

(1) |

$ |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Investment account |

|

|

Stocks |

|

|

Bonds |

|

Other |

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Name of Financial Institution |

|

|

|

|

|

Account number |

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current market value |

|

|

|

|

|

|

|

|

|

|

|

Minus loan balance |

|

|

|

|

|||||||

$ |

|

|

|

|

|

|

X .8 = $ |

|

|

|

|

|

|

– $ |

|

|

|

= |

(2a) |

$ |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Investment account |

|

|

Stocks |

|

|

Bonds |

|

Other |

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

Name of Financial Institution |

|

|

|

|

|

Account number |

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Current market value |

|

|

|

|

|

|

|

|

|

|

|

Minus loan balance |

|

|

|

|

|||||||

$ |

|

|

|

|

|

|

X .8 = $ |

|

|

|

|

|

|

– $ |

|

|

|

= |

(2b) |

$ |

|||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

Virtual currency |

|

|

Name of virtual currency |

|

Email address used to |

Location(s) of virtual |

|

|

|

|||||||||||||

|

|

|

|

|

wallet, exchange or digital |

currency |

|

|

|

||||||||||||||

Type of virtual currency |

|

|

|

|

|||||||||||||||||||

|

currency exchange (DCE) |

currency exchange or DCE |

|

|

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

Current market value in U.S. dollars as of today |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

$ |

|

|

|

|

|

|

X .8 = $ |

|

|

|

|

|

|

|

|

|

|

|

= |

(2c) |

$ |

||

|

|

|

|

|

|

|

|||||||||||||||||

|

|

|

|

Total investment accounts from attachment. [current market value minus loan balance(s)] |

(2d) |

$ |

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Add lines (2a) through (2d) =

(2) $

Retirement account |

401K |

IRA |

Other |

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

Name of Financial Institution |

|

|

|

Account number |

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

Current market value |

|

|

|

|

|

Minus loan balance |

|

|

|

|||

$ |

|

|

X .8 = $ |

|

|

|

– $ |

|

= |

(3a) |

$ |

|

|

|

|

|

|||||||||

|

Total of retirement accounts from attachment. [current market value X .8 minus loan balance(s)] |

(3b) |

$ |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

Add lines (3a) through (3b) =

(3) $

Note: Your reduction from current market value may be greater than 20% due to potential tax consequences/withdrawal penalties.

Cash value of Life Insurance Policies |

|

|

|

|

|

|

|

|

|

|

|

|

|

Name of Insurance Company |

Policy number |

|

|

|

||

|

|

|

|

|

|

|

Current cash value |

Minus loan balance |

|

|

|

||

$ |

|

– $ |

|

= |

(4a) |

$ |

|

|

|

|

|

||

Total cash value of life insurance policies from attachment |

Minus loan balance(s) |

|

|

|

||

$ |

|

– $ |

|

= |

(4b) |

$ |

|

|

|

|

|

|

|

|

|

|

Add lines (4a) through (4b) = |

(4) |

$ |

|

|

|

|

|

|||

Catalog Number 55896Q |

www.irs.gov |

|

Form |

|||

Document Specifics

| Fact | Description |

|---|---|

| Form Name | IRS Form 656-B |

| Purpose | Used for the Offer in Compromise program, which allows taxpayers to settle their tax debt for less than the full amount owed. |

| Components | Includes Form 656 and Form 433-A (OIC) for individuals or Form 433-B (OIC) for businesses. |

| Eligibility | Applicants must have filed all required tax returns and made all required estimated payments. |

| Filing Fee | There is a non-refundable fee, with certain low-income exceptions. |

| Governing Law | Federal tax law as administered by the Internal Revenue Service. |

Guide to Writing IRS 656-B

Once you've decided to request an offer in compromise with the IRS, which allows you to settle your tax debt for less than the full amount you owe, it's necessary to complete the IRS Form 656-B accurately. This form is crucial in making your case to the IRS. Filling it out requires attention to detail and a thorough understanding of your financial situation. Here are the steps to guide you through this process, ensuring you provide all the required information to the IRS.

Steps to Fill Out the IRS Form 656-B:

- Begin by reading the entire form carefully to understand what is required. The form comes with instructions that are essential to follow precisely.

- Collect all necessary financial documents and information beforehand, such as your income details, living expenses, asset information, and any debts you owe. This preparation will help you fill out the form more accurately and efficiently.

- Complete the form starting with the basic information section. Here, you'll enter your name, address, social security number (and your spouse's if filing jointly), and the tax periods for which you're requesting an offer in compromise.

- Section 2 will ask for detailed financial information. Here, you should report your monthly income sources and expenses. Be honest and precise, as this information will be verified by the IRS.

- In the section dedicated to assets, such as bank accounts, properties, vehicles, and personal assets, provide accurate values and information. This part is crucial for the IRS to assess your ability to pay.

- Review the form to ensure all fields are completed and that the information is accurate. Errors or omissions can delay the process or impact the outcome of your application.

- Sign and date the form. If you're filing jointly with a spouse, make sure they also sign the form.

- Gather any required documents that support the information provided in your form. This could include pay stubs, bank statements, property valuations, and other financial documents.

- Finally, mail the completed Form 656-B along with any supporting documents to the IRS at the address provided in the form instructions. Sending it through certified mail can provide you with a receipt and tracking for your records.

After submitting your Form 656-B, the next steps involve waiting for the IRS to review your application. This process can take some time as they thoroughly assess your financial situation and determine your eligibility for an offer in compromise. You may be contacted for additional information or documentation during this period. It's important to respond promptly to any requests from the IRS to keep the process moving. Once their review is complete, you will receive a decision from the IRS. If accepted, you’ll be given instructions on how to fulfill the terms of your offer in compromise.

Understanding IRS 656-B

If you're tackling your debt with the IRS and have come across the Form 656-B, you might have some questions. The Form 656-B, or the Offer in Compromise booklet, is a crucial step for many taxpayers looking to settle their tax liabilities for less than the full amount owed. Here, we'll explore some common questions related to this form and the process it entails.

What is the IRS Form 656-B?

The IRS Form 656-B is a document that taxpayers use to apply for an Offer in Compromise (OIC). This program allows you to settle your tax debt for less than the full amount you owe if you meet certain criteria. It's an option worth considering for those who cannot pay their full tax liability, or doing so would create financial hardship. The form comes as part of a booklet that includes instructions and other necessary forms like the 433-A (OIC) for individuals or 433-B (OIC) for businesses.

Who is eligible to apply for an Offer in Compromise?

Eligibility for an OIC depends on several factors. You may qualify if you cannot pay your full tax liability, or if doing so would cause financial hardship. The IRS considers your income, expenses, asset equity, and ability to pay when determining eligibility. Before applying, all filing and payment requirements must be up to date, and you cannot be in an open bankruptcy proceeding.

How do you submit Form 656-B?

To submit Form 656-B, you'll need to complete it along with the required documentation and submit it to the IRS. This includes a detailed financial statement using Form 433-A (OIC) for individuals or Form 433-B (OIC) for businesses. You'll also need to include the application fee and initial payment as outlined in the form's instructions unless you qualify for a low-income certification, which waives these requirements.

What is the application fee for an Offer in Compromise?

As of the last update, the application fee for an OIC is $205. This fee is non-refundable and must be submitted with your Form 656-B. However, if you meet criteria for low-income certification, this fee can be waived.

Can the initial offer payment be waived?

Yes, the initial offer payment can be waived for qualifying individuals. If you fall under the low-income certification guidelines, you will not be required to make the initial offer payment when you submit your Form 656-B. Additionally, there are different payment options available, which are outlined in the form's instructions, allowing you to customize your approach based on your financial situation.

How does the IRS decide to accept or reject an Offer in Compromise?

The IRS considers several factors, including your ability to pay, income, expenses, and asset equity. The key is proving to the IRS that your offered amount is the most they can expect to collect within a reasonable period, usually seen as being less than the full balance owed. The decision also takes into account any special circumstances that might affect your financial situation.

What happens if the IRS rejects your Offer in Compromise?

If the IRS rejects your Offer in Compromise, you will receive a written notice explaining the reasons for the decision. You have the right to appeal the rejection, but you must do so within 30 days of the date the notice was sent. The appeal process is outlined in the notice of rejection, and it gives you an opportunity to provide additional information or clarification that might affect the decision.

How long does it take for the IRS to make a decision on an Offer in Compromise?

The time frame for a decision on an OIC can vary significantly, but it generally takes the IRS about four to six months to review an offer and make a decision. This timeline can be longer if additional information is needed or if there are delays in processing. It's important to ensure that your application is complete and accurate to avoid unnecessary delays.

Navigating the Offer in Compromise process can seem daunting, but understanding the basics of Form 656-B and related procedures can help you take the first step towards resolving your tax debt. Always consider consulting a tax professional for guidance tailored to your specific situation.

Common mistakes

Not checking eligibility before applying. The IRS has strict qualifications for the Offer in Compromise program. Taxpayers often miss reviewing these criteria closely before submitting their application, which can result in immediate rejection.

Incorrect financial information. Many applicants underestimate the importance of accurate financial details. Failing to report income accurately, overestimating expenses, or omitting assets can not only cause delays but also lead to potential legal issues for providing false information to the IRS.

Missing documentation. Every piece of information on the 656-B form needs to be backed up with documentation. Taxpayers frequently submit their offers without the necessary documentation to support their financial status, leading to rejections.

Not considering all tax debts. It's crucial to include all tax debts in your offer. Some individuals mistakenly believe they can select which debts to compromise, but the IRS requires a comprehensive approach, taking all outstanding taxes into account.

Setting unrealistic payment offers. A common error is proposing a payment that's too low, based on wishful thinking rather than realistic financial capability. The IRS expects a reasonable offer that reflects one's ability to pay, considering their assets and income.

Attempting to navigate the process without professional help. While it's possible to submit an Offer in Compromise on your own, the complexity of the form and the negotiation process often benefits from professional guidance. Many people undervalue this and try to go it alone, which can lead to mistakes in the application process or in the negotiation itself.

When approached with care and thorough preparation, the Offer in Compromise can be a valuable tool for resolving tax debts. Avoiding these common mistakes can significantly improve the chances of an acceptance.

Documents used along the form

When navigating the intricacies of debt resolution with the IRS, the Form 656-B, Offer in Compromise booklet, plays a pivotal role. This form is a starting point for taxpayers seeking to negotiate a settlement for less than the full amount owed. However, understanding and completing this form is just one piece of the puzzle. To create a thorough and compelling case, several other forms and documents usually accompany Form 656-B. Here's a concise overview of other essential paperwork often required in this process.

- Form 433-A (OIC): This is the Collection Information Statement for Wage Earners and Self-Employed Individuals. It's crucial for providing detailed information about your financial situation, including income, expenses, assets, and liabilities.

- Form 433-B (OIC): Similar to 433-A, this Collection Information Statement is for Businesses. It's needed if the offer in compromise involves business debts, detailing the business's financial standing.

- Form 2848, Power of Attorney and Declaration of Representative: This form allows you to authorize an individual, such as a tax lawyer or accountant, to represent you in matters before the IRS, including negotiating and submitting your offer in compromise.

- Form 8821, Tax Information Authorization: This form permits a third party to access and receive your tax information, useful for those assisting you with your case but not representing you as a power of attorney.

- Form 4506-T, Request for Transcript of Tax Return: It's often necessary to provide copies of your past tax returns as part of the offer in compromise process. This form requests those transcripts from the IRS.

- Form 656-A, Income Certification for Offer in Compromise Application Fee and Payment: This form is used to certify that your income is below a certain threshold, potentially qualifying you for exemption from the application fee or initial payment.

- Copies of Current Bank Statements: Providing up-to-date bank statements for all checking, savings, and investment accounts is essential to prove your current financial situation.

- Copies of Recent Pay Stubs: These documents verify your income, an important factor in determining what you can reasonably offer to settle your tax debt.

- Proof of Living Expenses: Receipts, bills, and other documents showing monthly expenses help establish what you can afford to pay towards your debt.

- Documentation of Assets and Liabilities: Mortgage statements, car loan documents, retirement account statements, and similar documents provide a full picture of your assets and debts.

Successfully negotiating an Offer in Compromise with the IRS requires a detailed and accurate presentation of your financial life. Each document plays a crucial role in painting this picture, from forms detailing personal and business finances to proof of income and expenses. While the process might seem daunting, collecting and submitting the right information can significantly increase the chances of reaching a favorable resolution. Remember, this information is intended as a guide to help you understand the process and is not a substitute for professional advice.

Similar forms

The IRS Form 433-A (OIC) is similar to the IRS 656-B form, as both are crucial in the process of offering a compromise to the IRS. While the 656-B form is the formal offer document, the Form 433-A provides detailed financial information about the individual's ability to pay. This form collects comprehensive data regarding income, expenses, assets, and liabilities, painting a complete financial picture for the IRS to consider alongside the compromise offer.

Form 433-B (OIC) shares similarities with the IRS 656-B by also being integral to the offer in compromise process, but it focuses on businesses instead of individuals. Similar to how the 433-A offers a detailed financial snapshot for individuals, the 433-B does the same for business entities. This form is necessary for the IRS to evaluate the business's financial situation and determine its capacity for debt repayment, which is vital information when considering a compromise offer.

The IRS Form 9465 is another document akin to the 656-B, as it’s related to setting up payment arrangements with the IRS, albeit not specifically an offer in compromise. This form is used to request an installment agreement for paying off taxes in more manageable monthly payments. The similarity lies in the objective of both forms to alleviate the taxpayer’s debt burden, though they serve different purposes and lead to different payment solutions.

Form 1127 is similar to the IRS 656-B form in that it is used by taxpayers seeking relief from tax liability, but through the avenue of requesting an extension for tax payment. This form appeals to the IRS for more time to pay taxes due, based on demonstrating significant financial hardship. While both forms aim at reducing the immediate financial strain on the taxpayer, Form 1127 does not offer a compromise but rather a delay, giving taxpayers a temporary reprieve.

Last but not least, the IRS Form 2848, Power of Attorney and Declaration of Representative, shares its relevance with the 656-B in the context of tax resolution. Though not directly a financial or debt resolution form, it’s essential for taxpayers who wish to authorize a representative, such as a tax attorney or CPA, to handle their offer in compromise (or other tax matters) on their behalf. This form establishes the authority to communicate and negotiate with the IRS, making it a supplementary document that often accompanies the 656-B when a taxpayer has professional representation.

Dos and Don'ts

The process of completing an IRS 656-B form, which pertains to an offer in compromise, should be approached with careful attention to detail and thoroughness. This guide outlines what individuals should and shouldn't do to ensure that the form is filled out accurately and effectively.

Do's:

- Review the entire form and instructions carefully before starting to fill it out. This ensures that you understand all the requirements and gather all necessary information beforehand.

- Use blue or black ink if completing the form by hand, as these are the only colors that are reliably legible after the form is processed.

- Provide complete and accurate financial information. Transparency and accuracy are crucial, as they allow the IRS to assess your situation fairly.

- Attach all required documentation, such as proof of income, expenses, and debts, to substantiate the information provided in the form.

- Consider seeking advice from a tax professional or lawyer experienced in tax resolution, to ensure that your offer is structured in the best possible manner.

- Double-check your form and attached documents for any mistakes or missing information before submission, to avoid delays or rejections of your offer.

Don'ts:

- Don't guess or estimate figures. Use actual numbers from your financial statements to fill out the form. Inaccuracies can lead to rejection of your offer or further legal complications.

- Don't leave any sections blank unless instructed. If a section does not apply, write "N/A" (Not Applicable) to indicate that you have read and considered every part of the form.

- Don't omit information about any assets, income, or debts. Full disclosure is required for a fair assessment by the IRS.

- Don't forget to sign and date the form. An unsigned form is invalid and will be returned to you, which can delay the resolution of your tax issues.

- Don't submit the form without making a copy for your records. Having a copy is important for tracking your submission and future reference.

- Don't ignore deadlines. Submitting the form in a timely manner is critical for the consideration of your offer.

Misconceptions

The IRS 656-B form, often associated with the Offer in Compromise program, is surrounded by a number of misconceptions. This list aims to clarify some of the common misunderstandings.

Anyone can get their tax bill reduced through an Offer in Compromise. Not everyone qualifies for an Offer in Compromise. The IRS considers your ability to pay, income, expenses, and asset equity when making a determination.

Filing a 656-B form automatically stops collection activities. While it's true that the IRS may hold off on certain collection activities while your offer is being evaluated, it does not automatically stop all actions, such as collection of the existing balance due.

The process is quick. The process of reviewing an Offer in Compromise can be lengthy, taking several months and in some cases, up to a year.

There's a high success rate for Offers in Compromise. Actually, a significant number of applications are rejected due to various reasons, including incorrect forms, inability to pay the offer amount, or not meeting the IRS's criteria for doubt as to collectibility, doubt as to liability, or effective tax administration.

You need a tax professional to submit Form 656-B. While hiring a tax professional can help navigate the complexities of the process and potentially increase the likelihood of acceptance, individuals can submit the form and negotiate with the IRS on their own.

If the IRS rejects your offer, you can't appeal the decision. You have the right to appeal a rejection within 30 days after the date of the decision letter.

The fee for Form 656-B is always required. The IRS waives the application fee for low-income individuals or includes it in the offer amount under certain conditions.

You can't make any tax payments while waiting for a decision. You are generally required to continue making tax payments, especially if you are making estimated tax payments or have a business with employees.

Submitting an Offer in Compromise is an admission of financial hardship. While financial difficulty is a consideration, submitting this form is more about finding a realistic solution when full payment is not feasible, rather than an outright admission of financial distress.

Understanding the realities behind these misconceptions can help taxpayers navigate the complexities of submitting an IRS 656-B form more accurately and with appropriate expectations.

Key takeaways

The IRS 656-B form, more commonly known as the Offer in Compromise booklet, is an essential document for taxpayers seeking to negotiate a settlement with the IRS for less than the full amount owed. Understanding the key aspects of this form can significantly streamline the process. Below are six crucial takeaways regarding filling out and utilizing the 656-B form effectively.

- Eligibility Requirements Are Detailed: Before attempting to complete the form, it is important for individuals to thoroughly assess the eligibility requirements outlined within the document. These criteria must be met to successfully submit an Offer in Compromise.

- Complete Financial Disclosure is Necessary: The form requires comprehensive financial information from the applicant. This includes details about income, expenses, assets, and liabilities. Accurate and thorough disclosure is crucial for the IRS to make an informed decision.

- Payment Options Are Available: Within the 656-B form, applicants are given the choice between lump sum and periodic payment options for their offer. The selection made influences the initial payment amount and the overall processing of the offer.

- Application Fee and Initial Payment Must Be Included: When submitting the form, it is mandatory to include the non-refundable application fee and the initial payment towards the offer amount. These must be provided for the IRS to consider the application.

- Use of Correct Forms and Documentation: The 656-B booklet contains specific forms that vary based on the taxpayer’s individual circumstances, such as the 433-A (OIC) for individuals or the 433-B (OIC) for businesses. It is important to use the correct form tailored to the situation to avoid delays.

- Professional Advice May Be Beneficial: Given the complexities involved in submitting an Offer in Compromise, seeking advice from a tax professional can be advantageous. Professionals can provide guidance on the feasibility of an offer, assist with paperwork, and navigate the negotiation process with the IRS.

Popular PDF Documents

IRS 8822 - A necessary measure for accurate and timely receipt of IRS communications.

IRS W-4P - The form provides a way for people to maintain a balance in their tax situation, avoiding both underpayment and overpayment.

Federal Form 8822 - By using Form 8822, taxpayers can help safeguard against the loss of important IRS mailings due to incorrect address information.